Global Sodium Reduction Ingredients Market Size, Share, And Business Benefits By Type (Amino Acids, Mineral Salts (Potassium Chloride, Magnesium Sulphate, Potassium Lactate, Calcium Chloride , Others), Yeast Extract, Others), By Application (Bakery and Confectionery, Dairy and Frozen Foods, Sweet and Savory Snacks Meat, Seafood and Poultry, Soups, Dressings and Salads, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Food Service, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152663

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

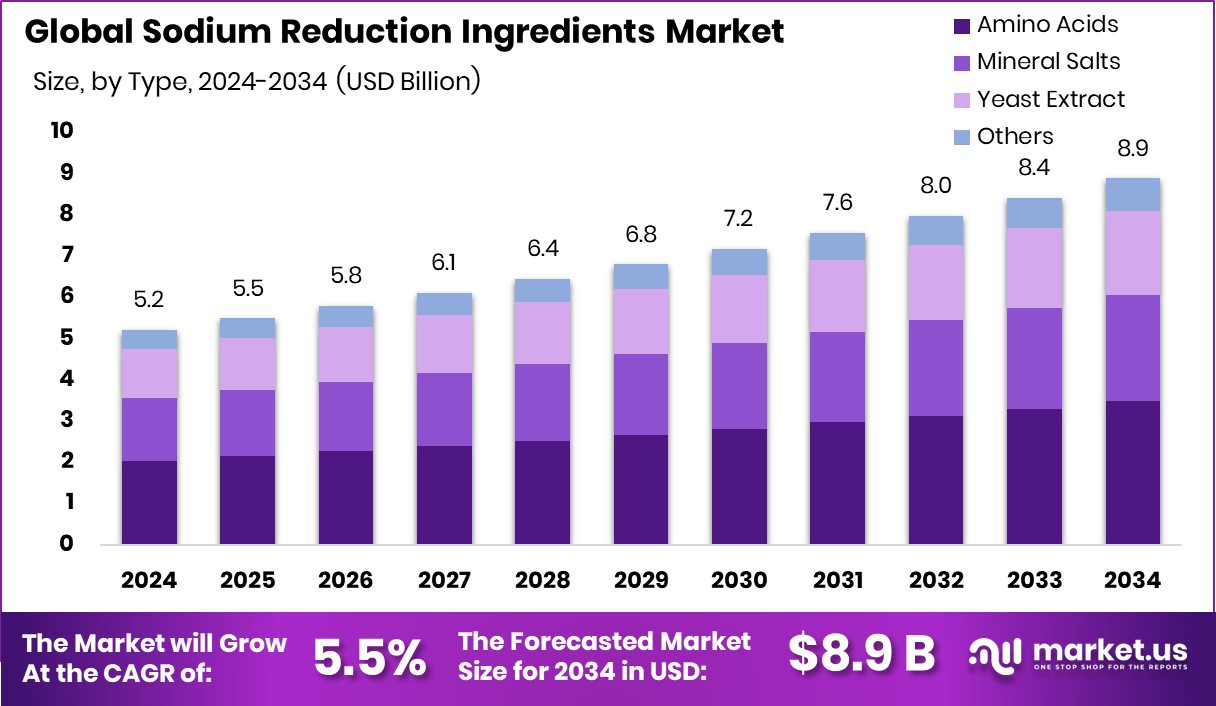

Global Sodium Reduction Ingredients Market is expected to be worth around USD 8.9 billion by 2034, up from USD 5.2 billion in 2024, and grow at a CAGR of 5.5% from 2025 to 2034. Strong demand for healthier foods continues to drive sodium reduction efforts in North America, 42.30%.

Sodium reduction ingredients are additives or compounds used in food formulations to lower the sodium content without compromising taste, texture, or shelf life. These ingredients, which may include mineral salts, amino acids, yeast extracts, and flavor enhancers, are especially important in processed and packaged foods where sodium is traditionally used for flavor and preservation. The rising awareness about the adverse health effects of high sodium intake—such as hypertension, cardiovascular diseases, and kidney disorders—has significantly pushed the food industry to explore and adopt sodium-reducing alternatives.

The sodium reduction ingredients market is driven by increasing consumer demand for healthier food options and growing public health campaigns promoting low-sodium diets. Governments in many countries have introduced sodium intake guidelines, while some have implemented mandatory sodium reduction targets in specific food categories. This regulatory push is encouraging food manufacturers to reformulate their products using sodium reduction solutions, thereby fueling market growth.

The demand is also rising due to a broader shift in consumer behavior toward clean-label and functional foods. Shoppers today prefer products that deliver health benefits without artificial additives. Sodium reduction ingredients, especially those derived from natural sources, align with this trend and are gaining traction in bakery, snacks, dairy, ready meals, and meat products. According to an industry report, GRObio has raised $60.3 million in Series B funding to accelerate its work in protein therapeutics.

An important market opportunity lies in the ongoing innovation of multifunctional ingredients that not only reduce sodium but also enhance overall product quality. Advances in food technology have enabled the development of ingredients that mimic the taste and function of salt while also offering nutritional benefits such as potassium enrichment. According to an industry report, Peptone, a biotech startup leveraging AI to develop drugs targeting complex disordered proteins, secured $40 million in venture capital.

Key Takeaways

- Global Sodium Reduction Ingredients Market is expected to be worth around USD 8.9 billion by 2034, up from USD 5.2 billion in 2024, and grow at a CAGR of 5.5% from 2025 to 2034.

- Amino acids hold a dominant 39.2% share in the sodium reduction ingredients market due to their effectiveness.

- Meat, seafood, and poultry applications account for 26.7%, highlighting sodium reduction in protein-rich products.

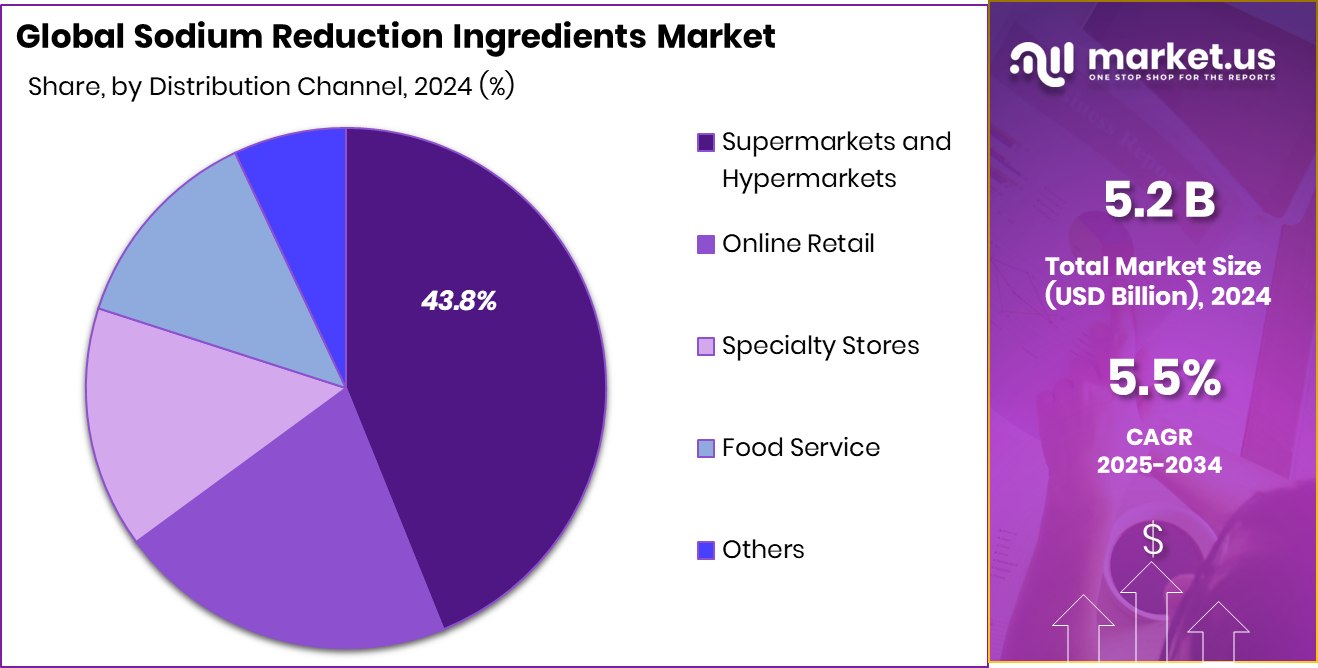

- Supermarkets and hypermarkets lead with a 43.8% share, driving widespread retail availability of reduced-sodium food products.

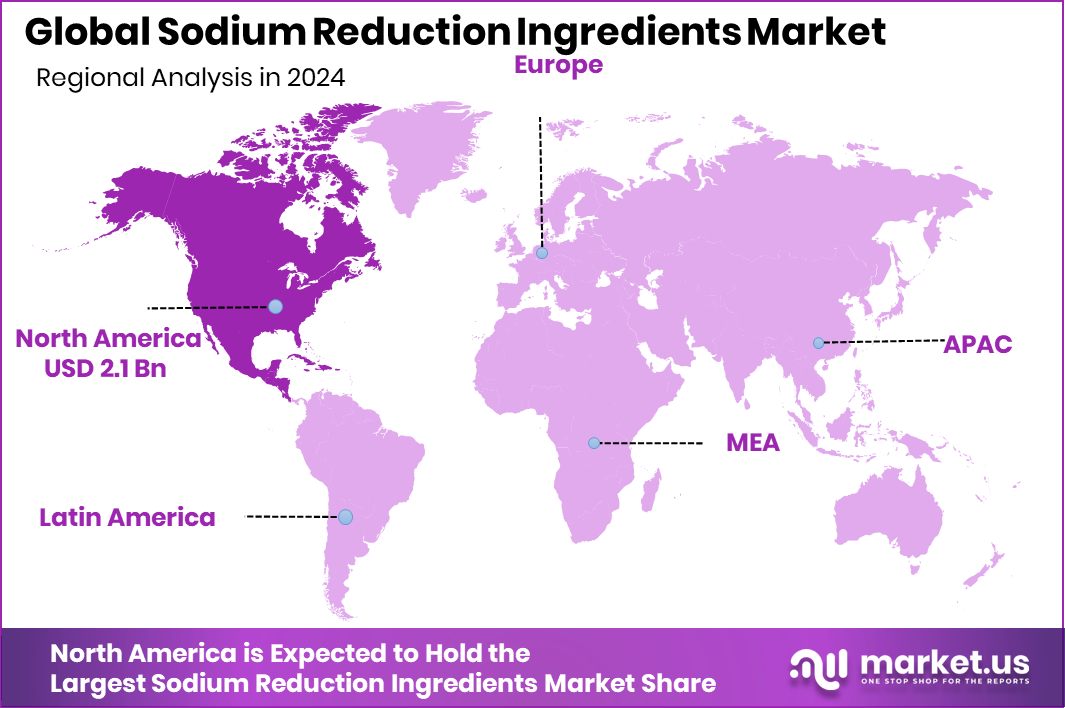

- The North American market size reached approximately USD 2.1 billion during the same year.

By Type Analysis

Amino acids dominate the sodium reduction ingredients market, holding 39.2%.

In 2024, Amino Acids held a dominant market position in the By Type segment of the Sodium Reduction Ingredients Market, with a 39.2% share. This leading position can be attributed to the growing preference for natural and functional ingredients that not only reduce sodium content but also maintain or enhance the flavor profile of food products.

Amino acids, particularly glutamic acid and its derivatives, are widely recognized for their umami properties, which help replicate the savory taste typically delivered by sodium. Their effectiveness in taste modulation makes them a preferred choice across a range of food categories, including processed meats, snacks, soups, and ready-to-eat meals.

The rise in consumer health awareness, coupled with regulatory initiatives focused on reducing sodium intake, has further accelerated the demand for amino acid-based solutions. Food manufacturers are increasingly reformulating products with amino acids to comply with health guidelines without sacrificing taste, which remains a critical factor for consumer acceptance.

Moreover, the clean-label appeal of certain amino acid ingredients, especially those derived from natural fermentation processes, aligns well with current consumer trends favoring transparency and minimally processed foods. As a result, amino acids continue to solidify their role as a key component in sodium reduction strategies within the global food industry.

By Application Analysis

The meat, seafood, and poultry segment accounts for a 26.7% share.

In 2024, Sweet and Savory Snacks, Meat, Seafood, and Poultry held a dominant market position in the By Application segment of the Sodium Reduction Ingredients Market, with a 26.7% share. This leadership reflects the high sodium content traditionally found in these product categories, where salt is extensively used for flavor enhancement, preservation, and texture development. Rising health concerns related to high sodium intake, particularly in processed meats and snack foods, have prompted both regulatory bodies and consumers to push for sodium reduction in these everyday items.

Food manufacturers operating within these segments are increasingly adopting sodium-reduction ingredients to meet evolving health standards and consumer expectations. These solutions help maintain the characteristic taste and mouthfeel while reducing the sodium levels, which is crucial for retaining customer satisfaction and brand loyalty. Moreover, the growing consumer preference for better-for-you snack options and clean-label protein foods is driving innovation in sodium reduction strategies across sweet and savory snacks as well as meat, seafood, and poultry applications.

The segment’s dominance is also influenced by reformulation efforts by producers seeking to align with sodium reduction targets set by health authorities. These combined drivers have established Sweet and Savory Snacks, Meat, Seafood, and Poultry as a primary application area for sodium reduction ingredients in 2024.

By Distribution Channel Analysis

Supermarkets and hypermarkets contribute 43.8% of total product sales.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Sodium Reduction Ingredients Market, with a 43.8% share. This leading position can be attributed to the extensive consumer reach, high foot traffic, and broad product assortment typically found in these retail formats. Supermarkets and hypermarkets serve as primary access points for consumers seeking packaged and processed food products, many of which now feature reduced sodium formulations due to increasing health awareness.

These retail outlets have increasingly focused on stocking health-focused product lines, including items formulated with sodium reduction ingredients, in response to consumer demand for better nutrition. Clear front-of-pack labeling and health tags in store aisles have made it easier for health-conscious shoppers to identify and select low-sodium options. Additionally, promotional campaigns and shelf-space prioritization for such products have helped reinforce the visibility and sales of sodium-reduced food offerings through this channel.

The segment’s performance is further supported by partnerships between food producers and large retail chains aimed at enhancing product availability and consumer education. As supermarkets and hypermarkets continue to evolve into health-centric retail destinations, their role in distributing sodium-reduction ingredient-based products is expected to remain strong and influential.

Key Market Segments

By Type

- Amino Acids

- Mineral Salts

- Potassium Chloride

- Magnesium Sulphate

- Potassium Lactate

- Calcium Chloride

- Others

- Yeast Extract

- Others

By Application

- Bakery and Confectionery

- Dairy and Frozen Foods

- Sweet and Savory Snacks: Meat, Seafood and Poultry

- Soups

- Dressings and Salads

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Retail

- Specialty Stores

- Food Service

- Others

Driving Factors

Health Concerns About High Sodium Intake Rising

One of the main driving factors for the sodium reduction ingredients market is the growing awareness of the health risks linked to consuming too much salt. High sodium intake is widely known to cause serious health problems such as high blood pressure, heart disease, and stroke. With more people learning about these risks through public health campaigns and medical advice, there is a noticeable shift toward choosing low-sodium foods.

Governments and health organizations in many countries are also setting daily sodium intake limits and encouraging food manufacturers to reduce salt levels in their products. This shift in public mindset is pushing food companies to use sodium reduction ingredients in processed foods, snacks, sauces, and ready meals to meet health expectations.

Restraining Factors

Taste and Texture Challenges Limit Product Acceptance

One major restraining factor in the sodium reduction ingredients market is the difficulty in maintaining the original taste and texture of food when salt is reduced. Sodium plays a key role not only in flavor but also in preserving food and improving its texture. When sodium is replaced or reduced, it often changes the taste of the final product, which many consumers may find less appealing.

Despite health benefits, people are usually unwilling to compromise on flavor. This creates a challenge for food manufacturers trying to reformulate recipes without losing customer satisfaction. As a result, product reformulation becomes complex and time-consuming, which can slow down the adoption of sodium reduction ingredients across the food industry.

Growth Opportunity

Multifunctional Ingredients Offering Added Health Benefits

One significant growth opportunity in the sodium reduction ingredients market lies in the development of multifunctional ingredients that provide both sodium reduction and additional health benefits. Consumers increasingly look for foods that contribute positively to their overall well-being, beyond just lower sodium levels.

Ingredients that not only reduce salt but also offer benefits like improved heart health, added minerals, or enhanced flavor profiles are especially attractive to health-conscious shoppers. Food manufacturers are exploring options such as potassium-enriched salt alternatives, savory enhancers, and fermented ingredients that naturally bring both taste and nutritional value to recipes.

These multifunctional solutions support the clean-label movement and allow companies to make impactful health claims. By leveraging these innovative ingredients, manufacturers can differentiate their products and meet evolving consumer demands for foods that are wholesome, flavorful, and better for health, all without compromising taste.

Latest Trends

Natural and Clean Label Ingredients Gaining Popularity

One of the latest trends in the sodium reduction ingredients market is the growing demand for natural and clean-label solutions. Consumers are now more conscious about the ingredients in their food and prefer products that use fewer artificial additives. This trend is encouraging food producers to choose natural sodium reduction options such as seaweed extracts, mineral salts, and fermented ingredients.

These alternatives not only help lower sodium but also align with the clean label movement, which focuses on transparency, minimal processing, and recognizable ingredients. As shoppers read food labels more carefully, clean-label sodium reduction solutions are becoming a preferred choice. This trend is reshaping how food is formulated, especially in packaged snacks, soups, and frozen meals.

Regional Analysis

In 2024, North America led the market with a 42.30% share, showing dominance.

In 2024, North America emerged as the dominant region in the global Sodium Reduction Ingredients Market, accounting for 42.30% of the overall market share, valued at approximately USD 2.1 billion. This regional leadership is supported by increased consumer awareness of sodium-related health risks and growing regulatory efforts promoting reduced sodium content in packaged and processed foods. The region has witnessed a notable shift in consumption patterns, with greater demand for clean-label, low-sodium food alternatives across snacks, ready meals, and processed meats.

In Europe, rising health concerns and supportive public health initiatives are also fostering steady adoption of sodium reduction solutions. The region’s well-established food industry and emphasis on reformulated products with balanced nutritional profiles have contributed to regional growth.

The Asia Pacific region is witnessing emerging demand, particularly due to urbanization, growing processed food consumption, and rising lifestyle-related health issues. Middle East & Africa and Latin America represent developing markets, where increased awareness and gradual regulatory measures are beginning to encourage sodium reduction across food categories.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF leveraged its strong R&D capabilities to develop advanced flavor modulation technologies. By focusing on peptide- and yeast-derived ingredients, the company aimed to offer scalable sodium-reducing solutions compatible with a wide range of food applications. BASF’s collaborations with regional food producers enabled rapid product rollouts in staple categories such as soups and sauces.

Biospringer, drawing on its expertise in fermentation and enzyme-based ingredients, pursued a clean-label formulation strategy. The company emphasized natural flavor enhancers and umami-rich extracts derived from microbial fermentation. Such solutions aligned well with consumer preferences for transparent ingredient sourcing, while delivering the sensory qualities needed in meat alternatives and plant-based offerings.

Cargill Inc. took a multi-pronged approach by combining its global supply chain infrastructure with investments in product innovation. The company introduced mineral salt blends and natural extracts tailored for specific food formats like snacks and ready meals. Through technical support and formulation services, Cargill facilitated adoption among food producers navigating sodium reduction mandates.

Corbion N.V. focused on its heritage in fermentation and biotechnology, enhancing ingredient functionality beyond sodium reduction. The company introduced multifunctional components, such as fermented specialty ingredients, which not only maintain taste but also extend shelf life or improve nutritional profiles. Their ingredients proved especially valuable in dairy, meat, and beverage segments where clean-label and natural properties were critical.

Top Key Players in the Market

- AJINOMOTO

- Barcelonesa Food Ingredients

- BASF

- Biospringer

- Cargill Inc.

- Corbion N.V.

- DuPont

- FMC Corporation

- Givaudan SA

- Ingredion

- Innophos Holdings Inc.

- Jungbunzlauer Suisse AG

- Kerry Group plc

- McCormick and Company

- Sensient Technologies Corporation

- Tate and Lyle

Recent Developments

- In June 2025, Ajinomoto Health & Nutrition North America introduced Salt Answer, reducing sodium by up to 30% using umami-based blends, and Palate Perfect, a fermentation-based flavor platform for enhancing taste while reducing ingredient volatility.

- In June 2025, Lesaffre (Biospringer’s parent) partnered with Zilor, acquiring a 70% stake in Biorigin. The joint venture aims to scale up production of yeast derivatives and savory ingredients, supporting global demand for natural sodium-reduction solutions.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 8.9 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Amino Acids, Mineral Salts (Potassium Chloride, Magnesium Sulphate, Potassium Lactate, Calcium Chloride , Others), Yeast Extract, Others), By Application (Bakery and Confectionery, Dairy and Frozen Foods, Sweet and Savory Snacks Meat, Seafood and Poultry, Soups, Dressings and Salads, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Food Service, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AJINOMOTO, Barcelonesa Food Ingredients, BASF, Biospringer, Cargill Inc., Corbion N.V., DuPont, FMC Corporation, Givaudan SA, Ingredion, Innophos Holdings Inc., Jungbunzlauer Suisse AG, Kerry Group plc, McCormick and Company, Sensient Technologies Corporation, Tate and Lyle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Reduction Ingredients MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Reduction Ingredients MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AJINOMOTO

- Barcelonesa Food Ingredients

- BASF

- Biospringer

- Cargill Inc.

- Corbion N.V.

- DuPont

- FMC Corporation

- Givaudan SA

- Ingredion

- Innophos Holdings Inc.

- Jungbunzlauer Suisse AG

- Kerry Group plc

- McCormick and Company

- Sensient Technologies Corporation

- Tate and Lyle