Global Mustard Flour Market Size, Share, And Business Benefits By Type (Yellow Mustard Flour, Brown Mustard Flour, Black Mustard Flour), By Application (Food Industry, Cosmetic Industry, Pharmaceutical Industry, Beverage Industry, Others), By End Use (Commercial, Household, Industrial), By Distribution Channel (Supermarkets, Online Retail, Convenience Stores, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151760

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

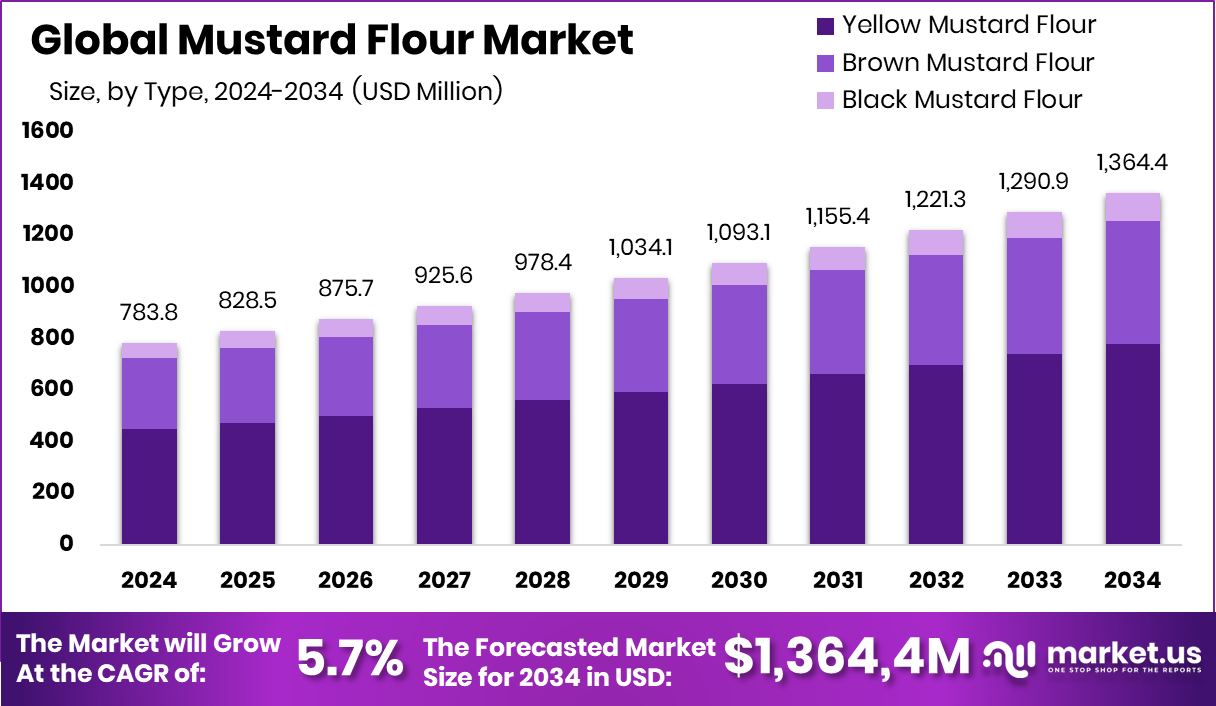

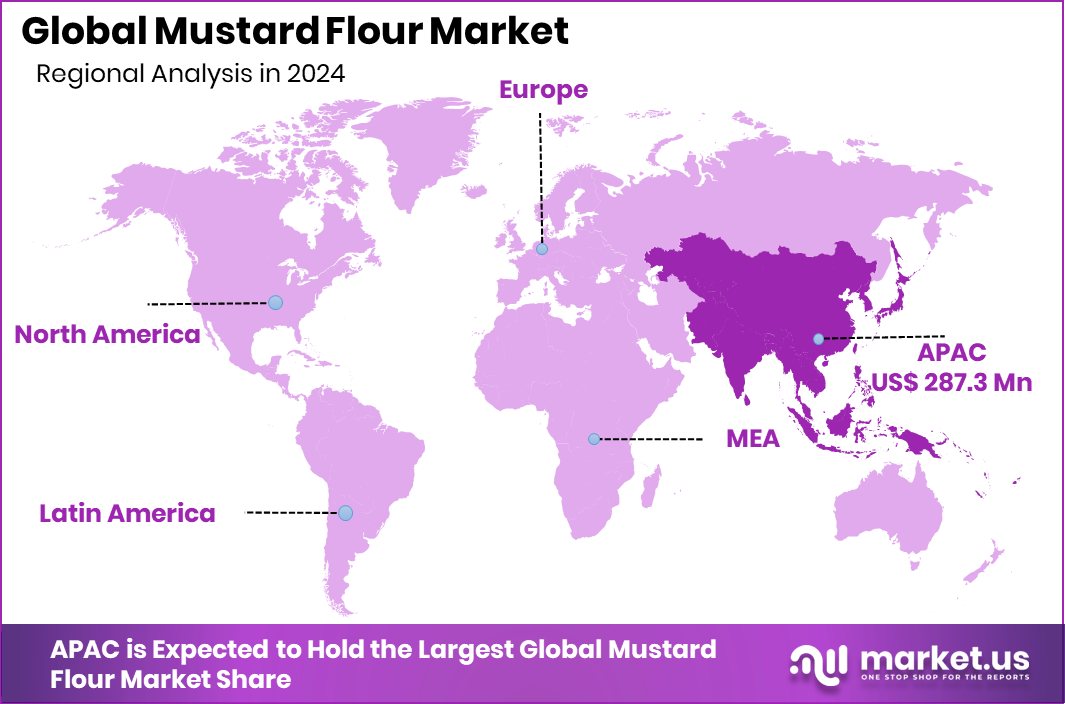

Global Mustard Flour Market is expected to be worth around USD 1,364.4 Million by 2034, up from USD 783.8 Million in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. Strong culinary traditions and rising clean-label demand boosted Asia-Pacific’s 38.9% mustard flour consumption.

Mustard flour is a finely ground powder derived from mustard seeds, typically yellow or brown varieties. It is commonly used as a spice or thickening agent in food preparation and serves as a key ingredient in salad dressings, sauces, pickles, and dry rubs. Known for its pungent aroma and sharp, tangy flavor, mustard flour is also valued for its preservative qualities and emulsifying properties. Beyond culinary applications, it has found limited use in traditional remedies and natural pest deterrents due to its bioactive compounds, including glucosinolates and essential oils.

The mustard flour market refers to the global trade and consumption of powdered mustard products, spanning food processing, culinary use, and select industrial applications. This market is shaped by trends in clean-label ingredients, rising interest in natural spices, and evolving consumer tastes. Growth is being driven by both the increasing demand from the food and beverage sector and the wider recognition of mustard’s functional benefits.

The market growth is primarily supported by a rising global preference for natural and clean-label food ingredients. As consumers shift away from synthetic additives, mustard flour is gaining traction due to its plant-based origin and minimal processing. Additionally, its role as a flavor enhancer and preservative aligns with evolving consumer demands for functional ingredients, particularly in processed and convenience foods. According to an industry report, Tiney, a tech-driven childcare startup based in London, UK, secured £7.2 million in Series A funding.

Demand for mustard flour is particularly strong in North America, Europe, and parts of Asia, driven by its widespread use in sauces, marinades, and spice blends. With the expansion of the processed food industry and increased home cooking trends post-pandemic, mustard flour is increasingly being stocked in retail kitchens and food service sectors.

Key Takeaways

- Global Mustard Flour Market is expected to be worth around USD 1,364.4 Million by 2034, up from USD 783.8 Million in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- Yellow mustard flour leads the mustard flour market by type, accounting for a dominant 57.2% share.

- The food industry holds the largest application share in the mustard flour market, contributing 68.1% in 2024.

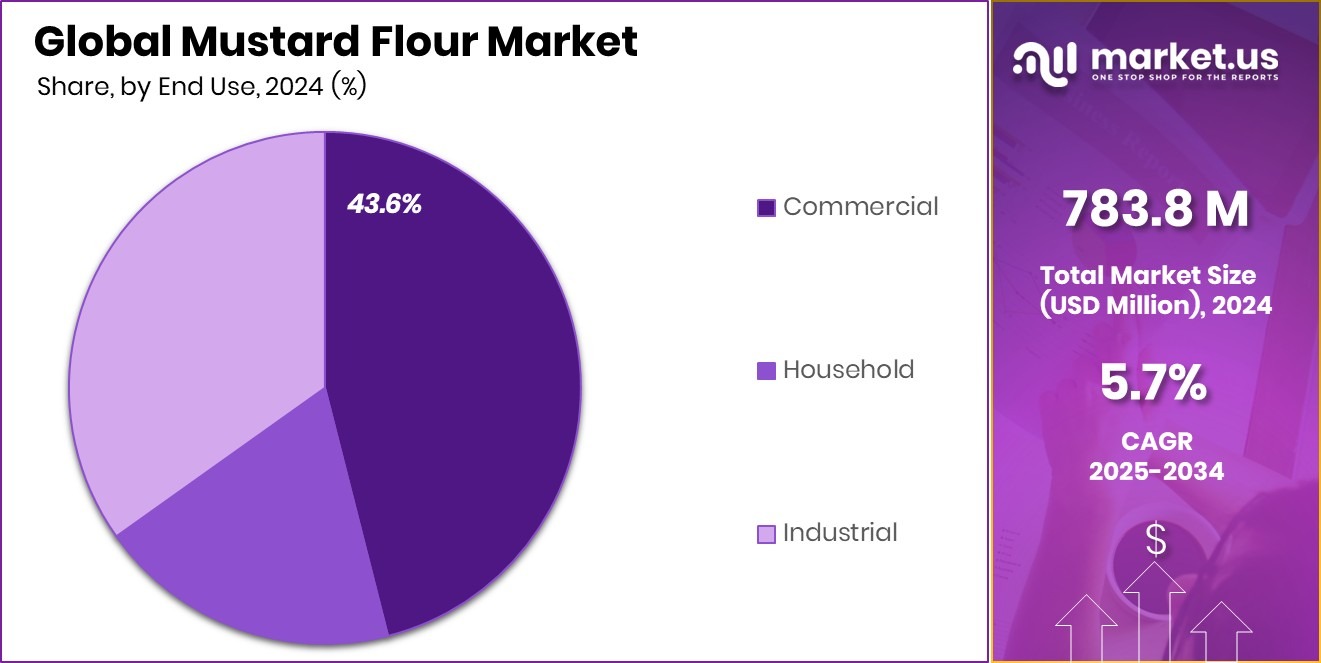

- Commercial usage remains the leading end-use segment in the mustard flour market with a 43.6% contribution.

- Supermarkets dominate the distribution channel in the mustard flour market, capturing 43.3% of the overall share.

- The regional market value in Asia-Pacific reached a total of USD 287.3 million.

By Type Analysis

Yellow mustard flour dominates the market, capturing 57.2% due to its versatility.

In 2024, Yellow Mustard Flour held a dominant market position in the By Type segment of the Mustard Flour Market, with a 57.2% share. This leading position can be attributed to the widespread use of yellow mustard seeds in food processing, particularly in North America and Europe, where their mild flavor and bright color are preferred in a variety of culinary applications.

Yellow mustard flour is commonly used in sauces, salad dressings, pickles, spice blends, and marinades due to its balanced pungency and emulsifying properties, making it a staple in processed and packaged food items.

The dominance of yellow mustard flour is also supported by its high availability and cost-effectiveness, as yellow mustard seeds are cultivated extensively in regions with established agricultural infrastructure. Additionally, its compatibility with clean-label and natural food trends has reinforced its demand, especially among consumers seeking plant-based, additive-free ingredients.

With the food industry placing increased focus on flavor enhancement and natural preservation, yellow mustard flour continues to meet both functional and flavoring needs. This consistent demand across both household and industrial food applications underscores its strong market share and cements its leadership within the type segmentation of the mustard flour market.

By Application Analysis

The food industry leads application share with 68.1%, driven by processed and packaged food usage.

In 2024, Food Industry Flour held a dominant market position in the By Application segment of the Mustard Flour Market, with a 68.1% share. This significant market share reflects the extensive use of mustard flour across various food processing applications, including sauces, condiments, seasoning mixes, processed meats, and ready-to-eat meals. Its strong pungency, natural preservative properties, and emulsifying capacity make it a valuable ingredient for enhancing both flavor and shelf life in food products.

The demand from the food industry is further reinforced by the rising consumer preference for natural, clean-label ingredients. As manufacturers seek to replace artificial additives and preservatives, mustard flour is increasingly utilized for its multifunctional benefits. Its adaptability across a wide range of cuisines and processed foods also adds to its widespread adoption.

Moreover, the ease of incorporation into both wet and dry formulations provides further operational convenience for large-scale food producers. With the continued expansion of the global processed food sector and growing interest in plant-derived functional ingredients, the food industry segment remains the leading driver of mustard flour consumption, securing its dominant position in the application landscape of the market.

By End Use Analysis

Commercial use accounts for 43.6%, supported by demand from restaurants and food services.

In 2024, Commercial held a dominant market position in the By End Use segment of the Mustard Flour Market, with a 43.6% share. This leading position is primarily driven by the widespread application of mustard flour in commercial food production settings such as restaurants, catering services, food processing units, and institutional kitchens.

Commercial establishments rely heavily on consistent, high-quality flavoring agents and functional ingredients, and mustard flour serves this need effectively with its sharp taste, natural preservative qualities, and ability to enhance food texture and aroma.

The commercial sector continues to favor mustard flour due to its ease of storage, long shelf life, and compatibility with bulk food preparation. Its integration into sauces, spice blends, marinades, and dressings makes it a reliable component for food service professionals aiming to deliver consistent taste profiles across high-volume operations.

Additionally, the growing demand for natural and additive-free ingredients in the foodservice industry supports the use of mustard flour, aligning with consumer expectations for clean-label meals even outside the home. This sustained preference from commercial food users underlines the segment’s dominant share and reaffirms its role as a key end-user in the mustard flour market landscape.

By Distribution Channel Analysis

Supermarkets hold a 43.3% distribution share, reflecting strong retail consumer preference for mustard flour.

In 2024, Supermarkets held a dominant market position in the By Distribution Channel segment of the Mustard Flour Market, with a 43.3% share. This dominance is largely due to the wide accessibility, product variety, and convenience offered by supermarket chains, which have become the preferred retail format for everyday grocery purchases, including culinary spices and functional food ingredients like mustard flour.

The organized retail environment of supermarkets allows consumers to easily compare brands, packaging sizes, and ingredient labels, which supports informed purchasing decisions.

Supermarkets also serve as key points for promotional activities, product sampling, and visibility of mustard flour products through structured shelving and strategic placements. The ability to cater to both individual buyers and small-scale commercial consumers further contributes to their strong market share.

Additionally, with urbanization and lifestyle shifts driving more frequent visits to modern retail stores, supermarkets have effectively positioned themselves as the primary channel for pantry staples, including spice-based flours. Their dominance is supported by strong supply chain networks, consistent product availability, and the trust associated with branded retail experiences.

Key Market Segments

By Type

- Yellow Mustard Flour

- Brown Mustard Flour

- Black Mustard Flour

By Application

- Food Industry

- Cosmetic Industry

- Pharmaceutical Industry

- Beverage Industry

- Others

By End Use

- Commercial

- Household

- Industrial

By Distribution Channel

- Supermarkets

- Online Retail

- Convenience Stores

- Specialty Stores

- Others

Driving Factors

Rising Demand for Natural Ingredients in Foods

One of the top driving factors in the mustard flour market is the growing global demand for natural and clean-label ingredients in everyday food products. Consumers today are becoming more health-conscious and are actively avoiding artificial additives, synthetic preservatives, and artificial flavoring agents. Mustard flour, being a plant-based and minimally processed ingredient, fits perfectly into this shift in consumer preference.

It is widely appreciated for its natural flavor, strong aroma, and ability to enhance both taste and shelf life in food items. Its application across sauces, dressings, marinades, and seasoning blends further boosts its popularity. As the clean-label trend continues to rise, mustard flour is expected to see stronger demand from food manufacturers and home cooks alike.

Restraining Factors

Strong Competition from Other Spice Alternatives

Mustard flour faces significant competition from other spice powders and natural flavor enhancers such as paprika, turmeric, garlic, and onion powders. Many manufacturers and home cooks opt for these alternatives to achieve desired flavors or colors in their dishes. This intense competition limits mustard flour’s market growth and pricing power.

Additionally, some of these substitutes may offer milder taste profiles or lower costs, making them more appealing for certain applications. As consumers and food producers seek variety, the unique pungent profile of mustard flour may not always align with every recipe or preference.

Growth Opportunity

Opportunity to Expand into Health-Focused Food Products

Mustard flour has a strong chance to grow in the health-focused and functional food segments. As people become more aware of foods that offer health benefits beyond basic nutrition, mustard flour can stand out due to its natural compounds, like antioxidants and anti-inflammatory agents.

Food makers can introduce new products—such as health bars, protein mixes, low-sodium seasonings, and natural preservatives—that leverage the wellness potential of mustard flour without adding artificial ingredients. Additionally, the rise of at-home cooking and meal kits provides an avenue for mustard flour to feature in recipes promoting gut health and overall wellness.

Latest Trends

Growing Popularity of Plant-Based and Vegan Cooking

A key trend shaping the mustard flour market is the rising popularity of plant-based and vegan cooking. As more people adopt vegetarian and vegan diets, the demand for natural, plant-based ingredients is increasing. Mustard flour fits well into this trend because it is 100% plant-derived and enhances the flavor of meat-free dishes without the need for artificial additives.

It is commonly used in vegan sauces, dressings, meat substitutes, and spice blends to add sharpness and depth of flavor. Home cooks and food manufacturers alike are exploring ways to include mustard flour in new, innovative recipes. This trend is expected to keep growing, making mustard flour a versatile and in-demand ingredient in modern plant-based kitchens.

Regional Analysis

In 2024, Asia-Pacific led the mustard flour market with 38.9% share.

In 2024, the Asia-Pacific region emerged as the leading market for mustard flour, accounting for 38.9% of the global share, with a market value of USD 287.3 million. This dominance is supported by the region’s strong culinary usage of spices, increasing demand for natural food ingredients, and expanding food processing industries in countries such as India, China, and Japan.

The popularity of traditional recipes incorporating mustard flour, along with rising urbanization and health awareness, further reinforces its widespread application in both household and commercial cooking.

North America and Europe also represent important markets for mustard flour, driven by their established processed food sectors and consumer preference for clean-label and additive-free ingredients. Meanwhile, Latin America and the Middle East & Africa regions are witnessing moderate growth, supported by the gradual adoption of mustard-based seasonings in regional cuisines and the growing trend toward natural ingredients.

However, these regions still trail behind Asia-Pacific in overall consumption and market value. The strong regional performance in Asia-Pacific underscores its critical role in driving the global mustard flour market, both in terms of volume and revenue contribution, marking it as the most influential region within the current market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global mustard flour market was influenced by several prominent players—ConAgra Foods, Unilever, McCormick and Company, and Cargill—each contributing distinct strategic advantages that shaped market dynamics.

ConAgra Foods leveraged its established presence in North America’s food sector to ensure the reliable distribution of mustard flour within its packaged and processed food product lines. The company’s deep integration into everyday retail channels allowed for consistent demand, supported by its ability to maintain clean-label product positioning and meet rising consumer expectations for natural ingredients.

Unilever brought its global brand strength and expansive supply network to the table. Known for its diverse food portfolio, Unilever incorporated mustard flour as a functional ingredient across dressings, sauces, and ready-to-eat lines. This integration within widely consumed condiment brands reinforced mustard flour’s relevance in mainstream kitchens and enhanced consumer trust through recognized labels.

McCormick and Company, esteemed for its specialty spices and flavor solutions, contributed through focused innovation. The company developed targeted mustard flour blends and flavor systems, supporting both industrial food processors and retail consumers. McCormick’s emphasis on product quality and consistent flavor performance reinforced mustard flour’s value in seasoning applications, boosting its appeal in both home cooking and commercial product formulations.

Cargill, a major agricultural and ingredient supply firm, played a crucial role in securing raw material supply chains. Its global mustard seed sourcing and processing capabilities ensured stable mustard flour availability and cost competitiveness. By supplying large-scale food producers, Cargill underpinned the market’s ability to scale, offering reliable volumes and support for functional-use growth.

Top Key Players in the Market

- ConAgra Foods

- Unilever

- McCormick and Company

- Cargill

- Archer Daniels Midland Company

- Ddev Spices Private Limited

- Factoria-Agro, Ltd.

- Great American Spice Company

- G.S. Dunn Dry Mustard Millers

- Divis Laboratories Ltd.

- ITC Limited

- Lanna Products Co., Ltd.

- McCormick & Company, Inc.

- Mincing Spice

- Minn-Dak Growers, Ltd.

- S&B Foods Inc

- Sakai Spice Corporation

Recent Developments

- In June 2025, Conagra announced that by the end of 2025, it would eliminate all certified Food, Drug & Cosmetic (FD&C) colors from its U.S. frozen product lineup. This effort is part of a multi‑year strategy to modernize its portfolio, responding to consumer demand for cleaner, more transparent ingredient lists.

- In March 2024, Unilever launched its first regenerative agriculture initiative in the UK, partnering with farms that grow mustard seeds for Colman’s products. The pilot, funded by its Climate & Nature Fund, involves cover and companion cropping, low-carbon fertilisers, reduced tillage, and digital irrigation scheduling—methods designed to improve soil health, increase yields, and protect farmers against climate instability.

- In December 2023, ADM finalized an agreement to acquire UK-based FDL, a specialist in flavor and functional ingredients systems. FDL boasts approximately $120 million in projected annual sales and operates three production facilities and two innovation centers in the UK. This acquisition was completed in early 2024 and positions ADM to strengthen its flavor solutions portfolio, benefiting food producers who may include ingredients like mustard flour in seasoning systems.

Report Scope

Report Features Description Market Value (2024) USD 783.8 Million Forecast Revenue (2034) USD 1,364.4 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Yellow Mustard Flour, Brown Mustard Flour, Black Mustard Flour), By Application (Food Industry, Cosmetic Industry, Pharmaceutical Industry, Beverage Industry, Others), By End Use (Commercial, Household, Industrial), By Distribution Channel (Supermarkets, Online Retail, Convenience Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ConAgra Foods, Unilever, McCormick and Company, Cargill, Archer Daniels Midland Company, Ddev Spices Private Limited, Factoria-Agro, Ltd., Great American Spice Company, G.S. Dunn Dry Mustard Millers, Divis Laboratories Ltd., ITC Limited, Lanna Products Co., Ltd., McCormick & Company, Inc., Mincing Spice, Minn-Dak Growers, Ltd., S&B Foods Inc, Sakai Spice Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ConAgra Foods

- Unilever

- McCormick and Company

- Cargill

- Archer Daniels Midland Company

- Ddev Spices Private Limited

- Factoria-Agro, Ltd.

- Great American Spice Company

- G.S. Dunn Dry Mustard Millers

- Divis Laboratories Ltd.

- ITC Limited

- Lanna Products Co., Ltd.

- McCormick & Company, Inc.

- Mincing Spice

- Minn-Dak Growers, Ltd.

- S&B Foods Inc

- Sakai Spice Corporation