Global Stout Market Size, Share, And Business Benefit By Product Type (Dry/Irish Stout, Milk/Sweet Stout, Coffee and Chocolate Stout, Others), By Packafing Format (Keg/Cask, Glass Bottle, Aluminium Can), By Distribution Channel (On Trade, Off Trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164947

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

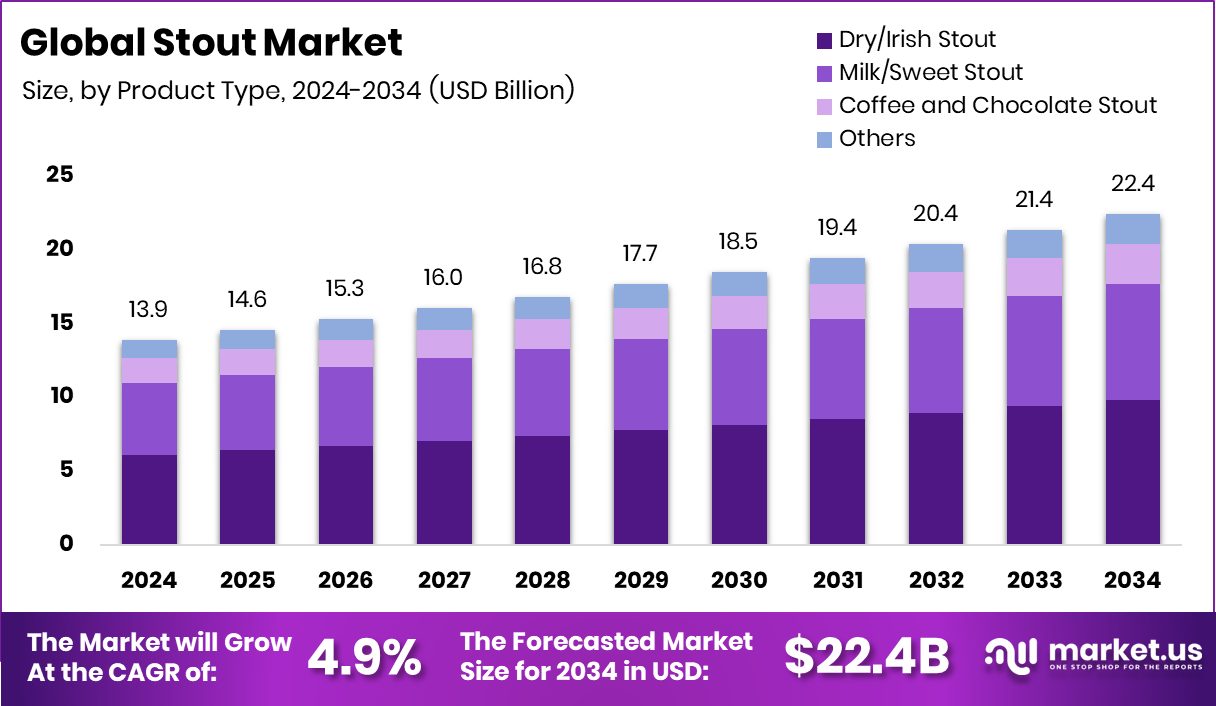

The Global Stout Market is expected to be worth around USD 22.4 billion by 2034, up from USD 13.9 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Europe’s 45.9% Share, leadership comes from its established brewing traditions and thriving premium stout culture.

Stout is a dark, rich beer style known for its deep flavors of roasted malt, coffee, and chocolate. It originated in England as a stronger version of porter beer, evolving into several variants such as dry stout, milk stout, and imperial stout. The drink is often associated with craft brewing culture and carries a premium image due to its complex taste and higher alcohol content.

The stout market represents a growing segment of the global beer industry, driven by rising demand for craft and specialty brews. Consumers today seek richer, more distinctive flavors, boosting the popularity of dark beers. Growth is supported by microbreweries and artisanal brands focusing on local and sustainable production. Innovative startups like Prefer and Voyage Foods, which raised $4.2 million and $52 million, respectively, are blending brewing traditions with sustainable alternatives such as bean-free cocoa and coffee.

One of the main growth factors is the increasing consumer shift toward premium and artisanal beverages. Demand for craft experiences and unique taste profiles has encouraged small brewers to innovate with natural ingredients and low-carbon processes. Investments such as Rage Coffee’s $5 million Series A round and Prefer’s $4.2 million funding showcase confidence in specialty beverage ventures that redefine brewing sustainability.

Urban millennials and younger adults are driving the surge in stout demand. Their preference for distinctive, locally crafted, and ethically produced drinks has shaped the industry’s direction. This trend aligns with the broader move toward eco-conscious consumption, where plant-based and carbon-reduced beverages find strong appeal.

The future holds vast opportunities for sustainable brewing and crossover innovations blending coffee, cocoa, and stout-inspired beverages. Financing commitments like Clarmondial’s $300 million for coffee and cocoa and Voyage Foods’ $52 million funding highlight strong investor focus on sustainable beverage chains. These initiatives will likely accelerate global expansion and encourage low-emission production models within the stout ecosystem.

Key Takeaways

- The Global Stout Market is expected to be worth around USD 22.4 billion by 2034, up from USD 13.9 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- Dry/Irish Stout dominates the Stout Market with 43.9%, favored for its smooth roasted flavor.

- Keg and cask formats lead the Stout Market with 39.7%, ensuring freshness and quality retention.

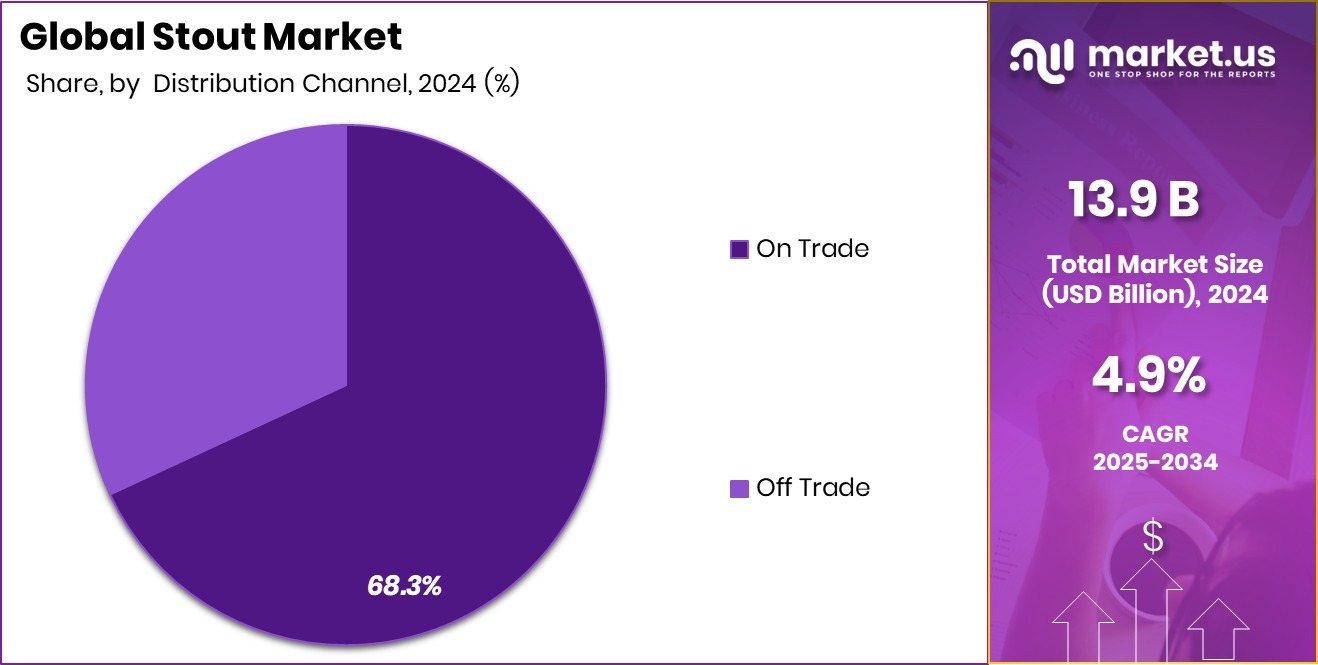

- On-trade channels account for 68.3% of the Stout Market, led by pubs and restaurants.

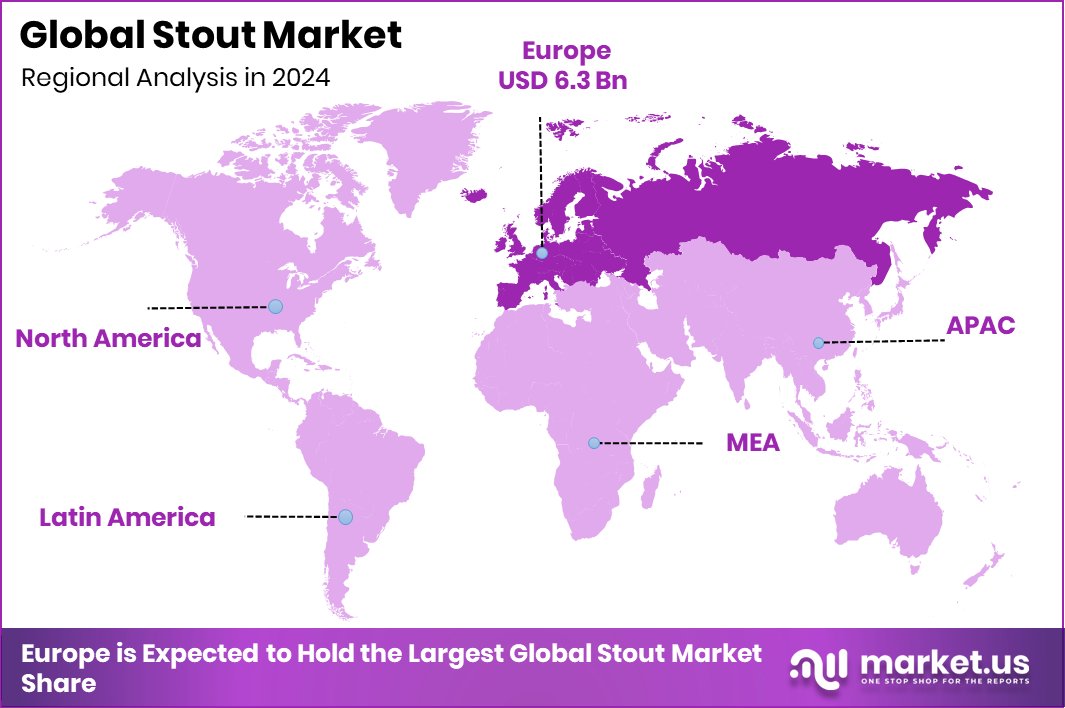

- The European market was valued at USD 6.3 billion, reflecting strong consumer demand.

By Product Type Analysis

The Stout Market sees a strong preference for dry/Irish stout at 43.9%.

In 2024, Dry/Irish Stout held a dominant market position in the By Product Type segment of the Stout Market, with a 43.9% share. This category maintained a strong consumer preference due to its smooth texture, roasted malt aroma, and balanced bitterness. Its classic profile continues to attract both traditional beer drinkers and craft enthusiasts across major markets.

The segment’s dominance also reflects its established cultural heritage, consistent demand in pubs and breweries, and adaptability in evolving beverage trends. The increasing inclination toward full-bodied, flavor-rich beers further reinforces the leadership of Dry/Irish Stout, positioning it as the core driver of overall market growth and a benchmark for quality and authenticity within the stout segment.

By Packaging Format Analysis

Keg and cask formats hold a 39.7% share in the stout market.

In 2024, Keg/Cask held a dominant market position in the By Packaging Format segment of the Stout Market, with a 39.7% share. This dominance was primarily supported by the strong presence of draught stout in pubs, taprooms, and breweries, where freshness and flavor preservation are key. Keg and cask formats allow optimal carbonation and consistent taste, making them preferred choices for premium and craft stout offerings.

Their continued use in hospitality venues also supports the traditional pub culture that defines stout consumption. The segment’s leadership reflects its role in maintaining quality, consumer loyalty, and on-trade sales momentum, reinforcing keg/cask as the most influential packaging format in the global stout industry.

By Distribution Channel Analysis

On-trade channels dominate the stout market, contributing 68.3% of total sales.

In 2024, On Trade held a dominant market position in the By Distribution Channel segment of the Stout Market, with a 39.7% share. This dominance was driven by the strong presence of stouts in bars, pubs, and restaurants, where draught formats and freshly poured beverages remain highly popular. The on-trade channel benefits from consumer preference for social drinking experiences and the authentic taste of tap-served stout.

Breweries continue to strengthen ties with hospitality outlets to ensure quality consistency and brand visibility. The segment’s leadership highlights the cultural significance of stout consumption in social settings, making On Trade the cornerstone for volume growth and customer engagement across the global stout market.

Key Market Segments

By Product Type

- Dry/Irish Stout

- Milk/Sweet Stout

- Coffee and Chocolate Stout

- Others

By Packafing Format

- Keg/Cask

- Glass Bottle

- Aluminium Can

By Distribution Channel

- On Trade

- Off Trade

Driving Factors

Rising Demand for Premium and Craft Beverages

A major driving factor for the Stout Market is the growing global demand for premium and craft beverages. Consumers, especially younger demographics, are showing strong interest in rich, flavor-driven drinks that offer unique experiences beyond mass-produced lagers. Stout’s bold character, roasted aroma, and smooth finish appeal to those seeking authenticity and quality in their beverages.

The rise of craft breweries and local brewpubs has further fueled this shift by offering experimental stout varieties that highlight regional ingredients and sustainable brewing practices. As disposable incomes rise and social drinking cultures expand, consumers are more willing to pay for artisanal stout products, pushing breweries to innovate and diversify their offerings within this evolving premium segment.

Restraining Factors

Limited Shelf Life and Storage Challenges

One key restraining factor for the Stout Market is its limited shelf life and sensitivity to storage conditions. Stout, being a rich and dark beer with specific carbonation levels, requires careful temperature control to maintain its flavor and quality. When stored improperly, it can lose its aroma, develop off-flavors, or experience oxidation, reducing its appeal to consumers. This makes logistics and distribution more complex, especially for small and craft brewers aiming to expand globally.

Retailers also face challenges in maintaining product freshness, particularly in warm climates or regions with less-developed cold-chain infrastructure. These storage and transportation issues increase operational costs and limit Stout’s availability in emerging markets, restraining broader commercial growth despite strong demand potential.

Growth Opportunity

Expansion Through Sustainable and Innovative Brewing Practices

A major growth opportunity for the Stout Market lies in adopting sustainable and innovative brewing practices. Consumers are increasingly drawn to eco-friendly production methods, natural ingredients, and low-carbon beverages that align with global sustainability goals.

Breweries experimenting with renewable energy, waste reduction, and alternative ingredients such as plant-based or bean-free cocoa and coffee are capturing strong interest. This shift not only enhances brand reputation but also opens new markets among environmentally conscious consumers.

Additionally, innovations in flavor development and hybrid products—such as coffee-infused or chocolate stouts—allow brewers to attract wider audiences. Embracing sustainability in production and packaging can help breweries strengthen market positioning while supporting the global transition toward greener beverage manufacturing.

Latest Trends

Rising Popularity of Coffee and Chocolate Stouts

One of the latest trends in the Stout Market is the growing popularity of coffee and chocolate-infused stouts. Consumers are increasingly drawn to rich, dessert-like flavors that combine the roasted bitterness of coffee with the smooth sweetness of cocoa. This fusion not only enhances the drinking experience but also appeals to both traditional beer lovers and new-age craft beverage enthusiasts.

Breweries are experimenting with locally sourced coffee beans and premium chocolates to create distinctive flavor profiles. These specialty stouts are becoming popular in pubs, restaurants, and seasonal releases, reflecting a shift toward indulgent yet sophisticated taste experiences. This trend highlights how innovation in flavor blending continues to redefine stout’s global appeal and consumer reach.

Regional Analysis

In 2024, Europe dominated the Stout Market with a 45.9% share.

In 2024, Europe held a dominant market position in the global Stout Market, accounting for 45.9% of the total share, valued at USD 6.3 billion. The region’s leadership is supported by its strong brewing heritage, large base of established beer consumers, and a vibrant craft beer culture in countries such as Ireland, the UK, and Germany.

North America follows with growing demand for premium and locally brewed stouts driven by the expanding microbrewery sector. The Asia Pacific region is witnessing steady growth as urban consumers increasingly adopt Western-style beverages and premium dark beers.

Meanwhile, the Middle East & Africa and Latin America markets are gradually emerging, supported by changing lifestyle patterns and the rising acceptance of international beverage trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Carlsberg Breweries A/S continued to strengthen its presence in the stout market by expanding its premium and craft beer portfolio. The company’s strategy focused on sustainability and innovation, enhancing its production efficiency through low-carbon brewing technologies and recyclable packaging. Carlsberg’s focus on European and Asian markets allowed it to maintain a strong distribution network while promoting locally inspired stout variants that appeal to evolving consumer preferences.

Asahi Group Holdings Ltd. demonstrated steady growth in the stout segment by combining its traditional brewing expertise with contemporary flavor innovations. The company emphasized high-quality ingredients and consistency across its premium product lines. With an increasing global footprint, Asahi leveraged its Asian base to tap into emerging markets where stout consumption is growing, particularly among younger urban consumers.

Heineken N.V. maintained its reputation as a global brewing leader through diversification in its dark beer portfolio. The company invested in marketing campaigns that celebrated craftsmanship and authenticity, positioning its stouts as both premium and accessible. Heineken’s global supply chain strength and regional collaborations helped expand its stout reach across Europe and North America, reflecting a balanced strategy of tradition and modernization within the evolving global stout market landscape.

Top Key Players in the Market

- Carlsberg Breweries A/S

- Asahi Group Holdings Ltd.

- Heineken N.V.

- Anheuser-Busch InBev SA/NV

- Kirin Brewery Co. Ltd.

- Diageo plc

- Molson Coors Beverage Co.

- The Boston Beer Co. Inc.

- Stone Brewing Co.

Recent Developments

- In March 2025, Asahi’s food and fermentation subsidiary, Asahi Group Foods, Ltd., signed an agreement on 5 March to acquire 100% of shares in Leiber GmbH by the end of April. Leiber, based in Germany, is a brewer’s yeast-related products company with six factories across Germany, Spain, and Poland. This acquisition strengthens Asahi’s yeast and fermentation ingredients business.

- In November 2024, Heineken’s Cambodia subsidiary launched a new stout called “ABC Smooth Stout” in the Cambodian market. The product aims to bring a smoother, premium dark beer experience to local consumers, reinforcing stout offerings in that region. Source: Heineken Cambodia announcement.

Report Scope

Report Features Description Market Value (2024) USD 13.9 Billion Forecast Revenue (2034) USD 22.4 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dry/Irish Stout, Milk/Sweet Stout, Coffee and Chocolate Stout, Others), By Packafing Format (Keg/Cask, Glass Bottle, Aluminium Can), By Distribution Channel (On Trade, Off Trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Carlsberg Breweries A/S, Asahi Group Holdings Ltd., Heineken N.V., Anheuser-Busch InBev SA/NV, Kirin Brewery Co. Ltd., Diageo plc, Molson Coors Beverage Co., The Boston Beer Co. Inc., Stone Brewing Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carlsberg Breweries A/S

- Asahi Group Holdings Ltd.

- Heineken N.V.

- Anheuser-Busch InBev SA/NV

- Kirin Brewery Co. Ltd.

- Diageo plc

- Molson Coors Beverage Co.

- The Boston Beer Co. Inc.

- Stone Brewing Co.