Global Power Generation Equipment Market Size, Share, And Enhanced Productivity By Equipment Type (Turbines, Engines, Boilers, Heat Exchangers, Power Transformers), By Fuel Source (Fossil Fuels, Renewable Energy, Nuclear Energy), By Capacity Range (Small (Up to 5 MW), Medium (5-50 MW), Large (Over 50 MW)), By Application (Baseload Generation, Peak Generation, Combined Heat and Power (CHP), Emergency Power), By End-use (Utility, Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167837

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

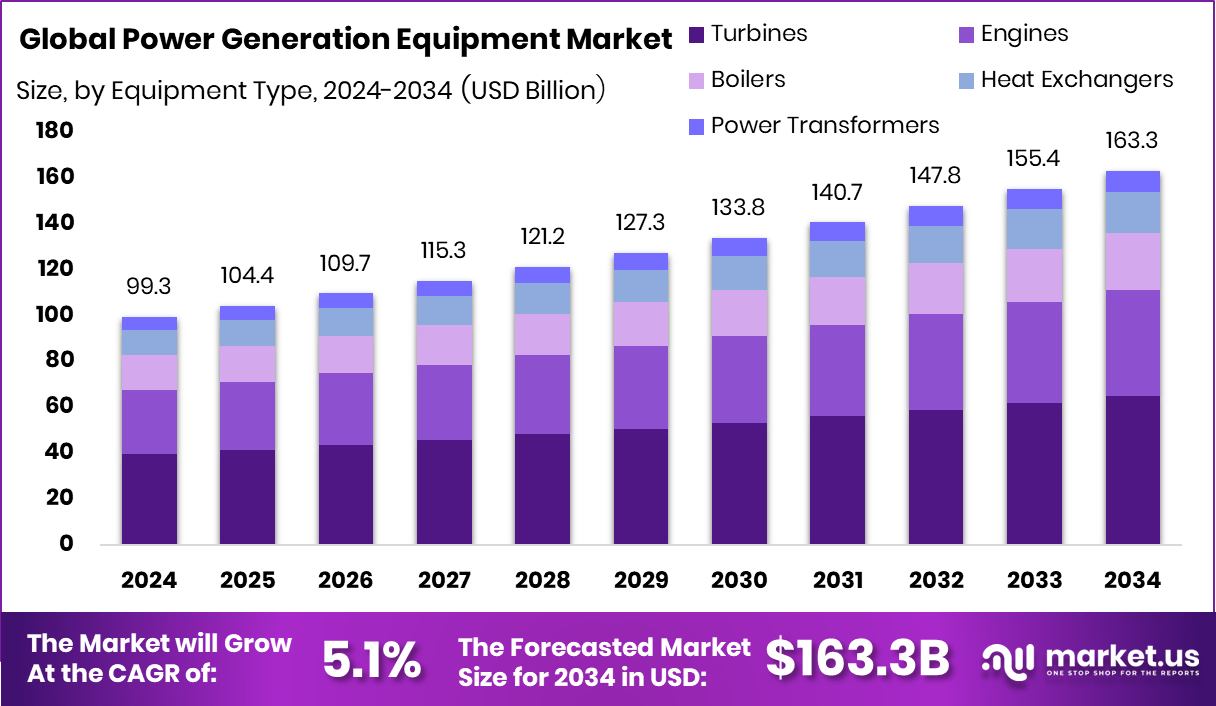

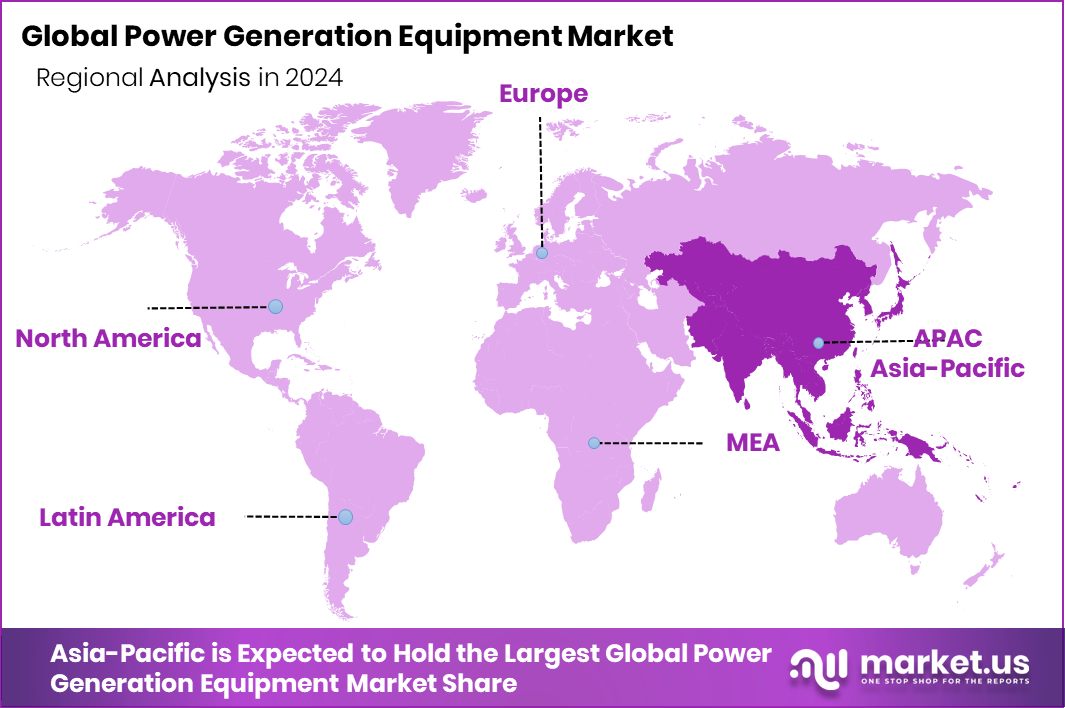

The Global Power Generation Equipment Market is expected to be worth around USD 163.3 billion by 2034, up from USD 99.3 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. Growing electrification and renewable projects continue strengthening Asia-Pacific’s 47.30% market presence.

Power generation equipment refers to the machines and systems used to convert energy sources into usable electricity. These include turbines, generators, transformers, control systems, and supporting infrastructure used in wind farms, hydro plants, thermal power stations, microgrids, and utility-scale renewable plants. The role of this equipment has expanded as nations shift toward cleaner, more efficient, and more resilient energy systems.

The Power Generation Equipment Market represents the global demand for machinery used across renewable, fossil fuel, and hybrid power systems. The market is shaped by rising electrification, grid expansion, industrial energy use, and government-backed clean-energy programs. As economies pursue energy security and decarbonization, the need for reliable and scalable power generation hardware continues to grow.

Growth is driven by increasing renewable installations and the modernisation of old power plants. New investments, like Britain raising wind farm incentives to $720 million and a $20 million DOE initiative for wind technology recycling, show how policy support accelerates adoption.

Demand is also rising due to innovation and funding momentum. Recent examples include $121 million investment in turbine financial infrastructure, €6 million for wind turbine transmission research, and $10 million for hydrokinetic turbine startups.

Opportunity continues to expand as next-generation technology attracts large capital, including the UK’s £86 million push for super-turbines and new hybrid power-generation systems.

Key Takeaways

- The Global Power Generation Equipment Market is expected to be worth around USD 163.3 billion by 2034, up from USD 99.3 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- In the Power Generation Equipment Market, turbines hold 39.8%, showing strong adoption across renewable and conventional power systems.

- The Power Generation Equipment Market is led by fossil fuels with 56.9%, reflecting existing installed infrastructure demand.

- In the Power Generation Equipment Market, medium capacity systems at 44.3% dominate due to balanced scalability and efficiency.

- The Power Generation Equipment Market sees baseload generation at 41.2%, supporting uninterrupted electricity supply requirements globally.

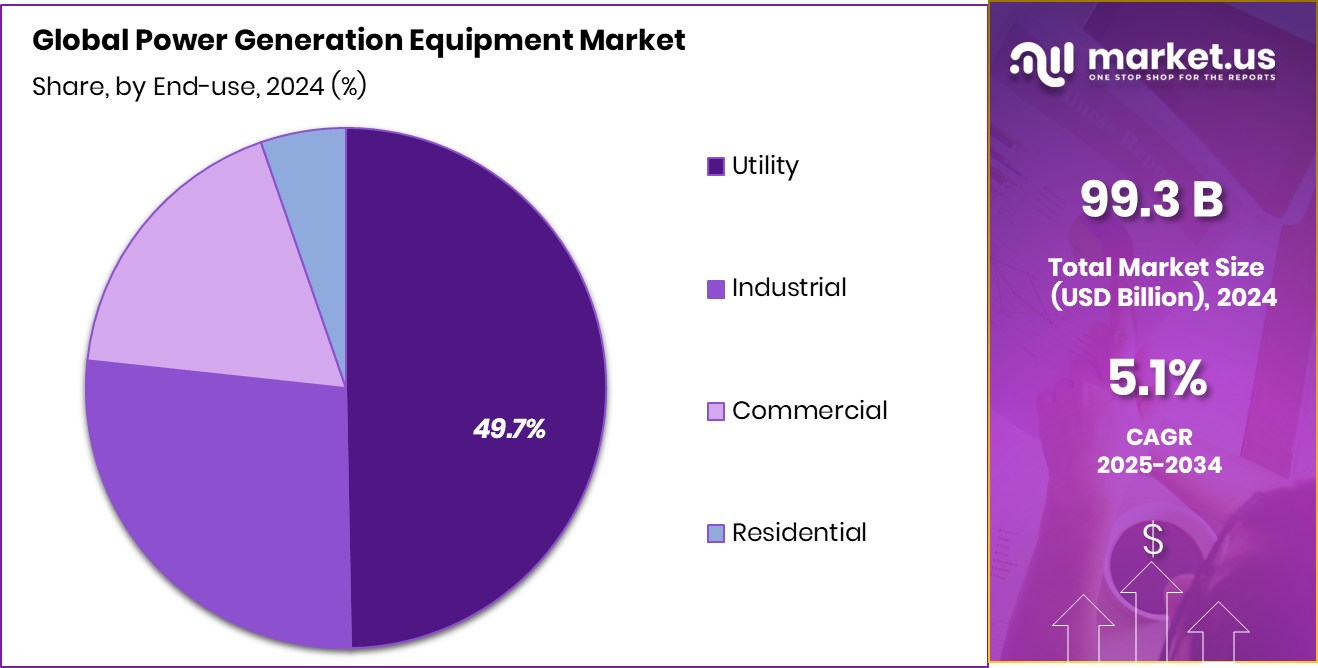

- In the Power Generation Equipment Market, the utility sector leads with 49.7%, driving long-term project installations.

- The market value in Asia-Pacific reaches USD 46.9 billion, reflecting large infrastructure needs.

By Equipment Type Analysis

The Power Generation Equipment Market grows as turbines hold 39.8% segment dominance.

In 2024, Turbines held a dominant market position in the By Equipment Type segment of the Power Generation Equipment Market, with a 39.8% share. Their strong position reflects their essential role in converting mechanical energy into electricity across wind, hydro, and traditional power systems. Turbines continue to benefit from steady installation in utility-scale power plants as well as distributed energy systems.

The market momentum is also supported by the modernisation of older plants, where efficiency upgrades and replacement of legacy turbine systems are common. With their wide application across renewable and conventional energy sources, turbines remain a critical part of global energy infrastructure, supporting expanding electrification needs and grid stability requirements across developing and developed markets.

By Fuel Source Analysis

The Power Generation Equipment Market demand rises, with fossil fuels holding a 56.9% share.

In 2024, Fossil Fuels held a dominant market position in the By Fuel Source segment of the Power Generation Equipment Market, with a 56.9% share. This strong position reflects the continued reliance on coal, natural gas, and oil-based systems for large-scale and stable electricity production. Fossil fuel-based power generation remains widely used due to established infrastructure, predictable performance, and the ability to support baseload demand.

Even with rising interest in renewable energy, many regions continue operating fossil-based power facilities to ensure grid stability and a consistent energy supply. The segment also benefits from ongoing maintenance, equipment replacement, and efficiency upgrades, which support operational continuity and extend the lifecycle of existing fossil fuel power assets.

By Capacity Range Analysis

The Power Generation Equipment Market expands as medium (5-50 MW) capacity reaches 44.3% share.

In 2024, Medium (5–50 MW) held a dominant market position in the By Capacity Range segment of the Power Generation Equipment Market, with a 44.3% share. This range remains widely adopted because it fits the operational needs of industrial facilities, commercial complexes, and regional utilities requiring dependable mid-scale electricity output.

Medium-capacity systems are also used in expanding distributed power networks, where flexibility and faster deployment are key priorities. Their operational balance between efficiency, cost, and scalability supports both standalone installations and grid-connected environments.

With increasing global focus on stable and resilient power solutions, this capacity range continues to serve as a strategic fit for applications requiring reliable power generation without the complexity or investment demands of larger utility-scale systems.

By Application Analysis

The Power Generation Equipment Market is strengthened with baseload generation holding 41.2% demand share.

In 2024, Baseload Generation held a dominant market position in the By Application segment of the Power Generation Equipment Market, with a 41.2% share. This leadership reflects its essential role in supplying continuous and stable electricity to grids, supporting both industrial activity and public infrastructure.

Baseload systems are typically designed for long operational hours and steady output, making them a core element of national and regional power supply planning. Their reliability supports energy demand that remains constant regardless of seasonal or peak variations.

With ongoing modernisation and lifecycle maintenance of existing power assets, baseload generation continues to rely on established equipment systems to ensure consistent performance and long-term operational security.

By End-use Analysis

The Power Generation Equipment Market leads globally as utility end-use reaches 49.7% share.

In 2024, Utility held a dominant market position in the By Application segment of the Power Generation Equipment Market, with a 49.7% share. This position reflects the large-scale deployment of power generation equipment across national and regional electricity networks to meet steady and rising demand.

Utilities continue to rely on established and efficient systems to ensure grid stability, long operating hours, and reliable output for residential, industrial, and commercial users.

The focus remains on long-term performance, operational reliability, and system upgrades to align with modern power requirements. With expanding electrification and infrastructure strengthening, utility-level installations continue to guide investment priorities and equipment adoption across the broader power ecosystem.

Key Market Segments

By Equipment Type

- Turbines

- Engines

- Boilers

- Heat Exchangers

- Power Transformers

By Fuel Source

- Fossil Fuels

- Renewable Energy

- Nuclear Energy

By Capacity Range

- Small (Up to 5 MW)

- Medium (5-50 MW)

- Large (Over 50 MW)

By Application

- Baseload Generation

- Peak Generation

- Combined Heat and Power (CHP)

- Emergency Power

By End-use

- Utility

- Industrial

- Commercial

- Residential

Driving Factors

Rising Investment and Policy Push Drives Growth

One major factor driving the Power Generation Equipment Market is the increasing financial support and policy activity happening around energy infrastructure. Funding decisions, both positive and restrictive, strongly influence how fast power systems expand or shift toward new technologies. For example, large investments in wind, hydro, and grid-scale systems continue to encourage installation of new equipment.

However, policy reversals also shape direction, such as when the Trump administration cancelled $13 billion in green energy funds, slowing some renewable developments but indirectly increasing demand for replacement and efficiency upgrades in existing conventional power systems.

As global energy systems evolve, a mix of funding acceleration and restructuring continues to push utilities, industries, and governments to modernise equipment and ensure long-term energy security.

Restraining Factors

High Costs Limit Faster Market Expansion

One key restraining factor for the Power Generation Equipment Market is the high upfront cost required for installation, maintenance, and system upgrades. Many regions, especially developing economies, face financial constraints when shifting from older infrastructure to newer and more efficient technologies.

While funding efforts exist, such as Mission 300 raising billions to power millions of Africans with renewable energy, the gap between funding availability and real deployment remains wide. High procurement costs, long approval timelines, and complex regulatory processes slow down project execution.

In some areas, grid modernisation and equipment replacement move at a slower pace because governments and private operators prioritise essential spending over large infrastructure investments. As a result, cost pressure continues to delay large-scale adoption and slows the overall market expansion.

Growth Opportunity

Growing Renewable Projects Create Strong Market Potential

A major growth opportunity for the Power Generation Equipment Market is the rising wave of renewable energy projects supported by new funding commitments. Governments and private organisations are pushing clean power systems to meet future electricity needs, and this shift increases demand for advanced generation equipment.

For example, ACEN approved a PHP 60-million funding facility to expand renewable-powered telecom solutions in the Philippines, supporting new equipment deployment in remote and off-grid areas. At the same time, Africa is set to receive over €2 billion from the European Investment Bank for renewable energy projects, which will accelerate solar, wind, and hybrid power development across the region.

As more countries expand renewable capacity, manufacturers and suppliers gain strong opportunities to deliver modern, efficient, and scalable power generation hardware.

Latest Trends

Smart Renewable Expansion Becomes Core Market Trend

A leading trend in the Power Generation Equipment Market is the fast shift toward smarter and renewable-focused energy systems supported by large-scale funding and policy agreements. Nations are moving toward cleaner power, and this trend is pushing demand for equipment that offers automation, efficiency, and long operational life.

Discussions are underway as Türkiye and the World Bank prepare a $6 billion grid funding program for renewable integration, signalling large-scale development and modernisation. Similarly, ReNew secured $331 million in funding from ADB for a major renewable energy project in Andhra Pradesh, reflecting how large capital flows are reshaping future power infrastructure.

As these investments grow, advanced generation technologies, digital control systems, and hybrid equipment are becoming standard, marking a noticeable shift from traditional power setups to smarter, renewable-driven energy environments.

Regional Analysis

Asia-Pacific holds a 47.30% share, showing the region’s strong power equipment demand.

Asia-Pacific dominated the Power Generation Equipment Market with a 47.30% share valued at USD 46.9 billion, reflecting its strong investment in electricity infrastructure, expanding industrial operations, and continuous grid upgrades. The region’s demand remains driven by growing urban populations and rising energy consumption from manufacturing and commercial sectors.

North America shows steady adoption of advanced generation solutions as industries and utilities continue enhancing system reliability and upgrading ageing energy assets. Europe maintains a structured transition pace with modernisation strategies focused on improving operational efficiency and long-term system resilience across diverse national power networks.

The Middle East & Africa region demonstrates increasing installation of generation equipment to support electrification, industrialisation, and expanding utility needs in developing markets. Latin America continues progressing through incremental energy system development and selective power generation upgrades, supporting gradual capacity expansion across the grid and distributed applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ABB continues to play a strategic role in the global Power Generation Equipment market by focusing on efficiency, automation, and system reliability. The company remains active in delivering solutions that support grid stability, modernisation of existing infrastructure, and integration of next-generation energy systems. Its technological approach aligns with increasing demand for scalable and intelligent equipment suitable for both large-scale and decentralised power environments.

Bharat Heavy Electricals Limited demonstrates strong relevance through its long-standing contribution to power generation infrastructure. The company remains engaged in supplying large industrial-scale equipment that supports baseload and grid-connected systems. Its focus on domestic and regional energy projects positions it as an important supporter of large electricity networks, especially in markets requiring equipment suited for continuous operations and long lifecycle performance.

Briggs & Stratton maintains its role in the market by supporting demand for smaller-scale and distributed power systems. The company continues serving sectors that require flexible energy options, backup systems, and equipment capable of supporting commercial and residential power needs. As distributed and supplementary power solutions gain importance, their offerings remain relevant for users prioritising reliability, practicality, and accessible generation capacity.

Top Key Players in the Market

- ABB

- Bharat Heavy Electricals Limited

- Briggs & Stratton

- Caterpilla

- Champion

- Cummins Power Systems

- Eaton

- General Electric

- Honda Power

- Hyundai Power

Recent Developments

- In December 2024, ABB signed an agreement to acquire the power electronics business of Gamesa Electric in Spain. The business includes equipment for wind converters (DFIG), battery energy storage systems (BESS), and utility-scale solar inverters. The deal brings over 100 specialised engineers and two converter factories in Madrid and Valencia into ABB’s portfolio. This move strengthens ABB’s offering in high-power renewable conversion and grid connection.

- In February 2024, Briggs & Stratton’s subsidiary Allmand debuted its “Hybrid LT-Series” light tower at The ARA Show in New Orleans. The tower uses a Vanguard lithium-ion battery and a smaller engine, reducing emissions, noise and fuel use.

Report Scope

Report Features Description Market Value (2024) USD 99.3 Billion Forecast Revenue (2034) USD 163.3 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Turbines, Engines, Boilers, Heat Exchangers, Power Transformers), By Fuel Source (Fossil Fuels, Renewable Energy, Nuclear Energy), By Capacity Range (Small (Up to 5 MW), Medium (5-50 MW), Large (Over 50 MW)), By Application (Baseload Generation, Peak Generation, Combined Heat and Power (CHP), Emergency Power), By End-use (Utility, Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Bharat Heavy Electricals Limited, Briggs & Stratton, Caterpillar, Champion, Cummins Power Systems, Eaton, General Electric, Honda Power, Hyundai Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power Generation Equipment MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Power Generation Equipment MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Bharat Heavy Electricals Limited

- Briggs & Stratton

- Caterpilla

- Champion

- Cummins Power Systems

- Eaton

- General Electric

- Honda Power

- Hyundai Power