Organ Transplant Immunosuppressant Drugs Market By Drug Class (Calcineurin Inhibitors, Antiproliferative Agents, mTOR Inhibitors, Corticosteroids, Monoclonal Antibodies, and Others), By Organ Type (Kidney, Liver, Heart, Lung, Pancreas, and Others), By Route of Administration (Oral, Intravenous, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150834

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

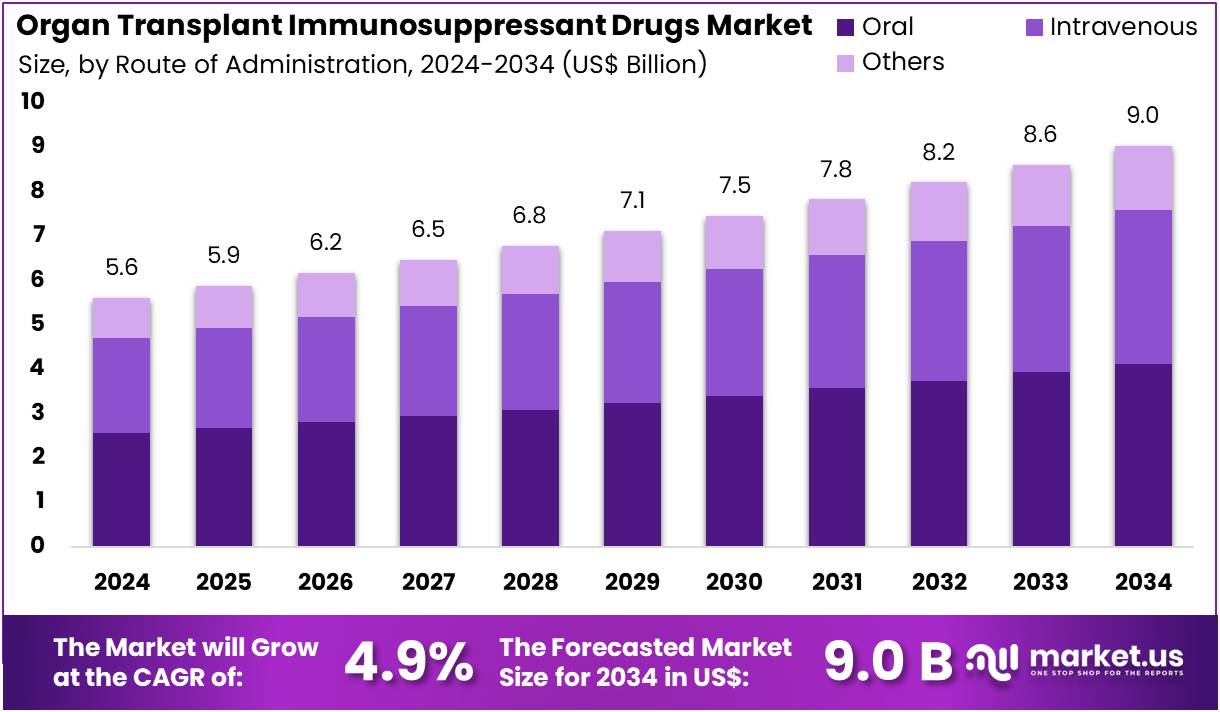

The Organ Transplant Immunosuppressant Drugs Market Size is expected to be worth around US$ 9.0 billion by 2034 from US$ 5.6 billion in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034.

Rising demand for organ transplants and the need for effective rejection management drive the organ transplant immunosuppressant drugs market. These drugs play a crucial role in preventing organ rejection following transplants, ensuring the success of procedures like kidney, liver, heart, and lung transplants. Recent advancements in immunosuppressant therapies, such as more targeted, patient-specific treatments, offer new opportunities for reducing side effects while enhancing patient outcomes.

Innovations like Veloxis Pharmaceuticals Inc.’s VEL-101, which received fast-track FDA approval in February 2022 for preventing renal allograft rejection, reflect the market’s shift toward more specialized therapies. Such developments not only improve graft survival rates but also help address the growing challenge of transplant rejection management. As the transplant market grows, the application of immunosuppressive agents expands to treat complications in various organ types, supporting improved long-term care for transplant recipients.

With advancements in personalized medicine, there is increasing potential for reducing the dependence on traditional broad-spectrum immunosuppressants, which can cause significant side effects. Furthermore, government investments and supportive regulatory policies offer promising avenues for continued research and market growth. Consequently, the organ transplant immunosuppressant drugs market is expected to see significant progress, catering to the evolving needs of transplant recipients globally.

Key Takeaways

- In 2024, the market for organ transplant immunosuppressant drugs generated a revenue of US$ 5.6 billion, with a CAGR of 4.9%, and is expected to reach US$ 9.0 billion by the year 2034.

- The drug class segment is divided into calcineurin inhibitors, antiproliferative agents, mtor inhibitors, corticosteroids, monoclonal antibodies, and others, with calcineurin inhibitors taking the lead in 2023 with a market share of 34.2%.

- Considering organ type, the market is divided into kidney, liver, heart, lung, pancreas, and others. Among these, kidney held a significant share of 37.5%.

- Furthermore, concerning the route of administration segment, the market is segregated into oral, intravenous, and others. The oral sector stands out as the dominant player, holding the largest revenue share of 45.6% in the organ transplant immunosuppressant drugs market.

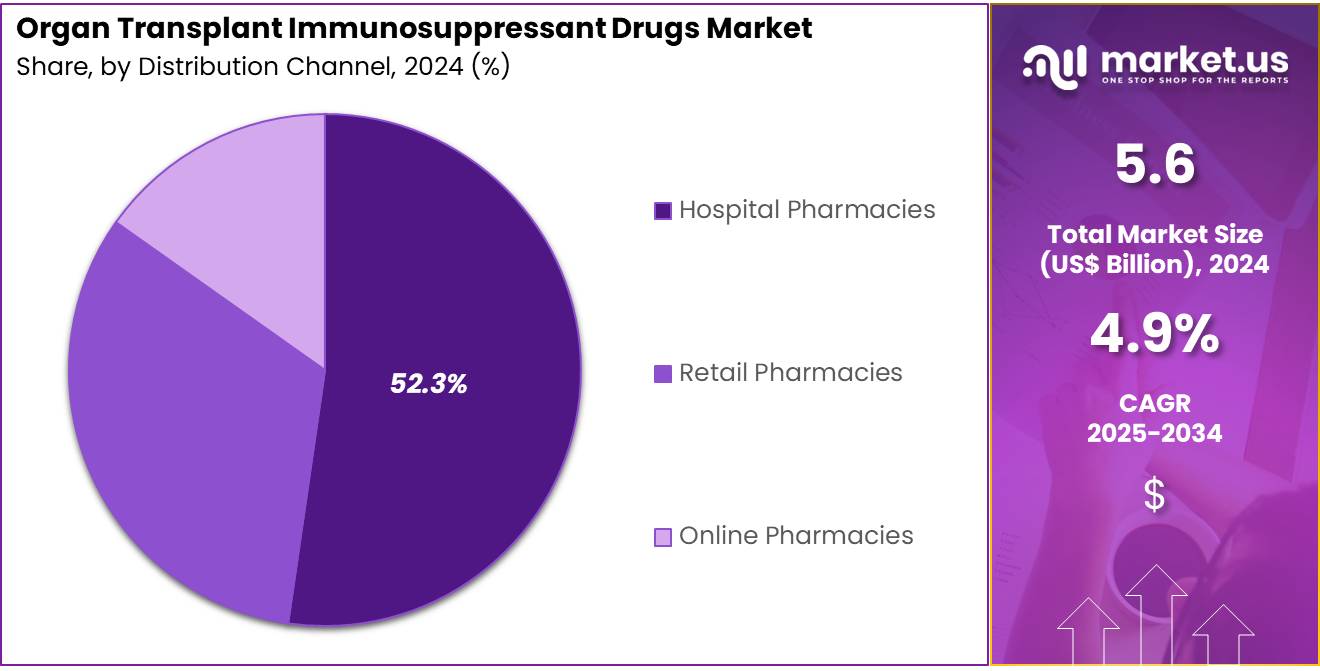

- The distribution channel segment is segregated into hospital pharmacies, retail pharmacies, and online pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 52.3%.

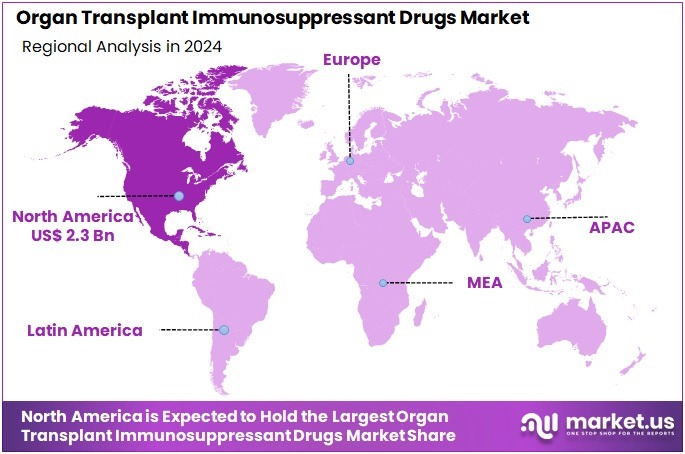

- North America led the market by securing a market share of 41.6% in 2023.

Drug Class Analysis

The calcineurin inhibitors segment claimed a market share of 34.2% owing to its essential role in preventing organ rejection after transplants, particularly kidney and liver transplants. Calcineurin inhibitors, such as tacrolimus and cyclosporine, are widely used for their ability to suppress immune responses effectively. This segment’s growth is anticipated to be driven by the increasing number of organ transplants globally and advancements in drug formulations that enhance the drugs’ efficacy and reduce side effects.

The growing prevalence of chronic kidney disease, which necessitates kidney transplantation, further supports the demand for calcineurin inhibitors. Additionally, the continuous improvements in drug delivery systems and formulations are likely to bolster this segment’s growth.

Organ Type Analysis

The kidney held a significant share of 37.5% due to a rising global incidence of chronic kidney diseases, diabetes, and hypertension, all of which contribute to kidney failure. The demand for kidney transplants is projected to continue rising, particularly in developed countries where dialysis treatments are costly and limited.

Moreover, kidney transplant procedures have higher success rates compared to other organ transplants, which is likely to increase the number of patients opting for such procedures. Innovations in immunosuppressive drug treatments that specifically target kidney transplant rejection are also anticipated to drive growth in this segment, making it a key focus for pharmaceutical companies in the organ transplant field.

Route of Administration Analysis

The oral segment had a tremendous growth rate, with a revenue share of 45.6% owing to its convenience and ease of use for patients requiring immunosuppressive therapy. Oral medications such as tacrolimus and mycophenolate mofetil are increasingly preferred over intravenous forms because they eliminate the need for hospital visits, enhancing patient compliance and convenience.

This segment’s growth is anticipated to be fueled by the growing demand for patient-friendly drug delivery forms and the rising number of outpatient treatments. As healthcare systems focus on improving patient adherence to medication regimens, the oral route is expected to become the dominant choice for post-transplant drug administration. Furthermore, advancements in oral drug formulations that ensure better absorption and reduced side effects are likely to contribute to the expansion of this segment.

Distribution Channel Analysis

The hospital pharmacies segment grew at a substantial rate, generating a revenue portion of 52.3% due to their crucial role in managing post-transplant patient care. These pharmacies are expected to be the primary point of access for immunosuppressive drugs, given their proximity to transplant centers and the expertise required to manage complex medications. Hospital pharmacies are likely to benefit from the rising number of organ transplant surgeries and the increasing demand for personalized immunosuppressive treatments.

Moreover, the growing collaboration between pharmaceutical companies and hospitals for tailored therapies and drug access programs is expected to bolster the growth of this segment. As hospitals become the main provider of specialized treatments for transplant patients, the demand for hospital pharmacies is anticipated to rise substantially.

Key Market Segments

By Drug Class

- Calcineurin Inhibitors

- Antiproliferative Agents

- mTOR Inhibitors

- Corticosteroids

- Monoclonal Antibodies

- Others

By Organ Type

- Kidney

- Liver

- Heart

- Lung

- Pancreas

- Others

By Route of Administration

- Oral

- Intravenous

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Number of Organ Transplants is Driving the Market

The growing number of organ transplant procedures performed globally is a primary driver for the organ transplant immunosuppressant drugs market. These life-saving procedures necessitate lifelong immunosuppressive therapy to prevent organ rejection. According to the Organ Procurement and Transplantation Network (OPTN) and the Health Resources and Services Administration (HRSA), more than 48,000 organ transplants were performed in the U.S. in 2024, reflecting a consistent upward trend.

This marked a significant increase from 46,632 organ transplants performed in 2023, which itself was an 8.7% increase over 2022. Globally, in 2022 alone, 157,553 organ transplants were performed worldwide. As transplant techniques improve and patient eligibility expands, the volume of these procedures is expected to continue rising, directly fueling the demand for immunosuppressant drugs.

Restraints

Significant Side Effects and Adherence Challenges are Restraining the Market

The organ transplant immunosuppressant drugs market faces significant restraint due to the notable side effects associated with long-term use of these medications and the persistent challenges in patient adherence. Immunosuppressants can cause a range of adverse effects, including increased risk of infection, kidney dysfunction, high blood pressure, diabetes, and certain cancers.

A review on immunosuppressant adherence after heart transplantation, published in March 2025, noted that non-adherence with medication management regimens was observed in 82.7% of patients on immunosuppressive medications within one to five years after heart transplantation. These side effects can severely impact patients’ quality of life, often leading to non-adherence, which then increases the risk of graft rejection and necessitates more intensive medical interventions, ultimately limiting the optimal therapeutic outcome despite their vital role.

Opportunities

Development of Novel and Personalized Immunosuppression Creates Growth Opportunities

The growing research in immunosuppressant therapies is driving new market opportunities. Scientists are focusing on the development of safer drugs that minimize broad immune suppression. Personalized immunosuppression strategies are gaining traction, aiming to reduce long-term side effects while maintaining transplant success. In November 2022, Temple University, in partnership with Veloxis Pharmaceuticals, launched a Phase 4 clinical trial. This trial evaluates the dosing of once-daily extended-release tacrolimus tablets in new kidney transplant patients. These advancements indicate increasing efforts toward more effective and safer drug regimens.

The market is also supported by innovations in precision medicine. Biomarkers are now being used to understand individual immune responses better. This enables physicians to tailor immunosuppressant doses for each patient, improving outcomes and lowering risks. A study published in April 2025 examined the use of biomarker-guided withdrawal in liver transplant patients. It showed promising results for predicting success without long-term immunosuppression. This trend reflects a shift toward patient-specific treatment, improving safety and effectiveness in transplantation care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the organ transplant immunosuppressant drugs market, particularly given the high cost associated with both transplant procedures and the lifelong medication required. Economic prosperity often leads to increased government and private healthcare spending, facilitating greater access to organ transplantation and the necessary immunosuppressant drugs. Conversely, economic downturns can result in budget cuts for healthcare systems, potentially impacting reimbursement policies for these expensive therapies or increasing out-of-pocket costs for patients.

Geopolitical factors, such as international trade agreements and the stability of global supply chains for active pharmaceutical ingredients (APIs) and manufacturing, are also critical. For instance, the Medicine Maker reported in May 2025 that pharmaceutical firms are prioritizing stronger connections with local suppliers due to geopolitical risks, highlighting a shift towards more resilient supply chains. Despite these broader influences, the critical and life-sustaining nature of organ transplantation ensures a foundational demand for these drugs, often leading to resilience in the face of economic and political shifts.

Current US tariff policies can have a direct impact on the organ transplant immunosuppressant drugs market. Tariffs on imported active pharmaceutical ingredients (APIs) or finished drug products, especially from key manufacturing regions, could significantly increase production costs for pharmaceutical companies.

The Journal of Managed Care & Specialty Pharmacy projected in May 2025 that a 25% ad valorem tariff could increase medication costs by an average of around US$600 per year per household in the United States, potentially affecting the affordability of immunosuppressants. This could translate to higher prices for these essential medications, potentially impacting patient access and adherence, which is critical for transplant success.

However, these tariffs could also incentivize domestic manufacturing of APIs and finished immunosuppressant drugs within the US. This might lead to a more secure and localized supply chain in the long term, potentially reducing dependency on foreign suppliers and enhancing national pharmaceutical resilience despite the initial cost pressures.

Trends

Increasing Focus on Biomarker-Guided Therapy is a Recent Trend

A prominent recent trend in the organ transplant immunosuppressant drugs market is the escalating focus on biomarker-guided therapy. This approach involves using specific biological markers to monitor a patient’s immune status and predict the risk of rejection or toxicity, thereby allowing for more personalized and precise adjustment of immunosuppressant drug dosages. This aims to optimize drug levels, reduce side effects, and improve long-term graft survival.

A clinical trial on biomarker-guided immunosuppression withdrawal in liver transplantation, published in April 2025, explored using transcript levels of specific genes in liver biopsies to predict withdrawal success, indicating the growing adoption of such strategies. This shift towards personalized, biomarker-driven management offers the potential for improved patient outcomes and more efficient use of immunosuppressant drugs.

Regional Analysis

North America is leading the Organ Transplant Immunosuppressant Drugs Market

North America held the highest revenue share of 41.6% in the market. This dominance is driven by the ongoing need to manage transplant recipients over the long term. Policy reforms have also strengthened market growth. A notable example is the Medicare immunosuppressive drug benefit, which began on January 1, 2023. This policy offers continuous drug coverage for certain kidney transplant patients, even after their standard Medicare ESRD benefits expire. By February 2024, 104 patients had enrolled under this program, reflecting its gradual implementation.

This benefit reduces the financial stress on patients. In the past, many had to ration or stop their medications due to cost. This often led to transplant failures. The new policy ensures uninterrupted access to immunosuppressive therapy, which improves long-term graft survival. Additionally, more patients are now living longer with functioning transplants. This further increases demand for these essential drugs. Together, improved access and longer survival continue to support the region’s strong market position.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to register the fastest compound annual growth rate (CAGR) in the organ transplant immunosuppressant drugs market. This growth is driven by rising healthcare investments and an increasing number of organ transplant procedures. According to the World Bank, health expenditure in East Asia and the Pacific reached 5.43% of GDP in 2022. This steady rise in funding reflects strong regional government support for healthcare. It is also enabling the expansion of advanced medical programs, particularly in transplant medicine, across developing countries.

Improved financial commitment is expected to strengthen transplant infrastructure. As a result, access to life-saving procedures is likely to grow. This expansion will increase the demand for immunosuppressant drugs used in post-transplant care. In addition, better healthcare systems and improved diagnostic capabilities are expected to identify more patients eligible for transplants. A larger patient base will further contribute to market growth. Collectively, these factors position Asia Pacific as a key high-growth region in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the organ transplant immunosuppressant drug market pursue various strategies to drive growth, including product innovation, strategic partnerships, and geographic expansion. Companies focus on developing new formulations and delivery methods to enhance efficacy and reduce side effects.

They also collaborate with healthcare providers to improve patient access to these therapies. Leading firms invest heavily in research and development to address unmet medical needs and maintain a competitive edge. Additionally, key players target emerging markets with high transplantation rates, capitalizing on the growing demand for these treatments.

Novartis is a global healthcare company that develops and manufactures a wide range of innovative medicines, including immunosuppressant drugs for organ transplant patients. Known for its strong research and development capabilities, Novartis focuses on improving the quality of life for transplant recipients through its robust immunosuppressive therapy portfolio.

The company has a significant global presence, with operations in over 140 countries, and continues to invest in expanding its portfolio through acquisitions, partnerships, and cutting-edge research to address the evolving needs of transplant patients.

Top Key Players in the Organ Transplant Immunosuppressant Drugs Market

- Viatris Inc.

- United Therapeutics

- Sanofi

- Novartis AG

- GlaxoSmithKline plc.

- Genentech

- Reddy’s Laboratories Ltd

- Astellas Pharma d.o.o.

- Accord Healthcare Ltd

Recent Developments

- In April 2024: United Therapeutics successfully performed the first-ever xenothymokidney transplant into a living human using immunosuppressive medications approved by the FDA. This breakthrough is expected to drive the organ transplant immunosuppressant drugs market by increasing demand for more advanced and effective immunosuppressive therapies, expanding the market’s potential for new treatments that ensure the success of complex transplant procedures.

- In June 2023: Dr. Reddy’s Laboratories Ltd. announced the successful completion of the Phase I trial for its proposed biosimilar immunosuppressive drugs. This development is set to drive the organ transplant immunosuppressant drugs market by introducing affordable alternatives to existing therapies, making these life-saving treatments more accessible and cost-effective, which is expected to increase adoption rates across different patient populations.

Report Scope

Report Features Description Market Value (2024) US$ 5.6 billion Forecast Revenue (2034) US$ 9.0 billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Calcineurin Inhibitors, Antiproliferative Agents, mTOR Inhibitors, Corticosteroids, Monoclonal Antibodies, and Others), By Organ Type (Kidney, Liver, Heart, Lung, Pancreas, and Others), By Route of Administration (Oral, Intravenous, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viatris Inc., United Therapeutics , Sanofi, Novartis AG, GlaxoSmithKline plc., Genentech, Dr. Reddy’s Laboratories Ltd, Astellas Pharma d.o.o., Accord Healthcare Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organ Transplant Immunosuppressant Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Organ Transplant Immunosuppressant Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris Inc.

- United Therapeutics

- Sanofi

- Novartis AG

- GlaxoSmithKline plc.

- Genentech

- Reddy’s Laboratories Ltd

- Astellas Pharma d.o.o.

- Accord Healthcare Ltd