Global Rice Husk Ash Market Size, Share, And Industry Analysis Report By Product (Powder, Nodules, Granules), By Silica Content (80 to 84, 85 to 89, 90 to 94, Greater than 95), By Process (Alkaline Extraction Method for Silica Gel, Participated Silica Extraction Method, Mesoporous Silica Extraction Method, Silica Gel Extraction By Sol to Gel Method), By Application (Building and Construction, Steel industry, Ceramics and refractory, Rubber), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176384

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

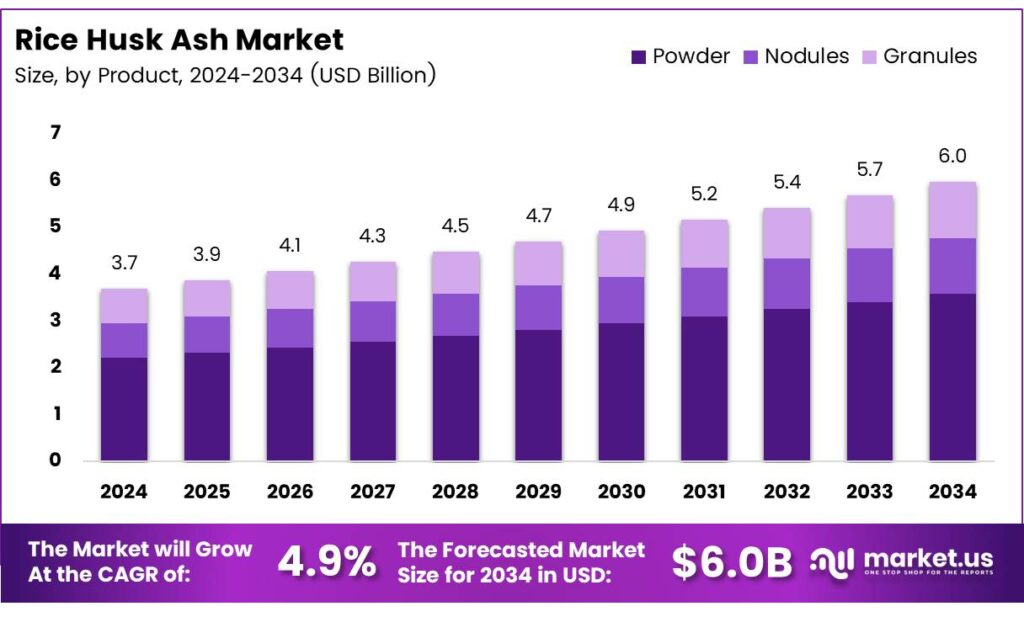

The Global Rice Husk Ash Market size is expected to be worth around USD 6.0 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Rice Husk Ash (RHA) Market represents a growing segment within the sustainable materials landscape, driven by rising industrial demand for eco-friendly silica sources. It supports applications across construction, steel, ceramics, and rubber, creating a circular economy model by converting agricultural residues into high-value materials. Businesses increasingly view RHA as a cost-efficient substitute for mined silica.

The market expands as industries invest in low-carbon materials. Construction firms adopt RHA-blended cement to reduce emissions, while chemical manufacturers explore RHA-derived silica for advanced materials. This shift accelerates opportunities for suppliers, especially as countries promote cleaner manufacturing. The market also benefits from rising global attention toward waste valorization and renewable feedstock utilization.

- The SiO₂ content of rice husk ash ranges from 76.4% to 97.9%, reflecting its suitability as a silica-rich material. Studies further note that combustion below 700 °C produces amorphous silica, while temperatures above 800 °C generate crystalline forms. Laboratory furnace tests conducted at 600–800 °C under controlled atmospheres confirm this behavior, supporting insights into industrial-grade processing.

RHA processed through rapid cooling at 21 ± 1 °C after reaching 800°C retains higher amorphous content. Additional tests show that firing at 700 °C for six hours yields RHA containing 85–90% amorphous silica, reinforcing its value for construction, fillers, and specialty chemical applications. These verified statistics strengthen the market’s credibility and future potential.

In addition, market interest grows as industries seek high-reactivity pozzolans for cement and concrete. RHA’s ability to enhance strength, permeability, and durability drives adoption in large-scale infrastructure. Emerging green construction policies also boost consumption, as governments promote substitutes that reduce clinker usage and support long-term sustainability goals.

Key Takeaways

- The Global Rice Husk Ash Market is valued at USD 3.7 billion by 2024 and projected to reach USD 6.0 billion by 2034 at a 4.9% CAGR.

- The Powder product segment leads with a 51.8% share due to its high usability.

- The 90 to 94 silica content category dominates the segment with 39.4% market share.

- The Alkaline Extraction Method for Silica Gel holds the highest process share at 31.5%.

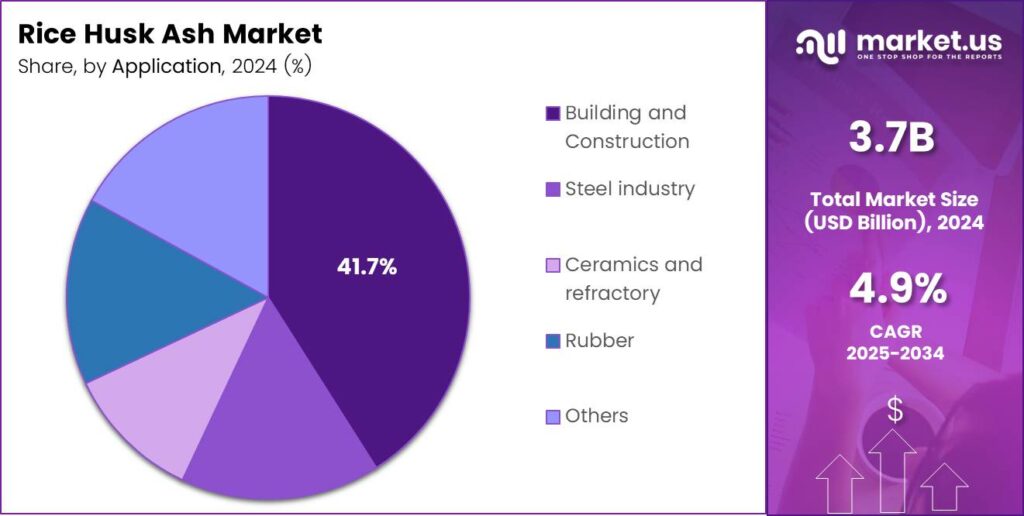

- Building and Construction leads all applications with a 41.7% contribution.

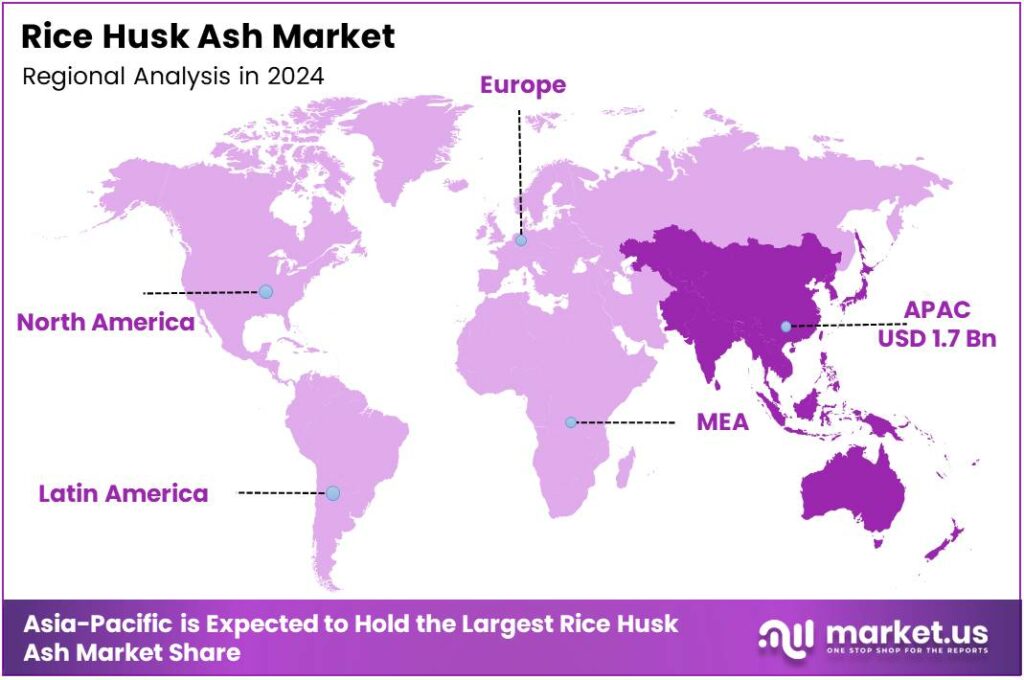

- Asia Pacific is the top regional market with 48.2% share, valued at USD 1.7 billion.

By Product Analysis

Powder dominates with 51.8% due to its high usability and consistent composition.

In 2025, Powder held a dominant market position in the By Product Analysis segment of the Rice Husk Ash Market, with a 51.8% share. Its fine texture supports smooth blending in construction mixtures and industrial formulations. It is widely used because it delivers reliable performance and efficient material utilization.

Nodules continued gaining attention as industries explored more structured forms of RHA for specialized applications. Their uniform size helps improve flow properties in cement and refractory mixes. They are also preferred in environments requiring better mechanical stability during processing or transport.

Granules remained valuable for processes demanding controlled particle size distribution. Their coarse nature supports filtration and soil conditioning applications. They are also used in rubber and ceramics, where gradual reactivity enhances product output. Industries adopting automated systems prefer granules for easier material handling.

By Silica Content Analysis

90 to 94 dominates with 39.4% as it provides ideal purity and performance.

In 2025, the 90 to 94 held a dominant market position in the By Silica Content Analysis segment of the Rice Husk Ash Market, with a 39.4% share. This range offers balanced purity and reactivity, making it suitable for industrial chemicals, construction materials, and silica-rich formulations requiring strong functional properties.

The 80 to 84 silica range served applications where moderate purity is sufficient, such as low-grade cement additives and soil improvement blends. Its cost-effectiveness makes it appealing to small manufacturers seeking affordable raw materials without compromising basic performance requirements in large-scale operations.

The 85 to 89 silica range found demand in blended applications that require stable performance and moderate reactivity. Industries utilize this range for controlled chemical processes and ceramic mixtures. It also enables improved durability in construction composites while maintaining a competitive manufacturing cost structure.

Greater than 95 silica content targeted premium applications such as high-purity silica extraction, advanced fillers, and specialty coatings. Its exceptional purity enhances product efficiency and technical performance. Although costlier, industries adopt it for high-value outputs where quality and consistency are critical.

By Process Analysis

The alkaline extraction method for Silica Gel dominates with 31.5% because it offers superior purity output.

In 2025, the Alkaline Extraction Method for Silica Gel held a dominant market position in the By Process Analysis segment of the Rice Husk Ash Market, with a 31.5% share. This method is preferred for producing high-quality silica gel used in chemicals, coatings, and industrial absorbents due to its strong extraction efficiency.

The Participated Silica Extraction Method remained relevant for industries focusing on economical silica extraction. It supports medium-purity silica requirements and is widely utilized in local manufacturing setups. Its simpler processing steps make it a practical choice for small-to-mid-scale producers looking for cost-efficient outputs.

The Mesoporous Silica Extraction Method supported applications demanding structured silica with controlled pore properties. It is widely used in catalysts, filtration materials, and high-performance industrial formulations. Manufacturers adopting innovative material technologies increasingly prefer this method for its ability to deliver tailored functional characteristics.

The Silica Gel Extraction by Sol to Gel Method gained traction due to its versatility in producing fine-grade silica materials. It is suitable for advanced coatings, specialty chemicals, and electronics-related fillers. Its gradual adoption reflects increasing industry interest in precision-engineered silica products.

By Application Analysis

Building and Construction dominates with 41.7% due to the wide use in cement and concrete enhancement.

In 2025, Building and Construction held a dominant market position in the By Application Analysis segment of the Rice Husk Ash Market, with a 41.7% share. Its pozzolanic properties improve concrete strength, durability, and sustainability. The sector relies heavily on RHA for cost-effective material optimization.

The Steel industry continued using RHA for insulation materials, slag conditioners, and thermal resistance applications. Its silica-rich nature helps regulate furnace operations and enhance metallurgical performance. Industries also value its lightweight structure for energy-efficient steel processing environments.

Ceramics and refractory manufacturing leveraged RHA for temperature-resistant formulations. Its high silica content supports improved dimensional stability and reduced thermal expansion. Producers adopt RHA to enhance product quality while lowering overall production costs in high-heat industrial applications.

The Rubber industry incorporated RHA as a reinforcing filler, supporting improved elasticity, tensile strength, and abrasion resistance. Its lightweight structure helps manufacturers reduce product weight while enhancing durability. It also offers a more sustainable alternative to conventional fillers.

Key Market Segments

By Product

- Powder

- Nodules

- Granules

By Silica Content

- 80 to 84

- 85 to 89

- 90 to 94

- Greater than 95

By Process

- Alkaline Extraction Method for Silica Gel

- Participated Silica Extraction Method

- Mesoporous Silica Extraction Method

- Silica Gel Extraction By Sol to Gel Method

By Application

- Building and Construction

- Steel industry

- Ceramics and refractory

- Rubber

- Others

Emerging Trends

Increasing Shift Toward Circular Economy Practices Supports Market Trends

A major trend shaping the Rice Husk Ash market is the global push toward circular economy practices. Industries are now focusing on converting agricultural waste into high-value products, and RHA fits perfectly into this model. This mindset encourages efficient use of resources and reduces environmental impact.

- Another important trend is the growing use of RHA in green infrastructure projects. Governments and private developers are adopting low-carbon building materials, increasing demand for RHA-based cement substitutes. A study describing controlled burning reports producing about 150 kg of RHA (about 15–20%) from 800–1000 kg of rice husk.

Technological improvements are also influencing market trends. Advanced burning systems now allow manufacturers to produce consistent, high-quality RHA suitable for specialized applications such as geopolymer concrete and high-purity silica processing. These innovations are expanding the scope of industrial uses.

Drivers

Growing Use of Eco-Friendly Construction Materials Drives Market Growth

The Rice Husk Ash (RHA) market is growing mainly because industries are shifting toward cleaner and more sustainable materials. RHA is widely used as a supplementary cementitious material due to its high silica content, which improves concrete strength and durability. As construction companies focus on reducing carbon emissions, the adoption of RHA continues to increase.

- Additionally, agricultural waste management initiatives encourage the use of rice husk by-products instead of burning them in open fields. The USDA Foreign Agricultural Service shows world rice production at 541.3 million metric tons for 2024/2025. When a crop is that large, even small by-product ratios translate into a substantial material stream.

The rising demand for cost-effective raw materials also supports market expansion. RHA is cheaper than traditional additives and provides comparable or better performance, particularly in construction, refractories, and rubber processing industries.

Restraints

Limited Processing Standards Create Barriers to Market Expansion

One of the biggest challenges in the Rice Husk Ash market is the lack of uniform processing standards. RHA quality varies widely depending on burning temperature and collection methods. This inconsistency affects its suitability for construction, silica extraction, and other industrial applications, causing buyers to hesitate.

- Many potential users do not fully understand the performance benefits of RHA, which slows adoption across sectors such as rubber, paints, and refractories. This knowledge gap restricts market penetration despite RHA’s potential. An International Rice Research Institute reference notes that the hull (husk) is about 20% of the rough rice weight.

The availability of high-quality RHA is inconsistent because rice production fluctuates seasonally. Regions with low rice milling activity struggle to maintain a steady supply. This becomes a limiting factor for industries that require large, reliable volumes.

Growth Factors

Rising Demand for High-Purity Silica Creates New Market Opportunities

The extraction of high-purity silica from Rice Husk Ash presents major growth opportunities. Electronics, solar panels, and advanced materials industries increasingly require high-grade silica, and RHA provides a cost-effective, naturally abundant source. Companies that invest in advanced extraction technologies are likely to benefit the most.

- Expanding use of RHA in green construction materials also opens new avenues. As more countries shift toward low-carbon building practices, RHA-based cement and concrete products are gaining attention. Peer-reviewed technical literature notes that silica is the main oxide in RHA but can vary widely, reported in the range of 80% to 95% depending on feedstock and processing conditions.

The agriculture sector also offers growth potential. RHA is being explored as a soil amendment due to its ability to improve water retention and nutrient balance. With increasing focus on sustainable farming practices, RHA-based soil conditioners may see wider adoption.

Regional Analysis

Asia Pacific Dominates the Rice Husk Ash Market with a Market Share of 48.2%, Valued at USD 1.7 Billion

Asia Pacific held the leading position in the global Rice Husk Ash Market, driven by its strong agricultural base and extensive rice production. The region accounted for a significant 48.2% share, translating to around USD 1.7 billion, supported by widespread industrial use in construction, steel manufacturing, and ceramics. Government initiatives promoting waste-to-value solutions further strengthen the region’s market dominance.

North America shows steady growth supported by increasing adoption of sustainable construction materials and stringent waste management regulations. The region benefits from rising interest in lightweight concrete and innovative silica-based formulations. Growing awareness of circular economy practices is gradually pushing industries toward the use of RHA as a supplementary cementitious material.

Europe’s market expansion is influenced by strong environmental policies and the region’s shift toward low-carbon construction technologies. The demand for high-quality amorphous silica drives RHA utilization across building materials, rubber, and specialty chemical industries. Additionally, the European Union’s sustainability frameworks encourage industries to integrate agricultural by-products like RHA into green manufacturing.

The Middle East & Africa region is emerging as an opportunity hub, supported by rising infrastructure development and interest in cost-effective cement additives. Limited rice cultivation in some countries drives imports, but industrial users increasingly recognize RHA’s performance benefits. Sustainability programs in Gulf countries also encourage the use of alternative materials in construction.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Husk Power Systems stands out for linking biomass residue management with energy-led circular models, which indirectly strengthens reliable rice husk ash (RHA) sourcing. Their operational discipline around feedstock collection and processing ecosystems can help stabilize ash quality and volumes, especially where decentralized rice milling is common. This kind of infrastructure-first approach improves traceability and supports downstream users who need consistent silica performance.

Pioneer Industries is typically viewed as a pragmatic, supply-focused player that can serve regional demand with steady output and cost control. Analysts often look at such firms for their ability to scale procurement relationships with mills and maintain uniform processing practices. In a market where variability is a key challenge, stable grading and predictable delivery schedules can be a competitive advantage for construction, ceramics, and industrial blending applications.

RHA Technologies appears more process- and specification-oriented, aligning well with buyers who need tighter particle size distribution, controlled carbon content, or higher silica consistency. In 2025, value is increasingly moving toward performance-grade ash rather than bulk disposal diversion. The firms that can document processing parameters and produce repeatable technical batches are better positioned for higher-margin industrial use cases.

Krbl Limited benefits from scale, integration, and proximity to large rice processing volumes, which can support dependable by-product availability. The expect stronger bargaining power in logistics and better internal control over residue streams, helping ensure continuous supply. This scale-led reliability can matter as RHA adoption grows and large end users seek long-term supply continuity.

Top Key Players in the Market

- Husk Power Systems

- Pioneer Industries

- RHA Technologies

- Krbl Limited

- Guru Metachem

- Yihai Kerry Arawana Holdings Co., Ltd.

- Jasoriya Rice Mill

- Rescon India Pvt. Ltd.

- Astrra Chemicals

- J.M. Biotech Pvt. Ltd.

Recent Developments

- In 2025, Husk Power Systems, originally known for biomass gasification using rice husks, had evolved its focus toward solar-hybrid minigrids while maintaining operations in rice-producing regions. The company partnered with Olam Agri to deploy a 1.3 MWp solar photovoltaic system integrated with an 860 kWh battery energy storage system at Olam’s rice operations in Rukubi, Nasarawa State, Nigeria.

- In 2025, Pioneer Industries (associated with Pioneer Carbon Company) specializes in rice husk ash (RHA) as a sustainable material. Their RHA product features a minimum 85% silica content, 25-micron particle size, and low loss on ignition (maximum 4%), produced via controlled burning at 700°C to yield amorphous silica.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Powder, Nodules, Granules), By Silica Content (80 to 84, 85 to 89, 90 to 94, Greater than 95), By Process (Alkaline Extraction Method for Silica Gel, Participated Silica Extraction Method, Mesoporous Silica Extraction Method, Silica Gel Extraction By Sol to Gel Method), By Application (Building and Construction, Steel industry, Ceramics and refractory, Rubber, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Husk Power Systems, Pioneer Industries, RHA Technologies, Krbl Limited, Guru Metachem, Yihai Kerry Arawana Holdings Co., Ltd., Jasoriya Rice Mill, Rescon India Pvt. Ltd., Astrra Chemicals, J.M. Biotech Pvt. Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Husk Power Systems

- Pioneer Industries

- RHA Technologies

- Krbl Limited

- Guru Metachem

- Yihai Kerry Arawana Holdings Co., Ltd.

- Jasoriya Rice Mill

- Rescon India Pvt. Ltd.

- Astrra Chemicals

- J.M. Biotech Pvt. Ltd.