Global Phosphorus Pentachloride Market Size, Share, And Business Benefits By Grade (Industrial Grade, Reagent Grade), By End-User (Chemical, Pharmaceutical, Agriculture, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161880

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

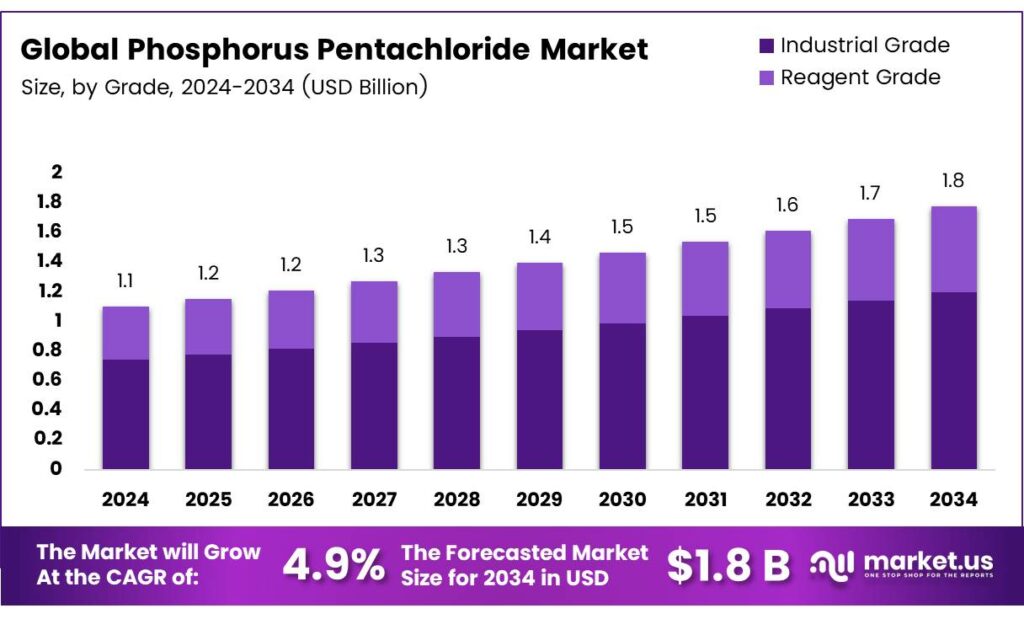

The Global Phosphorus Pentachloride Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Phosphorus Pentachloride (PCl₅) is a highly reactive chlorinating agent critical in industrial and pharmaceutical applications. With the formula PCl₅, it is one of the key phosphorus chlorides alongside PCl₃ and POCl₃. This greenish-yellow crystalline solid, often yellowish due to hydrogen chloride contamination, is water- and moisture-sensitive, decomposing into hydrochloric and phosphoric acids with heat that may ignite nearby materials. Its corrosive nature affects metals and tissues, and inhalation can cause adverse health effects.

Phosphorus pentachloride (PCl₅) is crucial for synthesizing acyl chlorides and acts as an intermediate in producing flame retardants, plasticizers, and catalysts. Its strong chlorinating properties drive innovation in organic synthesis and metallurgical processes. PCl₅ is indispensable in agrochemicals, pharmaceuticals, and specialty chemicals. It supports advanced material development and complex chemical transformations.

- The global PCl₅ market experienced a 34% decline in shipments last year, with 29 shipments from 10 exporters to 12 buyers, indicating reduced industrial demand. A 200% import surge in April 2024 compared to April 2023, and a 50% increase from March 2024, suggest a rebound. This uptick is likely driven by renewed interest in the pharmaceutical and agrochemical sectors. PCl₅’s utility is evident in reactions like butadiene chlorination, yielding pale yellow crystals under controlled conditions.

Phosphorus pentachloride (PCl₅) reacts vigorously with water, generating gaseous HCl and significant hazards. In a spill with excess water, half the maximum theoretical HCl yield forms in 0.54 minutes. Its corrosive and heat-generating properties require strict safety protocols. The Emergency Response Guidebook stresses proper handling to minimize risks. Careful management is essential to ensure safety.

Key Takeaways

- The Global Phosphorus Pentachloride Market is projected to grow from USD 1.1 billion in 2024 to USD 1.8 billion by 2034, at a CAGR of 4.9%.

- Industrial Grade phosphorus pentachloride held a 67.4% market share in 2024, driven by its use in manufacturing chlorinated compounds and agrochemicals.

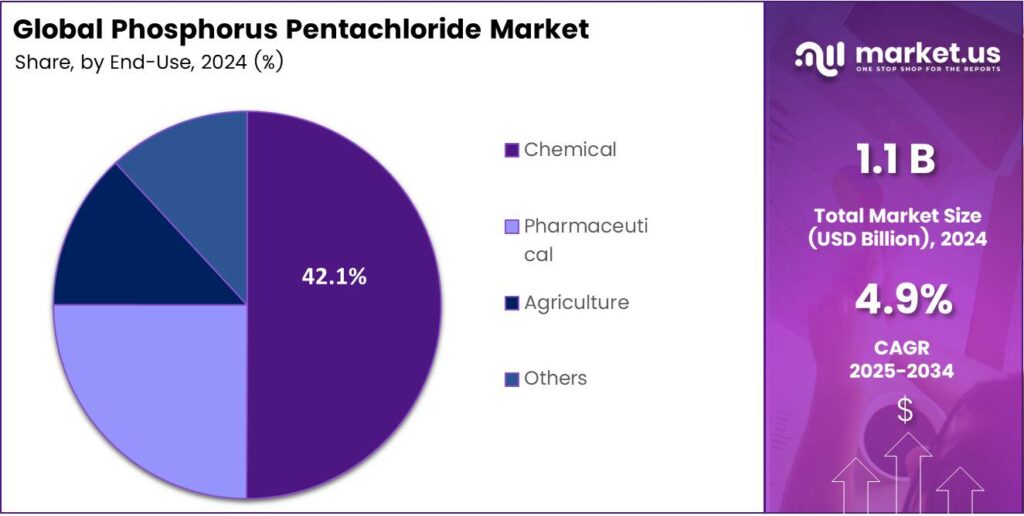

- The Chemical segment captured a 42.1% market share in 2024, fueled by its role as a chlorinating and dehydrating agent in chemical synthesis.

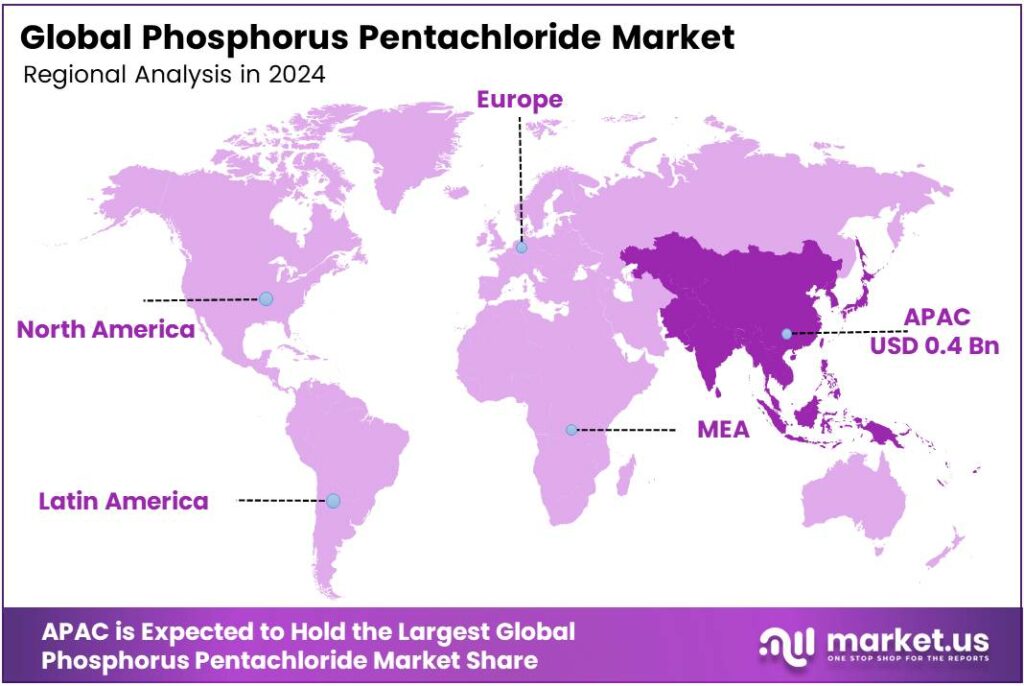

- Asia-Pacific led the market in 2024 with a 42.8% share, generating USD 0.4 billion, due to strong demand in the chemical and pharmaceutical industries.

By Grade

Industrial Grade Dominates the Phosphorus Pentachloride Market with 67.4% Share

In 2024, Industrial Grade held a dominant market position, capturing more than a 67.4% share of the global phosphorus pentachloride market. This grade is primarily used in large-scale manufacturing of chlorinated compounds, agrochemicals, and pharmaceutical intermediates. Its high reactivity and purity make it suitable for synthesis in chemical plants, where it serves as a chlorinating and dehydrating agent.

The growing demand from pesticide and dye manufacturers, particularly across Asia-Pacific and Europe, has reinforced its strong market standing. The industrial-grade segment is expected to continue expanding as industries adopt efficient chlorination processes and increase capacity for chemical intermediates.

The compound’s versatility in producing phosphorus oxychloride and other derivatives used in catalysts, plasticizers, and stabilizers further sustains its demand. Additionally, the ongoing modernization of chemical manufacturing facilities and tightening of purity standards in industrial applications continue to favor this segment’s growth trajectory.

By End-User

Chemical Segment Leads the Phosphorus Pentachloride Market with 42.1% Share

In 2024, Chemical held a dominant market position, capturing more than a 42.1% share of the global phosphorus pentachloride market. This segment benefits from the compound’s extensive use as a chlorinating and dehydrating agent in chemical synthesis, particularly in the production of phosphorus oxychloride, acid chlorides, and organic intermediates.

The chemical industry relies on phosphorus pentachloride for manufacturing dyes, plasticizers, and stabilizers, all of which are integral to downstream sectors like polymers, coatings, and specialty materials. Demand from the chemical sector is projected to remain strong due to expanding applications in fine and specialty chemical manufacturing.

The rising need for high-purity reagents in advanced synthesis and the growing trend of localized production of intermediates in the Asia-Pacific are key drivers sustaining the segment’s leadership. Additionally, regulatory support for domestic chemical manufacturing and the modernization of production plants continue to strengthen the role of phosphorus pentachloride in this end-user category.

Key Market Segments

By Grade

- Industrial Grade

- Reagent Grade

By End-User

- Chemical

- Pharmaceutical

- Agriculture

- Others

Emerging Trends

Greener chlorination under pesticide-stewardship pressure

A clear trend shaping phosphorus pentachloride (PCl₅) is the push toward greener chlorination for agrochemical intermediates: tighter pesticide-use stewardship is forcing producers to cut solvent loss, recycle chlorine/phosphorus streams, and validate cleaner routes (POCl₃/PCl₃ loops, continuous micro-reactors, and closed-vent systems). The signal is strongest from food-system regulators.

- The FAO reports that global agricultural pesticide use reached 3.73 million tonnes of active ingredients in 2023, up 14% over a decade, with intensity at 2.40 kg/ha—evidence that crop-protection demand remains structurally high even as governments ask for lower risk per kilogram used.

This is pushing formulators and their upstream reagent suppliers to document lower-emission chlorination and to substitute legacy batch steps with monitored, contained operations exactly where improved PCl₅ handling, recovery of by-product HCl/POCl₃, and solvent minimization matter.

Drivers

Rising Demand for High-Efficiency Pesticide Intermediates

One of the key driving forces behind the demand for phosphorus pentachloride (PCl₅) is the increasing need for more efficient, high-potency pesticide and agrochemical intermediates that can provide stronger effects at lower doses, thus aligning with regulatory and sustainability pressures.

Globally, pesticide use remains large in absolute terms even as regulators push for safer molecules. The Food and Agriculture Organization (FAO) reports that the total use of pesticide active ingredients, a modest decline over but still a huge volume overall. This sustained scale means that manufacturers of crop-protection molecules are under pressure to improve potency, reduce dose rates, and minimize non-target exposures.

Regulators are imposing stricter limits and incentives. The European Commission’s proposal for the revision of the Sustainable Use of Pesticides regulation aims to cut both pesticide use and associated risk by 50%. That means agrochemical companies must find molecules that deliver the same control at lower doses, pushing the need for highly reactive, selective intermediates where PCl₅ plays a role.

Restraints

Stringent Safety & Regulatory Pressures on Chlorinating Reagents

One serious restraint on the broader adoption or scaling of phosphorus pentachloride (PCl₅) is the intensifying regulatory and safety burden tied to its inherently hazardous nature and the risks of chlorination chemistry. Even as demand for chlorinated intermediates persists, strict rules, compliance costs, and public scrutiny slow investment and expansion.

PCl₅ is corrosive and dangerous: the U.S. NIOSH Pocket Guide cautions that exposure (by inhalation, skin, or eye contact) can cause irritation, respiratory effects, dermatitis, and more. Because of these hazards, operating plants must invest heavily in containment, leak detection, personal protective equipment (PPE), ventilation, emergency systems, and worker training. That adds substantial capital and operating costs.

On the regulatory side, food-system regulators are increasingly strict about pesticide safety, residues, and environmental fate. That means any agrochemical route, especially one using chlorination steps, must be rigorously validated to show that by-products, impurities, and unintended chlorine derivatives are controlled far below residue thresholds. That validation is laborious, expensive, and time-consuming.

Opportunity

Intensifying crop output keeps demand steady for chlorination intermediates

A major tailwind for phosphorus pentachloride (PCl₅) is the simple, stubborn fact that the world keeps growing and feeding more grain. The Food and Agriculture Organization’s latest outlook points to record or near-record cereal harvests, with updated projections showing higher coarse grain output across several big producers.

Even with pressure to lower risk, that is a vast, ongoing base of chemical control evidence that farmers still need reliable molecules that perform at the field scale. Those molecules frequently rely on efficient chlorination steps, keeping PCl₅-based transformations relevant in upstream manufacturing.

In the United States, one of the world’s bellwether row crop markets, 96% of soybean acreage was planted with herbicide-resistant varieties, a proxy for continued chemical weed-control programs that depend on robust, selective actives (and, in turn, on the intermediates made with reagents like PCl₅). When growers commit to these systems at such high penetration, it signals durable demand for the chemistry behind them.

Regional Analysis

Asia-Pacific leads with a 42.8% share and a USD 0.4 Billion market value.

In 2024, Asia-Pacific held a dominant position in the global Phosphorus Pentachloride market, accounting for over 42.8% of total revenue, valued at approximately USD 0.4 billion. The region’s leadership is attributed to its extensive chemical manufacturing base, high demand for agrochemicals, and expanding pharmaceutical sectors across China, India, Japan, and South Korea.

China remains the major production hub due to the large-scale presence of chlor-alkali plants and the growing export of phosphorus derivatives used in pesticides and flame retardants. India, supported by government programs like Make in India and rising fertilizer demand, is also contributing significantly to regional growth.

The increasing utilization of phosphorus pentachloride in chlorination processes, especially in producing organophosphorus compounds, pharmaceuticals, and plastic additives, continues to drive consumption. Moreover, regional players are expanding production capacities to meet domestic and international requirements amid tightening supply conditions in Europe. Japan and South Korea are witnessing moderate but steady demand supported by electronics and specialty chemical manufacturing.

The Asia-Pacific region leads the global phosphorus pentachloride market, driven by industrial growth in China and India, increasing specialty intermediate exports, and strong chemical infrastructure. Companies are adopting cleaner production technologies to meet sustainability and regulatory demands, enhancing efficiency. Lower production costs and government support solidify the region’s competitive edge. It is expected to maintain its dominance over the next decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Lucky Chemical Industries leverages extensive production capacity and an established international distribution network. The company’s strength lies in its ability to serve diverse industrial markets, including agrochemicals and pharmaceuticals, which require high-purity PCl₅. Their focus on consistent quality and reliable, large-volume supply solidifies their position as a key partner for major downstream manufacturers.

- Lianyungang Dongjin Chemical is a major force in the Asian market, capitalizing on its strategic location and integrated supply chain. The company benefits from proximity to raw materials and key industrial zones, ensuring cost-effective production and logistical advantages. Dongjin has established itself as a reliable and competitive manufacturer, crucial for the regional phosphorus pentachloride supply network.

- Taizhou Yongchang Chemical specializes in the production of fine chemicals, including high-purity phosphorus pentachloride. The company distinguishes itself through a strong focus on research and development and catering to niche, value-added applications. Their expertise in serving the pharmaceutical industry and specialty chemical synthesis allows them to command a premium position.

Top Key Players in the Market

- Lucky Chemical Industries

- Lianyungang Dongjin Chemical Co., Ltd.

- Taizhou Yongchang Chemical Co., Ltd.

- Wuhan Fortuna Chemical Co., Ltd.

- UPL

- Others

Recent Developments

- In 2024, Lucky Chemical Industries, based in Sarigam, Gujarat, India, continues to operate as a key manufacturer of phosphorus pentachloride (PCl5) and related phosphorus chemicals since its establishment. The company maintains a focus on quality assurance and export activities, with products like PCl5 highlighted for their exact composition and safe usage.

- In 2024, Lianyungang Dongjin Chemical Co., Ltd., located in Jiangsu Province, China, specializes in agrochemical intermediates but shows no direct involvement in phosphorus pentachloride production based on available profiles. The company focuses on pesticides like tolclofos-methyl and acephate, with no recent news or developments in the phosphorus sector.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Reagent Grade), By End-User (Chemical, Pharmaceutical, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lucky Chemical Industries, Lianyungang Dongjin Chemical Co., Ltd., Taizhou Yongchang Chemical Co., Ltd., Wuhan Fortuna Chemical Co., Ltd., UPL, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Phosphorus Pentachloride MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Phosphorus Pentachloride MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lucky Chemical Industries

- Lianyungang Dongjin Chemical Co., Ltd.

- Taizhou Yongchang Chemical Co., Ltd.

- Wuhan Fortuna Chemical Co., Ltd.

- UPL

- Others