Global Soy Milk Market By Type (Flavored, Unflavored), By Category (Conventional, Organic), By Application (Ice Creams, Desserts, Yoghurt, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Health Food Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151822

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

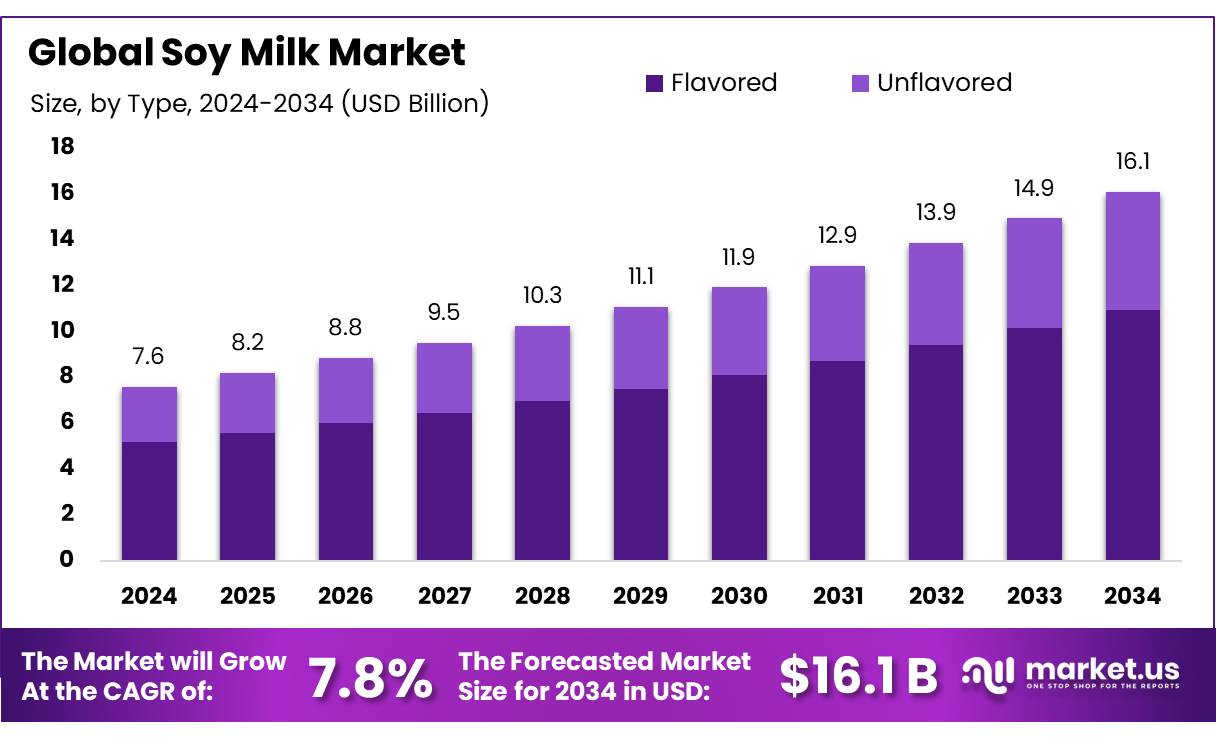

The Global Soy Milk Market size is expected to be worth around USD 16.1 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The soy milk concentrates industry encompasses the processing of defatted soy flour into concentrated soy proteins—namely soy protein concentrate (SPC)—used in beverages, meat and dairy alternatives, bakery goods, nutraceuticals, and animal feed. Production typically involves solvent extraction and membrane filtration to remove soluble carbohydrates, yielding products with approximately 65–90% protein content. As a key ingredient in soy milk concentrates, these protein-rich powders or liquids deliver functional benefits such as emulsification and water retention in diverse food matrices.

According to the Province of Manitoba’s report, in 2021, the global soy protein concentrate market reached approximately 563,000-tonnes, with North America accounting for over 204,000 tonnes, and total volumes projected to reach 664,000-tonnes by 2027, marking an 18% increase relative to 2021. This volume supply underpins the production of soy milk concentrates, which are used extensively in food formulations to provide protein functionality and nutrition.

Technological advancements are also contributing to the industry’s growth. The Indian Council of Agricultural Research (ICAR) has developed an automatic soymilk plant with a capacity of 100 liters per hour, designed to increase production efficiency and reduce labor costs. Such innovations are making soy milk production more accessible to small and medium enterprises.

Several governments have launched initiatives to foster plant-based protein sectors. For instance, the Indian Food Safety and Standards Authority (FSSAI) regulates labelling to accommodate plant-based milks, allowing ‘non dairy milk’ while restricting dairy terms. In Brazil, soy is a key agricultural export—over 131 million tons were produced in 2020—positioning the country as a principal soy concentrate supplier.

Government initiatives have reinforced market expansion. The U.S. Department of Agriculture’s Agricultural Research Service (USDAARS) released a soybean germplasm variant (USDAN5001) with 2–3% higher protein content to support SPC production and improve competitiveness. In Canada, the establishment of “Class7” industrial milk pricing in 2017 has similarly incentivized domestic production of milk protein concentrates, reinforcing the broader shift to protein-rich alternatives

Key Takeaways

- Soy Milk Market size is expected to be worth around USD 16.1 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 7.8%.

- Flavored held a dominant market position, capturing more than a 67.9% share of the global soy milk market.

- Conventional held a dominant market position, capturing more than a 79.1% share of the global soy milk market.

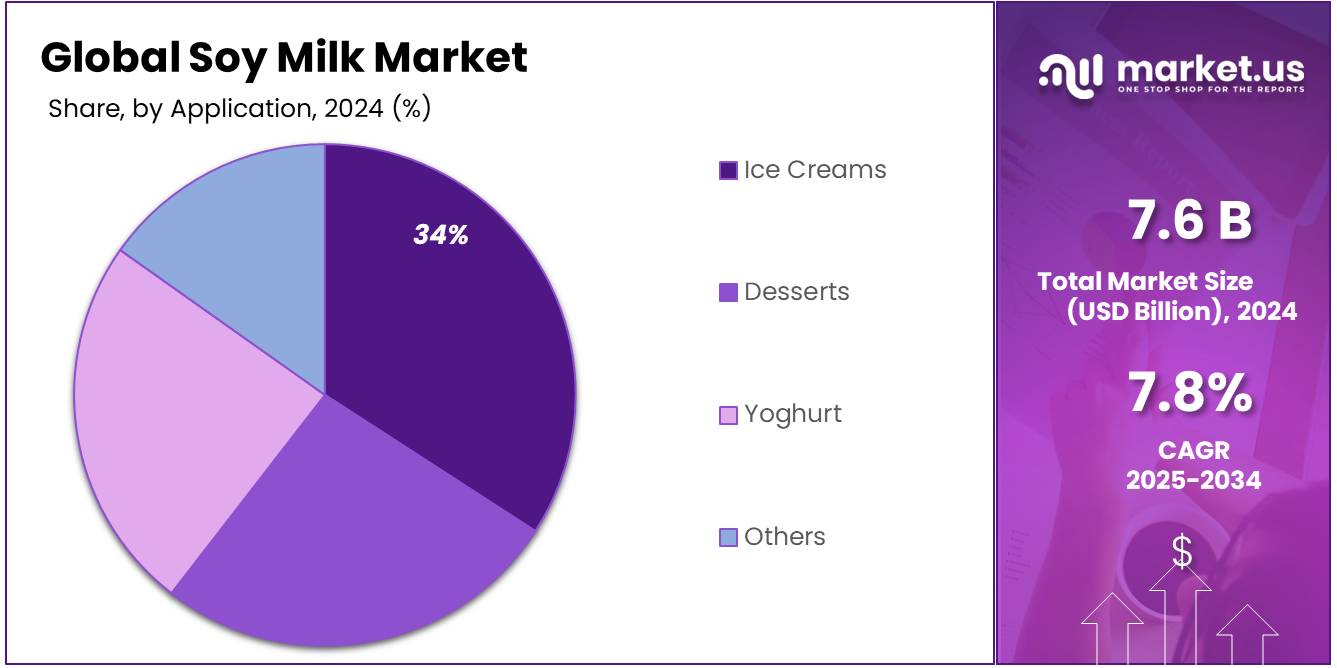

- Ice Creams held a dominant market position, capturing more than a 33.7% share in the global soy milk market.

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 47.3% share of the global soy milk market.

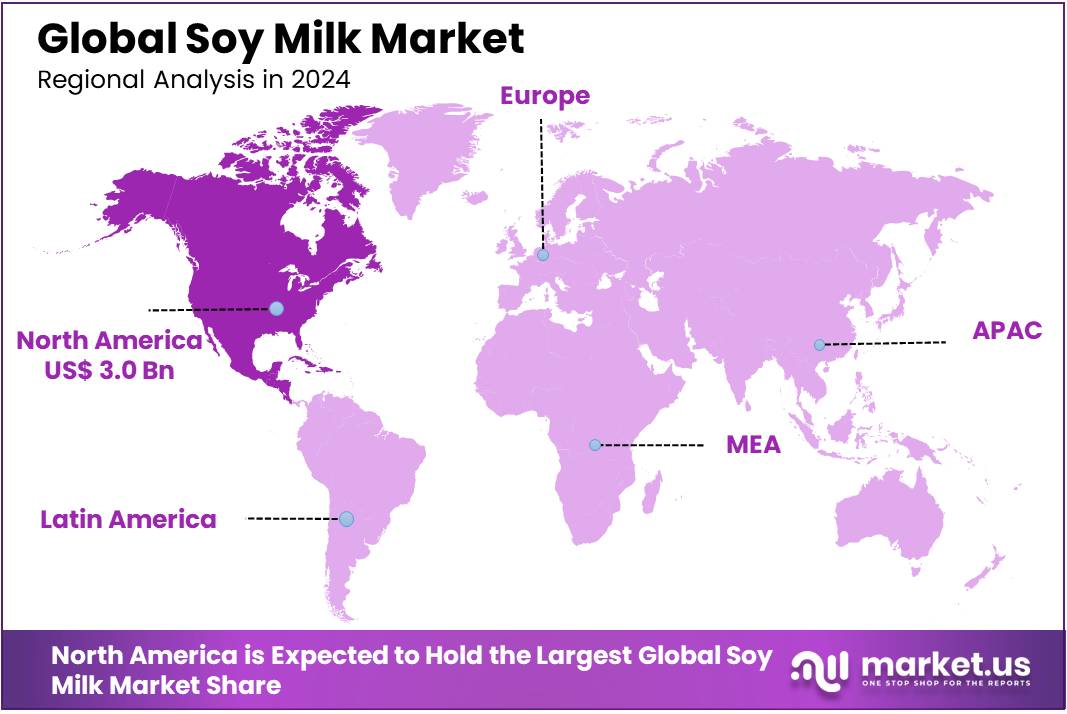

- North America emerged as the dominant region in the global soy milk market, capturing approximately 39.5% of the total market share, with a market value reaching USD 3.0 billion.

By Type

Flavored Soy Milk dominates with 67.9% share in 2024, driven by taste appeal and consumer preference.

In 2024, Flavored held a dominant market position, capturing more than a 67.9% share of the global soy milk market. This strong lead can be attributed to the rising consumer inclination toward taste-enhanced plant-based beverages that offer both nutrition and flavor. Flavored soy milk options—such as vanilla, chocolate, and strawberry—have successfully expanded the consumer base beyond traditional health-conscious buyers, attracting children, teenagers, and casual consumers who prefer sweetened and palatable dairy alternatives.

The availability of flavored variants in convenient packaging formats such as single-serve cartons and ready-to-drink bottles has further fueled adoption, particularly among urban working populations and on-the-go consumers. The inclusion of added nutrients such as calcium, vitamin D, and B12 in these products has also boosted their appeal, aligning with the growing demand for fortified plant-based beverages.

By Category

Conventional Soy Milk leads with 79.1% share in 2024, supported by easy availability and lower cost.

In 2024, Conventional held a dominant market position, capturing more than a 79.1% share of the global soy milk market. This segment continues to outperform due to its broad accessibility, lower production cost, and widespread consumer acceptance across both developed and developing regions. Unlike organic variants, conventional soy milk is more competitively priced, making it a preferred choice for cost-sensitive consumers, especially in mass retail and food service channels.

Conventional soy milk is widely distributed through supermarkets, convenience stores, and online platforms, allowing it to maintain strong visibility and shelf presence. Its use in everyday applications—such as breakfast cereals, coffee blends, smoothies, and cooking—has made it a staple in many households. The segment also benefits from consistent supply chains and well-established processing methods that keep production scalable and prices relatively stable.

By Application

Soy-Based Ice Creams dominate with 33.7% share in 2024, fueled by rising demand for dairy-free indulgence.

In 2024, Ice Creams held a dominant market position, capturing more than a 33.7% share in the global soy milk market by application. This strong performance is largely driven by the growing popularity of plant-based frozen desserts among lactose-intolerant consumers, vegans, and health-conscious individuals seeking dairy-free alternatives without compromising on taste or texture. As consumer interest in sustainable and animal-free products continues to rise, soy milk has emerged as a preferred base for non-dairy ice creams due to its creamy consistency and high protein content.

The segment has seen rapid innovation, with manufacturers introducing a wide variety of flavors—from classic vanilla and chocolate to more adventurous combinations like salted caramel and matcha—catering to a diverse consumer base. Soy-based ice creams have also gained traction in food service outlets, specialty dessert chains, and supermarket freezers, making them easily accessible to mainstream buyers.

By Distribution Channel

Supermarkets and Hypermarkets lead with 47.3% share in 2024, driven by strong shelf presence and consumer trust.

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 47.3% share of the global soy milk market by distribution channel. This leadership is primarily due to their wide product variety, convenience of access, and established reputation as trusted retail spaces for health and grocery products. These stores offer consumers the opportunity to compare multiple soy milk brands, flavors, and packaging sizes in one place, making it easier to make informed buying decisions.

The prominence of supermarkets and hypermarkets in urban and semi-urban regions has further supported the segment’s growth, as more health-conscious and time-sensitive shoppers prefer physical stores for their weekly or monthly grocery runs. Promotions, in-store tastings, and visibility in refrigerated sections have also played a key role in encouraging trial and repeat purchases of soy milk products.

Key Market Segments

By Type

- Flavored

- Unflavored

By Category

- Conventional

- Organic

By Application

- Ice Creams

- Desserts

- Yoghurt

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Health Food Stores

- Online Retail

- Others

Drivers

Government Support for Soy Milk Production in India

The Indian government’s initiatives to promote sustainable agriculture and plant-based diets have significantly impacted the soy milk market. Through various policies and programs, the government is encouraging the production and consumption of soy-based products, including soy milk.

A notable example is the Developed Agriculture Sankalp Abhiyan, launched by Union Agriculture Minister Shivraj Singh Chouhan. This nationwide campaign involved over 2,170 teams engaging with more than 1.35 crore farmers to identify challenges and opportunities in agriculture. One key finding was the stagnant productivity of soybean, a primary ingredient in soy milk.

In response, the government is focusing on research to enhance soybean yields through genome editing and improved farming techniques. Additionally, there’s an emphasis on value addition, including the promotion of soy-based products like tofu and soy milk, to increase farmers’ income and meet growing consumer demand for plant-based alternatives .

Furthermore, the Animal Husbandry Infrastructure Development Fund (AHIDF), established with a corpus of ₹15,000 crore, aims to boost private sector investment in developing animal husbandry infrastructure. While primarily focused on dairy, this fund also supports the establishment of facilities for processing plant-based products, including soy milk. By improving infrastructure, the government is facilitating the growth of the plant-based dairy sector, making products like soy milk more accessible to consumers .

These government efforts are aligned with the increasing consumer preference for plant-based diets. According to a report by Ipsos, soy milk holds a 45% share in India’s non-dairy milk market, indicating its popularity among consumers seeking healthier and ethical alternatives to traditional dairy products .

Restraints

Affordability and Accessibility Challenges in the Soy Milk Market

Despite the growing popularity of soy milk in India, affordability and accessibility remain significant barriers to its widespread adoption. While urban areas witness a surge in demand for plant-based alternatives, rural regions continue to face challenges in accessing and affording these products. The average price of a liter of soy milk in India can range from ₹80 to ₹120, which is notably higher than traditional dairy milk, priced between ₹50 and ₹60 per liter. This price disparity makes soy milk less accessible to a large portion of the population, especially in economically disadvantaged areas.

Government initiatives like the Production Linked Incentive (PLI) scheme for food processing aim to encourage investments in the alternate dairy sector. However, the benefits of such schemes have yet to significantly impact the affordability of soy milk for the average consumer. Additionally, the Goods and Services Tax (GST) regime in India imposes higher tax rates on plant-based products compared to their animal-based counterparts. For instance, while dairy products often fall under a lower tax bracket, plant-based milks like soy milk attract higher GST rates, further increasing their retail prices.

The disparity in taxation between vegan food and animal-based products under India’s GST regime highlights a significant economic and policy issue. This imbalance not only affects the affordability of soy milk but also creates an uneven playing field for plant-based product manufacturers. To bridge this gap, experts suggest that the government should consider revising tax policies to promote the consumption of plant-based alternatives, thereby supporting both consumer health and environmental sustainability.

Opportunity

Government Initiatives Fueling Soy Milk Market Growth in India

The Indian government’s proactive support for plant-based agriculture and food processing is creating significant growth opportunities for the soy milk market. Through various schemes and policies, the government is fostering an environment conducive to the expansion of plant-based dairy alternatives.

A notable initiative is the Developed Agriculture Sankalp Abhiyan, launched by Union Agriculture Minister Shivraj Singh Chouhan. This nationwide campaign involved over 2,170 teams engaging with more than 1.35 crore farmers to identify challenges and opportunities in agriculture. The initiative highlighted the stagnant productivity of soybean, a primary ingredient in soy milk.

In response, the government is focusing on research to enhance soybean yields through genome editing and improved farming techniques. Additionally, there’s an emphasis on value addition, including the promotion of soy-based products like tofu and soy milk, to increase farmers’ income and meet growing consumer demand for plant-based alternatives.

Furthermore, the Animal Husbandry Infrastructure Development Fund (AHIDF), established with a corpus of ₹15,000 crore, aims to boost private sector investment in developing animal husbandry infrastructure. While primarily focused on dairy, this fund also supports the establishment of facilities for processing plant-based products, including soy milk. By improving infrastructure, the government is facilitating the growth of the plant-based dairy sector, making products like soy milk more accessible to consumers.

These government efforts are aligned with the increasing consumer preference for plant-based diets. According to a report by Ipsos, the Indian plant-based foods market reached a value of INR 300 crore (~US$36 million) in 2024, growing at 18% in the past three years. This growth indicates a significant shift towards plant-based products, including soy milk, driven by health and environmental considerations.

Trends

Government Support Accelerates Soy Milk Market Growth in India

A notable example is the Developed Agriculture Sankalp Abhiyan, launched by Union Agriculture Minister Shivraj Singh Chouhan. This nationwide campaign involved over 2,170 teams engaging with more than 1.35 crore farmers to identify challenges and opportunities in agriculture. The initiative highlighted the stagnant productivity of soybean, a primary ingredient in soy milk.

In response, the government is focusing on research to enhance soybean yields through genome editing and improved farming techniques. Additionally, there’s an emphasis on value addition, including the promotion of soy-based products like tofu and soy milk, to increase farmers’ income and meet growing consumer demand for plant-based alternatives.

Furthermore, the Animal Husbandry Infrastructure Development Fund (AHIDF), established with a corpus of ₹15,000 crore, aims to boost private sector investment in developing animal husbandry infrastructure. While primarily focused on dairy, this fund also supports the establishment of facilities for processing plant-based products, including soy milk. By improving infrastructure, the government is facilitating the growth of the plant-based dairy sector, making products like soy milk more accessible to consumers.

These government efforts are aligned with the increasing consumer preference for plant-based diets. According to a report by Ipsos, the Indian plant-based foods market reached a value of INR 300 crore (~US$36 million) in 2024, growing at 18% in the past three years. This growth indicates a significant shift towards plant-based products, including soy milk, driven by health and environmental considerations.

Regional Analysis

North America leads the global soy milk market with 39.5% share, valued at USD 3.0 billion in 2024.

In 2024, North America emerged as the dominant region in the global soy milk market, capturing approximately 39.5% of the total market share, with a market value reaching USD 3.0 billion. This leadership is strongly attributed to a combination of high consumer awareness regarding plant-based nutrition, widespread lactose intolerance, and the rapid rise in demand for dairy alternatives across the U.S. and Canada. The growing trend toward vegan and flexitarian diets has also significantly contributed to increased soy milk consumption, particularly among younger demographics seeking protein-rich and cholesterol-free beverages.

Supermarkets and natural food stores across North America have played a crucial role in promoting soy milk, with major retail chains offering a wide range of flavored, fortified, and unsweetened variants to cater to different dietary preferences. Furthermore, consumers in the region are increasingly drawn to soy milk for its functional benefits, including high-quality plant protein, isoflavones, and calcium content—making it a popular choice for breakfast routines, smoothies, and baking recipes.

Additionally, supportive labeling policies, such as clear allergen information and organic certifications, have helped boost consumer confidence and product transparency. Innovation in packaging and the expansion of ready-to-drink formats have further contributed to the region’s strong market position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpro, a leading brand in the plant-based milk sector, is known for its wide range of soy milk products. Based in Belgium, the company offers both conventional and organic soy milk, catering to a growing demand for dairy alternatives. Alpro is committed to sustainability, sourcing soybeans responsibly and ensuring that its production processes minimize environmental impact. As part of Danone, it leverages the global reach of the brand to expand its market presence across Europe and other regions.

American Soy Products is a key player in the U.S. soy-based food and beverage market, specializing in high-quality soy milk and other soy-derived products. The company emphasizes its commitment to producing non-GMO soy products and ensuring excellent nutritional content in its offerings. By focusing on innovation and expanding its product range, American Soy Products continues to meet the increasing consumer demand for plant-based beverages, maintaining a solid position in the North American market.

Earth’s Own is a Canadian brand that specializes in plant-based milk products, including a variety of soy milk options. The company is known for its commitment to organic ingredients, environmental sustainability, and high-quality production. Earth’s Own focuses on offering delicious and nutritious soy milk that aligns with growing consumer interest in plant-based diets. With an increasing presence in both Canadian and U.S. markets, Earth’s Own continues to expand its product line to meet the demand for vegan and lactose-free beverages.

Top Key Players in the Market

- Alpro

- American Soy Products

- Danone

- Earth’s Own

- Eden Foods Inc

- Hain Celestial Group Inc

- Nestle

- Organic Valley

- Pacific Natural Foods

- Panos Brands

- Pureharvest

- Sanitarium

- Sunopta Inc

- Trader Joe’s

- Vitasoy

Recent Developments

In 2024, Earth’s Own reported annual revenues of approximately USD 80 million, solidifying its position as Canada’s largest soy beverage company.

In 2024, Alpro reported a turnover of £160.3 million in the UK alone, marking a 2% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Bn Forecast Revenue (2034) USD 16.1 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavored, Unflavored), By Category (Conventional, Organic), By Application (Ice Creams, Desserts, Yoghurt, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Health Food Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpro, American Soy Products, Danone, Earth’s Own, Eden Foods Inc, Hain Celestial Group Inc, Nestle, Organic Valley, Pacific Natural Foods, Panos Brands, Pureharvest, Sanitarium, Sunopta Inc, Trader Joe’s, Vitasoy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpro

- American Soy Products

- Danone

- Earth's Own

- Eden Foods Inc

- Hain Celestial Group Inc

- Nestle

- Organic Valley

- Pacific Natural Foods

- Panos Brands

- Pureharvest

- Sanitarium

- Sunopta Inc

- Trader Joe's

- Vitasoy