Global Skin Grafting System Market By Product Type (Dermatomes, Skin Graft Mesher Equipment, Wound Debridement Devices, Accessories and Others), By Technology (Autograft and Allograft), By Application (Burns, Chronic Wounds, Traumatic Wounds, Surgical Wounds and Others), By End-user (Hospitals, Ambulatory Surgical Centers and Specialty Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171699

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

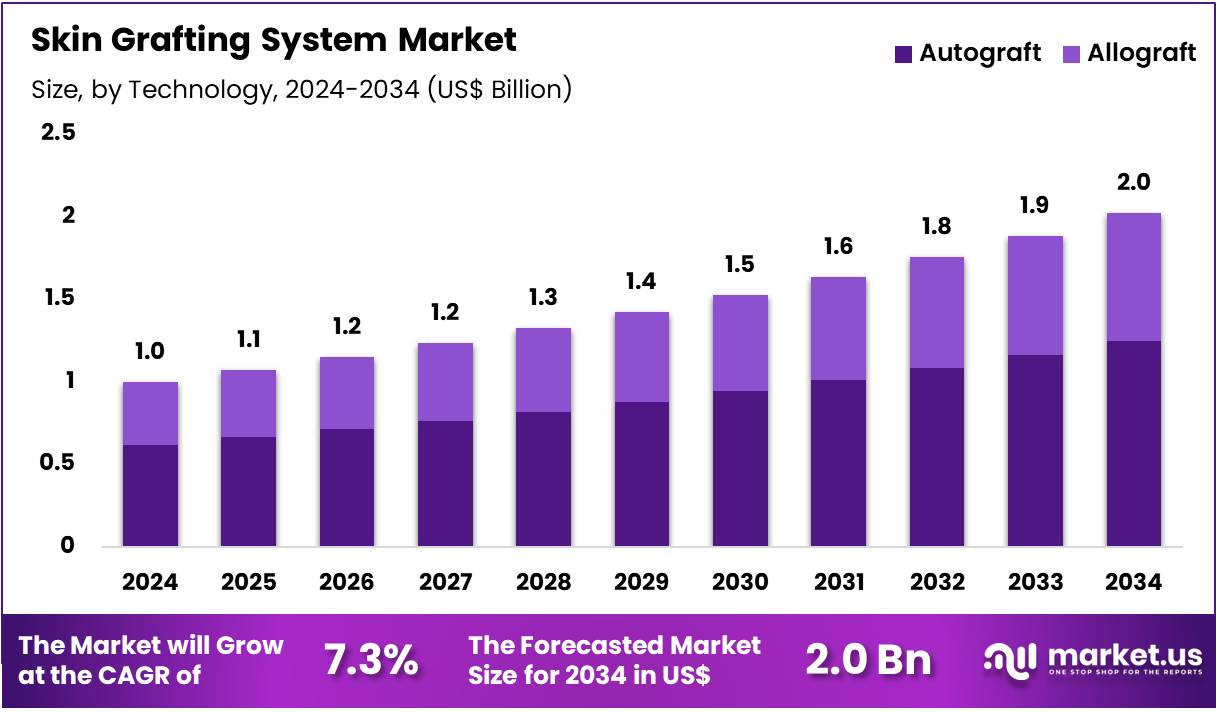

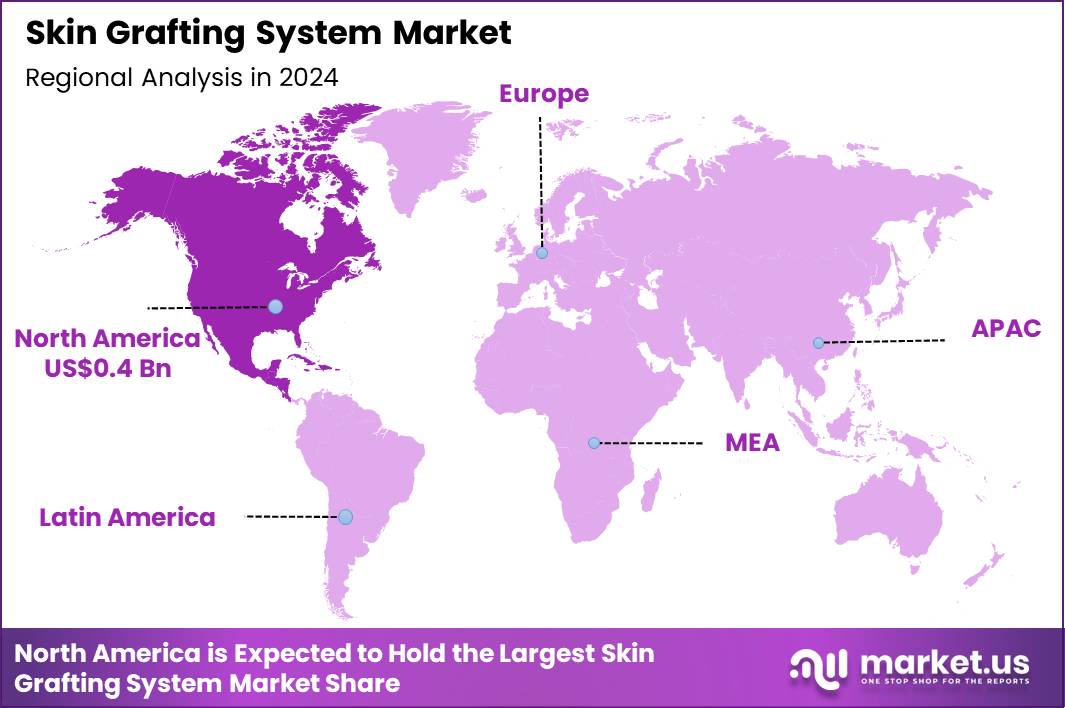

The Global Skin Grafting System Market size is expected to be worth around US$ 2.0 Billion by 2034 from US$ 1.0 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.4% share with a revenue of US$ 0.4 Billion.

Increasing prevalence of burn injuries and chronic wounds propels the Skin Grafting System market, as clinicians seek reliable methods to restore skin integrity and prevent complications in extensive tissue loss scenarios. Manufacturers advance meshers, dermatomes, and bioengineered matrices that facilitate uniform graft expansion and integration with host tissue.

These systems apply in severe thermal burn coverage to promote re-epithelialization over large surface areas, diabetic foot ulcer reconstruction to accelerate closure and limb salvage, pressure sore treatment in immobile patients for infection control, and post-Mohs surgery defect repair to achieve cosmetic restoration. Capacity expansions address escalating demand for advanced materials, creating opportunities for scalable production of synthetic and bioresorbable grafts.

In July 2025, Polynovo announced plans to expand its manufacturing capacity to increase graft output, directly responding to rising global demand for synthetic and bioresorbable skin graft materials in trauma, burn, and reconstructive procedures. This strategic move enhances supply reliability and supports sustained market growth through improved availability.

Growing adoption of autologous and allogeneic grafting techniques accelerates the Skin Grafting System market, as surgeons prioritize patient-derived or donor tissues that minimize rejection and support vascularization for durable outcomes. Companies refine harvesting tools like electric dermatomes that yield consistent split-thickness sheets with adjustable depths.

Applications encompass traumatic avulsion injuries requiring immediate coverage to preserve underlying structures, oncologic excision sites for margin-negative defect closure, pediatric scald burns utilizing expanded meshes for growth accommodation, and venous leg ulcer therapy combining grafts with compression for recurrence prevention.

Precision instruments open avenues for minimally invasive harvesting that reduce donor site morbidity and operative time. Research focuses on combining grafts with growth factor dressings to enhance engraftment rates in compromised wound beds. This clinical emphasis drives innovation in user-friendly systems tailored for varied surgical specialties.

Rising development of tissue-engineered and xenogeneic alternatives invigorates the Skin Grafting System market, as innovators create off-the-shelf matrices that serve as temporary scaffolds until autologous coverage becomes feasible. Biotechnology firms produce acellular dermal substitutes and cultured epithelial autografts that integrate seamlessly with host regeneration processes.

These advanced options support complex reconstructive needs in full-thickness defects from necrotizing infections, radiation-damaged tissue preparation for secondary grafting, congenital giant nevus excision in children for malignancy prevention, and hand burn contracture release to restore function.

Bioengineered trends create opportunities for hybrid systems that combine synthetic templates with cellular seeding for customized healing profiles. Collaborative trials actively evaluate long-term cosmetic and functional results to refine application guidelines. This regenerative direction establishes skin grafting systems as versatile platforms in comprehensive wound care strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.0 Billion, with a CAGR of 7.3%, and is expected to reach US$ 2.0 Billion by the year 2034.

- The product type segment is divided into dermatomes, skin graft mesher equipment, wound debridement devices, accessories and others, with dermatomes taking the lead in 2024 with a market share of 34.7%.

- Considering technology, the market is divided into autograft and allograft. Among these, autograft held a significant share of 61.8%.

- Furthermore, concerning the application segment, the market is segregated into burns, chronic wounds, traumatic wounds, surgical wounds and others. The burns sector stands out as the dominant player, holding the largest revenue share of 42.9% in the market.

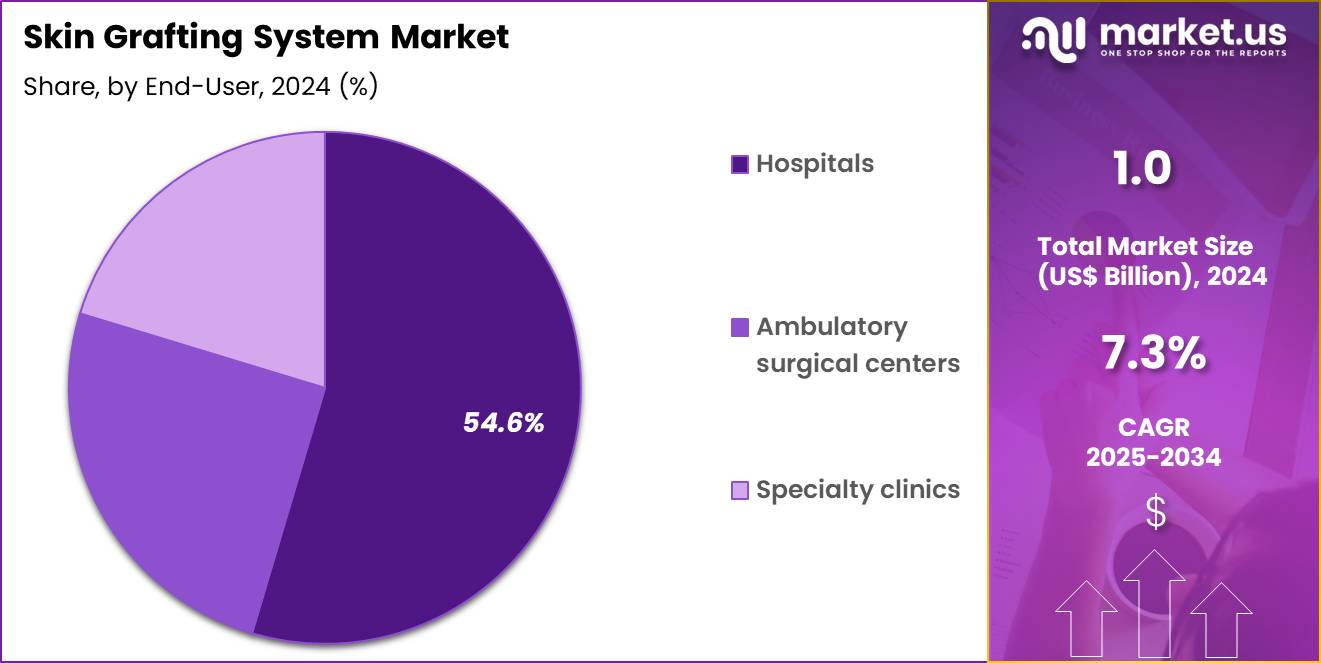

- The end-user segment is segregated into hospitals, ambulatory surgical centers and specialty clinics, with the hospitals segment leading the market, holding a revenue share of 54.6%.

- North America led the market by securing a market share of 39.4% in 2024.

Product Type Analysis

Dermatomes, holding 34.7%, are expected to dominate because precise and uniform skin harvesting remains critical for successful grafting outcomes. Surgeons prefer advanced dermatomes to control graft thickness accurately, which directly influences graft survival and healing time. Rising burn injuries and complex wound cases increase procedural volumes, strengthening demand for reliable harvesting tools.

Technological improvements enhance ergonomics and cutting precision, reducing operative time and surgeon fatigue. Hospitals invest in modern dermatomes to support higher patient throughput and consistent clinical results. Training standardization around dermatome use further reinforces adoption across surgical teams. These drivers keep dermatomes anticipated to remain the leading product type in the skin grafting system market.

Technology Analysis

Autograft, holding 61.8%, is projected to dominate because patient-derived tissue offers superior compatibility and lower rejection risk compared with donor alternatives. Clinicians prioritize autografts for definitive wound closure, especially in extensive burns and traumatic injuries. Improved surgical techniques support faster integration and reduced infection risk, improving patient recovery outcomes.

Increasing awareness of long-term graft durability strengthens preference for autologous tissue. Regulatory simplicity compared with donor tissue use also accelerates adoption in routine clinical practice. Expanding reconstructive procedures further elevate autograft utilization. These factors keep autograft expected to remain the dominant technology segment.

Application Analysis

Burns, holding 42.9%, are anticipated to dominate because severe thermal injuries frequently require surgical grafting for functional and cosmetic recovery. Rising industrial accidents, household fire incidents, and road trauma contribute to sustained burn treatment demand. Early excision and grafting protocols emphasize rapid surgical intervention, increasing graft system usage.

Specialized burn centers rely heavily on grafting systems to reduce hospitalization time and improve survival rates. Advances in critical care improve patient survival, expanding the population requiring reconstructive procedures. Public health initiatives focusing on burn care infrastructure strengthen treatment access. These trends keep burns expected to remain the leading application segment.

End-User Analysis

Hospitals, holding 54.6%, are projected to dominate because they manage the majority of acute burn cases and complex wound surgeries requiring grafting systems. Hospitals maintain specialized operating rooms, burn units, and trained surgical teams essential for graft procedures. Increasing referrals to tertiary care centers strengthen hospital-based procedure volumes.

Integration of advanced wound care and reconstructive surgery departments expands in-house grafting capabilities. Government and private investment in trauma and burn care infrastructure further boosts hospital adoption. Multidisciplinary post-operative care availability reinforces patient preference for hospital treatment. These drivers keep hospitals expected to remain the dominant end-user segment in the skin grafting system market.

Key Market Segments

By Product Type

- Dermatomes

- Skin Graft Mesher Equipment

- Wound Debridement Devices

- Accessories

- Others

By Technology

- Autograft

- Allograft

By Application

- Burns

- Chronic Wounds

- Traumatic Wounds

- Surgical Wounds

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Drivers

Increasing prevalence of chronic wounds is driving the market

Chronic wounds, including diabetic ulcers and venous leg ulcers, represent a growing public health challenge that necessitates advanced skin grafting systems for effective closure and tissue regeneration. The persistent nature of these wounds leads to prolonged healing times, elevating the demand for reliable grafting solutions to prevent secondary infections and amputations.

Healthcare systems worldwide are prioritizing interventions that accelerate epithelialization, with skin grafts serving as a cornerstone in multidisciplinary wound care protocols. This driver is compounded by comorbidities such as obesity and vascular disease, which exacerbate wound chronicity in aging populations.

National registries document escalating caseloads, prompting investments in grafting technologies compatible with outpatient settings. The versatility of modern grafting systems, from split-thickness to full-thickness options, supports tailored applications across diverse etiologies. Economic imperatives underscore the value of grafts in reducing recurrence rates and associated healthcare expenditures.

Professional societies advocate for early grafting in non-healing wounds, influencing clinical guideline updates. As incidence rises, supply chains for biocompatible materials expand to meet procedural volumes. Ultimately, this factor propels the market toward integrated, patient-centric innovations in dermal reconstruction.

Restraints

High rates of graft failure are restraining the market

Graft failure, characterized by partial or complete loss of transplanted tissue, remains a significant barrier to optimal outcomes in skin grafting procedures, often due to factors like poor vascularization and infection. This complication prolongs recovery and increases the need for revision surgeries, eroding clinician confidence in certain grafting modalities. Variability in recipient site preparation contributes to inconsistent integration, complicating predictive modeling for success.

Regulatory emphasis on post-procedure monitoring adds administrative burdens, delaying adoption of novel systems. Patient-specific risks, including smoking and malnutrition, amplify failure probabilities, necessitating rigorous pre-operative screening. The psychological impact on patients from repeated interventions further tempers enthusiasm for grafting as a primary option.

Resource allocation toward failure mitigation, such as adjunctive therapies, diverts funds from core system development. Standardization of grafting techniques lags, perpetuating disparities in efficacy across institutions. These challenges result in conservative prescribing patterns, favoring alternative wound management strategies. In summary, addressing failure mechanisms is essential to unlocking the full therapeutic potential of skin grafting systems.

Opportunities

Advancements in autologous cell harvesting technologies are creating growth opportunities

Autologous cell harvesting systems enable the preparation of patient-derived skin suspensions for grafting, minimizing rejection risks and promoting natural regeneration in acute and chronic wounds. These technologies reduce donor site requirements, allowing coverage of larger defects with minimal autologous tissue harvest. Integration with point-of-care processing streamlines workflows, making them suitable for resource-limited environments.

Collaborative validations demonstrate superior healing kinetics compared to traditional meshes, informing expanded indications. Scalability through miniaturized devices unlocks applications in ambulatory surgery centers, broadening accessibility. Synergies with biomaterials enhance cell viability during transport, extending utility in remote care scenarios. Global health partnerships facilitate technology dissemination to high-burden regions, addressing equity gaps.

Cost analyses reveal long-term savings from fewer donor site complications, supporting reimbursement advocacy. As precision improves, opportunities emerge for combination therapies with growth factors. Collectively, these innovations position autologous harvesting as a transformative pillar in regenerative dermatology.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics strengthen the skin grafting system market as increasing healthcare funding and growing incidences of severe wounds worldwide encourage medical centers and burn units to incorporate sophisticated harvesting tools and mesh expanders for optimal tissue repair. Leading producers promptly introduce ergonomic, electrically powered devices, leveraging the upward trend in reconstructive surgeries and advanced wound management protocols across diverse healthcare settings.

Lingering inflation and inconsistent global growth, however, raise expenses for high-grade blades and disposable components, leading facilities to postpone capital investments and maintain older systems longer in financially challenged areas. Geopolitical challenges, notably U.S.-China trade frictions and disruptions from international conflicts, often impede deliveries of specialized alloys and electronic parts, resulting in manufacturing setbacks and elevated risks for companies tied to global vendors.

Current U.S. tariffs apply a standard rate on imported surgical instruments combined with higher levies on Asian-sourced grafting equipment, increasing overall expenses for U.S. buyers and pressuring profit levels throughout the value chain. Such tariffs also elicit counter-tariffs from other nations that curb American shipments of superior grafting solutions and impede multinational research alliances.

Still, these obstacles stimulate substantial commitments to U.S.-centric factories and supply diversification, establishing stronger foundations that will promote technological progress and durable market advancement moving forward.

Latest Trends

FDA approval of the RECELL GO System is a recent trend

On May 30, 2024, the U.S. Food and Drug Administration approved the RECELL GO System, a compact autologous cell harvesting device from AVITA Medical for treating thermal burns and full-thickness skin defects. This approval validates its use in preparing Spray-On Skin Cells from a small donor site, requiring up to 95% less tissue than conventional methods. The system targets wounds covering less than 50% total body surface area, emphasizing reduced pain and accelerated donor site recovery.

Its streamlined enzyme incubation controls optimize cell yield, enhancing graft viability for immediate application. This development aligns with regenerative trends, shortening hospital stays through efficient closure strategies. Early clinical integrations highlight workflow improvements, easing training for surgical teams.

The approval extends the RECELL platform’s reach, previously cleared for broader indications, to miniaturized formats for versatile deployment. Regulatory documentation confirms biocompatibility and sterility, bolstering safety profiles. This milestone encourages parallel advancements in cell-based grafting tools. Overall, the 2024 clearance signifies a leap toward accessible, patient-matched dermal therapies.

Regional Analysis

North America is leading the Skin Grafting System Market

In 2024, North America secured a 39.4% portion of the global skin grafting system market, invigorated by rising incidences of thermal traumas and breakthroughs in regenerative dermatological techniques. Specialized burn units in leading hospitals adopt automated meshing devices and dermal substitutes to accelerate epithelialization, addressing extensive full-thickness wounds from industrial accidents and wildfires.

Federal allocations via the Health Resources and Services Administration bolster training programs for microvascular anastomosis tools, enhancing graft survival rates in reconstructive surgeries for veterans and trauma survivors. Biopharmaceutical collaborations yield bioengineered scaffolds infused with growth factors, optimizing vascular integration for chronic ulcer patients in outpatient dermatology practices.

Demographic expansions in outdoor recreation sectors heighten scald and friction injury volumes, compelling insurers to endorse portable harvesting kits for timely interventions. Supply network fortifications post-global disruptions guarantee sterile, single-use applicators, conforming to stringent biocompatibility norms.

Professional guilds disseminate evidence-based protocols, elevating procedural standardization across multidisciplinary wound care teams. These synergies manifest a dedicated pursuit of restorative excellence, mitigating long-term scarring sequelae. The National Fire Protection Association documented 13,250 reported civilian fire injuries in the United States during 2022, emphasizing the imperative for advanced grafting innovations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Clinicians foresee substantial momentum in skin grafting apparatuses throughout Asia Pacific over the forecast period, as escalating urbanization intensifies wound care exigencies. Health departments in India and Australia channel investments into subsidized procurement, equipping trauma centers with pneumatic dermatomes to harvest split-thickness autografts for blast victims in crowded metropolises.

Engineering consortia in China devise affordable acellular matrices, enabling peripheral clinics in Vietnam to perform allogeneic transplants for diabetic foot reconstructions amid rising metabolic disorders. Summit gatherings under the Asia-Pacific Burn Society exchange best practices on laser-assisted integration, arming surgeons in Indonesia with precision instruments for keloid-prone ethnicities.

Affluent demographics in Japan pursue elective cosmetic enhancements, propelling private enterprises to innovate vacuum-assisted closure hybrids for post-mastectomy sites. Policy alignments expedite clearance for stem cell-embedded meshes, allowing exporters in South Korea to furnish scalable options for earthquake-prone terrains.

Outreach initiatives educate nomadic herders in Mongolia on basic excision kits, curtailing infection cascades from frostbite exposures. These pursuits ignite transformative potentials, anchoring resilient frameworks against proliferative dermal assaults. The Global Burden of Disease Collaboration estimated 54,230,940 mild burn cases in Southeast Asia, East Asia, and Oceania in 2021, galvanizing regional advancements in grafting modalities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key companies in the Skin Grafting System market drive growth by advancing dermatomes, meshing devices, and regenerative adjuncts that improve graft take rates and surgical efficiency across burn and trauma care. Participants in the Skin Grafting System market expand adoption by partnering with burn centers, trauma hospitals, and plastic-surgery networks to standardize grafting protocols in acute and chronic wound pathways.

Product teams active in the Skin Grafting System market prioritize ergonomic design, precision control, and compatibility with negative-pressure wound therapy to enhance clinician efficiency and patient outcomes. Commercial leaders in the Skin Grafting System market secure scale through long-term hospital contracts while extending presence in emerging regions via localized training and service support.

Strategy groups operating in the Skin Grafting System market invest in clinical evidence generation and surgeon education to position grafting solutions as cost-effective alternatives to prolonged wound management. Smith+Nephew represents a leading player in the Skin Grafting System market through its comprehensive wound-care and surgical portfolio, global manufacturing footprint, and continuous innovation that supports reliable graft harvesting and preparation across diverse clinical settings.

Top Key Players

- Zimmer Biomet

- Surtex Instruments

- Integra LifeSciences

- B. Braun Melsungen AG

- De Soutter Medical

- Nouvag AG

- Aesculap

- Ethicon (Johnson & Johnson)

Recent Developments

- In June 2025, research teams from Sheba Tel Hashomer Medical Center and Tel Aviv University advanced the development of bioengineered skin constructs targeted at burn care. This progress reinforces clinical confidence in next-generation grafting solutions, accelerating adoption of advanced skin grafting systems that improve healing outcomes, reduce donor-site limitations, and expand treatment options for severe burn patients.

- In April 2025, CUTISS formed a strategic partnership with Tecan to integrate automation into the production of bioengineered human skin tissue. The collaboration supports scalable and standardized manufacturing of skin graft substitutes, directly driving market growth by improving consistency, lowering production costs, and enabling broader hospital-level deployment of skin grafting systems.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 Billion Forecast Revenue (2034) US$ 2.0 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dermatomes, Skin Graft Mesher Equipment, Wound Debridement Devices, Accessories and Others), By Technology (Autograft and Allograft), By Application (Burns, Chronic Wounds, Traumatic Wounds, Surgical Wounds and Others), By End-user (Hospitals, Ambulatory Surgical Centers and Specialty Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet, Surtex Instruments, Integra LifeSciences, B. Braun Melsungen AG, De Soutter Medical, Nouvag AG, Aesculap, Ethicon (Johnson & Johnson) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skin Grafting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Skin Grafting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zimmer Biomet

- Surtex Instruments

- Integra LifeSciences

- B. Braun Melsungen AG

- De Soutter Medical

- Nouvag AG

- Aesculap

- Ethicon (Johnson & Johnson)