Global Shipping Containers Market Size, Share, Growth Analysis By Product (ISO Containers, Non-standardized Containers), By Flooring (Wood, Vinyl, Bamboo, Metal, Others), By Application (Industrial Transport, Food Transport, Consumer Goods Transport, Others), By Size (40’ Containers, High Cube Containers, 20’ Containers, Others), By Type (Dry Containers, Tank Containers, Reefer Containers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151075

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

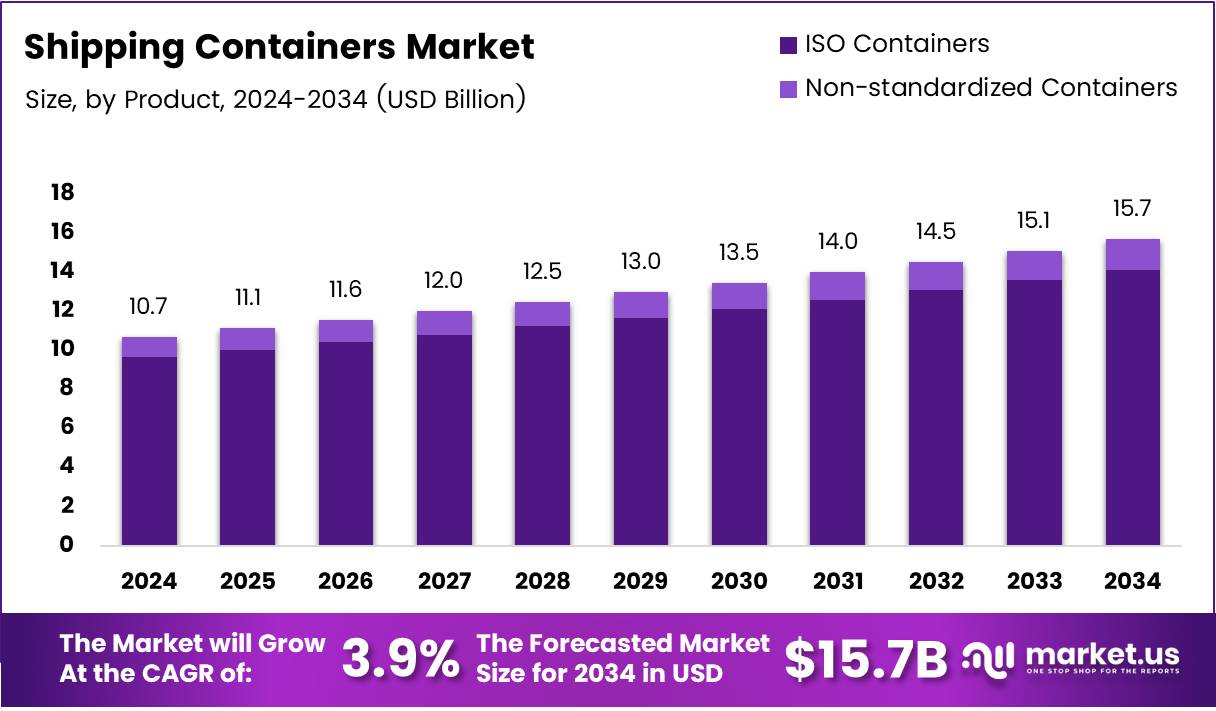

The Global Shipping Containers Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 10.7 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

The shipping containers market is integral to global trade and logistics, playing a crucial role in the movement of goods across international borders. Shipping containers are standardized, reusable units designed to hold various types of cargo, from bulk items to delicate goods. The market has been expanding due to increased demand for efficient transportation solutions and rising global trade volumes.

According to TheLoadstar, global container volumes grew by 6.2% in 2024 compared to 2023, with December 2024 seeing 16 million TEUs, a 4.5% rise over the same month in 2023. This growth reflects the strengthening of global supply chains and the rising demand for containerized freight, driven by e-commerce and industrial production.

In terms of regional shifts, according to UNCTAD, developing economies increased their share of global maritime freight from 38% in 2000 to 54% in 2023, with Asia—especially China—being the primary driver of this expansion. The rise of these economies has influenced the growth of the container shipping market as they increase imports and exports.

Furthermore, the shipping container market is supported by a substantial fleet of container ships. As per Contimod, there are about 5,600 container ships globally, with 65 million shipping containers in active use. This highlights the extensive infrastructure that underpins global trade, supporting the rapid movement of goods across oceans.

The shipping industry also contributes significantly to the global economy. According to the World Shipping Council, container shipping generates around $1.5 trillion annually, showcasing its importance to international commerce and the broader global economic system.

Moreover, a significant volume of goods is transported by containers each year. As per Hz-Containers, over 1.7 billion tonnes of goods are shipped in containers worldwide annually, further underscoring the vast scale of this market.

Opportunities within the shipping container market are influenced by ongoing advancements in container design, including innovations in container strength, security features, and material sustainability. Additionally, the growing demand for greener and more efficient solutions aligns with global efforts toward reducing carbon emissions in logistics.

Government investment in infrastructure also plays a key role. Ports and shipping routes are increasingly upgraded to accommodate larger vessels and more containers, supporting global trade and facilitating faster and more cost-effective shipping. However, regulatory frameworks concerning environmental standards, such as restrictions on emissions from ships, are shaping the future of the market by encouraging the adoption of more sustainable practices.

Key Takeaways

- The Global Shipping Containers Market is expected to reach USD 15.7 Billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

- ISO Containers dominate the By Product Analysis segment with a 97.3% share in 2024.

- Wood dominates the By Flooring Analysis segment with a 60.3% share in 2024.

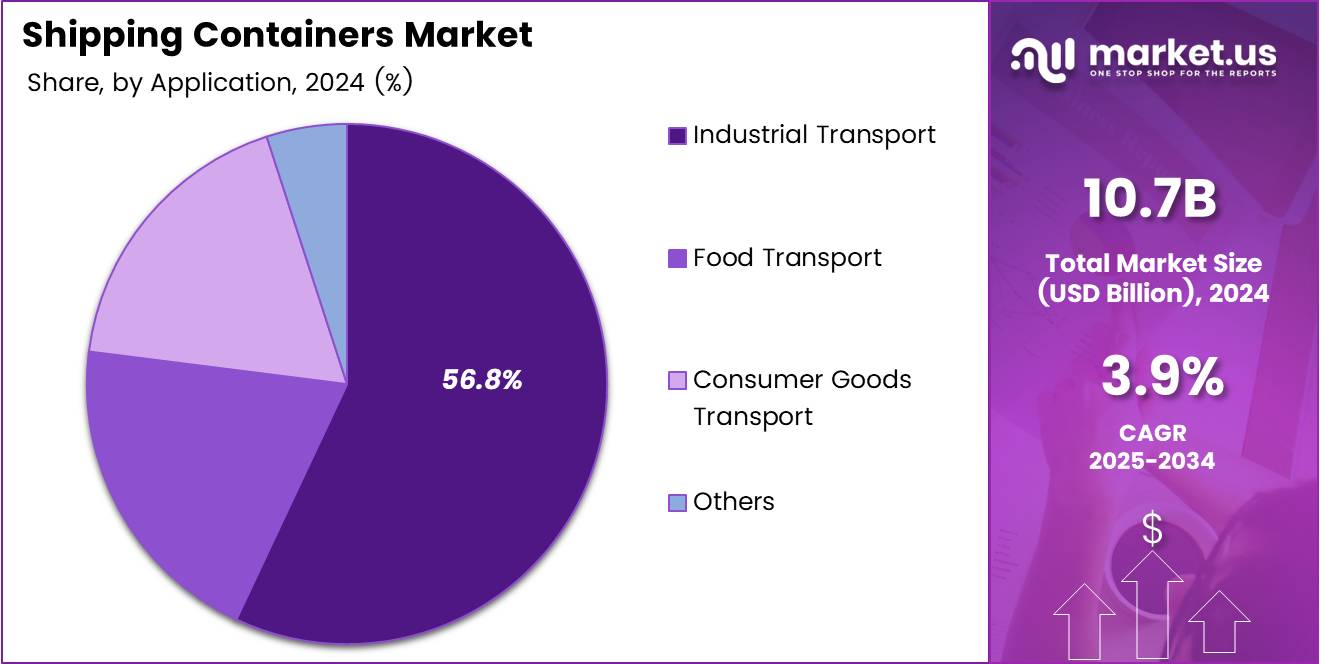

- Industrial Transport leads the By Application Analysis segment with a 56.8% share in 2024.

- 40’ Containers hold a dominant position in the By Size Analysis segment with a 49.2% share in 2024.

- Dry Containers dominate the By Type Analysis segment with an 80.5% share in 2024.

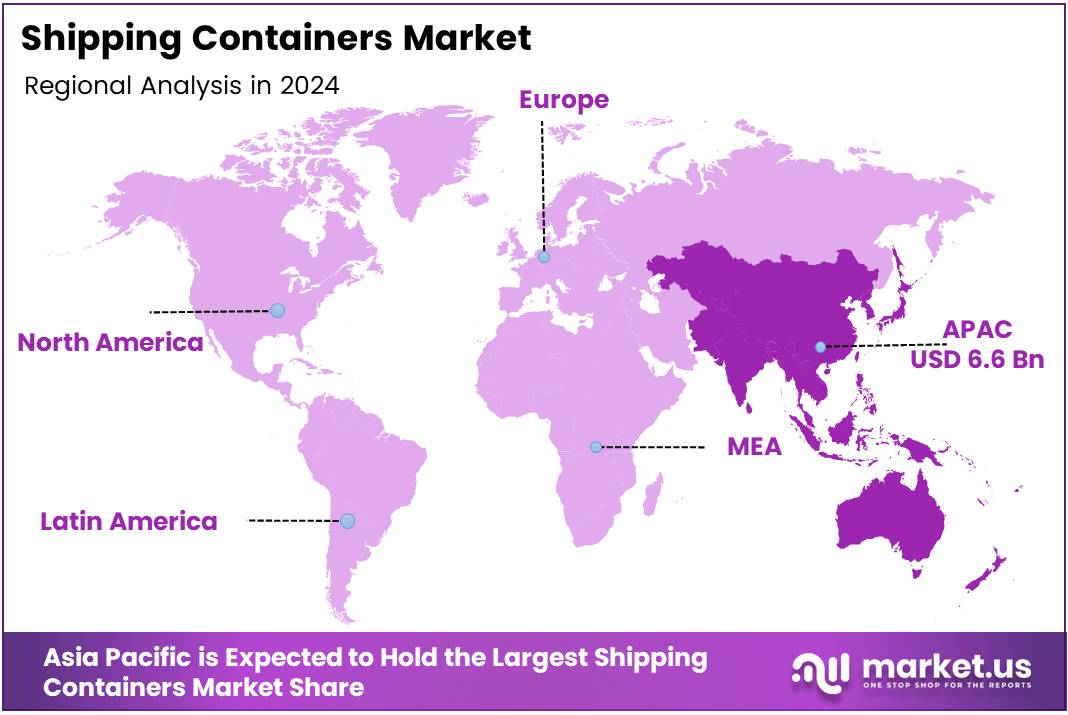

- Asia Pacific leads the global market, holding 62.6%, valued at USD 6.6 Billion in 2024.

Product Analysis

ISO Containers lead with 97.3% due to standardization and global interoperability.

In 2024, ISO Containers held a dominant market position in By Product Analysis segment of Shipping Containers Market, with a 97.3% share. Their dominance is attributed to strict adherence to international standards, making them suitable for intermodal transport across sea, road, and rail without the need for repacking.

The global logistics infrastructure is primarily built around ISO standards, which makes ISO Containers the preferred choice for shipping lines and freight operators. Their compatibility with automated systems at ports and ease of handling further support this leading position.

Non-standardized Containers, while serving niche or custom transport needs, account for a minor share. These containers are typically used for specific cargo requirements or unconventional dimensions, but lack of universal compatibility limits their scalability and usage across international borders.

Flooring Analysis

Wood dominates with 60.3% due to durability and cost-efficiency in container flooring.

In 2024, Wood held a dominant market position in By Flooring Analysis segment of Shipping Containers Market, with a 60.3% share. Wood flooring remains the standard in most containers, primarily for its resilience under heavy loads and cost-effective maintenance.

The adaptability of wood to diverse climate conditions and its relative ease of repair make it the top flooring material for shipping containers. It also provides better shock absorption for transported goods compared to metal or vinyl alternatives.

Vinyl and Bamboo are gaining slow traction due to their environmental benefits and aesthetic appeal, particularly in converted container spaces. Metal flooring, though highly durable, is often limited to specialty containers due to its weight and higher cost. The Others category includes emerging or hybrid materials, still at an experimental or low adoption stage.

Application Analysis

Industrial Transport leads with 56.8% owing to high-volume freight and global trade demands.

In 2024, Industrial Transport held a dominant market position in By Application Analysis segment of Shipping Containers Market, with a 56.8% share. The segment benefits from heavy use in transporting raw materials, machinery, and bulk commodities across long distances.

The industrial sector’s reliance on maritime freight for importing and exporting goods fuels the demand for robust and standardized containers, especially ISO models. These containers ensure secure, large-scale, and repeated usage, aligning perfectly with industrial logistics operations.

Food Transport follows as a significant application, driven by growing global trade in perishables and demand for temperature-controlled containers. Consumer Goods Transport is steadily growing, with retail and e-commerce expansion creating diverse cargo movement needs. Others includes specialty transports such as hazardous materials or high-value items, each requiring customized container solutions.

Size Analysis

40’ Containers dominate with 49.2% as the industry standard for cargo optimization.

In 2024, 40’ Containers held a dominant market position in By Size Analysis segment of Shipping Containers Market, with a 49.2% share. Their size makes them ideal for transporting a wide variety of goods while maximizing space efficiency in sea and rail logistics.

These containers are the most cost-effective for long-haul shipments and widely used by freight companies globally. Their balance of capacity and manageability makes them the preferred option across industrial, retail, and agricultural sectors.

High Cube Containers offer additional vertical space and are commonly used for voluminous or tall cargo, while 20’ Containers serve lighter or smaller shipments, often in intermodal or regional transport. Others includes specialized or modified sizes used in specific applications like modular housing or oversized freight.

Type Analysis

Dry Containers dominate with 80.5% due to their versatility in transporting general cargo.

In 2024, Dry Containers held a dominant market position in By Type Analysis segment of Shipping Containers Market, with a 80.5% share. These containers are widely used for shipping non-perishable and general-purpose cargo, making them the most in-demand container type across global shipping routes.

Their standardized design, structural integrity, and adaptability for a broad range of goods make Dry Containers the first choice for industries like retail, manufacturing, and construction. They offer a cost-effective and efficient solution for transporting packaged goods, electronics, textiles, and more.

Tank Containers serve niche markets such as chemicals, oil, and liquid food products. Though essential, their usage remains limited compared to general-purpose containers. Reefer Containers, designed for temperature-sensitive goods like food and pharmaceuticals, represent a growing segment but still account for a smaller portion of the market.

The Others category includes specialized containers used for unconventional cargo types or customized applications. While these play an important role in specific sectors, their collective share is minimal compared to the overwhelming preference for Dry Containers.

Key Market Segments

By Product

- ISO Containers

- Non-standardized Containers

By Flooring

- Wood

- Vinyl

- Bamboo

- Metal

- Others

By Application

- Industrial Transport

- Food Transport

- Consumer Goods Transport

- Others

By Size

- 40’ Containers

- High Cube Containers

- 20’ Containers

- Others

By Type

- Dry Containers

- Tank Containers

- Reefer Containers

- Others

Drivers

Expansion of Containerized Shipping Infrastructure Supports Market Growth

The global rise in trade activities and the booming e-commerce industry are pushing the demand for shipping containers. With more goods moving across borders every day, companies are relying on containers for fast, efficient, and secure delivery. This is especially true for international e-commerce platforms that need consistent and scalable shipping solutions.

As ports and terminals upgrade their infrastructure to handle larger volumes, containerized shipping becomes more reliable. Many regions are expanding their port capacities and investing in automation technologies, making it easier to handle large numbers of containers with minimal delays. This is helping boost confidence in global supply chain operations.

The shift toward environmentally friendly container designs is also supporting market growth. Companies are now focusing on reducing carbon footprints by using containers made from recycled materials or designs that are energy efficient. These efforts align with global climate goals, making them attractive to businesses and governments alike.

Altogether, these trends create a strong foundation for the continued expansion of the shipping container market. With modern logistics systems depending heavily on container transport, any improvements in infrastructure or design have a direct impact on growth.

Restraints

Rising Fuel Costs and Environmental Concerns Challenge Market Stability

One of the major challenges in the shipping container market is the rising cost of fuel. As shipping is energy-intensive, any spike in fuel prices directly increases transportation costs. This makes container shipping less affordable for companies, especially smaller ones, and can slow down overall market activity.

Environmental concerns are also affecting the market. Governments and international bodies are imposing stricter emissions regulations on the shipping industry. This pushes shipping companies to invest in cleaner technologies, which can be expensive and may not be feasible for all players in the short term.

Geopolitical tensions are another key restraint. Trade barriers, sanctions, and political instability in some regions disrupt the smooth flow of goods. These issues create uncertainty for investors and businesses, making it risky to depend heavily on global container shipping routes.

Additionally, fluctuating international relations can impact shipping agreements and cause delays. These external factors can make it harder for companies to plan logistics effectively, thereby slowing market momentum.

Overall, while the market has strong drivers, these restraints could limit its growth unless addressed with innovative and strategic solutions.

Growth Factors

Development of Smart Containers with IoT Integration Fuels Market Potential

The adoption of smart containers powered by IoT technology is opening new growth opportunities in the shipping container market. These containers can track location, temperature, and even detect tampering, offering better control over cargo. For logistics companies, this means fewer losses and improved customer satisfaction.

Another promising opportunity lies in sustainable materials. There is growing interest in developing recyclable and eco-friendly containers to meet environmental regulations and customer expectations. Using lighter and more durable materials can also lower fuel consumption, which benefits both the environment and operational costs.

Leasing markets for containers are also expanding. Many companies prefer leasing over owning to reduce capital expenditure. This trend is encouraging the growth of container leasing firms, which can provide flexible solutions tailored to different business needs.

Together, these developments are transforming the industry. By focusing on innovation, sustainability, and service flexibility, the market is well-positioned to meet future global logistics demands.

Emerging Trends

Integration of Digital Technologies for Fleet Management Reshapes Market Dynamics

Digital technology is becoming a key trend in the shipping container market. Advanced fleet management systems now allow companies to track and manage their containers in real time. This leads to better route planning, reduced delays, and increased operational efficiency.

Blockchain is also making waves in the industry. By offering a transparent and secure way to record container movements, blockchain helps reduce fraud, paperwork, and disputes between parties. It also speeds up customs clearance, making global shipping more efficient.

Cold chain logistics is gaining importance due to the rise in demand for perishable goods like food and pharmaceuticals. Containers equipped with temperature control features are now essential for maintaining product quality during transport. This trend is expanding the use of specialized containers and driving innovation in this segment.

These trending factors are shaping the future of the container shipping market. Companies that adopt these technologies early will likely gain a competitive edge and be better prepared to handle evolving logistics challenges.

Regional Analysis

Asia Pacific Dominates the Shipping Containers Market with a Market Share of 62.6%, Valued at USD 6.6 Billion

Asia Pacific leads the global shipping containers market, holding a significant market share of 62.6%, valued at USD 6.6 Billion. This dominance is driven by the region’s robust maritime trade, particularly with China, Japan, and South Korea being major shipping hubs. The region’s growing container fleet and increasing demand for containerized freight transportation further boost its market position.

North America Shipping Containers Market Trends

North America holds a strong position in the global shipping containers market, supported by the region’s advanced logistics infrastructure and high levels of trade with Asia and Europe. The U.S. is the key contributor, with its major ports handling a large portion of the global container traffic, fostering steady growth in this market segment.

Europe Shipping Containers Market Trends

Europe remains a significant player in the shipping containers market, with countries such as Germany, the Netherlands, and the U.K. leading in container operations. The region benefits from its well-established maritime trade routes and regulatory advancements, ensuring the efficient movement of containers across its borders.

Middle East and Africa Shipping Containers Market Trends

The Middle East and Africa are gradually expanding in the shipping containers market, fueled by increasing trade activities in the region, particularly through the ports of the UAE, Egypt, and South Africa. Investments in infrastructure development are expected to further boost the market in the coming years.

Latin America Shipping Containers Market Trends

Latin America has shown promising growth in the shipping containers market, with Brazil and Mexico being the key players in the region. Expanding trade agreements and the development of port facilities are set to contribute to an increase in container volumes, enhancing the region’s market share over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Shipping Containers Company Insights

The global shipping containers market in 2024 continues to evolve with robust contributions from key industry players. Sea Box, Inc. stands out with its focus on innovative and customizable container solutions, particularly in the military and emergency sectors, positioning itself as a specialized provider with strong niche capabilities.

W&K Containers, Inc. maintains a steady presence in the U.S. market by offering a broad inventory and reliable container leasing options, catering primarily to industrial and logistics clients with efficiency and flexibility.

OEG is strengthening its global footprint through offshore container services, especially in the energy and oil & gas industries, where safety compliance and engineering expertise are essential, giving it a solid edge in demanding environments.

TLS Offshore Containers/TLS Special Containers continues to gain recognition for its engineering precision and safety standards, particularly in the offshore and modular accommodation container segments, meeting the stringent requirements of high-risk sectors.

These companies, through strategic product development and industry-specific solutions, are helping shape the competitive landscape of the global shipping container market in 2024.

Top Key Players in the Market

- Sea Box, Inc.

- W&K Containers, Inc.

- OEG

- TLS Offshore Containers/TLS Special Containers

- IWES LTD.

- CXIC Group

- NewPort Tank

- Danteco Industries BV

- COSCO SHIPPING Development Co., Ltd.

- China International Marine Containers (Group) Ltd

- BNH Gas Tanks

- Bertschi AG

- A.P. Moller – Maersk

- Norcomp Nordic AB

Recent Developments

- In May 2025, Reefer container shipping platform Citrus Freight raised Rs 2.5 crore in a bridge funding round to support the expansion of its refrigerated container services and enhance its fleet for perishable goods transportation.

- In Jun 2024, SkyCell secured an additional $59 million to advance its eco-friendly smart pharma transport containers, helping pharmaceutical companies reduce carbon footprints while ensuring product integrity during transit.

- In Dec 2024, Rent-A-Container acquired the rental assets of Containerize Corp., marking its second acquisition in Q4 2024, further strengthening its position in the container rental market and expanding its service capabilities.

- In Apr 2024, Triton International announced its plans to acquire Global Container International, a strategic move to expand its container leasing portfolio and bolster its market share in the global shipping industry.

- In Aug 2024, Trane Technologies acquired Klinge Corporation, a company specializing in refrigerated containers, further enhancing its product offering and positioning itself as a leader in temperature-controlled solutions for the shipping sector.

Report Scope

Report Features Description Market Value (2024) USD 10.7 Billion Forecast Revenue (2034) USD 15.7 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (ISO Containers, Non-standardized Containers), By Flooring (Wood, Vinyl, Bamboo, Metal, Others), By Application (Industrial Transport, Food Transport, Consumer Goods Transport, Others), By Size (40’ Containers, High Cube Containers, 20’ Containers, Others), By Type (Dry Containers, Tank Containers, Reefer Containers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sea Box, Inc., W&K Containers, Inc., OEG, TLS Offshore Containers/TLS Special Containers, IWES LTD., CXIC Group, NewPort Tank, Danteco Industries BV, COSCO SHIPPING Development Co., Ltd., China International Marine Containers (Group) Ltd, BNH Gas Tanks, Bertschi AG, A.P. Moller – Maersk, Norcomp Nordic AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sea Box, Inc.

- W&K Containers, Inc.

- OEG

- TLS Offshore Containers/TLS Special Containers

- IWES LTD.

- CXIC Group

- NewPort Tank

- Danteco Industries BV

- COSCO SHIPPING Development Co., Ltd.

- China International Marine Containers (Group) Ltd

- BNH Gas Tanks

- Bertschi AG

- A.P. Moller - Maersk

- Norcomp Nordic AB