Global Starch Derivatives Market Size, Share, And Business Benefits By Form (Dry, Liquid), By Raw Material (Corn, Cassava, Potato, Wheat, Others), By Product (Maltodextrin, Glucose syrup, Cyclodextrin, Hydrolysates, Modified starc, Others), By Application (Food and Beverages, Cosmetics, Paper, Pharmaceuticals, Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152778

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

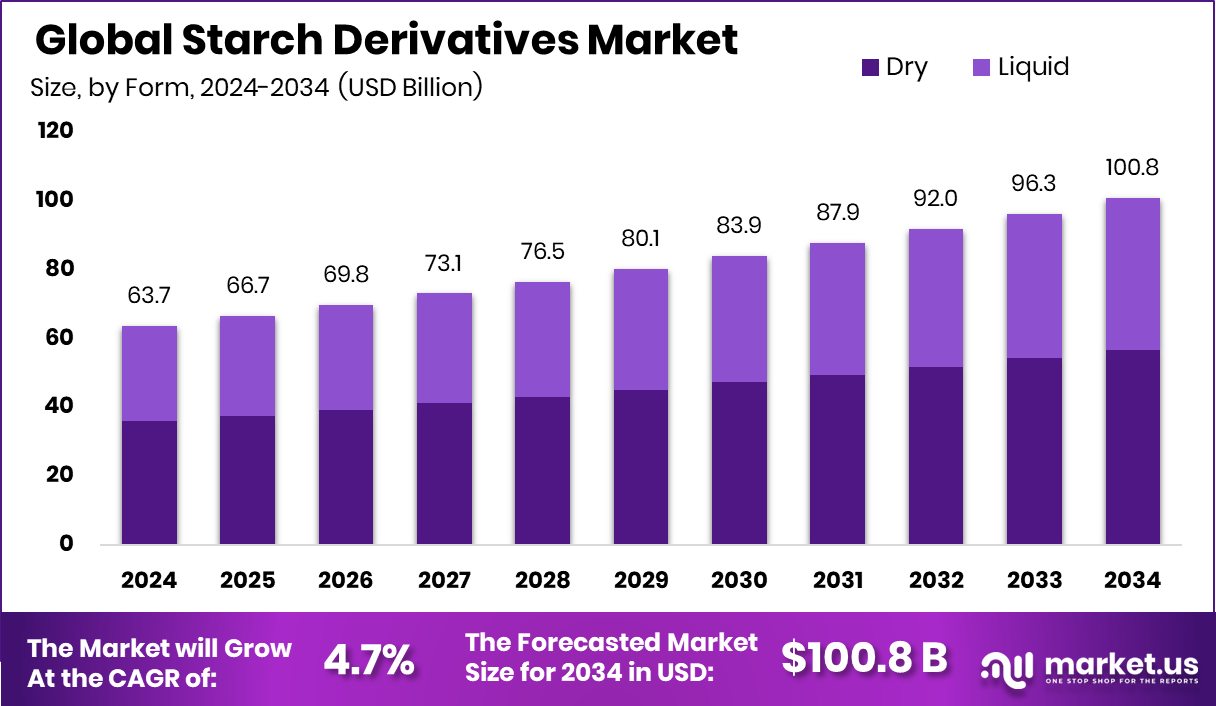

Global Starch Derivatives Market is expected to be worth around USD 100.8 billion by 2034, up from USD 63.7 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. North America remains the top region with a 47.20% share and USD 30.0 billion.

Starch derivatives are modified forms of starch that are processed through physical, enzymatic, or chemical means to enhance their performance in various industrial and food applications. These derivatives—such as maltodextrin, glucose syrup, hydrolysates, and modified starch—are designed to improve solubility, stability, texture, and shelf life. Extracted mainly from corn, potato, wheat, or tapioca, starch derivatives are widely used in food processing, pharmaceuticals, cosmetics, textiles, and paper industries due to their functional versatility and ease of formulation.

The starch derivatives market refers to the global industry involved in the production, distribution, and utilization of these processed starch products across multiple sectors. The market is shaped by the growing demand for functional ingredients, clean-label food solutions, and sustainable alternatives to synthetic chemicals.

The market growth is driven primarily by rising demand for processed and convenience foods, where starch derivatives serve as thickeners, stabilizers, and sweeteners. Increased health awareness has also led to higher demand for low-calorie and sugar-replacement products, further boosting the usage of starch-based ingredients in food formulations.

Demand is further reinforced by the pharmaceutical and personal care sectors. In drug formulations, starch derivatives are used as disintegrants and fillers, while in cosmetics, they offer natural binding, moisturizing, and absorbent properties. These functional attributes make starch derivatives increasingly preferred over synthetic counterparts, especially as consumers lean toward naturally derived ingredients.

Key Takeaways

- Global Starch Derivatives Market is expected to be worth around USD 100.8 billion by 2034, up from USD 63.7 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- In the starch derivatives market, the dry form dominates with a 56.3% share due to handling ease.

- Corn-based starch derivatives lead with a 67.2% share, driven by their wide availability and low processing cost.

- Maltodextrin accounts for 34.8% of the starch derivatives market due to its versatility in food formulations.

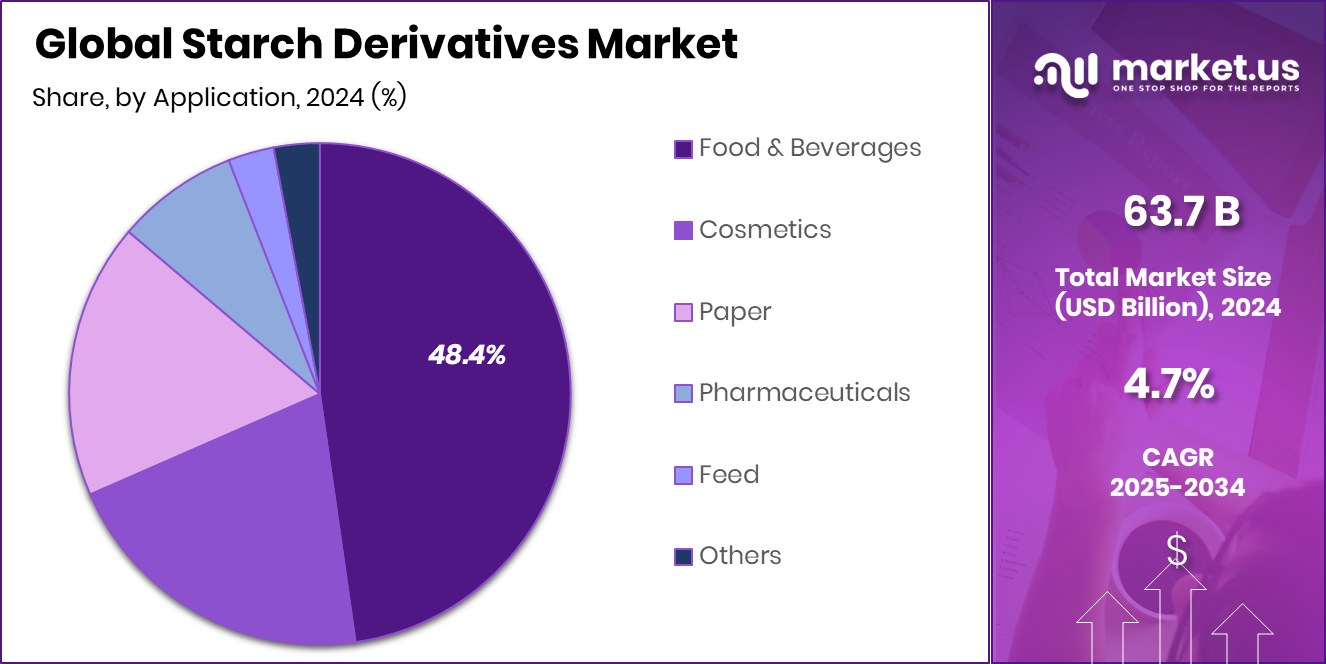

- The food and beverages segment holds a 48.4% share, reflecting strong demand for thickeners and stabilizers globally.

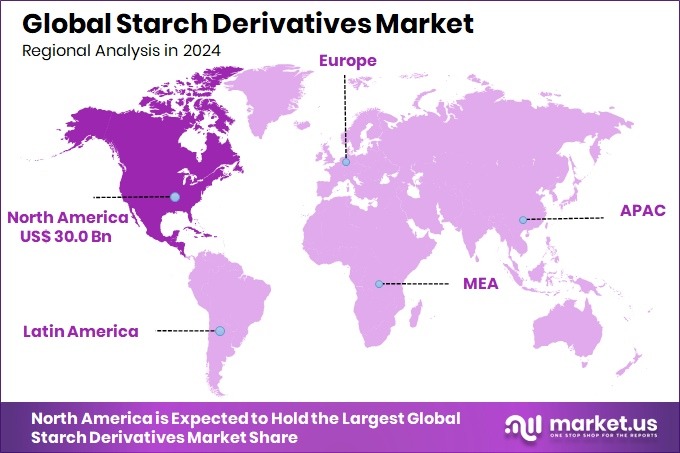

- The North American starch derivatives market was valued at USD 30.0 billion.

By Form Analysis

Starch Derivatives Market sees 56.3% share from dry form.

In 2024, Dry held a dominant market position in the By Form segment of the Starch Derivatives Market, with a 56.3% share. This strong preference for the dry form can be attributed to its ease of storage, longer shelf life, and cost-effective transportation compared to liquid alternatives. Dry starch derivatives are widely favored across food processing, pharmaceuticals, and industrial applications due to their better handling properties, uniform dispersion, and stable performance in various formulations.

The food industry, in particular, benefits from dry starch derivatives as they serve key functional roles such as thickening, binding, and emulsifying, without requiring refrigeration or specialized storage conditions. Moreover, manufacturers in the pharmaceutical and textile sectors utilize dry starch forms for tablet binding, disintegration, and surface finishing, respectively, due to their stable granular structure and compatibility with dry blending processes.

Additionally, dry starch derivatives offer greater flexibility in dosage and usage, enabling end-users to tailor their formulations with precision. This operational convenience, along with reduced logistical challenges, supports their high demand in both developed and emerging markets.

By Raw Material Analysis

Corn dominates Starch Derivatives Market, contributing 67.2% raw material share.

In 2024, Corn held a dominant market position in the By Raw Material segment of the Starch Derivatives Market, with a 67.2% share. The leading position of corn as a raw material is primarily supported by its widespread availability, high starch content, and cost-efficiency in large-scale production. Corn-based starch derivatives are extensively used across key end-use industries due to their consistent quality, process adaptability, and functional performance in both food and non-food applications.

Food manufacturers prefer corn-derived starches for producing sweeteners, thickeners, and stabilizers that meet the rising demand for processed foods, beverages, and low-calorie alternatives. In industrial applications, corn starch derivatives are valued for their ability to enhance product texture, binding strength, and shelf stability, making them suitable for use in pharmaceuticals, paper manufacturing, textiles, and adhesives.

The 67.2% share held by corn in this segment reflects its dominance not only in volume but also in value, due to its favorable processing properties and versatility. This position is expected to remain strong as global industries continue to favor scalable and efficient starch sources that align with evolving consumer and production demands.

By Product Analysis

Maltodextrin leads with 34.8% in the starch derivatives product segment.

In 2024, Maltodextrin held a dominant market position in the By Product segment of the Starch Derivatives Market, with a 34.8% share. This leading position can be attributed to maltodextrin’s extensive use across various industries due to its neutral taste, high solubility, and functional versatility. Its ability to act as a filler, thickener, and stabilizer makes it a widely adopted ingredient, particularly in the food and beverage sector, where it enhances texture, controls sweetness, and improves shelf stability.

The demand for maltodextrin is also driven by its ease of incorporation in powdered formulations, making it suitable for instant food mixes, nutritional supplements, and powdered beverages. Its role in improving mouthfeel and extending product shelf life further contributes to its dominance in the market. Additionally, maltodextrin’s compatibility with a wide range of ingredients and its ability to carry flavors and colors enhance its utility in processed foods.

Pharmaceutical and personal care industries also utilize maltodextrin for its binding and film-forming properties, supporting its wide-scale adoption. The 34.8% share in 2024 highlights maltodextrin’s strong positioning as a reliable, multifunctional starch derivative that continues to meet the evolving formulation needs across commercial and industrial applications.

By Application Analysis

Food and beverages application holds 48.4% Starch Derivatives Market share.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Starch Derivatives Market, with a 48.4% share. This leading share reflects the widespread use of starch derivatives in processed foods, bakery products, confectioneries, beverages, and dairy formulations. Starch derivatives, particularly in the form of thickeners, stabilizers, and sweeteners, are essential for improving texture, enhancing shelf life, and achieving desired consistency in food products.

The rising demand for convenient and ready-to-eat foods has further accelerated the use of starch derivatives in food processing. Their ability to replace fats and sugars in low-calorie and diet-specific food items also aligns with changing consumer preferences toward healthier alternatives. In beverages, these derivatives help in stabilizing emulsions and improving mouthfeel, making them suitable for a wide range of applications, including instant drinks and flavored milk.

The 48.4% share held by the Food and Beverages segment confirms its role as the primary consumer of starch-based ingredients, driven by both functional benefits and consumer-driven innovation. As food manufacturers continue to reformulate products to meet clean-label trends and dietary shifts, the demand for reliable and versatile starch derivatives is expected to remain robust within this segment.

Key Market Segments

By Form

- Dry

- Liquid

By Raw Material

- Corn

- Cassava

- Potato

- Wheat

- Others

By Product

- Maltodextrin

- Glucose syrup

- Cyclodextrin

- Hydrolysates

- Modified starch

- Others

By Application

- Food and Beverages

- Cosmetics

- Paper

- Pharmaceuticals

- Feed

- Others

Driving Factors

Rising Demand for Processed and Convenience Foods

One of the main driving factors of the starch derivatives market is the growing global demand for processed and convenience foods. As lifestyles become busier and urban populations rise, consumers are increasingly seeking ready-to-eat, packaged, and shelf-stable food products. Starch derivatives such as maltodextrin, glucose syrup, and modified starches are widely used in these products for their functional benefits.

They help improve texture, enhance flavor stability, increase shelf life, and act as thickeners or stabilizers. These ingredients also make food preparation quicker and more efficient for manufacturers. This shift in food consumption habits, especially in developing regions, continues to push the use of starch derivatives in food processing and is expected to support sustained market growth.

Restraining Factors

Fluctuating Raw Material Prices Affecting Production Costs

A key restraining factor in the starch derivatives market is the fluctuation in raw material prices, especially corn, wheat, and potatoes. These agricultural commodities are highly sensitive to changes in climate conditions, seasonal yield variations, and global supply-demand imbalances. Additionally, market volatility due to geopolitical issues, trade restrictions, and rising transportation costs can lead to unpredictable pricing.

For manufacturers of starch derivatives, such instability increases production costs and reduces profit margins. This creates challenges in pricing strategies, particularly in price-sensitive markets. Inconsistent raw material supply also disrupts the continuity of production, impacting the timely delivery of finished products.

Growth Opportunity

Growing Demand for Clean Label Food Ingredients

A major growth opportunity in the starch derivatives market lies in the increasing demand for clean-label food ingredients. Consumers are becoming more aware of what goes into their food and are actively choosing products with simple, natural, and recognizable components. Starch derivatives made from plant-based sources such as corn and potatoes align well with this trend, especially when they are minimally processed and free from artificial additives.

Food manufacturers are now reformulating products to meet clean label requirements, which boosts the demand for functional yet natural ingredients like maltodextrin and modified starch. This shift toward transparency, health-conscious eating, and natural formulation offers a strong opportunity for starch derivative producers to expand into health-focused and premium food segments globally.

Latest Trends

Rising Use of Starch Derivatives in Bioplastics

A current and notable trend in the starch derivatives market is the increasing use of these compounds in bioplastic production. With growing attention to plastic pollution and environmental impact, manufacturers are exploring bio-based alternatives to traditional plastics.

Starch derivatives such as modified starch and maltodextrin are being blended with biopolymers to form compostable films, loose-fill packaging, and biodegradable containers. These starch-based bioplastics offer a renewable and reduced-waste option, attractive to eco-conscious brands and consumers.

Their functional properties—such as film strength, flexibility, and water resistance—can be improved through chemical and enzymatic modification. This trend reflects a strategic shift in materials science and packaging innovation and presents a promising path for starch derivative applications outside conventional food and industrial uses.

Regional Analysis

In North America, starch derivatives held 47.20% market share in 2024.

In 2024, North America emerged as the leading region in the starch derivatives market, capturing a dominant 47.20% share, equivalent to a market value of USD 30.0 billion. The region’s stronghold can be attributed to the high demand for processed foods, advanced food manufacturing infrastructure, and the extensive use of starch derivatives in pharmaceuticals and industrial applications.

The United States, in particular, has a mature and technologically advanced food sector, which drives consistent consumption of products such as maltodextrin and glucose syrup for use as sweeteners, stabilizers, and thickeners.

While North America leads the market, other regions also show notable participation. Europe continues to maintain a strong presence, supported by its well-established food processing and cosmetic industries. Asia Pacific is emerging as a fast-growing market due to changing dietary habits and increased consumption of convenience foods, particularly in countries like China and India.

Meanwhile, the Middle East & Africa and Latin America represent developing markets where starch derivatives are gradually gaining traction, driven by industrial expansion and population growth. However, based on the current data, North America remains the dominating region in the global starch derivatives landscape, holding nearly half of the total market share, underlining its strategic importance to industry stakeholders.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global starch derivatives market was significantly shaped by the strategic activities of three key industry players: Avebe U.A., Cargill Incorporated, and Emsland Group. Their respective roles, capabilities, and positioning offer insights into the current and future dynamics of the market.

Avebe U.A. has established a renowned reputation for producing high-quality, plant-based starch derivatives. Through its focus on sustainable sourcing and innovations in potato-based products, the company meets rising global demand for clean-label ingredients. Avebe’s extensive European supply chain and strong partnerships in the food, pharmaceutical, and industrial sectors enable it to maintain consistent delivery and strong market presence.

Cargill Incorporated operates as a global powerhouse, offering a broad portfolio of starch derivatives including maltodextrin, glucose syrup, and modified starch. The company’s worldwide manufacturing footprint and integrated upstream operations allow for efficient cost management and flexible production scaling. As consumer trends emphasize natural, functional ingredients, Cargill’s research-driven approach and ability to tailor starch solutions across food, beverage, and non-food sectors strengthen its market leadership.

Emsland Group, with its specialization in potato-based starches and derivatives, occupies a distinct niche. The company leverages focused expertise to deliver customized solutions for both industrial and food-grade applications. Emsland’s investment in specialized processing technologies enhances the versatility and performance of its products.

Top Key Players in the Market

- Agrana Group

- Archer Daniels Midland Company

- Asia Modified Starch Co., Ltd (AMSCO)

- Avebe U.A.

- Cargill Incorporated

- Emsland Group

- Foodchem International Corporation

- Ingredion Incorporated

- JP & SB International

- Roquette Frères

- ShreeGluco Biotech Private Ltd.

- Tate & Lyle PLC

- Tereos S.A.

Recent Developments

- In September 2024, Agrana Stärke GmbH (a subsidiary of Agrana Group) signed a joint venture agreement with Ingredion Germany GmbH in Romania to strengthen its starch derivative production capabilities in Eastern Europe.

- In July 2024, ADM completed the purchase of a non‑GMO corn crush and starch extraction facility in Hungary for $123 million. This acquisition expands ADM’s capacity in starch derivative manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 63.7 Billion Forecast Revenue (2034) USD 100.8 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry, Liquid), By Raw Material (Corn, Cassava, Potato, Wheat, Others), By Product (Maltodextrin, Glucose syrup, Cyclodextrin, Hydrolysates, Modified starc, Others), By Application (Food and Beverages, Cosmetics, Paper, Pharmaceuticals, Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agrana Group, Archer Daniels Midland Company, Asia Modified Starch Co., Ltd (AMSCO), Avebe U.A., Cargill Incorporated, Emsland Group, Foodchem International Corporation, Ingredion Incorporated, JP & SB International, Roquette Frères, ShreeGluco Biotech Private Ltd., Tate & Lyle PLC, Tereos S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agrana Group

- Archer Daniels Midland Company

- Asia Modified Starch Co., Ltd (AMSCO)

- Avebe U.A.

- Cargill Incorporated

- Emsland Group

- Foodchem International Corporation

- Ingredion Incorporated

- JP & SB International

- Roquette Frères

- ShreeGluco Biotech Private Ltd.

- Tate & Lyle PLC

- Tereos S.A.