Global PV System EPC Installer Market Size, Share, And Enhanced Productivity By Service Type (Design and Engineering, Procurement, Construction, Maintenance), By Technology (Crystalline Silicon, Thin Film, Others), By Application (Residential, Commercial, Industrial, Utility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169537

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

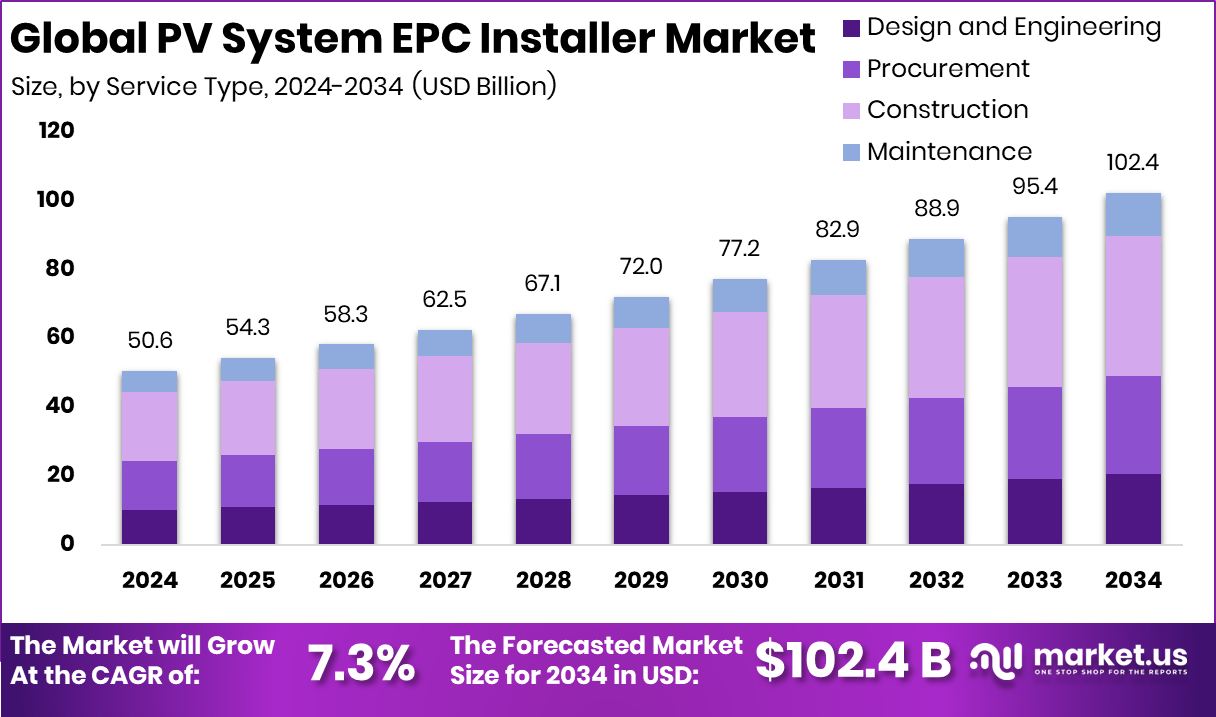

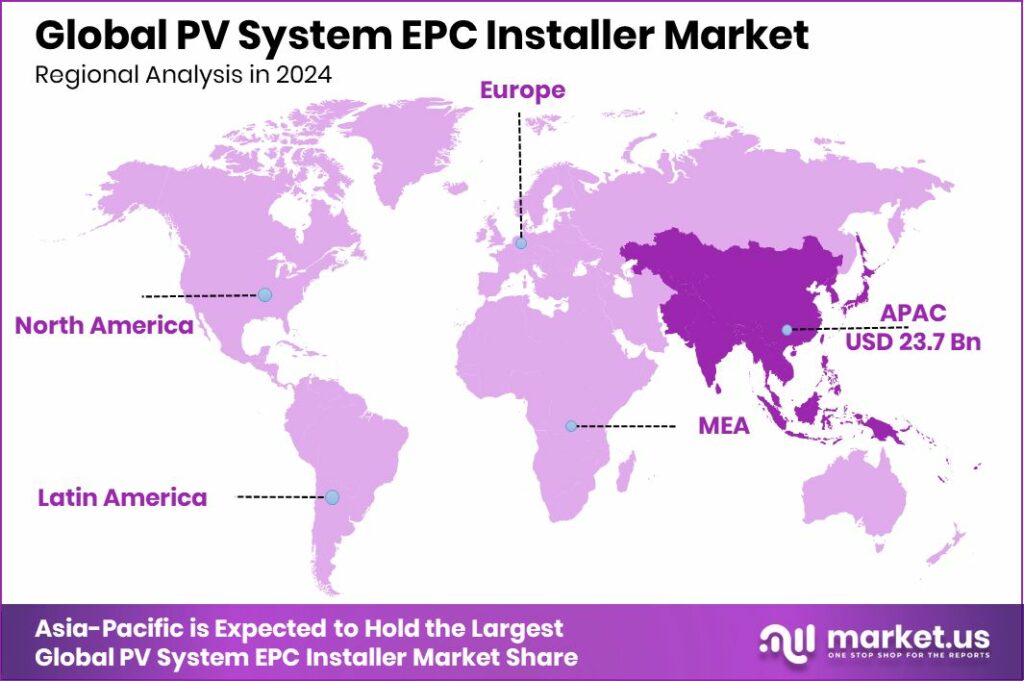

The Global PV System EPC Installer Market is expected to be worth around USD 102.4 billion by 2034, up from USD 50.6 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. North America’s dominance reflects strong solar deployment, representing 46.9% market, USD 23.7 Bn.

A PV System EPC Installer is a company or service provider that delivers Engineering, Procurement, and Construction (EPC) for solar photovoltaic systems. These installers manage the full project lifecycle—system design, equipment sourcing, installation, testing, and grid connection—ensuring the plant operates safely, efficiently, and in line with local regulations.

The PV System EPC Installer Market covers all commercial activities linked to utility-scale, commercial, and rooftop solar project execution. The market grows with solar capacity additions, government tenders, industrial decarbonization plans, and falling solar technology costs. EPC installers play a critical role by reducing project risk, compressing timelines, and optimizing plant performance from planning to commissioning.

Growth factors are strongly supported by global investments across the solar value chain. South Korea’s 336 billion won push into perovskite technology, Germany’s push for €100 million in annual solar research funding, and Germany-based NexWafe’s €10 million funding to reduce solar manufacturing costs and CO₂ emissions are all driving advanced module deployment. These innovations require skilled EPC execution, directly expanding installer demand.

Demand is increasing as governments strengthen domestic solar manufacturing and supply resilience. India’s Art-PV receiving a $10 million grant for advanced solar cells, the U.S. allocating $40 million to improve solar supply-chain lifecycle efficiency, and $325 million in CHIPS Act funding for polysilicon capacity in Michigan signal sustained project pipelines that rely on EPC installers for rapid rollout.

Opportunities are widening as new technologies move from labs to large-scale deployment. Funding, such as $14 million raised for liquid-crystal beamforming chips, supports smarter solar and power-management systems, increasing project complexity and EPC value. As solar plants integrate advanced cells, digital controls, and lower-carbon materials, EPC installers gain long-term opportunities in system integration, performance optimization, and repeat project execution.

Key Takeaways

- The Global PV System EPC Installer Market is expected to be worth around USD 102.4 billion by 2034, up from USD 50.6 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- In the PV System EPC Installer Market, construction services hold a 39.7% share due to large-scale solar project execution.

- The PV System EPC Installer Market is dominated by crystalline silicon technology with a 77.2% share globally.

- Utility-scale projects lead the PV System EPC Installer Market, capturing 48.6% share driven by grid-scale deployments.

- North America’s growth is driven by large-scale projects, holding 46.9% and USD 23.7 Bn.

By Service Type Analysis

Construction services dominate the PV System EPC Installer Market, holding a 39.7% share globally.

In 2024, Construction held a dominant market position in the By Service Type segment of the PV System EPC Installer Market, with a 39.7% share. This leadership reflects the central role construction plays in determining overall project quality, timelines, and operational reliability.

Construction activities include site preparation, mounting structures, module installation, electrical works, and final system integration, all of which require skilled labor and strict regulatory compliance. As solar projects scale in size and complexity, developers increasingly prioritize experienced EPC installers capable of managing on-site execution efficiently.

Delays or errors at the construction stage can directly affect project economics and long-term performance, making this service critical. The strong share also highlights rising demand for turnkey execution models, where developers rely on a single EPC partner to ensure seamless construction delivery and faster commissioning.

By Technology Analysis

Crystalline silicon technology leads the PV System EPC Installer Market, representing 77.2% of deployments.

In 2024, Crystalline Silicon held a dominant market position in the By Technology segment of the PV System EPC Installer Market, with a 77.2% share. This dominance is driven by the widespread adoption of crystalline silicon modules across rooftop, commercial, and utility-scale solar projects.

EPC installers favor this technology due to its proven performance, long operational life, and strong efficiency levels under diverse climatic conditions. The mature manufacturing ecosystem and standardized installation practices further support its large-scale deployment.

From an EPC perspective, crystalline silicon systems allow predictable design parameters, smoother procurement planning, and faster construction execution. Its reliability and bankability continue to make it the preferred technology choice for installers focused on delivering stable energy output and long-term project value.

By Application Analysis

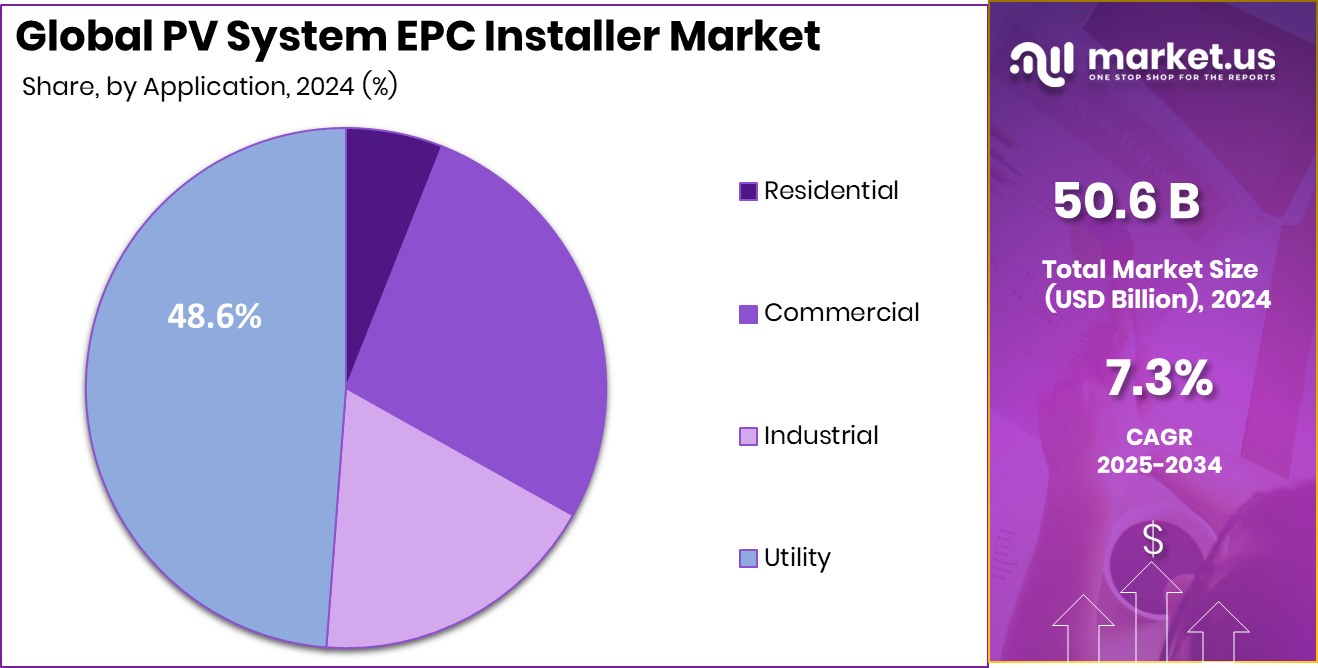

Utility applications drive the PV System EPC Installer Market, capturing 48.6% of installations.

In 2024, Utility held a dominant market position in the By Application segment of the PV System EPC Installer Market, with a 48.6% share. This dominance is supported by the continued development of large-scale solar power plants designed to supply electricity directly to national and regional grids.

Utility projects typically involve high-capacity systems, complex site conditions, and strict grid-connection requirements, which increase reliance on experienced EPC installers. The scale of these installations demands detailed engineering, efficient construction coordination, and precise commissioning processes.

From a market perspective, the strong share reflects the preference for centralized solar generation to meet rising power demand and improve energy security. Utility-scale projects also favor EPC partners capable of managing timelines and operational performance with consistency.

Key Market Segments

By Service Type

- Design and Engineering

- Procurement

- Construction

- Maintenance

By Technology

- Crystalline Silicon

- Thin Film

- Others

By Application

- Residential

- Commercial

- Industrial

- Utility

Driving Factors

Government-Backed Solar Manufacturing Fuels EPC Demand

One major driving factor for the PV System EPC Installer Market is strong government-backed investment in advanced solar technologies. A clear example is Japan’s $1.5 billion investment in ultra-thin solar cell development, aimed at strengthening domestic solar manufacturing and reducing reliance on external supply chains.

Such large-scale funding accelerates pilot projects, demonstration plants, and commercial solar deployments. As new technologies move into real-world installations, EPC installers are essential for engineering design, system integration, and on-ground execution. These projects require precise construction, experienced workforce management, and compliance with evolving technical standards.

Government funding not only expands solar capacity but also increases the volume and complexity of installations, directly boosting demand for professional EPC installers who can deliver reliable, grid-ready photovoltaic systems on time and at scale.

Restraining Factors

Emerging Technologies Increase Execution And Integration Risks

A key restraining factor for the PV System EPC Installer Market is the rapid emergence of new solar technologies that are still in the development stage. An example is Oxford Photovoltaics securing £8.7 million to further develop perovskite thin-film technology.

While such innovation improves long-term efficiency, it creates short-term challenges for EPC installers. New technologies often lack standardized installation methods, long-term performance data, and established supply chains. EPC teams must adapt designs, retrain workers, and manage higher technical risk during construction and commissioning.

These uncertainties can slow project approvals and increase execution costs. Until newer technologies mature and installation practices become routine, EPC installers may face hesitation from project owners, limiting short-term deployment despite strong innovation funding.

Growth Opportunity

Ultra-Thin Energy Storage Opens New EPC Scope

A major growth opportunity for the PV System EPC Installer Market comes from the rise of ultra-thin energy storage technologies. Swiss startup BTRY securing $5.7 million to scale paper-thin batteries, along with an Empa-ETH spin-off raising $5.7 million to industrialize ultra-thin solid-state batteries, highlights this shift.

As solar projects increasingly combine generation with compact energy storage, EPC installers gain new responsibilities. These systems require careful engineering to integrate lightweight batteries with photovoltaic panels, inverters, and control systems.

Rooftop and space-constrained installations especially benefit from thin, flexible storage solutions. This trend expands EPC service scope beyond standard solar construction, creating long-term opportunities in system optimization, hybrid design, and integrated solar-plus-storage project delivery.

Latest Trends

Smart Monitoring Technologies Transform Solar Project Management

One major latest trend in the PV System EPC Installer Market is the adoption of smart monitoring and tracking technologies across solar installations. Reelables securing $10.4 million in Series A funding to advance active smart label technology reflects the broader move toward real-time asset visibility and performance monitoring.

For EPC installers, this trend supports better tracking of solar components during delivery, installation, and operation. Smart labels help monitor panel conditions, logistics status, and on-site placement accuracy, reducing losses and rework.

Easy access to live data also improves project coordination and quality control. As project owners demand higher transparency and performance assurance, EPC installers increasingly integrate smart monitoring tools into solar project execution, improving efficiency, accountability, and long-term system reliability.

Regional Analysis

North America leads the PV EPC Installer Market with 46.9% share, USD 23.7 Bn.

North America dominates the PV System EPC Installer Market, holding a 46.9% share valued at USD 23.7 Bn. The region’s leadership reflects its large pipeline of utility-scale and commercial solar installations, where EPC installers play a critical role in managing complex engineering, grid integration, and construction timelines. Strong project execution capabilities and a mature solar development ecosystem continue to support North America’s dominant position.

Europe represents a steadily expanding regional market, driven by structured solar deployment across utility, commercial, and rooftop applications. EPC installers in the region focus on compliance with strict technical standards, efficient project coordination, and optimized construction practices, supporting consistent installation activity across multiple end-use segments.

Asia Pacific remains a high-potential region for PV system EPC installers due to ongoing solar capacity additions and expanding infrastructure development. EPC engagement in this region is closely linked to large project volumes, rapid construction cycles, and demand for scalable installation solutions across diverse climatic conditions.

The Middle East & Africa market is supported by increasing solar project development aimed at long-term energy diversification. EPC installers contribute through large, centralized solar projects that require robust engineering and reliable construction execution.

Latin America shows gradual market progress, supported by growing solar adoption and rising demand for professional EPC services to ensure timely, cost-effective project delivery across emerging solar markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, First Solar, Inc. continued to maintain a strong position in the PV System EPC Installer Market through its focus on large-scale solar project development and execution. The company is known for delivering integrated solar solutions with a clear emphasis on system performance, long-term reliability, and efficient project delivery. Its experience in handling complex utility-scale installations supports steady EPC activity across multiple regions.

SunPower Corporation remained active in the market by supporting EPC services primarily linked to high-efficiency solar installations. In 2024, the company’s involvement reflected a focus on quality-driven engineering, streamlined installation processes, and optimized system design. SunPower’s EPC-related activities align closely with projects where precision, durability, and long-term operational performance are key priorities.

JinkoSolar Holding Co., Ltd. played a significant role in the 2024 market through its vertically integrated capabilities supporting EPC execution. The company’s presence across manufacturing and project support enables smoother coordination during installation and commissioning. Its engagement in EPC-related activities reflects growing demand for scalable solar systems delivered with consistent construction quality and predictable project timelines.

Top Key Players in the Market

- First Solar, Inc.

- SunPower Corporation

- JinkoSolar Holding Co., Ltd.

- Canadian Solar Inc.

- Trina Solar Limited

- Yingli Green Energy Holding Company Limited

- Sharp Corporation

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

Recent Developments

- In November 2025, First Solar announced plans to build a fifth U.S. module plant with 3.7 GW annual output, aiming to lift its total domestic capacity to more than 14 GW by 2026.

- In September 2025, SunPower completed the acquisition of U.S. residential solar installer Sunder Energy, expanding its service footprint and aiming to strengthen its installation base across additional states.

Report Scope

Report Features Description Market Value (2024) USD 50.6 Billion Forecast Revenue (2034) USD 102.4 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Design and Engineering, Procurement, Construction, Maintenance), By Technology (Crystalline Silicon, Thin Film, Others), By Application (Residential, Commercial, Industrial, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape First Solar, Inc., SunPower Corporation, JinkoSolar Holding Co., Ltd., Canadian Solar Inc., Trina Solar Limited, Yingli Green Energy Holding Company Limited, Sharp Corporation, Hanwha Q CELLS Co., Ltd., JA Solar Technology Co., Ltd., LONGi Green Energy Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PV System EPC Installer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

PV System EPC Installer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- First Solar, Inc.

- SunPower Corporation

- JinkoSolar Holding Co., Ltd.

- Canadian Solar Inc.

- Trina Solar Limited

- Yingli Green Energy Holding Company Limited

- Sharp Corporation

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.