Global Polybutadiene Rubber Market By Product (High Cis, Low Cis, High Trans, High Vinyl), By Application (Tire Manufacturing, Footwear, Sports Accessories, Others), By Distribution Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151802

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

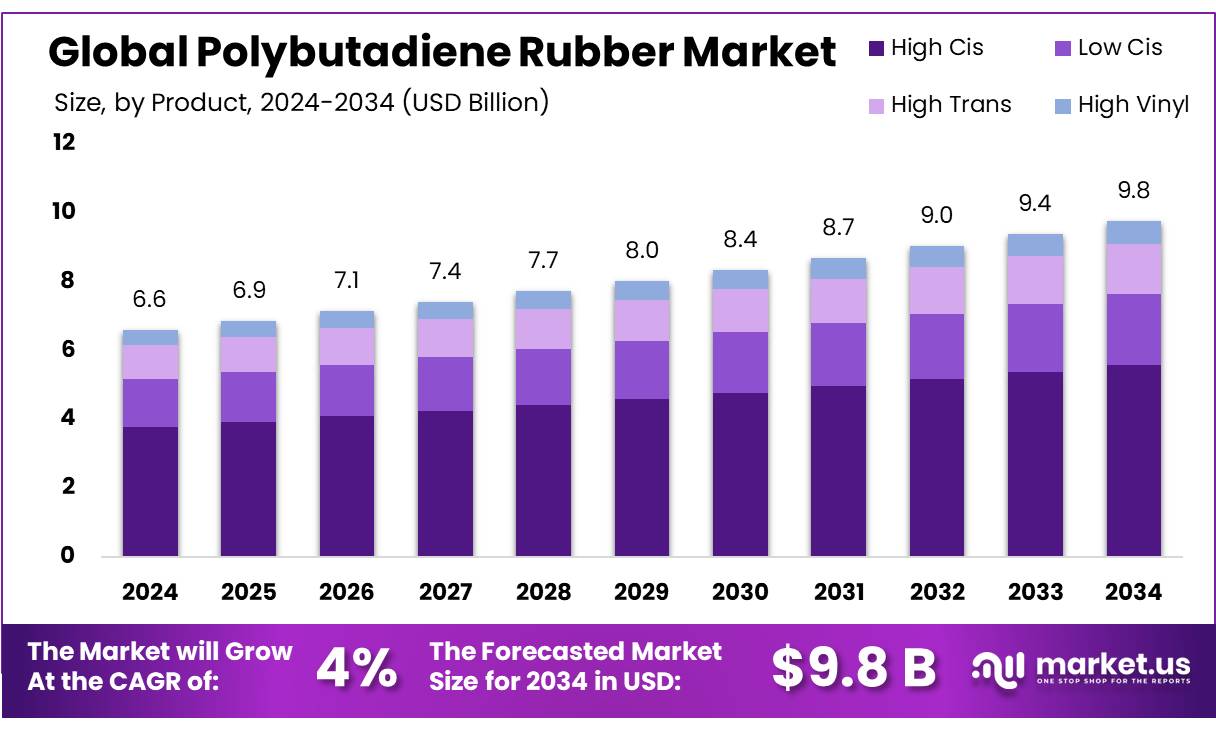

The Global Polybutadiene Rubber Market size is expected to be worth around USD 9.8 Billion by 2034, from USD 6.6 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

Polybutadiene rubber is a synthetic elastomer produced through polymerizing 1,3 butadiene. It is prized for its exceptional abrasion resistance, high elasticity, and low temperature flexibility, making it essential for tire treads and sidewalls—accounting for roughly 70% of global consumption. The remaining use is split between impact modifiers in plastics (~25%) and specialty products like golf balls and industrial goods.

Government initiatives further strengthen the industry. In India’s National Rubber Policy (2019), styrenebutadiene and polybutadiene rubbers constituted 63% and 34% of synthetic rubber production respectively. Additionally, the Rubber Board under the Ministry of Commerce and Industry supports R&D, market promotion, and statistical oversight for rubber, including PBR.

The 2014 Rubber Plantation Certification Scheme has evolved to include geomapping under the Indian Sustainable Natural Rubber (iSNR) framework, improving sustainability compliance; though targeting natural rubber, this framework enhances standards across the synthetic rubber value chain. Earlier, in 2020, a 10% import duty on PBR from South Korea was imposed to protect local producers.

PBR consumption is poised to expand alongside the shift to “green tires” aimed at reducing carbon emissions. The expanding construction sector driven by PMAY and Smart Cities further underpins demand in adhesives and sealants. Indian natural rubber production grew 8.6% (from 7.89 lakh tonnes in FY21-22 to 8.57 lakh tonnes in FY23 24), yet synthetic rubber consumption—including polybutadiene—rose to 428,600 tonnes in April September 2024, with polybutadiene constituting 133,200 tonnes.

Key Takeaways

- Polybutadiene Rubber Market size is expected to be worth around USD 9.8 Billion by 2034, from USD 6.6 Billion in 2024, growing at a CAGR of 4.0%.

- High Cis polybutadiene rubber held a dominant market position, capturing more than a 57.2% share of the overall product segment.

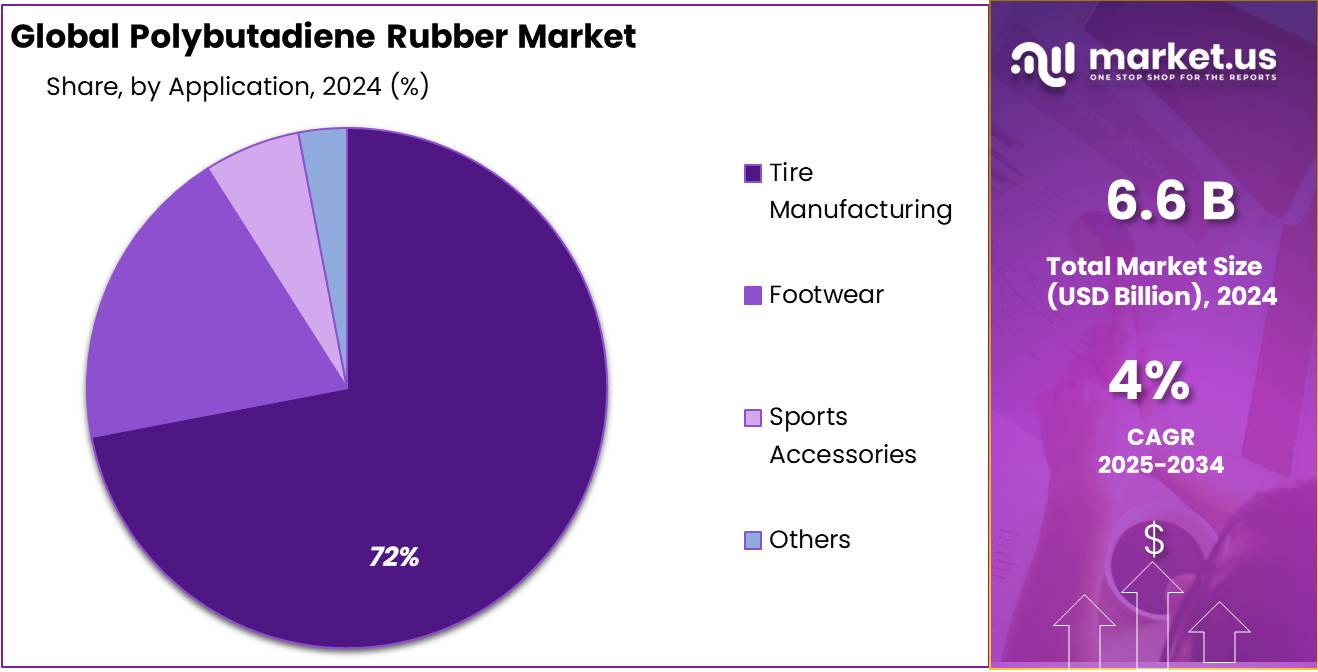

- Tire Manufacturing held a dominant market position, capturing more than a 72.9% share of the total polybutadiene rubber market.

- Online held a dominant market position, capturing more than an 81.7% share in the distribution channel segment of the polybutadiene rubber market.

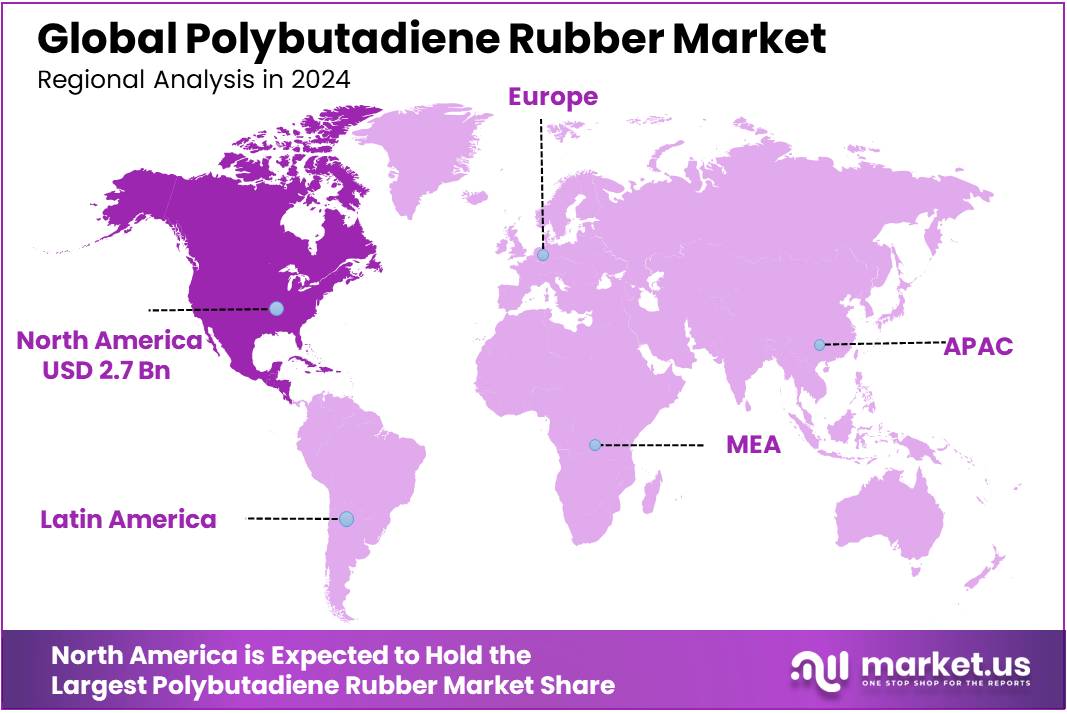

- North America stands out as a dominant region in the polybutadiene rubber market, capturing an estimated 41.3% share and generating approximately USD 2.7 billion in revenue.

By Product

High Cis Polybutadiene Rubber dominates with 57.2% share due to its superior elasticity and tire performance benefits.

In 2024, High Cis polybutadiene rubber held a dominant market position, capturing more than a 57.2% share of the overall product segment. This strong lead can be attributed to its high resilience, excellent abrasion resistance, and superior cold flexibility, making it an essential material in tire manufacturing. The structure of high cis PBR enables better rolling resistance and wet traction, which are crucial properties for performance tires used in both passenger and commercial vehicles. With global emphasis on fuel efficiency and low-carbon transportation solutions, tire makers have increasingly preferred high cis variants over other types due to their ability to enhance tire life and road grip while reducing energy loss.

The demand has been further supported by the rapid expansion of the automotive sector, particularly in Asia-Pacific and emerging economies, where tire replacement cycles are shortening. In addition, the use of high cis PBR in industrial belts, golf balls, and footwear also contributed to its volume growth in 2024.

By Application

Tire Manufacturing dominates with 72.9% share due to its critical demand for durability and fuel-efficient performance.

In 2024, Tire Manufacturing held a dominant market position, capturing more than a 72.9% share of the total polybutadiene rubber market by application. This large share reflects the strong dependence of the global automotive and transportation industries on polybutadiene rubber, particularly for producing high-performance tires. The material’s excellent abrasion resistance, low rolling resistance, and high resilience make it ideal for improving tire longevity, wet traction, and fuel efficiency.

These qualities are especially important as both consumers and regulators increasingly demand environmentally friendly and cost-effective mobility solutions. The rising vehicle production levels in emerging economies and the ongoing replacement tire demand in mature markets like North America and Europe have continued to boost consumption of polybutadiene rubber in tire applications.

By Distribution Channel

Online distribution dominates with 81.7% share due to its faster reach and simplified procurement process.

In 2024, Online held a dominant market position, capturing more than an 81.7% share in the distribution channel segment of the polybutadiene rubber market. This overwhelming preference for online platforms reflects a shift in how industrial buyers and manufacturers procure raw materials. The rise of digital marketplaces and e-procurement systems has made it easier for buyers to compare prices, check specifications, access bulk supply, and ensure timely deliveries without relying on traditional intermediaries.

In addition, online distribution has significantly improved supply chain transparency and reduced transaction costs, both of which are critical in large-scale rubber procurement. Many suppliers have expanded their digital presence to meet the demand for seamless and efficient order processing, especially from clients in automotive, tire manufacturing, and industrial rubber sectors.

Key Market Segments

By Product

- High Cis

- Low Cis

- High Trans

- High Vinyl

By Application

- Tire Manufacturing

- Footwear

- Sports Accessories

- Others

By Distribution Channel

- Online

- Offline

Drivers

Growing Automotive Demand Drives the Polybutadiene Rubber Market

One of the major driving factors for the polybutadiene rubber (PBR) market is the escalating demand from the automotive sector, specifically tied to tire production and evolving vehicle technologies. In 2023, the International Rubber Study Group reported that global synthetic rubber consumption—including PBR—reached approximately 15.5 million tonnes, with over 60% of this demand stemming from tire manufacturing activities. This high volume underscores the central role of the automotive industry in propelling PBR usage, supported by its key properties such as abrasion resistance, resilience, and low rolling resistance.

Furthermore, increasing vehicle electrification contributes to heightened usage of polybutadiene rubber. Electric vehicles demand tires that maintain high durability, energy efficiency, and traction support—areas where PBR’s material characteristics are valorised. As governments across the globe, including India, continue to promote green mobility, investments in electric vehicles are anticipated to strengthen PBR demand further.

Meanwhile, India’s synthetic rubber consumption rose from 411,830 tonnes in 2010–11 to 633,975 tonnes in 2017–18, with polybutadiene rubber representing roughly 34% of synthetic rubber production. This upward trend indicates a bridging shift toward PBR, supported by supportive government policies aiming at self-sufficiency.

Restraints

Raw Material Price Volatility Limits Polybutadiene Rubber Growth

A key restraining factor for the polybutadiene rubber (PBR) market is the volatility of raw material prices, especially those tied to petrochemical feedstocks. Butadiene, a crucial input, is derived from crude oil or natural gas processing, and its cost swings directly impact production economics.

For instance, in Q1 2024, U.S. PBR average prices dropped to USD 1,719/MT in March, even with steady demand, due to suppliers destocking amid raw material uncertainties. Conversely, in March 2024, Japan saw prices surge to USD 2,668/MT, driven by global crude price hikes despite adequate inventories. Such regional disparity creates planning challenges for manufacturers and buyers alike.

Government interventions in feedstock may help, but often lead to unintended effects. For example, in the U.S., new incentives to switch feedstocks—such as using natural gas instead of naphtha—can shift butadiene supply dynamics and price patterns. Such policy choices can help diversify supply, but also introduce new sources of volatility as petchem feedstock markets adjust.

Opportunity

Expanding Industrial Rubber Use in Food & Beverage Offers Growth Potential

The polybutadiene rubber (PBR) market stands to gain from the surging demand for industrial-grade hoses and seals used in food and beverage processing. In 2023 alone, the global industrial hose market—made largely of rubber compounds like PBR—was valued at about USD 11.3 billion, and it is forecast to grow at a robust CAGR of over 10% from 2024 to 2032. This growth reflects a rising need for reliable, food-grade materials in sanitary fluid transfer and packaging, where PBR’s chemical resistance, flexibility, and strength are highly valued.

Government guidelines and industry certification regimes have also supported this trend. For instance, food safety protocols from bodies such as the U.S. Food and Drug Administration (FDA) and European Food Safety Authority mandate the use of rubber compounds that do not leach into food products. As a result, manufacturers are turning to PBR-based hoses that meet these regulations. In tandem, India’s Centre for Fire, Explosive and Environment Safety has encouraged relevance of compliant materials in agro‐processing equipment through subsidy schemes under its Make in India initiative.

Another potent driver is rising consumer demand for packaged and processed foods in fast-growing regions like Asia-Pacific. As production scales up, so does the need for high-quality hoses and conveyor seals that maintain hygiene standards. PBR’s advantage in resisting abrasion, oils, and temperature stress reinforces its suitability for such uses.

Trends

Surge in 1,3 Butadiene Production Accelerates Polybutadiene Rubber Supply

National governments and industry regulators have responded by facilitating increased petrochemical integration. For instance, China’s recent policy incentives aimed at boosting butadiene yield from naphtha steam crackers have enabled petrochemical giants to repurpose crackers for higher elastomer feedstock output. This strategic shift supports downstream sectors including synthetic rubber, and aligns with national priorities in industrial resilience and export competitiveness.

In parallel, there is a marked shift toward upgrading steam-cracker facilities worldwide. Currently, approximately 78.5% of butadiene production is generated via steam cracking—a share that continues to inch upward thanks to new capacity investments. These modernised plants offer improved yield efficiencies and lower unit costs, which tend to be passed downstream to PBR producers, enabling margin support and encouraging reinvestment in production technologies.

Furthermore, this ramp in butadiene output provides downstream manufacturers with greater access to high-purity feedstock. As a result, PBR producers can prioritize the manufacture of value-added variants—such as high-cis and emulsion grades—without being constrained by feedstock limitations. This flexibility supports responsiveness to increasing demand in automotive and industrial applications.

Regional Analysis

North America leads with a commanding 41.3% share in 2024, contributing approximately USD 2.7 billion.

North America stands out as a dominant region in the polybutadiene rubber market, capturing an estimated 41.3% share and generating approximately USD 2.7 billion in revenue. This strong performance is primarily supported by the robust automotive and tire sectors—PBR is prized for its abrasion resistance, low rolling resistance, and high resilience, making it ideal for high‑performance tires.

Beyond automotive applications, North America’s infrastructure and industrial sectors—encompassing conveyor systems, belts, hoses, and footwear—contributed significantly to usage of PBR, further bolstering regional demand. Government investments in manufacturing and the shift toward electric vehicles have reinforced this trend: the electrification drive has prompted OEMs to adopt advanced elastomers like high-cis PBR, valued for low rolling resistance and enhanced longevity. In parallel, logistical improvements and feedstock reliability have ensured consistent supply to industrial consumers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ARLANXEO, a leading synthetic rubber producer headquartered in the Netherlands, is a key player in the global PBR market. The company specializes in high-cis polybutadiene used predominantly in tires and technical rubber goods. With advanced production facilities in Europe, Asia, and the Americas, ARLANXEO benefits from a wide distribution network. The company focuses heavily on innovation, sustainability, and process optimization to meet rising demand for durable, low rolling resistance materials in the automotive and industrial sectors.

ENEOS Materials Corporation, based in Japan, is known for its technological expertise in polymer manufacturing, including polybutadiene rubber. The company supplies high-performance PBR grades suited for tire treads and high-impact polystyrene modification. As part of the ENEOS Holdings Group, it leverages strong R&D and integrated petrochemical operations. ENEOS is increasingly investing in environmentally conscious production processes and caters primarily to automotive and electronic material industries across Japan, Southeast Asia, and North America.

Evonik Industries AG, a German specialty chemicals company, plays a significant role in the polybutadiene rubber value chain. Though not a direct PBR producer, Evonik provides essential additives, catalysts, and specialty chemicals used in synthetic rubber manufacturing. Through its global reach and focus on sustainability and innovation, Evonik supports the efficiency and performance of polybutadiene applications. Its technological partnerships and R&D initiatives continue to drive advancements in polymer processing and rubber formulation.

Top Key Players in the Market

- ARLANXEO

- ENEOS Materials Corporation

- Evonik Industries AG

- Indian Oil Corporation Ltd

- JSR Corporation

- KURARAY CO., LTD.

- Lanxess AG

- LG Chem Ltd.

- SABIC

- SIBUR International GmbH

- Synthos

- The Goodyear Tire & Rubber Company

- THE YOKOHAMA RUBBER CO., LTD

- Trinseo

- UBE Corporation

- Versalis S.p.A.

- ZEON CORPORATION

Recent Developments

In 2024, ARLANXEO further strengthened its position in the polybutadiene rubber (PBR) sector by diversifying its production footprint and modernizing its supply chain. The company operates multiple high-capacity PBR plants—including the 65 ktpa facility in southern Brazil inaugurated recently, as well as major sites in Dormagen (Germany), Port Jérôme (France), Orange, Texas (USA), and the Jubail, Saudi Arabia project slated to produce Nd-BR and LiBR from 2027.

In 2024, Evonik Industries AG reported total sales of €15.2 billion, with its Custom Solutions division—encompassing specialty additives, catalysts, and rubber-related technologies—accounting for €5.7 billion and supporting around 7,000 employees.

Report Scope

Report Features Description Market Value (2024) USD 6.6 Bn Forecast Revenue (2034) USD 9.8 Bn CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (High Cis, Low Cis, High Trans, High Vinyl), By Application (Tire Manufacturing, Footwear, Sports Accessories, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ARLANXEO, ENEOS Materials Corporation, Evonik Industries AG, Indian Oil Corporation Ltd, JSR Corporation, KURARAY CO., LTD., Lanxess AG, LG Chem Ltd., SABIC, SIBUR International GmbH, Synthos, The Goodyear Tire & Rubber Company, THE YOKOHAMA RUBBER CO., LTD, Trinseo, UBE Corporation, Versalis S.p.A., ZEON CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polybutadiene Rubber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Polybutadiene Rubber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ARLANXEO

- ENEOS Materials Corporation

- Evonik Industries AG

- Indian Oil Corporation Ltd

- JSR Corporation

- KURARAY CO., LTD.

- Lanxess AG

- LG Chem Ltd.

- SABIC

- SIBUR International GmbH

- Synthos

- The Goodyear Tire & Rubber Company

- THE YOKOHAMA RUBBER CO., LTD

- Trinseo

- UBE Corporation

- Versalis S.p.A.

- ZEON CORPORATION