Global Semi-Skim Organic Milk Powder Market By Form (Liquid, Powder), By Type (Full Cream, Low-fat), By End Use (Household, Commercial), By Distribution Channel (Supermarket/Hypermarket, Online Retail, Convenience Store, Departmental Store, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151833

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

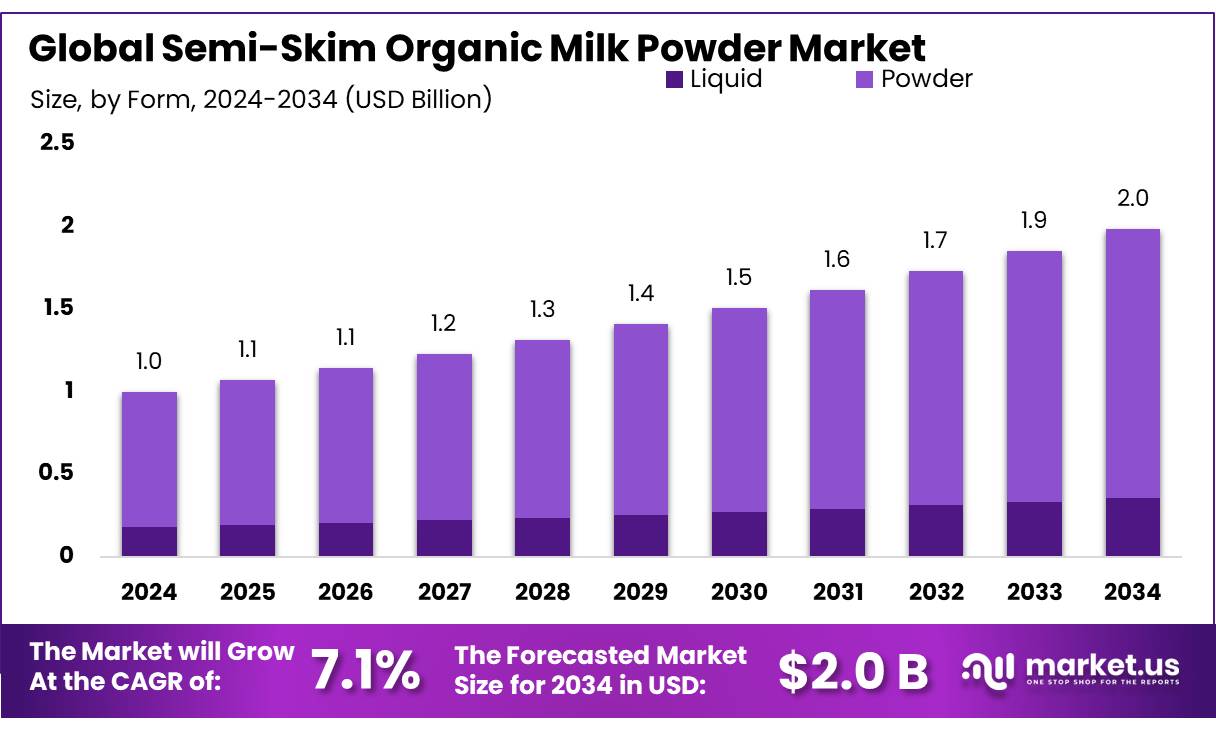

The Global Semi-Skim Organic Milk Powder Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

Semi-skim organic milk powder is derived from organic milk with reduced fat content (typically 1–1.5%), and is processed by spray-drying into a shelf-stable concentrate. This product is valued for preserving essential proteins and calcium, while offering reduced caloric content compared to full-fat powders. Its applications extend across infant formula, bakery, confectionery, and functional nutrition mixes due to its balance between nutrition and convenience.

Government initiatives play a crucial role in supporting the dairy sector in India. The Department of Animal Husbandry and Dairying (DAHD) has launched several schemes to promote dairy entrepreneurship and infrastructure development. The Dairy Entrepreneurship Development Scheme (DEDS) provides capital subsidies to farmers and entrepreneurs for setting up dairy units, facilitating the growth of the sector. Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of INR 15,000 crore, aims to enhance private sector investment in dairy infrastructure, including processing units and animal feed plants.

The National Dairy Development Board (NDDB) has been instrumental in modernizing dairy operations and promoting cooperative models. For instance, in Jharkhand, the establishment of a 20 MT per day milk powder plant at a cost of INR 80 crore marks a significant step in the state’s dairy development, reducing dependence on neighboring states for milk powder conversion.

Innovation in packaging and processing—such as instant powders, probiotic fortification, and customized blends (e.g., lactose-reduced)—is expected to capture health-conscious and convenience-oriented consumers. In India, state-level initiatives—such as the recent ₹80 crore Medha Dairy milk-powder plant capacity of 20 MT/day—underline growing value-addition strategies in dairy, bolstering regional security in processing and distribution.

Significant initiatives at national levels support organic dairy production. In India, the Department of Animal Husbandry, Dairying & Fisheries reported that production of skimmed milk powder (SMP) is projected at 0.8 MMT (million metric tons) by 2025, driven by increased fluid milk supply and supportive policies. Moreover, regional infrastructure development has been prioritized: for example, Jharkhand launched a 20 MT/day milk powder plant, backed by a ₹80 crore investment as part of the state’s “White Revolution,” with ambition to become surplus-milk producers within 5–7 years.

Key Takeaways

- Semi-Skim Organic Milk Powder Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 7.1%.

- Powder held a dominant market position, capturing more than a 82.3% share in the Semi-Skim Organic Milk Powder market.

- Low-fat held a dominant market position, capturing more than a 68.9% share in the Semi-Skim Organic Milk Powder market.

- Commercial held a dominant market position, capturing more than a 67.1% share in the Semi-Skim Organic Milk Powder market.

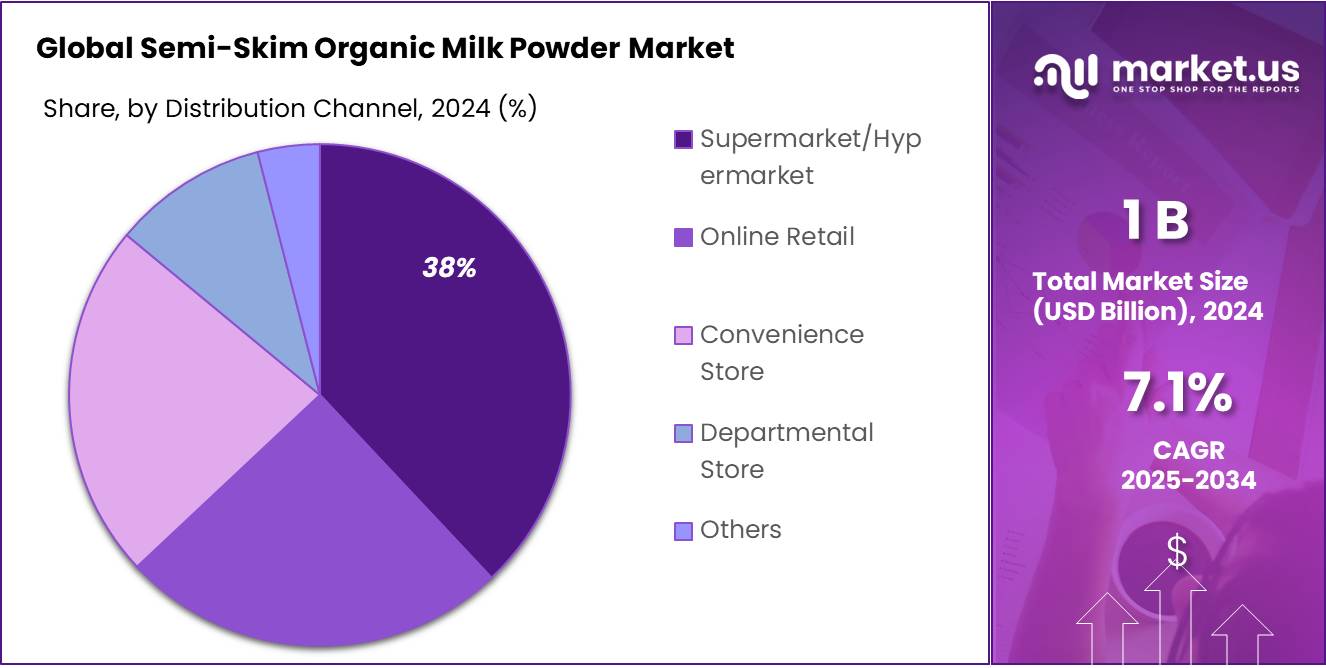

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 38.7% share in the Semi-Skim Organic Milk Powder market.

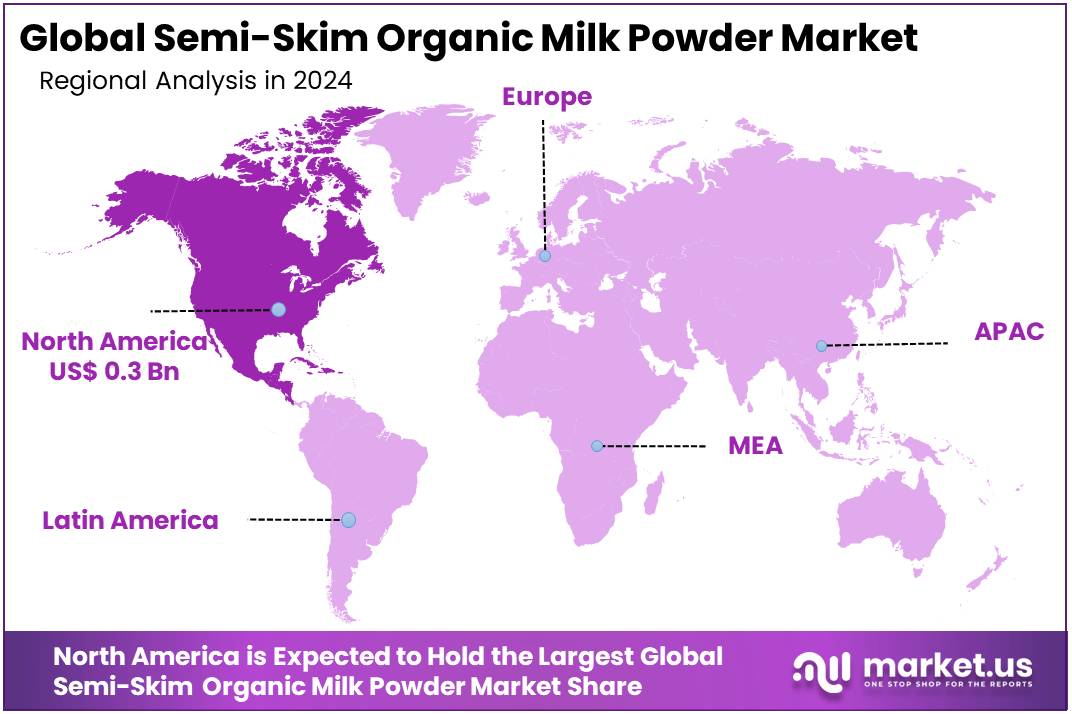

- North America emerged as the dominant region in the Semi-Skim Organic Milk Powder market, accounting for more than 38.9% of the global market share and generating a total value of approximately USD 0.3 billion.

By Form

Powder dominates with 82.3% due to its long shelf life and versatile use

In 2024, Powder held a dominant market position, capturing more than a 82.3% share in the Semi-Skim Organic Milk Powder market. This strong preference can be attributed to its longer shelf life, ease of transportation, and wide applicability across various food and beverage industries. Powdered form is especially favored by manufacturers in the bakery, confectionery, infant nutrition, and dairy processing sectors due to its stable composition and convenient storage. Additionally, it supports cost-effective bulk packaging and minimizes spoilage risks, making it suitable for export and extended distribution networks.

By Type

Low-fat leads with 68.9% share due to rising health awareness

In 2024, Low-fat held a dominant market position, capturing more than a 68.9% share in the Semi-Skim Organic Milk Powder market. The strong performance of this segment was primarily driven by the growing preference for healthier dairy alternatives among calorie-conscious consumers. With increasing awareness about lifestyle-related conditions such as obesity, cholesterol, and heart disease, demand for low-fat organic options has risen steadily across both developed and emerging economies. The segment is also widely adopted in functional foods, dietary products, and low-fat formulations in infant and elderly nutrition.

By End Use

Commercial use dominates with 67.1% share due to strong industrial demand

In 2024, Commercial held a dominant market position, capturing more than a 67.1% share in the Semi-Skim Organic Milk Powder market. This segment’s leadership was largely driven by its widespread use in food manufacturing, bakeries, confectioneries, and dairy-based product formulations. Semi-skim organic milk powder is highly valued by commercial users for its consistency, shelf stability, and ability to enhance product texture and flavor in a cost-effective way. Its organic certification adds appeal for manufacturers targeting health-conscious and clean-label consumers.

By Distribution Channel

Supermarkets and Hypermarkets lead with 38.7% share due to easy consumer access

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 38.7% share in the Semi-Skim Organic Milk Powder market. This dominance is largely due to the convenience and wide availability these retail formats offer to consumers seeking certified organic dairy products. Supermarkets and hypermarkets provide extensive shelf space, allowing brands to showcase a variety of pack sizes and formulations, which encourages impulse purchases and brand visibility. These stores also benefit from established supply chains and consistent footfall, making them a reliable channel for distributing health-focused products like semi-skim organic milk powder.

Key Market Segments

By Form

- Liquid

- Powder

By Type

- Full Cream

- Low-fat

By End Use

- Household

- Commercial

By Distribution Channel

- Supermarket/Hypermarket

- Online Retail

- Convenience Store

- Departmental Store

- Others

Drivers

Rising Health Consciousness Among Consumers

The global shift towards a healthier lifestyle is being fueled by concerns over the impact of conventional farming practices, particularly in relation to the use of pesticides and antibiotics. Semi-skim organic milk powder is seen as a safer, more natural alternative, as it is produced without the use of synthetic chemicals, making it an attractive choice for health-conscious consumers.

In a recent report, the Organic Trade Association (OTA) reported that organic food sales in the United States surpassed $60 billion in 2020, reflecting a growing consumer preference for organic products, including dairy items. This surge in organic food demand is not limited to the U.S.; global figures also show a steady upward trend. In fact, the European Union’s organic market has been expanding at an average annual rate of 6-7% over the past decade, according to the European Commission’s Organic Farming report.

Furthermore, government initiatives are supporting this trend by promoting organic farming practices. In countries like the U.S. and EU nations, there are subsidies and financial incentives for organic farmers, which contribute to the increased supply of organic products, including milk powder. For example, the European Union’s Common Agricultural Policy (CAP) encourages sustainable and organic farming through various funding schemes, helping farmers transition to organic practices.

Restraints

High Production Costs and Price Sensitivity

The production of organic milk requires more extensive land use, certified organic feed for cows, and more labor-intensive farming practices. Additionally, organic farms are subject to strict regulations and certification processes, which add to the cost. According to a report from the Food and Agriculture Organization (FAO), organic farming can cost up to 30% more than conventional farming due to these factors.

These high costs can limit the market’s accessibility, particularly in price-sensitive regions. The global demand for organic food is on the rise, but affordability remains a key barrier. For instance, in developing countries or price-conscious markets, consumers may opt for conventional milk powder due to its lower price point. The price disparity between organic and non-organic products can deter many potential customers from choosing semi-skim organic milk powder.

Governments are trying to alleviate some of these challenges through initiatives and subsidies. In the European Union, organic farmers can apply for subsidies under the Common Agricultural Policy (CAP), which helps offset some of the additional costs associated with organic farming. Similarly, the U.S. Department of Agriculture (USDA) offers support for organic dairy farming through its Organic Certification Program. However, despite these efforts, the price differential between organic and conventional dairy products continues to be a significant hurdle for broader market adoption.

Opportunity

Expansion in Emerging Markets

According to a 2021 report from the Food and Agriculture Organization (FAO), the organic market in Asia is projected to grow at an annual rate of 10-15%. Countries like China and India, with large and growing populations, present significant opportunities for organic dairy products, including semi-skim milk powder. These markets are seeing a steady rise in health-conscious consumers who are willing to pay a premium for organic products due to concerns over food safety and quality. In India, for example, the organic food market is expected to grow by 25% annually, according to a report by the Indian Ministry of Agriculture.

Governments in these emerging markets are also beginning to support organic farming and the organic food industry through subsidies and incentives. In India, the government has launched the National Programme for Organic Production (NPOP) to promote organic farming. Similarly, in China, the government is focusing on sustainable agricultural practices, which include organic farming, to ensure food safety and environmental protection. These efforts are expected to create a more favorable environment for organic products, including milk powder.

Additionally, as the middle class expands in these regions, there is a growing demand for convenience foods, and organic milk powder fits well into this trend. The convenience of milk powder, combined with the health benefits of organic certification, makes it an attractive product for consumers in fast-paced urban environments.

Trends

Growth of Organic Dairy Demand in Emerging Markets

In Asia, particularly in countries like China and India, the organic food market is experiencing rapid growth. The Food and Agriculture Organization (FAO) reports that Asia is the world’s largest milk-producing region, with milk output in 2022 expected to reach nearly 419 million tonnes. This growing production is accompanied by a rising consumer preference for organic products, driven by concerns over food safety and health.

Governments in these regions are also supporting the organic sector. In India, for instance, the government has been promoting organic farming through various initiatives. The state of Sikkim achieved its goal of converting to 100% organic farming, setting an example for other states. Additionally, the Indian government has been encouraging Zero Budget Natural Farming (ZBNF), a form of regenerative agriculture, to reduce the cost of farming and promote sustainability .

This combination of rising consumer demand and supportive government policies presents a significant growth opportunity for the semi-skim organic milk powder market in emerging economies. As these markets continue to develop, the demand for organic dairy products is expected to grow, offering new avenues for producers and suppliers in the industry.

Regional Analysis

In 2024, North America emerged as the dominant region in the Semi-Skim Organic Milk Powder market, accounting for more than 38.9% of the global market share and generating a total value of approximately USD 0.3 billion. This strong regional performance can be attributed to the widespread adoption of organic dairy products across the United States and Canada, where consumer awareness regarding clean-label, low-fat, and sustainably sourced food options is notably high. The presence of well-established retail infrastructure, along with a mature organic food industry, has further contributed to the high uptake of semi-skim organic milk powder in the region.

A rising number of consumers in North America are shifting toward healthier dairy alternatives, driven by growing concerns over obesity, cardiovascular diseases, and lactose intolerance. According to the USDA, organic dairy product sales in the U.S. have shown steady growth, particularly within milk powder formulations used in infant nutrition, sports supplements, and packaged food applications. Additionally, government-backed certifications, such as the USDA Organic Seal, play a crucial role in reinforcing consumer trust and product transparency, thereby boosting market adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Daioni Organic, a well-established brand in the organic dairy industry, specializes in producing organic milk powder and other dairy products. The company is known for its commitment to providing consumers with 100% organic milk, certified by the Soil Association. Daioni Organic’s semi-skim milk powder offers a healthy, sustainable alternative to conventional dairy products. The company’s dedication to ethical farming and quality control has made it a trusted name in the organic dairy market.

Organic Valley is one of the largest and most recognized brands in the organic dairy sector, known for its wide array of organic milk products, including semi-skim organic milk powder. With a cooperative model, Organic Valley works with over 1,800 family farms across the U.S. to provide high-quality, sustainably sourced organic dairy products. The company emphasizes environmental stewardship and animal welfare, making it a leading player in the organic milk powder market, known for its consistency and reliability.

Yeo Valley is a leading UK-based organic dairy brand, recognized for its premium range of organic milk products. The company has a longstanding commitment to sustainable farming practices and has established itself as a trusted provider of organic milk powder. Yeo Valley’s semi-skim organic milk powder is crafted with high-quality ingredients sourced from organic farms, ensuring both taste and nutritional value. The brand is popular for its innovation and environmental responsibility in dairy production.

Top Key Players in the Market

- Dale Farm Ltd

- Yeo Valley

- Daioni Organic

- Organic Valley

- Granarolo Group

- Tesco Plc.

- Arla Foods Amba

- Waitrose & Partners

- Elle & Vire

Recent Developments

In March 2024 Dale Farm Ltd, reported a net profit before tax of £29.8 million, up from £26.8 million the previous year, indicating a growth of approximately 11%. This growth is attributed to strategic decisions and the collective efforts of its 1,200 employees and farmer suppliers.

In 2024, Organic Valley, a U.S.-based farmer-owned cooperative, solidified its presence in the semi-skim organic milk powder sector. The cooperative, established in 1988, operates with 1,800 farmer-owners across the U.S., Canada, Australia, and the U.K., serving all 50 states and exporting to 25 countries.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Bn Forecast Revenue (2034) USD 2.0 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Type (Full Cream, Low-fat), By End Use (Household, Commercial), By Distribution Channel (Supermarket/Hypermarket, Online Retail, Convenience Store, Departmental Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dale Farm Ltd, Yeo Valley, Daioni Organic, Organic Valley, Granarolo Group, Tesco Plc., Arla Foods Amba, Waitrose & Partners, Elle & Vire Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semi-Skim Organic Milk Powder MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Semi-Skim Organic Milk Powder MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dale Farm Ltd

- Yeo Valley

- Daioni Organic

- Organic Valley

- Granarolo Group

- Tesco Plc.

- Arla Foods Amba

- Waitrose & Partners

- Elle & Vire