Global Diclofenac Market By Type(Tablet, Solution), By Disease Indication(Osteoarthritis, Rheumatoid Arthritis, Migraine, Others), By Administration Route(Oral, Injection, Topical Solution, Sprays, Patches, Eye-Drops, Others), By Distribution Channel(Online Pharmacy, Retail Pharmacy, Hospital Pharmacy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123293

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

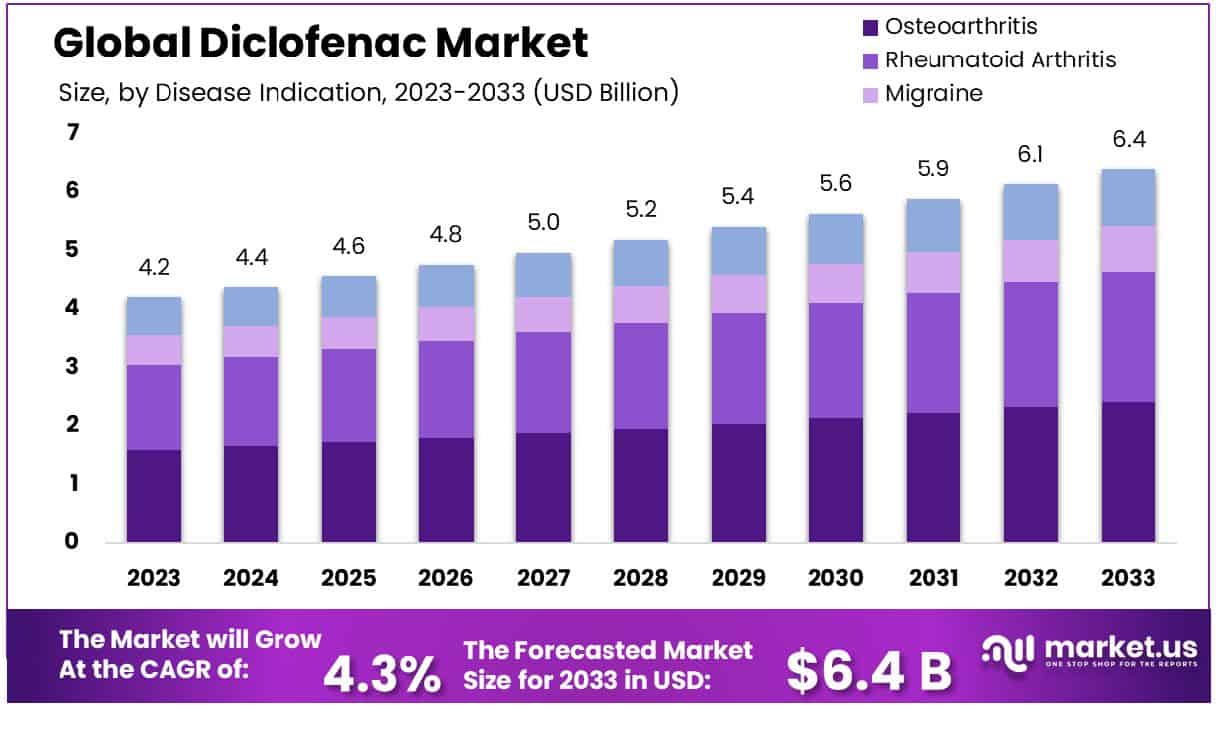

The Global Diclofenac Market size is expected to be worth around USD 6.4 Billion by 2033, From USD 4.2 Billion by 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Diclofenac Market encompasses the global production, distribution, and sales of Diclofenac, a nonsteroidal anti-inflammatory drug (NSAID) pivotal in managing pain and inflammatory disorders such as arthritis. This market’s valuation is influenced by the prevalence of chronic pain conditions, regulatory landscapes, and advancements in pharmaceutical formulations.

Key stakeholders include pharmaceutical companies, healthcare providers, and regulatory bodies, with strategic focus areas being product innovation, market expansion, and competitive pricing. The market is also shaped by trends in patent expiries, generic penetration, and consumer preference for effective, low-side-effect therapeutics.

The global Diclofenac market is poised for significant growth, driven by the rising prevalence of osteoarthritis and rheumatoid arthritis. Osteoarthritis, a leading cause of disability, affected an estimated 303 million people globally in 2020. Diclofenac, a nonsteroidal anti-inflammatory drug (NSAID), is extensively used for its efficacy in managing pain and inflammation associated with osteoarthritis.

Additionally, Diclofenac is indicated for the treatment of rheumatoid arthritis, an autoimmune disorder affecting approximately 23.7 million individuals worldwide, characterized by chronic joint inflammation. The increasing burden of these conditions underscores the critical need for effective therapeutic solutions, positioning Diclofenac as a pivotal component in arthritis management.

This trend is further supported by the growing geriatric population, which is more susceptible to musculoskeletal disorders, and advancements in drug formulation technologies enhancing the delivery and efficacy of Diclofenac. Consequently, the market is expected to witness robust demand, with pharmaceutical companies investing in research and development to address evolving patient needs.

Key Takeaways

- The Global Diclofenac Market is projected to grow from USD 4.2 billion in 2023 to USD 6.4 billion by 2033, with a CAGR of 4.3%.

- Asia Pacific dominates the Diclofenac market with a 35.5% share, valued at USD 1.5 billion.

- Tablets lead Diclofenac types with a 55.5% market share.

- Osteoarthritis indications account for 37.5% of Diclofenac usage.

- Oral administration is preferred by 37% of Diclofenac users.

- Distribution channels Retail Pharmacy dominates with a 68.4% market share.

Driving Factors

Rising Prevalence of Chronic Pain and Inflammatory Disorders

The Diclofenac market is significantly propelled by the increasing prevalence of chronic pain and inflammatory conditions such as arthritis, migraines, and fibromyalgia. With an upsurge in such ailments globally, the demand for effective and rapid pain relief solutions like Diclofenac escalates.

This nonsteroidal anti-inflammatory drug (NSAID) is sought after for its efficacy in reducing inflammation and pain. The World Health Organization (WHO) estimates that chronic diseases afflict over a billion people worldwide, suggesting a vast target demographic for Diclofenac, which directly enhances its market growth.

Increasing Geriatric Population Susceptible to Joint Diseases

Another pivotal growth driver for the Diclofenac market is the burgeoning geriatric population, which is notably prone to degenerative joint diseases such as osteoarthritis and rheumatoid arthritis.

As per United Nations data, the population aged 65 years and over is projected to double to 1.5 billion by 2050. This demographic shift significantly increases the patient pool requiring Diclofenac for pain management and symptomatic relief, thereby boosting the market expansion.

Expansion of Over-the-Counter NSAID Availability

The market dynamics for Diclofenac are also favorably influenced by the expansion of over-the-counter (OTC) availability of NSAIDs. Regulatory approvals for OTC Diclofenac in various regions make it more accessible to a broader audience, eliminating the need for prescriptions and thereby enhancing consumer convenience and adoption. This shift not only broadens the user base but also facilitates higher consumption rates, contributing robustly to the market’s growth trajectory.

Restraining Factors

Stringent Regulatory Guidelines for Drug Approval

The Diclofenac market faces significant constraints due to stringent regulatory guidelines for drug approval. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce rigorous testing and safety protocols to ensure drug efficacy and minimize risks.

These meticulous approval processes can delay market entry, limit the availability of new formulations, and increase development costs. Such regulatory hurdles can dampen the speed at which new Diclofenac products reach the market, thereby restraining rapid growth in this sector.

Adverse Effects Associated with NSAID Use

Another major impediment to the growth of the Diclofenac market is the documented adverse effects associated with NSAID use. These include gastrointestinal issues, cardiovascular risks, and renal complications. For instance, the FDA requires updated warning labels on all NSAIDs, including Diclofenac, highlighting their potential to increase the risk of heart attack and stroke.

This not only influences consumer perception negatively but also prompts healthcare providers to prescribe these drugs with greater caution. The resulting decrease in consumer confidence and prescribed usage directly impacts the market’s expansion.

By Type Analysis

Tablets hold a commanding 55.5% share in the Diclofenac market, indicating strong preference.

In 2023, Tablets held a dominant market position in the “By Type” segment of the Diclofenac Market, capturing more than a 55.5% share. The widespread preference for tablets can be attributed to their ease of use, precise dosage, and widespread availability. This form factor’s dominance underscores its established presence in consumer preferences and its efficacy in pain management regimes.

Following tablets, the solution form of diclofenac also made significant strides, although it holds a smaller segment of the market. Solutions are often preferred for their faster absorption rates and suitability for patients who experience difficulties with oral medications. The diversification in consumption preferences highlights the evolving dynamics of the market and indicates a segmented demand based on application ease and patient demographics.

The strategic positioning of tablets at the forefront of the diclofenac market is further reinforced by their robust distribution channels. Pharmacies, both online and offline, have facilitated extensive accessibility to tablet formulations, enhancing patient adherence to prescribed pain management treatments. This accessibility is crucial in maintaining the tablet’s leading position in the market.

Moreover, ongoing developments in pharmaceutical formulations and a focus on minimizing gastrointestinal side effects associated with oral diclofenac are likely to sustain the growth of the tablet segment. Pharmaceutical companies continue to innovate in coating technologies and combination therapies to enhance the therapeutic efficacy and patient compliance of diclofenac tablets.

By Disease Indication Analysis

Osteoarthritis accounts for 37.5% of Diclofenac usage, highlighting its critical role in treatment.

In 2023, Indication Osteoarthritis held a dominant market position in the “By Disease” segment of the Diclofenac Market, capturing more than a 37.5% share. This significant market share is indicative of the high prevalence of osteoarthritis globally, coupled with diclofenac’s effectiveness in managing the disease’s symptomatic pain and inflammation. The prominence of osteoarthritis as a key driver for diclofenac usage underscores the growing demand for effective pain management solutions in aging populations.

Rheumatoid arthritis and migraine also represent substantial segments within the market, reflecting the versatility of diclofenac in treating a variety of inflammatory conditions and pain syndromes. While rheumatoid arthritis showcases a steady demand for diclofenac due to its chronic inflammatory nature, the use of diclofenac for migraine relief highlights its efficacy in acute pain scenarios, further diversifying its application scope.

The category labeled “Others” includes additional lesser-known applications of diclofenac, such as the treatment of ankylosing spondylitis and postoperative pain, which, although smaller in market share, are essential to the comprehensive utility of the drug. These segments demonstrate the adaptability of diclofenac to a wide range of therapeutic needs, reinforcing its essential role in contemporary pharmaceutical care.

As market dynamics evolve, the role of diclofenac in treating diverse conditions continues to expand, driven by ongoing clinical research and patient-centered treatment innovations. This trend is anticipated to foster sustained growth and diversification in the diclofenac market, ensuring its relevance in the pharmaceutical landscape for managing disease-induced discomfort and improving quality of life.

By Administration Route Analysis

Oral administration leads with 37% in the Diclofenac market, preferred for its convenience.

In 2023, Oral held a dominant market position in the “By Administration Route” segment of the Diclofenac Market, capturing more than a 37% share. This mode of administration remains preferred due to its convenience, ease of dosage control, and patient familiarity. The widespread acceptance of oral diclofenac is supported by its extensive use in both acute and chronic pain management, illustrating its integral role in therapeutic regimes.

Following closely, injection and topical solutions are also prominent administration routes. Injections, often used for more immediate pain relief in clinical settings, account for a significant portion of the market due to their efficacy in delivering rapid anti-inflammatory effects. Topical solutions, preferred for their localized action with minimal systemic side effects, cater to patients seeking targeted relief without the gastrointestinal risks associated with oral forms.

Additional administration routes like sprays, patches, and eye drops each cater to specific patient needs. Sprays offer ease of application and fast absorption, suitable for muscle and joint pain. Patches provide controlled release of diclofenac, ideal for sustained pain relief over extended periods, while eye drops are essential in treating inflammatory conditions of the eye such as post-surgical pain.

The segment categorized as “Others” includes various innovative delivery forms being explored to enhance patient compliance and minimize side effects, reflecting the ongoing evolution in diclofenac administration. This diversity in administration routes highlights the dynamic nature of the market, driven by consumer preferences and the continuous development of more sophisticated drug delivery technologies.

By Distribution Channel Analysis

Direct distribution channels Retail Pharmacy dominate, accounting for 68.4% of Diclofenac sales, ensuring widespread availability.

In 2023, Retail Pharmacy held a dominant position in the “By Distribution Channel” segment of the Diclofenac Market, capturing more than a 68.4% share. This substantial market share underscores the critical role of retail pharmacies as the primary access point for diclofenac, facilitating widespread availability to the general population. Retail pharmacies’ extensive reach, ability to offer patient counseling, and immediate drug availability reinforce their leading position in the distribution landscape.

Hospital pharmacies also play a vital role, particularly in administering diclofenac in inpatient and emergency settings. These pharmacies are crucial for providing immediate relief through injectable or intravenous forms of diclofenac, essential in acute care scenarios. Although their overall market share is smaller compared to retail pharmacies, their impact is significant on clinical outcomes.

The Online Pharmacy segment, while smaller, is rapidly growing due to the increasing consumer preference for convenience, privacy, and sometimes lower prices. This segment has been expanding its market presence, driven by technological advancements and the rising trend of telemedicine. Online pharmacies enhance the accessibility of diclofenac, particularly in remote or underserved areas, and are expected to gain a larger market share in the coming years.

The distribution of diclofenac through these channels reflects the diverse needs of the patient population and the evolving retail landscape. As consumer behaviors shift towards more digital interactions and health services, online pharmacies are poised to play an increasingly prominent role in the pharmaceutical distribution network.

Key Market Segments

By Type

- Tablet

- Solution

By Disease Indication

- Osteoarthritis

- Rheumatoid Arthritis

- Migraine

- Others

By Administration Route

- Oral

- Injection

- Topical Solution

- Sprays

- Patches

- Eye-Drops

- Others

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

Growth Opportunities

Development of Novel Formulation Techniques

The 2023 outlook for the global Diclofenac market is particularly bright with the advent of novel formulation techniques. Innovations such as the development of extended-release and transdermal formulations offer significant growth opportunities. These new formulations not only enhance the drug’s efficacy by improving its bioavailability but also reduce the frequency of dosing, thereby improving patient compliance.

Additionally, such advancements can mitigate some of the adverse effects associated with frequent NSAID usage, potentially expanding the drug’s user base. The evolution in formulation technology is expected to revitalize the market, making Diclofenac a more attractive option for both patients and healthcare providers.

Expansion into Emerging Markets with Unmet Medical Needs

Another substantial growth avenue for the Diclofenac market in 2023 is its expansion into emerging markets, which are characterized by large populations with unmet medical needs. Countries in regions such as Asia-Pacific and Africa, where healthcare systems are developing and the incidence of chronic diseases is rising, present lucrative opportunities for the introduction of affordable and effective pain management solutions like Diclofenac.

The increasing healthcare spending and growing awareness of treatment options in these markets are key drivers that can facilitate the market’s growth. By tapping into these new geographic regions, companies can not only increase their market share but also contribute positively to global health outcomes.

Latest Trends

Growth in Generic Drug Production

The global Diclofenac market in 2023 is significantly influenced by the increasing production of generic drugs. As patents on Diclofenac formulations expire, numerous pharmaceutical companies are entering the market with cost-effective generic versions. This trend is particularly prominent in high-demand regions where cost constraints affect drug accessibility.

The availability of generics not only makes treatment more affordable but also intensifies market competition, potentially driving down prices further. However, while generics enhance accessibility, they also thin profit margins for original manufacturers, influencing market dynamics by shifting focus towards volume over margin.

Increasing Investment in Biologics and Targeted Therapies

Simultaneously, there is a notable trend towards increasing investment in biologics and targeted therapies, which could potentially reshape the Diclofenac market. These advanced therapeutic forms offer more specific mechanisms of action and fewer side effects compared to traditional NSAIDs like Diclofenac.

As research and development in this area intensify, with substantial investments flowing into the development of biologics, it could lead to a shift in prescribing habits from traditional NSAIDs to these newer, more specialized treatments. While this might restrict the growth of the Diclofenac market, it also pushes manufacturers to innovate and perhaps integrate biological concepts into their NSAID development strategies to retain relevance.

Regional Analysis

The Diclofenac market in Asia Pacific dominates with a 35.5% share, valued at USD 1.5 billion.

North America is a significant player in the Diclofenac market, supported by advanced healthcare infrastructure and high awareness of pain management therapies. The region sees strong demand due to the high prevalence of chronic conditions such as arthritis. However, stringent regulatory frameworks and the rising adoption of biologics could slightly temper market growth.

Europe follows closely, with a well-established pharmaceutical sector and substantial investment in drug development. The presence of a large elderly population susceptible to chronic pain and the widespread acceptance of NSAIDs fuel demand in this region. European countries’ focus on healthcare cost containment might boost the generic sector, including Diclofenac generics.

Asia Pacific is the dominating region in the Diclofenac market, holding a 35.5% market share and valued at USD 1.5 billion. The region’s growth is propelled by increasing healthcare expenditure, rising awareness of pain management solutions, and growing populations. Additionally, the expansion of healthcare systems in countries like China and India presents significant opportunities for the Diclofenac market.

Middle East & Africa and Latin America are emerging as promising markets for Diclofenac, driven by gradual improvements in healthcare infrastructure and growing middle-class populations with access to medical care. These regions exhibit potential for high growth, although currently, they contribute less to the global market compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

Amneal Pharmaceuticals LLC and Aurobindo Pharma Limited are recognized for their robust generic drug offerings, helping to enhance market accessibility and affordability of Diclofenac, especially in cost-sensitive markets. Their strategic manufacturing and distribution capacities enable them to meet global demand efficiently.

Bayer AG and GSK plc, with their established brand reputation and extensive R&D capabilities, drive innovation in the Diclofenac market. Bayer, in particular, has been pivotal in developing new formulations that reduce gastrointestinal side effects associated with NSAIDs.

Cipla Inc. and Glenmark Pharmaceuticals Ltd are key players in emerging markets, particularly in Asia Pacific, which is the largest segment of the Diclofenac market. Their deep market penetration and understanding of regional healthcare needs make them critical to the growth in these areas.

Haleon Group of Companies, recently spun off from GSK, focuses on consumer healthcare, pushing the boundaries in the OTC segments which could redefine Diclofenac’s market reach and consumer engagement.

Novartis AG and Teva Pharmaceutical Industries Ltd leverage their global networks and substantial investment in biologics to offer integrated therapy solutions, where Diclofenac plays a part in broader treatment protocols.

Krosyl Pharmaceutical Pvt. Ltd, Octavius Pharma Pvt. Ltd, and Wellona Pharma are smaller, nimble companies that cater specifically to niche markets or innovative Diclofenac formulations, filling gaps left by the larger corporations.

Market Key Players

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Limited

- Bayer AG

- Cipla Inc

- GSK plc.

- GLENMARK PHARMACEUTICALS LTD

- Haleon Group of Companies

- krosyl pharmaceutical Pvt. Ltd

- Novartis AG

- Octavius Pharma Pvt. Ltd

- Teva Pharmaceutical Industries Ltd

- Wellona Pharma.

Recent Development

- In 2024, Amneal Pharmaceuticals LLC, monthly distribution continued at a steady pace with an average of 11,000 units per month, reflecting the ongoing demand and effective market penetration strategies employed by Amneal.

- In 2023, Aurobindo’s distribution of Diclofenac products demonstrated robust performance, averaging 15,000 units per month. The peak distribution occurred in April with 17,500 units, driven by increased demand.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Billion Forecast Revenue (2033) USD 6.4 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Tablet, Solution), By Disease Indication(Osteoarthritis, Rheumatoid Arthritis, Migraine, Others), By Administration Route(Oral, Injection, Topical Solution, Sprays, Patches, Eye-Drops, Others), By Distribution Channel(Online Pharmacy, Retail Pharmacy, Hospital Pharmacy) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amneal Pharmaceuticals LLC, Aurobindo Pharma Limited, Bayer AG, Cipla Inc, GSK plc., GLENMARK PHARMACEUTICALS LTD, Haleon Group of Companies, krosyl pharmaceutical Pvt. Ltd, Novartis AG, Octavius Pharma Pvt. Ltd, Teva Pharmaceutical Industries Ltd, Wellona Pharma. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Diclofenac Market Size in 2023?The Global Diclofenac Market Size is USD 4.2 Billion in 2023.

What is the projected CAGR at which the Global Diclofenac Market is expected to grow at?The Global Diclofenac Market is expected to grow at a CAGR of 4.3% (2024-2033).

List the segments encompassed in this report on the Global Diclofenac Market?Market.US has segmented the Global Diclofenac Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Tablet, Solution), By Disease Indication(Osteoarthritis, Rheumatoid Arthritis, Migraine, Others), By Administration Route(Oral, Injection, Topical Solution, Sprays, Patches, Eye-Drops, Others), By Distribution Channel(Online Pharmacy, Retail Pharmacy, Hospital Pharmacy)

List the key industry players of the Global Diclofenac Market?Amneal Pharmaceuticals LLC, Aurobindo Pharma Limited, Bayer AG, Cipla Inc, GSK plc., GLENMARK PHARMACEUTICALS LTD, Haleon Group of Companies, krosyl pharmaceutical Pvt. Ltd, Novartis AG, Octavius Pharma Pvt. Ltd, Teva Pharmaceutical Industries Ltd, Wellona Pharma.

Name the key areas of business for Global Diclofenac Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Diclofenac Market.

-

-

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Limited

- Bayer AG

- Cipla Inc

- GSK plc.

- GLENMARK PHARMACEUTICALS LTD

- Haleon Group of Companies

- krosyl pharmaceutical Pvt. Ltd

- Novartis AG

- Octavius Pharma Pvt. Ltd

- Teva Pharmaceutical Industries Ltd

- Wellona Pharma.