Global Nutritional Bars Market Size, Share, And Enhanced Productivity By Product (Cereal/Granola Bars, Protein Bars, Energy Bars/Meal Replacements Bars, Fruits and Nuts Bars, Others), By Category (Gluten-free, Conventional), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172189

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

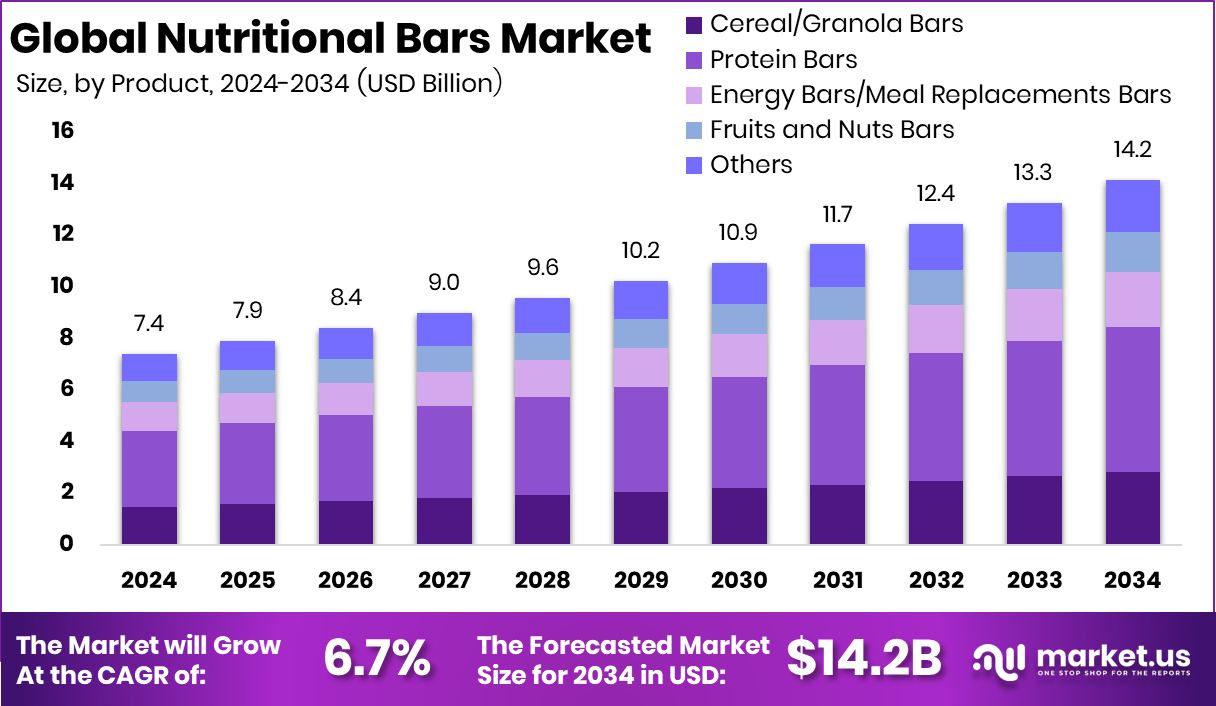

The Global Nutritional Bars Market is expected to be worth around USD 14.2 billion by 2034, up from USD 7.4 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. North America dominates the nutritional bars market with a 43.80% share, reaching USD 3.2 Bn.

Nutritional bars are compact food products designed to provide energy and essential nutrients in a convenient form. They often contain a mix of proteins, carbohydrates, healthy fats, fiber, vitamins, and minerals. These bars are commonly used as meal replacements, pre- or post-workout snacks, or quick hunger solutions for people with busy lifestyles. Their long shelf life, easy portability, and controlled portion size make them popular across age groups.

The Nutritional Bars Market refers to the global ecosystem involved in producing, selling, and consuming these bars across retail and online channels. It includes different formats such as protein bars, energy bars, low-sugar bars, and functional bars aimed at specific needs like focus, stamina, or weight management. The market has grown steadily as consumers increasingly look for healthier snack options.

Market growth is strongly supported by rising investment activity. A US protein bar brand, David, secured $75 million in a Series A round and acquired food-tech group Epogee, strengthening innovation capacity. Another signal is Protein Bar Maker David boosting its valuation to $725 million, reflecting confidence in long-term demand. These developments show strong financial backing behind product development and scale.

Consumer demand is rising due to lifestyle changes and a preference for clean, low-sugar snacks. A low-sugar snack bar brand raised $5 million, highlighting demand for reduced-sugar options. Similarly, Verb Energy raised $3.5 million to expand its caffeinated bar range, showing interest in functional energy-focused bars.

New brands continue to enter with strong funding support. All In Food raised $4 million for snack bar products, while The Whole Truth secured ₹133.3 crore in a Series C round at a 3.5X valuation, reflecting growth potential. At the grassroots level, 21-year-old founders launched a healthy bar and chocolate brand projecting ₹1.5 crore, showing room for innovation at all scales.

Key Takeaways

- The Global Nutritional Bars Market is expected to be worth around USD 14.2 billion by 2034, up from USD 7.4 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In 2024, Protein Bars held a dominant position in the Nutritional Bars Market, with 39.7%.

- The Conventional category captured 76.3% share, leading the Nutritional Bars Market segment significantly.

- Hypermarkets/Supermarkets accounted for 44.2% of sales, dominating the Nutritional Bars Market distribution.

- The nutritional bars market in North America is valued at USD 3.2 Bn.

By Product Analysis

In 2024, protein bars dominated the nutritional bars market with 39.7% share.

In 2024, protein bars held a dominant market position in the Nutritional Bars Market, accounting for 39.7% of the overall product segment. The rising health consciousness among consumers and increasing participation in fitness and sports activities have significantly boosted demand for protein-rich snacks. Protein bars are favored for their convenience, portability, and ability to provide essential nutrients, particularly for busy professionals and athletes seeking post-workout recovery.

Manufacturers are also innovating with fortified ingredients such as vitamins, minerals, and plant-based proteins to cater to vegan and lactose-intolerant consumers. This product segment is witnessing heightened competition, with brands focusing on clean-label formulations, natural flavors, and reduced sugar content to appeal to health-conscious buyers. The sustained preference for protein bars indicates strong growth potential, making it a key revenue contributor within the broader Nutritional Bars Market, and driving new product launches tailored to emerging dietary trends.

By Category Analysis

Conventional products led the nutritional bars market, capturing 76.3% of total revenue.

In 2024, conventional nutritional bars dominated the market category segment with a 76.3% share. Conventional bars, typically made with familiar ingredients like grains, nuts, and dairy-based proteins, continue to appeal to a wide consumer base due to their affordability and established taste profiles. While the demand for organic and plant-based bars is increasing, conventional bars maintain strong market traction owing to their widespread availability and consumer trust in established brands. These products are often positioned as convenient meal replacements or snack alternatives for on-the-go consumption, aligning with busy lifestyles and active routines.

Manufacturers are enhancing these bars with added functional ingredients, such as fiber and antioxidants, to improve nutritional value while retaining traditional formulations. The dominance of conventional bars underscores the balance between innovation and consumer preference, reflecting that familiarity, convenience, and accessibility remain critical drivers of growth in the Nutritional Bars Market.

By Distribution Channel Analysis

Hypermarkets and supermarkets held a 44.2% share in the nutritional bars market.

In 2024, hypermarkets and supermarkets emerged as the leading distribution channels for nutritional bars, capturing a 44.2% market share. This dominance can be attributed to the wide product variety, competitive pricing, and accessibility offered by these large retail formats, which appeal to both urban and semi-urban consumers. Shoppers are increasingly seeking one-stop destinations for health and wellness products, and hypermarkets provide visibility and convenience that smaller stores or online platforms cannot always match.

Retailers are also employing strategic promotions, bundle offers, and premium product placements to attract health-conscious buyers. Moreover, the presence of international and regional brands in these outlets enhances consumer trust and drives repeat purchases. With the growing trend of organized retail in emerging markets and evolving shopping habits in developed regions, hypermarkets and supermarkets remain a critical channel for sustaining the growth trajectory of the nutritional bars market.

Key Market Segments

By Product

- Cereal/Granola Bars

- Protein Bars

- Energy Bars/Meal Replacements Bars

- Fruits and Nuts Bars

- Others

By Category

- Gluten-free

- Conventional

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail

- Others

Driving Factors

Growing Demand for Functional and Convenient Nutritional Bars

One of the top driving factors in the Nutritional Bars Market is the increasing demand for functional and convenient snack options that fit today’s fast-moving lifestyles. People are looking for snacks that not only satisfy hunger but also provide specific benefits like better nutrition, energy, or recovery support after workouts. This trend has attracted significant funding and innovation across the industry. For example, Remedy Health raised $11 million and expanded into protein bars in collaboration with ADM, showing strong investor confidence in products that offer real nutritional value.

Additionally, the broader food tech sector saw major investment movements, such as a $60 million raise for Modern Milkman, reflecting growing interest in new and improved food solutions, including advanced snack formats like “ultrasonic” bars under development. These investments highlight that both consumers and backers are focused on snacks that deliver more than just calories. As lifestyles become busier and health awareness rises, demand for functional and convenient nutritional bars continues to grow, pushing companies to innovate and expand their offerings.

Restraining Factors

High Prices and Consumer Cost Sensitivity Limit Growth

One of the key restraining factors in the Nutritional Bars Market is high product prices and cost sensitivity among consumers. Many nutritional bars use premium ingredients like plant proteins, superfoods, or specialty nutrients, which push up production costs and retail prices. As a result, some consumers hesitate to buy these bars regularly, especially when cheaper snack alternatives are available. This challenge is noticeable even among new healthy snack brands trying to enter the market.

For example, Phab raised $2 million in seed funding to boost healthy snacking, showing strong investor support for better snacks, but the higher cost of producing these items can make it tough to reach price-sensitive buyers. Even with this funding, brands must balance offering quality nutrition with affordable pricing, or risk losing a portion of their potential market. Until production costs decrease or broader awareness leads more consumers to value long-term health benefits over short-term price savings, cost sensitivity will continue to restrain the market’s full growth potential.

Growth Opportunity

Innovation in Protein Ingredients Expands Market Potential

One major growth opportunity in the Nutritional Bars Market lies in innovation around new protein ingredients and clean formulations. As consumers look for healthier, sustainable, and better-digesting nutrition, brands are exploring alternative protein sources beyond traditional dairy or soy. This shift is supported by strong funding activity. For instance, The Protein Brewery raised €30 million to fuel mycoprotein ingredient innovation, highlighting growing interest in fungi-based proteins that offer high nutrition with lower environmental impact.

Such ingredients can help nutritional bars stand out through improved texture, taste, and sustainability appeal. At the brand level, Mumbai-based health food company The Whole Truth raised $15 million in a Series C round, enabling it to expand product development and reach more consumers seeking honest, clean-label nutrition. Together, these investments show that innovation in protein sources and transparent formulations presents a strong opportunity to attract new customers and drive long-term growth in the nutritional bars space.

Latest Trends

Rise of Animal-Free Protein Ingredients in Bars

A key latest trend in the Nutritional Bars Market is the increasing use of animal-free and alternative protein ingredients to meet consumer demand for sustainable and health-focused nutrition. Traditionally, whey and other animal-based proteins dominated the space, but now brands are exploring advanced solutions that offer similar nutrition without animal involvement. This shift aligns with growing interest in plant-based and environmentally friendly foods.

A strong example of this trend is Vivici, a big dairy-backed startup, raising $34 million for animal-free whey proteins. This funding shows investor confidence in creating high-performing protein alternatives that can be used in nutritional bars, shakes, and other products.

By incorporating such novel proteins, companies can appeal to vegans, flexitarians, and eco-conscious buyers who want both taste and sustainability. As animal-free whey and other innovative proteins become more available and affordable, this trend is expected to grow, helping brands differentiate their products and attract a wider range of health-minded consumers.

Regional Analysis

North America held a 43.80% share in the Nutritional Bars Market, valued at USD 3.2 Bn.

In 2024, North America held a dominant position in the nutritional bars market, accounting for 43.80% of the regional share, with a market value of USD 3.2 billion. The strong presence of health-conscious consumers, widespread fitness culture, and high adoption of convenient on-the-go snack products have driven the growth in this region.

Europe follows as a significant contributor, supported by increasing demand for protein-enriched and functional bars among urban populations seeking healthier lifestyles. The Asia Pacific region is witnessing steady growth due to rising awareness of balanced nutrition, expanding retail infrastructure, and an emerging fitness-focused consumer base.

Meanwhile, the Middle East & Africa are gradually adopting nutritional bars, propelled by urbanization and changing dietary patterns, though their market share remains relatively modest. Latin America is also experiencing growing interest in convenient and nutritious snack options, with gradual uptake among young and working populations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BellRock Brands has positioned itself as a prominent player in the nutritional bars segment, focusing on innovative formulations that cater to health-conscious and fitness-oriented consumers. The company emphasizes clean-label ingredients, combining protein, fiber, and functional nutrients to enhance both taste and nutritional value. Its product portfolio is designed to appeal to busy professionals and athletes seeking convenient on-the-go snacks. BellRock Brands’ commitment to quality and consistency has helped it build a loyal customer base, while its marketing strategies highlight the functional benefits of its products, such as energy support and muscle recovery, reinforcing its reputation in the health and wellness sector.

Canna River operates at the intersection of nutrition and wellness with a unique focus on integrating functional ingredients into its nutritional bars. The company leverages the growing consumer interest in plant-based and holistic nutrition by developing products that are not only convenient but also support overall wellness. Canna River emphasizes transparency in sourcing and formulation, which resonates strongly with consumers seeking healthier alternatives to traditional snacks.

Wana Brands has established a niche presence by creating nutritional bars that combine indulgence with health benefits. The brand focuses on innovative flavor profiles and high-quality ingredients to deliver products that satisfy both taste and functional requirements. Wana Brands’ approach to balancing nutrition with sensory appeal helps it differentiate itself in a competitive market, attracting consumers looking for healthier snack options without compromising on flavor.

Top Key Players in the Market

- BellRock Brands

- Canna River

- Wana Brands

- Kiva Confections

- Wyld

- Dixie Elixirs

- Coda Signature

- Bhang Corporation

- Uncrate

Recent Developments

- In April 2024, Coda Signature, known for crafting premium cannabis‑infused edibles like chocolate bars and Fruit Notes, was acquired by Canvas 1839 Group, a Colorado cannabis company. This deal meant Coda’s recipes and products will continue under new ownership, ensuring that its famous edibles remain available to customers. Canvas plans to restart production of beloved products such as the Coffee & Doughnuts and Lemon & White Chocolate bars, preserving the quality fans expect while expanding reach to more dispensaries.

- In February 2024, Kiva Confections introduced a new line of hemp‑derived Delta‑9 Camino edibles that have the same flavors and effects as their traditional Camino gummies. These products are legally sold directly to consumers in states where cannabis isn’t yet fully regulated, widening access beyond licensed dispensaries. This move brings Kiva’s well‑known gummies to 16 new markets via an online platform, helping adults in more areas try their trusted products.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 14.2 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cereal/Granola Bars, Protein Bars, Energy Bars/Meal Replacements Bars, Fruits and Nuts Bars, Others), By Category (Gluten-free, Conventional), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BellRock Brands, Canna River, Wana Brands, Kiva Confections, Wyld, Dixie Elixirs, Coda Signature, Bhang Corporation, Uncrate Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nutritional Bars MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Nutritional Bars MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BellRock Brands

- Canna River

- Wana Brands

- Kiva Confections

- Wyld

- Dixie Elixirs

- Coda Signature

- Bhang Corporation

- Uncrate