Global Pure Nicotine Market Size, Share, And Enhanced Productivity By Type (Synthetic Nicotine, Tobacco-Derived Nicotine), By Application (Smoking Cessation Products, Nicotine Replacement Therapy (NRT), E-liquids for Vaping, Agriculture, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175304

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

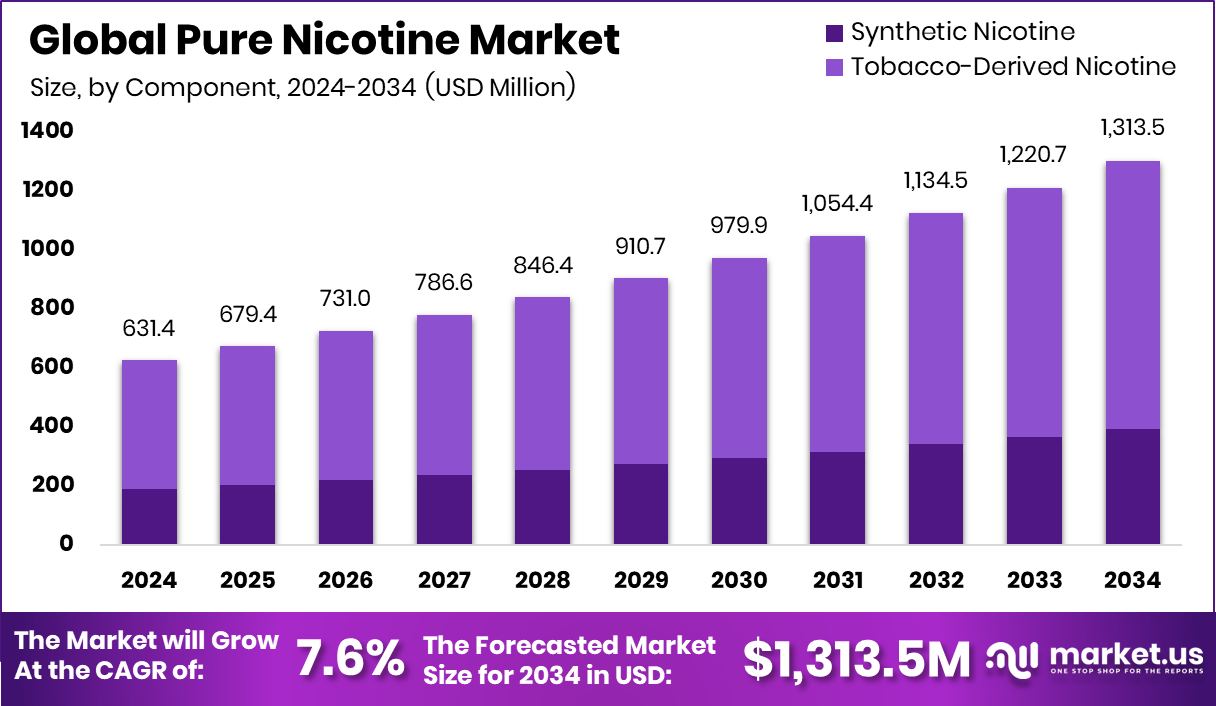

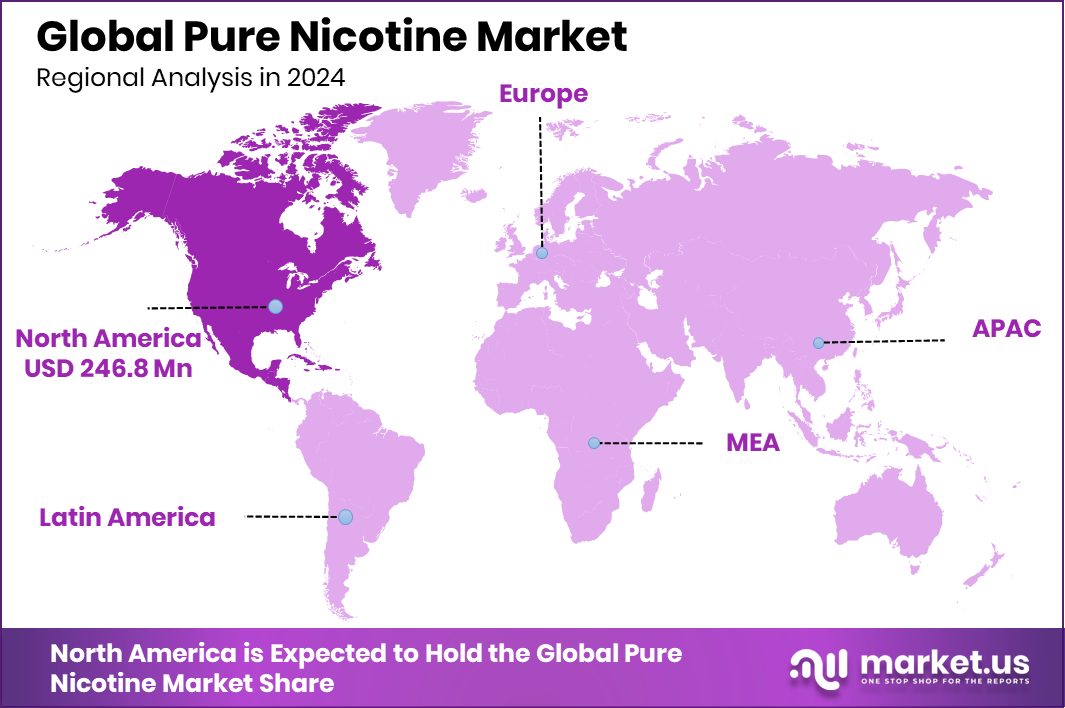

The Global Pure Nicotine Market is expected to be worth around USD 1,313.5 million by 2034, up from USD 631.4 million in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034. The Pure Nicotine Market in North America reached USD 246.8 Mn with 39.1% share.

Pure nicotine refers to a highly refined form of nicotine extracted either from tobacco leaves or produced synthetically to achieve very high purity. It is used as a base ingredient in several applications, including e-liquids, pharmaceutical formulations, NRT products, and agricultural treatments. The pure nicotine market represents the commercial ecosystem that produces, supplies, and distributes these high-purity nicotine inputs across industries that require controlled strength, consistency, and safety. This market is shaped by regulatory trends, the shift toward smoke-free products, and investments influencing nicotine-related research and alternatives.

One key growth factor comes from the rising demand for controlled-dose nicotine products, especially as governments and institutions push for reduced harms linked to traditional tobacco. For instance, UK councils facing pressure over £1 billion of tobacco-linked investments reflect a broader move toward cleaner nicotine sources, indirectly supporting demand for purified and regulated forms. This shift encourages manufacturers and researchers to prioritize safer nicotine delivery formats.

Demand is also expanding due to strong interest in next-generation nicotine alternatives. The recent $40 million funding raised by Sesh, a tobacco-free nicotine pouch brand, highlights growing consumer preference for products that use high-purity nicotine without combustible tobacco. Such investments support innovation and create new commercial opportunities for pure nicotine producers.

Research and regulatory science remain another opportunity area. The $20 million federal grant renewed for the Yale Tobacco Center of Regulatory Science shows an ongoing commitment to studying nicotine’s effects and improving product safety. This type of institutional funding strengthens long-term market prospects by supporting compliance, product development, and scientific innovation across applications, including NRT, e-liquids, pharmaceuticals, and agriculture.

Key Takeaways

- The Global Pure Nicotine Market is expected to be worth around USD 1,313.5 million by 2034, up from USD 631.4 million in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034.

- Tobacco-derived nicotine holds 69.3% share, dominating the Pure Nicotine Market due to its wide industrial usage.

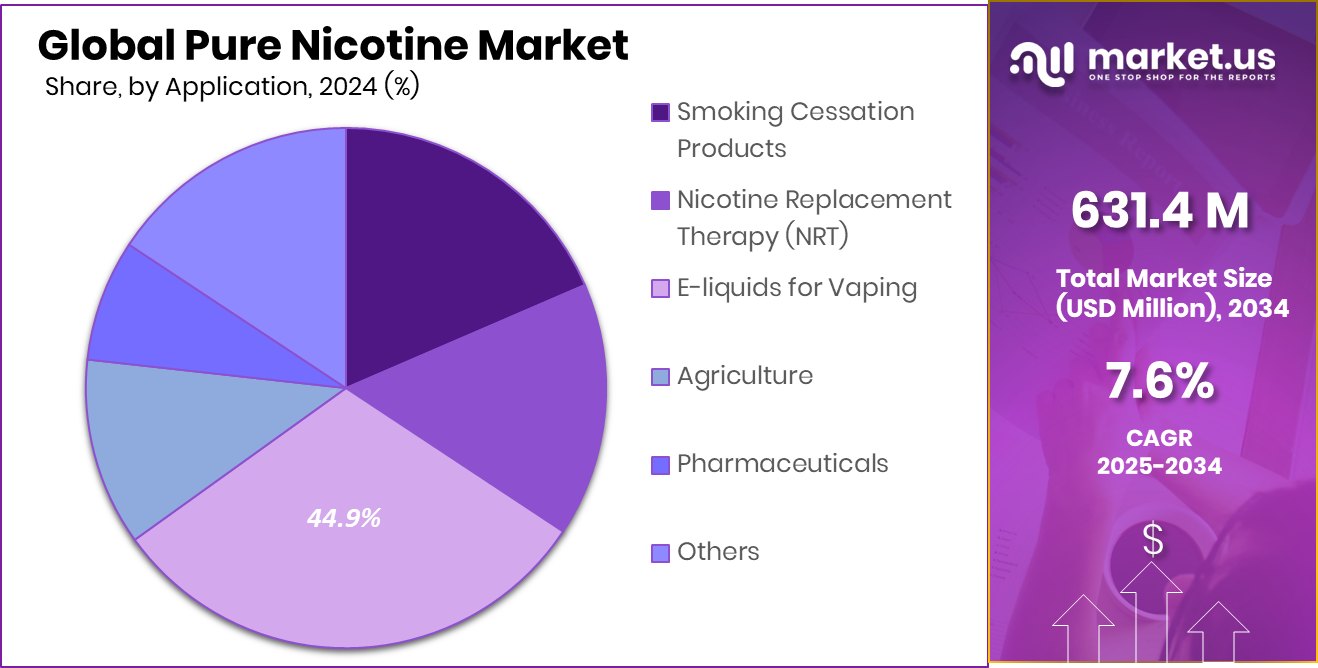

- E-liquids for vaping account for 44.9%, making them the largest Pure Nicotine Market application.

- In 2024, North America recorded 39.1% market dominance, totaling USD 246.8 Mn.

By Type Analysis

Tobacco-derived products dominate the Pure Nicotine Market with a strong 69.3% share.

In 2024, the Pure Nicotine Market saw strong momentum driven by the dominance of tobacco-derived nicotine, which accounted for 69.3% of the global share. This segment continued to lead due to its cost-effective extraction process, established supply chains, and high compatibility with existing nicotine formulations used by major manufacturers. Regulatory clarity in several regions supporting traditional extraction methods also helped strengthen its market presence.

As brands increasingly prioritize consistent purity levels for pharmaceutical, NRT (nicotine replacement therapy), and vaping applications, tobacco-derived nicotine remained the preferred raw material. Its widespread acceptance and scalability positioned it as the backbone of the market’s supply structure throughout 2024.

By Application Analysis

E-liquids lead the Pure Nicotine Market, capturing 44.9% global application share.

In 2024, application trends highlighted that e-liquids for vaping contributed 44.9% of the total market demand, making it the largest consuming segment. The rise of adult consumers shifting from combustible cigarettes to vapor products significantly expanded demand for high-purity nicotine suitable for premium vape formulations. Growth was further supported by the expansion of open-system devices, flavored nicotine products, and innovation in salt-nicotine blends offering smoother delivery.

Regulatory movements in key regions encouraging controlled, safer nicotine alternatives also reinforced the need for pharmaceutical-grade purity. With continuous product launches, rising online retail penetration, and strong consumer adoption, e-liquids retained their leading role in driving market consumption in 2024.

Key Market Segments

By Type

- Synthetic Nicotine

- Tobacco-Derived Nicotine

By Application

- Smoking Cessation Products

- Nicotine Replacement Therapy (NRT)

- E-liquids for Vaping

- Agriculture

- Pharmaceuticals

- Others

Driving Factors

Rising demand for smoke-free nicotine alternatives (Pure Nicotine Market)

The Pure Nicotine Market continues to grow as consumers shift from traditional smoking to smoke-free nicotine options, driven by rising awareness of health risks linked to combustible products. Pure nicotine plays a central role in enabling cleaner delivery formats such as pouches, NRT products, and vapor-based solutions. This transition is further supported by increasing scientific research aimed at understanding safer nicotine pathways.

A major boost came when the College of Medicine received a $20 million grant to research alternative tobacco products, reinforcing the momentum toward regulated, harm-reduction-focused nicotine use. Such institutional support not only validates the need for purified nicotine inputs but also accelerates the development of innovative formulations that meet evolving consumer preferences.

Restraining Factors

Health concerns reduce consumer adoption rates (Pure Nicotine Market)

Despite its growth, the Pure Nicotine Market faces resistance from segments of the population who remain cautious about nicotine’s long-term health effects. These concerns often influence purchasing behavior and slow the shift toward alternative delivery systems. Challenges are amplified when fluctuations in funding affect public education efforts.

For example, the Budget committee approval of a $3 million cut to South Dakota’s tobacco-use prevention fund, overriding an earlier proposal for a $2 million cut, reflects reduced support for awareness programs. At the same time, market uncertainty grows as companies navigate uneven investment patterns, such as HC Jones, Inc. raising $9 million of a $10.2 million equity round, demonstrating investor interest but also highlighting financial pressures that shape the market’s pace of adoption.

Growth Opportunity

Expanding NRT products strengthen future demand (Pure Nicotine Market)

The Pure Nicotine Market gains strong opportunities from the expanding landscape of nicotine replacement therapy (NRT) products aimed at helping people transition away from smoking. Pure nicotine is essential for the controlled-dose formulations used in patches, gums, sprays, and emerging oral formats. New product innovation further fuels this opportunity, especially with companies developing modern alternatives that appeal to younger demographics seeking tobacco-free options.

A clear example is Sett raising $3.8 million to produce functional oral pouches and releasing its first product, highlighting rising investment in nicotine delivery innovations. Such advancements support long-term market demand by broadening the range of solutions available to consumers aiming to quit or reduce smoking.

Latest Trends

Shift toward tobacco-free nicotine solutions (Pure Nicotine Market)

A major trend shaping the Pure Nicotine Market is the accelerating movement toward nicotine solutions that contain no tobacco plant material. Consumers increasingly seek cleaner profiles, simpler formulations, and products aligned with modern wellness expectations. This trend is also supported by public health organizations advocating for stronger regulatory oversight and prevention efforts.

For instance, a national coalition recently urged policymakers to allocate $310 million toward tobacco control, highlighting growing institutional pressure to reduce tobacco dependence and encourage less harmful alternatives. As tobacco-free nicotine gains recognition for offering controlled purity and consistency, the market continues evolving toward solutions designed to fit stricter regulations and changing consumer lifestyles.

Regional Analysis

North America led the Pure Nicotine Market with 39.1% share worth USD 246.8 Mn.

In 2024, North America dominated the Pure Nicotine Market with a 39.1% share valued at USD 246.8 million, driven by high adoption of vaping products and strong regulatory frameworks supporting purified nicotine formulations.

Europe followed with steady growth, supported by strict quality compliance norms and expanding demand for nicotine used in e-liquids and therapeutic applications. The Asia Pacific region continued to expand as rising urban populations and the growing shift toward smoke-free alternatives boosted consumption, especially in emerging economies.

Meanwhile, the Middle East & Africa saw gradual development, supported by niche demand for regulated nicotine products, whereas Latin America experienced moderate growth led by increasing awareness of vaping products across key countries. Together, these regions shaped a balanced global outlook, but North America’s large consumer base and higher adoption of premium nicotine products ensured its clear leadership position in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alchem International Pvt. Ltd. strengthened its position through its long-standing expertise in producing plant-derived active ingredients, including high-purity nicotine tailored for pharmaceutical and vape-grade needs. The company’s consistent emphasis on controlled extraction processes and quality certification enabled it to meet rising global demand for reliable nicotine inputs.

Nicobrand Ltd. remained notable for its specialized capabilities in producing premium-grade nicotine used across NRT products and e-liquids. Its strong focus on purification technologies and adherence to strict European standards positioned the company as a trusted supplier. Nicobrand’s commitment to consistency and traceability helped maintain its relevance among manufacturers seeking regulated and high-performance nicotine ingredients.

Chemnovatic continued to expand its influence by offering a wide range of pure nicotine and nicotine salts designed for global e-liquid producers. Known for its quality-controlled manufacturing and precise formulation capabilities, the company addressed the increasing demand for smooth-delivery nicotine solutions. Chemnovatic’s flexibility in supplying various concentrations and formats supported its strong customer base across multiple regions. Together, these companies shaped a competitive and quality-driven landscape for pure nicotine in 2024.

Top Key Players in the Market

- Alchem International Pvt. Ltd.

- Nicobrand Ltd.

- Chemnovatic

- Xian Taima Biological Engineering Co. Ltd.

- Abf Nicotine

- Vapor Beast

- NicSelect

Recent Developments

- In June 2024, NicSelect highlighted its T-MAX™ nicotine formulation, designed to offer a smoother vaping experience. NicSelect shared that T-MAX™ at 8 mg/ml or 14 mg/ml performs similarly to higher-strength nicotine, making it appealing for e-liquid manufacturers and adult vapers. This shows a focus on product performance and formulation quality.

- In January 2024, Xi’an Taima introduced a PG/VG-based flavour concentrate specifically designed for e-liquid mixing. This flavour concentrate requires blending with PG (propylene glycol), VG (vegetable glycerin), and nicotine to create DIY vape liquids, reflecting the company’s ongoing product expansion in the vape materials segment.

Report Scope

Report Features Description Market Value (2024) USD 631.4 Million Forecast Revenue (2034) USD 1,313.5 Million CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic Nicotine, Tobacco-Derived Nicotine), By Application (Smoking Cessation Products, Nicotine Replacement Therapy (NRT), E-liquids for Vaping, Agriculture, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alchem International Pvt. Ltd., Nicobrand Ltd., Chemnovatic, Xian Taima Biological Engineering Co. Ltd., Abf Nicotine, Vapor Beast, NicSelect Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alchem International Pvt. Ltd.

- Nicobrand Ltd.

- Chemnovatic

- Xian Taima Biological Engineering Co. Ltd.

- Abf Nicotine

- Vapor Beast

- NicSelect