Global Polyamide 6 Market Size, Share, And Business Benefits By Type (Polyamide-6 Fiber, Polyamide-6 Resin), By Form (Granules, Powder, Films, Sheets), By End-use (Automotive, Aerospace, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160992

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

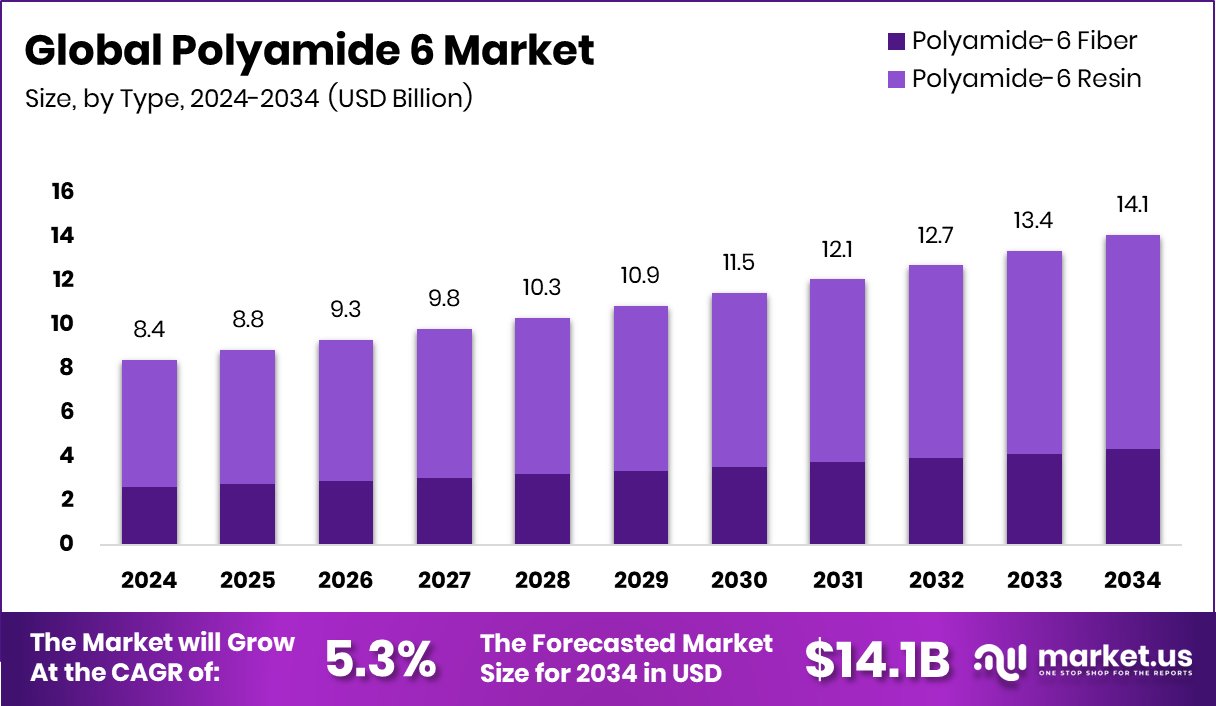

The Global Polyamide 6 Market is expected to be worth around USD 14.1 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Strong industrial growth and rising automotive production supported Asia-Pacific’s 45.20% leading regional market position.

Polyamide 6, also known as Nylon 6, is a synthetic thermoplastic polymer formed by the ring-opening polymerization of caprolactam. It offers high tensile strength, toughness, and chemical resistance, making it ideal for producing fibers, engineering plastics, films, and molded parts. Its durability, abrasion resistance, and thermal stability make it widely used in the automotive, textile, packaging, and electrical industries.

The Polyamide 6 market refers to the global trade and production of this versatile polymer across various end-use industries. Market growth is supported by its adaptability in high-performance engineering applications, particularly in replacing metals and conventional plastics. With increasing use in lightweight vehicle components and durable consumer goods, the market continues to expand across Asia-Pacific, Europe, and North America.

The market is driven by industrial demand for high-strength materials and rising production of lightweight automotive parts. Growing infrastructure and electrical component manufacturing further strengthen its demand.

Growing emphasis on sustainable materials and recyclability boosts Polyamide 6 demand in textiles and packaging sectors, where durability and environmental benefits are key.

Expanding applications in 3D printing, renewable energy components, and sustainable fiber production create new opportunities for Polyamide 6 producers, aligning with global sustainability and efficiency goals.

Key Takeaways

- The Global Polyamide 6 Market is expected to be worth around USD 14.1 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, Polyamide-6 Resin dominated the Polyamide 6 Market, capturing a strong 69.4% share.

- Granules held a notable 43.6% share in the Polyamide 6 Market during 2024, driving industrial consumption.

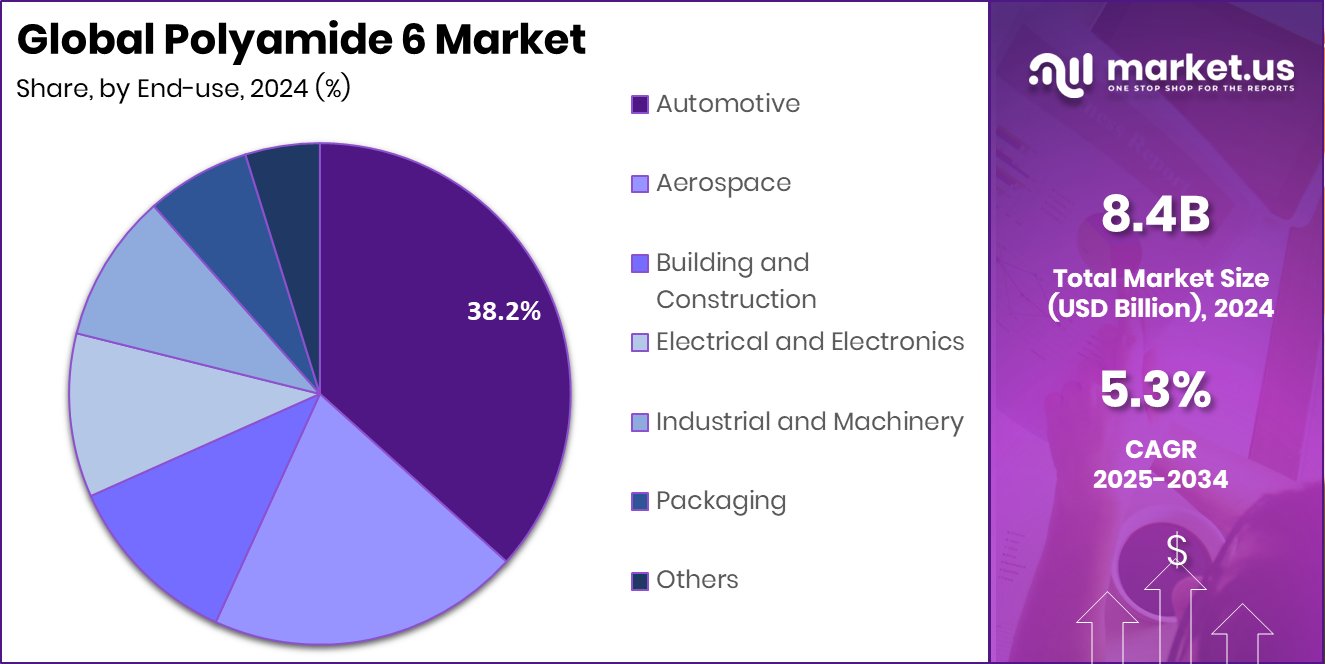

- The automotive sector led the Polyamide 6 Market in 2024, accounting for 38.2% market share.

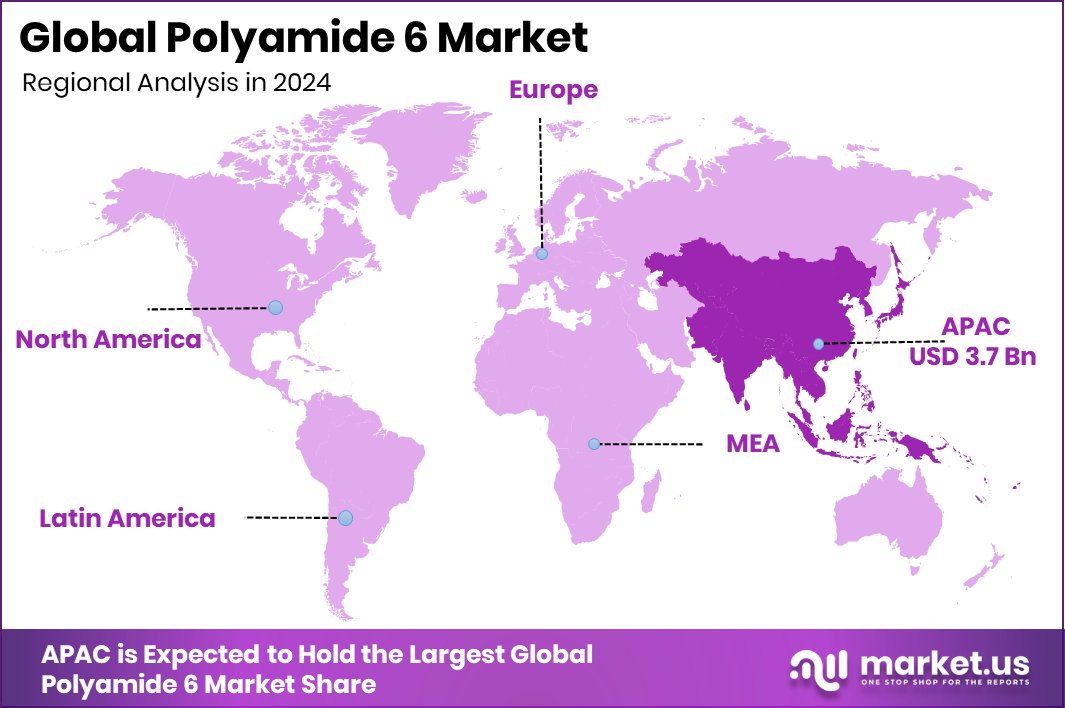

- The Asia-Pacific recorded an estimated market value of USD 3.7 billion overall.

By Type Analysis

In 2024, Polyamide-6 Resin dominated the Polyamide 6 Market with a 69.4% share.

In 2024, Polyamide-6 Resin held a dominant market position in the By Type segment of the Polyamide 6 Market, accounting for a 69.4% share. This dominance is primarily attributed to its extensive use in automotive components, packaging films, and textile fibers, owing to its high tensile strength, durability, and resistance to chemicals and abrasion. The resin’s excellent molding properties and cost-effectiveness make it a preferred choice for engineering plastics and industrial applications.

Moreover, the growing trend toward lightweight and high-performance materials in manufacturing has further supported the strong market position of Polyamide-6 Resin, reflecting its vital role in driving demand and innovation across end-use industries during the assessment year.

By Form Analysis

Granules held a 43.6% share in the Polyamide 6 Market and are widely used in injection molding.

In 2024, Granules held a dominant market position in the By Form segment of the Polyamide 6 Market, capturing a 43.6% share. This strong position is mainly due to their versatility and ease of processing in injection molding, extrusion, and compounding applications. Granules are widely preferred by manufacturers for producing automotive components, industrial parts, and packaging materials, as they ensure consistent quality, superior strength, and efficient production performance.

Their excellent recyclability and compatibility with additives also enhance product customization and sustainability. The widespread use of Polyamide 6 granules in engineering plastics and consumer goods production continues to strengthen their dominance in the market during the year.

By End-use Analysis

The automotive segment led the Polyamide 6 Market with a 38.2% share in 2024.

In 2024, automotive held a dominant market position in the end-use segment of the Polyamide 6 Market, accounting for a 38.2% share. This leadership is driven by the rising demand for lightweight and durable materials in vehicle manufacturing. Polyamide 6 is widely used in producing engine covers, air intake manifolds, and fuel system components due to its strength, heat resistance, and dimensional stability.

The shift toward fuel-efficient and electric vehicles has further increased their adoption, as it helps reduce overall vehicle weight and enhances performance. Continuous innovation in polymer technology and growing emphasis on sustainable automotive production have reinforced the strong market position of Polyamide 6 in the automotive sector during the year.

Key Market Segments

By Type

- Polyamide-6 Fiber

- Polyamide-6 Resin

By Form

- Granules

- Powder

- Films

- Sheets

By End-use

- Automotive

- Aerospace

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Driving Factors

Rising Demand for Lightweight Automotive Materials Worldwide

One of the key driving factors for the Polyamide 6 Market is the growing demand for lightweight materials in the automotive industry. Automakers are increasingly replacing metal parts with Polyamide 6 due to its excellent strength-to-weight ratio, durability, and resistance to heat and chemicals. These qualities make it ideal for producing engine covers, fuel lines, and interior components, helping reduce vehicle weight and improve fuel efficiency.

As electric and hybrid vehicle production rises, the need for advanced polymers like Polyamide 6 continues to expand. Its ability to meet safety and performance standards while supporting sustainability goals further strengthens its role as a preferred material in modern vehicle design and manufacturing.

Restraining Factors

Fluctuating Raw Material Prices Affect Market Growth

A key restraining factor for the Polyamide 6 Market is the fluctuation in raw material prices. Polyamide 6 is made from caprolactam, a chemical derived from crude oil. Any change in crude oil prices directly affects the production cost of Polyamide 6. When oil prices rise, manufacturers face higher expenses, which can reduce profit margins and limit production. These cost variations also make it difficult for producers to maintain stable prices in the global market.

Additionally, supply chain disruptions and raw material shortages further impact the availability and consistency of Polyamide 6 production. Such price instability can discourage small manufacturers and affect long-term investments in polymer production and processing facilities.

Growth Opportunity

Expanding Applications in Sustainable and Green Products

A major growth opportunity for the Polyamide 6 Market lies in its expanding use in sustainable and eco-friendly products. With industries focusing on reducing carbon emissions and promoting recyclable materials, Polyamide 6 is gaining attention for its recyclability and long lifespan. It is increasingly used in making reusable packaging, textiles, and automotive components that support environmental goals.

Manufacturers are also developing bio-based Polyamide 6 made from renewable resources, which helps lower dependency on petroleum-based feedstocks. This shift toward green materials opens new opportunities across packaging, electronics, and construction sectors. As global demand for sustainable solutions rises, Polyamide 6 is expected to play a key role in shaping cleaner and more responsible production practices.

Latest Trend

Increasing Adoption of Recycled Polyamide 6 Materials

One of the latest trends in the Polyamide 6 Market is the growing use of recycled Polyamide 6. Industries are increasingly turning to recycled forms to reduce waste, save energy, and support sustainability goals. Recycled Polyamide 6, made from post-industrial and post-consumer waste such as old textiles and automotive parts, offers similar strength and performance as virgin material. This shift helps manufacturers cut carbon emissions and meet government regulations on circular economy practices.

Many producers are investing in advanced recycling technologies to improve material quality and process efficiency. As consumers and industries move toward greener solutions, the demand for recycled Polyamide 6 is expected to grow rapidly across the packaging, automotive, and consumer goods sectors.

Regional Analysis

In 2024, the Asia-Pacific dominated the Polyamide 6 Market with a 45.20% share.

In 2024, Asia-Pacific held a dominant position in the global Polyamide 6 Market, accounting for 45.20% share, valued at USD 3.7 billion. This leadership is supported by rapid industrialization, expanding automotive manufacturing, and the strong presence of textile and packaging industries across China, India, Japan, and South Korea. The region’s growing demand for lightweight and high-performance materials, coupled with government initiatives promoting sustainable manufacturing, further strengthens its dominance.

North America followed, driven by the increasing use of Polyamide 6 in automotive and electrical components, supported by advancements in polymer technologies. Europe maintained steady growth due to its focus on environmental sustainability and the adoption of recyclable materials.

Meanwhile, Latin America and the Middle East & Africa showcased emerging potential, supported by expanding construction, automotive, and packaging sectors. Although their market shares remain smaller, infrastructure investments and industrial diversification efforts are expected to enhance regional consumption in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, LANXESS reinforced its standing in the global Polyamide 6 market through strong commitments to sustainability and product innovation. The company introduced the Durethan BLUEBKV60H2.0EF grade, which replaces up to 92% of its raw materials with sustainable alternatives, leveraging mass-balanced certification to provide transparency about circular content. LANXESS also reported a base resin carbon footprint of 3.66 metric tons CO₂ equivalent per ton, positioning it as more climate-friendly than many competitors in Europe. Its focus on low-emission production, recycling, and glass fiber reinforcement from industrial waste underpins its competitive edge in the engineering plastics space.

Mitsubishi Chemical (via its materials brands like Ertalon™ and Nylatron™) continues to maintain relevance by offering a broad portfolio of PA6 and PA66 products targeted at wear, bearing, and specialty engineering uses. Its range is tailored to meet different performance needs, enabling the adoption of PA6 in applications where a balance of cost and mechanical performance is vital.

SABIC also plays a critical role, promoting PA6 resins such as SABIC® PA6 S27, a low-viscosity, general-purpose grade used in engineering compounds, high-tensile filament, and paper coatings. SABIC’s extensive resin offerings support broad industry adoption and contribute to the base material landscape for Polyamide 6 globally.

Top Key Players in the Market

- LANXESS

- Mitsubishi Chemical

- SABIC

- NYCOA

- Elementis

- DSM

- BASF

- Kraton Corporation

- DuPont

- Ascend Performance Materials

- Solvay

Recent Developments

- In April 2025, Mitsubishi Chemical announced the expansion of flame-retardant compound production capacity in China and France; these compounds (often used in cable sheathing, electronics) use thermoplastics and polymers in their formulations.

- In May 2024, SABIC showcased its plastic innovations and circular solutions at NPE2024, including work under its TRUCIRCLE™ and BLUEHERO™ initiatives to promote sustainability and electrification in plastic products.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Billion Forecast Revenue (2034) USD 14.1 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyamide-6 Fiber, Polyamide-6 Resin), By Form (Granules, Powder, Films, Sheets), By End-use (Automotive, Aerospace, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LANXESS, Mitsubishi Chemical, SABIC, NYCOA, Elementis, DSM, BASF, Kraton Corporation, DuPont, Ascend Performance Materials, Solvay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LANXESS

- Mitsubishi Chemical

- SABIC

- NYCOA

- Elementis

- DSM

- BASF

- Kraton Corporation

- DuPont

- Ascend Performance Materials

- Solvay