Global Palm Oil Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Product (Crude Palm Oil, RBD Palm Oil, Palm Kernel Oil, Fractionated Palm Oil), By Application (Edible Oil, Bio-Diesel, Lubricants, Cosmetics, Others), By End-use (Food and Beverage, Personal Care and Cosmetics, Energy, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148589

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

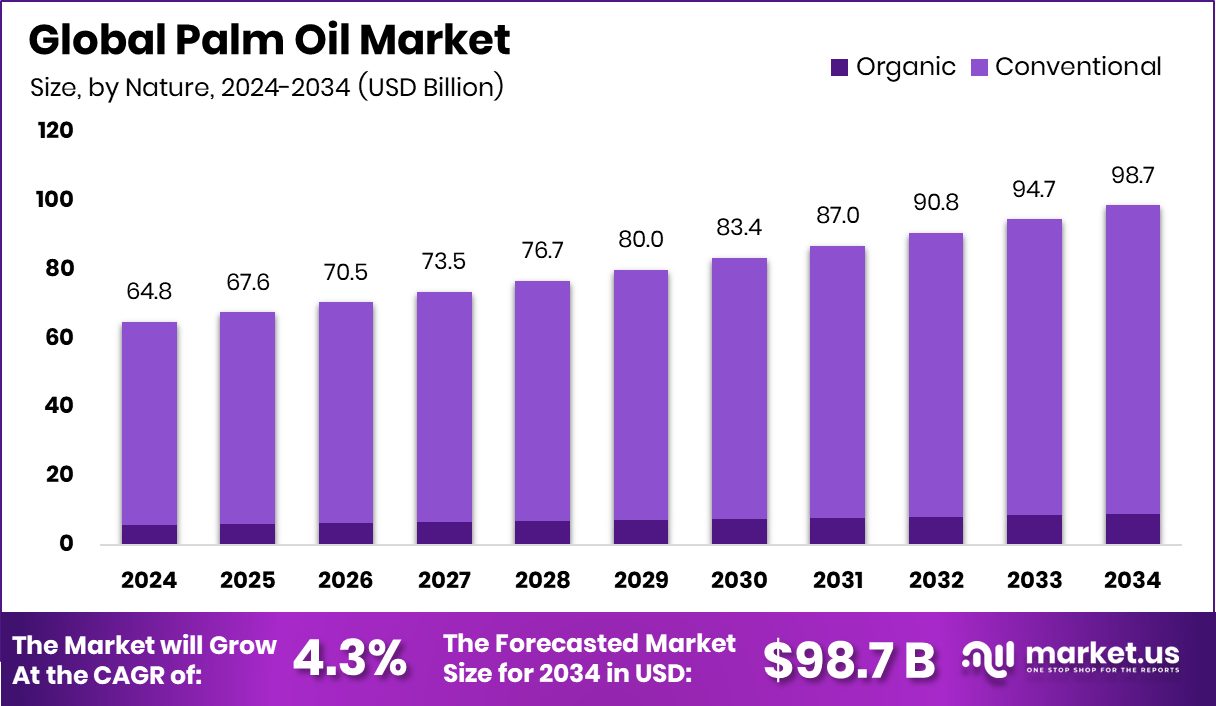

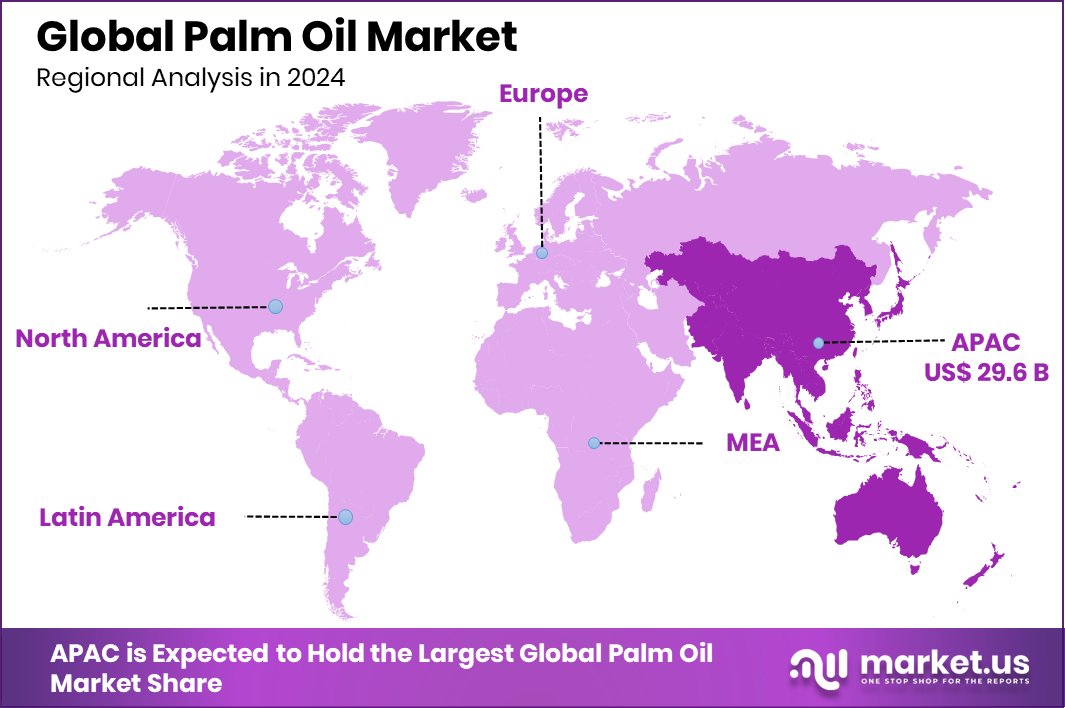

Global Palm Oil Market is expected to be worth around USD 98.7 billion by 2034, up from USD 64.8 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. USD 29.6 Bn revenue in Asia-Pacific reflects a 45.8% market dominance.

Palm oil is a versatile edible vegetable oil derived from the fruit of oil palm trees, primarily grown in tropical regions. It is extracted from both the flesh (mesocarp) and kernel of the fruit. The oil is widely used in food products, cosmetics, cleaning agents, and biofuels due to its semi-solid nature, high oxidative stability, and cost-effectiveness.

The palm oil market encompasses the production, processing, distribution, and sales of palm oil and its derivatives. This global market is driven by increasing demand for sustainable and affordable vegetable oils, particularly in the food, cosmetics, and biofuel industries. With expanding palm oil plantations in key producing countries and growing consumer awareness of sustainable sourcing practices, the market continues to evolve.

Rising consumption of processed foods and growing demand for affordable vegetable oils propel the palm oil market. Expanding applications in biofuels, driven by the shift towards renewable energy, also boost market growth. Additionally, the oil’s high yield per hectare makes it a cost-effective option compared to other vegetable oils, attracting significant investments in palm plantations.

In August 2021, the National Oil Palm Mission was launched with a financial allocation of Rs 11,040 crore. The Government of India contributes Rs 8,844 crore, while the state governments provide Rs 2,196 crore, covering viability gap funding and financial aid for planting material.

The initiative aims to expand oil palm cultivation by an additional 6.5 lakh hectares by 2025-26, targeting a total of 10 lakh hectares. Crude Palm Oil (CPO) production is projected to increase to 11.2 lakh tonnes by 2025-26 and reach 28 lakh tonnes by 2029-30.

Key Takeaways

- Global Palm Oil Market is expected to be worth around USD 98.7 billion by 2034, up from USD 64.8 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- In the Palm Oil Market, conventional palm oil dominates with a substantial 91.2% market share.

- Crude palm oil holds a significant position, capturing 49.3% of the total product segment.

- Edible oil applications drive demand, accounting for a prominent 62.9% of palm oil utilization.

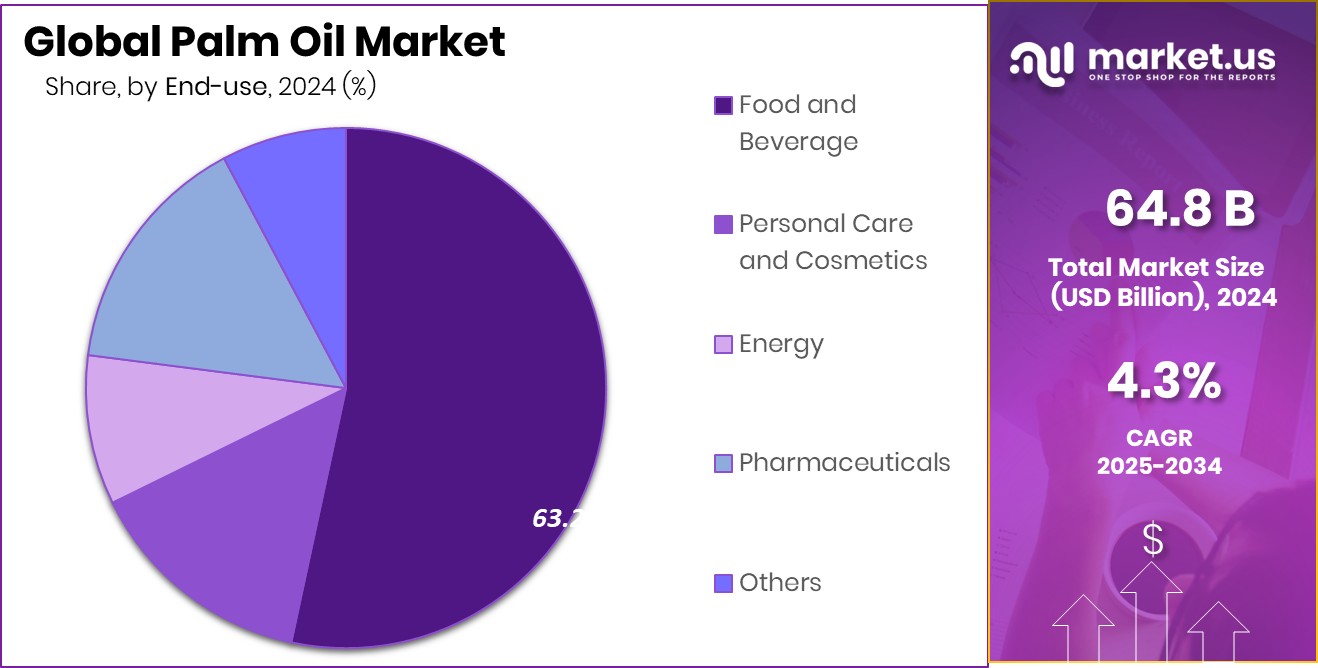

- The food and beverage sector remains the leading end-use segment, comprising 63.2% of total consumption.

- With a 45.8% market share, Asia-Pacific leads, earning USD 29.6 Bn.

By Nature Analysis

Conventional palm oil dominates the market, capturing a substantial 91.2% share.

In 2024, Conventional held a dominant market position in the By Nature segment of the Palm Oil Market, with a 91.2% share. The significant share of Conventional palm oil can be attributed to its widespread application in food and beverage products, where it is preferred for its stability and affordability.

Additionally, conventional palm oil continues to be extensively utilized in the production of processed foods, margarine, and baked goods, further solidifying its market dominance. The high yield and cost-effectiveness of conventional palm oil also contribute to its leading market share, as producers leverage its consistent supply chain and established cultivation practices.

The substantial share of 91.2% underscores the ongoing demand for conventional palm oil, driven by both industrial and retail sectors seeking reliable and economical edible oil solutions. As the market evolves, conventional palm oil is expected to maintain its stronghold due to its entrenched supply networks and widespread application across diverse food products.

By Product Analysis

Crude palm oil accounts for 49.3% of the market, showcasing strong demand.

In 2024, Crude Palm Oil held a dominant market position in the By Product segment of the Palm Oil Market, with a 49.3% share. The substantial share can be attributed to its extensive application in food processing and industrial sectors, where it serves as a cost-effective and versatile ingredient.

Crude palm oil remains a key raw material for producing edible oils, margarine, and shortenings, supporting its strong market presence. Additionally, its high yield and relatively lower production costs make it a preferred choice among manufacturers aiming to optimize cost-efficiency. The growing demand for processed foods and ready-to-eat meals further propels the use of crude palm oil, reinforcing its market dominance.

Moreover, its widespread utilization in biodiesel production also contributes to its significant market share, especially in regions with established biofuel mandates. The 49.3% market share underscores the importance of crude palm oil as a primary input in multiple industrial applications, positioning it as a critical product segment in the palm oil market.

By Application Analysis

Edible oil application leads the market, holding a commanding 62.9% share.

In 2024, Edible Oil held a dominant market position in the By Application segment of the Palm Oil Market, with a 62.9% share. The substantial share of edible oil can be attributed to its extensive usage in food processing, particularly in frying, baking, and margarine production.

The increasing demand for processed foods and ready-to-eat meals has significantly driven the consumption of palm oil as a primary cooking oil, reinforcing its market position. Furthermore, palm oil’s stability at high temperatures makes it a preferred choice for commercial frying applications, further supporting its dominance in the edible oil sector. Its affordability and neutral taste also contribute to its widespread adoption in both household and industrial food preparation.

Additionally, the ongoing growth of the food service sector has further accelerated the demand for palm oil in the edible oil segment, solidifying its 62.9% market share. As the market continues to expand, the edible oil segment is expected to maintain its leading position due to the sustained demand for cost-effective and versatile cooking oils in both emerging and developed markets.

By End-use Analysis

Food and beverage sector drives demand, representing 63.2% of palm oil usage.

In 2024, Food and Beverage held a dominant market position in the By End-use segment of the Palm Oil Market, with a 63.2% share. The significant share can be attributed to the extensive utilization of palm oil in processed foods, confectionery, and baked goods, where it serves as a key ingredient for texture enhancement and shelf-life extension.

Palm oil’s cost-effectiveness and versatility make it a preferred choice among food manufacturers, further solidifying its stronghold in the food and beverage sector. Additionally, the rising demand for ready-to-eat and packaged food products has propelled the consumption of palm oil, contributing to its substantial market share. Its stable composition at high temperatures makes it ideal for frying applications, further supporting its usage across fast food chains and commercial kitchens.

Moreover, the food and beverage industry leverages palm oil in the production of margarine, spreads, and snack foods, reinforcing its position as a staple ingredient. The 63.2% share underscores the critical role of palm oil in the food sector, driven by its widespread acceptance as a cost-efficient and functional ingredient in various food applications.

Key Market Segments

By Nature

- Organic

- Conventional

By Product

- Crude Palm Oil

- RBD Palm Oil

- Palm Kernel Oil

- Fractionated Palm Oil

By Application

- Edible Oil

- Bio-Diesel

- Lubricants

- Cosmetics

- Others

By End-use

- Food and Beverage

- Personal Care and Cosmetics

- Energy

- Pharmaceuticals

- Others

Driving Factors

Growing Demand for Edible Oils in Emerging Markets

The increasing consumption of edible oils in emerging economies is a significant driving factor for the palm oil market. As disposable incomes rise and urbanization accelerates, the demand for processed and packaged foods is witnessing substantial growth. Palm oil, being a versatile and cost-effective oil, is extensively used in cooking, baking, and food processing industries, further fueling its market expansion.

Additionally, the expanding foodservice sector and the rise of quick-service restaurants in developing countries are amplifying the demand for palm oil-based products. This trend is expected to continue as consumers increasingly opt for convenient, ready-to-eat food options, thereby bolstering the market for palm oil in the global edible oils sector.

Restraining Factors

Environmental Concerns and Deforestation Threaten Market Growth

The palm oil market faces significant challenges due to mounting environmental concerns associated with its production. The large-scale deforestation and habitat destruction caused by palm oil plantations have drawn criticism from environmental organizations and regulatory bodies worldwide.

This has led to increased scrutiny and stricter sustainability standards, compelling manufacturers to adopt sustainable sourcing practices. Additionally, consumer awareness regarding the environmental impact of palm oil is rising, pushing brands to seek alternative oils or certified sustainable palm oil.

These factors are restraining market growth as companies invest in eco-friendly practices, potentially increasing production costs. The ongoing pressure to balance economic gains with environmental responsibility remains a key challenge for the palm oil industry.

Growth Opportunity

Expanding Biofuel Industry Boosts Palm Oil Demand

The rising adoption of biofuels as a cleaner energy source presents a significant growth opportunity for the palm oil market. Palm oil is increasingly being utilized in the production of biodiesel due to its high yield and cost-effectiveness. Governments in several countries are implementing biofuel mandates and incentives to reduce carbon emissions, further driving demand for palm oil-based biofuels.

Additionally, the ongoing transition toward renewable energy and sustainable fuel alternatives is likely to accelerate palm oil consumption in the energy sector. This trend not only enhances market demand but also opens avenues for palm oil producers to diversify their product applications beyond the traditional food and beverage sector.

Latest Trends

Sustainable Sourcing Gains Momentum in Palm Oil Industry

Sustainability is emerging as a dominant trend in the palm oil sector. Companies are increasingly adopting responsible sourcing practices, driven by consumer demand for eco-friendly products and stricter environmental regulations.

Initiatives such as zero-deforestation commitments and sustainable certification programs are becoming essential for market players.

Additionally, there is a growing emphasis on transparency in supply chains, with companies leveraging digital tools to monitor and report sustainable practices.

This shift not only enhances brand reputation but also mitigates the risk of supply chain disruptions caused by environmental concerns. As more stakeholders prioritize sustainability, the palm oil market is witnessing a significant transformation towards greener and more ethical operations.

Regional Analysis

Asia-Pacific dominates the Palm Oil Market with a 45.8% share, generating USD 29.6 Bn.

In 2024, Asia-Pacific held a dominant position in the global palm oil market, capturing a 45.8% share and generating USD 29.6 Bn in revenue. The region’s substantial market share is driven by extensive palm oil production in countries such as Indonesia and Malaysia, coupled with growing demand in emerging economies. North America and Europe also represent significant markets, driven by the rising use of palm oil in processed foods and personal care products.

Meanwhile, the Middle East & Africa region is witnessing increasing adoption due to its expanding food processing sector. Latin America, with its abundant agricultural resources, continues to emerge as a notable market, focusing on both export and domestic consumption of palm oil.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ADM, Wilmar International Ltd., and Sime Darby Plantation Berhad played pivotal roles in the global palm oil market, leveraging their extensive production networks and strong market presence.

ADM continues to expand its palm oil segment by focusing on sustainable sourcing practices and enhancing its refining capacities to meet the increasing demand for edible oils in North America and Europe. The company is also investing in technology-driven initiatives to improve traceability and reduce its environmental footprint.

Wilmar International Ltd., a dominant player in Asia-Pacific, capitalizes on its vertically integrated operations, encompassing cultivation, processing, and distribution. The company’s strategic focus on sustainable palm oil production and strong supply chain management has solidified its market leadership in key regions such as Indonesia and Malaysia. Additionally, Wilmar is exploring value-added palm oil derivatives to capture emerging opportunities in food and non-food sectors.

Sime Darby Plantation Berhad, a leading palm oil producer, is recognized for its extensive land bank and advanced plantation management practices. The company prioritizes sustainable production, implementing zero-deforestation policies and advanced agricultural techniques. Its emphasis on high-yield, sustainable palm oil has positioned it as a key supplier for major global brands, particularly in the European and Asia-Pacific markets.

Top Key Players in the Market

- ADM

- Wilmar International Ltd.

- Sime Darby Plantation Berhad

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- United Plantations Berhad

- Kulim (Malaysia) Berhad

- IJM Corporation Berhad

- PT Sampoerna Agro, Tbk

- Univanich Palm Oil Public Company Ltd.

- PT. Bakrie Sumatera Plantations tbk

- Asian Agri

Recent Developments

- In January 2025, IOI unveiled a strategic plan focusing on product portfolio expansion, innovation, productivity, and sustainability. The roadmap aims to position IOI as a global leader in sustainable palm products and ingredients.

- In April 2024, Sime Darby Oils (PNG) Limited, a subsidiary of SD Guthrie, applied for clearance to acquire the downstream business of New Britain Palm Oil Limited. This acquisition is part of an internal restructuring to consolidate refining operations in Papua New Guinea.

Report Scope

Report Features Description Market Value (2024) USD 64.8 Billion Forecast Revenue (2034) USD 98.7 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product (Crude Palm Oil, RBD Palm Oil, Palm Kernel Oil, Fractionated Palm Oil), By Application (Edible Oil, Bio-Diesel, Lubricants, Cosmetics, Others), By End-use (Food and Beverage, Personal Care and Cosmetics, Energy, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, United Plantations Berhad, Kulim (Malaysia) Berhad, IJM Corporation Berhad, PT Sampoerna Agro, Tbk, Univanich Palm Oil Public Company Ltd., PT. Bakrie Sumatera Plantations tbk, Asian Agri Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Wilmar International Ltd.

- Sime Darby Plantation Berhad

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- United Plantations Berhad

- Kulim (Malaysia) Berhad

- IJM Corporation Berhad

- PT Sampoerna Agro, Tbk

- Univanich Palm Oil Public Company Ltd.

- PT. Bakrie Sumatera Plantations tbk

- Asian Agri