Global Soft Drinks Market Size, Share, And Business Benefits By Product (Carbonated, Non-carbonated, Bottled Water, Juice Drink, Functional Drink, Others), By Flavour (Cola, Citrus, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150691

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

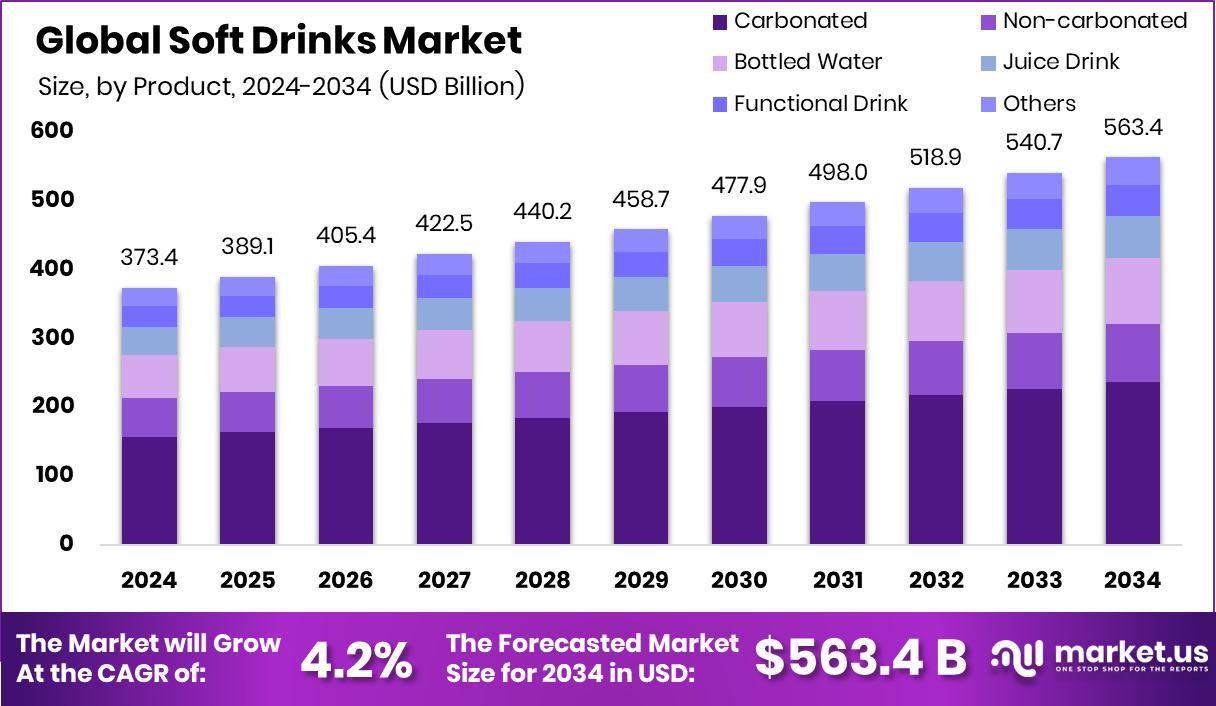

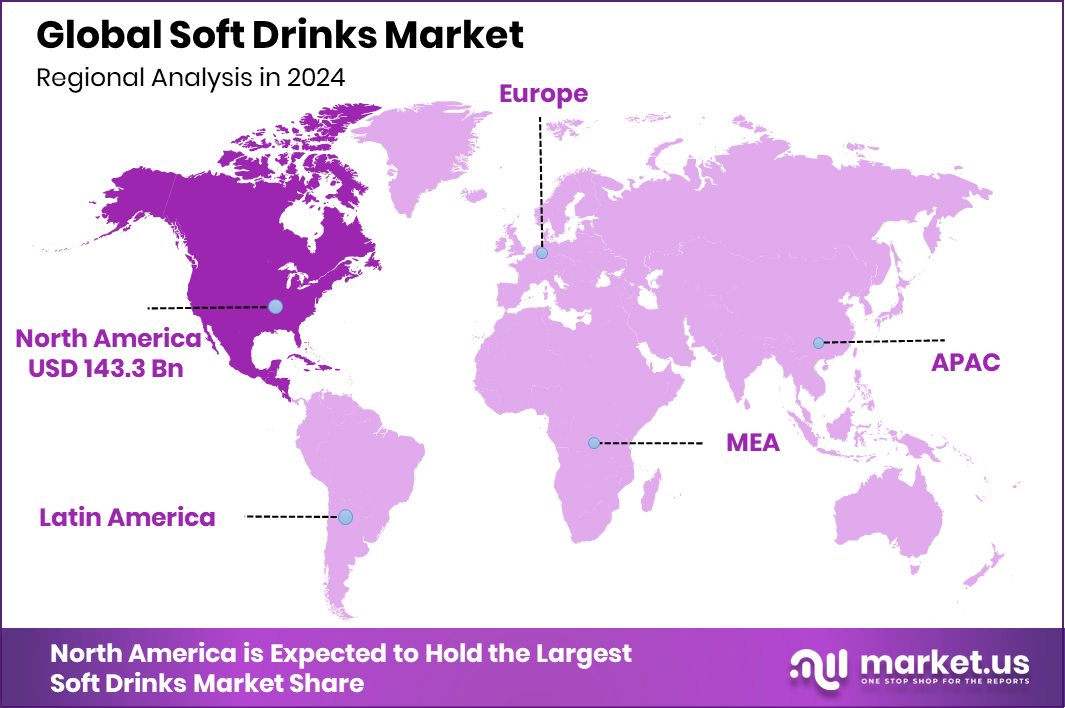

Global Soft Drinks Market is expected to be worth around USD 563.4 billion by 2034, up from USD 373.4 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034. Strong consumer demand and retail presence helped North America achieve USD 143.3 billion in sales.

Soft drinks are non-alcoholic beverages that typically contain carbonated water, sweeteners (sugar or artificial), and natural or artificial flavorings. Some also include caffeine, fruit juices, preservatives, or coloring agents. These drinks are commonly consumed cold and are popular for their refreshing qualities. They include sodas, flavored waters, energy drinks, and fruit-based carbonated drinks.

The soft drinks market refers to the global industry involved in the production, distribution, and sale of non-alcoholic beverages. It includes both carbonated and non-carbonated segments. This market has expanded significantly in recent years due to changing consumer lifestyles, urbanization, and an increasing preference for convenient, ready-to-drink products. According to an industry report, Culture Pop Soda secured $15 million through equity funding to support its growth plans.

One of the main growth factors for the soft drinks market is rising disposable income in developing countries. As people’s incomes increase, their spending on convenience beverages and lifestyle products also goes up. This trend supports higher sales volumes, especially among younger consumers seeking new flavors and functional beverages. According to an industry report, Pepsi entered the fast-growing gut-health space with a $2 billion acquisition of Poppi.

Demand is further driven by hot weather conditions, especially in tropical and subtropical regions. As temperatures rise, people tend to consume more cold drinks to stay refreshed and hydrated. The year-round demand pattern strengthens further during summer seasons, festivals, and outdoor events, contributing to a stable revenue flow for producers and sellers. According to an industry report, Olipop raised $50 million in Series C funding, reaching a $1.85 billion brand valuation.

Key Takeaways

- Global Soft Drinks Market is expected to be worth around USD 563.4 billion by 2034, up from USD 373.4 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034.

- Carbonated soft drinks hold a 42.5% share, driven by strong consumer preference and fizzy refreshment.

- Cola dominates the soft drinks market with 47.4%, remaining the top choice across all regions.

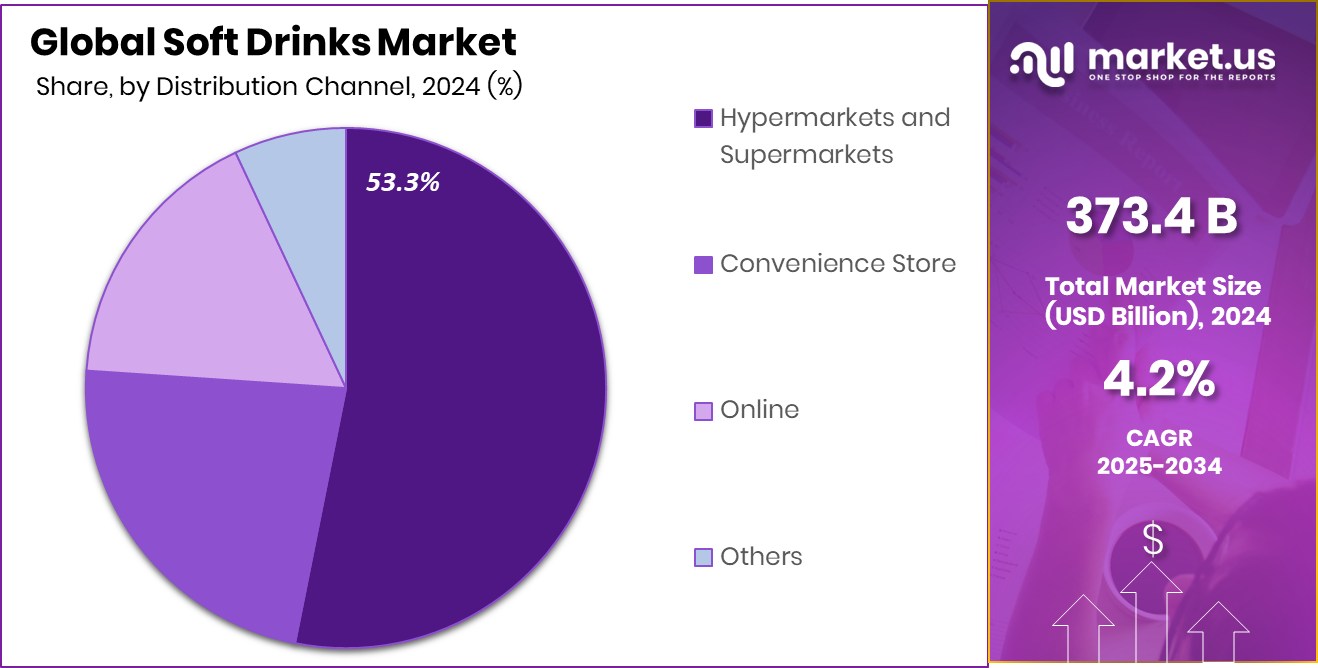

- Hypermarkets and supermarkets lead sales with 53.3%, offering a wide product variety and easy accessibility.

- The North American soft drinks market reached a value of USD 143.3 billion.

By Product Analysis

Carbonated drinks hold a 42.5% share in the global soft drinks market.

In 2024, Carbonated held a dominant market position in the By Product segment of the Soft Drinks Market, with a 42.5% share. This strong performance is largely attributed to the widespread consumer preference for fizzy and flavored beverages, especially in urban areas where on-the-go lifestyles and quick refreshment needs drive consumption. Carbonated soft drinks remain a staple choice for social gatherings, foodservice establishments, and convenience stores, contributing to their high visibility and easy accessibility.

The appeal of carbonation, combined with a wide variety of flavors and packaging formats, has continued to attract a broad customer base across different age groups. Seasonal demand peaks—especially during summer months and festive seasons—further support sustained growth in this segment. Moreover, the long shelf life and established distribution networks across retail and foodservice channels have reinforced the stronghold of carbonated beverages in the soft drinks industry.

While changing consumer health preferences are prompting innovation in formulations, the carbonated category continues to hold cultural and habitual significance in many markets, ensuring repeat purchases. With a 42.5% market share, carbonated drinks lead the product landscape, reinforcing their role as the most consumed category within the soft drinks sector in 2024.

By Flavour Analysis

Cola flavor leads with 47.4% preference among soft drink consumers worldwide.

In 2024, Cola held a dominant market position in the By Flavour segment of the Soft Drinks Market, with a 47.4% share. This leadership is driven by the long-standing global appeal of cola-flavored beverages, which continue to resonate with consumers due to their classic taste and strong brand familiarity. Cola has maintained its relevance across generations, often being the preferred choice in both individual consumption and large-scale social occasions.

The 47.4% market share reflects not only consumer loyalty but also the deep market penetration of cola across multiple sales channels, including supermarkets, convenience stores, vending machines, and restaurants. Cola-flavored drinks are often associated with fast food and festive occasions, further enhancing their volume of consumption throughout the year.

In addition, the consistent availability of cola in multiple packaging sizes and formats—from small cans to family-sized bottles—supports its dominance by catering to various consumer needs and consumption settings. Its ability to pair well with different food items also plays a key role in driving repeat purchases.

By Distribution Channel Analysis

Hypermarkets and supermarkets dominate distribution, contributing 53.3% of total soft drink sales.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Soft Drinks Market, with a 53.3% share. This dominance is primarily driven by the convenience, variety, and competitive pricing these retail formats offer to consumers. Hypermarkets and supermarkets serve as one-stop destinations where customers can access an extensive range of soft drink brands and flavors, often promoted through discounts and bundled offers.

Their strong share of 53.3% also reflects the advantage of established shelf space, effective in-store promotions, and strategic product placements that encourage impulse purchases. The spacious layouts and visibility of soft drink sections further increase consumer footfall and purchase frequency. Additionally, these retail stores are widely distributed in urban and semi-urban areas, making them easily accessible to a large consumer base.

Moreover, consumers trust the freshness and authenticity of products purchased from organized retail outlets, which further enhances their preference for hypermarkets and supermarkets. Bulk buying for families and events also contributes to higher volume sales through this channel.

Key Market Segments

By Product

- Carbonated

- Non-carbonated

- Bottled Water

- Juice Drink

- Functional Drink

- Others

By Flavour

- Cola

- Citrus

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Store

- Online

- Others

Driving Factors

Rising Urbanization and Fast-Paced Lifestyle Choices

One major reason the soft drinks market is growing fast is because more people are moving to cities and living busier lives. In urban areas, consumers often look for quick, refreshing drinks during work breaks, travel, or social outings. Soft drinks are easy to carry, instantly satisfying, and available almost everywhere—from small local shops to large supermarkets.

As people’s schedules get tighter, they tend to buy more ready-to-drink options instead of preparing beverages at home. This shift in lifestyle creates more demand for soft drinks. Also, with increasing income levels, people don’t mind spending a bit more on convenient beverages.

Restraining Factors

Health Concerns Over Sugar and Artificial Ingredients

One big reason that could slow down the soft drinks market is growing health concerns. Many people are now more aware of the harmful effects of drinking too much sugar and artificial additives. Regular soft drinks often have high sugar content, which is linked to problems like obesity, diabetes, and heart disease.

Because of this, health-conscious consumers are starting to avoid these drinks or reduce how much they drink them. Parents are also more careful about giving sugary drinks to children. As a result, some people are switching to healthier alternatives like water, fresh juices, or low-sugar drinks. This shift in consumer habits is putting pressure on traditional soft drink sales in several regions.

Growth Opportunity

Growing Demand for Low-Sugar and Healthy Beverages

A big opportunity for the soft drinks market is the rising demand for healthier options. Many people today are looking for drinks with less sugar, fewer calories, and natural ingredients. This is especially true for young adults and health-conscious consumers. Soft drink companies can grow by offering products like low-sugar sodas, natural fruit-based drinks, and functional beverages with added vitamins or herbal ingredients.

These types of drinks appeal to people who want to stay healthy but still enjoy refreshing beverages. As fitness trends and diet awareness grow, the market for healthy soft drinks is expected to expand. Brands that focus on better ingredients and clear labeling can attract a large group of new and loyal customers.

Latest Trends

Flavored Sparkling Water Gaining More Popularity

A major trend in the soft drinks market is the fast-growing popularity of flavored sparkling water. Many people now prefer drinks that are fizzy but don’t contain a lot of sugar or artificial ingredients. Flavored sparkling water gives the fun and refreshing feel of a soda, but is often made with natural flavors and has zero or very low calories.

This makes it a smart choice for people who want to enjoy a bubbly drink without feeling guilty. It’s especially popular among younger consumers and fitness-minded individuals. With more flavors like lemon, berry, mango, and cucumber coming into stores, this trend is expected to grow even more as people choose healthier and tastier refreshment options.

Regional Analysis

In 2024, North America held a 38.3% share of the Soft Drinks Market.

In 2024, North America dominated the global Soft Drinks Market, accounting for 38.3% of the total share, with a market value of USD 143.3 billion. The region’s strong performance is supported by high per capita consumption, a well-established retail infrastructure, and a consistent demand for carbonated and flavored beverages across the United States and Canada. Convenience, brand familiarity, and lifestyle alignment continue to drive soft drink sales across urban and suburban markets in this region.

Europe remains a significant contributor to the global market, benefiting from high consumer awareness and a preference for sugar-free and flavored beverages, though specific values are not disclosed. In the Asia Pacific region, rising disposable incomes, a growing young population, and increased urbanization are accelerating the shift toward packaged soft drinks.

Meanwhile, the Middle East & Africa region is witnessing steady growth, driven by expanding retail penetration and hot climatic conditions supporting year-round demand. Latin America, although smaller in comparison, is experiencing a gradual rise in soft drink consumption supported by changing lifestyles and the growing popularity of flavored beverages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PepsiCo, Inc. maintained its position through a balance of traditional carbonated snacks and beverages and an expanding portfolio of low-sugar, functional drinks. With its strong distribution networks spanning convenience stores, supermarkets, and foodservice outlets worldwide, PepsiCo effectively reached a broad consumer base. The company’s ongoing investment in innovation—especially in flavored, low-calorie beverages—supports its relevance among health-conscious consumers, while classic staples continue to generate significant volume across global markets.

Nestlé carved out a niche by emphasizing non-carbonated beverages, including bottled water, flavored waters, and ready-to-drink teas and coffees. Although smaller in market share compared to giant soda manufacturers, Nestlé’s focus on health-oriented products positions it well in evolving markets. Its strength lies in leveraging global water brands and instant beverage solutions to cater to daily hydration needs, particularly in emerging economies where convenience and premium packaging drive consumer choice.

The Coca-Cola Company retained its dominant market status through iconic brands and consistent consumer loyalty. Coca‑Cola’s global marketing prowess, extensive portfolio—including diet and zero‑sugar variants—and deep-rooted distribution channels across both developed and emerging regions reinforce its leadership. In 2024, Coca‑Cola continued to invest in product reformulation, package diversification, and brand engagement, thereby sustaining a loyal customer base while attracting new drinkers.

Top Key Players in the Market

- Pepsico, Inc.

- Nestlé

- The Coca-Cola Company

- Keurig Dr Pepper Inc (KDP)

- Red Bull GmbH

- Unilever PLC

- Monster Energy Company

- Appalachian Brewing Company

- ITO EN INC.

- AriZona Beverages USA LLC

- Dr Pepper Snapple Group

- ITO EN INC.

- AriZona Beverages USA LLC

- Appalachian Brewing Company

- Asahi Group Holdings

Recent Developments

- In May 2025, Nestlé appointed Rothschild to explore strategic options—including sale or partnership—for its standalone water business. The unit, valued at over €5 billion, includes brands like Perrier and San Pellegrino.

- In March 2024, PepsiCo launched Bubly Burst, a lightly sweetened sparkling water with bold fruit flavors and zero added sugar. It debuted in six flavors—Triple Berry, Peach Mango, Watermelon Lime, Pineapple Tangerine, Cherry Lemonade, and Tropical Punch—each in 16.9 oz recycled PET bottles with just 10 calories or less.

Report Scope

Report Features Description Market Value (2024) USD 373.4 Billion Forecast Revenue (2034) USD 563.4 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carbonated, Non-carbonated, Bottled Water, Juice Drink, Functional Drink, Others), By Flavour (Cola, Citrus, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Pepsico, Inc., Nestlé, The Coca-Cola Company, Keurig Dr Pepper Inc (KDP), Red Bull GmbH, Unilever PLC, Monster Energy Company, Appalachian Brewing Company, ITO EN INC., AriZona Beverages USA LLC, Dr Pepper Snapple Group, ITO EN INC., AriZona Beverages USA LLC, Appalachian Brewing Company, Asahi Group Holdings Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pepsico, Inc.

- Nestlé

- The Coca-Cola Company

- Keurig Dr Pepper Inc (KDP)

- Red Bull GmbH

- Unilever PLC

- Monster Energy Company

- Appalachian Brewing Company

- ITO EN INC.

- AriZona Beverages USA LLC

- Dr Pepper Snapple Group

- ITO EN INC.

- AriZona Beverages USA LLC

- Appalachian Brewing Company

- Asahi Group Holdings