Global Soju Market Size, Share Analysis Report By Type (Distilled, Diluted), By Packaging (Bottles, Cans, Others), By Age Group (20-40 Years Old, 40-60 Years Old, Above 60 Years Old), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152500

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

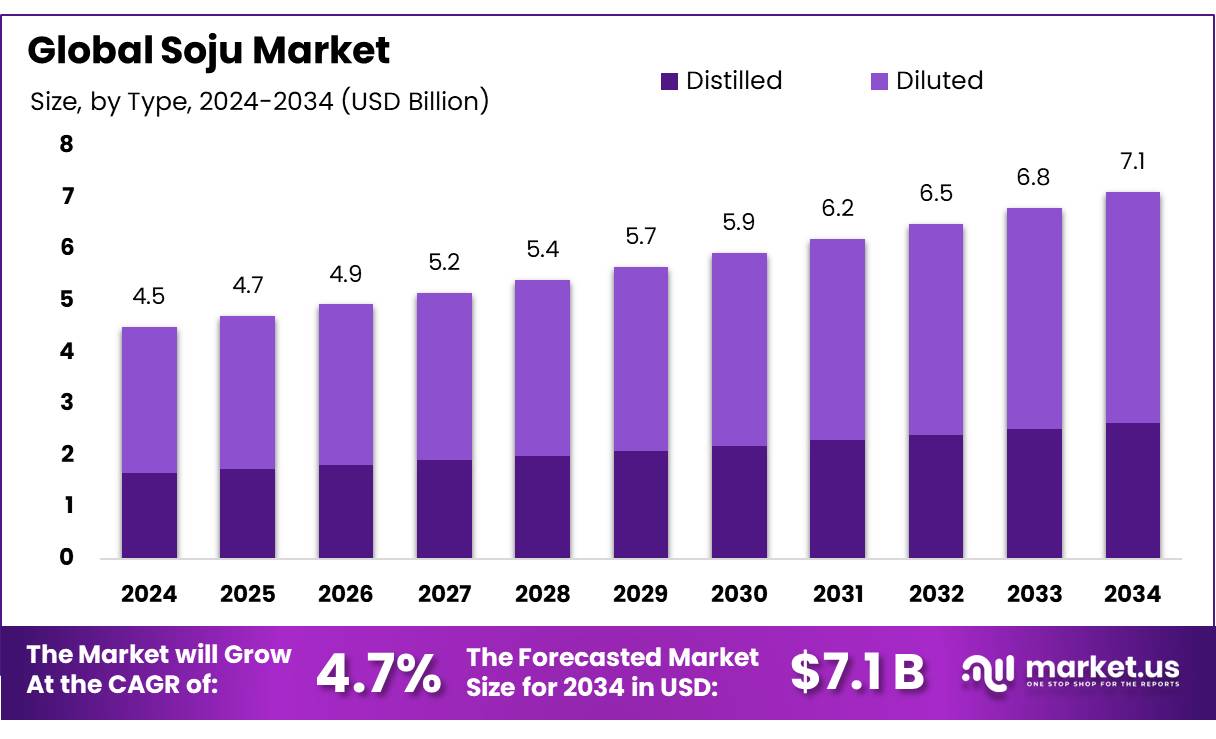

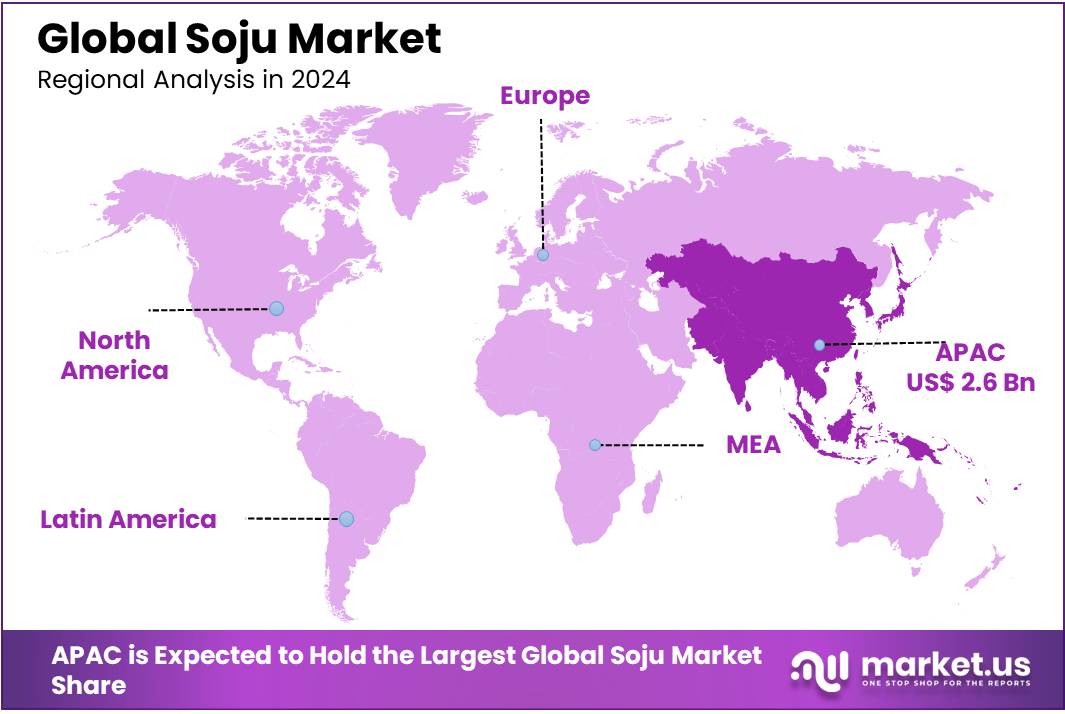

The Global Soju Market size is expected to be worth around USD 7.1 Biliion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 59.6% share, holding USD 2.6 billion revenue.

Soju, a traditional Korean distilled spirit, has evolved significantly over the past century, transitioning from a locally consumed beverage to a globally recognized product. Historically, soju was crafted from rice; however, due to rice shortages in the 1960s, the South Korean government mandated the use of alternative starches like sweet potatoes and tapioca. This shift was further supported by policies that consolidated the industry, designating regional monopolies to streamline production and distribution. By the late 20th century, deregulation efforts led to a more competitive market, with HiteJinro emerging as the dominant player, accounting for over 50% of South Korea’s soju market share.

In 2023, the Korean Hotel, Restaurant, and Institutional (HRI) sector, which encompasses establishments serving soju, reached a valuation of $147 billion, marking an 8.3% increase from the previous year. This growth reflects a resurgence in consumer demand for dining experiences and alcoholic beverages, including soju. The global popularity of soju is also evident, with Jinro’s soju being recognized as the world’s best-selling liquor in 2019, surpassing other spirits like vodka and whiskey.

Several factors are driving the expansion of the soju industry. The South Korean government’s “globalization of Korean food” initiative has been instrumental in promoting soju exports, providing financial and promotional support to local producers. Additionally, the introduction of flavored soju variants has attracted younger consumers, diversifying the product’s appeal.

Government initiatives have also played a role in shaping the soju industry. In South Korea, the government has implemented policies to regulate and promote the soju market. For instance, the Beverage Container Deposit System imposes a deposit on recyclable containers, encouraging consumers to return bottles for reuse. This system has led to a significant increase in the recycling rate of soju bottles, from 87.9% in 2015 to 97.2% in 2018. Such initiatives not only support environmental sustainability but also enhance the efficiency of the soju production process.

Key Takeaways

- Soju Market size is expected to be worth around USD 7.1 Biliion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 4.7%.

- Diluted soju held a dominant market position, capturing more than a 63.4% share of the overall soju market.

- Bottles held a dominant market position in the soju market, capturing more than an 89.3% share.

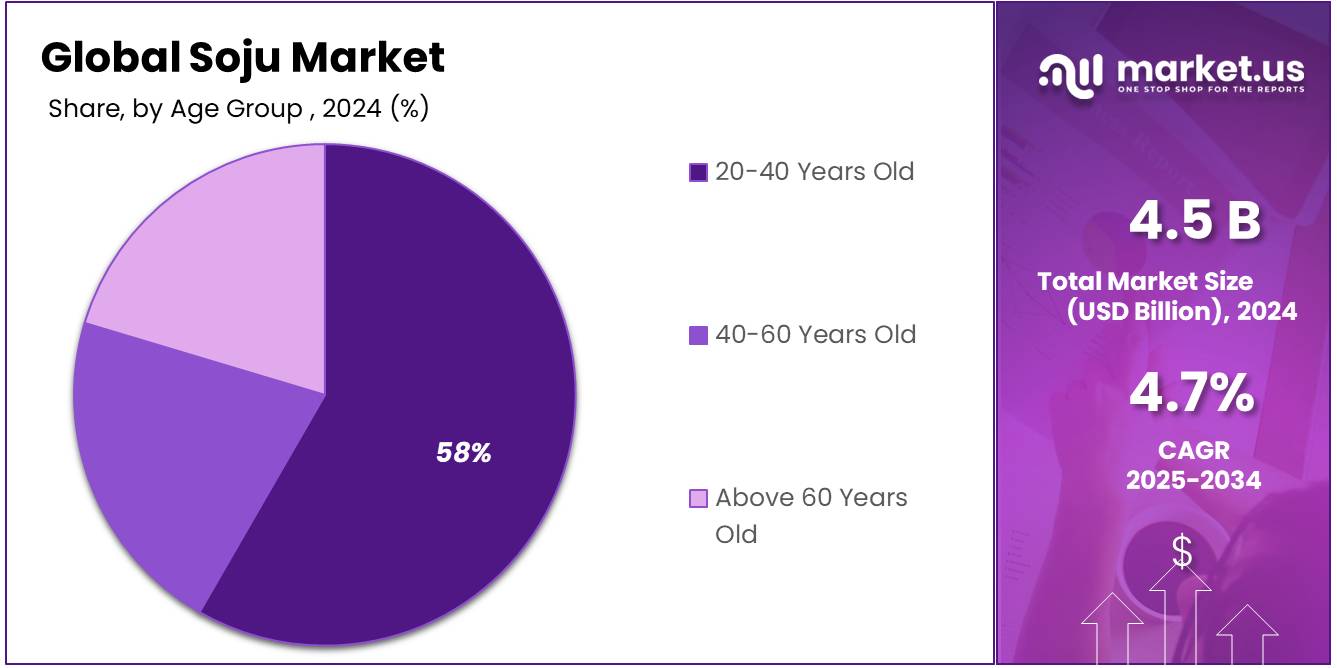

- 20–40 years old age group held a dominant market position in the soju market, capturing more than a 58.7% share.

- Convenience stores held a dominant market position in the soju market, capturing more than a 38.9% share.

- Asia Pacific (APAC) region emerged as the leading regional market for soju, capturing a dominant 59.6% share and generating revenues worth approximately USD 2.6 billion.

By Type Analysis

Diluted Soju dominates with 63.4% in 2024 due to its affordability and mass appeal

In 2024, diluted soju held a dominant market position, capturing more than a 63.4% share of the overall soju market. This segment’s strong performance is mainly driven by its affordability, wide accessibility, and consumer preference for lighter alcoholic content. Diluted soju typically contains an alcohol content ranging between 16% and 20%, making it a popular choice among both seasoned drinkers and casual consumers who prefer a smoother, less intense beverage. The market appeal of diluted soju is also enhanced by its availability in a wide variety of flavors, which helps attract younger consumers and female drinkers.

Manufacturers have strategically positioned diluted soju as an everyday alcoholic drink, often packaging it in smaller, convenient bottles that cater to both on-the-go and in-home consumption. In countries like South Korea, where soju consumption remains culturally significant, diluted variants continue to dominate shelves in restaurants, convenience stores, and liquor outlets. Furthermore, its relatively low production cost allows companies to maintain competitive pricing, making it a strong performer in price-sensitive markets.

By Packaging Analysis

Bottled Soju leads with 89.3% in 2024, driven by convenience and consumer familiarity

In 2024, bottles held a dominant market position in the soju market, capturing more than an 89.3% share. This clear preference for bottled packaging is largely due to its convenience, traditional appeal, and ease of distribution across retail and hospitality channels. Glass bottles, in particular, have long been associated with soju consumption, offering a familiar and culturally rooted experience for consumers, especially in regions like South Korea where soju is deeply ingrained in social dining and drinking culture.

The dominance of bottled packaging is also supported by infrastructure. Most soju manufacturers operate established bottling lines, allowing for efficient large-scale production while maintaining quality and cost control. Additionally, bottled soju is easy to recycle, and with government-backed recycling programs in countries like South Korea, where return rates exceed 95%, the use of bottles aligns with broader sustainability goals. This eco-friendly aspect adds to consumer trust and brand loyalty.

By Age Group Analysis

Young Adults Aged 20–40 Lead Soju Market with 58.7% Share in 2024

In 2024, the 20–40 years old age group held a dominant market position in the soju market, capturing more than a 58.7% share. This strong performance is largely due to changing lifestyle patterns, increasing social drinking habits, and rising interest in trendy, flavored alcoholic beverages among younger consumers. This age group is especially drawn to soju for its moderate alcohol content, affordable pricing, and wide availability in social spaces such as restaurants, pubs, and casual dining venues.

Soju brands have increasingly tailored their products and marketing strategies to appeal to this demographic. Flavored variants, stylish bottle designs, and active social media promotion have played a big role in connecting with younger drinkers. This group also shows a strong preference for drinks that are lighter, easy to mix, and can be shared in group settings, all of which match soju’s profile perfectly. The rising popularity of Korean pop culture, especially among international audiences in this age range, further boosts demand for soju as a cultural and lifestyle product.

By Distribution Channel Analysis

Convenience Stores lead Soju Sales with 38.9% Share in 2024 due to easy access and impulse buying

In 2024, convenience stores held a dominant market position in the soju market, capturing more than a 38.9% share. This segment’s strength comes from its high accessibility, long operating hours, and the ability to serve consumers who prefer quick, on-the-go purchases. Convenience stores are widespread across both urban and semi-urban areas, making them a frequent stop for individuals looking to purchase alcohol without visiting larger retail chains or liquor outlets.

For younger consumers and working professionals, convenience stores offer the flexibility to buy soju in smaller quantities, often chilled and ready to consume. Many of these stores are located near residential complexes, office areas, and transportation hubs, making them ideal for last-minute purchases or spontaneous buying decisions. Moreover, store layouts often promote alcohol at checkout counters or in prominent coolers, boosting impulse buying behavior.

Key Market Segments

By Type

- Distilled

- Diluted

By Packaging

- Bottles

- Cans

- Others

By Age Group

- 20-40 Years Old

- 40-60 Years Old

- Above 60 Years Old

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience stores

- Online

- Others

Emerging Trends

Innovative Product Variants and Health-Conscious Offerings

A notable emerging trend in the soju market is the development of innovative product variants that cater to health-conscious consumers. In recent years, there has been a growing demand for beverages that align with healthier lifestyles, prompting soju producers to introduce options with lower alcohol content, reduced sugar levels, and added functional ingredients.

For instance, the introduction of fruit-infused soju and sparkling soju has gained popularity, particularly among younger demographics seeking lighter and more flavorful alternatives to traditional spirits. These innovations not only appeal to health-conscious consumers but also attract those looking for unique and diverse drinking experiences.

The South Korean government has recognized the importance of these innovations and has supported the development and export of such products. Through initiatives like the designation of excellent Korean restaurants overseas and participation in international food fairs, the government has facilitated the introduction of these innovative soju variants to global markets. For example, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) has designated outstanding Korean restaurants in cities like New York, Paris, and Tokyo, which showcase Korean cuisine and beverages, including innovative soju products, to international audiences.

These government-backed efforts have contributed to the growing recognition of Korean soju as a versatile and health-conscious alcoholic beverage on the global stage. As consumer preferences continue to shift towards healthier and more innovative options, the soju market is well-positioned to capitalize on these trends, offering products that meet the evolving demands of today’s consumers.

Drivers

Increasing Global Popularity and Cultural Influence

The rising global popularity of Korean culture, particularly K-pop and Korean dramas, has significantly boosted the demand for soju, a traditional Korean spirit. As more people worldwide are exposed to Korean entertainment, the consumption of soju has seen a notable surge, particularly in markets outside South Korea.

According to the Korean Ministry of Agriculture, Food and Rural Affairs (MAFRA), soju exports reached US$105 million in 2023, marking a 10% increase from the previous year. This growth is largely driven by the expanding influence of Korean pop culture and the growing interest in Korean cuisine, both of which have made soju a fashionable drink in countries like the United States, Japan, and parts of Southeast Asia.

Government initiatives have also played a role in supporting the international expansion of soju. The South Korean government has provided financial assistance and marketing support for soju producers aiming to increase their global footprint.

In line with this, Korean alcoholic beverage companies have been participating in various international trade shows and promotional events to introduce the spirit to new markets. These efforts align with the government’s broader strategy to promote Korean exports, which have been steadily growing across various sectors, including food and beverages.

The increasing preference for healthier, lower-alcohol alternatives is another factor driving soju’s popularity. Unlike many other distilled spirits, soju is generally lower in alcohol content, making it an appealing option for consumers looking for lighter alcoholic beverages. As global health trends shift toward moderation and mindful drinking, soju has positioned itself as a more approachable alternative to stronger liquors.

Restraints

Regulatory Challenges and Alcohol Taxation

One of the major restraining factors for the soju market is the increasing regulatory challenges and high alcohol taxation in key international markets. As the global demand for soju grows, various countries are tightening their alcohol-related regulations, imposing higher taxes on imported spirits, and enforcing stricter advertising and distribution rules. This has created significant barriers for South Korean producers trying to expand their market share globally.

For instance, in the United States, alcoholic beverages are subject to federal and state-level taxes, which can significantly raise the price of imported alcohol. According to the Alcohol and Tobacco Tax and Trade Bureau (TTB), excise taxes on distilled spirits are $13.50 per proof gallon in the U.S., contributing to the overall cost of imported products like soju.

Additionally, the European Union has introduced stricter rules around the labeling and marketing of alcoholic beverages, including soju. These regulations require producers to provide detailed information about alcohol content, ingredients, and health warnings. Such compliance measures can be costly and time-consuming for producers, particularly for small and medium-sized companies in South Korea. According to the European Commission’s report on alcoholic beverages, there has been a push for more transparency and better regulation of alcoholic drinks sold within the EU, which could hinder the growth of soju in these markets.

Government initiatives aimed at promoting soju are often overshadowed by these regulatory challenges. While the South Korean government has supported the expansion of soju through trade agreements and promotional events, these efforts may be limited by stringent tax and regulatory policies in target markets. Consequently, the burden of these policies has made it more difficult for soju to compete on price and availability in some regions.

Opportunity

Government Support and Export Growth

A significant growth opportunity for the soju market lies in the expanding international demand, supported by South Korea’s proactive government initiatives. In 2023, South Korea’s Ministry of Agriculture, Food and Rural Affairs (MAFRA) reported that soju exports reached US$105 million, reflecting a 10% increase from the previous year. This growth is attributed to the global rise in interest in Korean culture, including K-pop and Korean cuisine, which has led to increased consumption of soju in markets such as the United States, Japan, and Southeast Asia.

The South Korean government has played a pivotal role in this expansion by providing financial assistance and marketing support to soju producers aiming to increase their global footprint. These efforts align with the government’s broader strategy to promote Korean exports, which have been steadily growing across various sectors, including food and beverages. Additionally, the government’s focus on promoting Korean food culture through international events and trade agreements has further facilitated the introduction of soju to new markets.

Furthermore, the increasing preference for healthier, lower-alcohol alternatives presents another avenue for soju’s growth. With its relatively low alcohol content compared to other spirits, soju appeals to consumers seeking lighter alcoholic beverages. This trend is particularly evident in Western markets, where consumers are becoming more health-conscious and open to trying new, culturally diverse products.

Regional Insights

Asia Pacific dominates the global soju market with 59.6% share, valued at USD 2.6 billion in 2024

In 2024, the Asia Pacific (APAC) region emerged as the leading regional market for soju, capturing a dominant 59.6% share and generating revenues worth approximately USD 2.6 billion. This commanding position is primarily attributed to the deep-rooted cultural association of soju consumption across East Asian countries, particularly South Korea, where it is considered a staple alcoholic beverage. South Korea alone accounts for the highest per capita consumption of soju globally, with more than 3.5 billion bottles consumed annually, supported by a well-established domestic production and distribution infrastructure.

The growth of the APAC soju market is driven by a combination of factors, including rising urbanization, changing consumer preferences toward lighter and flavored alcoholic beverages, and the increasing influence of Korean pop culture, commonly referred to as the “K-wave.” Countries such as China, Japan, and Vietnam are witnessing steady demand growth, as younger consumers adopt soju for its lower alcohol content and affordability compared to traditional spirits.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

HiteJinro Co., Ltd., a leading South Korean beverage company, is one of the largest producers of soju globally. Known for its popular brands like Chamisul and Jinro, the company holds a significant share of the global soju market. HiteJinro has focused on expanding its presence in both domestic and international markets, with innovative product lines such as low-alcohol and flavored soju varieties, catering to health-conscious consumers. The company has also invested heavily in marketing campaigns to promote its brands.

Hwayo is a premium soju brand renowned for its high-quality ingredients and craftsmanship. It differentiates itself in the market by offering luxury products that cater to upscale consumers. The brand emphasizes its use of natural ingredients and traditional brewing methods, positioning itself as a high-end alternative to standard soju. With a growing presence in both domestic and international markets, Hwayo appeals to those looking for a more refined, artisanal drinking experience. Its distinct flavor profile has contributed to its increasing popularity.

Korea Alcohol Co., Ltd. is a prominent South Korean alcohol manufacturer known for its diverse range of alcoholic beverages, including soju. The company has a strong foothold in the domestic market, with a focus on maintaining high-quality production standards. With its flagship product Chungju, Korea Alcohol Co., Ltd. aims to offer consumers a balance of tradition and modern tastes. The company is expanding its footprint in international markets through strategic partnerships and increased exports of its signature products.

Top Key Players Outlook

- HiteJinro Co., Ltd.

- Hwayo

- Korea Alcohol Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- OB Brewing Co., Ltd.

- Sool Soju

- The Han

- The Soju Company

- Tokki Soju

Recent Industry Developments

In 2024, Hwayo stood out in the soju market as a premium distilled rice soju, reflecting both heritage and elegance. Founded in 2003, the brand has steadily elevated its global presence; notably, in March 2024 Hwayo became the official soju partner for both the “World-50-Best Restaurants” and “Asia-50-Best Restaurants” events, signifying its acceptance in high-end dining circles.

In 2024, Lotte Chilsung Beverage Co., Ltd. boosted its soju exports by 3% year-on-year, underscoring its growing global presence in the spirits sector.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Bn Forecast Revenue (2034) USD 7.1 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Distilled, Diluted), By Packaging (Bottles, Cans, Others), By Age Group (20-40 Years Old, 40-60 Years Old, Above 60 Years Old), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HiteJinro Co., Ltd., Hwayo, Korea Alcohol Co., Ltd., Lotte Chilsung Beverage Co., Ltd., OB Brewing Co., Ltd., Sool Soju, The Han, The Soju Company, Tokki Soju Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HiteJinro Co., Ltd.

- Hwayo

- Korea Alcohol Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- OB Brewing Co., Ltd.

- Sool Soju

- The Han

- The Soju Company

- Tokki Soju