Global N-Propyl Acetate Market Size, Share, And Business Benefit By Purity (Less Than 99%, Greater Than 99%), By Application (Solvent, Flavoring Agent, Others), By End-Use (Paint and Coatings, Chemical, Pharmaceutical, Printing Ink, Food and Beverages, Agrochemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165319

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

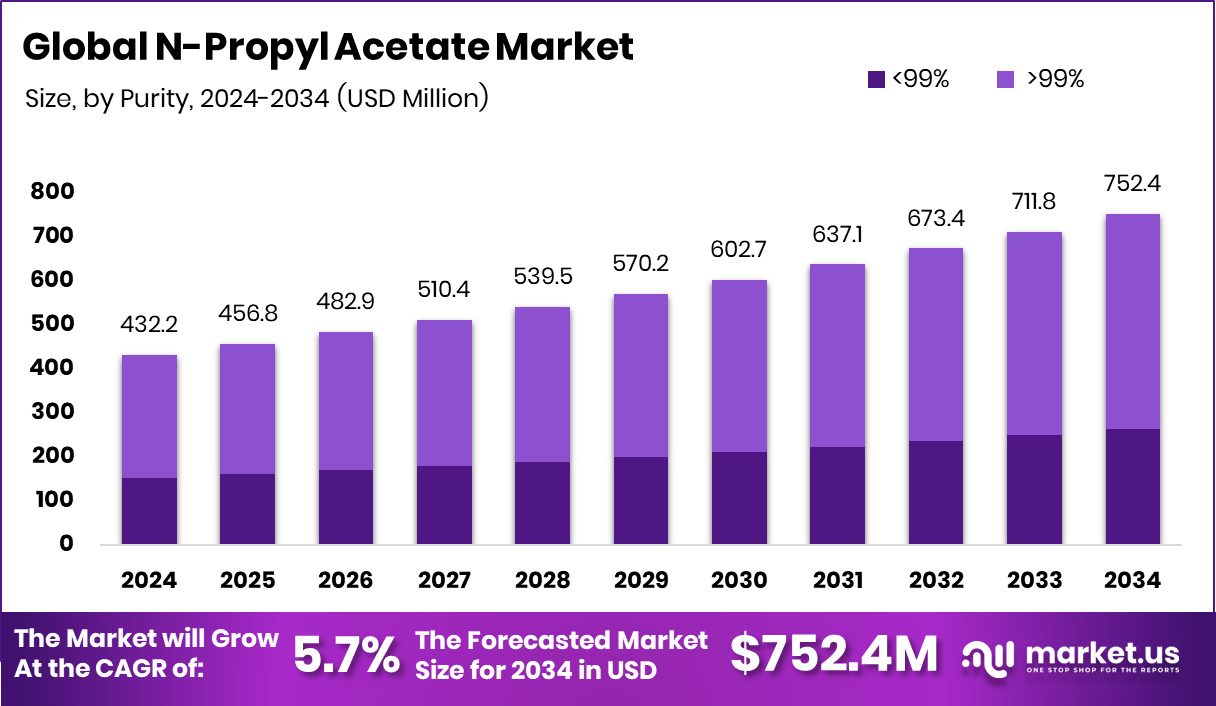

The Global N-Propyl Acetate Market is expected to be worth around USD 752.4 million by 2034, up from USD 432.2 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Expanding coatings, printing, and agrochemical sectors in Asia-Pacific, 46.9% boosted solvent demand significantly.

N-Propyl Acetate is an organic ester compound made by combining acetic acid and n-propyl alcohol. It is a clear, colorless liquid with a pleasant, fruity odor and is commonly used as a solvent in coatings, printing inks, paints, adhesives, and fragrances. Due to its fast evaporation rate and low toxicity, it is often chosen for industrial and consumer applications where clean evaporation is essential.

The demand for N-Propyl Acetate is rising due to its role in manufacturing low-VOC coatings and inks, especially as industries seek more sustainable and worker-safe solvents. It is also being used more in flexible packaging, offset inks, and industrial paints, thanks to its favorable evaporation rate and compatibility with other solvents.

Agriculture is becoming a major user of N-Propyl Acetate as agrochemical production expands. Recent funding highlights this momentum: Kotak’s Rs 375 crore investment in Cropnosys, IFC’s Rs 300 crore in Crystal Crop Protection, and India Agri Business Fund II’s US$15M investment in an agro-chemical firm all indicate scaling demand for chemicals like N-Propyl Acetate in crop solutions.

Additionally, companies are investing in process innovations. Scimplifi raised $3.67M in seed funding, aiming to improve specialty chemical supply chains. Meanwhile, Vive Crop Protection secured $11.2M CAD to enhance agri-chemical efficiency, signaling a greater need for solvents in precision formulations.

Another signal of opportunity is Arbuda Agrochemicals’ NSE IPO for 64 lakh shares, aimed at funding a ₹120 crore debt repayment and expanding ALP lines. Such expansions reflect strong market appetite and future potential for N-Propyl Acetate in industrial and agrochemical manufacturing.

Key Takeaways

- The Global N-Propyl Acetate Market is expected to be worth around USD 752.4 million by 2034, up from USD 432.2 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- N-Propyl Acetate with >99% purity dominates the market, accounting for 65.9% total share.

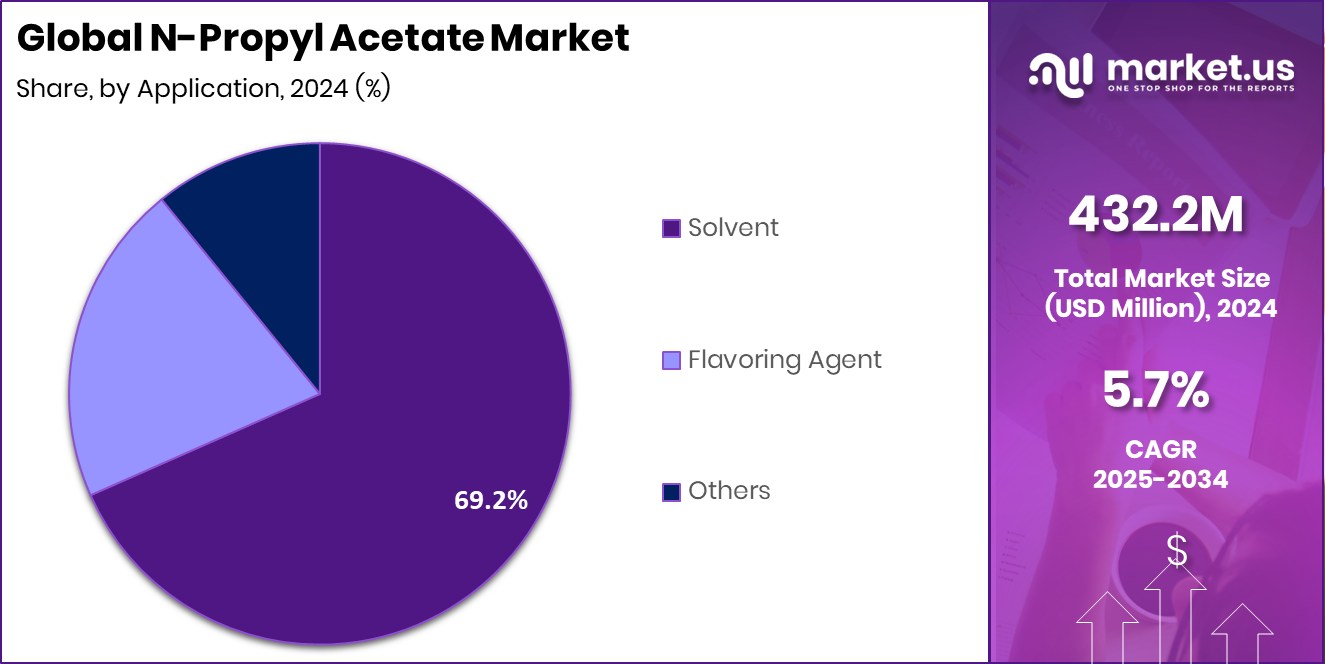

- As a solvent, N-Propyl Acetate leads demand, contributing 69.2% due to industrial processing needs.

- The paint and coatings sector drives usage, capturing 38.5% share in N-Propyl Acetate consumption.

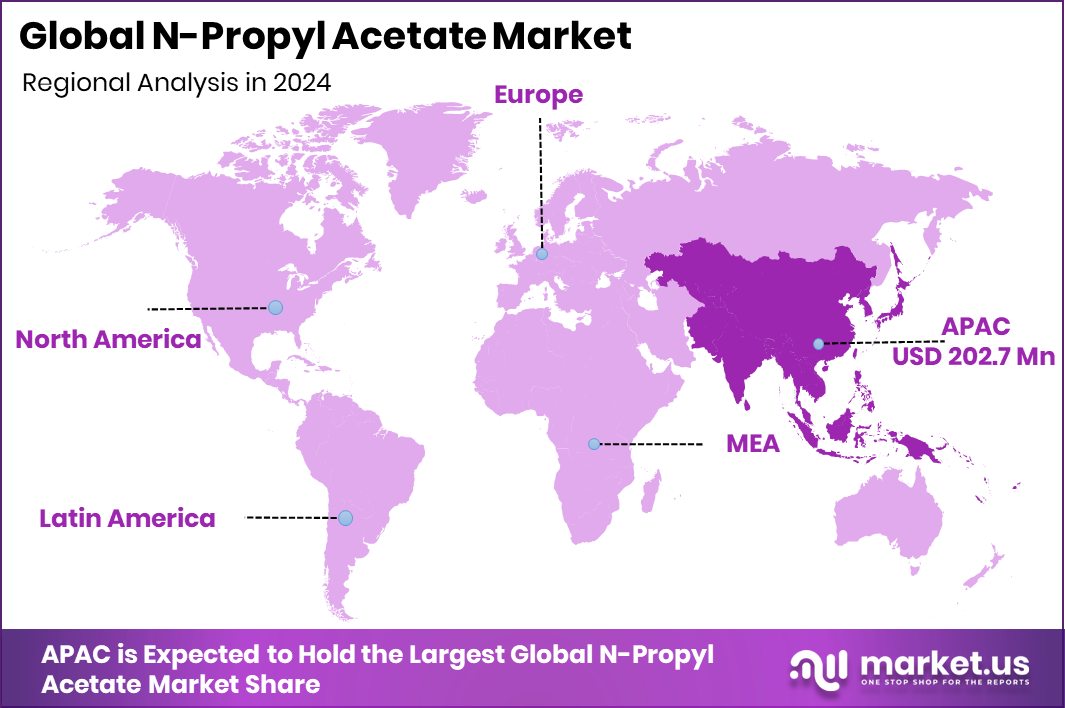

- The Asia-Pacific market value reached USD 202.7 million, showcasing strong industrial growth.

By Purity Analysis

N-Propyl Acetate Market with >99% purity holds a 65.9% share.

In 2024, >99% held a dominant market position in the “By Purity” segment of the N-Propyl Acetate Market, accounting for a 65.9% share. This high-purity grade was preferred across paints, coatings, inks, and pharmaceutical formulations where solvent clarity and consistency are critical. Its superior evaporation rate and low moisture content made it ideal for precision coatings and formulations requiring clean finishes. Manufacturers in the agrochemical and industrial sectors also favored >99% purity due to its compatibility with sensitive active ingredients, ensuring better solubility and product performance.

The growing focus on sustainable and high-efficiency solvents further boosted demand for >99% N-Propyl Acetate. Industries are shifting to low-VOC, high-purity solutions that reduce emissions and enhance safety standards. The purity-driven performance advantage supported its dominance as industries expanded production capacities for eco-compliant coatings and high-grade chemical formulations.

By Application Analysis

Solvent application dominates the N-Propyl Acetate Market with 69.2% usage.

In 2024, Solvent held a dominant market position in the “By Application” segment of the N-Propyl Acetate Market, accounting for a 69.2% share. This dominance was driven by its extensive use across coatings, inks, adhesives, and cleaning formulations. Owing to its excellent solvency, moderate evaporation rate, and pleasant odor, N-Propyl Acetate became a preferred choice in automotive, industrial, and decorative coating systems. Its ability to dissolve resins, pigments, and additives uniformly enhances surface finish quality and durability.

The solvent application also benefited from the global push toward low-VOC and eco-friendly materials. Manufacturers favored N-Propyl Acetate over traditional solvents for its low toxicity and superior performance in high-solid coatings and ink formulations. Additionally, the growing demand for precision cleaning agents and electronic-grade solvents further reinforced its strong market standing.

By End-Use Analysis

The paint and coatings industry leads with 38.5% N-Propyl Acetate demand.

In 2024, Paint and Coatings held a dominant market position in the “By End-Use” segment of the N-Propyl Acetate Market, accounting for a 38.5% share. The segment’s leadership stemmed from the compound’s strong solvency, fast drying rate, and ability to create smooth, durable finishes. N-Propyl Acetate was widely adopted in automotive, industrial, and architectural coatings due to its excellent balance between evaporation and flow control, helping achieve superior gloss and film integrity.

Its low odor and compatibility with acrylics, alkyds, and cellulose-based resins made it a preferred solvent in premium coating formulations. The rising demand for eco-compliant coatings with low volatile organic compound (VOC) emissions further supported its usage. As global construction and infrastructure activities expanded, manufacturers increasingly turned to N-Propyl Acetate for its consistency, workability, and environmental safety.

Key Market Segments

By Purity

- <99%

- >99%

By Application

- Solvent

- Flavoring Agent

- Others

By End-Use

- Paint and Coatings

- Chemical

- Pharmaceutical

- Printing Ink

- Food and Beverages

- Agrochemical

- Others

Driving Factors

Rising Industrial Investments Driving N-Propyl Acetate Demand

One of the major driving factors for the N-Propyl Acetate market is the increasing industrial investment across the manufacturing, printing, and coatings sectors. The compound’s versatility as a solvent in paints, inks, and adhesives has led to higher adoption by industries expanding production capacity. Recent funding activities highlight this momentum—Novenda secured $6.1 million in Series A funding to advance its dental 3D printing solutions, where N-Propyl Acetate plays a role in resin processing and cleaning applications.

Similarly, Hubergroup India’s talks with banks for Rs 1,500 crore funding indicate rising financial support for ink and coating manufacturing infrastructure. These developments reflect growing industrial confidence and investment flow, directly strengthening the demand for high-quality solvent systems like N-Propyl Acetate.

Restraining Factors

Environmental Regulations and Cost Pressures Limiting

A key restraining factor for the N-Propyl Acetate market is the growing pressure from environmental regulations and rising production costs. Governments are tightening emission norms and restricting the use of certain volatile organic compounds (VOCs), which affects solvent-based product formulations. Compliance with these standards often requires additional investment in purification and emission control systems, increasing overall costs for manufacturers.

Recent developments highlight the global shift toward sustainable materials — for instance, Mighty Buildings raised $52 million to expand eco-friendly 3D construction printing, and a plastic recycling innovation received $3 million to promote waste reduction technologies. Such funding trends show industries are moving toward greener alternatives, creating gradual limitations for traditional solvent use, like N-Propyl Acetate, in specific applications.

Growth Opportunity

Expanding 3D Printing and Digital Ink Innovations

A major growth opportunity for the N-Propyl Acetate market lies in the expansion of 3D printing and digital ink technologies. The solvent’s clean evaporation and excellent compatibility with resins and inks make it valuable for precision printing applications. Recent funding in this field underscores the rising potential — Inkmonk raised $750K to scale its online printing marketplace, while Inkbit secured $30 million to advance self-correcting 3D printing technology.

Additionally, Tampere University received €5.9 million in profiling funding to strengthen research in advanced materials and digital manufacturing. These investments reflect a strong shift toward high-performance, solvent-based formulations in modern printing and coating systems, opening new opportunities for N-Propyl Acetate across innovative manufacturing and design platforms.

Latest Trends

Integration of Printing Technologies Across New Industries

One of the latest trends in the N-Propyl Acetate market is the integration of advanced printing technologies into diverse industrial applications. The compound’s strong solvency and quick-drying nature make it ideal for high-precision printing inks and coating systems. This trend is gaining momentum as companies expand the scope of printing beyond traditional uses.

For instance, HP secured a $50 million CHIPS Act boost to adapt its inkjet technology for life sciences applications, while Ink’d Greetings raised $1 million to expand its personalized printing kiosk network. These investments highlight how innovative printing and coating technologies are opening new growth areas for N-Propyl Acetate, especially in sectors blending chemistry, digital printing, and industrial design solutions.

Regional Analysis

In 2024, Asia-Pacific dominated the N-Propyl Acetate Market with a 46.9% share.

In 2024, the Asia-Pacific region held a dominant position in the global N-Propyl Acetate Market, accounting for a 46.9% share valued at USD 202.7 million. The region’s strong industrial and manufacturing base, particularly in China, India, Japan, and South Korea, has driven demand for solvents used in paints, coatings, and inks. Expanding construction activities, growth in automotive coatings, and the rising adoption of eco-friendly formulations further strengthened the region’s market leadership.

North America followed, supported by steady consumption in the coatings and adhesives sectors, with industries focusing on low-VOC solvent technologies to meet environmental standards. Europe also showed stable growth, driven by sustainable chemical production and innovations in green coatings.

Meanwhile, the Middle East & Africa and Latin America demonstrated gradual expansion due to emerging industrialization and infrastructure development projects, which are increasing solvent demand across local manufacturing hubs.

Overall, Asia-Pacific remained the core contributor to global revenue due to its large-scale production capabilities, cost-effective raw materials, and growing end-use industries that continue to shape the future demand outlook for N-Propyl Acetate across the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

OQ Chemicals GmbH continued to emphasize high-purity ester production through process efficiency and sustainability initiatives. Its focus on low-emission and bio-based chemical manufacturing supported the global shift toward cleaner industrial solvents, strengthening its presence in coatings and specialty applications.

Solvay, with its deep expertise in specialty chemicals, leveraged advanced formulation technologies to enhance solvent performance and reduce environmental impact. Its emphasis on circular chemistry and product safety positioned it as a preferred partner for manufacturers seeking regulatory compliance and green alternatives.

BASF SE, a leading global chemical company, maintained its leadership through integrated production systems and continuous R&D investments in solvent efficiency. BASF’s focus on energy-efficient processes and improved downstream applications helped expand its role across coatings, inks, and adhesive markets.

Top Key Players in the Market

- OQ Chemicals GmbH

- Solvay

- BASF SE

- Sasol

- DOW chemicals

- Eastman Chemical company

- SHOWA DENKO K.K.

- Tokyo Chemical Industries

- Jiangsu Baichuan High-tech New Materials Co., Ltd.

- Shiny Chemical Industries Co. Ltd

Recent Developments

- In March 2025, OQ Chemicals announced that its Oberhausen (Germany) site would launch dedicated production of heptanoic acid by June 2025. This expansion strengthens its carboxylic‐acid portfolio and supports supply security for multiple industries.

- In October 2024, Solvay announced the completion of a major greenhouse-gas (GHG) emissions reduction initiative at its Green River facility (USA) in October 2024. The project introduced a new process and phased out coal usage, targeting roughly a 4 % reduction in company-wide emissions by 2025.

Report Scope

Report Features Description Market Value (2024) USD 432.2 Million Forecast Revenue (2034) USD 752.4 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (<99%, >99%), By Application (Solvent, Flavoring Agent, Others), By End-Use (Paint and Coatings, Chemical, Pharmaceutical, Printing Ink, Food and Beverages, Agrochemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape OQ Chemicals GmbH, Solvay, BASF SE, Sasol, DOW chemicals, Eastman Chemical company, SHOWA DENKO K.K., Tokyo Chemical Industries, Jiangsu Baichuan High-tech New Materials Co., Ltd., Shiny Chemical Industries Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  N-Propyl Acetate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

N-Propyl Acetate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- OQ Chemicals GmbH

- Solvay

- BASF SE

- Sasol

- DOW chemicals

- Eastman Chemical company

- SHOWA DENKO K.K.

- Tokyo Chemical Industries

- Jiangsu Baichuan High-tech New Materials Co., Ltd.

- Shiny Chemical Industries Co. Ltd