Global Monoethanolamine Market Size, Share Analysis Report By Grade (Industrial Grade and Pharmaceutical Grade), By Application (Gas Treatment, Wood Preservation, Pharmaceuticals, Personal Care And Cosmetics, Detergents And Cleaners, Metalworking Fluids, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169584

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

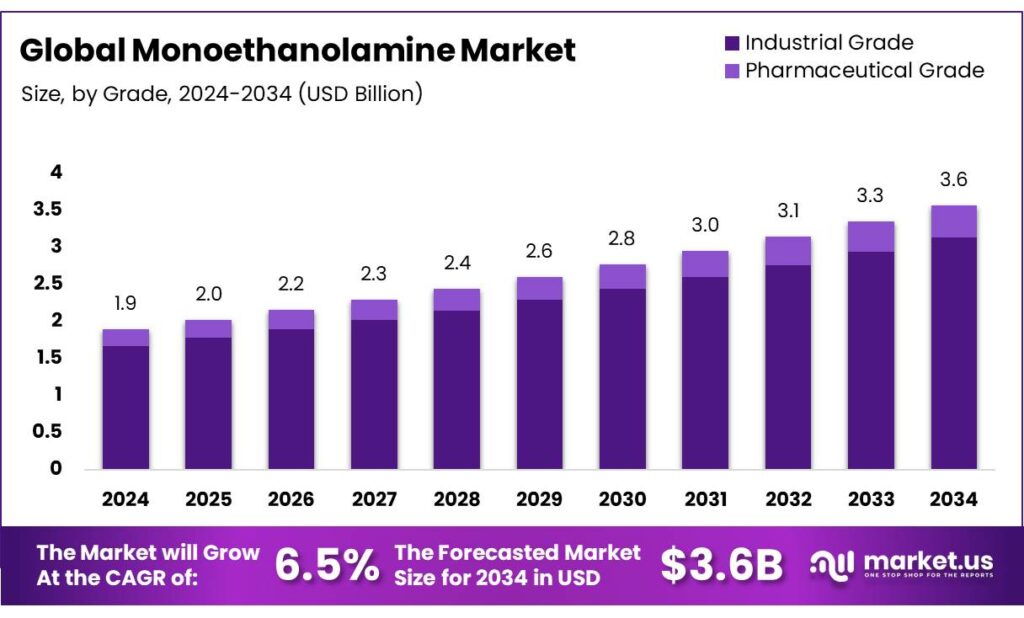

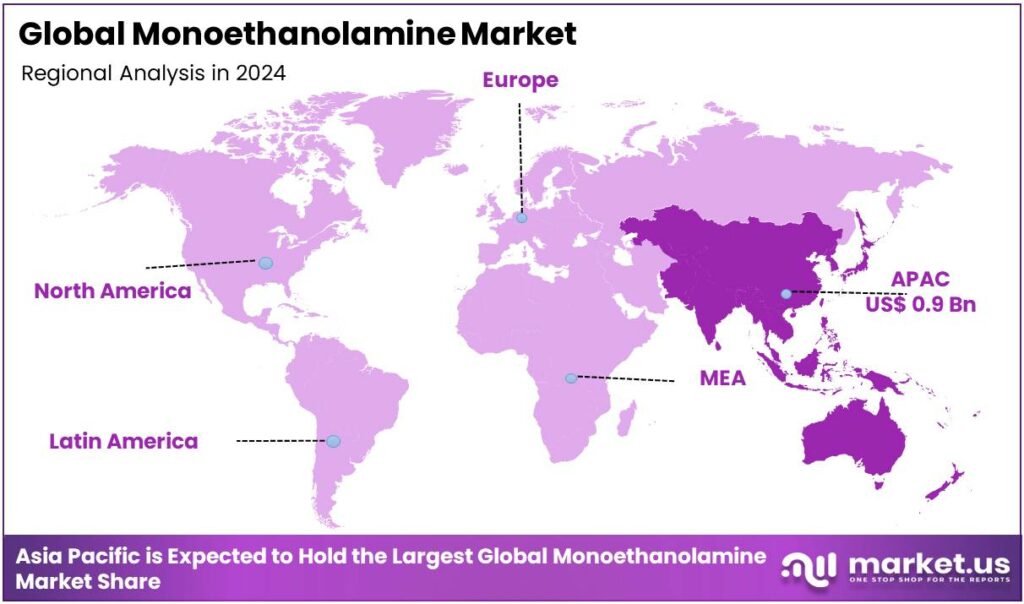

The Global Monoethanolamine Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 48.9% share, holding USD 0.9 Billion revenue.

Monoethanolamine (MEA), known as ethanolamine, is a versatile, colorless, viscous organic liquid with both alcohol (-OH) and primary amine (-NH2) groups, making it useful as a building block in many industries, functioning as a surfactant, emulsifier, and pH adjuster. The MEA market is driven by its widespread use across various industrial applications, with detergents and cleaners being the largest consumers due to the effective surfactant properties of MEA. It plays a key role in reducing surface tension and enhancing the performance of cleaning agents, making it indispensable in household and industrial cleaning formulations.

Additionally, the application of MEA in the production of agrochemicals and carbon capture technologies further boosts its demand. In addition, its role in gas treatment, particularly in CO2 removal processes, and its use in textile processing and oil recovery contribute significantly to its market presence. However, the market faces competition from alternatives such as diethanolamine and triethanolamine, which offer similar properties while being more sustainable. The chemical remains a crucial chemical in multiple sectors due to its versatility, effectiveness, and cost-efficiency.

- In the United States alone, the annual production of ethylene oxide reaches almost 3 million metric tons, and production of ammonia is around 16 million metric tons, both of which are the key raw materials in the production of monoethanolamine.

Key Takeaways

- The global monoethanolamine market was valued at USD 1.9 billion in 2024.

- The global monoethanolamine market is projected to grow at a CAGR of 6.5% and is estimated to reach USD 3.6 billion by 2034.

- Based on the grade, industrial grade monoethanolamine dominated the market, with a market share of around 87.9%.

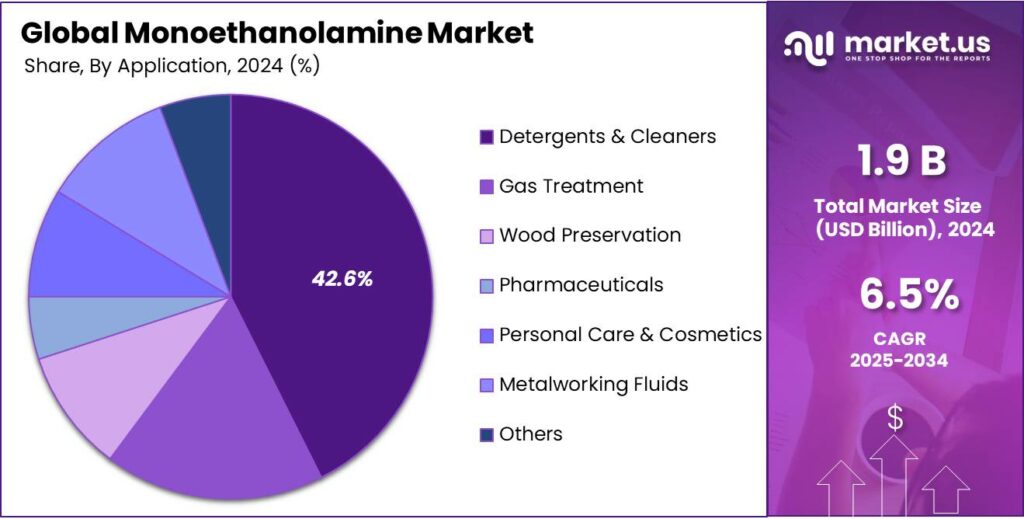

- Among the applications of monoethanolamine, the detergents and cleaners sector held a major share in the market, 42.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the monoethanolamine market, accounting for around 48.9% of the total global consumption.

Grade Analysis

Industrial Grade Monoethanolamine Held the Largest Share in the Market.

The monoethanolamine market is segmented based on the grade into industrial grade and pharmaceutical grade. The industrial-grade monoethanolamine dominated the market, comprising around 87.9% of the market share, due to its cost-effectiveness and suitability for a wide range of industrial applications. Industrial-grade MEA is produced with less stringent purity standards, making it more affordable for large-scale manufacturing processes in industries such as textiles, agriculture, oil and gas, and chemical production.

These applications often require MEA for tasks such as gas treatment, surfactant synthesis, and chemical intermediate production, where the higher purity of pharmaceutical-grade MEA is not essential. In contrast, pharmaceutical-grade MEA undergoes stricter purification processes to meet the high standards required for medical or cosmetic formulations, making it more expensive and less practical for general industrial use. Similarly, industrial-grade MEA is the preferred choice for most large-scale operations due to its availability, lower cost, and adequate performance for non-medical applications.

Application Analysis

The Monoethanolamine Were Mostly Utilized in the Detergents and Cleaners Sector.

Based on the applications of monoethanolamine, the market is divided into gas treatment, wood preservation, pharmaceuticals, personal care & cosmetics, detergents & cleaners, metalworking fluids, and other applications. The detergents and cleaners sector dominated the market, with a market share of 42.6%, due to its excellent surfactant properties and cost-effectiveness. MEA helps reduce surface tension, which enhances the cleaning action of detergents and allows for better emulsification of oils, greases, and other dirt particles.

Additionally, its mild alkalinity helps break down organic stains and improve the overall cleaning efficiency of formulations. The applications, such as gas treatment, wood preservation, and personal care, require more specialized formulations, often involving higher purity chemicals or more complex processes.

For instance, in gas treatment, MEA is effective for CO2 removal, but its application is more capital-intensive and limited to large-scale industrial operations. Similarly, the use of MEA in wood preservation and personal care requires stricter safety and regulatory controls, reducing its widespread use in these sectors. The versatility and relatively lower cost of MEA make it the preferred choice in detergent and cleaner formulations.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

By Application

- Gas Treatment

- Wood Preservation

- Pharmaceuticals

- Personal Care & Cosmetics

- Detergents & Cleaners

- Metalworking Fluids

- Other Applications

Drivers

Application of Monoethanolamine in the Production of Surfactants Drives the Monoethanolamine Market.

Monoethanolamine plays a pivotal role in the production of surfactants, which are essential components in a wide range of industrial and consumer products, including detergents, personal care products, and industrial cleaners. MEA acts as a key intermediate in the synthesis of ethoxylates, which are used to produce nonionic surfactants, known for their mildness and effectiveness. These surfactants are valued for their ability to reduce surface tension and improve the spreadability of formulations, making them ideal for applications in cleaning agents, cosmetics, and agricultural products.

The demand for MEA-based surfactants is driven by their cost-effectiveness compared to other chemicals and a stable, established supply chain. Furthermore, industries such as textiles and oil recovery leverage MEA-derived surfactants for enhanced performance. For instance, in the textile industry, MEA is used to create surfactants that facilitate the efficient removal of oils and stains during fabric processing.

Restraints

Availability of Effective Alternatives Poses a Challenge to the Monoethanolamine Market.

The availability of effective alternatives to monoethanolamine poses a significant challenge to its market growth. As industries seek more cost-effective and environmentally friendly solutions, various substitutes, such as diethanolamine (DEA), triethanolamine (TEA), and other amines, are increasingly being utilized in applications such as carbon capture, surfactant production, and agrochemicals. These alternatives often offer comparable or superior performance in specific use cases, with some providing enhanced environmental benefits, such as lower toxicity or better biodegradability.

For instance, TEA is frequently used in surfactant formulations and provides similar emulsifying and foaming properties as MEA, while DEA is considered an effective alternative in gas treatment applications. As regulatory pressures around environmental sustainability intensify, industries are exploring greener options such as bio-based amines, which are derived from renewable sources and reduce dependency on petroleum-based chemicals. This shift toward alternatives is expected to influence the demand for MEA, particularly as innovation in chemical solutions continues to evolve.

Opportunity

Application of Monoethanolamine in Carbon Capture and Storage Creates Opportunities in the Market.

Monoethanolamine is increasingly recognized for its crucial role in carbon capture and storage (CCS) technologies, particularly in the removal of carbon dioxide (CO2) from industrial emissions. The chemical is used in amine-based scrubbing systems, where it effectively absorbs CO2 from gas streams, making it a key component in mitigating climate change. The growing focus on reducing global carbon emissions has significantly boosted the demand for MEA in CCS systems, particularly within industries such as power generation, natural gas processing, and petrochemical manufacturing.

- According to the World Meteorological Organization (WMO), from 2023 to 2024, the global average concentration of CO2 surged by 3.5 ppm. In 2024, global carbon dioxide emissions reached an all-time high, with total energy-related emissions increasing by 0.8% to 37.8 gigatons (Gt).

The ability of monoethanolamine to selectively capture CO2 and form a stable complex allows for efficient removal and subsequent storage or utilization of the gas. The rising global emphasis on sustainability and environmental stewardship further fuels the adoption of MEA in carbon capture processes, creating new opportunities in the market. For instance, the Paris Agreement (UNFCCC) is a legally binding global treaty to limit warming to well below 2°C (ideally 1.5°C) by promoting Nationally Determined Contributions (NDCs) for GHG emissions cuts, including carbon dioxide, and resilience building.

Trends

Rising Demand in Agrochemicals.

The rising demand for monoethanolamine in agrochemicals is a significant trend in the market, driven by the growing need for efficient and sustainable agricultural practices. According to FAO, every year up to 40% of the global crop production is lost due to plant diseases and pests. Additionally, each year, these losses cost the global economy over USD 20 billion, and invasive insects at least USD 70 billion. To mitigate these problems, crop protection agrochemicals such as insecticides and herbicides play an important role in the agricultural industry. Monoethanolamine is widely used in the formulation of herbicides, fungicides, and pesticides due to its ability to enhance the solubility and stability of active ingredients.

According to market.us, the global agrochemicals market was valued at US$ 5,683.5 million as of 2024.

The role of monoethanolamine as a surfactant in agrochemical formulations improves the spreadability and penetration of chemicals, ensuring better efficacy in crop protection. In addition, MEA is used in the production of plant growth regulators, which help optimize crop yields and ensure higher agricultural productivity. As the global population increases, the demand for high-efficiency agrochemicals rises, further accelerating the use of MEA in the agricultural sector. The trend is further supported by the push towards the need for advanced crop protection solutions.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Monoethanolamine Market by Shifting Trade Flows.

Geopolitical tensions have had a significant impact on the monoethanolamine market, disrupting supply chains, raw material availability, and manufacturing operations. Conflicts such as the Russia-Ukraine war and trade frictions between the U.S. and China have disrupted the supply of key feedstock such as ethylene oxide, a petrochemical. The Middle East has emerged as a key supplier of petrochemical feedstocks after the Russia-Ukraine conflict, capitalizing on relatively stable energy markets. Europe, which relies heavily on imported petrochemical intermediates, has experienced supply chain constraints and rising energy costs, leading to reduced operating rates in several manufacturing plants.

Additionally, trade disputes and sanctions, particularly between major economies, have hindered the global distribution of MEA and its derivatives. The tensions between the U.S. and China have led to delays in the movement of chemicals and a shift in trade patterns, affecting the availability and cost of MEA. For instance, Dow Chemical, a large manufacturer of ethanolamines, has increased prices on all grades and packaging types of its ethanolamine products in North America, including monoethanolamine, whose price increased by US$0.05/lb. The geopolitical risks often prompt companies to seek alternative supply sources or invest in local production facilities, which can reshape the dynamics of the global monoethanolamine market.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Monoethanolamine Market.

In 2024, the Asia Pacific dominated the global monoethanolamine market, holding about 48.9% of the total global consumption. The region holds the largest share of the global monoethanolamine market, driven by the region’s rapidly expanding industrial sectors and strong demand from key end-use industries such as textiles, agrochemicals, and oil and gas. Countries such as China, India, and Japan are significant consumers of Monoethanolamine due to their large-scale manufacturing activities.

For instance, in the textile industry, which is prominent in countries such as China and India, Monoethanolamine is used in detergent formulations and fabric processing. India’s textile industry is a massive economic engine, second to agriculture for employment, contributing around 2-2.3% to GDP of the country.

Similarly, China is the world’s largest exporter of textiles, with annual export revenues of USD 293.6 billion in 2023 and an annual share of GDP at 8.7%. Additionally, the growing agricultural sector in these countries fuels the demand for Monoethanolamine-based herbicides, pesticides, and plant growth regulators. Furthermore, the oil and gas sector in the region increasingly relies on Monoethanolamine for gas treatment processes, such as CO2 removal.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the monoethanolamine market employ several strategies to increase sales and gain a competitive edge, such as product innovation, investments, and expansion to cater to the growing demand for monoethanolamine. The company’s focus on product differentiation through the development of high-purity Monoethanolamine for specialized applications, such as pharmaceuticals and personal care, while maintaining cost-effective solutions for industrial uses such as detergents and gas treatment. Additionally, companies invest in expanding their production capacity and improving supply chain efficiency to ensure consistent availability and competitive pricing.

Similarly, some companies emphasize sustainability by developing bio-based MEA or improving production processes to reduce environmental impact, appealing to the growing demand for eco-friendly products. Moreover, the companies try to maintain strategic partnerships with key industries, such as agriculture and oil & gas, that secure long-term contracts and foster customer loyalty. Furthermore, major players increase their geographical presence through expansion in emerging markets such as the Asia Pacific to tap into new growth opportunities, capitalizing on rising industrialization in these regions.

The Major Players in The Industry

- BASF SE

- Dow Inc.

- Nouryon

- SABIC

- Nippon Shokubai Co., Ltd.

- Amines & Plasticizers Ltd.

- Sintez OKA Group of Companies

- PTT Global Chemical Public Company Limited

- Jay Dinesh Chemicals

- Other Key Players

Key Development

- In September 2024, BASF inaugurated a production plant for alkyl ethanolamines at its Verbund site in Belgium. The investment was to increase the global annual production capacity of the company for the ethanolamines.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 3.6 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade and Pharmaceutical Grade), By Application (Gas Treatment, Wood Preservation, Pharmaceuticals, Personal Care & Cosmetics, Detergents & Cleaners, Metalworking Fluids, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Dow Inc., Nouryon, SABIC, NIPPON SHOKUBAI CO., LTD., Amines & Plasticizers Ltd., Sintez OKA Group of Companies, PTT Global Chemical Public Company Limited, Jay Dinesh Chemicals, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Dow Inc.

- Nouryon

- SABIC

- Nippon Shokubai Co., Ltd.

- Amines & Plasticizers Ltd.

- Sintez OKA Group of Companies

- PTT Global Chemical Public Company Limited

- Jay Dinesh Chemicals

- Other Key Players