Global Monoethylene Glycol Market By Technology (Gas-Based, Naphtha-Based, Coal-Based, Bio-Based), By Application (PET, Polyester Fibers, Antifreeze, Others), By End-use (Textile, Packaging, Automotive, Plastics, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151602

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

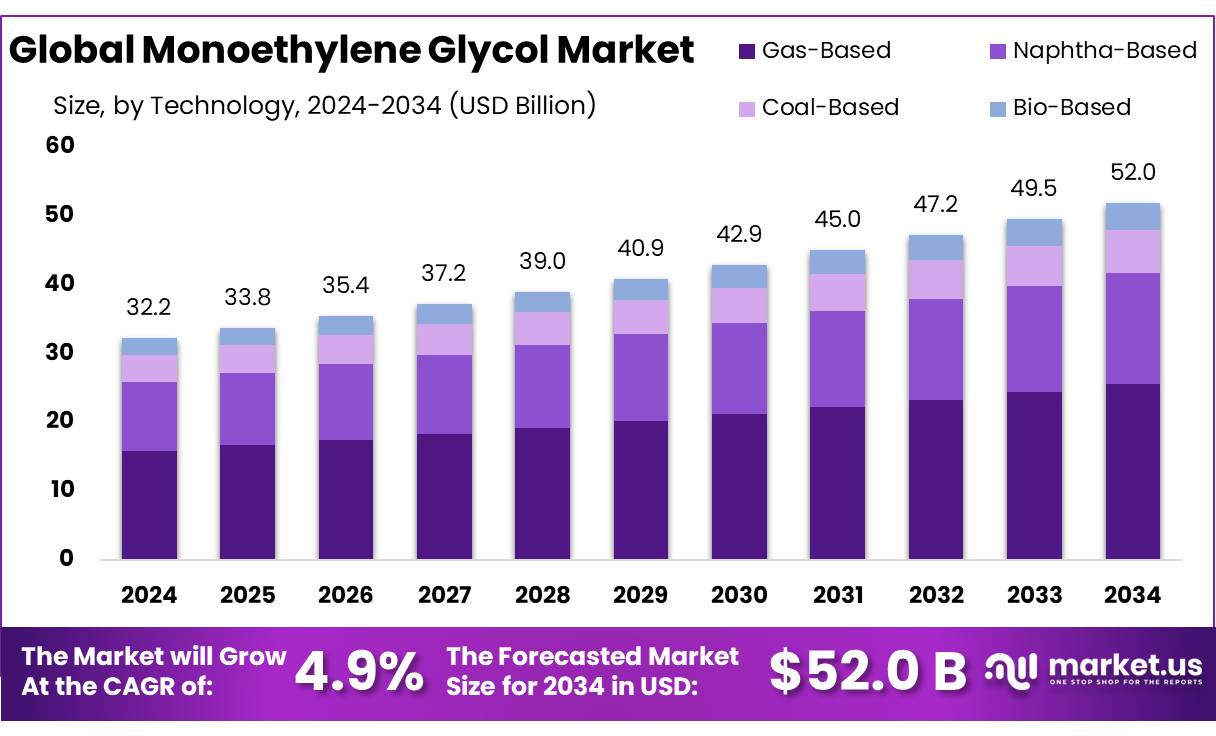

The Global Monoethylene Glycol Market size is expected to be worth around USD 52.0 Billion by 2034, from USD 32.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The monoethylene glycol (MEG) market holds a pivotal position within the petrochemical sector, given its extensive use in the production of polyester fibers, PET resins and in applications such as antifreeze, solvents and heat-transfer fluids. Industrial production typically involves two key stages: the controlled oxidation of ethylene to ethylene oxide, followed by hydration to MEG. The conventional hydration achieves up to 90% yield, whereas the advanced Shell OMEGA process—licensed from Mitsubishi Chemicals—attains more than 99% selectivity, significantly reducing byproducts and waste-heat requirements.

Governmental support for petrochemical feedstocks and waste-to-product innovation is also strengthening MEG’s industrial footing. For instance, the U.S. Department of Energy is funding microbial conversion processes that transform mixed plastic waste into MEG, supporting sustainable circular economy models.

Meanwhile, the U.S. Department of Energy reports that domestic ethane production, a key olefinic feedstock for ethylene, has nearly doubled from 0.95 million barrels per day in 2013 to approximately 1.85 million b/d by early 2021, with exports also reaching record levels. Ethane’s growth is projected to support long-term petrochemical demand through at least 2023.

Technological advancements—such as catalytic improvements, heat and carbon dioxide integration, and novel bio- and waste-based production routes—are anticipated to enable cost reductions and environmental benefit. For example, recent pilot-scale modeling demonstrates high-yield MEG production via integrated ethylene-to-ethylene oxide and MEG plants at an assumed capacity of 600,000t/y.

Key Takeaways

- Monoethylene Glycol Market size is expected to be worth around USD 52.0 Billion by 2034, from USD 32.2 Billion in 2024, growing at a CAGR of 4.9%.

- Gas-Based technology held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 49.3% share.

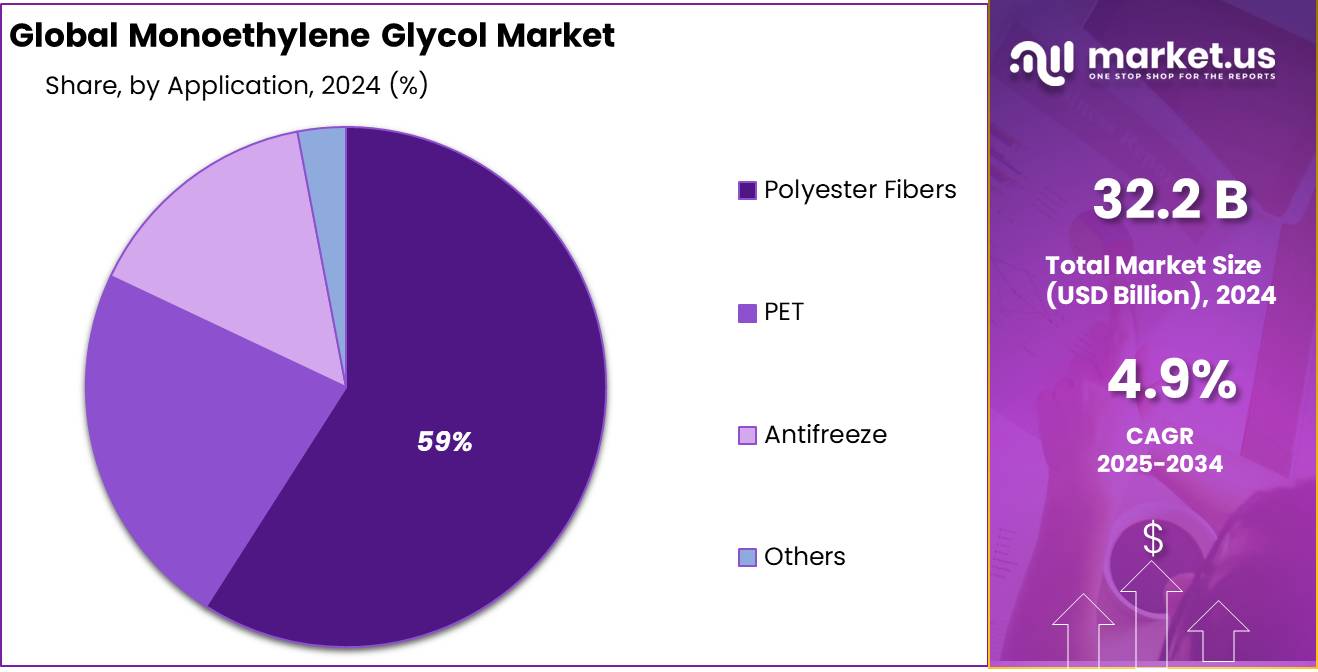

- Polyester Fibers held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 59.1% share.

- Textile held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 56.8% share.

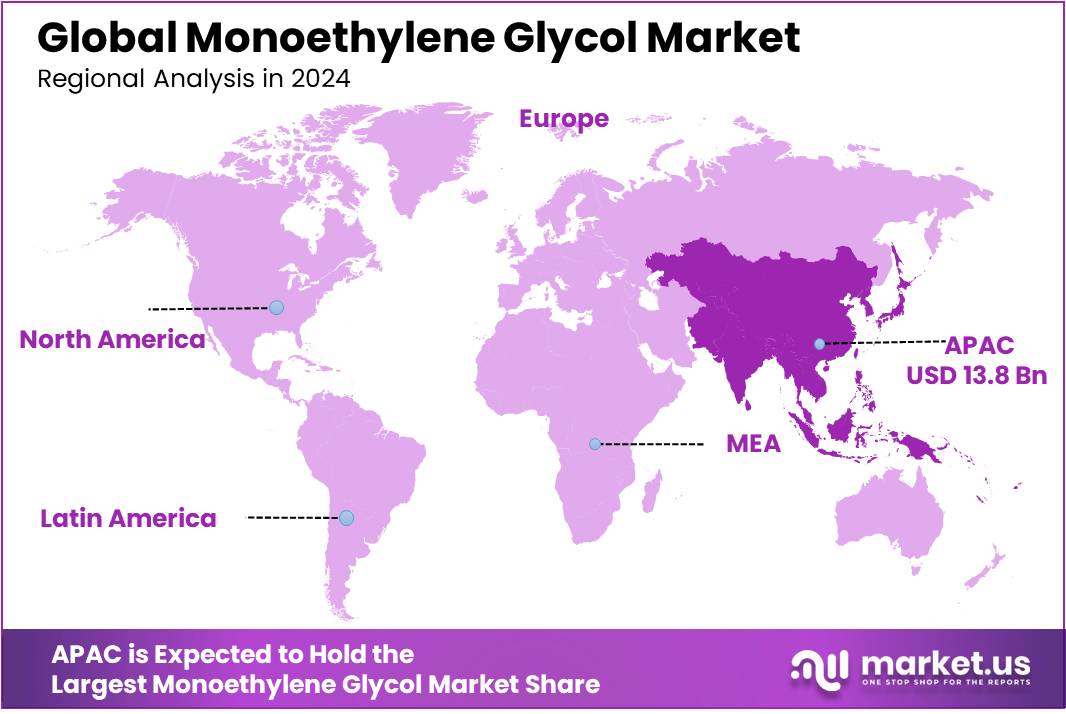

- Asia-Pacific (APAC) region stands as the dominant force in the global Monoethylene Glycol (MEG) market, commanding a substantial share of 42.9%, equating to approximately USD 13.8 billion.

By Technology

Gas-Based Technology dominates with 49.3% share in 2024 due to cost efficiency and scalability.

In 2024, Gas-Based technology held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 49.3% share. This segment maintained its lead primarily due to its economic production process, especially in regions with abundant natural gas reserves. Gas-based MEG production offers lower raw material costs and fewer carbon emissions compared to traditional naphtha-based routes, making it a preferred choice among manufacturers focused on operational efficiency and environmental compliance.

Countries in the Middle East and parts of North America have particularly benefited from gas-based facilities, utilizing local feedstocks to support large-scale MEG output. As industries push for cleaner and cost-effective technologies, the adoption of gas-based MEG production is expected to continue growing steadily through 2025.

By Application

Polyester Fibers dominate with 59.1% share in 2024 due to strong textile industry demand.

In 2024, Polyester Fibers held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 59.1% share. This stronghold was primarily driven by the rising demand for synthetic textiles across the apparel, home furnishings, and industrial fabric sectors. MEG is a key raw material in the production of polyester, making its consumption closely tied to the growth of polyester fiber manufacturing.

With the global textile sector expanding, especially in Asia-Pacific regions like China, India, and Vietnam, the consumption of MEG for polyester fiber production saw a significant boost. Additionally, the shift towards lightweight, wrinkle-resistant, and moisture-wicking fabrics in consumer products further fueled this application segment. The year 2025 is also expected to maintain strong momentum, supported by increasing urbanization and middle-class spending on affordable fashion.

By End-use

Textile sector leads with 56.8% share in 2024 due to high polyester fiber usage.

In 2024, Textile held a dominant market position in the global monoethylene glycol (MEG) market, capturing more than a 56.8% share. This strong presence is mainly due to MEG’s essential role in the production of polyester fibers, which are extensively used in clothing, upholstery, home textiles, and industrial fabrics. The global textile industry has been witnessing consistent demand, especially from fast-growing economies where affordable, durable, and lightweight synthetic fabrics are preferred.

MEG, being a key ingredient in polyester, saw a surge in consumption aligned with the rising output of textile mills and garment manufacturers. The trend continued through early 2025, supported by increasing exports from Asia-Pacific nations, advancements in fabric technologies, and consumer preference for easy-care and quick-drying materials. The textile sector’s large-scale dependency on polyester ensures that MEG remains a vital industrial input in this space.

Key Market Segments

By Technology

- Gas-Based

- Naphtha-Based

- Coal-Based

- Bio-Based

By Application

- PET

- Polyester Fibers

- Antifreeze

- Others

By End-use

- Textile

- Packaging

- Automotive

- Plastics

- Other

Drivers

Growth in Demand for Packaging Applications

One major driving factor for the Monoethylene Glycol (MEG) market is the growing demand for packaging applications. As the food and beverage industry continues to expand, the need for effective and sustainable packaging solutions is more prominent. MEG is an essential raw material used in the production of polyethylene terephthalate (PET), a plastic commonly used in packaging, especially in bottles and containers for beverages and food products.

According to the Food and Agriculture Organization (FAO), the global food packaging market was valued at approximately USD 300 billion in 2023, with a compound annual growth rate (CAGR) of about 4.5% expected in the next five years. This increase in demand for packaged goods is directly influencing the MEG market, as PET remains a dominant choice for manufacturers due to its durability, recyclability, and cost-effectiveness.

Additionally, sustainability efforts within the food industry are further driving the market. In response to global environmental concerns, the shift toward eco-friendly and recyclable materials is increasing. MEG’s role in PET production is crucial as it helps create a more sustainable packaging material.

Initiatives like the European Union’s Circular Economy Action Plan, which aims to make all packaging reusable or recyclable by 2030, are pushing industries to increase their adoption of recycled PET (rPET). The European Commission also projects a 10-15% increase in the adoption of rPET by 2027, which further enhances the demand for MEG to produce new PET packaging material from recycled sources.

Restraints

Volatility in Raw Material Prices

A major restraining factor for the Monoethylene Glycol (MEG) market is the volatility in raw material prices. MEG is primarily produced from ethylene, which is derived from natural gas and crude oil. As global energy markets fluctuate, the cost of producing MEG becomes highly unstable.

This price uncertainty creates challenges for MEG manufacturers, who face difficulties in managing production costs and maintaining profit margins. According to the U.S. Energy Information Administration (EIA), in 2024, crude oil prices have fluctuated by nearly 25% over a six-month period, directly affecting the cost of ethylene and, consequently, MEG production.

The rising energy prices, coupled with the ongoing geopolitical tensions, particularly in regions like the Middle East, have exacerbated this issue. A significant portion of ethylene production relies on natural gas, which has seen price hikes due to supply disruptions, further impacting MEG manufacturing costs.

For example, in Europe, natural gas prices surged by over 50% in 2024, putting pressure on industries like chemicals and plastics that rely on ethylene as a key feedstock. These price fluctuations undermine the stability of the MEG market, making it harder for manufacturers to predict costs and plan effectively.

Government initiatives aimed at reducing energy dependence, such as the EU’s Green Deal, may help alleviate long-term volatility in raw material prices. However, in the short term, these fluctuations continue to strain the MEG market. The uncertainty in raw material pricing is pushing manufacturers to seek alternative feedstocks and more energy-efficient production methods to counteract the rising costs.

Opportunity

Growth Opportunities in Sustainable Packaging

The Monoethylene Glycol (MEG) market is experiencing significant growth, primarily driven by the increasing demand for sustainable packaging solutions. MEG is a key component in the production of polyethylene terephthalate (PET), a widely used plastic in food and beverage packaging. With the global push towards reducing plastic waste and enhancing recyclability, PET has emerged as a preferred material due to its durability and ease of recycling.

According to the U.S. Environmental Protection Agency (EPA), the recycling rate for PET bottles and jars in the United States was approximately 29% in 2022. This indicates a substantial opportunity for growth in the use of recycled PET (rPET), which requires MEG for its production. As the demand for rPET increases, so does the need for MEG, presenting a significant growth opportunity for the market.

Furthermore, the European Union’s Circular Economy Action Plan aims to make all packaging recyclable or reusable by 2030. This initiative is expected to boost the demand for PET and, consequently, MEG, as manufacturers seek to comply with these regulations by adopting more sustainable materials and processes.

In response to these trends, companies are investing in more sustainable production methods. For instance, UPM Biochemicals has developed a bio-based MEG, UPM BioPura, which is derived from sustainable forest-based materials. This innovation aligns with the growing consumer and regulatory demand for eco-friendly products and offers a competitive edge in the market.

Trends

Bio-Based Production and Sustainable Packaging

One of the most significant trends in the Monoethylene Glycol (MEG) market is the increasing shift towards bio-based production methods and sustainable packaging solutions. This transformation is primarily driven by the growing consumer demand for eco-friendly products and the implementation of stringent environmental regulations worldwide.

In 2023, UPM Biochemicals introduced UPM BioPura, a sustainable bio-based MEG produced from renewable forest-based materials. This innovation aligns with the European Union’s Circular Economy Action Plan, which aims to make all packaging recyclable or reusable by 2030. Such initiatives are expected to boost the demand for PET and, consequently, MEG, as manufacturers seek to comply with these regulations by adopting more sustainable materials and processes.

Furthermore, the U.S. Environmental Protection Agency (EPA) has been promoting the use of MEG in greener packaging, stimulating demand. Companies like Coca-Cola and PepsiCo are increasingly adopting recycled PET (rPET) in their packaging to reduce plastic waste. This shift towards rPET is directly influencing the MEG market, as PET remains a dominant choice for manufacturers due to its durability, recyclability, and cost-effectiveness.

Regional Analysis

The Asia-Pacific (APAC) region stands as the dominant force in the global Monoethylene Glycol (MEG) market, commanding a substantial share of 42.9%, equating to approximately USD 13.8 billion in market value. This dominance is propelled by the region’s robust industrial base, particularly in countries like China and India, which are pivotal in the production and consumption of MEG.

China’s extensive manufacturing capabilities, especially in textiles and packaging, significantly contribute to the demand for MEG. The country’s textile industry, a major end-user of MEG, continues to expand, driven by both domestic consumption and export activities. Similarly, India’s burgeoning automotive and textile sectors are escalating MEG consumption, with the automotive industry increasingly adopting MEG-based antifreeze and coolant solutions. This trend is further supported by the government’s initiatives to bolster the automotive sector, including the promotion of electric vehicles, which utilize MEG in various applications.

The APAC region’s growth trajectory is also influenced by the increasing adoption of sustainable practices. The shift towards bio-based MEG production aligns with global sustainability goals, with countries in the region investing in green technologies and renewable resources. This transition not only caters to the rising demand for eco-friendly products but also positions APAC as a leader in sustainable MEG production.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Acuro Organics Ltd. is a prominent player in the chemical industry, providing high-quality Monoethylene Glycol (MEG) for diverse applications. With a focus on delivering sustainable and cost-effective solutions, the company serves industries like textiles, automotive, and packaging. Acuro’s commitment to excellence, coupled with its strong distribution network, has enabled it to maintain a significant presence in the MEG market. The company emphasizes research and development to improve product quality and meet evolving market demands.

BASF SE, a global leader in the chemical sector, produces Monoethylene Glycol (MEG) as part of its broad portfolio of chemicals. Known for its innovative and sustainable solutions, BASF serves industries such as automotive, textiles, and packaging. The company prioritizes energy-efficient and environmentally friendly production methods, maintaining a strong commitment to sustainable practices. With a well-established presence worldwide, BASF remains one of the most influential players in the global MEG market, contributing to advancements in chemical production technologies.

Euro Industrial Chemicals is a leading supplier of Monoethylene Glycol (MEG) and other chemical products, serving industries like textiles, automotive, and packaging. With a focus on high-quality standards, the company ensures its MEG products meet stringent industry requirements. Euro Industrial Chemicals is committed to sustainable practices, aiming to minimize environmental impact while providing cost-effective solutions. The company’s efficient supply chain and strong market presence make it a reliable player in the global MEG market, meeting growing demand with a focus on innovation.

Top Key Players in the Market

- Acuro Organics Ltd.

- Arham Petrochem Pvt. Ltd.

- BASF SE

- Dow

- Euro Industrial Chemicals

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Ishtar Company, LLC

- Kimia Pars Co.

- LyondellBasell N.V.

- MEGlobal

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Nouryon

- Pon Pure Chemicals Group

Recent Developments

In 2024, Acuro reported operating revenue in the range of INR 1 crore to 100 crore, with a notable increase in EBITDA by 7633.59% and a substantial rise in book net worth by 11436.91% compared to the previous year.

In 2024, BASF reported annual sales of €65.3 billion, underscoring its robust market position.

Report Scope

Report Features Description Market Value (2024) USD 32.2 Bn Forecast Revenue (2034) USD 52.0 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Gas-Based, Naphtha-Based, Coal-Based, Bio-Based), By Application (PET, Polyester Fibers, Antifreeze, Others), By End-use (Textile, Packaging, Automotive, Plastics, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acuro Organics Ltd., Arham Petrochem Pvt. Ltd., BASF SE, Dow, Euro Industrial Chemicals, India Glycols Limited, Indian Oil Corporation Ltd., Ishtar Company, LLC, Kimia Pars Co., LyondellBasell N.V., MEGlobal, Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, Nouryon, Pon Pure Chemicals Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monoethylene Glycol MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Monoethylene Glycol MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acuro Organics Ltd.

- Arham Petrochem Pvt. Ltd.

- BASF SE

- Dow

- Euro Industrial Chemicals

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Ishtar Company, LLC

- Kimia Pars Co.

- LyondellBasell N.V.

- MEGlobal

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Nouryon

- Pon Pure Chemicals Group