Oseltamivir Market By Product Type (Suspension, Capsule, and Others), By Application (Influenza A, Influenza B, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133435

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

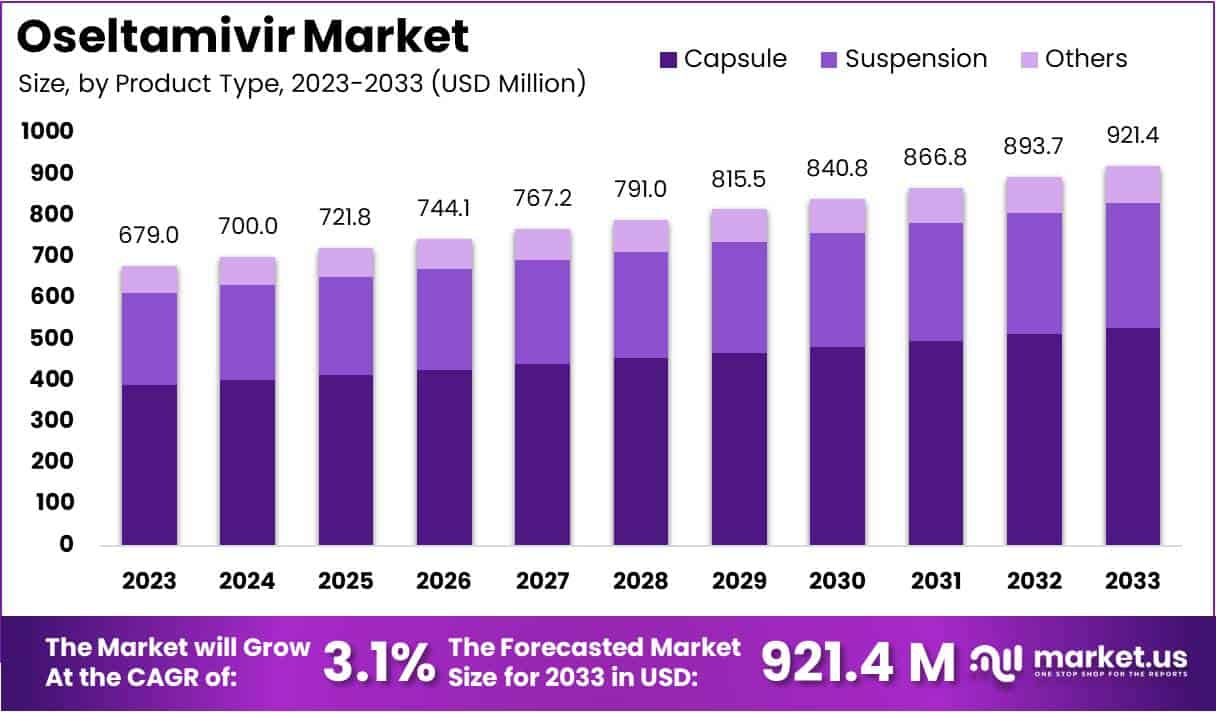

The Oseltamivir Market size is expected to be worth around US$ 921.4 million by 2033 from US$ 679 million in 2023, growing at a CAGR of 3.1% during the forecast period 2024 to 2033.

Growing incidence of seasonal influenza and the increasing need for effective antiviral therapies drive the oseltamivir market. Oseltamivir, widely used for both the treatment and prevention of influenza A and B plays a critical role in reducing symptom severity and preventing complications in high-risk populations.

According to WHO data, between 2021 and 2022, WHO GISRS laboratories tested over 490,516 specimens, identifying 12,368 positive flu cases, with 8,423 attributed to influenza A and 3,945 to influenza B. Rising healthcare expenditure, as reflected in OECD data showing that U.S. healthcare spending accounted for 17.8% of the GDP in 2021, highlights the growing investment in antiviral drugs and flu management.

Recent trends in the market show a shift toward developing next-generation formulations, such as extended-release capsules and pediatric-friendly liquid forms, to improve patient compliance and expand the drug’s use across different age groups. Opportunities also emerge from increased demand for stockpiling antiviral medications to prepare for potential flu pandemics, supporting public health initiatives and emergency response strategies.

Key Takeaways

- In 2023, the oseltamivir market achieved revenues of US$ 679 million, growing at a CAGR of 3.1%.

- It’s projected to reach US$ 921.4 million by 2033.

- The market includes suspension, capsule, and other product types, with capsules leading at a 57.4% market share in 2023.

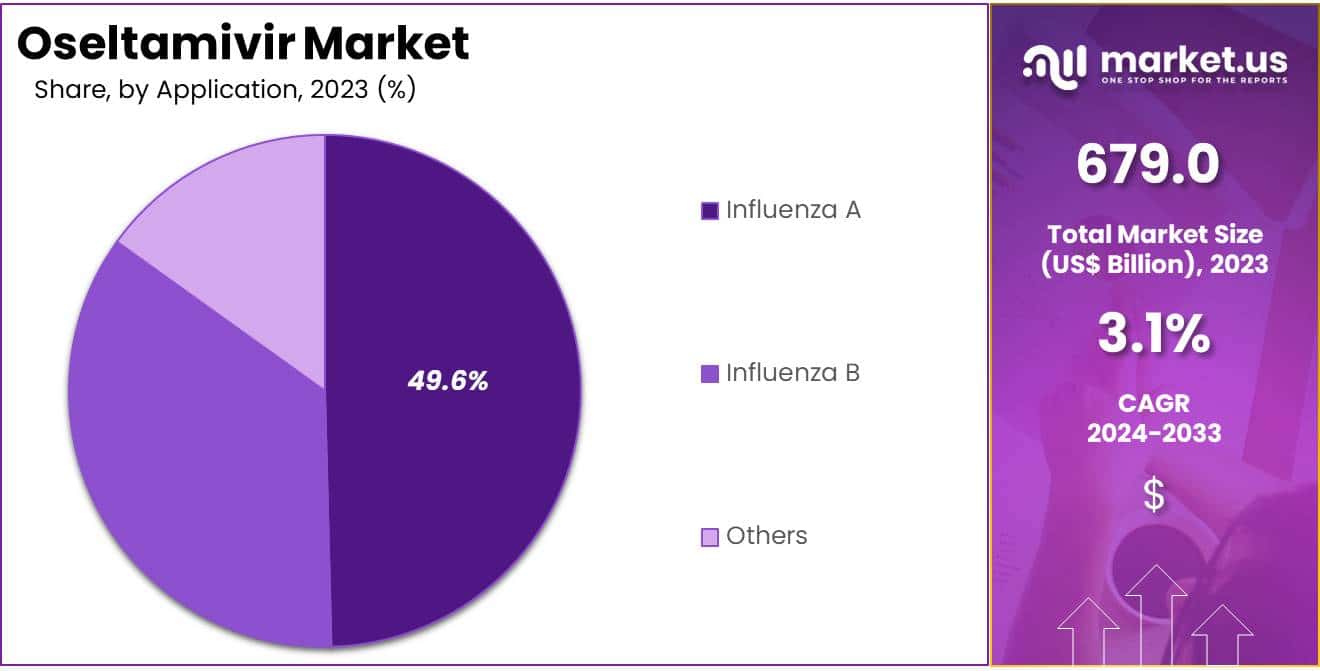

- The application segments are influenza A, influenza B, and others, with influenza A holding a 49.6% share.

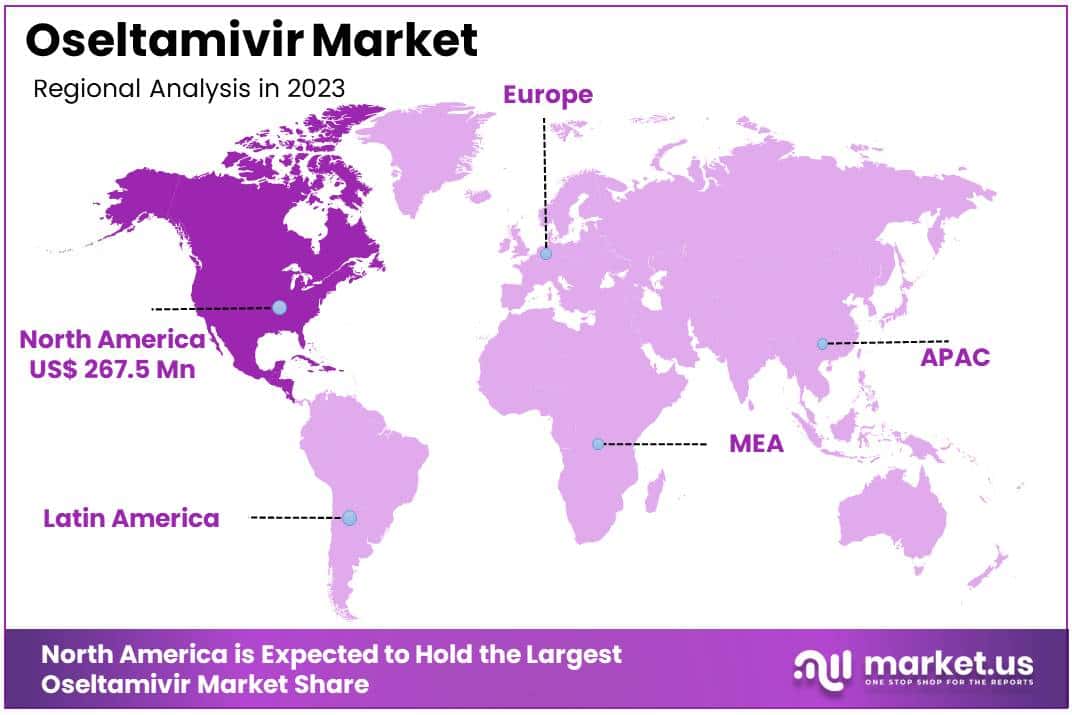

- North America dominated the market with a 39.4% share in 2023.

Product Type Analysis

The capsule segment led in 2023, claiming a market share of 57.4% owing to the convenience and ease of administration that capsules offer, particularly for adults and older children. Capsules provide accurate dosing, improving treatment efficacy and reducing the risk of underdosing or overdosing. The stability and longer shelf life of capsules further enhance their appeal in various healthcare settings, including hospitals and pharmacies.

Additionally, healthcare providers often prefer capsules for their quick absorption and reliable therapeutic outcomes. The growing prevalence of influenza globally and the rising demand for antiviral medications during seasonal flu outbreaks are likely to boost the capsule segment. As awareness about early treatment and prevention of influenza increases, the capsule segment is projected to dominate the oseltamivir market.

Application Analysis

The influenza Aheld a significant share of 49.6% due to the high prevalence and severity of influenza A infections, which often result in more severe complications and higher hospitalization rates. Oseltamivir remains a key antiviral treatment for managing influenza A due to its proven efficacy in reducing the duration and severity of symptoms.

The segment also benefits from widespread global initiatives aimed at controlling influenza outbreaks, particularly those caused by highly virulent influenza A strains such as H1N1 and H3N2. Increased diagnostic capabilities for early detection of influenza A infections further support demand for oseltamivir in this segment. As public health efforts intensify to manage seasonal and pandemic influenza, the influenza A segment is anticipated to experience robust growth in the oseltamivir market.

Key Market Segments

By Product Type

- Suspension

- Capsule

- Others

By Application

- Influenza A

- Influenza B

- Others

Drivers

Rising Impact of COVID-19 on the Oseltamivir Market

The COVID-19 pandemic has significantly driven the demand for oseltamivir as healthcare providers explore treatments to manage co-infections and overlapping symptoms with influenza. According to an article published in Annals of Medicine and Surgery in May 2022, administering oseltamivir to COVID-19 patients led to shorter hospital stays, quicker recovery times, and reduced mortality rates.

These findings highlighted the potential of oseltamivir as a supportive therapy in managing respiratory symptoms during the pandemic. The overlapping symptomatology between influenza and COVID-19 has also intensified the need for antiviral drugs like oseltamivir, especially during flu seasons.

Increased awareness and proactive prescription practices have expanded its use beyond influenza treatment, contributing to market growth. As healthcare systems worldwide continue to battle respiratory illnesses, the oseltamivir market is anticipated to experience sustained demand driven by its utility in mitigating severe outcomes in COVID-19 patients.

Restraints

Rising Cost of Oseltamivir

The high cost of oseltamivir significantly restrains its market growth, particularly in low- and middle-income countries. The expenses associated with oseltamivir treatment, including production, distribution, and retail pricing, often place a financial burden on healthcare systems and patients. Limited insurance coverage and high out-of-pocket costs further exacerbate accessibility challenges, particularly in regions with constrained healthcare budgets.

Rising production costs due to raw material shortages and stringent regulatory requirements also contribute to the elevated pricing. These financial barriers impede the adoption of oseltamivir as a standard treatment for influenza and other viral infections. Additionally, alternative, more affordable antiviral options often divert demand, limiting oseltamivir’s market penetration. The cost constraint is anticipated to hinder broader adoption, particularly in regions where economic factors significantly influence healthcare decisions.

Opportunities

Growing Prevalence of Influenza

The growing prevalence of influenza presents a significant opportunity for the oseltamivir market as the drug remains a first-line treatment for managing flu symptoms and reducing complications. According to the CDC, from October 2021 to June 2022, influenza infections in the U.S. caused 8-13 million symptomatic cases, 3.7-6.1 million medical visits, 82,000-170,000 hospitalizations, and 5,000-14,000 deaths.

Additionally, an article published in Vaccines Journal in May 2022 highlighted 68,077 cases of H3N2 Darwin type A influenza reported in Brazil between November and December 2021. These statistics underscore the persistent global burden of influenza, emphasizing the need for effective antiviral treatments.

Oseltamivir’s proven efficacy in reducing flu severity and preventing complications positions it as a critical tool in combating seasonal influenza outbreaks. As public health campaigns and vaccination efforts increase awareness about flu management, the demand for oseltamivir is projected to grow, particularly in high-risk populations.

Impact of Macroeconomic / Geopolitical Factors

Economic growth in developed regions boosts healthcare spending, leading to increased procurement and distribution of antiviral medications like oseltamivir. This growth enhances access to essential treatments. However, economic instability and inflation in emerging markets can restrict healthcare budgets, limiting access to crucial drugs.

Geopolitical tensions and trade restrictions can disrupt global supply chains. This disruption leads to shortages and higher production costs for pharmaceutical companies. Additionally, diverse regulatory environments across different regions pose challenges for market entry and affect the availability of products like oseltamivir.

The expansion of healthcare infrastructure and a heightened focus on pandemic preparedness offer growth opportunities in the oseltamivir market. These factors encourage innovation and investment, driving demand for antiviral drugs. Government initiatives supporting influenza prevention and treatment further bolster this demand.

Trends

Impact of High Occurrence of Flu-Related Fatalities on the Oseltamivir Market

Rising flu-related fatalities have heightened the demand for effective antiviral treatments. In 2022, the Centers for Disease Control and Prevention (CDC) reported approximately 18,000 flu-related deaths, 25 million illnesses, and 280,000 hospitalizations. Among these cases, 54.2% were attributed to influenza A(H3N2), and 45.8% to influenza A(H1N1).

This significant morbidity and mortality underscore the critical need for antiviral medications like oseltamivir. Healthcare providers and public health agencies have intensified efforts to promote timely antiviral therapy to mitigate severe outcomes.

Pharmaceutical companies are responding by increasing production capacities and ensuring adequate supply chains to meet the growing demand. As awareness of influenza’s impact continues to rise, the oseltamivir market is projected to experience sustained growth, driven by the imperative to reduce flu-related complications and fatalities.

Regional Analysis

North America is leading the Oseltamivir Market

North America dominated the market with the highest revenue share of 39.4% owing to heightened influenza activity and proactive governmental measures. The U.S. Department of Health and Human Services (HHS), through the Administration for Strategic Preparedness and Response (ASPR), responded to increased antiviral demand by releasing additional supplies of Tamiflu from the Strategic National Stockpile in December 2022.

This action ensured adequate availability of oseltamivir across various jurisdictions, facilitating timely treatment during the flu season. The widespread occurrence of influenza-like illnesses, coupled with public health campaigns emphasizing early antiviral intervention, further propelled market expansion.

Additionally, the healthcare sector’s emphasis on preparedness and the strategic stockpiling of antiviral medications contributed to the sustained demand for oseltamivir in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing influenza incidences and strategic distribution partnerships. In February 2023, Zhongchao Inc. declared that Chongqing Xinjiang Pharmaceutical Co., Ltd. secured the right for general distribution in Mainland China for an anti-influenza drug (provided by Natco Pharma Limited).

This collaboration aims to enhance the availability of effective antiviral treatments, addressing the region’s significant influenza burden. Rising healthcare awareness, improved diagnostic capabilities, and government initiatives focusing on infectious disease management are anticipated to further stimulate market growth. The expansion of healthcare infrastructure and increased access to antiviral medications in emerging economies are also expected to contribute to the heightened adoption of oseltamivir across the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the oseltamivir market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the oseltamivir market focus on expanding their production capacities to meet the seasonal surge in demand during flu outbreaks.

Many invest in research to develop generic versions and enhance affordability in price-sensitive markets. Companies collaborate with governments and healthcare organizations to stockpile antiviral medications as part of pandemic preparedness strategies. They also strengthen their distribution networks, ensuring timely delivery to pharmacies and healthcare facilities. Marketing campaigns emphasizing the drug’s effectiveness in early flu treatment help raise awareness and drive adoption among healthcare providers and patients.

Top Key Players in the Oseltamivir Market

- Zydus Cadila

- NATCO Pharma Limited

- Macleods Pharmaceuticals Ltd

- Lupin

- Hetero Healthcare Limited

- F. Hoffmann-La Roche Ltd

- Cipla Inc.

- Amneal Pharmaceuticals LLC

- Alembic Pharmaceuticals Limited

Recent Developments

- In January 2022: Strides Pharma Science Ltd received approval from the U.S. Food and Drug Administration (FDA) for its generic version of oseltamivir phosphate for oral suspension. This approval enhances the availability of cost-effective treatments for influenza, contributing to the growth of the oseltamivir market by increasing competition and expanding patient access to antiviral therapies.

- In October 2021: M.D. Anderson Cancer Center initiated a Phase II clinical study to evaluate the efficacy of baloxavir in combination with oseltamivir for treating severe influenza infections in patients who have undergone hematopoietic stem cell transplants. This study highlights the potential for combination therapies to improve outcomes in high-risk populations, supporting the oseltamivir market by expanding its application in specialized treatment regimens.

Report Scope

Report Features Description Market Value (2023) US$ 679 million Forecast Revenue (2033) US$ 921.4 million CAGR (2024-2033) 3.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Suspension, Capsule, and Others), By Application (Influenza A, Influenza B, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zydus Cadila, NATCO Pharma Limited, Macleods Pharmaceuticals Ltd, Lupin, Hetero Healthcare Limited, F. Hoffmann-La Roche Ltd, Cipla Inc., Amneal Pharmaceuticals LLC, and Alembic Pharmaceuticals Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zydus Cadila

- NATCO Pharma Limited

- Macleods Pharmaceuticals Ltd

- Lupin

- Hetero Healthcare Limited

- F. Hoffmann-La Roche Ltd

- Cipla Inc.

- Amneal Pharmaceuticals LLC

- Alembic Pharmaceuticals Limited