Orthopedic Biomaterials Market By Material Type (Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cement, Metals and Composites), By Application (Orthopedic Implants, Joint Replacement/ Reconstruction, Orthobiologics, Viscosupplementation and Bio-Resorbable Tissue Fixation), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154945

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

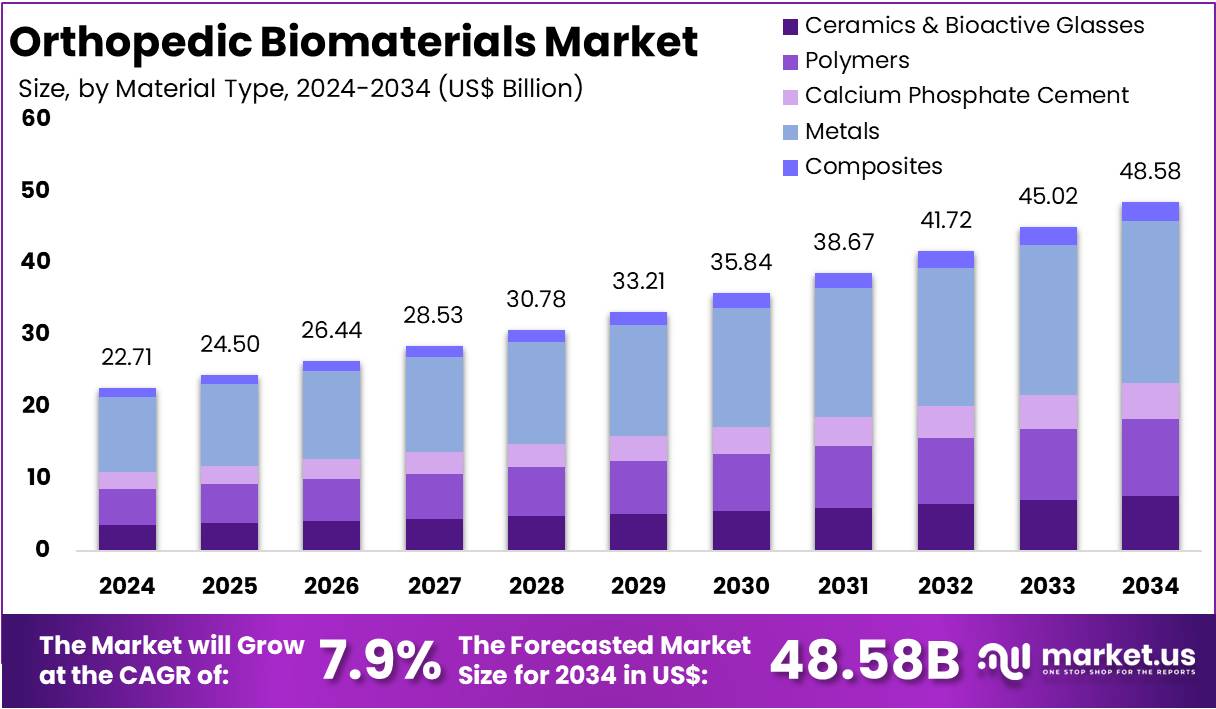

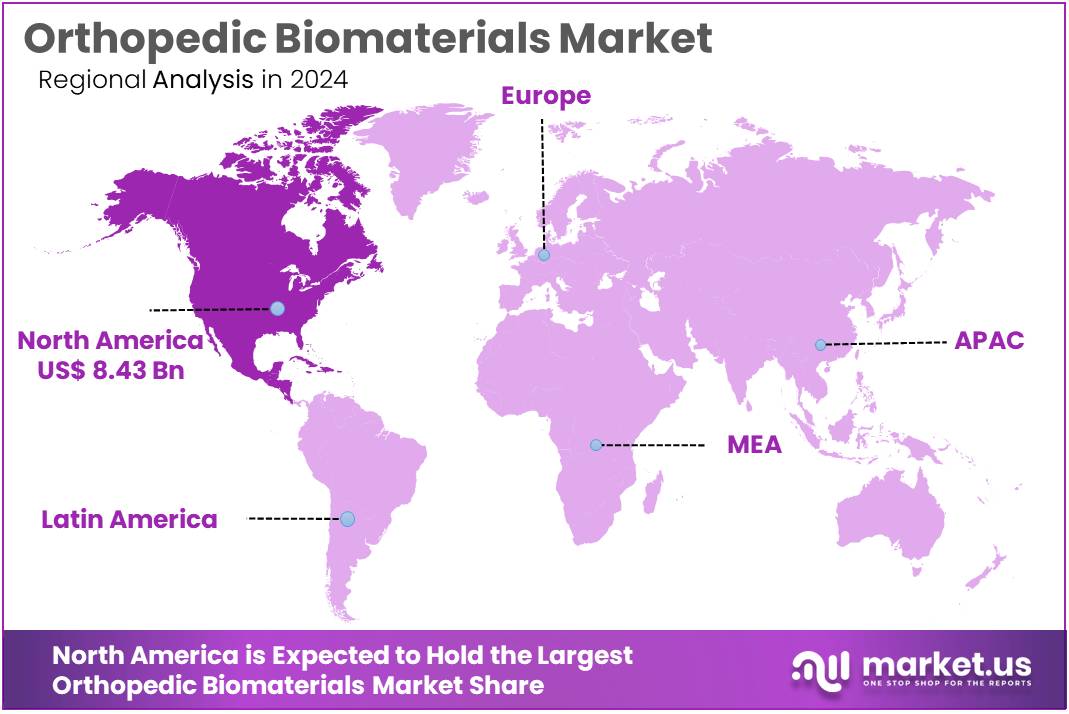

The Global Orthopedic Biomaterials Market Size is expected to be worth around US$ 48.58 Billion by 2034, from US$ 22.71 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.1% share and holds US$ 8.43 Billion market value for the year.

Orthopedic biomaterials are advanced materials designed to improve mobility and reduce pain in patients undergoing orthopedic treatments. These materials are widely used in fracture fixation, joint replacement, and dynamic stabilization. Product categories include reconstructive implants, spinal devices, fracture management tools, arthroscopy tools, casting materials, rehabilitation products, and electrical stimulation devices. Their versatility and application in restoring function and quality of life make them essential to orthopedic care. As the demand for orthopedic procedures increases, the use of specialized biomaterials continues to gain prominence across global healthcare systems.

These materials must perform under high-load conditions, especially in weight-bearing joints. Metals, despite the growing use of polymers and ceramics, remain the primary material of choice in orthopedics. This preference is due to their superior mechanical and chemical properties. Metals such as stainless steel and cobalt-chromium (Co-Cr) alloys offer strength, toughness, and corrosion resistance. Their durability and biocompatibility make them ideal for use in fracture fixation devices and total joint arthroplasty (TJA), where long-term performance and load distribution are critical for patient recovery.

Among metal biomaterials, titanium (Ti) and its alloys are increasingly preferred in orthopedic implants. Titanium offers an excellent balance of strength, corrosion resistance, and biological compatibility. Unlike stainless steel or Co-Cr, titanium is lightweight yet strong, reducing patient discomfort while maintaining durability. Its superior integration with bone also lowers the risk of rejection. Consequently, titanium is widely used in both temporary and permanent implants, from screws and plates to complex joint replacements. Its widespread adoption reflects the evolving focus on advanced, patient-centered orthopedic care.

In February 2025, Maxx Orthopedics received U.S. FDA 510(k) clearance for its asymmetrical Porous Tibial Baseplate. This baseplate is part of the Freedom Total Knee System and is made using 3D printed porous titanium. The design enhances initial implant fixation and supports long-term durability in cementless total knee arthroplasty. This FDA clearance highlights Maxx Orthopedics’ continued innovation in biomaterials. Their product showcases the shift toward personalized, high-performance implants using additive manufacturing and biocompatible metals like titanium in complex orthopedic procedures.

In November 2024, Auxein, a global orthopedic solutions provider, marked a strong presence at MEDICA 2024 in Düsseldorf, Germany. The event featured over 5,800 exhibitors from 72 countries and attracted around 80,000 visitors from 165 nations. Auxein showcased its advanced product portfolio, demonstrating leadership in biomaterial innovation. The company’s participation highlights the growing international demand for high-quality orthopedic materials and solutions. As global healthcare facilities increasingly adopt advanced implants and biomaterials, manufacturers like Auxein continue to play a key role in meeting evolving clinical needs.

Key Takeaways

- In 2024, the market for Orthopedic Biomaterials generated a revenue of US$ 22.71 billion, with a CAGR of 7.9%, and is expected to reach US$ 48.58 billion by the year 2034.

- The System Type segment is divided into Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cement, Metals, and Composites with Metals taking the lead in 2024 with a market share of 46.3%.

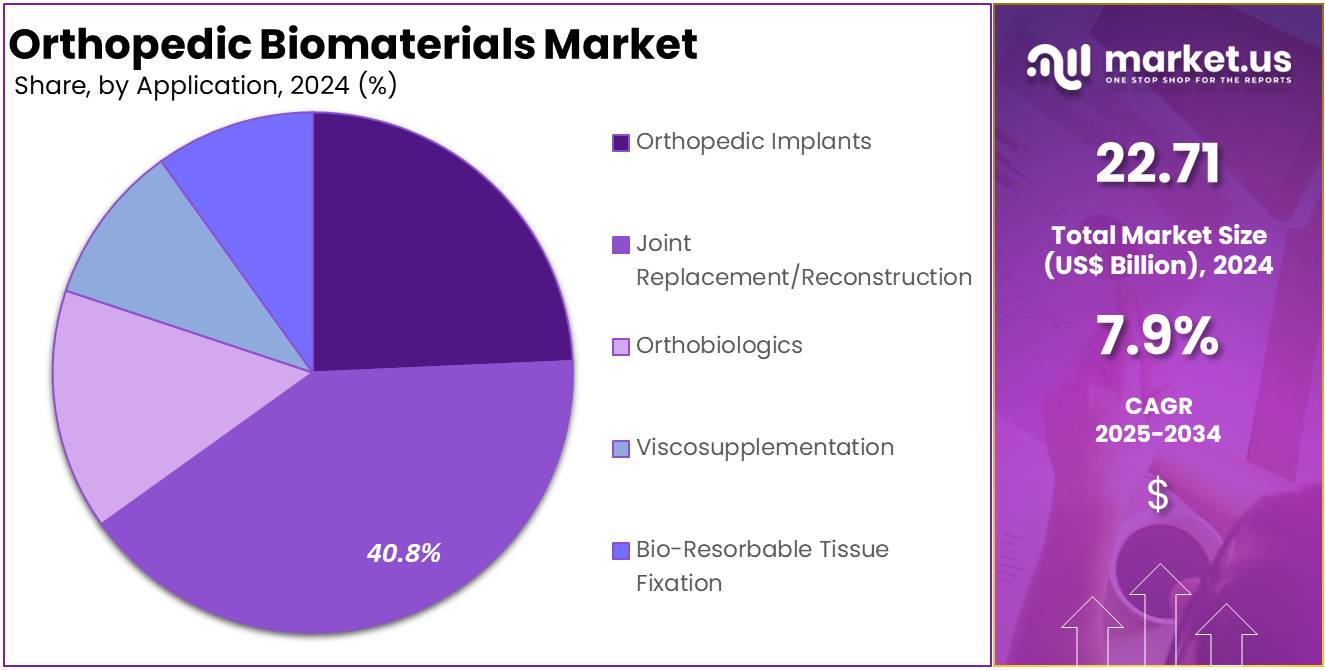

- By Application, the market is bifurcated into Orthopedic Implants, Joint Replacement/Reconstruction, Orthobiologics, Viscosupplementation, and Bio-Resorbable Tissue Fixation, with Joint Replacement/Reconstruction leading the market with 40.8% of market share in 2024.

- Considering the end user segment, the market is bifurcated into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others, with Hospitals taking the lead in 2024 with 55.8% market share.

- North America led the market by securing a market share of 37.1% in 2024.

Material Type Analysis

In the orthopedic biomaterials market, metals dominated as the leading material segment with 46.3% market share. This dominance is largely due to the unique properties that metals offer, including high strength, ductility, fracture toughness, corrosion resistance, and excellent biocompatibility. Metals such as titanium, stainless steel, and cobalt-chromium alloys are widely used in fracture fixation devices, joint replacements, and spinal implants, providing the necessary mechanical support for load-bearing applications.

Metals are particularly favored in total joint arthroplasty (TJA) and fracture fixation because they can withstand high mechanical loads and stresses without compromising the structural integrity of the implant. Additionally, metals are highly customizable in terms of formability, allowing them to be shaped into complex geometries for specific patient needs. In December 2024, Zimmer Biomet Holdings, Inc., a global leader in medical technology, announced that it has received U.S. Food and Drug Administration (FDA) 510(k) clearance for the Persona SoluTion Porous Plasma Spray (PPS) Femur.

Application Analysis

In the orthopedic biomaterials market, the joint replacement/reconstruction segment is the dominant application accounting for over 40.8% market share in 2024. This sector has seen significant growth due to the increasing aging population, rising incidence of joint disorders, and advancements in surgical techniques and biomaterial technologies. Joint replacement, particularly in hips and knees, requires materials that can endure long-term wear and high mechanical loads. Metals, polymers, and ceramics are commonly used in joint implants to provide strength, durability, and biocompatibility.

According to Medbridge statistics from May 2022, total knee arthroplasty (TKA) is the most frequently performed joint replacement surgery, with over 600,000 procedures conducted annually. Total hip arthroplasty (THA) ranks as the second most common. By 2030, the annual number of knee replacements is expected to exceed 3 million.

The typical patient undergoing joint replacement is under 70 years old and belongs to the baby boomer generation (currently aged 57-75). Since joint replacement surgery is elective, many patients consult with two to three different surgeons before deciding to proceed with the procedure.

Additionally, joint reconstruction, often needed for patients with traumatic injuries or degenerative diseases, requires the use of advanced biomaterials that not only restore function but also promote healing. This segment’s growth is also driven by improvements in materials that enhance implant longevity and reduce complications such as wear or implant failure.

End User Analysis

In the orthopedic biomaterials market, hospitals are the dominant end user with 55.8% market share. Hospitals, particularly those with specialized orthopedic departments, play a central role in the treatment and management of bone and joint disorders. They are equipped with advanced surgical facilities, allowing for complex procedures such as joint replacements, spinal surgeries, and fracture fixations. The need for orthopedic biomaterials in hospitals is high due to the large volume of surgeries conducted annually, including elective and trauma-related procedures.

In May 2025, STAR Hospitals in Nanakramguda introduced the New-Gen Robotic Surgery System for joint replacement surgeries. This advanced innovation is designed to offer enhanced precision, quicker recovery, and reduced pain for patients dealing with chronic knee joint issues. Hospitals are often the primary settings for major orthopedic surgeries, where high-quality implants and biomaterials are critical for patient outcomes. Additionally, hospitals have the necessary infrastructure for post-surgical care, rehabilitation, and follow-up treatments.

Key Market Segments

By Material Type

- Ceramics & Bioactive Glasses

- Polymers

- Calcium Phosphate Cement

- Metals

- Composites

By Application

- Orthopedic Implants

- Joint Replacement/Reconstruction

- Orthobiologics

- Viscosupplementation

- Bio-Resorbable Tissue Fixation

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Growing Burden of Aging Population

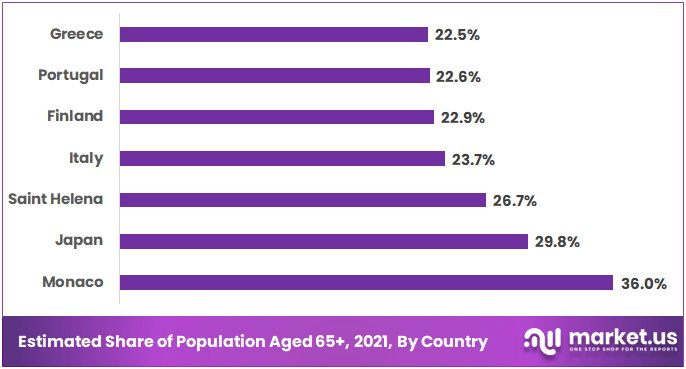

The aging population is a significant driver of the orthopedic biomaterials market. As people live longer, the incidence of musculoskeletal disorders, such as osteoarthritis, fractures, and bone diseases, increases. According to the World Health Organization, by 2050, the global population aged 60 years and older is expected to reach over 2 billion.

As bones weaken with age, the need for orthopedic procedures, including joint replacements, spinal surgeries, and bone repairs, rises. This demographic shift drives demand for orthopedic biomaterials such as ceramics, metals, and polymers, which are used in implants and prosthetics.

Additionally, older individuals are more likely to suffer from falls and fractures, further amplifying the need for orthopedic interventions. The growing prevalence of age-related conditions such as osteoporosis is expected to continue fueling the market for orthopedic biomaterials, creating opportunities for innovations in materials and improving patient outcomes in the long term.

Restraints

High Cost of Implants

The high cost of orthopedic implants and biomaterials is a key restraint in the market. The advanced technology and quality control required in manufacturing orthopedic biomaterials, such as custom implants, biodegradable materials, and specialized coatings, significantly increase their production cost. As a result, the final product can be expensive, limiting its accessibility, particularly in low- and middle-income regions. Patients may also face financial barriers to accessing necessary treatments, leading to delayed surgeries or suboptimal healthcare outcomes.

Even though healthcare systems in developed countries may cover a portion of these costs, the overall price of procedures like joint replacements can still be prohibitively high. This challenge underscores the need for cost-effective alternatives and advancements in material science that can lower the cost of production without compromising quality and safety. Overcoming this barrier requires innovations in cost-efficient manufacturing techniques and wider insurance coverage to improve global access to advanced orthopedic care.

Opportunities

Growth in Emerging Markets

Emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, present significant opportunities for the orthopedic biomaterials market. As healthcare infrastructure improves in these regions, there is a rising demand for advanced medical solutions, including orthopedic implants and biomaterials.

Increased urbanization, a growing middle class, and greater access to healthcare are key factors contributing to the market’s expansion. Moreover, countries like China and India, with large populations, face a high incidence of musculoskeletal disorders due to both aging populations and lifestyle factors, driving the demand for orthopedic interventions.

As healthcare systems in these regions develop and as more people seek treatment for conditions like osteoarthritis and sports injuries, orthopedic biomaterials are expected to experience robust growth. Expanding healthcare coverage, government initiatives, and medical tourism are also expected to boost the adoption of orthopedic technologies, creating new revenue streams for market players.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as economic growth, disposable income, and healthcare expenditure play a crucial role in shaping the market. In regions with strong economic growth, there is often increased spending on healthcare, including orthopedic procedures. As a result, demand for joint replacements, fracture fixation devices, and spinal implants rises. Conversely, economic downturns or recessions can lead to budget cuts in healthcare systems, reducing the affordability of elective orthopedic surgeries, thereby affecting the market negatively.

Healthcare infrastructure and insurance are also critical macroeconomic factors. In countries with well-established healthcare systems and comprehensive insurance coverage, patients are more likely to undergo expensive orthopedic treatments, driving market growth. However, in emerging markets with limited access to healthcare or poor insurance penetration, the demand for advanced orthopedic biomaterials might be lower.

Geopolitical factors such as political stability, trade policies, and global supply chain disruptions can also influence the market. Trade restrictions, tariffs, or geopolitical tensions may affect the supply of raw materials for orthopedic biomaterials, especially metals, which are vital for implants. Countries with political instability may also face challenges in importing or manufacturing these materials, limiting market availability.

Latest Trends

Preference Towards 3D Printing and Customization

One of the most notable trends in the orthopedic biomaterials market is the growing use of 3D printing for the customization of implants. This trend is revolutionizing the way orthopedic procedures are approached, allowing for implants tailored to individual patient anatomy, improving both fit and functionality. Traditional implants often face challenges related to misalignment or patient-specific requirements, but 3D printing offers a solution by producing precise, personalized designs based on detailed imaging scans of the patient’s body.

This technology is particularly valuable in complex orthopedic surgeries such as joint replacements, spinal fusion, and reconstructive surgeries. In addition to providing better outcomes, 3D printing allows for quicker manufacturing times and the potential for lower production costs. The trend also supports the development of bioresorbable and hybrid materials that improve recovery and reduce the need for follow-up surgeries. As this technology becomes more accessible and cost-effective, it is likely to play a pivotal role in shaping the future of orthopedic biomaterials, enhancing surgical precision and patient satisfaction.

In October 2024, VCA Animal Hospitals, a leader in personalized care solutions for pets, announced the opening of its state-of-the-art 3D Printing Lab dedicated to orthopedic surgeries for pets at VCA Northwest Veterinary Specialists in Clackamas, Ore. This innovative facility aims to transform the treatment of orthopedic conditions in pets, providing customized solutions that promote faster recovery and improve quality of life.

Regional Analysis

North America is leading the Orthopedic Biomaterials Market

North America leads the orthopedic biomaterials market with 37.1% market share due to its advanced healthcare infrastructure, high disposable income, and strong demand for orthopedic treatments. The U.S. and Canada are home to some of the world’s most technologically advanced healthcare systems, where a large number of orthopedic procedures, such as joint replacements, spinal surgeries, and fracture fixations, are performed annually.

The aging population in North America is a significant driver, with an increasing number of individuals requiring joint replacements and treatments for musculoskeletal disorders. The region’s well-established insurance systems also make these procedures more accessible to patients.

Additionally, major orthopedic implant manufacturers, such as Stryker, Zimmer Biomet, and Johnson & Johnson, are based in North America, contributing to market growth through innovation and the introduction of advanced biomaterials. Furthermore, North America’s emphasis on research and development, supported by significant healthcare funding, ensures that it remains a leader in the orthopedic biomaterials market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key Opinion Leaders

Leader Name Opinion Dr. Emily Carter, Vice President of Research and Development, Zimmer Biomet “The orthopedic biomaterials industry is at an exciting juncture, driven by innovations that are transforming patient care. As demand for joint replacements and fracture fixation grows globally, there is a clear need for materials that offer enhanced durability, strength, and biocompatibility. The evolution of materials like advanced polymers, ceramics, and bioactive coatings is fundamentally changing how we approach orthopedic treatments. I believe we are just beginning to realize the potential of next-generation materials that can improve patient outcomes, minimize complications, and prolong the life of implants. Zimmer Biomet is proud to be at the forefront of these advancements, shaping the future of orthopedic care.” Dr. David Lee, Chief Medical Officer, Stryker Corporation “The orthopedic biomaterials industry is entering a period of rapid transformation. With the rising prevalence of musculoskeletal disorders, we are seeing an increased demand for implants that not only perform better but also address long-term patient needs. The focus is now on creating materials that can withstand greater mechanical stresses, while also promoting faster recovery and reducing complications. The shift towards bioactive and resorbable materials, combined with advances in 3D printing and customization, is pushing the boundaries of what is possible in orthopedic care.” Dr. Richard Miller, Director of Orthopedic Innovation, DePuy Synthes “The orthopedic biomaterials industry is experiencing significant advancements, with a growing emphasis on improving the functionality and longevity of implants. As the global population ages and the demand for orthopedic procedures increases, the need for innovative materials that can meet the challenges of load-bearing applications is paramount. We are seeing tremendous progress in the development of biomaterials that not only enhance mechanical strength but also support natural tissue healing through bioactive properties. With new materials like calcium phosphate and advanced ceramics, we’re paving the way for longer-lasting solutions that improve the quality of life for patients. The future of this industry is bright, and DePuy Synthes is excited to be leading the charge toward more effective, biocompatible, and durable orthopedic biomaterials.” Top Key Players in the Orthopedic Biomaterials Market

- Zimmer Biomet

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Medtronic

- Smith & Nephew

- Globus Medical

- Invibio Ltd.

- Evonik Industries AG

- Wright Medical Group N.V.

- NuVasive, Inc.

- K2M, Inc.

- Braun Melsungen AG

- Other players

Recent Developments

- In June 2024, Restor3d, a company specializing in 3D-printed orthopedic implants, secured USD 70 million in funding. This includes a USD 55 million Series A round led by Summers Value Partners, along with USD 15 million in debt capital from Trinity Capital.

- In May 2023, OceanTech Acquisitions I Corp. announced a definitive agreement and merger plan with Regentis Biomaterials Ltd. Regentis developed the Gelrin platform, which uses resorbable hydrogel implants to regenerate damaged or diseased tissue in orthopedic treatments. The key components of the Gelrin platform include polyethylene glycol diacrylate (PEGDA) and denatured fibrinogen.

- In March 2023, NuVasive received FDA 510(k) clearance for the expanded use of the Precice IMLL system, including the Precice Short, for limb lengthening of the tibia (shin bone) and femur (thigh bone) in patients over 12 years old. This update ensures that healthcare providers are informed about the current indications and Instructions for Use for the IMLL system. Additionally, healthcare providers are reminded that the device should be removed after one year.

Report Scope

Report Features Description Market Value (2024) US$ 22.71 billion Forecast Revenue (2034) US$ 48.58 billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cement, Metals and Composites), By Application (Orthopedic Implants, Joint Replacement/Reconstruction, Orthobiologics, Viscosupplementation and Bio-Resorbable Tissue Fixation), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Medtronic, Smith & Nephew, Globus Medical, Invibio Ltd., Evonik Industries AG, Wright Medical Group N.V., NuVasive, Inc., K2M, Inc., B. Braun Melsungen AG, and Other players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Orthopedic Biomaterials MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Biomaterials MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zimmer Biomet

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Medtronic

- Smith & Nephew

- Globus Medical

- Invibio Ltd.

- Evonik Industries AG

- Wright Medical Group N.V.

- NuVasive, Inc.

- K2M, Inc.

- Braun Melsungen AG

- Other players