Global Sea Salt Market Size, Share, And Enhanced Productivity By Salt Type (Refined, Unrefined), By Application (Regenerating Water Agent, De-Icing Agent, Detoxifying Agent, Antioxidant Agent, Others), By End-Use (Food Industry, Agriculture, Cosmetics, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176106

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

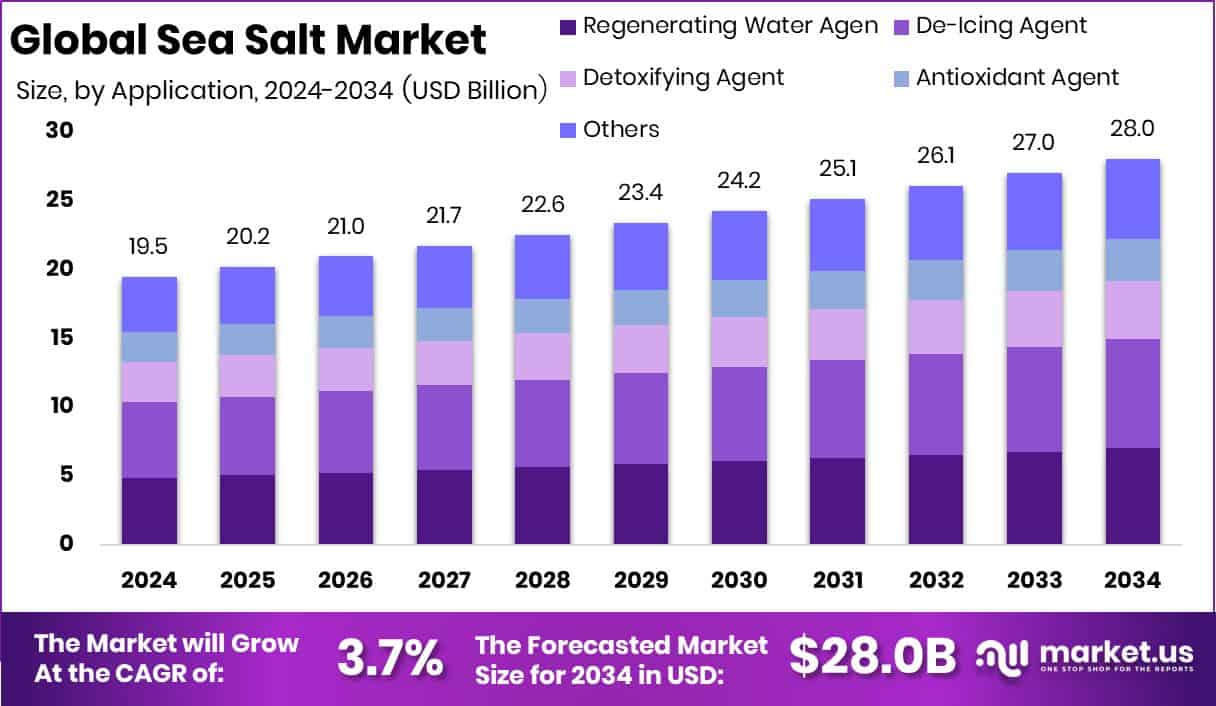

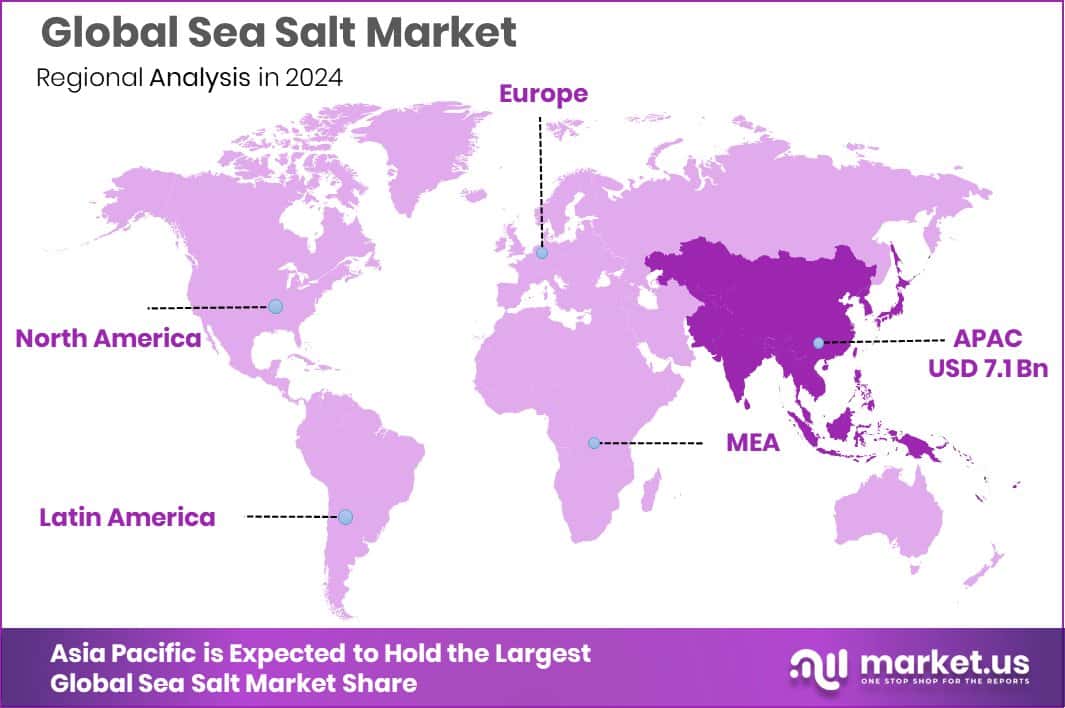

The Global Sea Salt Market is expected to be worth around USD 28.0 billion by 2034, up from USD 19.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. In the Asia Pacific, the Sea Salt Market achieved 36.7% share and USD 7.1 Bn.

The Sea Salt Market is shaped by rising demand for naturally sourced salt obtained through the evaporation of seawater. Sea salt differs from refined salt because it keeps essential minerals like magnesium, calcium, and potassium, giving it a more natural composition and broader use across food, agriculture, cosmetics, and wellness sectors. As consumers shift toward cleaner and minimally processed ingredients, sea salt continues to gain stronger acceptance in household and industrial applications.

Sea salt as a market represents the production, processing, and distribution of various salt types, including refined and unrefined forms, used across multiple end-use industries. Market growth is also supported by expanding applications such as detoxifying agents, de-icing uses, antioxidant blends, regenerating water agents, and food processing needs. Its versatility makes it an essential input across both consumer and industrial sectors.

Growth factors for the market include global initiatives focusing on water treatment and sanitation. For example, Italy’s €2.5 million support to vulnerable communities in Homs highlights the ongoing need for reliable salt-based purification and water management solutions. Such developments enhance demand for industrial-grade sea salt.

Opportunities are further strengthened by major regeneration and infrastructure projects. The £1bn Eastgate Quarter redevelopment and £35m flood defence funding signal increasing construction activity, which indirectly boosts demand for de-icing, water-softening, and industrial salts required in utility and municipal systems.

Agriculture also drives notable demand, supported by programs improving soil and land health. The NFWF’s $14.7 million grants for regenerative agriculture reflect growing interest in sustainable farming practices, where mineral-rich sea salt contributes to soil conditioning, animal feed, and crop nutrition applications.

Key Takeaways

- The Global Sea Salt Market is expected to be worth around USD 28.0 billion by 2034, up from USD 19.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- Sea Salt Market shows unrefined salt leading strongly with a 65.2% share.

- Sea Salt Market sees de-icing agent applications reaching a notable 28.3% share.

- Sea Salt Market reports the food industry dominating significantly with a 57.1% share.

- The region Asia Pacific maintained 36.7% dominance, reaching a notable USD 7.1 Bn.

By Salt Type Analysis

The Sea Salt Market sees strong momentum as unrefined salt captures 65.2% global demand.

In 2024, the Sea Salt Market continued to expand as unrefined sea salt held a dominant share of 65.2%, reflecting strong consumer interest in minimally processed and mineral-rich salt varieties. Buyers across food, skincare, and wellness categories increasingly favored unrefined salt because it retains natural magnesium, calcium, and potassium, making it more appealing than heavily processed alternatives.

The culinary sector especially drove its acceptance, as chefs and households preferred authentic texture and flavor depth in gourmet preparations. The shift toward cleaner labels and natural sourcing further strengthened this segment’s leadership. Additionally, rising awareness about sustainable harvesting practices encouraged premium product launches, pushing manufacturers to invest more in quality-focused sea salt extraction and packaging.

By Application Analysis

Growing reliance on sea salt as a de-icing agent strengthens its 28.3% application share worldwide.

In 2024, the Sea Salt Market saw significant demand from infrastructure services, with the de-icing agent segment accounting for 28.3% of total application share. This growth was supported by colder winter conditions in North America and Europe, where municipalities and industries relied on sea salt for road safety, sidewalk maintenance, and airport operations. Sea salt’s cost-effectiveness and availability made it a reliable alternative to synthetic chemicals.

Its lower environmental impact compared to some chloride blends also improved adoption among eco-focused city administrations. Increasing transportation activities, along with the expansion of logistics hubs in snowfall-prone regions, boosted bulk consumption. As a result, suppliers focused on scaling production and improving cold-weather delivery systems to meet seasonal surges.

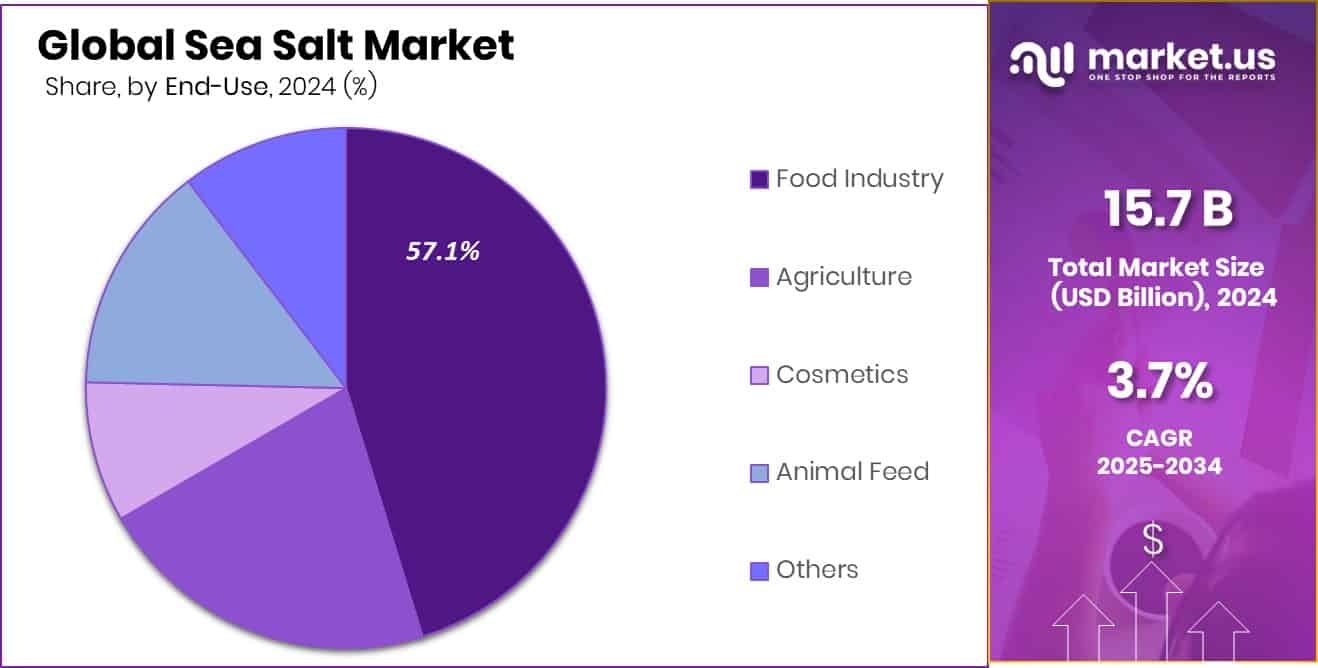

By End-Use Analysis

Rising clean-label preferences boost the Sea Salt Market, with the food industry holding 57.1% dominance.

In 2024, the Sea Salt Market experienced strong commercial traction from the food industry, which captured a 57.1% share due to widespread use in packaged foods, bakery items, snacks, meat processing, and artisanal gourmet blends. Consumers’ shift toward natural, clean-label ingredients influenced brands to replace refined salt with sea salt in both premium and mass-market products. Growing interest in Mediterranean diets and organic seasonings further amplified market momentum.

Foodservice operators also increased adoption to enhance flavor profiles across cuisines. Meanwhile, manufacturers introduced value-added sea salt variants—such as smoked, flavored, and micro-granulated types—specifically targeting food processors. This rising emphasis on natural texture, purity, and mineral composition reinforced the food industry’s position as the leading end-use segment.

Key Market Segments

By Salt Type

- Refined

- Unrefined

By Application

- Regenerating Water Agent

- De-Icing Agent

- Detoxifying Agent

- Antioxidant Agent

- Others

By End-Use

- Food Industry

- Agriculture

- Cosmetics

- Animal Feed

- Others

Driving Factors

Rising demand for natural salt products

The Sea Salt Market is benefiting from the growing shift toward natural and minimally processed ingredients, especially as consumers look for cleaner choices in food, wellness, and household use. This preference strengthens the position of sea salt compared with refined alternatives.

An additional contributing force comes from community-level economic support such as the Minnesota companies providing $3.5M in grants to help small businesses during the ICE surge, which reinforces local production stability and supply continuity for producers using sea salt in food and consumer applications. These combined factors create a healthier commercial environment where natural salt products remain in steady demand across major regions.

Restraining Factors

High production costs limit scalability

The Sea Salt Market faces challenges stemming from the cost of production, especially in regions where evaporation or harvesting conditions require more controlled operations. These higher expenses restrict scalability and reduce competitiveness for smaller producers. Another relevant backdrop is rising investment in alternative technologies, such as GlassPoint, raising $20 million to decarbonize industrial heat with solar solutions, signaling a broader shift toward modern energy practices.

While this funding targets industrial heat, it also highlights how industries are reconsidering traditional energy-intensive processes, creating pressure for salt producers to upgrade operations. These factors collectively slow rapid expansion, demanding more efficient harvesting and processing methods.

Growth Opportunity

Increasing adoption in wellness formulations

The Sea Salt Market is witnessing expanding opportunities as wellness brands incorporate mineral-rich sea salt into detox blends, bath formulations, digestive products, and topical applications. This widening usage strengthens demand across lifestyle and personal care categories.

In addition, government-backed efforts such as the NOAA Sea Grant’s $8.8 million investment to enhance aquaculture production and knowledge sharing create indirect benefits for coastal industries, including salt producers operating near aquaculture zones. These funded initiatives encourage better resource management and improved marine practices, paving the way for stronger collaboration between sea-based food systems and natural salt suppliers.

Latest Trends

Rising preference for unrefined sea salt

A clear market trend is the growing preference for unrefined sea salt, driven by interest in products that retain natural minerals and offer more authentic flavor and texture. This shift aligns with broader global conversations about sustainable resource use. Discussions around feeding a future population of 10 billion people, including insights from the Great Salt Lake’s ecosystem, highlight the importance of responsible salt harvesting and ecological balance. These themes influence industry behavior, encouraging producers to adopt gentler extraction methods and prioritize environmentally mindful practices. As a result, unrefined sea salt gains cultural and commercial momentum within global food and wellness markets.

Regional Analysis

Asia Pacific leads the Sea Salt Market with a strong 36.7% share, valued at USD 7.1 Bn.

Asia Pacific holds the leading position in the Sea Salt Market, capturing a dominant 36.7% share valued at USD 7.1 Bn. The region benefits from extensive coastlines, strong culinary usage, and rising demand for natural minerals in food processing and personal care applications.

North America follows with steady growth driven by increasing consumption of premium sea salt in packaged foods and wellness products, supported by strong retail distribution networks.

Europe shows consistent adoption as consumers prefer clean-label and artisanal salt varieties, further strengthened by rising gourmet food trends across major countries. In the Middle East & Africa, demand expands gradually due to food industry requirements and growing interest in mineral-rich salt alternatives. Latin America continues to develop its market presence as manufacturers leverage coastal production capabilities and rising household consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill, Inc. continued to leverage its large-scale salt operations, benefiting from its broad supply network and experience in producing high-quality food-grade and industrial sea salt. The company’s long-standing presence in the salt sector helped it maintain reliable output and serve diverse applications, from food manufacturing to de-icing requirements.

Morton Salt, Inc. remained an influential participant, supported by its strong brand recognition and wide consumer reach. Its portfolio of culinary sea salts, specialty blends, and industrial salt solutions allowed it to maintain relevance across retail and commercial channels. Morton’s focus on consistent product quality helped reinforce trust among food processors and household buyers seeking dependable sea salt options.

Tata Salt contributed significantly to the market through its established reputation in household salt categories. Known for offering clean and safe salt products, the company strengthened its sea-salt presence with consumer-driven positioning and strong distribution channels. Its brand equity across Asian markets supported overall regional growth, making Tata Salt a key contributor to rising sea salt consumption trends.

Top Key Players in the Market

- Cargill, Inc.

- Morton Salt, Inc.

- Tata Salt

- China National Salt Industry Corporation

- K+S Aktiengesellschaft

- Salins Group

- Maldon Crystal Salt Company Ltd.

- Cheetham Salt Limited

- Murray River Salt

- Dominion Salt Limited

- Compass Minerals International, Inc.

Recent Developments

- In March 2025, Compass Minerals took steps to cut costs and focus more on its core salt and plant nutrition products. The company announced plans to reduce general expenses and streamline operations, aiming to improve profitability for its salt segment. As part of this strategy, it exited the Fortress fire retardant business and sold the related assets, so the company can respond better to salt demand and strengthen its main market focus.

- In June 2024, Dominion Salt Limited reported a strong salt production year from Lake Grassmere in New Zealand. The company recorded a “bumper harvest” with significantly more salt produced than average, attributed to favorable weather for seawater evaporation. This increased raw sea salt volumes benefited their supply to food, pharmaceutical, and animal nutrition markets.

Report Scope

Report Features Description Market Value (2024) USD 19.5 Billion Forecast Revenue (2034) USD 28.0 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Salt Type (Refined, Unrefined), By Application (Regenerating Water Agent, De-Icing Agent, Detoxifying Agent, Antioxidant Agent, Others), By End-Use (Food Industry, Agriculture, Cosmetics, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Inc., Morton Salt, Inc., Tata Salt, China National Salt Industry Corporation, K+S Aktiengesellschaft, Salins Group, Maldon Crystal Salt Company Ltd., Cheetham Salt Limited, Murray River Salt, Dominion Salt Limited, Compass Minerals International, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Inc.

- Morton Salt, Inc.

- Tata Salt

- China National Salt Industry Corporation

- K+S Aktiengesellschaft

- Salins Group

- Maldon Crystal Salt Company Ltd.

- Cheetham Salt Limited

- Murray River Salt

- Dominion Salt Limited

- Compass Minerals International, Inc.