Global Saffron Market Size, Share, And Enhanced Productivity By Grade (Grade I, Grade II, Grade III, Grade IV), By Type (Organic, Traditional), By Form (Liquid, Powder, Stigma, Petals, Stamen), By Application (Food Supplements, Cosmetics, Personal Care Products, Food and Beverage, Others), By Distribution Channel (B2B, B2C), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172759

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

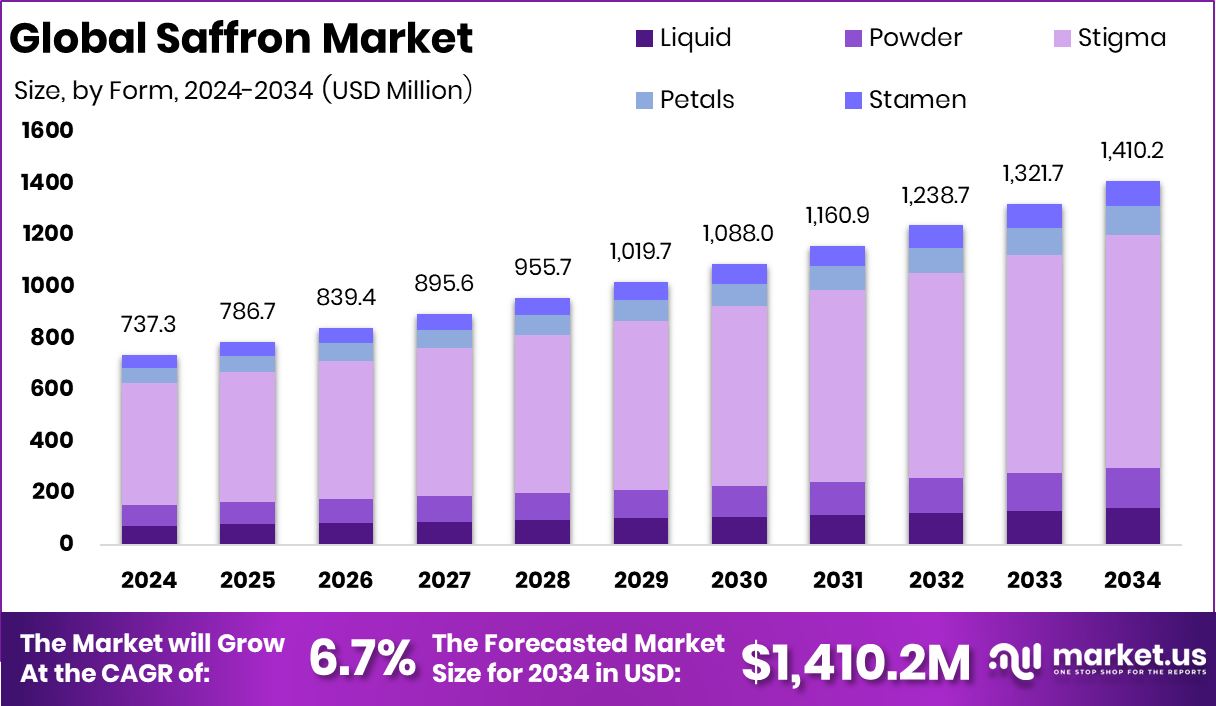

The Global Saffron Market is expected to be worth around USD 1,410.2 million by 2034, up from USD 737.3 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. Strong demand positioned the Middle East and Africa at 54.8% and USD 404.0 Mn.

Saffron is a natural spice obtained from the dried stigmas of the saffron crocus flower. It is valued for its deep color, strong aroma, and distinct flavor. Beyond cooking, saffron is also used in traditional remedies, wellness products, and personal care due to its antioxidant and mood-supporting properties. Its labor-intensive harvesting makes it one of the world’s most precious spices.

The saffron market covers the global production, processing, trade, and consumption of saffron across food, beverage, nutraceutical, and wellness applications. It includes whole stigmas, powders, and extracts sold through wholesale, foodservice, and retail channels. Demand is shaped by culinary traditions, health awareness, and preference for natural ingredients.

Market growth is supported by rising interest in natural wellness ingredients. Funding activity highlights this shift, as Kradle secured $4 M to expand pet supplement offerings and Nuritas raised $42 million in Series C funding to scale plant-based bioactive ingredients. These investments reflect broader momentum toward functional, plant-derived inputs that indirectly support saffron usage.

Demand is expanding across nutrition-focused products and animal wellness. A DTC dog supplement brand raised $10 million, showing how functional ingredients are moving into everyday health solutions. Saffron’s perceived calming and antioxidant benefits align well with this growing supplement demand.

Opportunities also emerge from food security and nutrition support efforts. Moore declared a state of emergency and released $10 M to food banks to supplement SNAP, reinforcing demand for nutritious, value-added food ingredients. This environment supports saffron’s role in premium, health-oriented food formulations.

Key Takeaways

- The Global Saffron Market is expected to be worth around USD 1,410.2 million by 2034, up from USD 737.3 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In 2024, Grade I dominated the saffron market with 42.8% share due to superior quality.

- Traditional saffron led the market by type, capturing 69.3% demand from culinary preferences worldwide consumers.

- Stigma form held dominance with 64.1% share, favored for aroma, potency, and authenticity across markets.

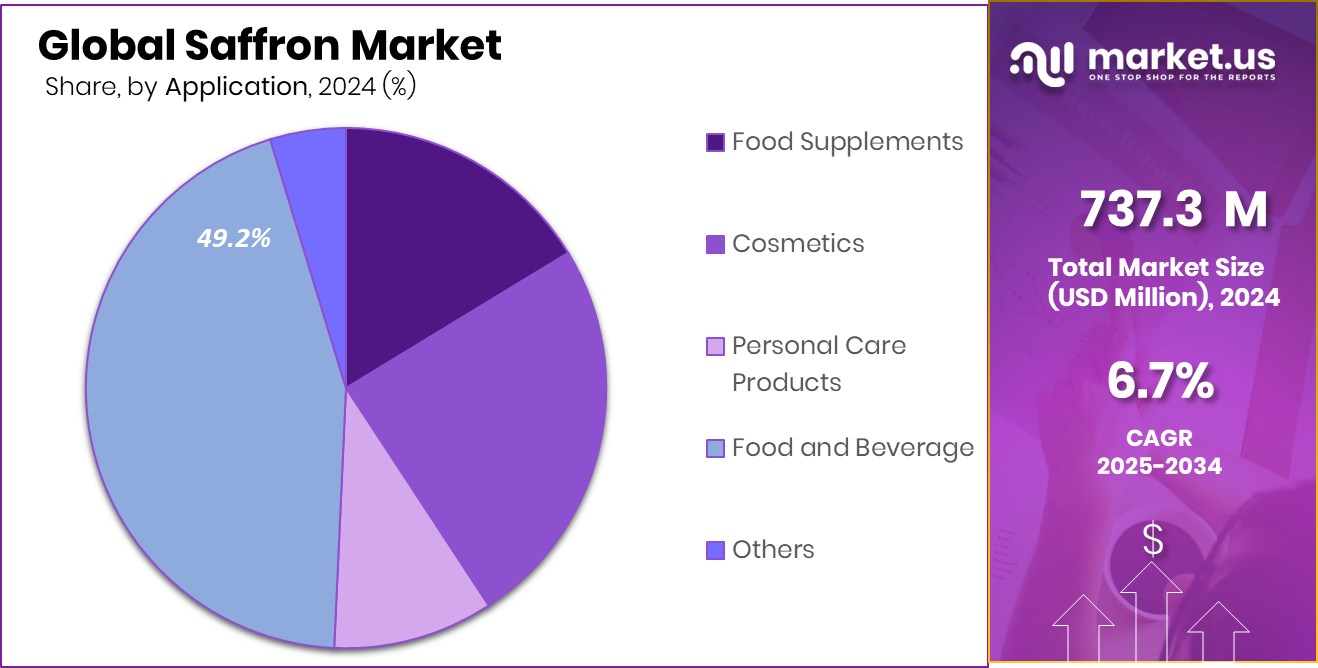

- Food and beverage applications accounted for 49.2% share, driven by premium flavor enhancement usage globally.

- B2B distribution channels dominated saffron sales with 69.7% share, supported by bulk procurement networks worldwide.

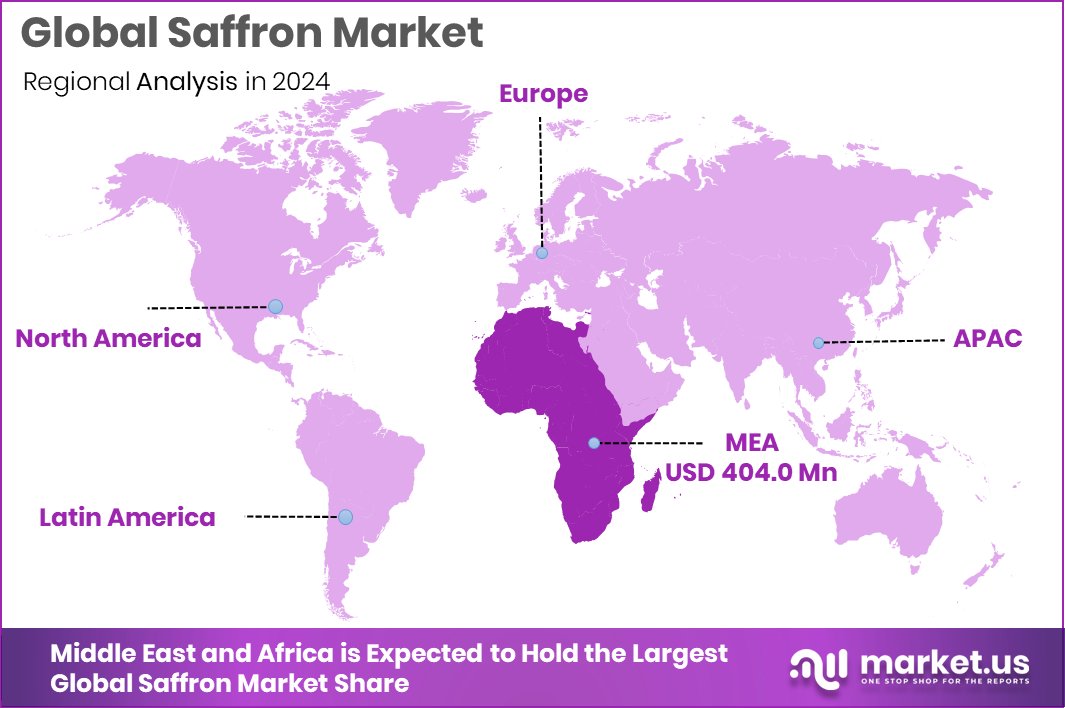

- Middle East and Africa Saffron Market reached USD 404.0 Mn in 2024.

By Grade Analysis

In Saffron Market, Grade I dominates quality demand with 42.8% share globally.

In 2024, Grade I saffron held a dominant position in the Saffron Market, accounting for 42.8% share. This leadership reflects rising demand for premium-quality saffron with strong color strength, high crocin content, and superior aroma. Food manufacturers, exporters, and pharmaceutical users prefer Grade I due to its consistency and compliance with international quality standards.

As global buyers focus on authenticity and traceability, certified Grade I saffron gains preference over mixed or lower grades. Growing awareness about adulteration has further shifted demand toward lab-tested, high-grade products. Additionally, premium restaurants and wellness brands increasingly use Grade I saffron to maintain product quality and brand trust. These factors together reinforce Grade I’s strong market position in 2024.

By Type Analysis

Traditional type leads Saffron Market consumption patterns, accounting for 69.3% overall demand.

In 2024, Traditional saffron dominated the By Type segment of the Saffron Market with a 69.3% share. Traditional saffron, harvested manually and dried using conventional methods, is valued for its purity and cultural significance. Many buyers believe traditional processing preserves natural compounds better than modern techniques. This preference is especially strong in Middle Eastern, South Asian, and European markets, where saffron is deeply rooted in culinary and medicinal practices.

Artisanal harvesting also supports small farmers, which appeals to ethically conscious buyers. Despite higher prices, traditional saffron continues to outperform alternatives due to trusted quality, heritage appeal, and long-standing trade relationships. These factors collectively sustain its dominant position in 2024.

By Form Analysis

Stigma form remains preferred in Saffron Market due to purity, holding 64.1%.

In 2024, Stigma form saffron led the By Form segment of the Saffron Market, capturing 64.1% share. Whole saffron stigmas are widely preferred because they offer visible authenticity and longer shelf life compared to powders or extracts. Buyers can easily assess quality through color, length, and aroma, reducing the risk of adulteration.

Food processors and households alike favor stigma form for controlled usage and better flavor release during cooking. Additionally, premium export markets often specify stigma-only saffron to meet regulatory and quality benchmarks. As transparency and quality assurance become more important, demand for stigma-form saffron remains strong, reinforcing its leading role in the market during 2024.

By Application Analysis

Food and beverage applications drive Saffron Market usage, contributing 49.2% share globally.

In 2024, the Food and Beverage segment dominated saffron applications, accounting for 49.2% of the Saffron Market. Saffron’s unique flavor, color, and aroma make it a valuable ingredient in rice dishes, desserts, dairy products, and beverages. Rising interest in premium and natural ingredients has increased their use in gourmet and ethnic cuisines.

Food brands are also leveraging saffron’s perceived health benefits, such as antioxidant properties, to position products as premium offerings. Growth in global culinary tourism and restaurant chains further supports demand. As consumers seek authentic taste experiences, food and beverage applications continue to anchor saffron consumption in 2024.

By Distribution Channel Analysis

B2B distribution channel dominates Saffron Market sales flows, capturing 69.7% revenue worldwide.

In 2024, B2B distribution dominated the By Distribution Channel segment of the Saffron Market with a 69.7% share. Large food processors, exporters, pharmaceutical firms, and hospitality groups prefer bulk procurement through B2B channels to ensure steady supply and price stability. These channels enable direct sourcing from producers, improving traceability and quality control.

Long-term contracts and bulk discounts also make B2B more cost-effective than retail channels. Additionally, international trade of saffron largely operates through wholesalers and exporters, strengthening B2B dominance. As demand scales across industries, B2B distribution remains the primary route for saffron sales in 2024.

Key Market Segments

By Grade

- Grade I

- Grade II

- Grade III

- Grade IV

By Type

- Organic

- Traditional

By Form

- Liquid

- Powder

- Stigma

- Petals

- Stamen

By Application

- Food Supplements

- Cosmetics

- Personal Care Products

- Food and Beverage

- Others

By Distribution Channel

- B2B

- B2C

Driving Factors

Rising Demand for Premium Natural Beauty Ingredients

The saffron market is strongly driven by growing demand for premium, natural, and plant-based ingredients in beauty and personal care products. Consumers are moving away from harsh chemicals and are actively looking for clean, high-value ingredients that offer skin benefits. This shift is clearly supported by funding activity in the beauty space. YSE Beauty secured $15 million Series A funding to expand its clean beauty portfolio, showing strong investor confidence in natural formulations.

Similarly, SUGAR Cosmetics raised $5 Mn from Anicut Capital and others, highlighting continued demand for ingredient-driven beauty products. In addition, FAE Beauty secured INR 17 Cr funding led by Spring Marketing Capital, reflecting growth momentum in premium beauty brands. These investments indicate rising production, marketing, and innovation around natural ingredients. Saffron benefits directly from this trend due to its antioxidant properties, natural color, and premium positioning, making it attractive for modern beauty formulations.

Restraining Factors

High Cost and Limited Supply Restrains Growth

The saffron market faces a major restraint due to its high price and limited supply, which makes large-scale usage difficult. Saffron requires manual harvesting, and thousands of flowers are needed to produce a small quantity, keeping costs high. This price sensitivity pushes brands to carefully control ingredient spending. Even though beauty and wellness brands are receiving fresh capital, cost remains a concern.

Indian FAE Beauty landed $2 million in fresh funding, helping the brand manage sourcing challenges while maintaining quality. Likewise, FAE Beauty raised ₹17 crore in fresh funding led by Spring Marketing Capital, supporting operations and formulation efficiency. These funds help brands manage expensive inputs, but they also highlight that premium ingredients like saffron can limit mass-market adoption. As long as production remains labor-intensive, pricing pressure will continue to restrain broader market growth.

Growth Opportunity

Clean Label Home and Personal Care Expansion

The saffron market has a strong growth opportunity through the expansion of clean-label home and personal care products. Consumers are increasingly choosing products made with natural, plant-based ingredients that are safe and environmentally friendly. This shift is clearly supported by recent funding activity. Home care products maker Happi Planet raised $2 Mn, allowing it to expand its range of eco-friendly household products that rely on natural inputs.

In addition, Cellugy secured $9.25M to fight microplastics in personal care products using biobased solutions, highlighting industry movement toward sustainable formulations. As brands replace synthetic colors and additives, saffron gains attention for its natural coloring and functional benefits. These trends create new opportunities for saffron use across soaps, cleaners, and personal care items, supporting steady market growth.

Latest Trends

Premium Gifting and Experiential Product Demand Rising

A key latest trend in the saffron market is its growing use in premium gifting and experience-based products. Consumers are increasingly buying saffron as a luxury gift item for festivals, weddings, and corporate occasions, rather than only for cooking. This trend aligns with strong funding activity in India’s gifting ecosystem.

India’s top-funded gifting startups include Xoxoday with $30.6 million, Ferns N Petals with $26.1 million, ZoomIn with $21 million, Bakingo and FlowerAura with $16 million each, and eYantra with $10.9 million. These investments show rising demand for premium, customizable, and value-added gifts. Saffron fits well into this trend due to its high value, cultural importance, and elegant packaging potential. As gifting platforms expand curated luxury offerings, saffron-based gift boxes and wellness kits are gaining visibility, supporting steady market momentum.

Regional Analysis

In 2024, the Middle East and Africa led the Saffron Market with 54.8% share globally.

The Saffron Market by region shows clear variation in consumption patterns across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped mainly by culinary traditions and trade structures. The Middle East and Africa remain the dominating region, holding a commanding 54.8% share of the global market and reaching a value of USD 404.0 Mn, reflecting its long-standing role in saffron cultivation, trading, and daily food usage. The region’s dominance is supported by deep-rooted consumption in traditional cuisines and strong export-oriented supply chains.

Europe represents a mature consumption market where saffron is widely used in specialty foods and premium culinary applications, supporting steady demand levels. Asia Pacific shows consistent uptake driven by traditional dishes and cultural acceptance, especially in household and foodservice use. North America maintains a smaller but stable share, supported by rising interest in premium spices and gourmet cooking.

Latin America remains a developing market, with limited but gradually expanding usage tied to niche culinary applications. Overall, the regional landscape highlights the Middle East and Africa as the core demand and value center, while other regions contribute through steady, application-driven consumption patterns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Esfedan Trading Company continues to play a focused role in the global saffron market through its emphasis on quality-driven sourcing and export consistency. The company’s operations reflect a strong understanding of buyer expectations around purity, grading, and origin assurance. Its steady presence in international trade channels highlights disciplined supply management rather than aggressive volume expansion. This approach positions Esfedan as a reliability-led participant, appealing to long-term B2B buyers seeking stable partnerships in a market sensitive to quality variation and authenticity concerns.

Safran Global Company S.L.U. demonstrates a market-facing strategy centered on branding, standardized processing, and alignment with international food requirements. In 2024, the company stands out for bridging traditional saffron heritage with modern commercial structures. Its ability to cater to diversified regional buyers strengthens its relevance in premium food and specialty ingredient segments. The company’s positioning reflects a balance between heritage value and commercial scalability, supporting sustained demand without diluting product integrity.

Meanwhile, Tarvand Saffron Co. remains closely tied to origin-based value, leveraging deep production expertise and controlled handling practices. Its strength lies in maintaining product consistency across harvest cycles, which is critical for repeat buyers. In 2024, Tarvand’s role reinforces the importance of origin credibility and disciplined processing, contributing steadily to global saffron trade dynamics without reliance on speculative market expansion.

Top Key Players in the Market

- Esfedan Trading Company

- Safran Global Company S.L.U.

- Tarvand Saffron Co.

- Saffron Business Company

- Gohar Saffron

- Rowhani Saffron Co.

- Mehr Saffron

- Flora Saffron

- Royal Saffron Company

- Iran Saffron Company

Recent Developments

- In September 2025, Mehr Saffron described itself publicly as one of the highest-rated saffron brands focused on purity, artistry, and sensory quality. This reflects the brand’s recent emphasis on positioning its product as premium saffron for global buyers.

Report Scope

Report Features Description Market Value (2024) USD 737.3 Million Forecast Revenue (2034) USD 1,410.2 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Grade I, Grade II, Grade III, Grade IV), By Type (Organic, Traditional), By Form (Liquid, Powder, Stigma, Petals, Stamen), By Application (Food Supplements, Cosmetics, Personal Care Products, Food and Beverage, Others), By Distribution Channel (B2B, B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Esfedan Trading Company, Safran Global Company S.L.U., Tarvand Saffron Co., Saffron Business Company, Gohar Saffron, Rowhani Saffron Co., Mehr Saffron, Flora Saffron, Royal Saffron Company, Iran Saffron Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Esfedan Trading Company

- Safran Global Company S.L.U.

- Tarvand Saffron Co.

- Saffron Business Company

- Gohar Saffron

- Rowhani Saffron Co.

- Mehr Saffron

- Flora Saffron

- Royal Saffron Company

- Iran Saffron Company