Global Motorcycle Battery Market By Battery Type (Lead-Acid Batteries (Wet Cell, Maintenance-Free, Absorbent Glass Mat (AGM), Gel Cell, Others), Lithium-Ion Batteries), By Capacity (Upto 50 AH, 50 AH to 10 AH, 10 AH to 15 AH, Above 15 AH), By Propulsion Type (Internal Combustion Engine (ICE), Electric), By Application (Standard, Cruiser, Moped, Sports, Adventure, Others), By End-user (OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150931

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

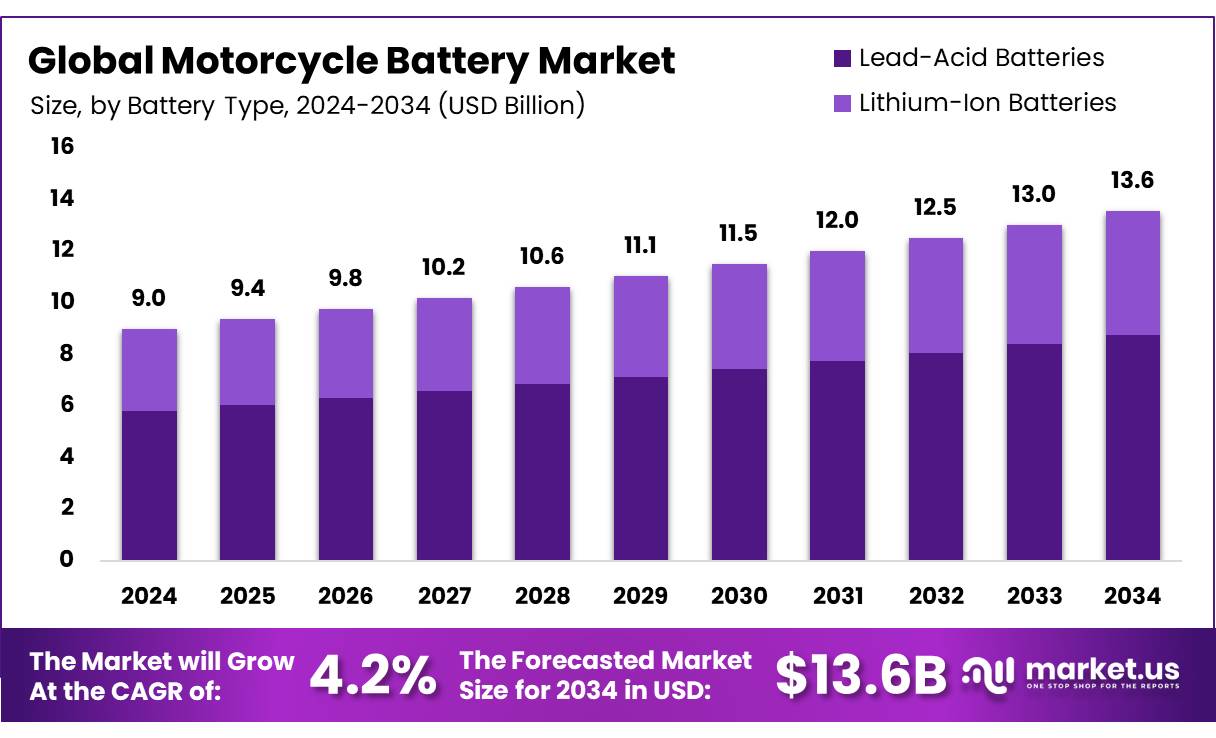

The Global Motorcycle Battery Market size is expected to be worth around USD 13.6 Billion by 2034, from USD 9.0 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

A motorcycle battery is an electrical storage device that powers various functions of a motorcycle, including starting the engine, lighting, and electronic systems, by storing and releasing electrical energy through a reversible chemical reaction—commonly between lead and acid in traditional batteries. The importance of motorcycle batteries lies in their role in ensuring reliable performance, energy efficiency, and convenience for riders, especially with the growing adoption of electric motorcycles.

As motorcycles continue to serve as a primary mode of transport in many regions especially across Asia-Pacific, Latin America, and Africa the demand for high-performance, durable, and maintenance-free battery solutions has increased.

Globally, the motorcycle battery market is experiencing steady growth, driven by rising two-wheeler sales, increased electrification of transport, and technological advancements such as lithium-ion and swappable battery systems. The market is further supported by government incentives, urban mobility shifts, and consumer preference for cleaner, low-maintenance transport options.

Key Takeaways

- The global motorcycle battery market was valued at USD 9.0 billion in 2024.

- The global motorcycle battery market is projected to grow at a CAGR of 4.2 % and is estimated to reach USD 13.6 billion by 2034.

- Among battery types, lead-acid batteries accounted for the largest market share of 64.5%.

- Among capacity, 50 AH to 10 AH accounted for the majority of the market share at 37.5%.

- By propulsion type, Internal Combustion Engine (ICE) accounted for the largest market share of 78.3%.

- By application, Standard accounted for the majority of the market share at 43.3%.

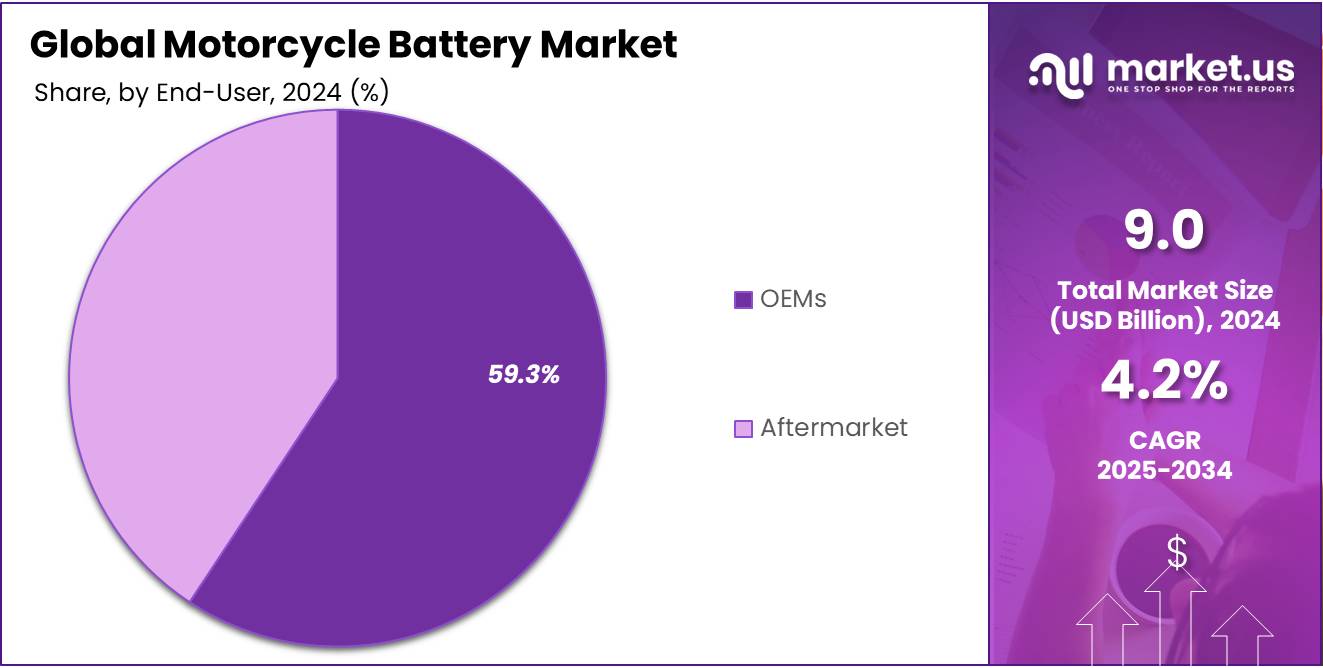

- Among end-users, OEMs accounted for the largest market share of 59.3%

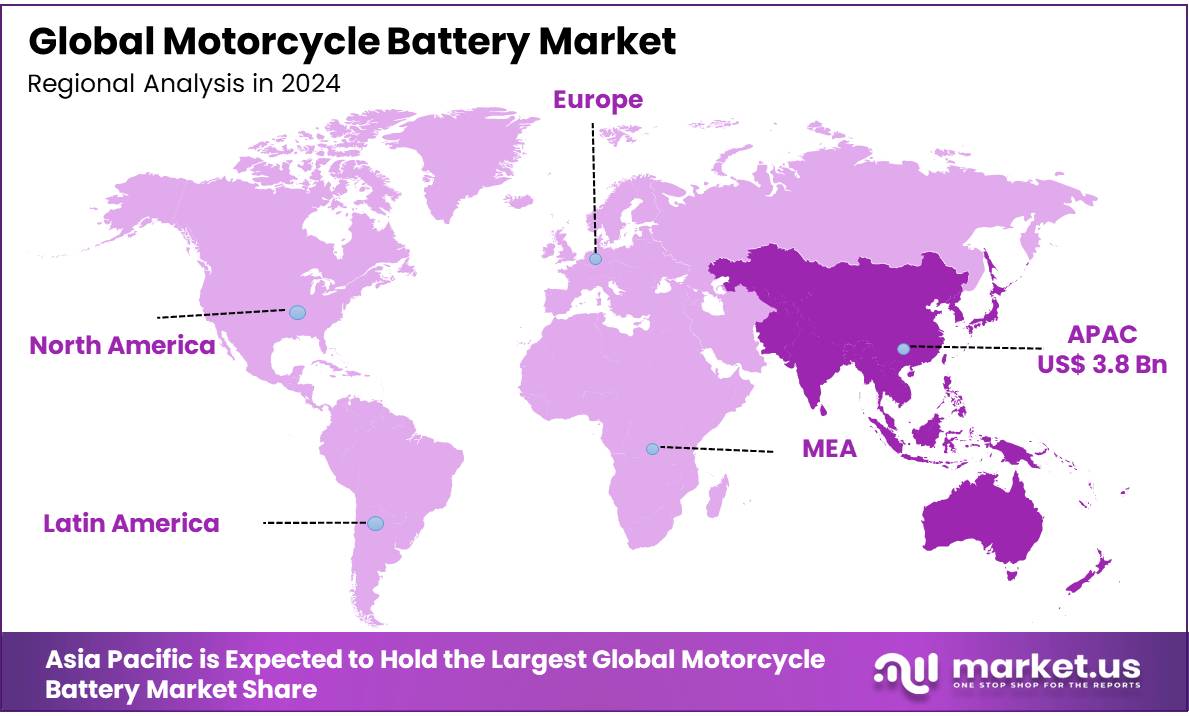

- Asia Pacific is estimated as the largest market for motorcycle batteries with a share of 43.3% of the market share.

Battery Type Analysis

By Battery Type Lead Acid Batteries Dominated in 2024 Due To Their Low Cost And Wide Availability.

The Motorcycle Battery market is segmented based on Battery type into Lead-Acid Batteries and lithium-ion Batteries. In 2024, the Lead-Acid Batteries segment held a significant revenue share of 64.5%. Due to their cost-effectiveness, widespread availability, and established use in conventional internal combustion engine (ICE) motorcycles. These batteries are relatively inexpensive to produce and replace, making them particularly popular in price-sensitive markets across Asia-Pacific, Latin America, and Africa. Additionally, their mature supply chain, ease of recyclability, and robust performance under varied climatic conditions continue to support their dominance, especially in entry-level and commuter motorcycle segments.

Capacity Analysis

By Capacity Range 50 AH to 10 AH Segment Led The Market Due To Its Compatibility With Daily-Use Motorcycles.

Based on Capacity, the market is further divided into Up to 50 AH, 50 AH to 10 AH, 10 AH to 15 AH, and Above. The predominance of the 50 AH to 10 AH, commanding a substantial 37.5% market share in 2024. Due to the widespread use of motorcycles that fall within the commuter and mid-range performance categories, which typically require batteries in this capacity range. These motorcycles represent a large portion of the two-wheeler population, especially in emerging economies, where they are used for daily commuting, delivery services, and utility purposes. The balance between sufficient power output and affordability in this capacity segment makes it a preferred choice for both manufacturers and end users.

Propulsion Type Analysis

By Propulsion Type, ICE Motorcycles Held Major Share In 2024 Due To Widespread Use And Established Infrastructure.

Among Propulsion Types, the motorcycle battery market is classified into Internal Combustion Engine (ICE), and Electric. In 2024, Internal Combustion Engine (ICE) held a dominant position with a 78.3% share. Due to the existing large base of ICE motorcycles, especially in developing regions where affordability, established refueling infrastructure, and longer driving range continue to favor traditional combustion engine models. Despite the growing adoption of electric motorcycles, ICE vehicles still represent the majority of two-wheelers on the road, supported by mature supply chains, widespread maintenance networks, and lower initial costs compared to electric alternatives.

Application Analysis

By Application Standard Motorcycles Accounted for Largest Share In 2024, Driven By High Adoption For Everyday Commuting.

By application, the market is categorized into standard, cruiser, moped, sports, adventure, and others. The standard segment emerged as the dominant application, holding 43.3% of the total market share in 2024. This dominance is attributed to the widespread use of standard motorcycles for daily commuting, especially in densely populated and developing regions where affordability, fuel efficiency, and ease of maintenance make them a preferred choice. Additionally, their versatility and compatibility with various battery types support consistent demand for replacements and upgrades, thereby reinforcing the segment’s leading position in the market.

End-Use Analysis

End-User OEMs Led Market Due To Direct Integration Of Batteries During Vehicle Manufacturing.

In the motorcycle battery market, OEMs lead the market, accounting for a dominant 59.3% share. Driven by the growing production of new motorcycles, especially in emerging economies, where demand for reliable factory-fitted batteries is high. OEMs ensure compatibility, performance consistency, and warranty support, which boosts consumer confidence. Additionally, partnerships between battery manufacturers and motorcycle brands have further strengthened OEM sales, contributing to their substantial market share.

Key Market Segments

By Battery Type

- Lead-Acid Batteries

- Wet Cell

- Maintenance-Free

- Absorbent Glass Mat (AGM)

- Gel Cell

- Others

- Lithium-Ion Batteries

By Capacity

- Upto 50 AH

- 50 AH to 10 AH

- 10 AH to 15 AH

- Above 15 AH

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Application

- Standard

- Cruiser

- Moped

- Sports

- Adventure

- Others

By End-user

- OEMs

- Aftermarket

Drivers

Growth of electric motorcycles and E-scooters.

The rapid growth of electric motorcycles and e-scooters is a significant driver fueling the expansion of the global motorcycle battery market. As demand for cleaner, more efficient two-wheeler transportation intensifies amid rising concerns over climate change and greenhouse gas emissions, electric two-wheelers are increasingly favored for their zero tailpipe emissions, lower operating costs, and reduced maintenance requirements. This shift towards sustainable urban mobility is directly boosting the need for advanced battery technologies, particularly lithium-ion batteries, which provide the high energy density and longevity required to power the next generation of electric motorcycles and e-scooters.

- According to the International Energy Agency, 90% of lithium-ion batteries in use are for electrification in the transport sector.

- Additionally, over 9% of the global two- and three-wheeler fleet is electric as of 2024, making it the most electrified segment of road transport and a key driver of growth in the motorcycle battery market.

Furthermore, electrification of vehicles especially two-wheelers has emerged as an important element in global decarbonization efforts. Motorcycles, widely used in urban centers for both personal and commercial applications, are central to this transition. Electric motorcycles and e-scooters have emerged as a promising alternative to conventional two-wheelers, offering benefits such as zero tailpipe emissions, lower operational costs, and reduced maintenance needs. This shift is fueling robust demand in the global motorcycle battery market, as advanced battery technologies particularly lithium-ion become essential for powering the next generation of electric two-wheelers.

- According to the International Energy Agency since 2020, approximately USD 130 billion has been allocated globally to support EV adoption, including significant initiatives like the EU Recovery and Resilience Facility and the US Inflation Reduction Act. Additionally, around USD 25 billion has been directed towards battery manufacturing and recycling incentives, further strengthening the motorcycle battery market in urban mobility solutions.

Additionally, governments across the world introduce incentive programs for electric mobility and urban consumers seek cost-effective, sustainable transport options, the market for electric two-wheelers continues to expand. The rapid growth of electric motorcycles and e-scooters remains a primary catalyst for innovation and investment across the motorcycle battery supply chain. Supportive government policies, urban sustainability goals, and rising consumer awareness are further accelerating the adoption of electric two-wheelers, positioning battery manufacturers and mobility solution providers to benefit from this transformation in urban transport. Increasing financial support from governments in recent years, provided through clean vehicle credits, tax credit exemptions, and state-backed loans, has led to a surge in global investment in EV batteries.

- According to International Energy Agency reports United States is now aiming to increase the adoption of EVs through the provision of generous subsidies under the Inflation Reduction Act of 2022 for domestically produced models that meet Clean Vehicle Tax Credit requirements. The Inflation Reduction Act of 2022 makes more than USD 15 billion of production credits available for advanced manufacturing.

- In the European Union, the Important Projects of Common European Interest (IPCEI) initiative offers incentives to support battery manufacturing.

Restraints

Rising Safety Concerns about Battery

The growing safety concern about battery one of the important factors restraining the global motorcycle battery market growth. As battery technology majorly depends on thermal, chemical, and mechanical energy risks such as thermal runaway, chemical leakage, and explosion hazards, especially in lithium-ion technologies, raises significant issues related to human safety, property damage, and environmental impact. These concerns are further amplified by the complexity of managing battery aging, which affects both operational reliability and long-term costs.

Additionally, battery safety requires multi-layered system design, including thermal management, electrical protection, and robust enclosure systems. However, incidents involving fire and system failure have heightened regulatory scrutiny, often resulting in stricter safety standards, longer certification timelines, and increased production costs. These factors may limit market expansion, especially in high-density urban and commercial applications.

Opportunity

Expansion of Swappable Battery Network

The expansion of swappable battery networks is emerging as a significant growth opportunity for the global motorcycle battery market, especially within the electric two-wheeler this technology addresses several critical adoption barriers most notably charging time, range anxiety, and upfront costs by offering users to replace depleted batteries with fully charged ones in a matter of minutes. For densely populated urban areas and high-frequency delivery use cases, battery swapping offers a fast, convenient, and cost-effective alternative to traditional charging infrastructure. This efficiency makes electric motorcycles more appealing as compared to the refueling experience of internal combustion engine motorcycles.

- For instance, UNESCAP’s 2023 report highlights that battery swapping can reduce downtime by over 90% compared to plug-in charging, which is critical for high-frequency delivery fleets.

Additionally, the adoption of standardized battery specifications across manufacturers is enabling the deployment of interoperable swapping networks, which enhances user convenience and encourages infrastructure scalability. Swappable battery systems also align with circular economy principles by facilitating battery reuse and second-life applications, thus reducing environmental impact and total lifecycle costs. As electric vehicle technologies evolve This creates new demand for advanced lithium-based batteries, especially ternary lithium and lithium iron phosphate, battery swapping will play a pivotal role in accelerating the shift to electric mobility.

Furthermore, several governments are actively facilitating the shift toward motorcycle battery swapping through a combination of targeted policies and regulatory initiatives. A key focus is the introduction of battery standardization frameworks, which are essential for building scalable and interoperable battery-swapping networks across brands. At the same time, public investment is being channeled into research and development, as well as strategic industry partnerships, to accelerate the commercialization of advanced battery technologies. These combined efforts help to overcome key adoption challenges but also create a strong policy and industrial foundation to support long-term growth in the global motorcycle battery market.

- According to the International Council on Clean Transportation, Thailand plans to become Southeast Asia’s EV hub, targeting 650,000 electric two-wheelers by 2030, alongside 12,000 charging points and 1,450 battery swapping stations.

- For instance, UNEP’s Global Electric Mobility Programme supports more than 60 countries in the Global South with US$130 million in grants to promote a shift from fossil fuels in transportation. It champions e-mobility targets and policies worldwide and collaborates with the International Energy Agency through Global Working Groups, including the one focused on electric two- and three-wheelers.

Trends

Increased waterproofing and rugged battery casing

A growing trend in the global motorcycle battery market is the increased demand for waterproofing and rugged battery casings, driven by the need for durability and enhanced performance in diverse environmental conditions. As electric motorcycles and e-scooters are increasingly used across urban, rural, and off-road terrains, battery systems are being designed to withstand exposure to water, dust, vibrations, and extreme temperatures. Manufacturers are investing in IP-rated enclosures and robust protective materials to ensure the longevity and safety of battery packs under varying operational scenarios.

This shift is particularly crucial for regions with high rainfall, poor road conditions, or significant temperature fluctuations, where conventional battery designs may face premature degradation. Waterproof and rugged casings not only improve the resilience and lifespan of batteries but also reduce maintenance requirements, making electric motorcycles more reliable for daily commuting and commercial applications. As consumers prioritize durability and low total cost of ownership, the trend toward enhanced protective features is expected to play a key role in shaping product development and competitiveness in the motorcycle battery market.

Geopolitical Impact Analysis

Geopolitical Impact of US-China-EU Trade Disputes On the Disrupt Supply Chain and Production of Motorcycle Battery Market.

Recent geopolitical developments, particularly the ongoing trade tensions among the United States, China, and the European Union, have significantly disrupted the global motorcycle battery market by affecting supply chains and production capabilities. The imposition of tariffs during the Trump administration has notably increased the cost of imported batteries and critical materials, especially those sourced from China. China currently supplies over 90% of the lithium-ion battery cells for U.S. motorcycle battery projects, making the sector highly vulnerable to such policy changes.

As a global leader in battery manufacturing, China plays a dominant role in the clean energy supply chain, particularly in lithium-ion battery production. In response to U.S. trade restrictions, China introduced its own export controls and licensing requirements on critical raw materials used in motorcycles including electric bikes and high-performance bikes. In April 2025, China escalated these measures by restricting exports of seven rare earth elements and specialized magnets. These materials are essential for a wide range of applications, including electric vehicle batteries, motorcycles, two-wheelers, and e-bikes.

- For instance, after the United States imposed tariffs as high as 145% on Chinese battery imports, China retaliated with tariffs of up to 125% on select U.S. goods, including those in the motorcycle battery sector. This tariff exchange between two major economic powers has led to widespread disruptions across global supply chains.

These tariff wars between two global power countries have disrupted global supply chains, driven up demand for non-Chinese battery suppliers, and introduced widespread price volatility. U.S. developers, in search of alternative sources, are now facing intensified competition, leading to higher prices and extended lead times in international markets. Overall, this geopolitical tension is impacting motorcycle battery project development and investment worldwide. However, it is also driving strategic shifts, promoting countries to accelerate domestic motorcycle battery manufacturing and diversify supply chains to reduce dependency on imports vulnerable to international trade policies.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Motorcycle Battery Market

In 2024, Asia Pacific dominated the global Motorcycle Battery market, accounting for 43.3% of the total market share, Driven by growing two-wheeler penetration and rising demand for electric mobility solutions. Countries such as India, China, Indonesia, Vietnam, and Thailand are at the forefront of this expansion, supported by large-scale urbanization, cost-sensitive consumers, and government initiatives promoting electric vehicle adoption. The shift toward electric two-wheelers, especially in densely populated cities increased demand for advanced battery technologies, especially lithium-ion batteries.

Regional growth is further supported by favorable policies, including subsidies for electric vehicles, tax incentives, and investments in battery manufacturing and swapping infrastructure. Additionally, local production capabilities and the presence of key battery manufacturers strengthen Asia-Pacific’s position as a critical hub in the global supply chain. As environmental concerns and fuel costs rise, the region’s transition toward cleaner, battery-powered mobility is expected to significantly shape the future trajectory of the global motorcycle battery market.

- For instance according to the International Energy Association in 2024, China, India, and Southeast Asia collectively dominate the global motorcycle battery market, accounting for nearly 80% of total sales. India, in particular, is witnessing rapid electrification in the two- and three-wheeler segments, with electric three-wheeler sales reaching 700,000 units and showing nearly 20% year-on-year growth.

- In May 2025 alone, India recorded over 179,000 electric vehicle registrations, with high-speed electric two-wheelers comprising more than half of the total.

- Indonesia is also accelerating its electric mobility agenda, targeting 2.5 million electric motorcycles by 2025 and scaling up to 13 million by 2030.

These ambitious national targets, combined with strong market demand and supportive policies, are positioning the Asia-Pacific region as a central growth engine in the global motorcycle battery industry.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Global motorcycle battery Market Maintain Dominance through Innovation and Expansion

Leading companies in the global energy storage market such as EnerSys, Clarios, Samsung SDI, Leoch International Technology Ltd, and Toshiba, are actively shaping the industry landscape through innovation, global expansion, and strategic collaborations. These firms are at the forefront of market growth, innovating advanced motorcycle battery technologies, forming strategic partnerships, and implementing large-scale project deployments to maintain their dominance in this rapidly evolving sector.

Companies like Toshiba are making significant R&D investments, focusing on developing next-generation battery chemistries with improved safety, energy density, and cost-efficiency. Company enhancing both product performance and safety standards. Company forming Strategic alliances with motorbike manufacturing companies’ growth.

The Major Players in The Industry

- GS Yuasa International Ltd

- Exide Group

- EnerSys

- BS-Battery

- UNIBAT batteries

- Bosch

- Deltran Battery Tender

- Koyo Battery Co., Ltd.

- Clarios

- East Penn Manufacturing

- Samsung SDI

- Baterias Moura

- JYC Battery Manufacturer Co., Ltd

- Yukinova

- Leoch International Technology Ltd

- Tesla

- Toshiba

- Other Key Players

Recent Development

- In March 2025 – Toshiba unveiled its SCiB™ lithium-ion battery in Thailand, featuring advanced lithium titanium oxide (LTO) technology designed to enhance safety, lifespan, and fast charging for electric motorcycle taxis, supporting the country’s carbon neutrality goals.

Report Scope

Report Features Description Market Value (2024) USD 9.0 Bn Forecast Revenue (2034) USD 13.6 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lead-Acid Batteries (Wet Cell, Maintenance-Free, Absorbent Glass Mat (AGM), Gel Cell, Others), Lithium-Ion Batteries), By Capacity (Upto 50 AH, 50 AH to 10 AH, 10 AH to 15 AH, Above 15 AH), By Propulsion Type (Internal Combustion Engine (ICE), Electric), By Application (Standard, Cruiser, Moped, Sports, Adventure, Others), By End-user (OEMs, Aftermarket) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape GS Yuasa International Ltd., Exide Group, EnerSys, BS-Battery, UNIBAT batteries, Bosch, Deltran Battery Tender, Koyo Battery Co., Ltd., Clarion, East Penn Manufacturing, Samsung SDI, Baterias Moura, JYC Battery Manufacturer Co., Ltd, Yukinova, Leoch International Technology Ltd, Tesla, Toshiba, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GS Yuasa International Ltd

- Exide Group

- EnerSys

- BS-Battery

- UNIBAT batteries

- Bosch

- Deltran Battery Tender

- Koyo Battery Co., Ltd.

- Clarios

- East Penn Manufacturing

- Samsung SDI

- Baterias Moura

- JYC Battery Manufacturer Co., Ltd

- Yukinova

- Leoch International Technology Ltd

- Tesla

- Toshiba

- Other Key Players