Global Mobile POS Systems Market Size, Share, Industry Analysis Report By Component (Hardware, Software), By Type (Tablets, Others), By Application (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158195

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- By Component – Hardware: 70.5%

- By Type – Tablets: 60.6%

- By Application – Healthcare: 28.5%

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

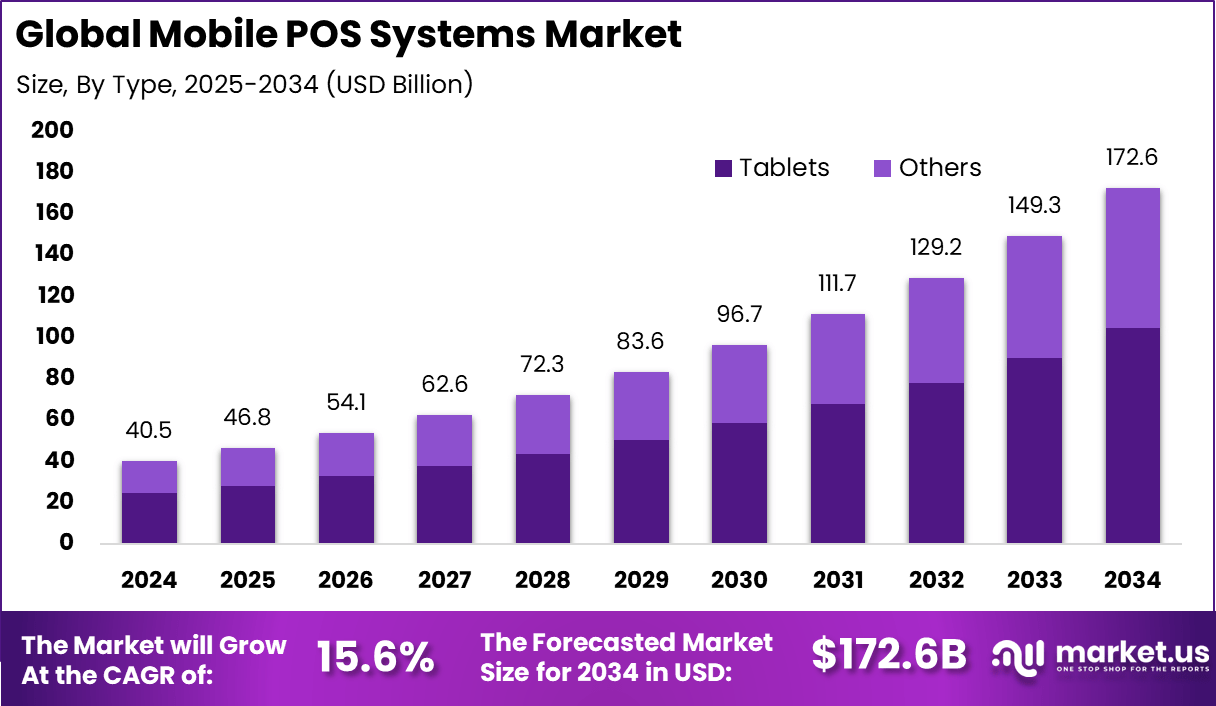

The Global Mobile POS Systems Market size is expected to be worth around USD 144.9 Billion By 2034, from USD 3.6 billion in 2024, growing at a CAGR of 44.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 1.3 Billion revenue.

Mobile POS systems are transforming transaction experiences for businesses around the world. These solutions allow payments to be accepted from nearly any location using smartphones or tablets connected to the internet. The technology has seen fast adoption across a variety of sectors, including retail, hospitality, and service-based enterprises.

The convenience and flexibility of mobile POS are reshaping daily business operations, enabling seamless payments for customers in stores and at remote events. These systems greatly appeal to businesses seeking greater efficiency and affordability, especially small and medium-sized enterprises that want to modernize payment infrastructure without heavy upfront investment.

Demand for mobile POS systems is particularly strong among small and medium-sized businesses that seek to avoid the high cost of traditional point-of-sale infrastructure. Large enterprises are also adopting mPOS systems to enable line-busting in retail stores and table-side payments in restaurants. Healthcare providers, delivery services, and transportation operators are increasingly turning to mPOS solutions to provide seamless billing experiences.

According to Keevee, 79% of businesses currently use a POS system, reflecting its critical role in inventory tracking, sales monitoring, and transaction processing. Moreover, 82% of retailers are prioritizing POS upgrades as they seek to improve transaction speed, accuracy, and overall customer experience.

The adoption of modern technologies is further reshaping the market. Mobile POS systems are expected to grow at an annual rate of 20%, offering portability and convenience for businesses operating on the go. At the same time, 64% of retailers have adopted cloud-based POS systems, which reduce upfront costs while providing scalability and remote management capabilities.

Key Insight Summary

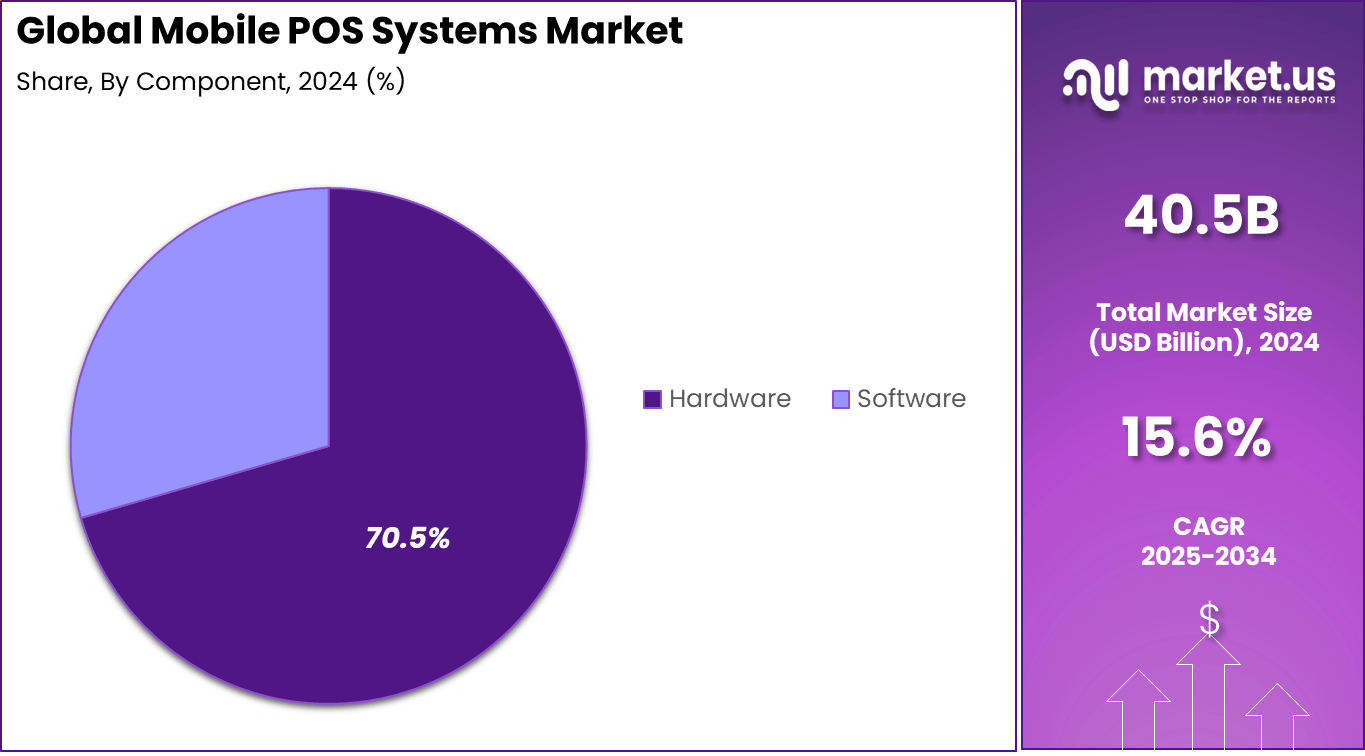

- By Component: Hardware accounted for 70.5% share, reflecting strong demand for POS terminals and supporting devices.

- By Type: Tablets dominated the market with a 60.6% share, driven by portability and ease of integration.

- By Application: The Healthcare sector captured 28.5% share, highlighting rising adoption of mobile POS for billing and patient services.

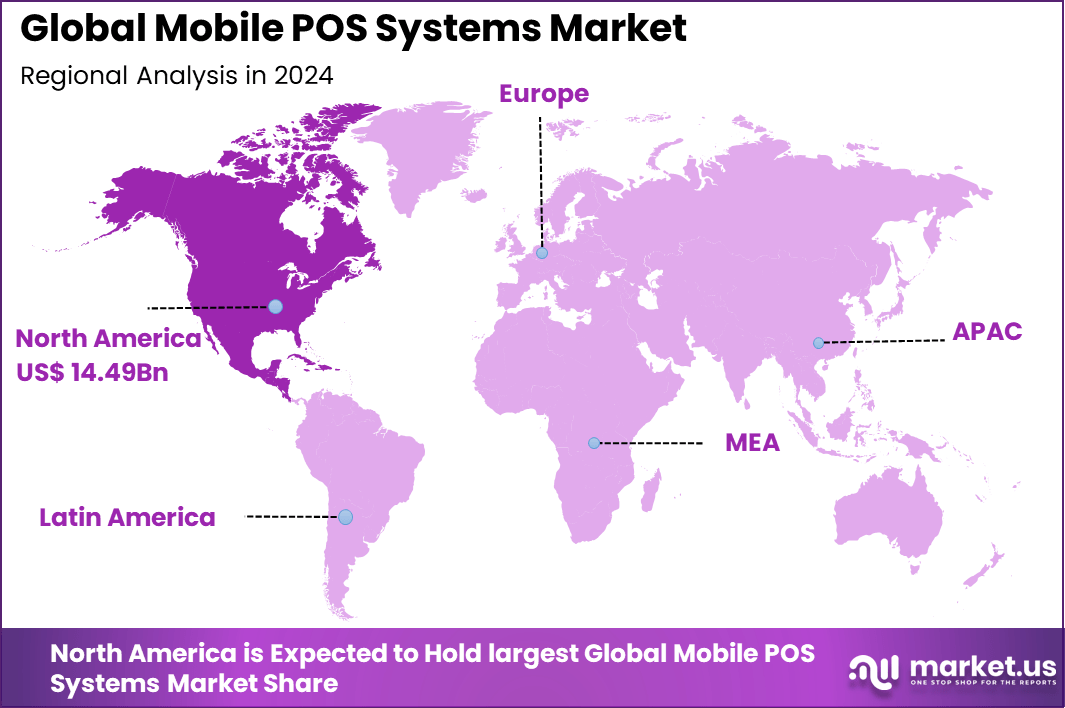

- North America led the global market with 35.8% share.

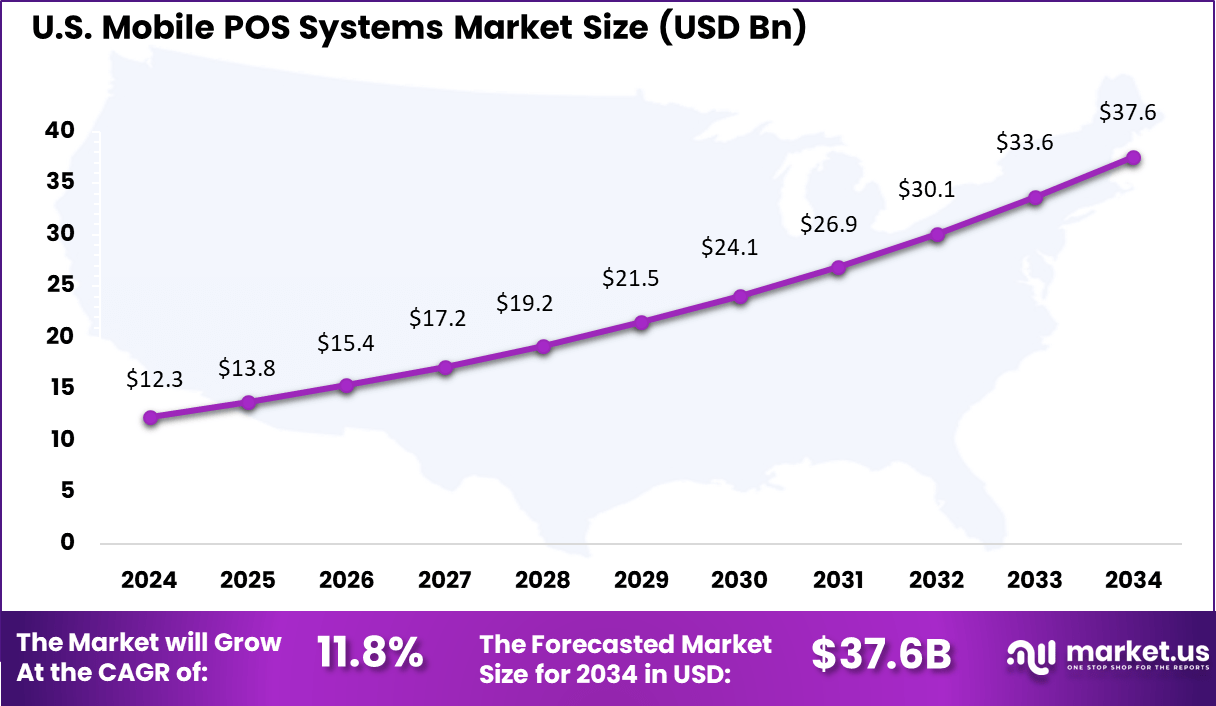

- The U.S. market was valued at USD 12.32 Billion in 2024 and is projected to grow at a robust CAGR of 11.80%, supported by high digital payment adoption and strong retail penetration.

Analysts’ Viewpoint

Mobile POS adoption is increasing as contactless technology, cloud-based software, and AI-powered analytics become standard features. Integration with loyalty programs, support for split billing, biometric security, and real-time analytics rank among the key technologies now being deployed.

The widespread use of Android and iOS platforms further accelerates this movement, making mobile POS easy for employees to use and flexible to customize for different industries. The reasons for adopting mobile POS often focus on competitive advantage and operational improvements. Businesses gain from reduced wait times for customers, faster transaction processing, and the ability to accept payments on the go.

Cost-effectiveness is another major incentive, with reduced upfront expenses and more affordable subscription models compared to traditional POS systems. The ability to gather rich customer data at the point of sale also enables better inventory management and targeted marketing, enhancing business intelligence and service quality.

Role of Generative AI

Generative AI has emerged as a pivotal force in mobile POS systems, transforming how transactions and customer interactions are handled. These advanced models create personalized shopping experiences, automatically generate product recommendations, and draft marketing messages to keep customers engaged.

A significant 73% of retailers adopting generative AI have reported quicker decisions and improved automation in day-to-day operations. The technology also supports fraud-prevention by analyzing suspicious activity and streamlining digital onboarding for merchants, helping the sector achieve lower costs and higher customer trust.

Investment and Business Benefits

Investment opportunities in this sector are notable as retailers, hospitality, and service providers seek scalable solutions that link offline and online transactions. There is particular interest in developing mobile POS platforms that offer analytics, cloud integration, and compatibility with emerging payment technologies.

Business benefits of mobile POS are clear and compelling. Companies see improvements in customer satisfaction, reduced operational costs, and better scalability for fast-growing enterprises. Real-time transaction monitoring and analytics provide actionable insights. Mobile POS brings flexibility to staffing, as fewer fixed terminals are needed.

The regulatory environment for mobile POS is shaped by data protection standards and consumer protection law. Businesses must comply with regional rules concerning data privacy and payment security, including encryption and authentication for financial transactions. Regulations promoting cashless payments and interoperability among devices increasingly define the ecosystem, supporting more secure and inclusive financial activity for both consumers and businesses.

US Market Size

The United States is at the forefront of mobile POS adoption, with the segment expected to reach $12.32 billion, growing at a CAGR of 11.80% by 2025. American retailers, service providers, and healthcare networks are investing in advanced mobile POS solutions to optimize payment experiences and meet the evolving demands of modern consumers.

In the US, strict regulations around payment security, coupled with high consumer expectations for speed and convenience, have pushed rapid upgrades and expansion of mobile-enabled transaction environments, outpacing most other regions. US market growth is fueled by robust competition among technology vendors, strong infrastructure, and high rates of digital wallet and contactless payment usage.

Large and small businesses alike are seeking systems that can integrate seamlessly with inventory management, CRM, and analytics tools, reflecting an ongoing shift toward unified, digitized commerce. Despite some lingering challenges in cost and integration, leading POS vendors are delivering highly customizable solutions to support US businesses in meeting consumer preference for mobile-first transaction options.

North America claims the largest regional share in the Mobile POS market, holding 35.8% of total worldwide sales and deployments. High penetration rates are seen in the US and Canada, as regional businesses embrace mobile POS solutions for retail, healthcare, entertainment, and transport.

Early technology adoption, intense competition, and a strong vendor presence support continued market expansion. North America benefits from extensive infrastructure and favorable consumer attitudes toward digital payments, driving POS modernization across most sectors.

Regional growth is strengthened by successful integration of cloud-based and tablet POS devices, robust regulatory frameworks, and high user acceptance. As businesses in North America prioritize speed, flexibility, and security in payment systems, mobile POS is fast becoming the norm, helping vendors capture new opportunities in both established markets and emerging sectors.

By Component – Hardware: 70.5%

The hardware segment is the bedrock of the mobile POS systems market, accounting for the largest share at 70.5%. Retailers, healthcare institutions, and restaurants are expanding their deployment of handheld terminals, tablets, and dedicated payment devices due to the convenience in transaction execution, billing, product identification, and digital receipts.

Hardware demand remains strong because businesses want reliable, portable physical tools at the point of sale, especially as consumers expect fast and seamless checkouts with integrated payment options. The variety ranges from retail-hardened tablets to compact card readers, each tailored to setting-specific requirements for durability and security.

Increasing mobile payment adoption, integration of contactless technologies, and rising demand for operational efficiency are further fueling hardware growth. However, upfront investment costs and concerns over system security may slow uptake for smaller businesses, yet the overall industry trend points to expansion in retail and healthcare, where portable payment devices are now key for service delivery.

By Type – Tablets: 60.6%

Tablet POS systems are becoming the dominant type, capturing 60.6% share in the Mobile POS market. The appeal of tablets lies in their user-friendly interfaces, compact design, and flexibility for various business environments.

Organizations favor them for their ability to perform not only payment processing but also inventory management, appointment scheduling, and real-time analytics, supporting both front-line staff and management equally.

Restaurants, retailers, and service industries find tablet POS particularly helpful for enhancing customer service and accelerating the checkout process, especially with modern cloud-based and AI modules boosting functionality and personalization.

Tablet POS adoption is shaped by a combination of cost-effectiveness, easy app integration, and mobile payment capability, making it an attractive upgrade over traditional fixed POS systems. Vendors are investing heavily in R&D to improve tablet performance, security, and interoperability, targeting needs from small businesses through to multinational chains.

By Application – Healthcare: 28.5%

Healthcare providers are increasing their reliance on mobile POS solutions, accounting for 28.5% share in the market. These devices are reshaping front-desk operations, as providers manage patient payments, appointment bookings, and even medication orders on mobile platforms. Custom healthcare mobile POS systems also support digital patient records, reducing administrative backlog and improving privacy and billing accuracy.

The push toward digital health and remote care delivery models is making mobile POS indispensable in both large hospital systems and smaller clinics, enabling secure and fast transactions while complying with privacy standards. The ongoing digitization of healthcare infrastructure is opening up new demand for mobile POS systems, driven by advances in mobile networks and regulatory requirements for secure transactions.

Even as some facilities face initial hurdles around integrating POS hardware with existing IT environments, improved device compatibility and specialized healthcare-focused software are making adoption easier and more beneficial, especially in high-volume settings where speed and accuracy are paramount.

Emerging Trends

Emerging trends in mobile POS for 2025 reflect a push towards cloud adoption, touchless payments, and omnichannel integration. Over 62% of new installations now feature cloud-based systems, enabling real-time sync and multi-location access for retail chains and pop-up stores.

AI-powered analytics in mobile POS platforms are helping businesses predict demand, spot fast-moving items, and avoid stockouts, with more than 58 percent of boutiques using these insights for smarter inventory control.

Integration with augmented reality is letting customers preview products before paying, while voice-activated POS systems are reducing average checkout times by up to 41% in busy environments. Sustainability features, such as waste reduction and targeted inventory ordering, are now part of more than 35% of installed systems, aligning businesses with consumer expectations for eco-friendly solutions.

Growth Factors

Growth factors driving the mobile POS systems market include digital payment adoption and smartphone penetration. Cashless transactions have grown at an annual rate exceeding 27% among retailers using mobile devices, fueled by rising consumer expectations for fast, secure payments.

The affordability of mPOS has enabled small and midsize businesses to compete with larger players, particularly in emerging markets, where financial inclusion has jumped more than 49% in the last two years.

Technological advances such as contactless payments and integrated CRM tools have increased operational efficiency, with 54% of businesses reporting a reduction in transaction and inventory errors after switching to advanced mobile POS solutions.

Key Market Segments

By Component

- Hardware

- Software

By Type

- Tablets

- Others

By Application

- Restaurant

- Hospitality

- Healthcare

- Retail

- Warehouse

- Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise of Digital Payments

The widespread shift toward cashless transactions is a strong driver for Mobile POS Systems adoption. Consumers now expect options like credit cards, mobile wallets, and contactless payments wherever they shop, pushing businesses to upgrade to flexible payment solutions.

Mobile POS systems allow small retailers, food trucks, and even pop-up stores to process payments anywhere, smoothing the checkout process and boosting operational efficiency. This flexibility leads to quicker sales and less waiting, which improves both customer satisfaction and business output.

Digital transformation and the adoption of mobile devices such as smartphones and tablets further speed up this transition. Retailers and service providers find it easier to accept diverse payment types, and the shift is making a real difference in emerging markets where traditional payment infrastructure is often lacking.

Restraint

Security Concerns

Security remains one of the main restraints when it comes to mobile POS adoption. Processing sensitive transactions on portable devices increases the risk of data breaches, fraud, and unauthorized access, especially when businesses rely on internet connections for cloud-based systems.

Retailers must invest in secure payment software, keep up with industry regulations, and train staff in basic security protocols, which sometimes slows down implementation for smaller businesses. The potential for reputational damage makes owners carefully weigh the risks, particularly if they have limited resources to address IT issues.

Opportunity

Integration with Analytics & CRM

Mobile POS systems present exciting opportunities for deeper integration with customer analytics and relationship management tools. By collecting detailed sales and behavior data at each transaction, retailers can tailor marketing campaigns, manage inventory more efficiently, and personalize the shopping experience.

These insights help even smaller businesses build loyalty programs and offer targeted discounts, driving higher customer engagement without big upfront investment. Cloud-based mobile POS platforms offer scalable analytics capabilities and remote access, opening new doors for businesses of all sizes. The ability to connect real-time transaction data with CRM tools provides a low-cost way to understand customers and optimize operations across multiple sales channels.

Challenge

Internet & Infrastructure Limitations

One persistent challenge for Mobile POS Systems relates to dependence on stable internet connections and digital infrastructure. Many models require reliable connectivity to access cloud features or process payments securely, limiting their usefulness in rural areas or busy outdoor settings where networks are often patchy.

Businesses operating in markets with weak coverage may face disruptions or delayed transactions, which can frustrate customers and lead to lost sales. Upgrading local IT infrastructure or opting for hybrid POS models – those able to work offline temporarily – adds complexity and cost for business owners.

Competitive Analysis

In the mobile POS systems market, Fiserv, Ingenico, VeriFone, and PAX Technology are recognized as leading players. Their strong global presence and advanced payment processing solutions make them key providers for retailers, restaurants, and service providers. These companies focus on secure, fast, and user-friendly mobile payment systems, supporting the rapid shift toward cashless transactions.

Technology giants such as Samsung, Oracle, NEC Corporation, Panasonic Holdings, Toshiba Corporation, and Zebra Technologies contribute with integrated hardware and software solutions. Their offerings include tablets, kiosks, and handheld terminals designed for mobile payment applications. With expertise in enterprise systems and connectivity, they enable businesses to manage transactions, inventory, and customer engagement from a single platform.

Specialized firms including Posiflex Technology, Spectra Technologies, and QVS Software strengthen the market through innovative and customizable solutions. Their focus lies in providing flexible mobile POS platforms tailored to niche markets and regional needs. These companies emphasize affordability and adaptability, making mobile POS adoption accessible to small and mid-sized businesses.

Top Key Players in the Market

- Fiserv, Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico

- NEC Corporation

- Oracle

- Panasonic Holdings Corporation

- PAX Technology

- Posiflex Technology, Inc.

- QVS Software

- SAMSUNG

- SPECTRA Technologies

- TOSHIBA CORPORATION

- VeriFone, Inc.

- Zebra Technologies Corp.

- Others

Recent Developments

- In August 2025, iVend introduced a mobile POS system tailored for US retailers that emphasizes speed, flexibility, and compliance with upcoming PCI DSS v4.0 mandates, helping merchants modernize checkout lanes and reduce queues. The system supports curbside pickup and other omnichannel sales channels.

- In June 2024, SAP announced its acquisition of WalkMe, a leader in digital adoption platforms, aiming to enhance its digital payment offerings and user engagement capabilities across POS systems. In 2025, Salesforce agreed to acquire PredictSpring, aiming to expand its mobile commerce solutions and strengthen customer engagement with integrated POS platforms.

Report Scope

Report Features Description Market Value (2024) USD 40.5 Bn Forecast Revenue (2034) USD 172.6 Bn CAGR(2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software), By Type (Tablets, Others), By Application (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fiserv, Inc., Hewlett Packard Enterprise Development LP, Ingenico, NEC Corporation, Oracle, Panasonic Holdings Corporation, PAX Technology, Posiflex Technology, Inc., QVS Software, SAMSUNG, SPECTRA Technologies, TOSHIBA CORPORATION, VeriFone, Inc., Zebra Technologies Corp., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile POS Systems MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile POS Systems MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiserv, Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico

- NEC Corporation

- Oracle

- Panasonic Holdings Corporation

- PAX Technology

- Posiflex Technology, Inc.

- QVS Software

- SAMSUNG

- SPECTRA Technologies

- TOSHIBA CORPORATION

- VeriFone, Inc.

- Zebra Technologies Corp.

- Others