Global Pitch Coke Market Size, Share Analysis Report By Type (Fuel Grade Pet Coke, Other Grade Pet Coke), By Application (Aluminum Anode, Artificial Graphite Electrode, Recarburizer, Carbon Specialty, Carbon Additive, Antifriction, Flame Retardant, Refectories, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153815

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

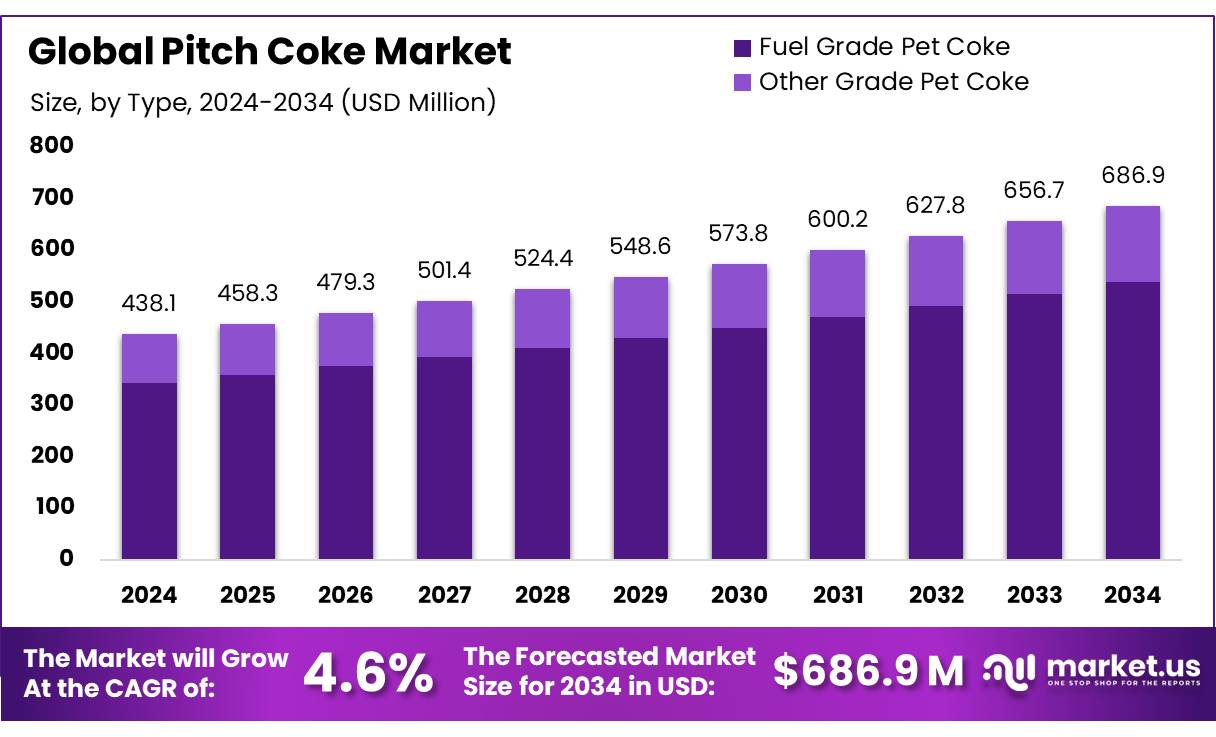

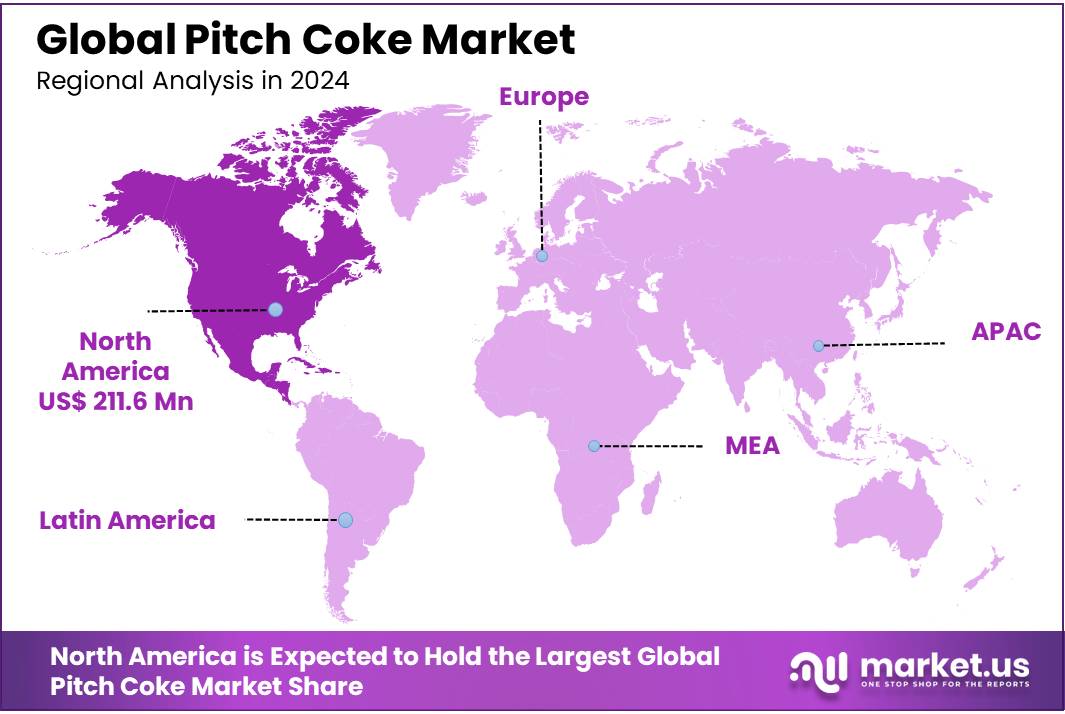

The Global Pitch Coke Market size is expected to be worth around USD 686.9 Million by 2034, from USD 438.1 Million in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.30% share, holding USD 211.6 Million revenue.

Pitch coke, primarily derived from coal tar or petroleum, is a critical material in the production of graphite electrodes and anodes, which are essential for various industrial applications, including steel manufacturing and energy storage systems. In India, the production of pitch coke is closely linked to the coal and petroleum industries, with the country being one of the largest consumers of coal globally. However, the domestic production of high-quality metallurgical coke, a precursor to pitch coke, faces challenges due to the lower quality of indigenous coal, leading to a reliance on imports to meet the demand of the steel industry.

In India, the pitch coke industry is influenced by both domestic production capabilities and import dynamics. The Directorate General of Foreign Trade (DGFT) allocated approximately 1.87 million tonnes of Green Petroleum Coke (GPC) for the fiscal year 2025–26, slightly down from the previous year’s 1.9 million tonnes. This allocation was distributed among 25 calciners, with Rain CII Carbon receiving the largest share of 462,589 tonnes. Additionally, the Commission for Air Quality Management raised the Calcined Petroleum Coke (CPC) quota to 800,000 tonnes per year, effective from the 2025–26 fiscal year, up from 500,000 tonnes previously.

The pitch coke concentrates in India is influenced by several factors. The country’s steel production capacity, which stood at approximately 200 million metric tons annually, relies heavily on the availability of quality coke for blast furnaces. In 2023, India’s met coke production increased by 8% month-on-month to 4.16 million tonnes in May, reflecting a growing demand for this critical raw material. However, challenges persist due to the quality and consistency of domestically produced coke, leading to import curbs. In December 2024, the Indian government imposed restrictions on low-ash metallurgical coke imports, capping them at 713,583 tonnes per quarter for the first half of 2025, aiming to bolster domestic production.

Key Takeaways

- The global Pitch Coke market is projected to reach USD 686.9 million by 2034, up from USD 438.1 million in 2024, registering a CAGR of 4.6% over the forecast period.

- Fuel Grade Pet Coke dominated the market with a 78.4% share of the global pitch coke demand.

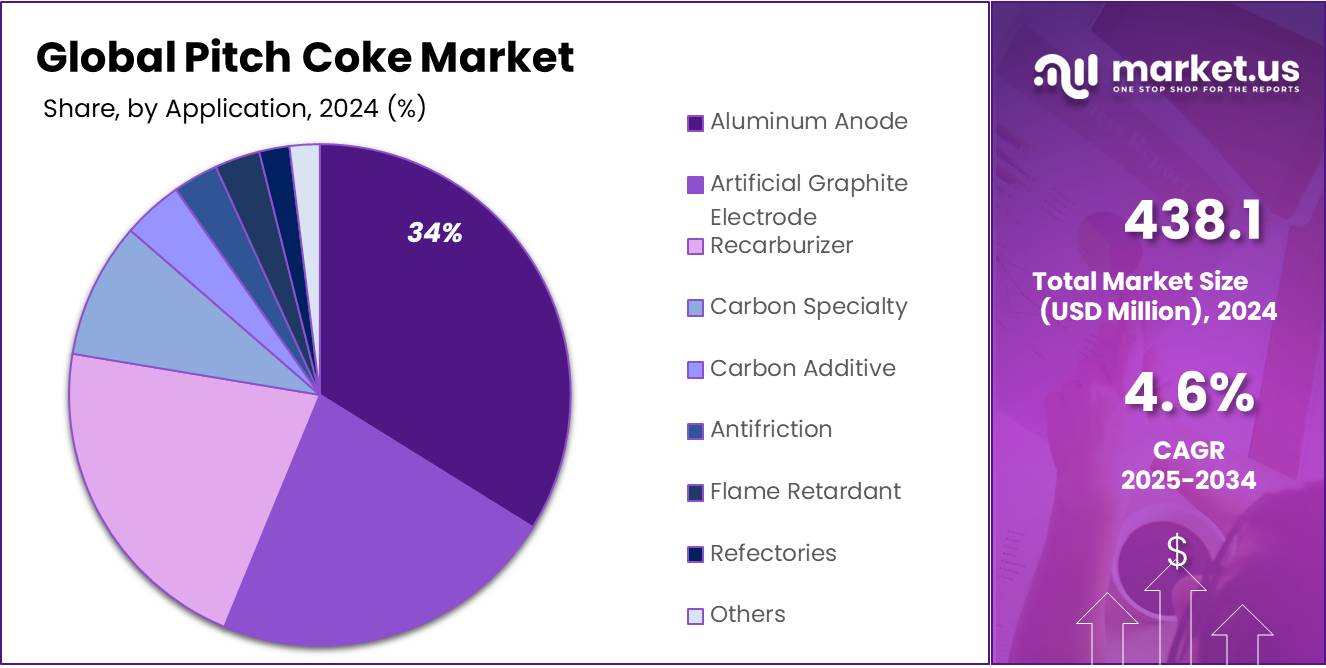

- Aluminum Anode was the leading application segment, accounting for 34.8% share of the global market.

- North America emerged as the leading regional market, holding a 48.3% share of global demand, valued at approximately USD 211.6 million in 2024.

By Type Analysis

Fuel Grade Pet Coke leads with 78.4% share due to its extensive industrial demand.

In 2024, Fuel Grade Pet Coke held a dominant market position, capturing more than a 78.4% share in the global pitch coke market by type. This significant share can be attributed to its high calorific value and cost-effectiveness, which make it a preferred choice for power generation, cement kilns, and industrial boilers across heavy industries. Its wide use as a fuel in energy-intensive sectors, especially in developing economies, has further cemented its market leadership.

In 2025, the segment is expected to retain its strong position, supported by consistent demand from thermal energy applications and limited availability of cost-efficient fuel alternatives. Moreover, countries with surplus refining capacity continue to export large volumes of fuel grade pet coke, reinforcing its global trade relevance. Despite environmental concerns, the affordability and energy output of this type maintain its prominence across major industrial regions.

By Application Analysis

Aluminum Anode leads with 34.8% share due to rising demand from smelters.

In 2024, Aluminum Anode held a dominant market position, capturing more than a 34.8% share in the global pitch coke market by application. This leading position is mainly driven by the growing need for high-quality carbon anodes in aluminum smelting processes. Pitch coke is essential in the production of these anodes due to its high carbon purity and strength. With global aluminum production increasing steadily to meet the rising demand from automotive, construction, and packaging industries, the consumption of pitch coke in anode manufacturing has also grown.

In 2025, the aluminum anode segment is expected to maintain its lead as more smelters invest in efficient and high-purity carbon inputs to improve output and reduce emissions. Countries such as China, India, and the Gulf nations are expected to play a key role in supporting segment growth, as they expand their aluminum production capacities.

Key Market Segments

By Type

- Fuel Grade Pet Coke

- Other Grade Pet Coke

By Application

- Aluminum Anode

- Artificial Graphite Electrode

- Recarburizer

- Carbon Specialty

- Carbon Additive

- Antifriction

- Flame Retardant

- Refectories

- Others

Emerging Trends

Expansion of Coal Tar Pitch (CTP) Production Capacity in India

India’s coal tar pitch (CTP) industry is experiencing significant growth, driven by increasing demand from sectors such as aluminum production, battery manufacturing, and graphite electrode production. In response to this demand, Rain Industries, a leading player in the sector, is investing in expanding its CTP production capacity.

The company plans to start the first phase of a new CTP facility in Andhra Pradesh’s Special Economic Zone in the second half of 2025, with an annual capacity of approximately 50,000 metric tonnes. Subsequent phases aim to increase this capacity to 200,000 metric tonnes per year.

This expansion aligns with India’s broader industrial growth objectives, including the “Make in India” initiative, which seeks to boost domestic manufacturing capabilities. The government’s support for such infrastructure projects underscores its commitment to strengthening the domestic supply chain and reducing dependency on imports.

The increased CTP production capacity is expected to meet the growing needs of key industries, contributing to the nation’s economic development and industrial self-sufficiency. By enhancing local production capabilities, India aims to reduce reliance on imported CTP, ensuring a more resilient and sustainable industrial ecosystem.

Drivers

Growing Demand for Sustainable and Eco-Friendly Products Drives Pitch Coke Market Growth

One of the key driving factors for the growth of the pitch coke market is the increasing demand for sustainable and eco-friendly products across various industries, particularly in the food and beverage sector. As consumers become more environmentally conscious, there is a noticeable shift towards products that are produced with minimal environmental impact. Pitch coke, a byproduct of coal tar, plays a crucial role in the production of aluminum and steel, both of which are essential in the manufacturing of lightweight, energy-efficient products.

The global trend towards sustainability is reflected in initiatives by major organizations. For instance, the United Nations’ Sustainable Development Goals (SDGs) emphasize reducing the environmental impact of industrial processes. Many food and beverage companies, especially those with substantial packaging needs, are increasingly adopting aluminum products, which rely heavily on pitch coke in their production.

According to the Food and Agriculture Organization (FAO), the aluminum industry is one of the largest consumers of pitch coke due to its role in creating high-strength, lightweight materials. This demand is expected to grow as more companies seek to reduce their carbon footprint and align with global sustainability targets.

Government initiatives also play a pivotal role. For example, in the European Union, the European Green Deal is promoting carbon-neutral production techniques, boosting demand for sustainable materials like aluminum, which in turn increases the need for pitch coke. This trend is expected to continue as regulations tighten on carbon emissions and industries move towards greener alternatives.

Restraints

Regulatory Challenges and Environmental Concerns Limit Pitch Coke Market Growth

A major restraining factor for the pitch coke market is the increasing regulatory pressure on industries that use this material, especially due to its environmental impact. As governments around the world focus more on sustainability and reducing industrial pollution, the production and use of pitch coke face stringent regulations. This is particularly relevant in the food and beverage industry, where sustainability is becoming a key driver in consumer decision-making.

Pitch coke, being a byproduct of coal tar, releases harmful pollutants during its production process. These emissions contribute to air pollution and can be detrimental to local ecosystems. In response, many governments have introduced stricter environmental regulations. For example, the European Union’s Industrial Emissions Directive (IED) enforces limits on industrial emissions, including those from coke production. These regulations not only increase production costs but also force companies to adopt cleaner, more expensive technologies to meet these standards.

The increasing environmental concerns around pitch coke also affect its acceptance in the food industry, where sustainability is becoming a top priority. According to the World Health Organization (WHO), industrial pollutants can lead to long-term health risks, including respiratory issues and contamination of food products. As a result, many food manufacturers are exploring alternative materials that have a lower environmental footprint. This shift away from traditional raw materials like pitch coke is putting pressure on its market share.

Opportunity

Expansion of Aluminum Production Offers Significant Growth Opportunities for Pitch Coke Market

One of the most promising growth opportunities for the pitch coke market lies in the growing demand for aluminum, which is heavily reliant on pitch coke in its production. Aluminum is widely used across various industries, including food and beverage packaging, automotive manufacturing, and the construction sector. As global industries move towards more energy-efficient and sustainable solutions, aluminum has become the material of choice due to its lightweight and recyclable properties. This trend is expected to drive the demand for pitch coke, which is an essential raw material in aluminum production.

The Food and Agriculture Organization (FAO) has highlighted the increasing need for aluminum in food packaging, as it offers both durability and recyclability, which are vital for reducing environmental impact.

- According to the FAO, in 2024, global aluminum production is projected to grow by 4%, with food packaging being one of the primary drivers of this increase. This surge in demand for aluminum will directly influence the need for pitch coke, as it is a key component in aluminum smelting.

Furthermore, government initiatives aimed at promoting sustainability and reducing carbon emissions are also creating opportunities for pitch coke. For example, the U.S. government’s Green New Deal and the European Union’s Circular Economy Action Plan encourage the use of recyclable materials like aluminum. These policies not only support the growth of aluminum production but also favor the use of pitch coke as an essential material in the production of high-quality aluminum.

Regional Insights

North America dominates with a 48.30% share equivalent to USD 211.6 million in pitch coke regional revenue.

In 2024, North America held a commanding position in the global pitch coke market, capturing 48.30% of total regional demand, representing approximately USD 211.6 million in market value. This leadership reflects the region’s mature industrial infrastructure and high-end applications in aluminum smelting and graphite electrode production. The United States and Canada are primary contributors within North America, supported by long-established aluminum and steel sectors that rely on high-purity pitch coke for consistent and efficient operations.

Government agencies such as the U.S. Geological Survey (USGS) report notable stability in domestic carbon material output, while Canadian industry bodies track aluminum anode and graphite electrode production closely. These sources provide high‑purity carbon material statistics that support sustained North American demand patterns.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SUMMIT CRM Limited, a Japan-based trading company, plays a strategic role in the global pitch coke market through its carbon materials division. The firm supplies high-quality pitch coke for aluminum, graphite, and refractory applications, primarily sourcing from Asia. With a strong presence in industrial chemicals and metals, it leverages long-standing relationships with manufacturers to ensure consistent supply. Its focus on high-purity carbon materials supports growing demand from steelmaking and advanced material sectors across Japan, Southeast Asia, and beyond.

ASBURY CARBONS, based in New Jersey, USA, is a prominent producer and supplier of carbon and graphite materials, including pitch coke. Known for its technical expertise and product quality, the company serves industries such as steel, friction materials, and lubricants. Asbury Carbons has a broad distribution network and provides custom carbon solutions tailored to client specifications. Its product innovation and focus on purity make it a preferred supplier in North America for applications requiring high-performance pitch coke.

Bilbaina de Alquitranes, S.A., headquartered in Spain, specializes in the distillation of coal tar and the production of carbon derivatives such as pitch coke. With over 90 years of experience, the company supplies carbon materials to the aluminum, steel, and construction industries. Its manufacturing processes prioritize high thermal resistance and purity, meeting the requirements of anode-grade coke. Bilbaina maintains a strong export presence across Europe and Latin America, supported by strict quality controls and environmentally responsible production practices.

Top Key Players Outlook

- SUMMIT CRM Limited

- Rain Carbon Inc.

- Sojitz JECT Corporation

- ASBURY CARBONS

- Bilbaina de Alquitranes, S.A

- Shamokin Carbons

- Mitsubishi Chemical

- Tianjin Yunhai Carbon Element Products Co., Ltd.

- RESORBENT S.R.O.

- NIPPON STEEL Chemical & Material Co., Ltd.

Recent Industry Developments

In 2024, Bilbaína de Alquitranes, S.A. (BASA) celebrated nearly 100 years of experience in coal‑tar distillation, serving Europe’s leading steel groups under its operations in Barakaldo, Spain.

In 2024, Sojitz JECT Corporation conducted a vigorous export operation in pitch coke, recording 127 export shipments valued at approximately USD 26.85 million, which comprised 55.12 percent of its total pitch coke export volume (HS code 270820).

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fuel Grade Pet Coke, Other Grade Pet Coke), By Application (Aluminum Anode, Artificial Graphite Electrode, Recarburizer, Carbon Specialty, Carbon Additive, Antifriction, Flame Retardant, Refectories, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SUMMIT CRM Limited, Rain Carbon Inc., Sojitz JECT Corporation, ASBURY CARBONS, Bilbaina de Alquitranes, S.A, Shamokin Carbons, Mitsubishi Chemical, Tianjin Yunhai Carbon Element Products Co., Ltd., RESORBENT S.R.O., NIPPON STEEL Chemical & Material Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SUMMIT CRM Limited

- Rain Carbon Inc.

- Sojitz JECT Corporation

- ASBURY CARBONS

- Bilbaina de Alquitranes, S.A

- Shamokin Carbons

- Mitsubishi Chemical

- Tianjin Yunhai Carbon Element Products Co., Ltd.

- RESORBENT S.R.O.

- NIPPON STEEL Chemical & Material Co., Ltd.