Global Pet Milk Replacers Market Size, Share, And Enhanced Productivity By Pet Category (Dogs, Cats, Others), By Product (Medicated, Non-medicated), By Form (Powder, Liquid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173719

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

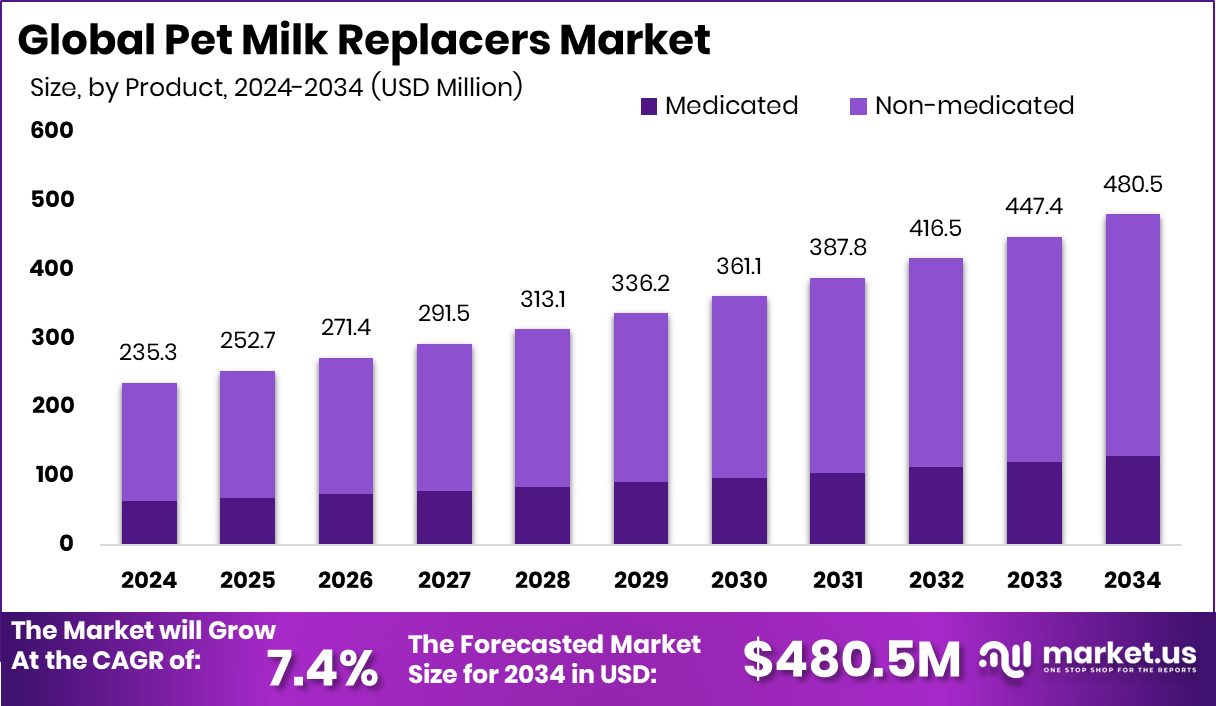

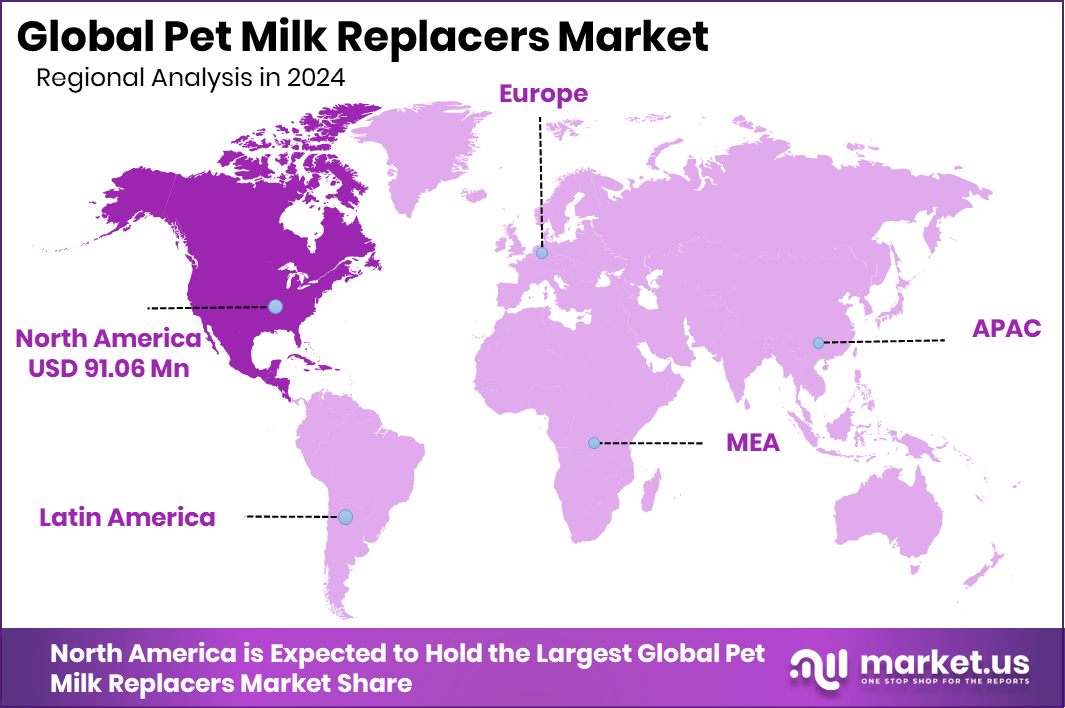

The Global Pet Milk Replacers Market is expected to be worth around USD 480.5 million by 2034, up from USD 235.3 million in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. North America dominates Pet Milk Replacers Market with 38.7% worth USD 91.06 Mn.

Pet milk replacers are specially formulated liquid or powdered nutritional products designed to feed newborn or young animals when natural mother’s milk is unavailable, insufficient, or not an option. They provide essential proteins, fats, vitamins, and minerals to support early growth, immune development, and healthy digestion. Pet milk replacers are commonly used for orphaned animals, litters with large numbers that exceed the mother’s capacity, or when mothers have health or lactation issues. These products are often crafted to closely mimic the nutritional profile of a species’ natural milk, ensuring that young pets like puppies and kittens receive balanced nourishment during their most critical growth stages.

The pet milk replacers market refers to the global trade and demand for these nutritional products across various distribution channels, including veterinary clinics, animal shelters, pet stores, and online platforms. This market reflects trends in pet ownership, breeder practices, and awareness of early life nutrition among pet parents.

Growth in this market is fueled by increasing adoption rates of companion animals and rising investment into innovative animal nutrition technologies. For example, Brazil’s Future Cow secured R$4.85M to scale up animal-free dairy proteins via fermentation, and France’s Nutropy raised €7M to industrialize animal-free dairy proteins, showing broader interest in advanced protein solutions that could influence future milk replacer formulations.

A key growth factor for the pet milk replacers market is the expanding global pet population combined with rising awareness of proper early life care, which drives demand for high-quality nutritional alternatives when natural milk is not available. Pet owners are more informed than ever about the long-term health benefits of early nutrition, driving sustained demand for reliable replacer products.

The demand for pet milk replacers continues to rise as more people treat pets as family members and prioritize investment in their health. The trend is supported by broader funding in animal nutrition, including a Matt Comyn-backed milk start-up raising $10M and entering a French joint venture, signaling investor confidence in the broader nutritional space that can benefit related pet nutrition sectors.

There are significant opportunities in pet milk replacers tied to innovation and alternative protein development, such as fermentation-based dairy proteins that may improve product performance and sustainability. Additionally, funding flows like the $6.7M Series A raised by pet food startup Dogsee Chew show rising capital interest in novel pet nutrition ventures, presenting chances for cross-industry collaboration and new product development in this evolving market.

Key Takeaways

- The Global Pet Milk Replacers Market is expected to be worth around USD 480.5 million by 2034, up from USD 235.3 million in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- In the Pet Milk Replacers Market, dogs dominated demand, holding 54.8% share due to adoption.

- In the Pet Milk Replacers Market, non-medicated products led with 73.1% share, preferred for safety.

- In the Pet Milk Replacers Market, powder form dominated at 61.5% due to convenience globally.

- Pet Milk Replacers Market in North America reached 38.7%, generating USD 91.06 Mn.

By Pet Category Analysis

Dogs dominate the Pet Milk Replacers Market, holding 54.8% share globally today.

In 2024, dogs held a dominant position in the Pet Milk Replacers Market with a 54.8% share, mainly due to the high global dog population and rising awareness about early-life nutrition for puppies. Many pet owners consider milk replacers essential for orphaned, weak, or newborn puppies that cannot nurse properly. Veterinarians often recommend dog-specific milk replacers because their nutritional profile closely matches natural canine milk.

Urban lifestyles, increased pet adoption, and growing spending on companion animal care further support this trend. Breeders and shelters also rely heavily on dog milk replacers to improve survival rates during the first few weeks of life. As dog owners become more informed about digestive sensitivity and immune support, demand for species-specific milk replacers continues to grow steadily.

By Product Analysis

Non-medicated products lead the Pet Milk Replacers Market with 73.1% adoption worldwide.

In 2024, non-medicated products accounted for 73.1% of the Pet Milk Replacers Market, reflecting strong consumer preference for safe, everyday nutrition solutions. Pet owners increasingly choose non-medicated milk replacers for routine feeding rather than treatment, especially for newborns and young pets. These products are widely trusted because they focus on balanced proteins, fats, vitamins, and minerals without added drugs.

Regulatory caution around medicated pet foods also supports this shift, as non-medicated options face fewer restrictions and are easier to purchase. Veterinarians often advise starting with non-medicated formulas unless a specific medical condition is diagnosed. This segment benefits from clean-label trends, transparency in ingredients, and the growing belief that preventive nutrition is better than corrective treatment in early pet development.

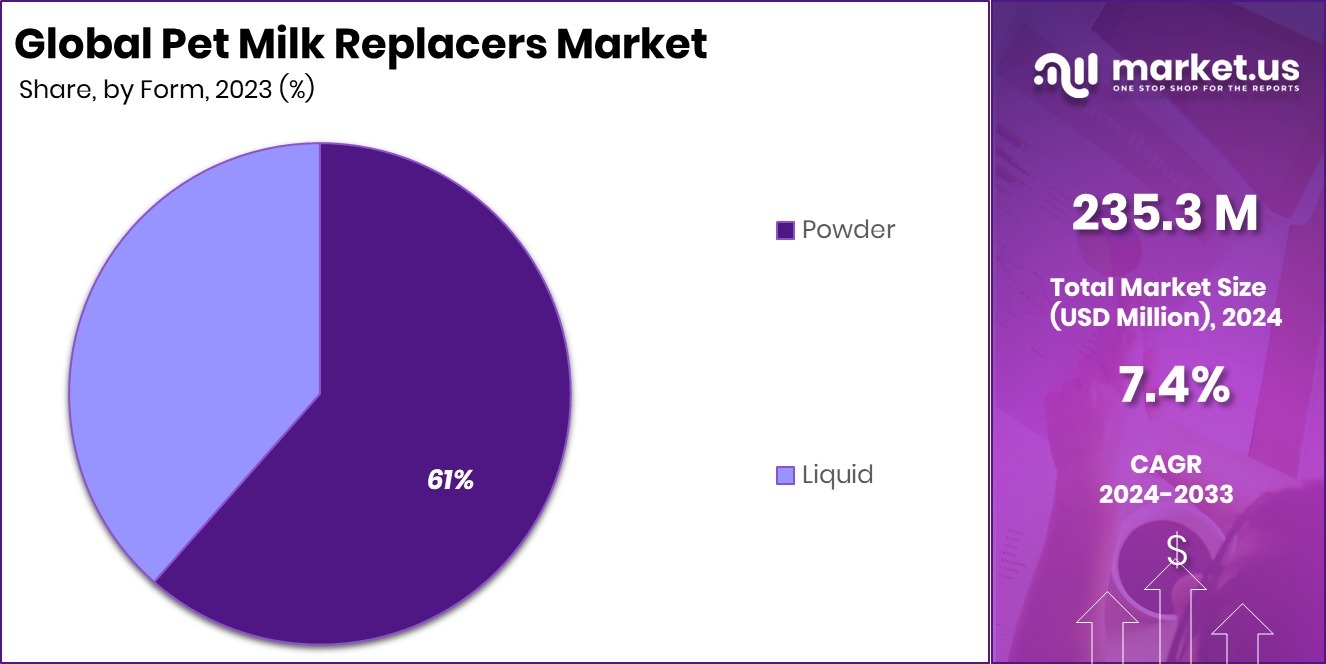

By Form Analysis

Powder form dominates the Pet Milk Replacers Market, capturing 61.5% demand overall.

In 2024, powder form dominated the Pet Milk Replacers Market with a 61.5% share, driven by convenience, longer shelf life, and cost efficiency. Powdered milk replacers are easy to store, transport, and measure, making them popular among breeders, shelters, and pet owners. They allow flexible preparation, as users can mix only the required quantity, reducing waste.

Compared to liquid forms, powders are less prone to spoilage and do not require refrigeration before opening. This is especially valuable in regions with limited cold-chain infrastructure. Manufacturers also prefer powder formats because they are easier to package and distribute at scale. As pet owners seek practical and reliable feeding options for young animals, powdered milk replacers continue to see strong and consistent demand.

Key Market Segments

By Pet Category

- Dogs

- Cats

- Others

By Product

- Medicated

- Non-medicated

By Form

- Powder

- Liquid

Driving Factors

Rising Focus On Early Pet Nutrition Care

One major driving factor for the Pet Milk Replacers Market is the growing focus on proper early-stage nutrition for young pets. Pet owners, breeders, and shelters now understand that early feeding directly affects immunity, digestion, and long-term health. When mother’s milk is unavailable, milk replacers become essential. This awareness is supported by innovation in alternative dairy science.

For example, Change Foods closed a record USD 12 million seed extension to disrupt traditional cheese using animal-free dairy technology. Such investments highlight rising confidence in advanced dairy alternatives, which can improve the nutritional quality and safety of future pet milk replacers. As nutrition science improves, trust in formulated replacers increases, driving steady market growth.

Restraining Factors

High Costs Of Advanced Nutrition Technologies

A key restraining factor in the Pet Milk Replacers Market is the high cost linked to developing advanced, dairy-like nutrition alternatives. Creating products that closely match natural milk requires research, precision fermentation, and specialized ingredients, which increases production costs. This can make milk replacers less affordable for small breeders or price-sensitive pet owners.

The challenge is visible across the wider dairy-alternative ecosystem. Australia’s Eden Brew raised USD 24.5 million in Series A funding to scale animal-free casein micelle and dairy protein production, showing that large capital is needed before cost efficiencies are achieved. Until such technologies become more affordable, pricing pressure may limit wider adoption in pet milk replacers.

Growth Opportunity

Innovation In Animal-Free Nutrition Ingredients

One strong growth opportunity for the Pet Milk Replacers Market lies in animal-free fats and proteins that improve digestibility and sustainability. These ingredients can help create milk replacers that are closer to natural milk while avoiding supply issues linked to traditional dairy. Innovation in this space is accelerating.

India’s Phyx44 raised USD 1.2 million to develop animal-free dairy fats and proteins, highlighting growing confidence in scalable alternatives. Such innovations can reduce dependency on conventional dairy, improve formulation flexibility, and support longer shelf life. As these technologies mature, pet milk replacers can become more consistent, ethical, and accessible, opening new growth paths for manufacturers.

Latest Trends

Microbial Fermentation Reshaping Milk Replacer Formulations

A major latest trend in the Pet Milk Replacers Market is the use of microbial fermentation to produce dairy-like proteins. This approach allows precise control over nutrition while avoiding animal-based sourcing risks. Fermentation-derived casein can improve texture, digestibility, and nutrient absorption in milk replacers. The trend is gaining momentum with strong financial backing.

Fermify raised USD 5 million to produce affordable animal-free casein using microbes, signaling growing industry confidence. As fermentation scales up, pet milk replacers can achieve better consistency and performance. This trend supports innovation, sustainability, and long-term reliability across pet nutrition products.

Regional Analysis

North America leads Pet Milk Replacers Market at 38.7%, valued USD 91.06 Mn.

North America dominates the Pet Milk Replacers Market, holding a 38.7% share valued at USD 91.06 Mn, supported by strong pet ownership culture, advanced veterinary care, and high awareness of neonatal pet nutrition. The region benefits from widespread availability of specialized pet nutrition products and strong trust in commercial milk replacers among breeders, shelters, and households.

Europe represents a well-established market, driven by responsible pet care practices, strict quality standards, and consistent demand for scientifically formulated pet nutrition products. Asia Pacific shows steady market development, supported by rising pet adoption in urban areas, growing middle-class households, and increasing awareness about early-life feeding for companion animals.

The Middle East & Africa market remains smaller but stable, with gradual growth linked to improving access to pet care products and expanding veterinary services in urban centers. Latin America contributes moderate demand, supported by increasing companionship trends and the gradual shift from homemade feeding solutions to packaged pet milk replacers.

Overall, while multiple regions contribute to market expansion, North America clearly leads in value and adoption, setting benchmarks for product quality, usage patterns, and consumer trust within the global Pet Milk Replacers Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Pet-Ag, Inc. remains a highly focused player in the global Pet Milk Replacers Market due to its long-standing specialization in neonatal and early-life pet nutrition. The company is widely recognized for developing species-specific milk replacers designed to closely match natural mother’s milk. Its strong connection with veterinarians, breeders, and animal shelters reinforces trust in its formulations. Pet-Ag’s narrow but deep product focus allows it to maintain consistency in quality, formulation accuracy, and usability, especially for puppies and kittens that require sensitive digestive support during early growth stages.

Cargill, Incorporated brings a different strength to the Pet Milk Replacers Market through its global nutrition expertise and large-scale ingredient capabilities. With deep experience in animal nutrition, Cargill supports milk replacer formulations through high-quality proteins, fats, and nutritional inputs. Its broad agricultural and feed background enables stable sourcing and formulation reliability. Cargill’s role is more upstream and formulation-driven, helping ensure nutritional balance, safety, and scalability for pet milk replacer solutions across regions.

Archer Daniels Midland Company (ADM) contributes to the market through its strong portfolio of nutritional ingredients and processing expertise. ADM’s focus on proteins, oils, and functional nutrition components supports the development of consistent, digestible milk replacer formulations. The company’s emphasis on ingredient quality, traceability, and nutritional science strengthens its relevance in pet nutrition applications. ADM’s capabilities align well with evolving expectations for reliable, high-performance pet milk replacer products in 2024.

Top Key Players in the Market

- Pet-Ag, Inc.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Land O’Lakes

- Glanbia plc

- Liprovit BV

- Calva Products, LLC

- Jordan Agri Limited

Recent Developments

- In April 2024, Glanbia plc, a global nutrition company making dairy-based and ingredient solutions, agreed to buy Flavor Producers LLC for about $300 million. This deal expands Glanbia’s reach into flavor and premix ingredients, strengthening its ability to support nutritional product development across animal and human nutrition categories.

Report Scope

Report Features Description Market Value (2024) USD 235.3 Million Forecast Revenue (2034) USD 480.5 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Category (Dogs, Cats, Others), By Product (Medicated, Non-medicated), By Form (Powder, Liquid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Pet-Ag, Inc., Cargill, Incorporated, Archer Daniels Midland Company, Land O’Lakes, Glanbia plc, Liprovit BV, Calva Products, LLC, Jordan Agri Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Milk Replacers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Pet Milk Replacers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pet-Ag, Inc.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Land O’Lakes

- Glanbia plc

- Liprovit BV

- Calva Products, LLC

- Jordan Agri Limited