Global Synthetic Graphite Market By Grade (High-Purity Graphite, Medium-Purity Graphite, Low-Purity Graphite), By Application ( Rechargeable Batteries, Fire Retardants, Coatings, High-Temperature Resistant Crucibles, Lubricants, Others), By End-Use (Consumer Electronics, Automotive, Industrial Machinery, Aerospace Defense, Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151083

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

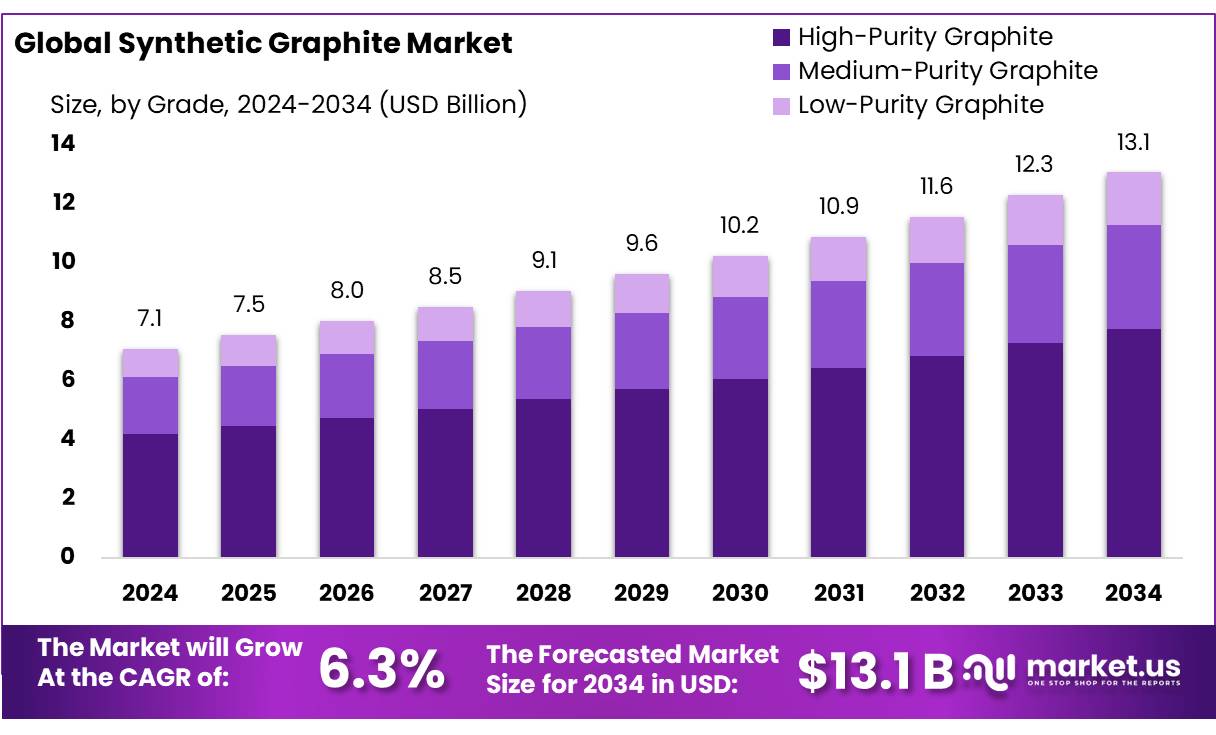

The Global Synthetic Graphite Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Synthetic graphite concentrates are high-purity carbon materials produced through the refining of petroleum coke or coal tar pitch via graphitization at temperatures exceeding 2,500°C. This industrial product offers exceptional electrical conductivity, thermal stability, and structural uniformity, rendering it indispensable in applications such as Lithiumion battery anodes, semiconductor manufacturing, steelmaking refractories, and aerospace components. In 2022, global consumption of all graphite types exceeded 1.3 million metric tons, with synthetic graphite accounting for approximately 67% of total kg consumption—principal demand originating from Asia.

The EV revolution is the primary growth driver; over 65 percent of synthetic graphite demand is linked to EV batteries. The U.S. DOE recently backed Novonix’s Chattanooga plant with a conditional USD 754 million loan to establish a 31,500 tpa capacity facility, with plans to scale to 75,000 tpa.

Demand for synthetic graphite is principally driven by the expanding lithium-ion battery sector. Over 90% of battery anode material in EVs depends on graphite. China alone accounts for approximately 98% of planned anode capacity expansions through 2030.

Several governments have introduced supportive measures to promote synthetic graphite production. China enforces export controls and licensing requirements for graphite products, reinforcing its global market position while encouraging domestic capacity.

The US Inflation Reduction Act, sourcing mandates allow Chinese graphite until 2027 measures including 25% tariffs on Chinese graphite anodes have been introduced to encourage domestic supply, though analysts expect only about 40% of US demand will be met by compliant sources by 2030. A USD 1.2 billion DOE loan has been granted to Novonix to establish a 31,500tpa synthetic graphite plant in Tennessee, expanding to 75,000t by 2030.

Key Takeaways

- Synthetic Graphite Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.3%.

- High-Purity Graphite held a dominant market position, capturing more than a 59.3% share in the global synthetic graphite market.

- Rechargeable Batteries held a dominant market position, capturing more than a 39.1% share of the global synthetic graphite market.

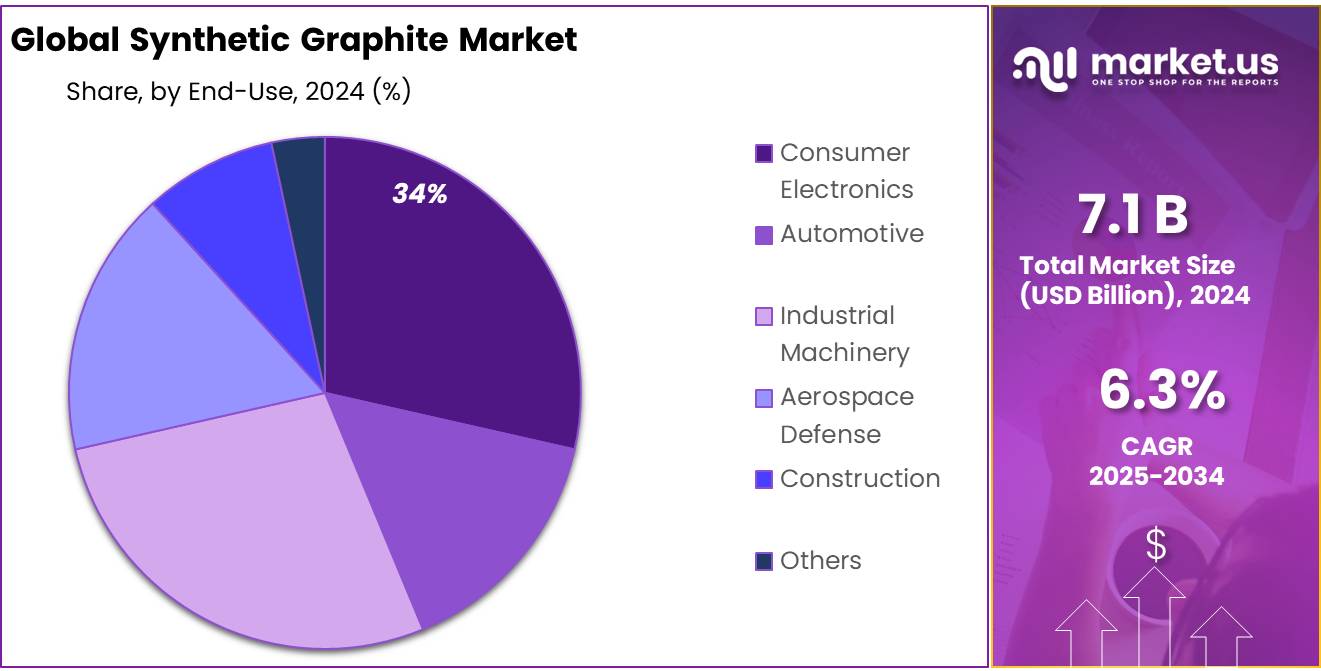

- Consumer Electronics held a dominant market position, capturing more than a 34.9% share of the global synthetic graphite market.

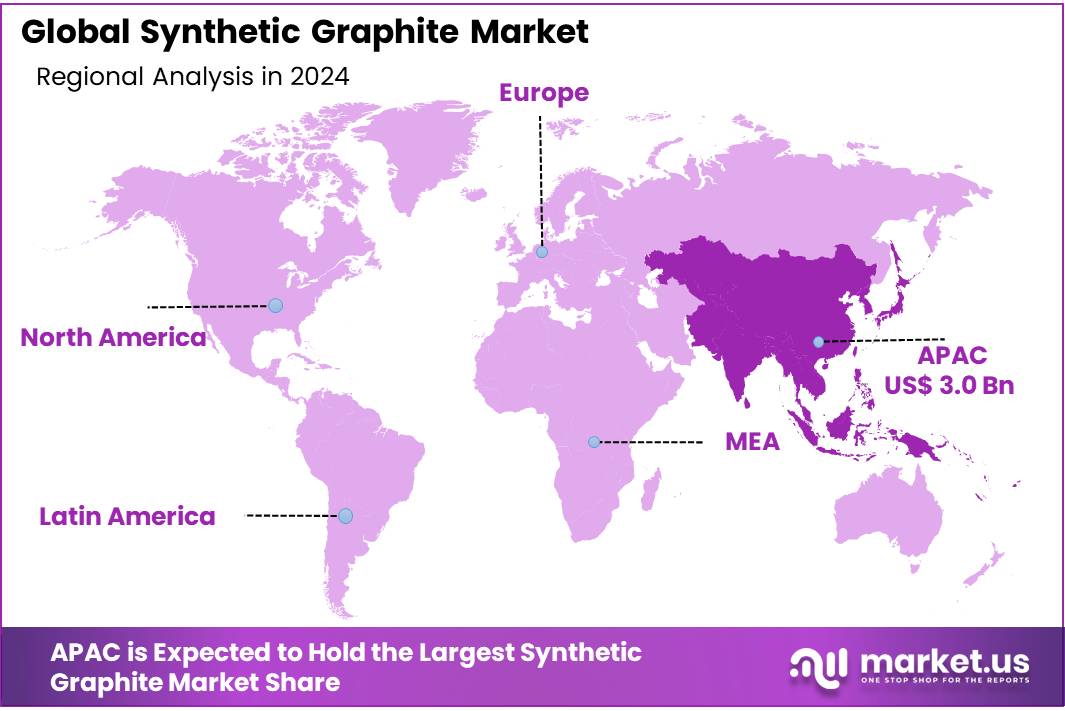

- Asia-Pacific (APAC) held a dominant position in the global synthetic graphite market, capturing approximately 42.9% of the total market share, valued at around USD 3.0 billion.

By Grade

High-Purity Graphite leads with 59.3% due to its critical role in lithium-ion batteries and high-tech industries.

In 2024, High-Purity Graphite held a dominant market position, capturing more than a 59.3% share in the global synthetic graphite market by grade. This dominance is mainly driven by its essential role in the production of lithium-ion battery anodes, where high purity is required to ensure long battery life and stability. The growing demand from electric vehicles, energy storage systems, and portable electronics continues to push manufacturers toward high-purity grades that meet strict performance and safety standards.

Furthermore, high-purity synthetic graphite is increasingly used in semiconductor manufacturing, aerospace components, and high-temperature industrial furnaces, where contamination risks must be minimized. In 2025, the share of High-Purity Graphite is expected to remain strong, supported by rising EV adoption globally and government-backed projects focused on clean energy storage. The consistent demand for precision-engineered materials across emerging technologies is likely to keep this segment in a leading position throughout the forecast period.

By Application

Rechargeable Batteries dominate with 39.1% share, powered by booming EV and energy storage demand.

In 2024, Rechargeable Batteries held a dominant market position, capturing more than a 39.1% share of the global synthetic graphite market by application. This strong lead is largely driven by the accelerating production of lithium-ion batteries used in electric vehicles, portable electronics, and stationary energy storage systems. Synthetic graphite is preferred in these batteries due to its high conductivity, structural uniformity, and long cycle life.

As governments and industries push for electrification and low-emission technologies, the need for efficient battery materials has surged. In 2025, this segment is expected to grow steadily as battery gigafactories expand in regions such as North America, Europe, and Asia-Pacific. Strategic investments in domestic battery manufacturing and recycling infrastructure are further expected to reinforce synthetic graphite’s role in this application. As the world transitions to clean energy and electric mobility, rechargeable batteries will remain a key growth engine for the synthetic graphite industry.

By End-Use

Consumer Electronics leads with 34.9% share, fueled by rising demand for lightweight, high-performance devices.

In 2024, Consumer Electronics held a dominant market position, capturing more than a 34.9% share of the global synthetic graphite market by end-use. This dominance is mainly due to the widespread use of synthetic graphite in the batteries and heat dissipation systems of smartphones, laptops, tablets, and wearables. The material’s excellent electrical conductivity and thermal stability make it ideal for compact devices that require efficient energy management and high durability.

As the global population continues to adopt smart, portable technologies, the consumption of synthetic graphite in this segment is projected to rise steadily. In 2025, the segment is expected to maintain its leading position, supported by growing electronics production in Asia-Pacific and increasing consumer demand for longer-lasting and faster-charging devices. Additionally, innovations in foldable phones and compact computing devices are likely to increase the material requirements for high-purity, thermally conductive graphite solutions, reinforcing its importance in the consumer electronics sector.

Key Market Segments

By Grade

- High-Purity Graphite

- Medium-Purity Graphite

- Low-Purity Graphite

By Application

- Rechargeable Batteries

- Fire Retardants

- Coatings

- High-Temperature Resistant Crucibles

- Lubricants

- Others

By End-Use

- Consumer Electronics

- Automotive

- Industrial Machinery

- Aerospace Defense

- Construction

- Others

Drivers

Growing Demand for Electric Vehicles (EVs) Driving the Synthetic Graphite Market

In recent years, the growing adoption of electric vehicles (EVs) has significantly boosted the demand for synthetic graphite, a crucial material in the production of lithium-ion batteries used in EVs. As the automotive industry shifts towards electric mobility, manufacturers are increasingly turning to synthetic graphite due to its superior performance in high-energy density batteries, contributing to faster charging times and longer ranges.

The global EV market is experiencing unprecedented growth. According to the International Energy Agency (IEA), global electric car sales reached 10.5 million units in 2022, marking a 55% increase from 2021. This surge in sales is expected to continue, with projections estimating that the number of electric cars on the road will exceed 125 million by 2030, up from around 26 million in 2020. As a result, the demand for key battery materials, including synthetic graphite, is anticipated to rise sharply.

Governments around the world are also playing a pivotal role in this growth. Several countries have introduced policies to support the transition to electric vehicles, such as providing incentives for EV purchases and investing in charging infrastructure. For instance, the European Union’s Green Deal aims to reduce emissions by 55% by 2030, which includes pushing for widespread EV adoption. In the U.S., the Inflation Reduction Act allocates $7.5 billion to develop a national EV charging network, further accelerating the need for materials like synthetic graphite.

Restraints

Environmental Concerns and Sustainability Challenges

One of the major restraining factors for the synthetic graphite market is the environmental impact associated with its production process. The manufacturing of synthetic graphite involves high energy consumption, primarily from fossil fuels, which leads to significant carbon emissions. This makes the industry vulnerable to increasing environmental regulations and a growing demand for sustainable practices.

Synthetic graphite is produced through the high-temperature treatment of petroleum coke, a byproduct of petroleum refining. This process requires substantial energy, contributing to carbon emissions that negatively impact the environment. According to the International Energy Agency (IEA), the global cement industry alone accounts for approximately 7% of global CO2 emissions, and industries like graphite production also share a significant portion of these emissions. In addition, concerns over the long-term availability of raw materials, such as petroleum coke, and the environmental toll of their extraction, are beginning to prompt calls for alternative, more sustainable production methods.

Governments worldwide are tightening regulations on emissions, particularly in the wake of global climate change initiatives. For instance, the European Union’s Green Deal aims to reduce emissions by 55% by 2030 compared to 1990 levels. Such initiatives are pushing industries, including graphite production, to innovate or face penalties. Furthermore, increasing consumer awareness and preference for environmentally friendly products are encouraging companies to adopt sustainable practices. This shift may present a challenge for traditional synthetic graphite producers who rely on energy-intensive methods.

Opportunity

Expansion of Renewable Energy Storage Solutions

A significant growth opportunity for the synthetic graphite market lies in the expanding use of renewable energy storage solutions. As countries strive to meet renewable energy targets and reduce dependency on fossil fuels, the need for efficient energy storage systems, such as lithium-ion batteries, has surged. These batteries rely heavily on synthetic graphite as a key anode material, creating a promising demand for the material in the energy storage sector.

Renewable energy sources like wind and solar are intermittent, meaning they produce electricity when weather conditions are favorable but require effective storage systems to ensure a consistent supply. According to the International Renewable Energy Agency (IRENA), global renewable power capacity is expected to more than double by 2030, reaching over 4,800 GW. This growth directly correlates with an increase in demand for energy storage solutions. The U.S. alone plans to deploy 10,000 MWh of energy storage by 2025 under its Energy Storage Grand Challenge.

Synthetic graphite plays a vital role in improving the performance of energy storage systems, especially in large-scale grid applications. As more governments, such as those in Europe, implement aggressive green energy policies, synthetic graphite’s role in supporting battery technologies becomes more critical. The European Union, for example, has committed to achieving a Green Deal by 2050, which includes significant investments in renewable energy and storage infrastructure.

Trends

Adoption of Renewable Energy Storage Solutions

A significant trend shaping the synthetic graphite market is its increasing application in renewable energy storage systems. As the world transitions towards cleaner energy sources, the demand for efficient energy storage solutions has surged, positioning synthetic graphite as a critical material in this evolution.

Synthetic graphite is integral to the production of lithium-ion batteries, which are pivotal in storing energy generated from renewable sources like solar and wind. These batteries help address the intermittent nature of renewable energy by storing excess power for use during periods of low generation. The International Energy Agency (IEA) reports that global renewable energy capacity is expected to more than double by 2030, reaching over 4,800 GW. This expansion necessitates advanced energy storage solutions, thereby driving the demand for synthetic graphite.

Governments worldwide are implementing policies to support the integration of renewable energy and storage systems. For instance, the European Union’s Green Deal aims to reduce emissions by 55% by 2030, which includes significant investments in renewable energy infrastructure. In the United States, the Inflation Reduction Act allocates $7.5 billion to develop a national EV charging network, indirectly boosting the demand for energy storage solutions.

Regional Analysis

In 2024, Asia-Pacific (APAC) held a dominant position in the global synthetic graphite market, capturing approximately 42.9% of the total market share, valued at around USD 3.0 billion. The region’s dominance is largely driven by its robust battery manufacturing ecosystem, led by China, Japan, and South Korea.

China alone accounts for over 65% of global synthetic graphite production, supported by abundant raw materials, established processing infrastructure, and significant government subsidies for battery component manufacturing. Additionally, the country plays a crucial role in the global electric vehicle (EV) value chain, producing over 60% of the world’s EV batteries. South Korea and Japan are also major players in advanced lithium-ion battery technologies, further boosting regional demand for synthetic graphite.

Governments across APAC have actively supported synthetic graphite production through policy incentives, tax benefits, and national EV promotion schemes. China’s Ministry of Industry and Information Technology (MIIT) continues to invest in critical mineral development and battery innovation hubs, while India has launched critical mineral auctions to attract domestic and foreign investment in graphite and battery materials. Moreover, rising demand for portable consumer electronics and energy storage systems is contributing to significant graphite consumption across APAC markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asbury Carbons, founded in 1895, is a prominent supplier of synthetic graphite, petroleum cokes, and carbon products. Catering to diverse industries—such as friction materials, lubricants, fuel cells, and metallurgy—it provides over 2,000 grades of carbon-based materials and supports application-specific custom solutions. The company operates globally with production facilities across North America and Canada, offering high-purity synthetic graphite powders ranging from submicron to chunky particles with fast delivery for industrial clients.

Canada Carbon Inc. is a graphite exploration and development company focused on Quebec, Canada. It holds 100% stakes in the Miller and Asbury graphite projects. These projects involve historical graphite mines revitalized for modern extraction and purification, aiming to supply high-quality natural and synthetic graphite material for energy storage and advanced tech uses. The company recently completed bulk sampling in October 2024 to assess head assays and workability, reinforcing its commitment to environmentally responsible graphite production.

GrafTech International, established in 1886 and now part of Brookfield, is a leading manufacturer of graphite electrodes used in electric arc furnace steel production. The company is vertically integrated into petroleum needle coke supply via its Seadrift facility, supporting ultra-high power electrode manufacturing across multiple plants in North America and Europe. In 2023, GrafTech reported net sales of USD 621 million and operates some of the world’s highest-capacity electrode facilities.

Top Key Players in the Market

- Asbury Carbons

- Beiterui New Material Group Co. Ltd

- Canada Carbon Inc.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Graphite India

- HEG

- Imerys Graphite & Carbon Ltd.

- Mason Graphite

- Mersen

- Nippon Kokuen Group

- SGL Carbon

- Showa Denko Materials Co., Ltd.

- Tokai Carbon

- XRD Graphite Manufacturing Co., Ltd.

Recent Developments

In 2024 Graphit Kropfmühl GmbH, strengthened its position by repurchasing a 40% ownership stake, completing the deal in March 2025—highlighting renewed confidence and strategic focus on graphite production.

In 2024, Albemarle secured USD 67.1 million in U.S. Department of Energy grants to support the development of lithium metal anode and synthetic graphite production in North Carolina.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Bn Forecast Revenue (2034) USD 13.1 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High-Purity Graphite, Medium-Purity Graphite, Low-Purity Graphite), By Application (Rechargeable Batteries, Fire Retardants, Coatings, High-Temperature Resistant Crucibles, Lubricants, Others), By End-Use (Consumer Electronics, Automotive, Industrial Machinery, Aerospace Defense, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asbury Carbons, Beiterui New Material Group Co. Ltd, Canada Carbon Inc., GrafTech International, Graphit Kropfmuhl GmbH, Graphite India, HEG, Imerys Graphite & Carbon Ltd., Mason Graphite, Mersen, Nippon Kokuen Group, SGL Carbon, Showa Denko Materials Co., Ltd., Tokai Carbon, XRD Graphite Manufacturing Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asbury Carbons

- Beiterui New Material Group Co. Ltd

- Canada Carbon Inc.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Graphite India

- HEG

- Imerys Graphite & Carbon Ltd.

- Mason Graphite

- Mersen

- Nippon Kokuen Group

- SGL Carbon

- Showa Denko Materials Co., Ltd.

- Tokai Carbon

- XRD Graphite Manufacturing Co., Ltd.