Global Military Aircraft Battery Market Size, Share, And Industry Analysis Report By Battery Type (Lead-Acid Batteries, Nickel-Cadmium Battery), By Aircraft Type (Helicopters, Combat Aircraft, Transport Aircraft), By Charging Type (Rechargeable, Non-Rechargeable), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168229

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

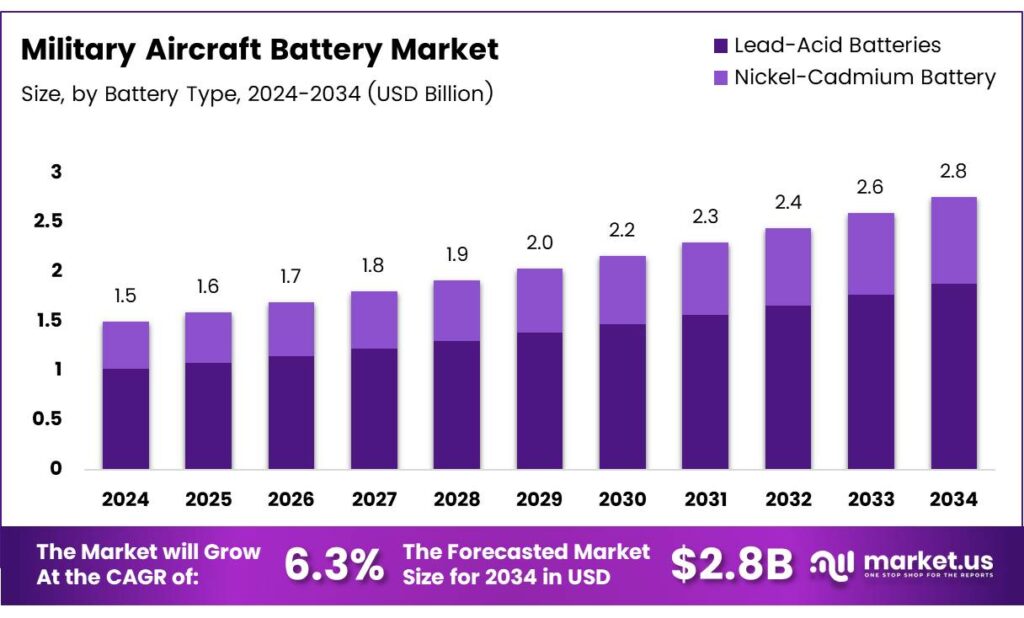

The Global Military Aircraft Battery Market size is expected to be worth around USD 2.8 billion by 2034, from USD 1.5 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Military Aircraft Battery Market refers to the ecosystem supplying onboard energy-storage systems that power starting, backup, avionics, avionics redundancy, emergency systems, and mission-critical electronics in defense aircraft. These batteries support fighters, transport planes, helicopters, and UAVs. Moreover, they must meet strict military standards for safety, reliability, shock resistance, and thermal stability.

The market is evolving steadily as militaries modernize aircraft fleets and expand unmanned platforms. Consequently, demand rises for compact, lightweight batteries supporting higher electrical loads. Digital avionics, fly-by-wire systems, radar upgrades, and electronic warfare capabilities increasingly depend on reliable onboard power, creating sustained procurement opportunities across defense aviation programs.

Defense forces actively pursue electrification strategies to improve fuel efficiency and operational flexibility, indirectly accelerating lithium battery adoption across fixed-wing and rotary military platforms. Lithium-ion batteries operate at a nominal voltage of 3.7 volts per cell and deliver specific energy densities between 150 and 250 Wh/kg. This significantly exceeds traditional chemistries, enabling higher onboard power availability without redesigning aircraft structures or payload capacities.

Performance advantages further strengthen lithium adoption in military aircraft batteries. Lithium-ion systems achieve cycle life values up to 2,000 cycles and deliver charging efficiencies of around 90–95%. Lithium-ion batteries function reliably across extreme temperature ranges from –51°C to 75°C. This capability ensures consistent power delivery during high-altitude missions, desert deployments, and naval aviation operations, reinforcing their role in next-generation military aircraft energy architectures.

Key Takeaways

- The Global Military Aircraft Battery Market is projected to grow from USD 1.5 billion in 2024 to USD 2.8 billion by 2034, registering a 6.3% CAGR.

- Lead-Acid Batteries remain the dominant battery type, accounting for a market share of 67.9% in 2024.

- Combat Aircraft represent the leading aircraft type segment with a share of 44.8%, driven by mission-critical power needs.

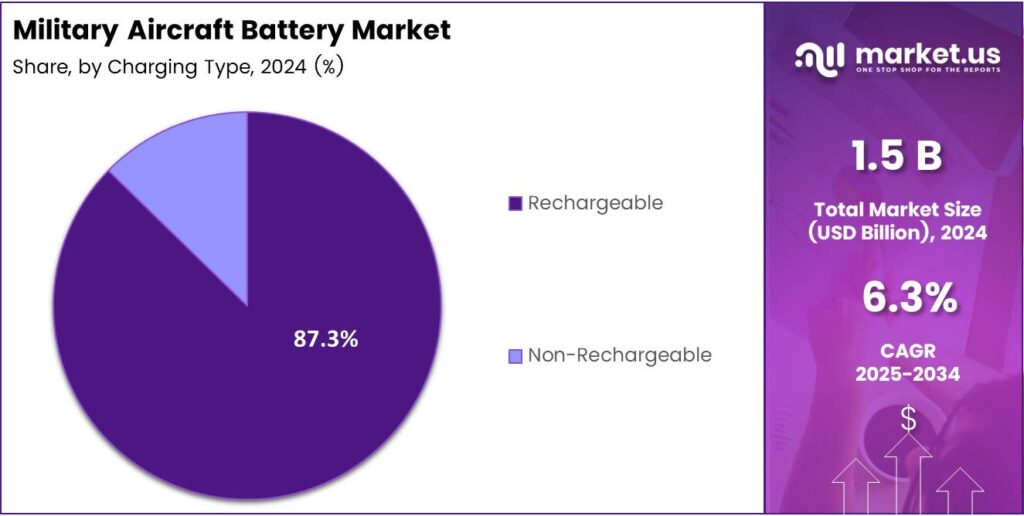

- Rechargeable batteries dominate the charging type segment, holding a substantial 87.3% market share in 2024.

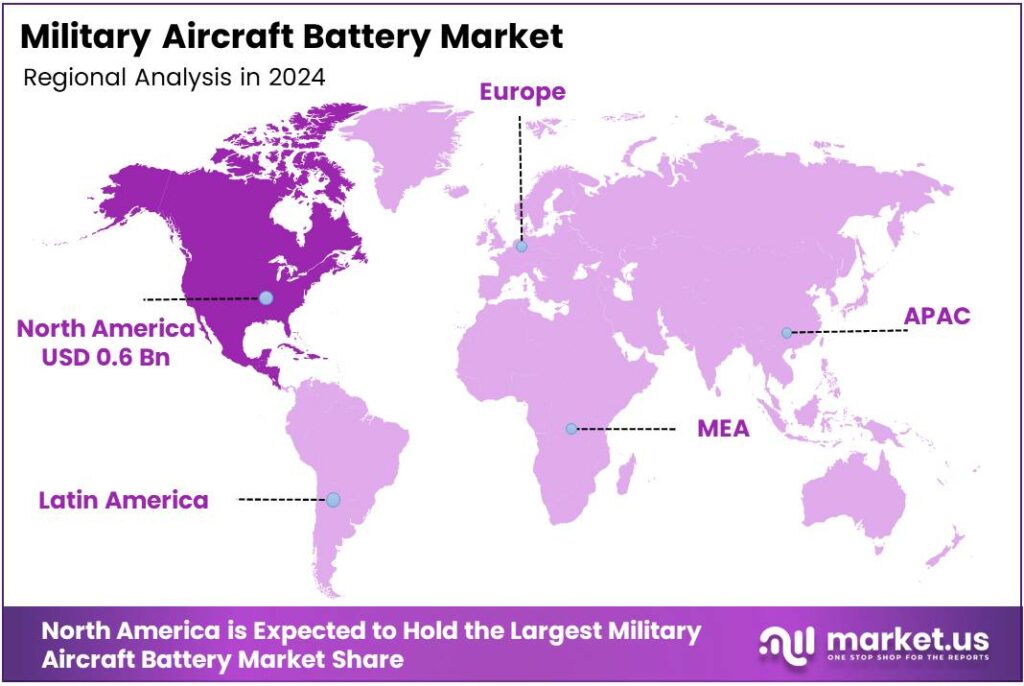

- North America leads the global market with a regional share of 44.9%, valued at approximately USD 0.6 billion.

By Battery Type Analysis

Lead-Acid Batteries dominate with 67.9% due to proven reliability, cost control, and ease of maintenance.

In 2024, Lead-Acid Batteries held a dominant market position in the By Battery Type Analysis segment of the Military Aircraft Battery Market, with a 67.9% share. These batteries remain widely preferred due to their stable performance, predictable behavior in extreme conditions, and strong acceptance across legacy military aircraft platforms.

Nickel-Cadmium Batteries continue to support specialized military aviation needs where durability matters. Although adoption is lower, they deliver steady output under temperature stress and high load cycles. However, environmental concerns and higher servicing needs gradually limit broader deployment across modern military aircraft fleets.

By Aircraft Type Analysis

Combat Aircraft lead with 44.8% driven by higher deployment intensity and advanced onboard power requirements.

In 2024, Combat Aircraft held a dominant market position in the By Aircraft Type Analysis segment of the Military Aircraft Battery Market, with a 44.8% share. These platforms demand reliable power for avionics, weapons systems, and emergency functions, making battery performance a mission-critical requirement.

Helicopters rely on aviation batteries for start-up reliability and backup power during tactical missions. Their operating environment requires dependable energy delivery during frequent takeoffs, landings, and hover operations. As military rotorcraft fleets modernize, battery consistency remains essential for operational readiness.

Transport Aircraft use batteries mainly for auxiliary power and safety systems during long-haul military operations. While battery loads are moderate, reliability is crucial for troop movement and logistics missions. Fleet stability limits rapid change, keeping adoption steady rather than aggressive.

By Charging Type Analysis

Rechargeable batteries dominate with 87.3% due to repeated mission use and long-term operational efficiency.

In 2024, Rechargeable batteries held a dominant market position in the By Charging Type Analysis segment of the Military Aircraft Battery Market, with an 87.3% share. These systems support extended aircraft service life while enabling cost control through repeated charge cycles across training and combat missions.

Non-rechargeable batteries remain in limited use for specific emergency and backup functions. They provide instant energy availability and long shelf life. However, disposal concerns and limited operational flexibility reduce their attractiveness for regular military aviation applications.

Key Market Segments

By Battery Type

- Lead-Acid Batteries

- Nickel-Cadmium Battery

By Aircraft Type

- Helicopters

- Combat Aircraft

- Transport Aircraft

By Charging Type

- Rechargeable

- Non-Rechargeable

Emerging Trends

Adoption of Lightweight and High-Energy Batteries Is a Key Trend

A major trend in the military aircraft battery market is the shift toward lightweight and high-energy-density batteries. Armed forces want batteries that reduce aircraft weight while delivering higher power output. This supports better fuel efficiency and longer mission duration.

- Growing interest in lithium-ion and next-generation chemistries that offer strong performance with less maintenance. Another trend is the integration of battery monitoring systems for real-time health tracking. The U.S. Air Force Research Laboratory has highlighted that next-generation platforms require onboard electrical power levels exceeding 1 megawatt for future combat systems.

This improves safety and reduces unexpected failures. Demand for batteries that can handle fast charging and extreme environments is also rising. These trends reflect how operational efficiency and safety are shaping battery innovation in military aviation.

Drivers

Rising Military Aircraft Modernization Programs Drive Battery Demand

Modern armed forces are investing heavily in upgrading fighter jets, transport aircraft, and helicopters. As aircraft become more advanced, the need for reliable and high-performance batteries also increases. Military aircraft batteries support key functions such as engine start, emergency backup power, avionics, radar systems, and onboard weapons electronics.

- Modernization programs as a direct driver because older battery systems are often replaced with lighter, safer, and more efficient solutions. In addition, new aircraft platforms demand batteries that can perform in extreme temperatures, high vibration, and combat stress conditions. Global military expenditure reached USD 2.4 trillion in 2023, reflecting sustained defense investment across air forces.

Governments are also focusing on improving mission readiness, which increases demand for batteries with longer life and faster charging. The shift toward more electric aircraft systems further boosts battery usage. Overall, defense upgrades across air forces create steady and long-term demand for military aircraft batteries.

Restraints

High Certification Standards Act as a Key Market Restraint

One major restraint in the military aircraft battery market is the strict certification and testing process. Military batteries must meet very high safety, reliability, and performance standards before approval. This increases development time and cost for manufacturers. This slows market entry, especially for new players. In addition, batteries must comply with military aviation regulations, environmental rules, and transport safety norms.

Any design change often requires re-certification, delaying deployment. High production costs also limit large-scale adoption of newer battery technologies. Maintenance and disposal rules for certain battery chemistries add further complexity. As a result, procurement cycles are long, and defense buyers remain cautious. These factors together restrict quick market expansion despite growing demand.

Growth Factors

Transition Toward Electric and Hybrid Aircraft Creates Growth Opportunities

The move toward electric and hybrid military aircraft opens strong growth opportunities for battery suppliers. Future aircraft designs aim to reduce fuel dependence and improve energy efficiency. This increases reliance on advanced battery systems for auxiliary and propulsion support.

- Strong opportunities in lightweight lithium-based batteries and smart energy storage solutions. Several governments are actively funding these capabilities. India’s Ministry of Defence allocated over USD 1.8 billion in recent budgets toward indigenous unmanned and surveillance aircraft programs.

Unmanned aerial vehicles and next-generation combat drones also require compact and reliable batteries. Expansion of defense manufacturing under domestic production programs further supports market growth. Battery upgrades for existing aircraft fleets also offer repeat business. Technology innovation and electrification trends create new revenue paths for the military aircraft battery market.

Regional Analysis

North America Dominates the Military Aircraft Battery Market with a Market Share of 44.9%, Valued at USD 0.6 billion

North America leads the military aircraft battery market due to continuous fleet modernization and strong defense spending. In this region, the market accounts for a dominant 44.9% share, with a total valuation of around USD 0.6 billion, reflecting its mature aerospace ecosystem. High adoption of advanced battery systems supports aircraft reliability and mission readiness. Ongoing investments in next-generation combat and support aircraft continue to sustain demand.

Europe shows steady growth driven by joint defense programs and upgrades of legacy military aircraft. Several countries are focusing on improving power reliability and safety standards in airborne systems. The regional market benefits from long-term procurement cycles and a strong focus on operational efficiency. Collaboration across defense alliances supports stable market expansion.

Asia Pacific is emerging as a high-growth region due to rising defense budgets and expanding air force capabilities. Countries in the region are investing in new combat aircraft, transport planes, and helicopters. This creates consistent demand for durable and high-performance aircraft batteries. Localization of manufacturing and maintenance further supports market development.

The U.S. market remains a key contributor within North America due to its large and diverse military aircraft fleet. Continuous upgrades, testing programs, and operational deployments drive regular battery replacement cycles. Strong emphasis on performance, safety, and endurance sustains market demand. Long-term defense planning ensures steady consumption of aircraft batteries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Military Aircraft Battery Market continues to be shaped by a small group of specialized manufacturers that combine aviation certification expertise with proven battery reliability. The military platforms demand batteries with extreme tolerance to vibration, temperature variation, and mission-critical power continuity.

Cella Energy Limited is viewed as an innovation-driven player, particularly noted for its work on advanced energy-storage concepts designed for defense aviation and aerospace missions. Its focus on lightweight and high-energy solutions supports future military aircraft electrification and endurance-focused missions.

Concorde Battery Corp. holds a stable position in military aviation through its proven sealed lead-acid aircraft batteries, valued for reliability and low maintenance. Analysts consider Concorde a dependable supplier for legacy and mixed-fleet military aircraft requiring consistent standby and emergency power.

EaglePicher Technologies LLC plays a critical role in high-performance military aircraft programs, supported by deep experience in lithium-based and specialty batteries. The company is often associated with mission-critical aerospace power where safety, redundancy, and performance cannot be compromised.

ENERSYS benefits from scale, diversified chemistry offerings, and strong defense-sector alignment, allowing it to support both OEM and aftermarket military aircraft needs. Its broad portfolio supports long service life, global serviceability, and compliance with strict military standards.

Top Key Players in the Market

- Cella Energy Limited

- Concorde Battery Corp.

- EaglePicher Technologies LLC

- ENERSYS

- GS Yuasa Corp.

- HBL Power Systems Ltd

- MarathonNorco Aerospace

- Marvel Aero International Inc.

- Meggitt Plc

- TADIRAN BATTERIES Ltd.

- Teledyne Technologies Inc.

Recent Developments

- In 2024, Cella Energy was highlighted as a key player in the UAV battery market, driven by increasing military investments in border surveillance and intelligence gathering in countries like the US and Japan. This reflects ongoing relevance in hydrogen fuel cell alternatives to traditional batteries for extending UAV flight times in military operations.

- In 2024, Concorde maintained a strong market position in the aircraft battery sector, driven by demand for durable, FAA- and military-spec compliant batteries in general aviation, commercial, and defense applications. The company reported continued production of over 90 models of direct-replacement batteries for military platforms.

Report Scope

Report Features Description Market Value (2024) USD 1.5 billion Forecast Revenue (2034) USD 2.8 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lead-Acid Batteries, Nickel-Cadmium Battery), By Aircraft Type (Helicopters, Combat Aircraft, Transport Aircraft), By Charging Type (Rechargeable, Non-Rechargeable) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cella Energy Limited, Concorde Battery Corp., EaglePicher Technologies LLC, ENERSYS, GS Yuasa Corp., HBL Power Systems Ltd, MarathonNorco Aerospace, Marvel Aero International Inc., Meggitt Plc, TADIRAN BATTERIES Ltd., Teledyne Technologies Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Military Aircraft Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Military Aircraft Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cella Energy Limited

- Concorde Battery Corp.

- EaglePicher Technologies LLC

- ENERSYS

- GS Yuasa Corp.

- HBL Power Systems Ltd

- MarathonNorco Aerospace

- Marvel Aero International Inc.

- Meggitt Plc

- TADIRAN BATTERIES Ltd.

- Teledyne Technologies Inc.