Global Research Antibodies Market By Product Type (Primary Antibodies and Secondary Antibodies), By Antibody Type (Monoclonal Antibodies, Polyclonal Antibodies and Recombinant Antibodies), By Source (Mouse, Rabbit, Goat and Others), By Technology (Western Blotting, Immunohistochemistry, Flow Cytometry, ELISA, Immunofluorescence, Immunoprecipitation and Others), By Research Area (Immunology, Oncology, Neuroscience, Infectious Disease, Cell and Molecular Biology, Stem Cell and Others), By End-User (Academic & Research Institutes, Pharmaceutical and Biotechnology Companies, CROs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173095

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Antibody Type Analysis

- Source Analysis

- Technology Analysis

- Research Area Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

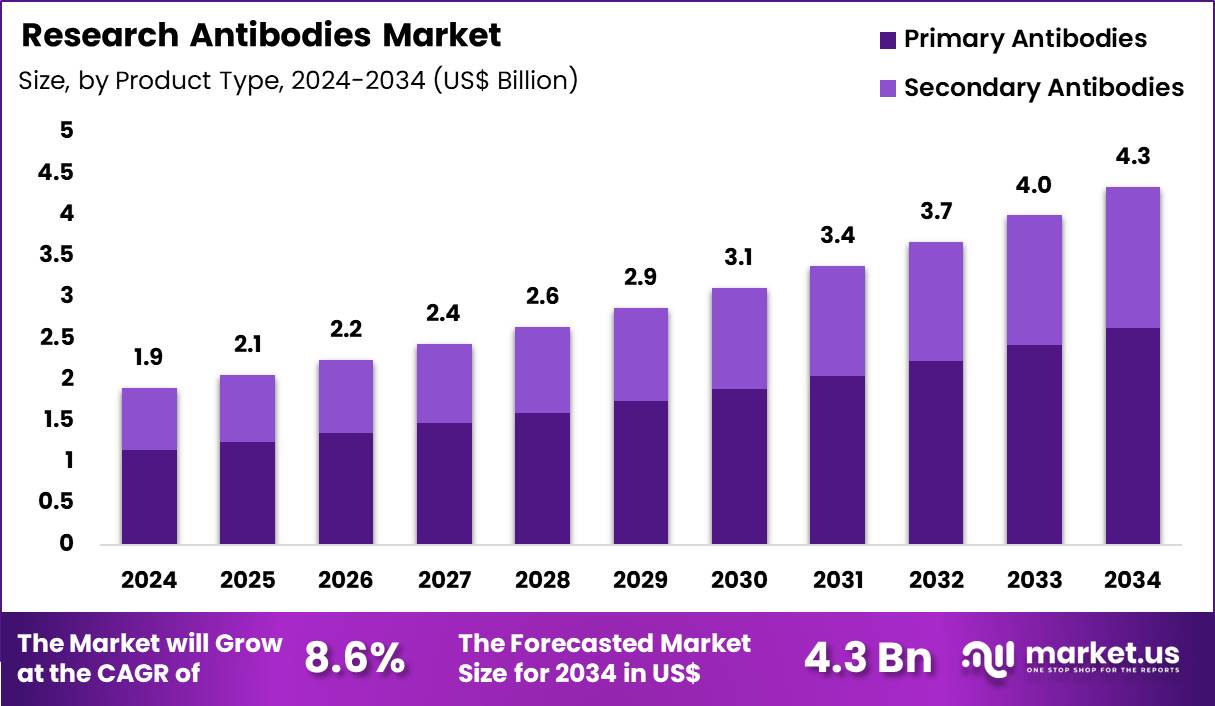

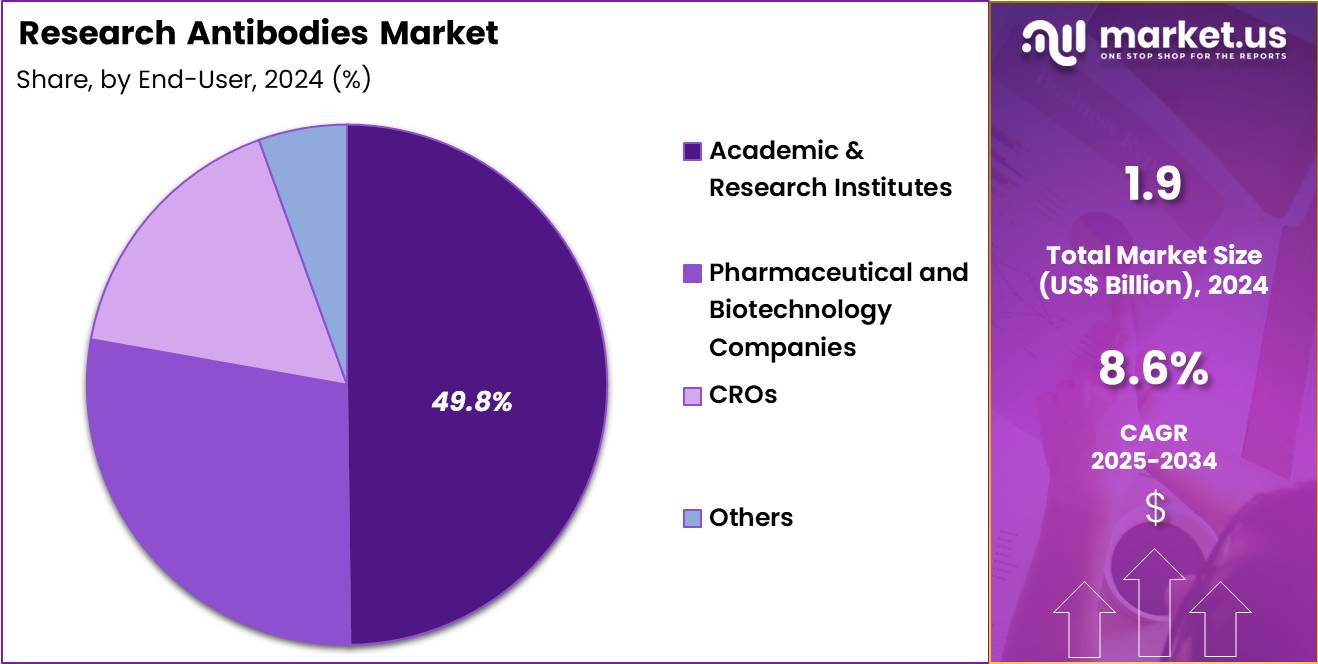

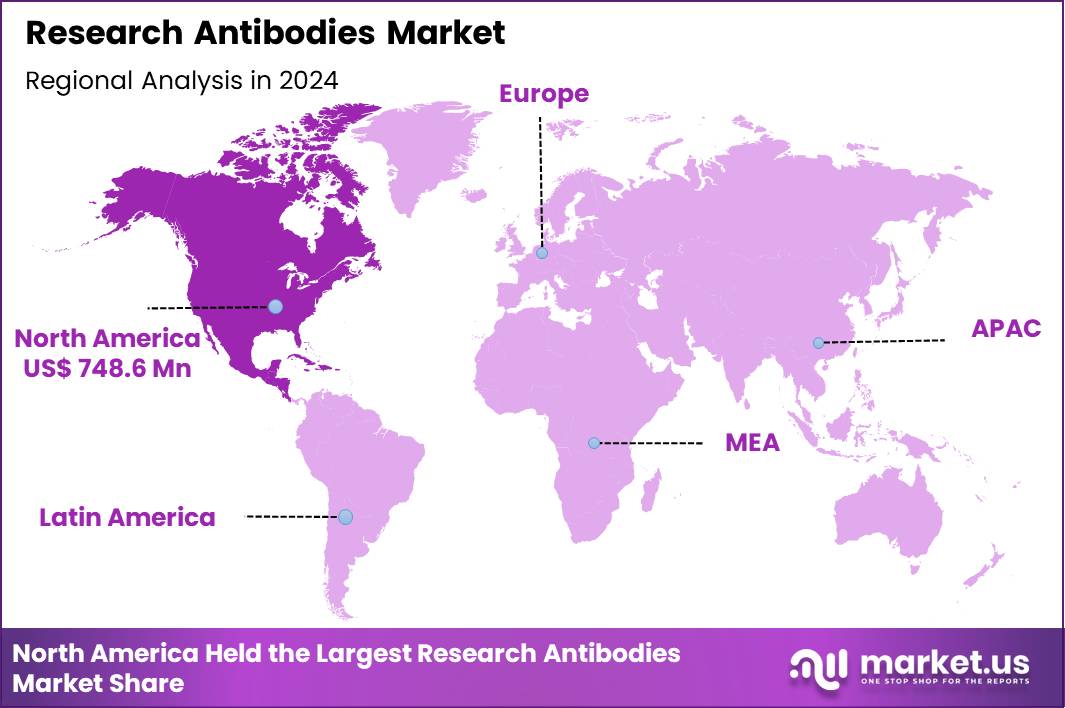

The Global Research Antibodies Market size is expected to be worth around US$ 4.3 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 8.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.4% share with a revenue of US$ 748.6 Million.

Growing demand for precise molecular tools in life sciences research propels the adoption of research antibodies that facilitate accurate detection and quantification of proteins across diverse experimental workflows. Scientists increasingly employ monoclonal antibodies in immunohistochemistry to visualize antigen expression in tissue sections, supporting detailed analysis of tumor microenvironments in oncology studies.

These reagents enable flow cytometry applications by labeling surface markers on immune cells, aiding investigations into lymphocyte activation and differentiation in immunology research. Researchers utilize western blotting with primary and secondary antibodies to confirm protein presence and modifications in cell signaling pathways. These tools support ELISA protocols for quantitative measurement of cytokines and growth factors in inflammatory disease models.

In August 2025, BRIC-THSTI invited biopharmaceutical partners to co develop a novel monoclonal antibody under a ₹10 crore program spanning research, GMP manufacturing, and IND enabling studies. This initiative drives the research antibodies market by strengthening early stage antibody discovery and preclinical research ecosystems in India. Public funded programs stimulate demand for custom antibodies, assay development reagents, and translational research tools, while accelerating movement of monoclonal antibodies from laboratory research into regulated development pipelines.

Biotechnology companies capitalize on opportunities to develop recombinant antibody formats that offer superior specificity and consistency for high-throughput proteomics and single-cell analysis. Developers engineer multispecific antibodies for simultaneous targeting of multiple epitopes, expanding utility in complex protein interaction studies within neuroscience and infectious disease research. These advancements broaden applications in CRISPR validation, where antibodies confirm gene editing efficiency through targeted protein detection.

Opportunities emerge in stem cell research, utilizing antibodies for sorting and characterization of pluripotent populations in regenerative medicine investigations. Firms pursue custom monoclonal generation services that address unique antigens in rare disease models, facilitating biomarker discovery and validation. Enterprises invest in conjugation technologies that attach fluorophores or enzymes, enhancing signal amplification in advanced imaging techniques for cellular dynamics.

Industry innovators advance AI-assisted antibody design platforms to predict binding affinities, streamlining discovery of high-affinity reagents for challenging targets in metabolomics and epigenetics. Developers refine validation standards through independent quality assessments, improving reproducibility in antibody-based assays for drug mechanism studies.

Market participants prioritize secondary antibodies with enhanced brightness and low cross-reactivity, optimizing multiplexing capabilities in multi-parameter flow cytometry. Companies integrate recombinant production systems to eliminate animal-derived variability, supporting ethical and consistent supply for long-term academic collaborations. Ongoing efforts emphasize bispecific formats for probing protein complexes in structural biology, delivering deeper insights into macromolecular interactions across diverse research disciplines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.9 Billion, with a CAGR of 8.6%, and is expected to reach US$ 4.3 Billion by the year 2034.

- The product type segment is divided into primary antibodies and secondary antibodies, with primary antibodies taking the lead in 2024 with a market share of 60.6%.

- Considering antibody type, the market is divided into monoclonal antibodies, polyclonal antibodies and recombinant antibodies. Among these, monoclonal antibodies held a significant share of 62.3%.

- Furthermore, concerning the source segment, the market is segregated into mouse, rabbit, goat and others. The mouse sector stands out as the dominant player, holding the largest revenue share of 41.8% in the market.

- The technology segment is segregated into western blotting, immunohistochemistry, flow cytometry, ELISA, immunofluorescence, immunoprecipitation and others, with the western blotting segment leading the market, holding a revenue share of 28.5%.

- The research area segment is divided into immunology, oncology, neuroscience, infectious disease, cell and molecular biology, stem cell and others, with oncology taking the lead in 2023 with a market share of 34.4%.

- The end-user segment is segregated into academic & research institutes, pharmaceutical and biotechnology companies, CROs and others, with the academic & research institutes segment leading the market, holding a revenue share of 49.8%.

- North America led the market by securing a market share of 39.4% in 2024.

Product Type Analysis

Primary antibodies accounted for 60.6% of the research antibodies market, reflecting their indispensable role in target specific detection across life science research. Researchers rely on primary antibodies to directly bind antigens, which enables accurate protein identification and quantification. Expanding proteomics and molecular biology studies increase routine consumption of primary antibodies.

High specificity requirements in advanced research workflows strengthen demand. Growth in biomarker discovery and validation further accelerates usage. Custom and application specific primary antibodies improve experimental precision. Continuous publication driven research activity sustains recurring demand.

Vendors expand validated antibody catalogs to support diverse targets. Reproducibility initiatives reinforce preference for high quality primary antibodies. This segment is projected to maintain dominance due to its foundational role in experimental design.

Antibody Type Analysis

Monoclonal antibodies represented 62.3% of the research antibodies market, driven by their high specificity and batch to batch consistency. Researchers favor monoclonals for reproducible results in quantitative and comparative studies. Increasing emphasis on data reliability strengthens adoption across academic and industrial labs.

Advances in hybridoma and recombinant technologies improve antibody performance. Large scale screening programs depend on monoclonal uniformity. Oncology and immunology research intensify usage of target specific reagents. Regulatory expectations for research quality reinforce monoclonal preference.

Long term availability supports extended research programs. Reduced cross reactivity improves experimental clarity. This segment is anticipated to remain dominant due to precision and reproducibility advantages.

Source Analysis

Mouse sourced antibodies accounted for 41.8% of the research antibodies market, supported by extensive hybridoma libraries and historical validation. Researchers benefit from the wide availability of mouse derived monoclonal antibodies. Established protocols optimize compatibility with mouse antibodies across platforms.

Cost effective production supports broad adoption. Longstanding characterization enhances trust in experimental outcomes. Vendors maintain extensive mouse antibody catalogs covering diverse targets. Integration with secondary antibody systems improves workflow efficiency. Training familiarity reduces technical barriers for new users. Continuous target discovery sustains production demand. This source segment is likely to retain leadership due to availability and proven performance.

Technology Analysis

Western blotting represented 28.5% of the research antibodies market, reflecting its central role in protein expression analysis. Laboratories rely on this technique for protein size verification and relative quantification. Strong compatibility with primary and monoclonal antibodies supports widespread use. Research workflows frequently include western blotting for validation purposes.

Cost efficiency compared to advanced imaging methods sustains adoption. Standardized protocols ensure consistent data generation. Training prevalence across institutions reinforces routine usage. Advances in detection reagents improve sensitivity. Publication requirements often include western blot confirmation. This technology segment is expected to remain prominent due to methodological familiarity and reliability.

Research Area Analysis

Oncology accounted for 34.4% of the research antibodies market, driven by intense global focus on cancer biology and therapeutics. Rising cancer incidence accelerates investment in oncogenic pathway research. Biomarker identification programs depend heavily on antibody based assays. Translational research bridges basic studies with clinical development.

Precision oncology initiatives increase demand for target specific antibodies. Funding support prioritizes cancer research across regions. High publication volume sustains continuous reagent demand. Collaborative research networks expand experimental scale. Antibody validation underpins therapeutic target discovery. This research area is projected to sustain leadership due to sustained scientific and clinical focus.

End-User Analysis

Academic and research institutes held 49.8% of the research antibodies market, reflecting their role as primary centers of basic and applied research. Universities and public laboratories conduct large volumes of exploratory studies. Grant funded projects generate recurring antibody consumption. Training programs expose researchers to antibody based techniques early.

Diverse research portfolios require broad antibody catalogs. Institutional core facilities support centralized purchasing. Publication driven research activity sustains steady demand. Expansion of interdisciplinary research increases reagent usage. Budget allocation favors essential consumables. Consequently, this end user segment is likely to remain dominant due to research intensity and continuous experimentation.

Key Market Segments

By Product Type

- Primary Antibodies

- Secondary Antibodies

By Antibody Type

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Antibodies

By Source

- Mouse

- Rabbit

- Goat

- Others

By Technology

- Western Blotting

- Immunohistochemistry

- Flow Cytometry

- ELISA

- Immunofluorescence

- Immunoprecipitation

- Others

By Research Area

- Immunology

- Oncology

- Neuroscience

- Infectious Disease

- Cell and Molecular Biology

- Stem Cell

- Others

By End-User

- Academic & Research Institutes

- Pharmaceutical and Biotechnology Companies

- CROs

- Other

Drivers

Increasing approvals of biologic therapies is driving the market

The research antibodies market is significantly driven by the rising approvals of biologic therapies, which require high-quality antibodies for development, validation, and production processes. Biopharmaceutical firms utilize research antibodies to characterize and optimize novel biologics, ensuring efficacy in preclinical stages. Regulatory bodies prioritize biologics in approval pathways, accelerating the demand for specialized antibodies in therapeutic pipelines.

Healthcare systems integrate these therapies for targeted treatments, sustaining antibody usage in diagnostic applications. Academic research employs antibodies to explore biologic mechanisms, supporting translational advancements. Global collaborations focus on antibody-based assays to facilitate biologic testing in diverse populations. Economic incentives for biologics encourage investment in antibody technologies for scalable manufacturing.

Patient care benefits from antibody-enabled biologics in oncology and immunology fields. Pharmaceutical innovation aligns with approval trends to address unmet medical needs. The U.S. Food and Drug Administration approved 37 novel drugs in 2022, 55 in 2023, and 50 in 2024, with a notable proportion being biologics reliant on research antibodies.

Restraints

Reproducibility issues in antibody research are restraining the market

The research antibodies market faces substantial restraints due to ongoing reproducibility issues, where nonselective or poorly validated antibodies lead to inconsistent experimental outcomes. Scientists encounter challenges in replicating results across studies, undermining confidence in antibody-dependent research. Regulatory agencies highlight the need for rigorous validation to mitigate these problems in biomedical investigations.

Pharmaceutical developers invest additional resources in antibody characterization to ensure reliability in drug discovery pipelines. Academic institutions implement stricter protocols for antibody selection, increasing operational complexities. Global research communities advocate for standardized guidelines to address variability in antibody performance.

Economic implications arise from wasted resources in irreproducible experiments using flawed antibodies. Clinical translations suffer delays due to doubts over antibody-derived data integrity. Ethical concerns emphasize the responsibility of suppliers to provide verifiable antibody specifications. A 2024 article from the National Institutes of Health detailed how insufficient validation contributes to the reproducibility crisis in antibody-based research.

Opportunities

Growth in personalized medicine initiatives is creating growth opportunities

The research antibodies market presents growth opportunities through the expansion of personalized medicine initiatives, which demand customized antibodies for biomarker identification and targeted therapies. Developers can create specialized antibodies to support genomic profiling in individual patient treatments. Regulatory frameworks endorse personalized approaches, facilitating antibody integration in companion diagnostics.

Healthcare providers adopt antibodies for precision oncology, enhancing treatment efficacy in heterogeneous diseases. Pharmaceutical partnerships focus on antibody libraries tailored to genetic variations across populations. Academic research leverages antibodies in pharmacogenomics to advance personalized drug responses.

Global health programs invest in antibody technologies to address disparities in treatment access. Patient-centric models benefit from antibodies enabling real-time monitoring of therapeutic progress. Economic analyses project long-term savings from personalized interventions reducing adverse events. The National Institutes of Health’s All of Us Research Program enrolled over 1 million participants by 2024, emphasizing antibody use in diverse genomic data for personalized medicine.

Impact of Macroeconomic / Geopolitical Factors

Increasing global R&D investments and biotechnological progress energize the research antibodies market, compelling suppliers to develop advanced monoclonal and polyclonal reagents that support groundbreaking discoveries in immunology and oncology. Executives at forefront companies strategically scale operations, harnessing economic booms in Asia and Europe to fulfill heightened demands from pharmaceutical giants and academic institutions.

Inflationary surges, however, drive up expenses for cell cultures, purification kits, and shipping, forcing firms to implement cost controls and defer expansions amid sluggish growth phases. Geopolitical disputes, notably U.S.-China trade clashes and instability in reagent-sourcing hotspots like Eastern Europe, consistently block essential imports, escalating lead times and risks for producers reliant on cross-border networks.

Current U.S. tariffs under Section 301 levy duties up to 25% on Chinese-origin lab reagents and equipment as of December 2025, amplifying acquisition costs for American distributors and straining overall profitability. These tariffs further incite countermeasures from international counterparts, curtailing U.S. exports of specialized antibodies and disrupting joint research endeavors.

Despite these pressures, the tariff framework motivates substantial shifts toward North American production hubs and diversified supplier alliances, enhancing operational security. This evolution cultivates a more robust ecosystem, accelerating local innovations and ensuring prosperous, enduring market development.

Latest Trends

Integration of artificial intelligence in antibody discovery is a recent trend

In 2025, the research antibodies market has observed a prominent trend toward the integration of artificial intelligence in discovery processes, enabling faster identification and optimization of high-affinity antibodies. Developers employ AI algorithms to analyze vast datasets for predicting antibody-antigen interactions with greater accuracy. Scientists utilize machine learning models to design novel antibodies, reducing experimental iterations in preclinical phases.

Regulatory discussions address validation of AI-generated antibodies for clinical applicability. Pharmaceutical firms incorporate AI tools to enhance library screening efficiency in therapeutic development. Academic studies explore AI-driven epitope mapping to improve antibody specificity across applications. Global collaborations refine AI platforms for multi-omics integration in antibody research. Patient benefits arise from accelerated discovery of antibodies for rare diseases.

Ethical guidelines ensure transparent AI methodologies in research practices. A 2025 publication from the National Institutes of Health reviewed AI’s role in reshaping antibody engineering through advanced computational models.

Regional Analysis

North America is leading the Research Antibodies Market

In 2024, North America held a 39.4% share of the global research antibodies market, catalyzed by substantial increases in biomedical research funding and the proliferation of advanced applications in drug discovery, diagnostics, and therapeutic development. Academic institutions and biopharmaceutical companies ramped up procurement of polyclonal and monoclonal antibodies to support high-throughput screening and biomarker validation in oncology and immunology projects, bolstered by federal grants that prioritized precision medicine initiatives.

Regulatory frameworks expedited approvals for recombinant antibody platforms, enabling seamless integration into CRISPR-based gene editing workflows for enhanced specificity. Rising incidences of autoimmune disorders prompted expanded use of affinity-purified reagents in clinical trials, driving demand for customized conjugation services. Biotechnology hubs invested in next-generation sequencing-compatible antibodies, optimizing epitope mapping for vaccine design amid emerging pathogen threats.

Collaborative consortia refined production techniques using mammalian expression systems, ensuring high-yield scalability for preclinical studies. Supply chain enhancements guaranteed reliable delivery of validated, low-endotoxin products, aligning with good laboratory practice standards in multi-center investigations. The National Institutes of Health awarded $36.94 billion in extramural research funding across all 50 U.S. states in fiscal year 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts forecast robust progression in the research antibodies sector throughout Asia Pacific over the forecast period, as nations bolster indigenous capabilities in life sciences amid surging chronic disease research imperatives. Investigators harness affinity reagents to advance proteomic analyses, pinpointing therapeutic targets for metabolic syndromes prevalent in urbanizing populations.

Authorities earmark budgets for hybridoma technology upgrades, equipping national laboratories to generate region-specific monoclonals against tropical infectious agents. Biotech enterprises cultivate phage display libraries, tailoring variants to genetic diversities that influence immunogenicity in vaccine trials. Regional partnerships expedite flow cytometry-grade conjugates, streamlining adoption in immunology hubs tackling autoimmune flares.

Pharmaceutical innovators license cutting-edge purification kits, optimizing yields for biosimilar development compliant with harmonized pharmacopeias. Extension programs train researchers on immunoblotting applications, fostering equitable access in emerging economies. The World Bank reports that research and development expenditure reached 2.82% of GDP in East Asia and Pacific in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the research antibodies market drive growth by expanding validated portfolios that cover emerging targets in oncology, immunology, and neuroscience, enabling faster assay development for academic and biotech users. Companies strengthen differentiation by prioritizing reproducibility through rigorous validation, lot-to-lot consistency controls, and transparent datasheets that reduce experimental failure.

Commercial strategies emphasize bundled workflows across primary antibodies, secondary antibodies, controls, and buffers, which increases basket size and locks in repeat purchasing. Innovation teams invest in recombinant antibody platforms and custom antibody services to meet demand for specificity, scalability, and IP-friendly supply.

Geographic expansion targets fast-growing life science hubs while leveraging e-commerce and distributor networks to improve availability and lead times. Abcam represents a key participant through its large catalog of research antibodies and protein tools, global customer reach, and strong focus on validation and customer support for reliable experimental outcomes.

Top Key Players

- Abcam Plc. (Acquired by Danaher)

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc. (Now Revvity)

- Merck KGaA

- Santa Cruz Biotechnology Inc.

- Cell Signaling Technology, Inc.

- Proteintech Group, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Techne Corporation

- Jackson ImmunoResearch Inc.

- GenScript Biotech Corp.

- Agilent Technologies, Inc.

- Promega Corporation

- Lonza Group Ltd.

- Qiagen

- Revvity

Recent Developments

- In April 2025, Merck KGaA acquired SpringWorks Therapeutics for USD 3.9 billion to strengthen its oncology portfolio with rare cancer and tumor therapies. This acquisition drives the research antibodies market by increasing demand for highly specific antibodies used in target validation, biomarker discovery, and translational oncology research. Expansion of rare cancer pipelines requires extensive use of research grade antibodies for pathway analysis, mechanism of action studies, and companion diagnostic development, thereby sustaining long term growth in antibody based research tools across academic and industrial laboratories.

- In August 2023, Danaher acquired Abcam for USD 5.7 billion to expand its life sciences capabilities through Abcam’s extensive antibody portfolio serving more than 750,000 researchers globally. This transaction significantly drives the research antibodies market by scaling production, distribution, and validation of high quality antibodies. Integration into Danaher’s global platform improves accessibility, standardization, and reproducibility of research antibodies, supporting increased usage across proteomics, cell biology, and drug discovery workflows worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 4.3 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Primary Antibodies and Secondary Antibodies), By Antibody Type (Monoclonal Antibodies, Polyclonal Antibodies and Recombinant Antibodies), By Source (Mouse, Rabbit, Goat and Others), By Technology (Western Blotting, Immunohistochemistry, Flow Cytometry, ELISA, Immunofluorescence, Immunoprecipitation and Others), By Research Area (Immunology, Oncology, Neuroscience, Infectious Disease, Cell and Molecular Biology, Stem Cell and Others), By End-User (Academic & Research Institutes, Pharmaceutical and Biotechnology Companies, CROs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abcam Plc., Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Merck KGaA, Santa Cruz Biotechnology Inc., Cell Signaling Technology, Inc., Proteintech Group, Inc., Becton, Dickinson and Company, Bio-Techne Corporation, Jackson ImmunoResearch Inc., GenScript Biotech Corp., Agilent Technologies, Inc., Promega Corporation, Lonza Group Ltd., Qiagen, Revvity. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abcam Plc. (Acquired by Danaher)

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc. (Now Revvity)

- Merck KGaA

- Santa Cruz Biotechnology Inc.

- Cell Signaling Technology, Inc.

- Proteintech Group, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Techne Corporation

- Jackson ImmunoResearch Inc.

- GenScript Biotech Corp.

- Agilent Technologies, Inc.

- Promega Corporation

- Lonza Group Ltd.

- Qiagen

- Revvity