Global Ricebran Oil Market Size, Share Analysis Report By Type (Refined, Non-Refined), By Category (Organic, Conventional), By Application (Food Processing, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152322

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

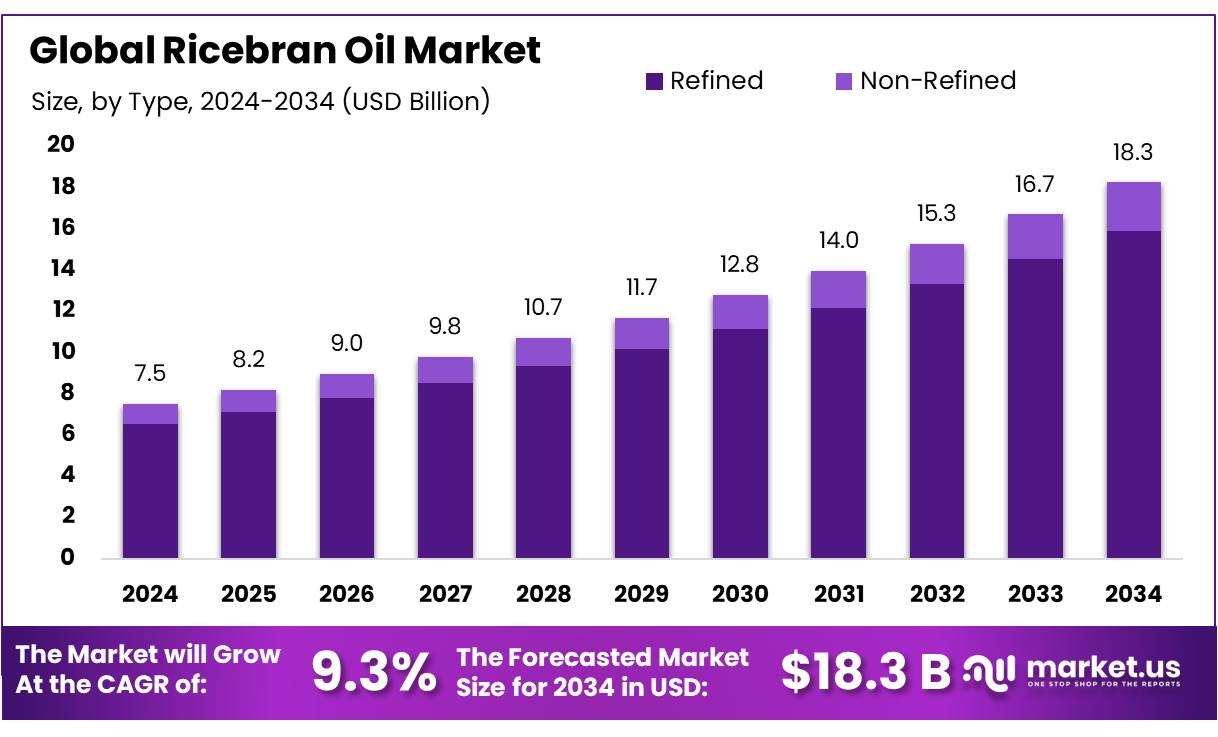

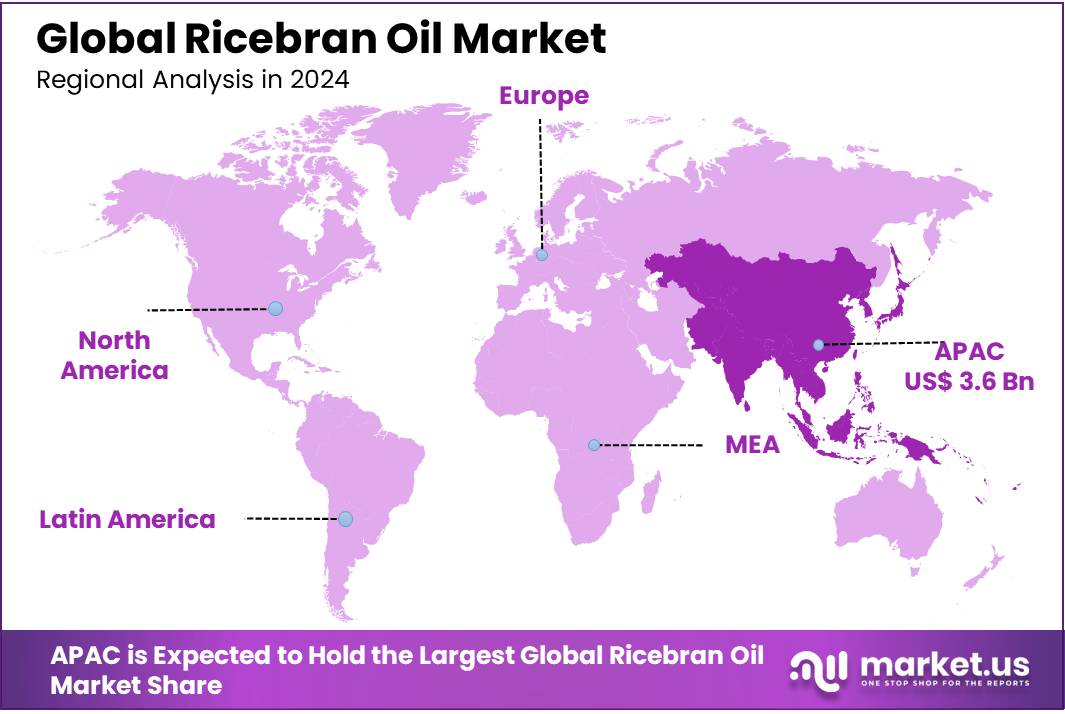

The Global Ricebran Oil Market size is expected to be worth around USD 18.3 Billion by 2034, from USD 7.5 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 48.2% share, holding USD 3.6 billion revenue.

Rice bran oil, extracted from the outer bran layer of milled rice, is valued for its high smoke point (~232°C) and balanced fatty acid profile (approximately 38% monounsaturated, 37% polyunsaturated, 25% saturated). It is rich in bioactive compounds such as γ-oryzanol, tocopherols, and tocotrienols, which deliver antioxidant and cholesterol-lowering benefits—factors that have elevated its appeal in both food and nutraceutical industries.

Technological improvements will be instrumental emerging extraction methods promise lower solvent residues and higher quality, aiding the premiumization of rice bran oil. Moreover, with India aiming self-sufficiency—projecting 70.2 MT edible oil supply by 2047—rice bran oil is poised as a key strategic resource.

From an industrial perspective, Asia-Pacific dominates the market. India alone accounts for roughly 46.8% of global production and processes over 1.2 million tons of rice bran annually, covering around 60% of refined rice bran oil worldwide. India’s domestic production of rice bran oil rose from 920kt in 2014–15 to 1 031 kt in 2016–17. Governmental data indicate total domestic oilseed production in India is anticipated at 9.7 MMT, increasing by nearly 2% year-on-year, with rice bran contributing significantly.

Developing nations are actively promoting the adoption and production of rice bran oil. In India, the Ministry of Food & Public Distribution launched NAFED-fortified rice bran oil in June 2021 to reduce dependence on imports and support the Atmanirbhar Bharat initiative. The central government also set a target to boost production capacity to 1.8 million metric tonnes (MT), encouraging rice mill tech upgrades.

Key Takeaways

- Ricebran Oil Market size is expected to be worth around USD 18.3 Billion by 2034, from USD 7.5 Billion in 2024, growing at a CAGR of 9.3%.

- Refined held a dominant market position, capturing more than an 87.1% share of the global ricebran oil market.

- Conventional held a dominant market position, capturing more than an 82.9% share of the global ricebran oil market.

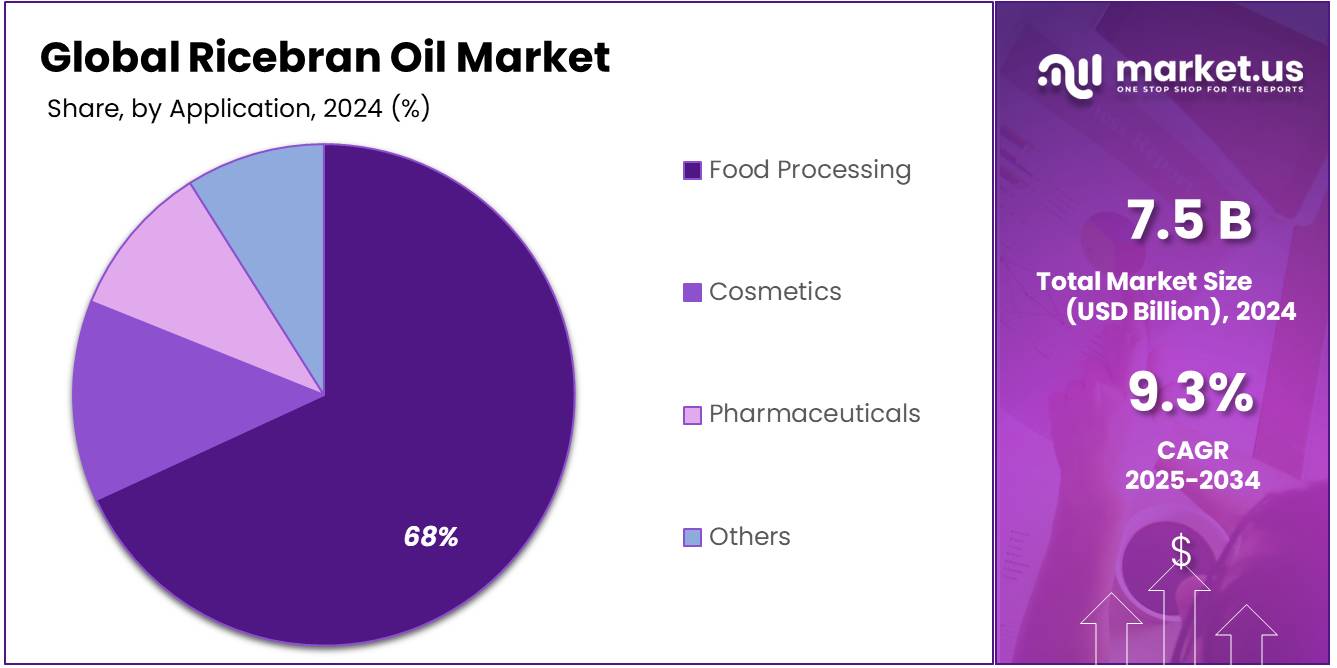

- Food Processing held a dominant market position, capturing more than a 68.4% share of the global ricebran oil market.

- Supermarket/Hypermarket held a dominant market position, capturing more than a 44.7% share of the global ricebran oil market.

- Asia-Pacific region emerged as the dominant ricebran oil market, accounting for a substantial 48.2% share, which translates to approximately USD 3.6 billion.

By Type Analysis

Refined Ricebran Oil leads with 87.1% share in 2024, supported by strong demand in household and industrial cooking.

In 2024, Refined held a dominant market position, capturing more than an 87.1% share of the global ricebran oil market. This significant lead is largely driven by its suitability for large-scale use in both domestic and commercial kitchens. Refined ricebran oil is known for its neutral flavor, longer shelf life, and high smoke point, which makes it ideal for deep frying and everyday cooking—qualities that continue to attract consumers and food businesses alike.

The refining process also helps reduce impurities like wax, free fatty acids, and undesirable odors, making the oil more stable and consumer-friendly. In major rice-producing countries such as India, China, and Thailand, the availability of raw bran and government support for value-added agri-processing have encouraged greater output of refined variants. Additionally, the health-focused appeal of ricebran oil—rich in oryzanol and low in saturated fats—has helped build steady demand across urban households.

By Category Analysis

Conventional Ricebran Oil dominates with 82.9% share in 2024, driven by large-scale production and cost-efficiency.

In 2024, Conventional held a dominant market position, capturing more than an 82.9% share of the global ricebran oil market. This dominance is largely due to the widespread cultivation of rice using conventional farming methods, which ensures a steady and cost-effective supply of rice bran—the primary raw material for oil extraction. Conventional ricebran oil is widely used in everyday cooking across households and foodservice sectors, particularly in price-sensitive regions like South and Southeast Asia.

Its affordability, availability in bulk, and wide usage in processed food manufacturing make it a preferred choice among both producers and consumers. While organic and specialty variants are gradually gaining interest, especially among health-conscious consumers, conventional oil continues to lead due to its strong distribution network and consistent quality.

By Application Analysis

Food Processing dominates with 68.4% share in 2024, supported by wide use in snacks, ready meals, and baked goods.

In 2024, Food Processing held a dominant market position, capturing more than a 68.4% share of the global ricebran oil market. This leadership is mainly driven by the oil’s functional properties that suit a variety of processed food applications, such as frying snacks, baking, and preparing ready-to-eat meals.

Food manufacturers prefer ricebran oil due to its mild flavor, stable shelf life, and high smoke point, which make it suitable for large-scale production without altering the taste or texture of final products. The presence of natural antioxidants like oryzanol and vitamin E further enhances its appeal in health-focused product lines, particularly as consumers increasingly demand better-for-you alternatives in everyday foods.

By Distribution Channel Analysis

Supermarket/Hypermarket dominates with 44.7% share in 2024, driven by consumer trust and product variety under one roof.

In 2024, Supermarket/Hypermarket held a dominant market position, capturing more than a 44.7% share of the global ricebran oil market. This channel continues to be the preferred shopping destination for many consumers due to its ability to offer a wide variety of brands, packaging sizes, and price points all in one place. Customers often trust supermarket chains for product quality and authenticity, especially when it comes to edible oils like ricebran oil.

Additionally, attractive promotions, bundled offers, and in-store discounts make this channel particularly appealing for household buyers seeking value for money. The visibility of premium and health-focused ricebran oil variants in these stores also helps educate and influence buyers, further boosting sales. In countries like India, Thailand, and Indonesia—where ricebran oil is widely used in everyday cooking—major retail outlets play a crucial role in both urban and semi-urban consumption.

Key Market Segments

By Type

- Refined

- Non-Refined

By Category

- Organic

- Conventional

By Application

- Food Processing

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Retail Stores

- Others

Emerging Trends

Surge in Organic & Non-GMO Rice Bran Oil Consumption

This movement aligns with global agricultural policies. For example, the U.S. Department of Agriculture (USDA) National Organic Program sets rigorous standards for certification, ensuring organically produced oils meet strict criteria regarding cultivation, processing, and handling. As a result, rice bran oil brands seeking USDA certification must comply with these standards, which enhances consumer trust and supports price premiums in the market.

Meanwhile, regulatory frameworks from food safety authorities such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) continue to reinforce industry norms around purity and labeling. Although these agencies do not directly mandate “organic” claims, their oversight of contaminant limits and clear labeling rules indirectly bolster the integrity of organic product lines.

Environmental sustainability also contributes to the trend. Organic farming practices typically involve reduced pesticide use and enhanced soil health, conforming with United Nations Sustainable Development Goals (SDGs) related to responsible production. Several national subsidy and grant programs, such as India’s Paramparagat Krishi Vikas Yojana (PKVY), provide incentives to farmers for organic cultivation. Although PKVY is not specific to rice bran oil, it encourages rice farmers to adopt organic practices, benefiting downstream oil supply chains focused on certified organic output.

Drivers

Rising Global Demand for Healthier Edible Oils

One of the key driving forces behind the growth of the rice bran oil market is the growing consumer shift toward healthier edible oil alternatives. Rice bran oil, extracted from the outer layer of rice grains, is increasingly preferred for its high smoke point, light flavor, and impressive nutritional composition, especially its balanced fatty acid profile and natural antioxidants like gamma-oryzanol.

According to data from the United States Department of Agriculture (USDA), global consumption of vegetable oils surpassed 219 million metric tons in 2023, reflecting steady growth as more people across the world adopt plant-based and heart-friendly diets. Within this broader category, rice bran oil is finding a strong foothold in countries such as India, Japan, China, and the U.S., where public awareness campaigns and clinical studies have highlighted its cholesterol-lowering properties and antioxidant benefits. The Food Safety and Standards Authority of India (FSSAI) also endorsed rice bran oil as a “heart-friendly oil” in their Eat Right Movement, a nationwide campaign aimed at improving public health through dietary changes.

In India—one of the largest producers and consumers of rice bran oil—the Solvent Extractors’ Association (SEA) reported an annual production of nearly 1.05 million metric tons of rice bran oil in 2023. This number is expected to rise as more rice mills are equipped with integrated oil extraction systems and government subsidies promote local edible oil processing to reduce reliance on imports. The Indian government has also launched initiatives such as the National Edible Oil Mission–Oil Palm (NMEO-OP) to boost domestic oilseed processing, indirectly benefitting rice bran oil producers by strengthening oil refining infrastructure.

Restraints

High Production Costs and Limited Raw Material Availability

One of the major restraining factors for the rice bran oil market is the relatively high cost of production combined with limited availability of the raw material—rice bran—compared to more common edible oils. Unlike palm, soybean, or sunflower oils, which enjoy economies of scale and well-established supply chains, rice bran oil requires more complex extraction and refining processes. As persistence in-market research points out, rice bran oil “typically costs about 20% to 30% more” than its more abundant counterparts. This price difference makes it less appealing to price-sensitive consumers and large-scale food processors

Rice bran itself is a by-product of rice milling, and its supply is tightly linked to fluctuations in rice production. According to the FAO, global rice output reached approximately 738 million metric tons in 2022—but only a fraction of that becomes rice bran oil, with just 5–7 % of rice bran in India being diverted to oil production. This limited conversion rate creates supply constraints, meaning the cost per ton of rice bran oil remains high due to low volumes and underutilization of processing infrastructure.

Opportunity

Expansion of Biodiesel Use Boosts Rice Bran Oil Demand

In India, government programmes like the National Biodiesel Mission aim to achieve 5% biodiesel blending by 2030. While current blending rates remain modest—approximately 0.6% in FY-2025—continued policy encouragement and subsidies offer a clear path for higher uptake. Rice bran oil is increasingly seen by policymakers and producers as a sustainable option, thanks to its availability as a rice milling byproduct and competitive fatty acid profile.

The sustainability appeal is no accident: by utilizing rice bran—formerly a low-value byproduct—the industry supports cost-effective circular-resource utilization. This aligns with broader national goals of energy independence and rural economic growth. It also helps rice millers access additional revenue streams, improving farmer incomes and industry viability.

Technically, rice bran oil is well-suited for biodiesel conversion due to its balanced fatty acid composition and low free fatty acid content, which translates into smoother transesterification processes. Also, research into biodiesel from rice bran oil is gaining interest—India’s support for pilot plants and R&D in rice bran-based biofuels signals broader industry commitment.

Regional Insights

Asia-Pacific (APAC) dominates with 48.2% share and around USD 3.6 billion in 2024

In 2024, the Asia-Pacific region emerged as the dominant ricebran oil market, accounting for a substantial 48.2% share, which translates to approximately USD 3.6 billion in revenue. This leadership is driven primarily by significant demand from major rice-consuming countries such as India, China, Japan, Thailand, and Indonesia—nations where ricebran oil usage is deeply embedded in traditional cooking styles and rapidly expanding food industries.

Government support plays a pivotal role in sustaining this market lead. Nations across the region, notably India and China, continue to promote value-added agriprocessing through subsidies, export incentives, and fortified edible oil programs. These initiatives aim to improve farmer incomes and encourage adoption of ricebran oil in both household and industrial cooking sectors, thus solidifying APAC’s dominant position.

Additionally, APAC benefits from abundant raw material availability—rice bran is readily accessible as a byproduct of local large-scale rice milling operations. This substantially reduces input cost and boosts production efficiency, reinforcing the region’s competitive advantage.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3F Industries Ltd, founded in 1962, is a pioneer in rice bran oil production in India, operating solvent extraction and refining facilities including a unique fractionation plant in Tadepalligudem. The company produces branded oils like “Tandul Actilite,” backed by RSPO membership and sustainable practices. With strong export networks, 3F maintains a significant presence in domestic and global edible oil markets, supported by eco-friendly methods and longstanding industry experience.

BCL Industries began rice bran oil extraction in 1977 and built its refinery in 1982, later expanding to include branded products like Murli and White Gold. The company combines solvent extraction with refining, offering high-purity rice bran refined oil alongside other edible oils. It has earned national recognition through awards like the B.K. Goenka award for quality. Today, BCL stands among India’s top rice bran oil producers, serving both domestic and regional South Asian markets.

Cargill operates major edible oil refineries in India—at Paradeep, Kandla, and Kurkumbh—applying advanced technology and international food safety certifications (HACCP, FSSC 22000). It supports rice bran oil production under household brands like Gemini™ and Nature Fresh, and serves B2B clients across 70 countries. With global revenues of USD 165 billion (2022) and a workforce of 160,000, Cargill leverages its integrated supply chain and sustainability credentials to hold a strong position in the rice bran oil sector.

Top Key Players Outlook

- 3F Industries Ltd

- A.P. Refinery Private Limited

- BCL Industries Limited

- Cargill, Inc.

- Ricela Group of Companies

- King Rice Oil Group

- Modi Naturals Ltd.

- Rice King Oil Group

- Sethia Oils Ltd.

- TSUNO Group Co., Ltd

- Vaighai Agro Products Ltd.

Recent Industry Developments

In 2024, 3F Industries Ltd. reported consolidated revenue of ₹2,760crore (approximately USD 333 million) for the fiscal year ending March 31,2024—emphasizing its strong standing in rice bran and specialty fats production.

In 2024, Cargill reported global employment of approximately 160,000 staff, emphasizing its expansive reach across agribusiness and edible oils, including rice bran oil operations in India and Southeast Asia.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Bn Forecast Revenue (2034) USD 18.3 Bn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Refined, Non-Refined), By Category (Organic, Conventional), By Application (Food Processing, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3F Industries Ltd, A.P. Refinery Private Limited, BCL Industries Limited, Cargill, Inc., Ricela Group of Companies, King Rice Oil Group, Modi Naturals Ltd., Rice King Oil Group, Sethia Oils Ltd., TSUNO Group Co., Ltd, Vaighai Agro Products Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3F Industries Ltd

- A.P. Refinery Private Limited

- BCL Industries Limited

- Cargill, Inc.

- Ricela Group of Companies

- King Rice Oil Group

- Modi Naturals Ltd.

- Rice King Oil Group

- Sethia Oils Ltd.

- TSUNO Group Co., Ltd

- Vaighai Agro Products Ltd.