Global Nuclear Imaging Equipment Market By Product Type (SPECT and PET), By Application (Oncology, Cardiology, Neurology and Others), By End-User (Hospitals, Diagnostic imaging centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176674

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

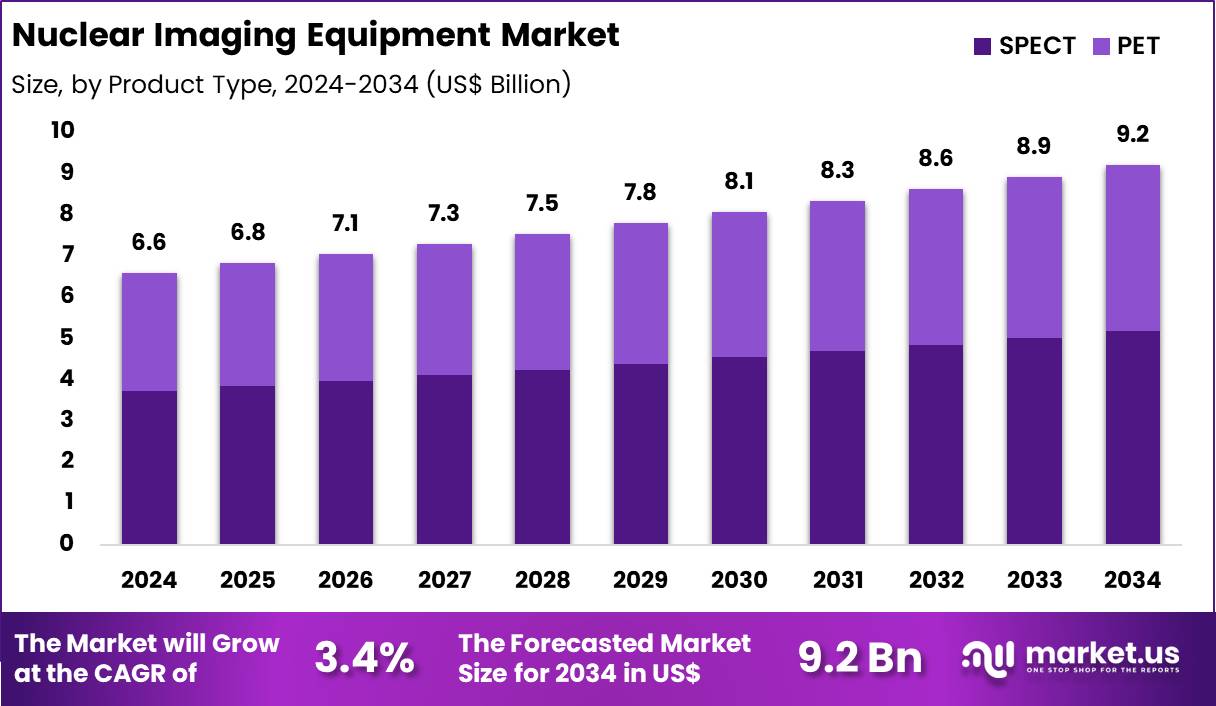

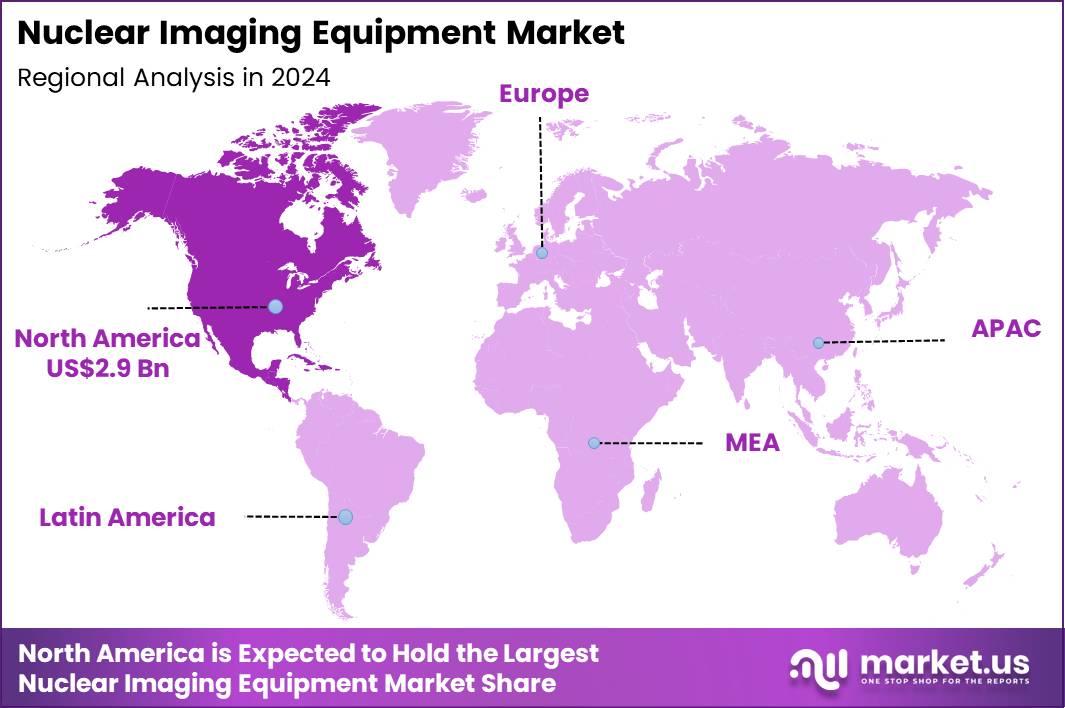

Global Nuclear Imaging Equipment Market size is expected to be worth around US$ 9.2 Billion by 2034 from US$ 6.6 Billion in 2024, growing at a CAGR of 3.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.3% share with a revenue of US$ 2.9 Billion.

Rising demand for precise diagnostic imaging in oncology and cardiology accelerates the nuclear imaging equipment market as healthcare providers adopt advanced modalities that deliver functional and molecular insights beyond anatomical detail.

Nuclear medicine specialists increasingly utilize positron emission tomography combined with computed tomography to stage malignancies, detecting metastatic spread in breast, lung, and prostate cancers through fluorodeoxyglucose uptake patterns.

These systems support cardiac perfusion imaging with technetium-99m agents, assessing myocardial viability and ischemia in patients with coronary artery disease to guide revascularization decisions. Clinicians apply single-photon emission computed tomography for brain perfusion studies, identifying hypoperfusion zones in dementia, epilepsy, and stroke recovery planning.

Nuclear imaging equipment also enables bone scintigraphy to localize metastatic lesions and fractures, providing early detection in prostate cancer and multiple myeloma cases. Theranostic applications integrate diagnostic scans with targeted radionuclide therapy, where gallium-68-labeled compounds confirm somatostatin receptor expression prior to lutetium-177 treatment in neuroendocrine tumors.

Manufacturers pursue opportunities to develop hybrid PET/MRI systems that combine metabolic and soft-tissue contrast information, expanding applications in neurological disorders and pediatric oncology where radiation dose reduction remains critical. Developers advance time-of-flight PET detectors that improve lesion detectability and quantification accuracy, facilitating earlier diagnosis in low-tumor-burden scenarios.

These innovations support quantitative SPECT for dosimetry in radionuclide therapy planning, optimizing therapeutic indices in prostate-specific membrane antigen-targeted treatments. Opportunities emerge in artificial intelligence-enhanced reconstruction algorithms that reduce scan times and injected activity, broadening access in resource-constrained facilities.

Companies invest in portable gamma cameras for intraoperative sentinel node mapping and bedside cardiac assessments. Recent trends emphasize theranostics integration and molecular-targeted tracers, positioning nuclear imaging equipment as a cornerstone of personalized medicine across oncology, cardiology, and neurology.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.6 Billion, with a CAGR of 3.4%, and is expected to reach US$ 9.2 Billion by the year 2034.

- The product type segment is divided into SPECT and PET, with SPECT taking the lead with a market share of 56.3%.

- Considering application, the market is divided into oncology, cardiology, neurology and others. Among these, oncology held a significant share of 48.9%.

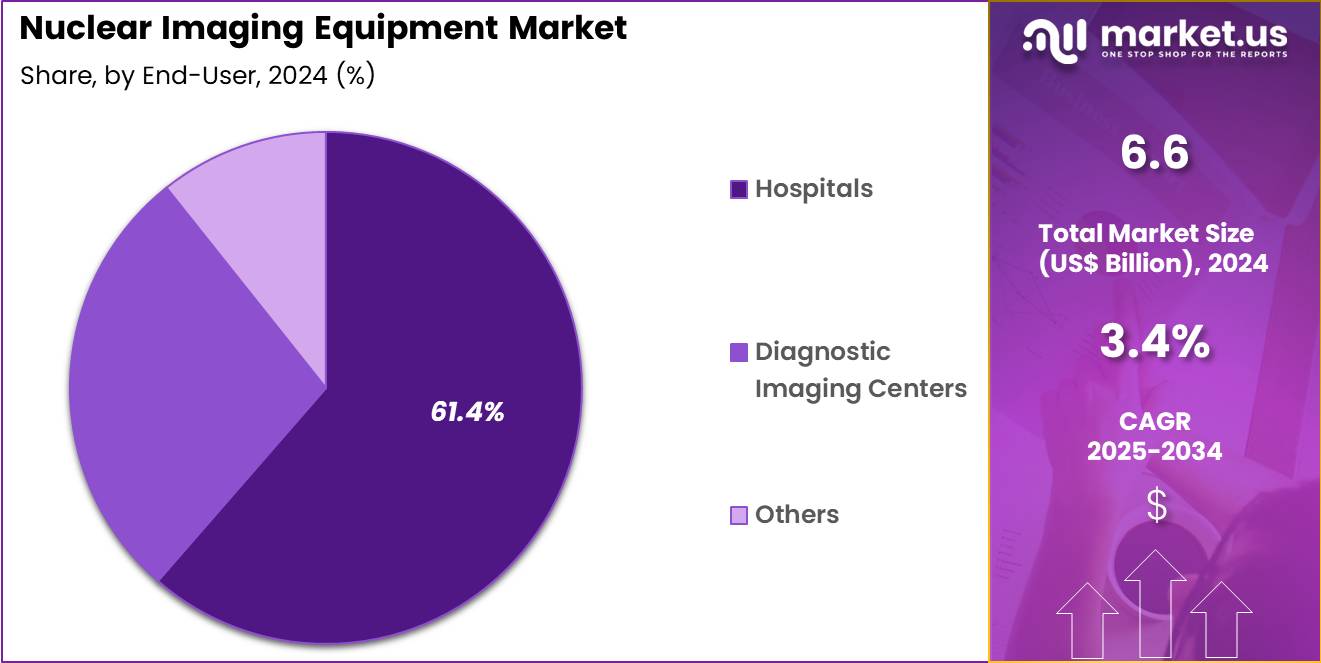

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic imaging centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 61.4% in the market.

- North America led the market by securing a market share of 43.3%.

Product Type Analysis

SPECT contributed 56.3% of growth within product type and led the nuclear imaging equipment market due to its wide clinical availability, lower system cost, and strong reimbursement familiarity across healthcare systems.

Hospitals and imaging centers rely on SPECT for routine functional imaging in cardiology, oncology, and neurology because it supports high patient throughput and established radiotracer workflows. The technology fits well within existing nuclear medicine infrastructure, which encourages upgrades rather than full modality replacement. Broad clinician familiarity strengthens utilization across both large and mid-sized hospitals.

Growth strengthens as manufacturers introduce hybrid SPECT systems with improved detectors and image reconstruction software. Expanded use in cardiac perfusion imaging and bone scans sustains procedural volumes. Developing regions favor SPECT due to affordability and operational simplicity.

Long equipment lifecycles and steady upgrade cycles reinforce procurement consistency. The segment is expected to remain dominant as cost-effective functional imaging continues to play a central role in nuclear medicine.

Application Analysis

Oncology generated 48.9% of growth within application and emerged as the leading segment due to rising cancer incidence and increasing reliance on functional imaging for diagnosis, staging, and treatment monitoring.

Nuclear imaging supports tumor detection, metastatic assessment, and therapy response evaluation, which strengthens its role across the cancer care continuum. Clinicians integrate nuclear scans into personalized treatment planning, especially for solid tumors and metastatic disease. Growing adoption of targeted therapies increases demand for precise functional imaging support.

Growth accelerates as oncology care shifts toward earlier detection and longitudinal monitoring. Multidisciplinary cancer centers expand imaging capacity to manage rising patient volumes. Imaging-guided decision-making improves treatment accuracy and outcome tracking. Research activity in oncology further drives equipment utilization. The segment is projected to maintain leadership as cancer management continues to depend on advanced diagnostic imaging.

End-User Analysis

Hospitals accounted for 61.4% of growth within end-user and dominated the nuclear imaging equipment market due to their comprehensive diagnostic capabilities and high patient inflow. Hospitals manage complex cases that require integrated imaging, radiopharmacy access, and specialist interpretation. Availability of multidisciplinary teams supports broader use of nuclear imaging across departments. Centralized procurement and capital investment capacity strengthen hospital adoption of advanced imaging systems.

Growth continues as hospitals expand oncology and cardiology service lines that rely on nuclear diagnostics. Accreditation standards and clinical guidelines reinforce imaging utilization. Teaching hospitals further increase demand through research and training programs. Referral networks concentrate advanced imaging procedures within hospital settings. The segment is anticipated to remain the primary growth driver as hospitals continue to anchor nuclear medicine services and diagnostic care delivery.

Key Market Segments

By Product Type

- SPECT

- PET

By Application

- Oncology

- Cardiology

- Neurology

- Others

By End-User

- Hospitals

- Diagnostic imaging centers

- Others

Drivers

Increasing prevalence of cancer is driving the market.

The rising global incidence of cancer has notably heightened the demand for nuclear imaging equipment, which is essential for accurate diagnosis and staging in oncology practices. Technological improvements in positron emission tomography and single-photon emission computed tomography systems have enhanced their utility in detecting tumors and monitoring treatment responses. Healthcare providers are increasingly relying on these modalities to support multidisciplinary cancer care teams.

According to the World Health Organization, there were an estimated 20 million new cancer cases worldwide in 2022. This statistic reflects the substantial clinical burden and the corresponding need for advanced imaging to guide therapeutic decisions. Nuclear imaging equipment enables non-invasive visualization of metabolic activity, aiding in the identification of malignancies at earlier stages.

Governmental health policies are promoting cancer screening programs that incorporate molecular imaging techniques. Major companies are responding by developing hybrid systems to meet this expanding diagnostic requirement. This driver correlates with demographic aging and lifestyle factors contributing to higher cancer rates. Overall, the cancer prevalence trend continues to underpin investments in nuclear imaging infrastructure.

Restraints

High cost of nuclear imaging equipment is restraining the market.

The substantial investment required for acquiring and maintaining nuclear imaging systems, such as positron emission tomography scanners, limits their adoption in facilities with constrained financial resources. Complex manufacturing processes involving high-precision components contribute to elevated pricing structures for these devices.

Smaller healthcare institutions often prioritize essential equipment over advanced imaging modalities due to budget limitations. Regulatory demands for radiation safety compliance add additional expenses to operational frameworks. In public health sectors, fiscal priorities favor cost-effective alternatives, delaying upgrades to state-of-the-art systems.

Providers may opt for refurbished units to manage expenditures, impacting demand for new equipment. This restraint affects market expansion, particularly in developing regions with limited funding. Collaborative financing models are being explored to mitigate these barriers over time. Despite diagnostic advantages, economic considerations hinder widespread implementation. Addressing affordability through policy interventions is crucial for overcoming this market challenge.

Opportunities

Growth in imaging segment revenues is creating growth opportunities.

The positive performance in imaging revenues among leading manufacturers indicates potential for expanded utilization of nuclear imaging equipment in clinical settings. Increased investments in radiology departments support the integration of advanced modalities for precise disease assessment. Siemens Healthineers reported total adjusted revenues for its Imaging segment at USD 13.2 billion in fiscal year 2024, up 5% from USD 12.7 billion in 2023.

This growth reflects sustained demand for technologies that enhance procedural outcomes in oncology and cardiology. Strategic alliances with healthcare networks facilitate the deployment of hybrid imaging solutions in high-volume centers. The substantial procedural base in developed economies amplifies prospects for system enhancements.

Reforms in diagnostic reimbursement strengthen infrastructure developments. Primary corporations are pursuing regional expansions to capitalize on economic recoveries. This opportunity corresponds with initiatives to elevate standards in minimally invasive diagnostics. Focused strategies can generate notable advancements in specialized segments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the nuclear imaging equipment market through hospital capital budgets, government healthcare spending, and long term planning cycles for imaging centers. Inflation and higher interest rates raise financing costs for large systems, which slows replacement and expansion decisions.

Geopolitical tensions disrupt supplies of detectors, semiconductors, shielding materials, and precision electronics, increasing lead times and project risk. Current US tariffs on imported components and finished systems elevate acquisition and service costs, which tightens margins and stretches approval processes. These pressures weigh on smaller providers and delay access in cost sensitive regions.

On the positive side, trade friction accelerates domestic assembly, supplier diversification, and service localization. Rising clinical demand for advanced oncology and cardiology imaging sustains utilization and justifies investment. With disciplined sourcing, software driven upgrades, and lifecycle service models, the market remains positioned for steady and resilient growth.

Latest Trends

Launch of advanced PET/CT systems is a recent trend in the market.

In 2024, the introduction of innovative positron emission tomography/computed tomography systems has improved diagnostic capabilities for detecting coronary artery disease. These devices incorporate air-cooled detectors to enhance energy efficiency and image quality. GE HealthCare began manufacturing its Omni Legend PET/CT in Wisconsin in 2024, with the 100th system installed in the United States.

This development facilitates faster scans and reduced radiation exposure for patients. Manufacturers are emphasizing digital integration to support artificial intelligence-driven analysis. Clinical applications extend to oncology and neurology, addressing diverse imaging needs. The trend prioritizes sustainability through lower power consumption designs.

Regulatory clearances in 2024 for these models have accelerated their availability. Industry partnerships optimize features for real-time data processing. These innovations aim to streamline workflows in high-acuity environments.

Regional Analysis

North America is leading the Nuclear Imaging Equipment Market

North America holds a 43.3% share of the global Nuclear Imaging Equipment market, experiencing dynamic expansion in 2024 owing to burgeoning demand for hybrid modalities like PET/CT hybrids that enhance diagnostic accuracy in oncology and cardiology through fused anatomical and functional data.

Distinguished vendors such as GE HealthCare and Siemens Healthineers have pioneered digital detectors and AI-driven reconstruction algorithms, enabling lower radiation doses and faster scan times to accommodate high patient throughput in tertiary hospitals. The locale’s comprehensive insurance policies have incentivized upgrades to cyclotron-integrated systems for on-site radiotracer production, supporting timely imaging for neurodegenerative assessments.

Directives from the Centers for Medicare & Medicaid Services have prioritized value-based reimbursements for evidence-backed scans, propelling installations in ambulatory settings. Mounting incidences of chronic ailments have urged integrations with electronic health records for seamless workflow, minimizing diagnostic delays.

Alliances among radiologists and tech firms have validated novel tracers for inflammation imaging, broadening clinical utility. Additionally, federal grants have underwritten infrastructure for theranostics, linking diagnostics to targeted radionuclide therapies. The FDA cleared approximately 3,000 medical devices through the 510(k) pathway in 2024, facilitating the swift integration of cutting-edge imaging innovations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project remarkable progress in the radiopharmaceutical diagnostics field across Asia Pacific over the forecast period, since health ministries escalate expenditures on hybrid scanners to bolster early detection of malignancies in densely populated zones. Corporations in Japan and Australia design compact SPECT units that optimize space in urban clinics, while researchers in India validate cost-efficient gamma cameras for cardiac evaluations amid surging heart disease rates.

Providers in Vietnam equip provincial hospitals with mobile PET systems that enable remote consultations, bridging gaps in specialist access for neurological disorders. Contributors in the Philippines sponsor technician certifications on dose calibration, elevating precision in tracer administrations for endocrine studies.

Executives in Indonesia negotiate tech transfers that localize component assembly, slashing import costs for widespread deployment. Specialists in Malaysia fuse cloud analytics with imaging data to predict equipment maintenance, sustaining uptime in humid conditions.

Producers in South Korea export advanced detectors that amplify signal sensitivity, capturing market share in emerging economies. The NMPA approved 138 innovative medical devices since 2022, invigorating high-end equipment adoption throughout the area.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the nuclear imaging equipment market accelerate growth by advancing system performance with higher resolution detectors, enhanced software analytics, and hybrid imaging integrations that support precise diagnostics across oncology, cardiology, and neurology. They expand commercial reach through strategic collaborations with major hospital networks and imaging centers, ensuring broad clinical adoption and service contracts that stabilize recurring revenue.

Firms also tailor financing and upgrade programs that lower acquisition barriers for mid-size facilities while reinforcing long-term customer relationships. Geographic expansion into emerging healthcare markets in Asia Pacific and Latin America balances saturation in developed regions and captures rising demand for advanced diagnostic capacity.

Siemens Healthineers stands as a leading global medical technology company with a deep portfolio of nuclear and multimodality imaging systems, strong service infrastructure, and a coordinated global sales and support organization that drives clinical preference. The company sustains momentum through disciplined R&D investment, targeted partnerships, and commercialization strategies that align product innovation with evolving clinical priorities.

Top Key Players

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- United Imaging Healthcare

- Mediso

- Spectrum Dynamics Medical

- Digirad

- DDD Diagnostics

- Positron Corporation

Recent Developments

- In 2025, Siemens Healthineers reported that its Imaging segment—which includes molecular imaging and advanced PET/CT systems—achieved total adjusted revenues of US$ 15.149 billion for the full fiscal year. The company noted that this growth was particularly bolstered by a sharp increase in demand for its Molecular Imaging product lines, which saw strong expansion across the Americas and EMEA regions.

- In 2025, GE HealthCare announced that its Imaging segment, encompassing specialized SPECT/CT and PET technologies, recorded third-quarter revenues of US$ 2.349 billion, representing a 5% increase compared to the previous year. This performance was largely driven by the adoption of its digital PET/CT systems, such as the Omni Legend, and successful strategic long-term enterprise agreements within the US.

Report Scope

Report Features Description Market Value (2024) US$ 6.6 Billion Forecast Revenue (2034) US$ 9.2 Billion CAGR (2025-2034) % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (SPECT and PET), By Application (Oncology, Cardiology, Neurology and Others), By End-User (Hospitals, Diagnostic imaging centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, United Imaging Healthcare, Mediso, Spectrum Dynamics Medical, Digirad, DDD Diagnostics, Positron Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nuclear Imaging Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Nuclear Imaging Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- United Imaging Healthcare

- Mediso

- Spectrum Dynamics Medical

- Digirad

- DDD Diagnostics

- Positron Corporation