Global Micro Turbine Market Size, Share, And Business Benefits By Power Rating (12 kW -50 kW, 50 kW-250 kW, 250 kW-500 kW), By Application (Combined Heat and Power (CHP), Standby Power), By End-Use (Commercial, Industrial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154852

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

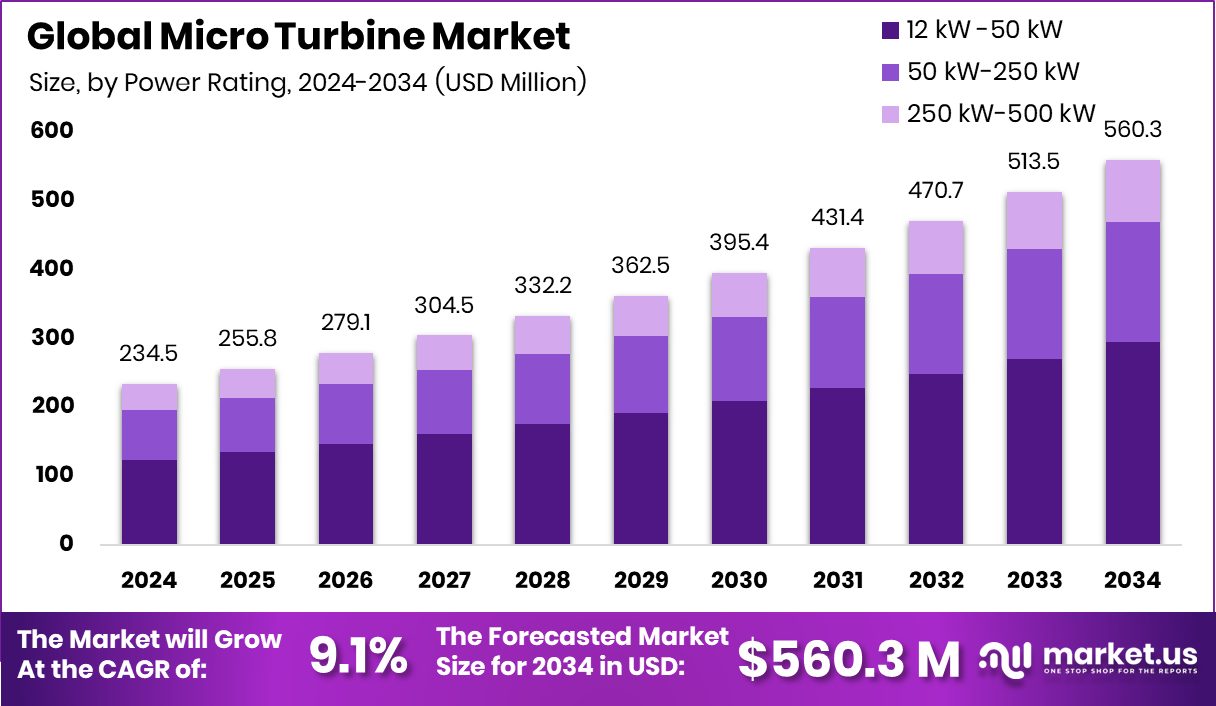

The Global Micro Turbine Market is expected to be worth around USD 560.3 million by 2034, up from USD 234.5 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034. This growth reflects increasing demand for reliable on-site power across North American 42.7% facilities.

A micro turbine is a small-scale combustion turbine that generates electricity and, in some cases, heat, through the operation of a compact rotating system. These turbines typically range from 25 kW to 500 kW in capacity and are known for their ability to deliver distributed power solutions with lower emissions and high fuel efficiency. Micro turbines can operate on a variety of fuels, including natural gas, biogas, diesel, or hydrogen, making them versatile for different energy applications, especially in off-grid or remote locations.

The micro turbine market refers to the global industry surrounding the design, production, and deployment of these compact energy systems. It includes the use of micro turbines in combined heat and power (CHP) systems, remote power generation, and backup energy for commercial, industrial, and residential settings. The market is witnessing gradual traction as nations focus on reducing carbon emissions and improving energy reliability through decentralized systems.

The growth of the micro turbine market is being driven by the global push toward cleaner and more sustainable energy solutions. Governments and industries are increasingly adopting distributed power systems to reduce reliance on centralized grids and cut greenhouse gas emissions. Micro turbines provide a flexible and efficient option, particularly in combined heat and power setups, which enhances overall system efficiency and lowers operational costs.

Demand for micro turbines is also rising in sectors that require continuous, reliable power, such as hospitals, data centers, and manufacturing units. The ability to run on renewable or low-carbon fuels adds to their appeal in a carbon-conscious economy. Their low maintenance needs and compact design further support adoption in urban and space-constrained environments. According to an industry report, Nabhdrishti Aerospace raises $3 million to advance fuel-flexible gas turbine engine technology. Also, Netherlands-based Micro Turbine Technology receives €5 million investment from Avila Energy in Canada.

Key Takeaways

- The Global Micro Turbine Market is expected to be worth around USD 560.3 million by 2034, up from USD 234.5 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034.

- In the Micro Turbine Market, 12 kW–50 kW systems held a 52.7% share in 2024.

- Combined Heat and Power (CHP) dominated the Micro Turbine Market, capturing a 78.6% application share.

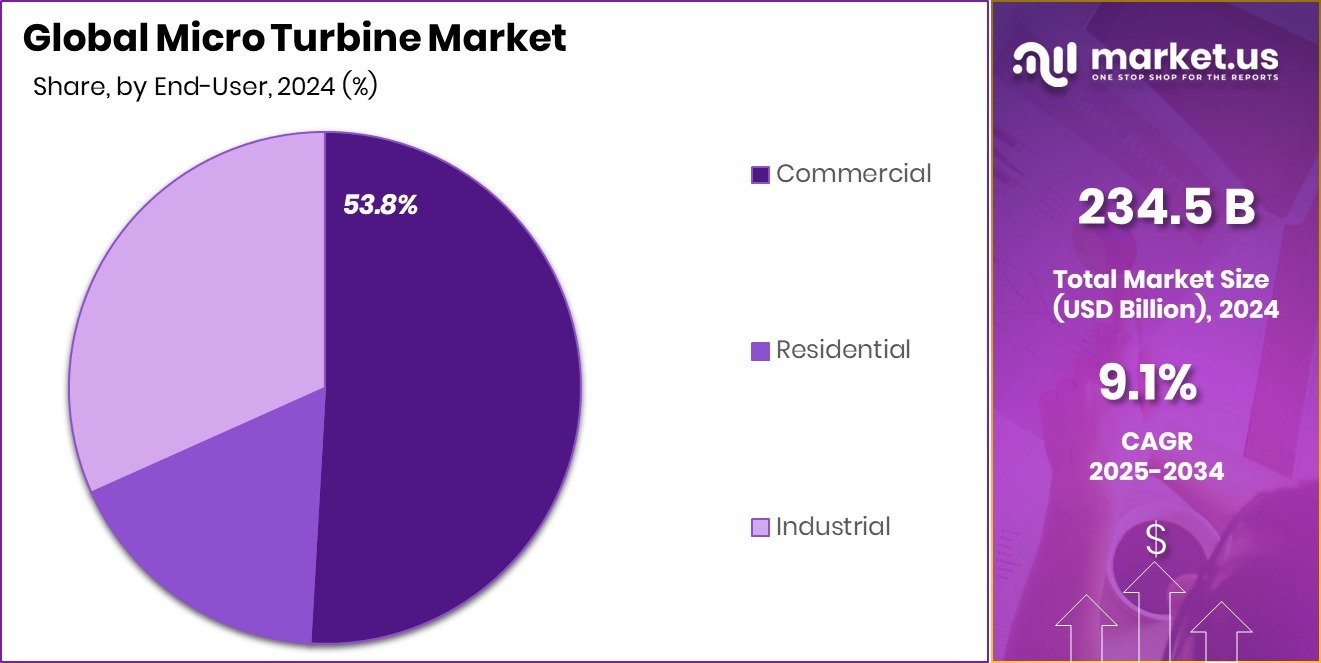

- The commercial segment accounted for 53.8% of the Micro Turbine Market demand, driven by energy efficiency needs.

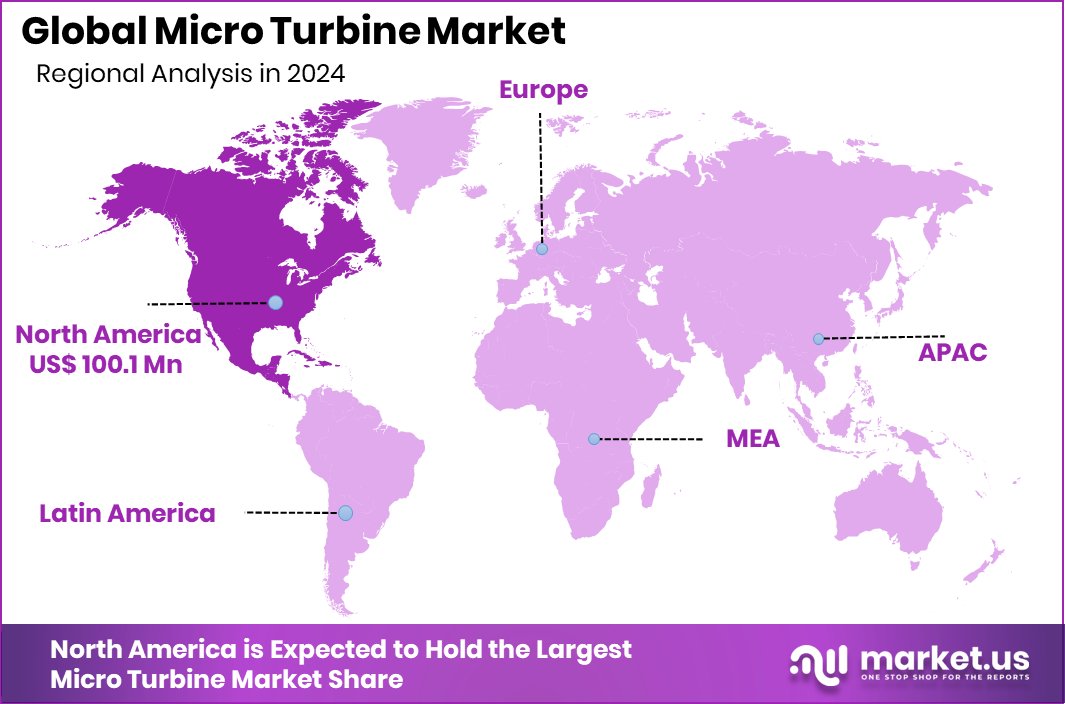

- The North American market reached a value of approximately USD 100.1 million.

By Power Rating Analysis

The microturbine market is led by the 12–50 kW systems segment.

In 2024, 12 kW – 50 kW held a dominant market position in the By Power Rating segment of the Micro Turbine Market, with a 52.7% share. This power rating range has gained significant traction due to its suitability for a broad range of applications, particularly in commercial and small industrial facilities where moderate energy demand is common. The 12 kW – 50 kW systems are widely preferred for combined heat and power (CHP) installations, offering efficient energy production along with heat recovery, which helps in reducing overall energy costs and minimizing environmental impact.

The dominance of this segment can be attributed to the balance it offers between compact design, output capacity, and operational efficiency. These systems are especially favored in locations where space constraints exist and where grid reliability is either limited or unstable. Their adaptability to multiple fuel types, including natural gas and biogas, further strengthens their position in areas emphasizing clean energy transitions.

The 52.7% market share reflects growing end-user confidence in mid-range microturbines that fulfill both primary and backup power needs without extensive infrastructure requirements. Their economic viability, ease of installation, and lower maintenance costs contribute to their strong preference in the global micro turbine landscape in 2024.

By Application Analysis

CHP systems drive 78.6% of the microturbine market usage.

In 2024, Combined Heat and Power (CHP) held a dominant market position in the By Application segment of the Micro Turbine Market, with a 78.6% share. This substantial market dominance reflects the growing global preference for energy solutions that maximize efficiency by simultaneously generating electricity and utilizing the waste heat for thermal applications.

The adoption of micro turbines in CHP systems has proven to be highly effective in reducing fuel consumption and cutting down greenhouse gas emissions, making them an ideal choice for energy-conscious sectors.

The 78.6% share indicates strong demand from industries and commercial establishments seeking to improve energy efficiency and reduce operating costs. CHP-based micro turbine systems are particularly valued in facilities where there is a continuous demand for both electricity and heat, as they significantly improve the overall utilization of fuel input. The integration of these systems also aligns with energy-saving goals in urban and semi-urban environments where energy infrastructure optimization is critical.

Their compact size, lower emissions profile, and ability to run on various fuels further reinforce their dominance in CHP applications. As energy strategies shift toward decentralized, cost-efficient models, the CHP segment is expected to maintain its leading position within the micro turbine market.

By End-Use Analysis

The commercial sector holds a 53.8% share in the microturbine market.

In 2024, Commercial held a dominant market position in the By End-Use segment of the Micro Turbine Market, with a 53.8% share. This dominance highlights the growing reliance of commercial facilities on efficient, low-emission power generation solutions that offer both reliability and cost savings. The commercial sector—including office buildings, shopping centers, hotels, and institutions—has increasingly adopted microturbines to meet on-site energy demands, especially in regions where grid supply is either unreliable or expensive.

The 53.8% market share reflects the segment’s preference for distributed energy systems that ensure uninterrupted power while also reducing dependency on traditional utility grids. Micro turbines provide a viable solution for commercial users due to their compact size, low operational noise, and the ability to support Combined Heat and Power (CHP) applications, which help cut energy costs by utilizing waste heat.

The ability to operate on various fuels also supports compliance with local emission regulations and sustainability goals. As commercial establishments continue to seek out energy-efficient technologies that support business continuity and environmental responsibility, the commercial end-use segment remains at the forefront of microturbine adoption in 2024.

Key Market Segments

By Power Rating

- 12 kW – 50 kW

- 50 kW-250 kW

- 250 kW-500 kW

By Application

- Combined Heat and Power (CHP)

- Standby Power

By End-Use

- Commercial

- Industrial

- Residential

Driving Factors

Rising Demand for Reliable On-Site Power Supply

One of the main factors driving the micro turbine market is the growing demand for reliable on-site power generation, especially in commercial and industrial areas. Many businesses today need uninterrupted power to maintain their operations. Power cuts or grid failures can lead to serious losses, especially in sectors like healthcare, data centers, hospitality, and manufacturing.

Micro turbines offer a practical solution by generating electricity directly at the point of use, reducing dependency on traditional power grids. These systems also support combined heat and power (CHP), which means they produce both electricity and usable heat from the same energy source. This improves energy efficiency and lowers operating costs. As a result, more businesses are turning to micro turbines for clean and dependable energy.

Restraining Factors

High Initial Cost Limits Widespread Market Adoption

A key factor holding back the growth of the micro turbine market is the high initial cost of installation. Although micro turbines offer long-term savings through energy efficiency and low maintenance, the upfront investment is still a major concern for many users—especially small businesses or organizations with limited budgets. The cost includes not just the equipment, but also installation, grid connection, and sometimes additional infrastructure for combined heat and power (CHP) systems.

This financial barrier makes it harder for potential buyers to justify switching from conventional energy sources. In markets where cheaper alternatives like diesel generators are still common, the higher price of micro turbines slows down their adoption despite their long-term benefits and cleaner energy output.

Growth Opportunity

Growing Use of Biogas in Power Generation

One major growth opportunity in the micro turbine market is the increasing use of biogas as a fuel source. As countries focus on reducing carbon emissions and managing organic waste, biogas is gaining attention as a clean and renewable energy option. Micro turbines are well-suited for using biogas produced from landfills, wastewater treatment plants, and agricultural waste.

This creates a win-win situation—waste is reduced, and clean energy is generated. Many local governments are also supporting biogas projects with financial incentives and policy support. This trend opens up new markets for micro turbines, especially in rural and semi-urban areas where biogas sources are available. Using micro turbines with biogas not only supports sustainability but also reduces fuel costs over time.

Latest Trends

Shift Towards Hybrid Microgrid Power Generation Systems

A leading trend in the micro turbine market is the growing shift toward hybrid microgrid systems. These systems combine micro turbines with renewable energy sources like solar or wind, along with battery storage, to create a flexible and efficient energy network. Micro turbines play a key role by providing stable backup power when solar or wind output is low, ensuring a continuous energy supply.

This trend is becoming popular in areas with unreliable grids or remote locations where full-scale infrastructure is not available. Hybrid systems help reduce fuel usage, lower emissions, and improve energy reliability. As energy users look for cleaner and more resilient power solutions, the integration of micro turbines into hybrid microgrids is gaining strong momentum globally.

Regional Analysis

In 2024, North America held a 42.7% share of the Micro Turbine Market.

In 2024, North America emerged as the dominant region in the global Micro Turbine Market, accounting for 42.7% of the total share with a market value of USD 100.1 million. The region’s leadership is primarily supported by rising adoption of distributed energy systems and a growing focus on cleaner and more reliable on-site power solutions across commercial and industrial sectors. The presence of favorable policy frameworks, especially in the United States and Canada, has further encouraged investments in micro turbine installations for combined heat and power (CHP) applications.

Europe also demonstrated notable activity in the market, driven by efforts to reduce carbon emissions and modernize aging energy infrastructure. Asia Pacific is showing gradual momentum, with rising energy demand and infrastructure expansion in developing countries. The Middle East & Africa and Latin America markets remained comparatively smaller but are witnessing early signs of interest in micro turbines, particularly in areas where access to centralized grids is limited.

While all regions are exploring decentralized power options, North America maintained its lead in 2024, supported by a mix of technological readiness, policy support, and strong end-user demand. This established the region as the most influential player in shaping the direction of the global micro turbine landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ansaldo Energia Spa has continued to be recognized in 2024 for its engineering excellence and robust product portfolio within micro turbine technologies. Its position is strengthened by advanced design capabilities and deployment in industrial-scale energy applications. Ongoing innovation and refinement of turbine efficiency have empowered the company to sustain a respectable standing in the market, particularly in regions where reliability and service support are prioritized.

Aurelia Turbine represents a technology-driven player, with a clear orientation toward compact and modular solutions. In 2024, the company expanded its reach by refining product usability in decentralized energy environments. Its focus on simple installation and fuel flexibility serves to increase its relevance among customers pursuing streamlined solutions for specific industrial and commercial energy use‑cases.

Bladon Micro Turbine has remained identified with distributed generation and hybrid system integration. Throughout the year, its solutions were consistently acknowledged for delivering uninterrupted power across facilities where continuity is mission‑critical. Simplicity of deployment and operational resilience continued to position the company as a trusted partner for distributed energy projects.

Brayton Energy LLC, operating with a focus on innovative thermodynamic cycles, maintained a dedicated presence in the market. Recognized for product differentiation through cycle efficiency and performance, the company emphasized technological refinement in 2024. Its specialization lent it appeal in niche applications where enhanced energy recovery and lower emissions are of strategic importance.

Top Key Players in the Market

- Ansaldo Energia Spa

- Aurelia Turbine

- Bladon Micro Turbine

- Brayton Energy LLC

- Calnetix Technologies LLC

- Capstone Turbine Corporation

- Dresser-Rand

- FlexEnergy Solutions

- MTT Microturbine

- Toyota Turbine Systems

Recent Developments

- In August 2024, an Aurelia A400 turbine unit was deployed in August 2024 as part of the ROBINSON project on Eigerøy island, Norway. This unit serves as the core of a Combined Heat and Power (CHP) system, operating on a fuel mix that includes syngas, biomethane, and hydrogen. Its flexible fuel usage and up to 20% higher energy efficiency compared to other micro‑turbines make it well-suited for decentralized energy systems.

- In May 2024, Ansaldo Green Tech—a subsidiary of Ansaldo Energia—led a consortium awarded funding by the Liguria Region’s FILSE institution, supported by European Regional Development Funds. The project is focused on developing a zero-impact microturbine prototype intended for use in energy communities and micro‑grids. Emphasis is placed on the use of CO₂-neutral e‑fuels, including hydrogen, and ensuring compatibility of materials and safe operation under variable load conditions.

Report Scope

Report Features Description Market Value (2024) USD 234.5 Million Forecast Revenue (2034) USD 560.3 Million CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Rating (12 kW -50 kW, 50 kW-250 kW, 250 kW-500 kW), By Application (Combined Heat and Power (CHP), Standby Power), By End-Use (Commercial, Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ansaldo Energia Spa, Aurelia Turbine, Bladon Micro Turbine, Brayton Energy LLC, Calnetix Technologies LLC, Capstone Turbine Corporation, Dresser-Rand, FlexEnergy Solutions, MTT Microturbine, Toyota Turbine Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ansaldo Energia Spa

- Aurelia Turbine

- Bladon Micro Turbine

- Brayton Energy LLC

- Calnetix Technologies LLC

- Capstone Turbine Corporation

- Dresser-Rand

- FlexEnergy Solutions

- MTT Microturbine

- Toyota Turbine Systems