Global Natural Fiber Composites Market Size, Share, And Business Benefits By Raw Material (Wood, Cotton, Flax, Kenaf, Hemp, Others), By Matrix (Inorganic Compound, Natural Polymer, Synthetic Polymer), By Technology (Injection Molding, Compression Molding, Pultrusion, Others), By Application(Automotive (Door Panels, Seat Backs and Headrests, Package Trays, Dashboards, Interior Trim, Others), Construction (Decking and Railing Systems, Window and Door Frames, Wall Panels and Sidings, Roof Tiles, Insulation Materials, Others), Consumer Goods and Packaging (Furniture Components, Luggage and Cases, Sports Equipment, Packaging Materials, Others), Aerospace (Interior Panels, Overhead Storage Bins, Seat Components, Others), Marine (Boat Hulls and Decks, Interior Panels, Buoys and Marine Structures, Others), Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159878

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

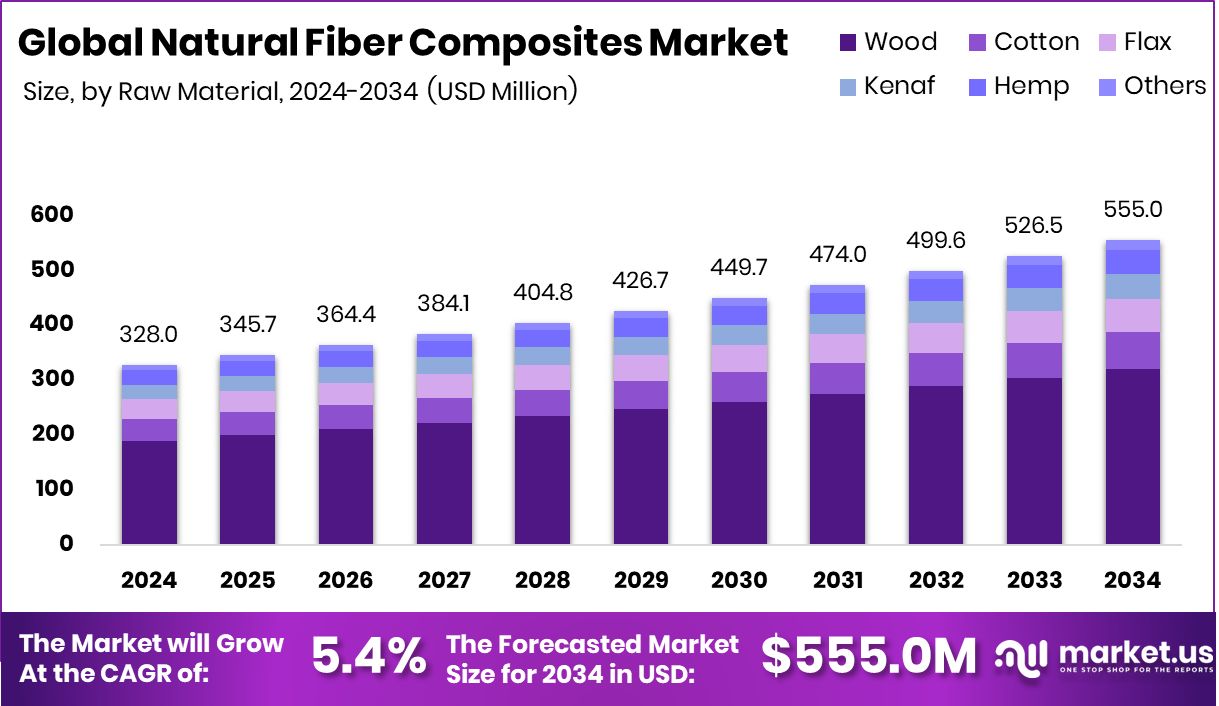

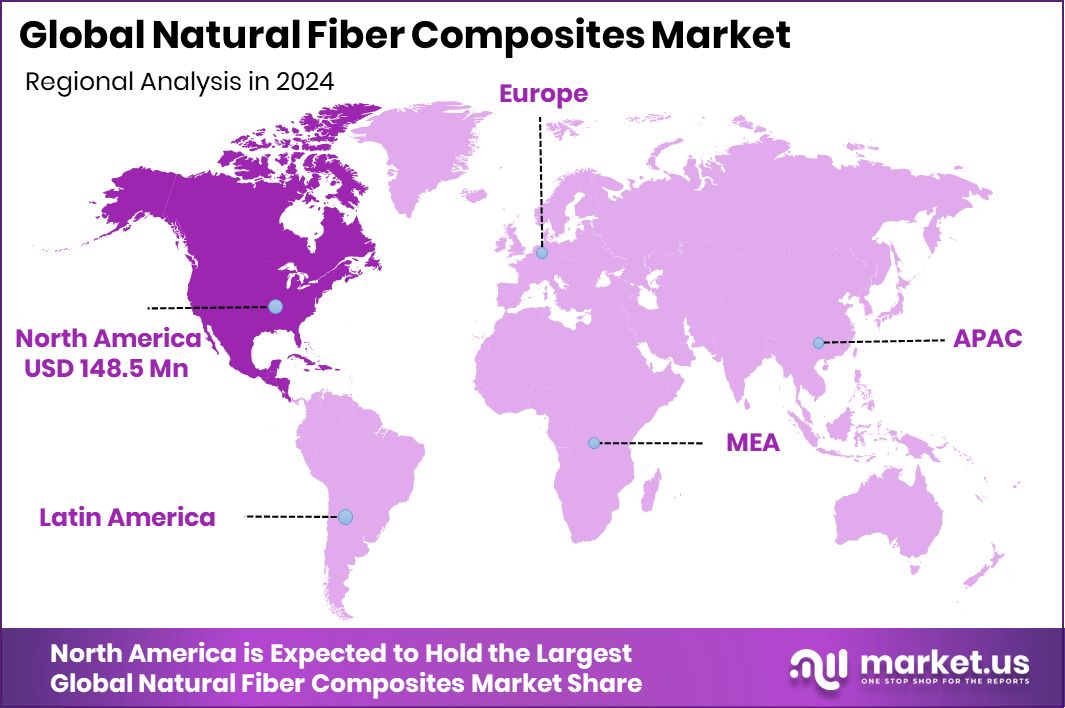

The Global Natural Fiber Composites Market is expected to be worth around USD 555.0 million by 2034, up from USD 328.0 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With a 45.30% share, North America recorded a USD 148.5 Mn market size.

Natural Fiber Composites (NFCs) are materials made by combining plant-based fibers like jute, flax, hemp, or kenaf with a polymer matrix. These fibers act as reinforcements, providing strength and stiffness while making the composite lighter and more sustainable than conventional synthetic fiber composites. They are widely used in automotive parts, building materials, furniture, and consumer goods due to their eco-friendly profile and cost-effectiveness.

The natural fiber composites market refers to the global trade, production, and use of these bio-based composites. Its growth is driven by increasing demand for sustainable and lightweight materials, stricter environmental regulations, and industries’ shift toward green alternatives. The market has been gaining traction as manufacturers explore renewable options that reduce dependency on petroleum-based products.

One major growth factor is the rising consumer preference for eco-friendly products. With industries under pressure to lower carbon footprints, NFCs are becoming a favored choice. Their biodegradability and recyclability align with global sustainability goals, boosting adoption across multiple sectors.

Looking at opportunities, government and institutional support have been notable. The USDA Forest Service recently announced $41 million in funding under the Wood Innovations Grant Program, and the Community Wood Energy & Innovation Program awarded $6 million to encourage advanced wood-based products. Meanwhile, Cathie Wood’s Ark fund, surpassing $300 million in fees, highlights growing investor interest in sustainable and innovation-driven industries. These initiatives and funding opportunities create fertile ground for further advancements in natural fiber composites.

Key Takeaways

- The Global Natural Fiber Composites Market is expected to be worth around USD 555.0 million by 2034, up from USD 328.0 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Wood holds a 57.9% share in the Natural Fiber Composites Market, highlighting its dominance in sustainability.

- Synthetic polymers account for 59.3%, showcasing their essential role in strengthening natural fiber composites globally.

- Injection molding leads with 43.6%, reflecting its efficiency and scalability in composite manufacturing processes.

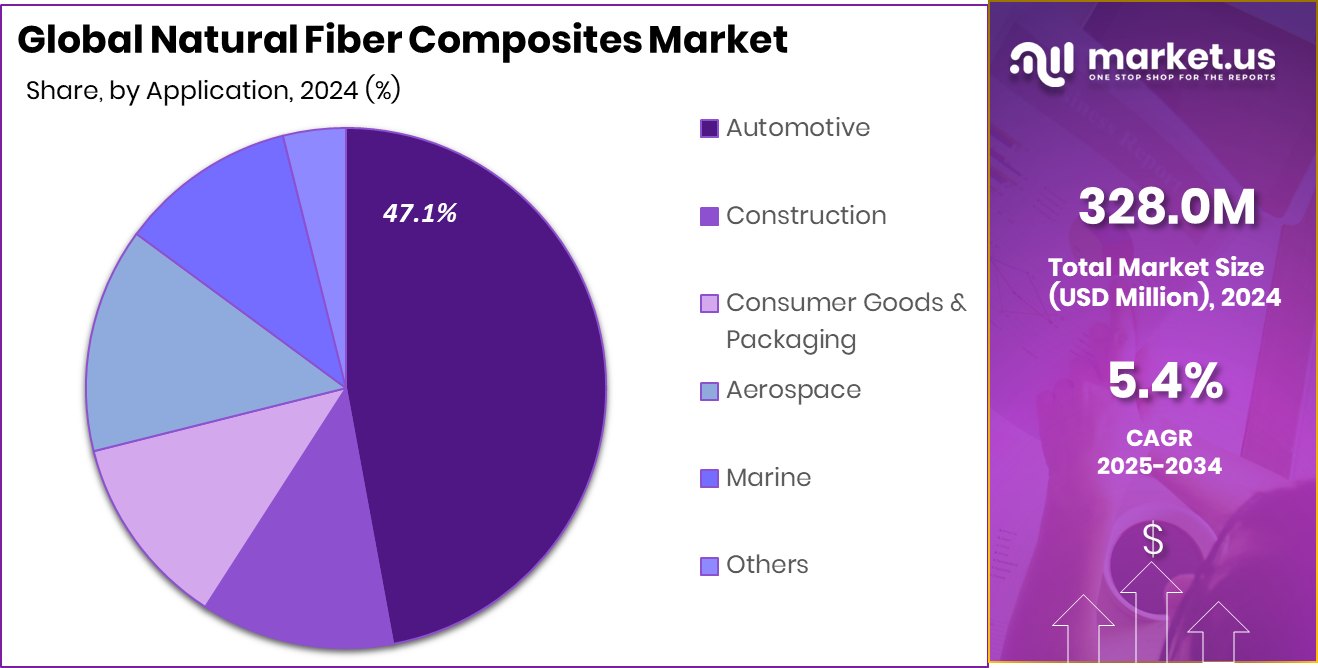

- Automotive applications capture 47.1%, driven by demand for lightweight, eco-friendly materials, enhancing fuel efficiency.

- The Natural Fiber Composites Market in North America reached USD 148.5 Mn, capturing 45.30%.

By Raw Material Analysis

Wood dominates the natural fiber composites market, holding 57.9% of the raw material share.

In 2024, Wood held a dominant market position in the By Raw Material segment of the Natural Fiber Composites Market, with a 57.9% share. This leadership reflects the wide use of wood fibers in composite applications due to their availability, cost-effectiveness, and favorable mechanical properties. Wood-based composites are extensively utilized in construction, automotive interiors, and consumer goods, where strength and sustainability are equally valued.The material’s ability to balance durability with environmental benefits has reinforced its acceptance across industries. With increasing emphasis on renewable resources and eco-friendly solutions, wood continues to play a central role in driving the Natural Fiber Composites Market forward, maintaining its position as the most widely adopted raw material choice.

By Matrix Analysis

Synthetic polymer matrix leads the natural fiber composites market with a 59.3% share.

In 2024, Synthetic Polymer held a dominant market position in the By Matrix segment of the Natural Fiber Composites Market, with a 59.3% share. This dominance is largely driven by the versatility and processing advantages of synthetic polymers when combined with natural fibers. They provide improved bonding, durability, and resistance to wear, making them highly suitable for large-scale applications in automotive, construction, and consumer goods.The adaptability of synthetic polymers in molding and shaping processes has also enhanced their preference, enabling manufacturers to produce lightweight yet robust components. With this strong share, synthetic polymers continue to be the leading matrix material, reinforcing their critical role in the overall adoption of natural fiber composites.

By Technology Analysis

Injection molding technology accounts for a 43.6% share in the natural fiber composites market.

In 2024, Injection Molding held a dominant market position in the By Technology segment of the Natural Fiber Composites Market, with a 43.6% share. This leadership is attributed to the efficiency and scalability of injection molding in producing complex and high-volume components. The process allows precise shaping, consistent quality, and cost-effective mass production, which has made it the preferred technology for industries adopting natural fiber composites.Its ability to integrate natural fibers into polymer matrices while maintaining mechanical strength and lightweight properties further supports its dominance. With these advantages, injection molding continues to be the most widely used technology, solidifying its role in advancing natural fiber composite applications.

By Application Analysis

Automotive applications dominate, capturing a 47.1% share of the natural fiber composites market.

In 2024, Automotive held a dominant market position in the By Application segment of the Natural Fiber Composites Market, with a 47.1% share. This strong presence is driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions.

Natural fiber composites offer an ideal balance of strength, weight reduction, and sustainability, making them well-suited for interior panels, dashboards, and structural components. Their ability to provide acoustic insulation and thermal stability further adds to their value in vehicle manufacturing. With automotive manufacturers focusing on eco-friendly and performance-driven solutions, the sector continues to lead in the adoption of natural fiber composites, securing its position as the largest application segment.

Key Market Segments

By Raw Material

- Wood

- Cotton

- Flax

- Kenaf

- Hemp

- Others

By Matrix

- Inorganic Compound

- Natural Polymer

- Synthetic Polymer

By Technology

- Injection Molding

- Compression Molding

- Pultrusion

- Others

By Application

- Automotive

- Door Panels

- Seat Backs and Headrests

- Package Trays

- Dashboards

- Interior Trim

- Others

- Construction

- Decking and Railing Systems

- Window and Door Frames

- Wall Panels and Sidings

- Roof Tiles

- Insulation Materials

- Others

- Consumer Goods and Packaging

- Furniture Components

- Luggage and Cases

- Sports Equipment

- Packaging Materials

- Others

- Aerospace

- Interior Panels

- Overhead Storage Bins

- Seat Components

- Others

- Marine

- Boat Hulls and Decks

- Interior Panels

- Buoys and Marine Structures

- Others

- Others

Driving Factors

Rising Demand for Eco-Friendly and Lightweight Materials

One of the key driving factors for the natural fiber composites market is the rising demand for eco-friendly and lightweight materials across industries. Natural fiber composites are gaining importance because they reduce dependence on petroleum-based products while offering durability and cost benefits. In sectors like automotive and construction, using lighter materials helps cut emissions and improve efficiency.

Growing awareness of sustainability and stricter environmental rules are also pushing industries to adopt these composites at a faster pace. Adding to this momentum, the Department of Energy has announced a $25 million investment in polymer upcycling research to reduce plastic waste, which directly supports innovation in sustainable materials and strengthens opportunities for natural fiber composites to expand further.

Restraining Factors

Limited Mechanical Strength Compared to Synthetic Alternatives

A major restraining factor for the Natural Fiber Composites Market is the limited mechanical strength of these materials when compared to synthetic fiber composites. While natural fibers are eco-friendly and lightweight, they often show lower resistance to moisture, heat, and long-term stress, which can restrict their use in heavy-duty or high-performance applications. This drawback creates hesitation among industries that demand consistent durability and reliability.

Manufacturers are working on treatments and hybrid solutions to overcome these limitations, but challenges remain in scaling these improvements at competitive costs. At the same time, funding in related sectors continues, with Livspace making a $5.5 million bet on furniture hardware startup TplusA, reflecting how investments are shifting toward material innovation.

Growth Opportunity

Expanding Use in Sustainable Furniture and Interiors

One major growth opportunity for the Natural Fiber Composites Market lies in the rising use of eco-friendly materials in furniture and interior applications. As consumers and industries move toward sustainable lifestyles, natural fiber composites offer an attractive balance of strength, aesthetics, and environmental benefits. Their lightweight nature, biodegradability, and ability to replace traditional plastics make them an ideal choice for modern furniture, home décor, and interior design solutions. This shift is further supported by investments in advanced manufacturing and material innovation. Recently, Chinese furniture hub Foshan launched $488 million in funds for robotics, signaling strong growth in automation and technology that can also support efficient production of natural fiber composite-based furniture and interior products.

Latest Trends

Growing Integration of Natural Fibers in Furniture Design

A key latest trend in the Natural Fiber Composites Market is the growing integration of these materials in modern furniture design. With rising demand for eco-friendly and stylish solutions, natural fiber composites are being adopted in furniture manufacturing for their durability, lightweight properties, and sustainable profile.

Designers and producers are using these composites to create innovative products that balance function with environmental responsibility, appealing to conscious consumers. This trend is also supported by active funding in the furniture sector, such as Furniture retailer Furnishka raising Rs 27 crore from India Quotient, which highlights increasing investor confidence in sustainable and design-driven businesses that incorporate natural fiber composites into their growth strategies.

Regional Analysis

In 2024, North America held a 45.30% share, valued at USD 148.5 Mn.

The Natural Fiber Composites Market is segmented across key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

In 2024, North America emerged as the dominating region, holding a significant 45.30% market share valued at USD 148.5 million. This strong position reflects the region’s focus on sustainable materials and the growing use of natural fiber composites in automotive and construction applications. Europe continues to show steady adoption, supported by strict environmental policies and an increasing shift toward renewable resources.

Asia Pacific, led by its expanding industrial base and large-scale manufacturing activities, is becoming a vital growth contributor. Meanwhile, the Middle East & Africa are gradually exploring opportunities in construction and infrastructure where lightweight composites provide practical benefits, and Latin America is seeing growing awareness and adoption in consumer goods and furniture applications.

While all regions contribute to the market’s development, North America’s leadership demonstrates its advanced infrastructure, consumer preference for eco-friendly products, and early adaptation of natural fiber composites. The regional distribution highlights both mature and emerging opportunities, with North America currently maintaining the largest share, setting a benchmark for other regions to follow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Flexform SpA continues to stand out as a specialist in natural fiber composites for the automotive sector. The company has maintained its reputation by providing lightweight, durable, and sustainable solutions tailored to automotive interiors and structural components. Its long-standing expertise in combining natural fibers with polymer matrices has allowed it to address rising environmental concerns while meeting performance requirements demanded by vehicle manufacturers.

Procotex plays a significant role with its wide portfolio of natural fibers processed for composite applications. The company’s strength lies in its vertically integrated approach to processing raw fibers, ensuring quality and consistency. By supplying fibers like flax and hemp to multiple industries, Procotex has expanded its relevance beyond automotive to construction and consumer goods. This diversity allows the company to benefit from demand in varied end-use sectors, strengthening its position in the global landscape.

TECNARO GMBH, with its innovative biopolymer technologies, continues to push the boundaries of sustainability. Known for its product lines based on renewable raw materials, TECNARO focuses on providing alternatives to conventional plastics. Its natural fiber composites have gained attention in sectors such as electronics, furniture, and consumer products, where performance must align with eco-friendly practices.

Top Key Players in the Market

- Flexform SpA

- Procotex

- TECNARO GMBH

- Trex Company, Inc.

- Bcomp

- Polyvlies Franz Beyer GmbH

- Green Dot Bioplastics

- Fiberon LLC,

- Tecnaro GmbH

Recent Developments

- In April 2025, TECNARO obtained FSC® and PEFC™ certification via DIN CERTCO for its bioplastic compounds ARBOFORM®, ARBOBLEND®, and ARBOFILL®, enabling traceable and certified sustainable sourcing across its supply chain.

- In 2024, Bcomp closed a CHF 36 million Series C funding round (approx. US$40 million) to fuel innovation and scaling of its flax-based bio-composite solutions across vehicles, infrastructure, and sports sectors.

Report Scope

Report Features Description Market Value (2024) USD 328.0 Million Forecast Revenue (2034) USD 555.0 Million CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Wood, Cotton, Flax, Kenaf, Hemp, Others), By Matrix (Inorganic Compound, Natural Polymer, Synthetic Polymer), By Technology (Injection Molding, Compression Molding, Pultrusion, Others), By Application(Automotive (Door Panels, Seat Backs and Headrests, Package Trays, Dashboards, Interior Trim, Others), Construction (Decking and Railing Systems, Window and Door Frames, Wall Panels and Sidings, Roof Tiles, Insulation Materials, Others), Consumer Goods and Packaging (Furniture Components, Luggage and Cases, Sports Equipment, Packaging Materials, Others), Aerospace (Interior Panels, Overhead Storage Bins, Seat Components, Others), Marine (Boat Hulls and Decks, Interior Panels, Buoys and Marine Structures, Others), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Flexform SpA, Procotex, TECNARO GMBH, Trex Company, Inc., Bcomp, Polyvlies Franz Beyer GmbH, Green Dot Bioplastics, Fiberon LLC,, Tecnaro GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Fiber Composites MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Fiber Composites MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Flexform SpA

- Procotex

- TECNARO GMBH

- Trex Company, Inc.

- Bcomp

- Polyvlies Franz Beyer GmbH

- Green Dot Bioplastics

- Fiberon LLC,

- Tecnaro GmbH