Global Polyacetal Resin Market Size, Share, And Business Benefits By Type (Acetal Homopolymer Resin, Acetal Copolymer Resin), By Application (Automotive, Electrical and Electronics, Consumer Appliances, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151958

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

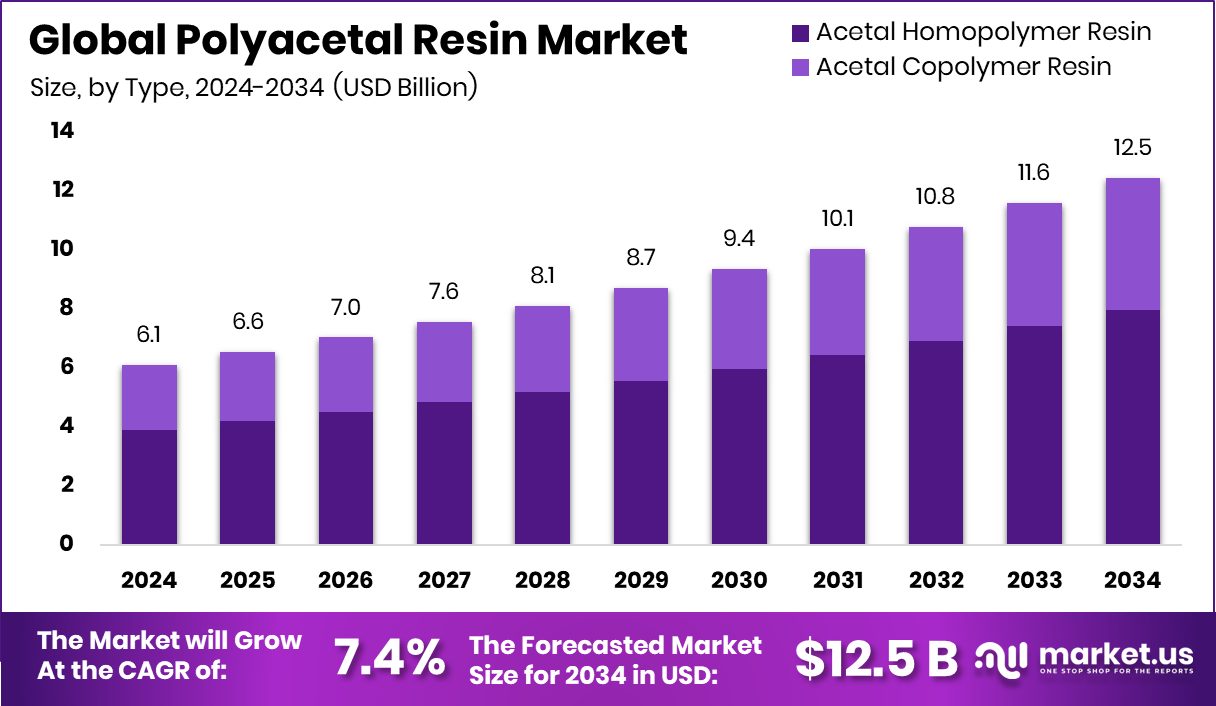

Global Polyacetal Resin Market is expected to be worth around USD 12.5 billion by 2034, up from USD 6.1 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034. Growth in the automotive and electronics sectors supported Asia-Pacific’s 47.9% dominance in polyacetal resin usage.

Polyacetal resin, also known as polyoxymethylene (POM), is a high-performance engineering thermoplastic known for its excellent strength, rigidity, and dimensional stability. It is widely used for precision parts that require low friction and high wear resistance, including gears, bearings, automotive components, and electronic devices. Its chemical resistance and low moisture absorption make it ideal for both industrial and consumer applications.

The polyacetal resin market refers to the global production, distribution, and consumption of POM materials across various industries such as automotive, electrical and electronics, industrial machinery, and consumer goods. The market is influenced by factors including raw material availability, advancements in polymer technology, and shifts in manufacturing trends. As industries increasingly seek lightweight and durable materials to enhance performance and reduce energy consumption, the demand for polyacetal resins continues to grow across both developed and developing economies.

The growth of the polyacetal resin market can be attributed to the rising need for high-performance materials that replace metal in precision engineering applications. With industries prioritizing lightweight components to improve efficiency and reduce emissions, especially in the automotive and aerospace sectors, polyacetal resin provides a valuable alternative. Its durability, heat resistance, and machinability contribute to its expanding application in complex component design.

Increasing industrial automation and miniaturization in electronics are driving demand for polyacetal-based parts such as conveyor belts, electrical housings, and switches. In addition, consumer preference for durable, long-lasting household products has boosted demand in the appliance and furniture sectors. As regulations tighten around product quality and reliability, manufacturers are turning to materials like polyacetal that offer consistent performance and extended service life.

Key Takeaways

- Global Polyacetal Resin Market is expected to be worth around USD 12.5 billion by 2034, up from USD 6.1 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034.

- Acetal Homopolymer Resin holds a dominant 63.9% share in the Polyacetal Resin Market due to its performance.

- The automotive sector accounts for 38.4% of the Polyacetal Resin Market, driven by demand for lightweight components.

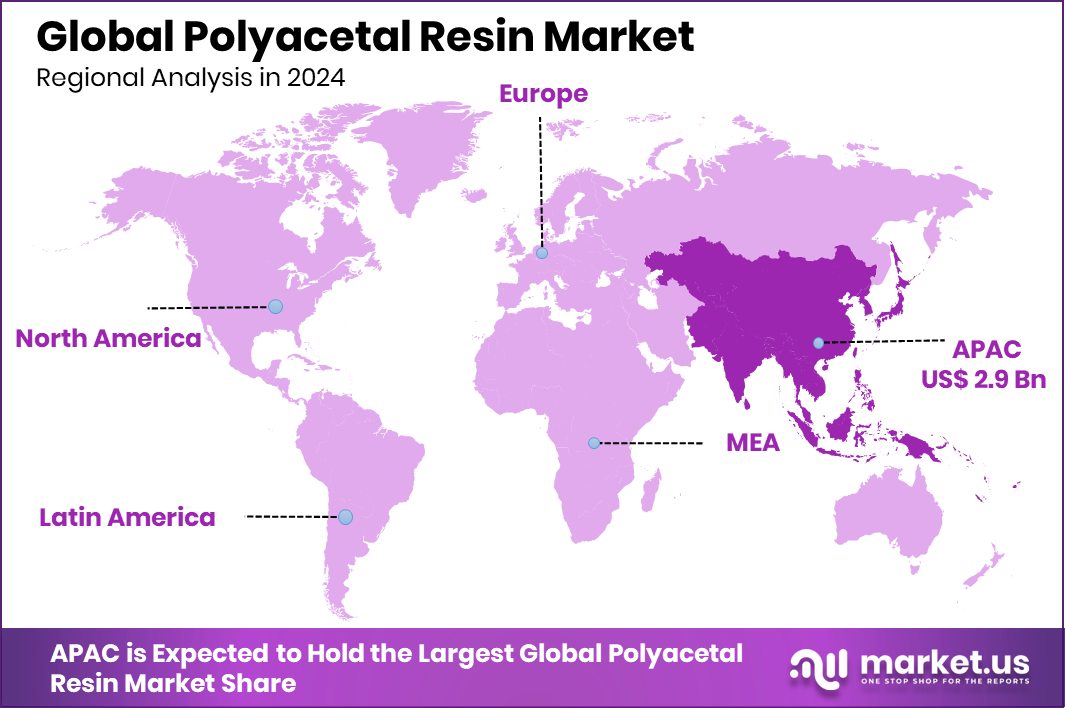

- The Asia-Pacific market value reached approximately USD 2.9 billion, showing strong industrial demand.

By Type Analysis

Acetal homopolymer resin holds a 63.9% share in the polyacetal resin market usage.

In 2024, Acetal Homopolymer Resin held a dominant market position in the By Type segment of the Polyacetal Resin Market, accounting for a significant 63.9% share. This dominance can be attributed to its superior mechanical properties, including higher tensile strength, stiffness, and fatigue resistance compared to its copolymer counterpart.

Industries requiring tight dimensional tolerances and low-friction applications, such as automotive, electronics, and consumer goods manufacturing, continue to favor acetal homopolymer for critical precision components. The resin’s higher crystallinity contributes to improved hardness and rigidity, making it ideal for gears, bearings, fasteners, and valve parts where durability and load-bearing capacity are essential. Additionally, its excellent machinability and ease of molding further enhance its suitability for complex, high-performance parts.

The rising global emphasis on lightweight, high-strength alternatives to metals is expected to sustain strong demand for acetal homopolymer resin. As manufacturers seek cost-effective materials that do not compromise on strength or functionality, this resin remains a preferred choice across high-volume production sectors.

By Application Analysis

The automotive sector contributes 38.4% to the global polyacetal resin market demand.

In 2024, Roller Automotive held a dominant market position in the By Application segment of the Polyacetal Resin Market, accounting for a substantial 38.4% share. This strong presence is driven by the increasing use of polyacetal resin in automotive applications, particularly in components such as seatbelt systems, fuel system parts, window lift mechanisms, and lock systems, where durability, low friction, and dimensional stability are essential.

The automotive sector continues to rely heavily on high-performance engineering plastics to reduce vehicle weight and improve fuel efficiency without compromising on safety or mechanical strength. Polyacetal resin, with its excellent wear resistance, rigidity, and chemical tolerance, fulfills these requirements effectively. Its ability to maintain structural integrity under dynamic stress and temperature variations makes it highly suitable for automotive roller components.

As vehicle manufacturers strive for reduced emissions and enhanced performance, the substitution of metal with lighter, durable plastic parts further strengthens the role of polyacetal in this segment. Moreover, advancements in component design and increased automation in vehicle assembly have expanded the scope of its application in rolling systems.

Key Market Segments

By Type

- Acetal Homopolymer Resin

- Acetal Copolymer Resin

By Application

- Automotive

- Electrical and Electronics

- Consumer Appliances

- Healthcare

- Others

Driving Factors

Growing Demand for Lightweight Materials in Automobiles

A key factor driving the growth of the polyacetal resin market is the increasing demand for lightweight and durable materials in the automotive sector. As global fuel efficiency standards become stricter and the push for reduced vehicle emissions intensifies, automakers are actively replacing metal parts with high-performance plastics. Polyacetal resin offers excellent strength, stiffness, and wear resistance while being much lighter than traditional metals.

This makes it ideal for precision automotive components such as gears, fuel system parts, door locks, and seatbelt mechanisms. Its ability to maintain shape and function under mechanical stress and varying temperatures further supports its use. As the automotive industry expands, especially in electric and hybrid vehicles, the demand for polyacetal resin is expected to rise steadily.

Restraining Factors

Environmental Concerns and Recycling Limitations Restrict Growth

One of the major restraining factors in the polyacetal resin market is the growing concern over environmental sustainability and limited recycling options. Polyacetal resin, due to its chemical structure and thermal stability, is not easily recyclable through conventional plastic recycling methods. This presents challenges for industries and governments aiming to reduce plastic waste and promote circular economy practices.

Additionally, the combustion of polyacetal can release harmful gases, raising safety concerns during disposal or incineration. As environmental regulations become stricter across various regions, manufacturers are under pressure to shift toward eco-friendly materials. This may reduce the preference for polyacetal in certain applications unless sustainable alternatives or improved recycling technologies are developed in the coming years.

Growth Opportunity

Rising Industrialization in Emerging Markets Boosts Demand

A major growth opportunity for the polyacetal resin market lies in the rapid industrialization of emerging economies across Asia, Latin America, and parts of Africa. As these regions experience strong growth in automotive manufacturing, electronics production, and industrial machinery, the need for high-performance engineering plastics like polyacetal is increasing.

Local manufacturers are seeking cost-effective, durable, and lightweight materials to improve product quality and reduce manufacturing costs. Polyacetal resin’s excellent mechanical strength, chemical resistance, and long service life make it a suitable choice for various applications in these expanding industries.

Latest Trends

Growing Use of Bio-Based Polyacetal Resin Solutions

One of the latest trends in the polyacetal resin market is the increasing development and adoption of bio-based polyacetal resins. With industries and consumers becoming more environmentally conscious, there is a rising focus on sustainable materials that reduce carbon footprints and dependency on fossil fuels. Bio-based polyacetal resins are developed from renewable resources and aim to offer the same strength, durability, and thermal resistance as traditional petroleum-based resins.

These eco-friendly alternatives are being explored in automotive, electronics, and consumer goods applications where both performance and sustainability are key priorities. As governments encourage greener manufacturing practices and companies seek to align with environmental goals, this shift toward bio-based materials is expected to gain further momentum across various sectors.

Regional Analysis

In 2024, Asia-Pacific led the Polyacetal Resin Market with a 47.9% share.

In 2024, Asia-Pacific held the dominant position in the global Polyacetal Resin Market, capturing a significant 47.9% share, valued at approximately USD 2.9 billion. The region’s leadership can be attributed to its strong industrial base, particularly in automotive and electronics manufacturing, which are key consumers of polyacetal resin. Countries such as China, Japan, South Korea, and India have witnessed growing demand for engineering plastics driven by increased production of vehicles, consumer electronics, and precision components.

In North America and Europe, the market showed steady growth, supported by advanced manufacturing technologies and the rising need for high-performance materials in industrial automation and healthcare equipment. These regions continue to focus on innovation and quality, which maintains stable consumption patterns for polyacetal resin.

Meanwhile, Latin America and the Middle East & Africa registered moderate market activity, with demand gradually increasing due to ongoing urbanization and the expansion of local manufacturing sectors. However, the share of these regions remains comparatively lower than that of Asia-Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asahi Kasei maintained its relevance by leveraging its deep materials science expertise and well-established production capabilities. The company emphasized high-purity and stable-performance polyacetal resins, addressing strict quality demands from industries such as electronics and automotive. Its operational scale across Asia enabled consistent supply to high-growth regions, supporting customer demands efficiently.

BASF, with its strong global presence, focused on enhancing its engineering plastics portfolio by offering polyacetal resins tailored for sustainability, durability, and high mechanical strength. In 2024, BASF reinforced its supply reliability by optimizing production capacities across key locations, particularly targeting automotive applications where polyacetal’s wear resistance and thermal stability are essential. The company also promoted material solutions aligned with energy efficiency and lightweighting trends.

Celanese continued to lead with its advanced material technology and vertically integrated operations. Known for consistent product quality and global customer support, the company maintained its competitiveness by expanding its specialized POM grades suited for industrial and medical use. In 2024, Celanese demonstrated a strong commitment to performance-driven innovation, offering customized polyacetal solutions that meet evolving manufacturing needs.

Top Key Players in the Market

- Asahi Kasei

- BASF

- Celanese

- Korea Engineering Plastics

- Mitsubishi Gas Chemical

- Polymersan

- Polyplastics

Recent Developments

- In October 2024, Celanese launched three new sustainable engineering thermoplastics, which included advanced POM grades. These offerings are designed for high-performance sectors such as automotive, consumer goods, and industrial machinery. The innovations align with Celanese’s focus on improved material sustainability and mechanical durability.

- In September 2024, Asahi Kasei showcased its POM-based and related engineering plastics at Fakuma 2024 in Germany. The company displayed materials targeting thermal management for EVs, recycling, and lightweight 3D printing composites, confirming its intent to support evolving automotive and additive manufacturing demands.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Billion Forecast Revenue (2034) USD 12.5 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Acetal Homopolymer Resin, Acetal Copolymer Resin), By Application (Automotive, Electrical and Electronics, Consumer Appliances, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asahi Kasei, BASF, Celanese, Korea Engineering Plastics, Mitsubishi Gas Chemical, Polymersan, Polyplastics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Kasei

- BASF

- Celanese

- Korea Engineering Plastics

- Mitsubishi Gas Chemical

- Polymersan

- Polyplastics