Global Methacrylic Acid Market Size, Share, And Business Benefit By Type (Liquid, Glacial), By Application (Paint, Adhesive, Fibre Processing Agent, Rubber Modifier, Leather Treatment, Paper Processing Agent, Lubricant Additive, Cement Mixing Agent, Others), By End Use (Construction, Automobiles, Electronics, Textile, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164548

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

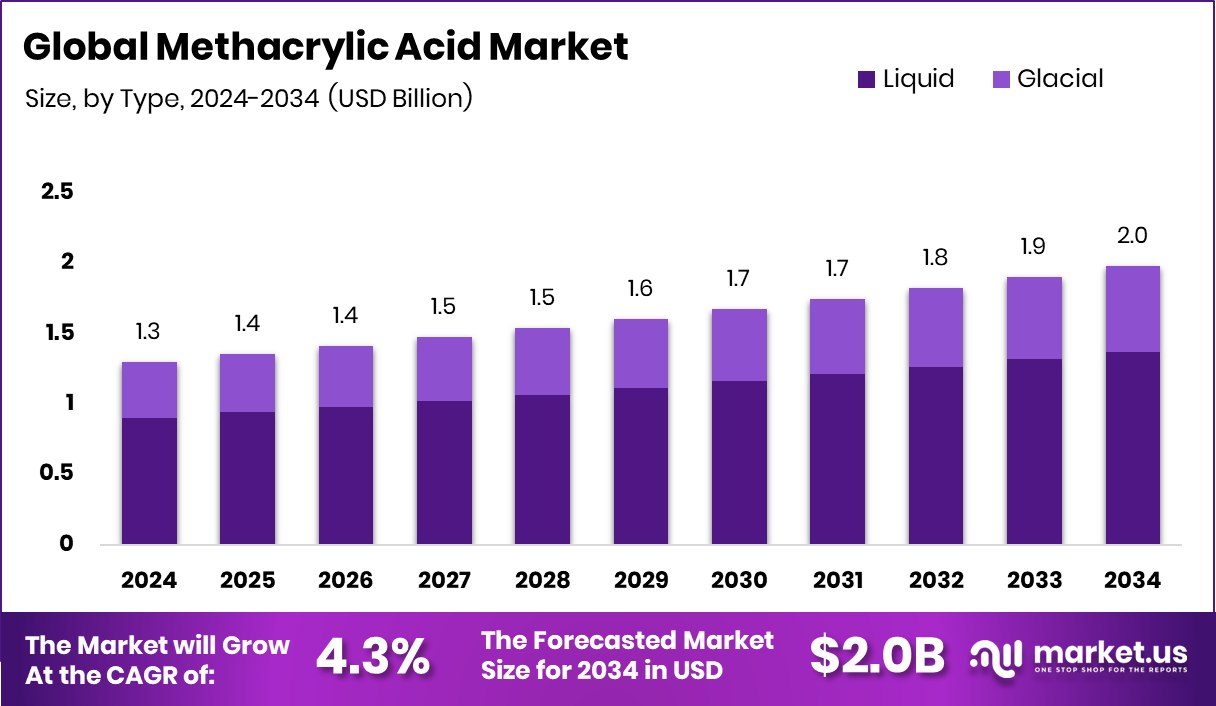

The Global Methacrylic Acid Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Growing infrastructure development and sustainable coating demand strengthened North America’s 44.90% leading market position.

Methacrylic acid is a colorless, viscous organic compound widely used as a building block for acrylic and methacrylate polymers. It is known for its strong adhesive and coating properties, making it essential in the production of paints, adhesives, plastics, and surface coatings. The compound enhances hardness, transparency, and durability in polymer formulations. It also plays a vital role in manufacturing resins and superabsorbent polymers used across industries like construction, automotive, electronics, and personal care.

The methacrylic acid market represents the production, trade, and applications of methacrylic acid and its derivatives. It is closely tied to the performance materials industry, with rising usage in paints, adhesives, coatings, and plastics. As industries move toward sustainable and energy-efficient solutions, methacrylic acid finds growing relevance in bio-based formulations and low-VOC products. Market players are investing in research and cleaner production processes to meet environmental standards and growing global demand.

One of the main growth drivers for methacrylic acid is the increasing adoption of durable and eco-friendly coatings. The growing shift toward sustainable construction and high-performance materials continues to push demand. Ecoat recently secured €21 million for developing low-carbon paints and coatings, reflecting how sustainable coating innovations are strengthening MAA consumption. Additionally, the expanding use of MAA in industrial adhesives and protective coatings supports growth as industries modernize infrastructure and production processes.

Demand for methacrylic acid is also rising due to its wide usage in consumer and industrial goods. Its role in enhancing transparency, gloss, and resistance makes it a preferred choice in coatings and plastic modifiers. The construction and electronics sectors are witnessing steady growth, boosting the consumption of MAA-based resins. Furthermore, infrastructure expansions in developing economies, coupled with packaging and personal care product innovations, continue to generate consistent demand for methacrylic acid formulations worldwide.

The methacrylic acid market presents opportunities in green chemistry, circular materials, and innovation-driven industrial growth. India’s JSW Group’s $790 million bond issue to fund acquisitions reflects renewed investments in material-focused ventures. Similarly, EndureAir Systems’ Rs 13.5 crore funding led by an Asian Paints co-promoter signals confidence in advanced technology-linked materials.

Key Takeaways

- The Global Methacrylic Acid Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, liquid methacrylic acid dominated the market, capturing 69.3% share across applications.

- Paint applications held a 23.9% share of the methacrylic acid market, highlighting its strong formulation role.

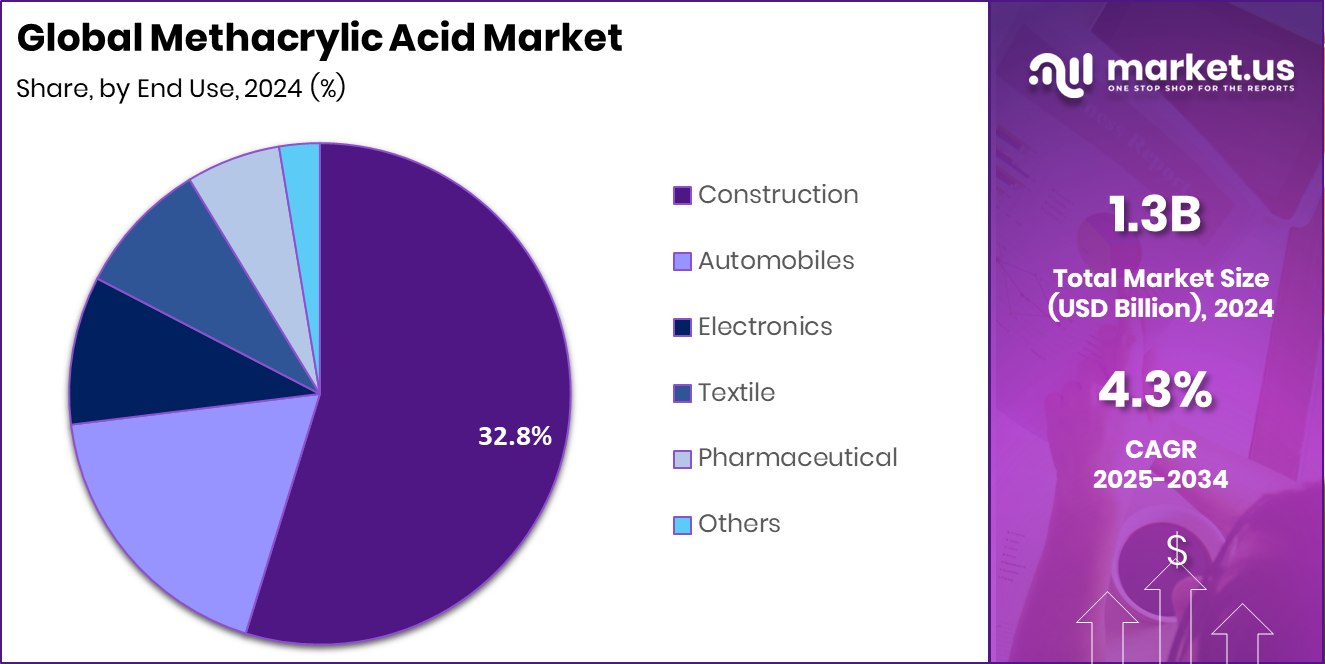

- The construction sector accounted for a 32.8% share in the methacrylic acid market during the year.

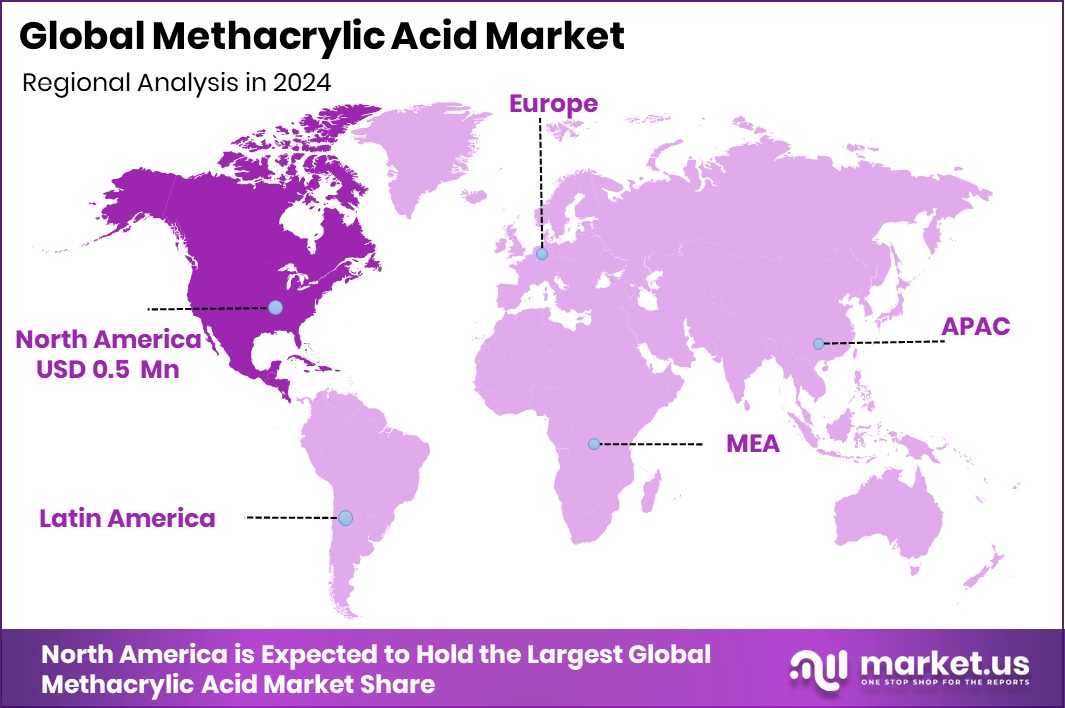

- The North American market value reached approximately USD 0.5 billion, driven by industrial applications.

By Type Analysis

In 2024, the liquid type dominated the methacrylic acid market with a 69.3% share.

In 2024, Liquid held a dominant market position in the By Type segment of the Methacrylic Acid Market, capturing a 69.3% share. This leadership was driven by its extensive use in coatings, adhesives, and high-performance polymer applications. The liquid form of methacrylic acid ensures superior dispersion and ease of blending in industrial formulations, making it the preferred choice across paints and coatings manufacturing.

Its compatibility with sustainable and low-VOC coating systems further enhanced adoption among eco-conscious industries. Supported by the growing infrastructure sector and continuous advancements in resin technologies, the liquid segment maintained a strong foothold, reflecting its vital role in modern chemical and material applications.

By Application Analysis

The paint application dominated the methacrylic acid market, capturing a 23.9% share in 2024.

In 2024, Paint held a dominant market position in the By Application segment of the Methacrylic Acid Market, accounting for a 23.9% share. This dominance was supported by the rising use of methacrylic acid-based formulations in producing high-performance, durable paints with superior adhesion, gloss, and weather resistance. The growing preference for low-VOC and eco-friendly coating systems across residential, commercial, and industrial construction further strengthened its presence.

Paint manufacturers increasingly relied on methacrylic acid to enhance color retention and protective properties, particularly in architectural and automotive coatings. The segment’s leadership reflected ongoing innovation in sustainable paint technologies and the expanding demand for long-lasting, high-quality surface finishes.

By End Use Analysis

The construction end-use dominated the methacrylic acid market, holding a 32.8% share globally.

In 2024, Construction held a dominant market position in the By End Use segment of the Methacrylic Acid Market, capturing a 32.8% share. This dominance was driven by the extensive use of methacrylic acid-based polymers and coatings in infrastructure development, flooring, waterproofing, and surface protection applications. The compound’s strong adhesion, chemical resistance, and durability made it an essential material for concrete sealants and protective coatings used in modern construction.

With rapid urbanization and increasing investments in sustainable building materials, the construction sector continued to integrate methacrylic acid derivatives to enhance performance and longevity. This strengthened the segment’s leadership, reflecting its vital role in supporting durable and eco-efficient construction solutions.

Key Market Segments

By Type

- Liquid

- Glacial

By Application

- Paint

- Adhesive

- Fibre Processing Agent

- Rubber Modifier

- Leather Treatment

- Paper Processing Agent

- Lubricant Additive

- Cement Mixing Agent

- Others

By End Use

- Construction

- Automobiles

- Electronics

- Textile

- Pharmaceutical

- Others

Driving Factors

Rising Infrastructure Investments Boost Methacrylic Acid Demand

One of the major driving factors for the Methacrylic Acid Market is the growing investment in infrastructure and construction projects worldwide. Methacrylic acid plays a vital role in producing coatings, adhesives, and sealants used in buildings, bridges, and industrial facilities. The push for durable, weather-resistant, and eco-friendly materials is increasing their use in construction-related coatings and flooring applications.

Recent financial developments, such as the £2.4 million funding backing commercial units construction at a business park, highlight the strong flow of capital into infrastructure growth. Such investments not only expand the construction sector but also create higher demand for methacrylic acid-based products, supporting long-term market expansion through innovation in performance materials.

Restraining Factors

Stringent Environmental Rules Limit Methacrylic Acid Growth

A key restraining factor for the Methacrylic Acid Market is the tightening of environmental regulations on chemical manufacturing and emissions control. Producing methacrylic acid involves processes that generate volatile organic compounds (VOCs) and other emissions, leading to stricter compliance requirements and higher operational costs for producers. These environmental limitations often slow down expansion projects and discourage new investments in production capacity.

Additionally, the transition toward greener alternatives and bio-based chemicals challenges traditional methacrylic acid manufacturing. However, innovation remains active in this space, with technology-focused ventures like ConCntric raising $10 million in Series A funding to support sustainable industrial solutions. Such efforts indicate a gradual move toward cleaner, compliant production methods despite regulatory pressures.

Growth Opportunity

Growing Shift Toward Sustainable Construction Creates Opportunity

A major growth opportunity for the Methacrylic Acid Market lies in the rising global shift toward sustainable and energy-efficient construction materials. Methacrylic acid-based coatings and resins are increasingly used in green building applications due to their durability, weather resistance, and low environmental impact. The market stands to benefit from the surge in eco-friendly infrastructure projects and the modernization of construction practices.

For example, Lumina aims to raise $20–40 million in Series A funding to develop electric construction equipment, reflecting the industry’s commitment to cleaner and more efficient technologies. As sustainable construction accelerates, the demand for methacrylic acid in advanced coatings and adhesives designed for long-lasting, low-emission buildings is expected to grow significantly.

Latest Trends

Rising Green Construction Trends Transform Methacrylic Acid Market

One of the latest trends shaping the Methacrylic Acid Market is the growing emphasis on green and sustainable construction practices. Governments and industries are increasingly focusing on developing eco-friendly housing and infrastructure projects that use durable, low-emission materials. Methacrylic acid is gaining traction in producing high-performance coatings, sealants, and resins that align with these sustainability goals.

The recent initiative, where the government unleashes the next generation of construction workers to build 1.5 million homes, highlights a renewed focus on large-scale, sustainable housing projects. This trend is driving steady demand for methacrylic acid-based products, particularly those that enhance energy efficiency, durability, and environmental performance in modern construction and architectural applications.

Regional Analysis

In 2024, North America dominated the Methacrylic Acid Market with a 44.90% share.

In 2024, North America held a dominant position in the global Methacrylic Acid Market, capturing a 44.90% share valued at around USD 0.5 billion. The region’s leadership was supported by the strong presence of advanced manufacturing industries and the growing adoption of high-performance coatings and adhesives across the construction and automotive sectors.

Government initiatives promoting sustainable infrastructure and energy-efficient materials have further enhanced the use of methacrylic acid-based formulations. In Europe, the demand was driven by strict environmental regulations and the rising trend toward low-VOC paints and coatings.

The Asia Pacific region exhibited steady growth due to expanding industrial activity, construction investments, and increasing demand for consumer goods manufacturing. Meanwhile, Latin America and the Middle East & Africa showed moderate development, supported by gradual industrialization and improving urban infrastructure.

Collectively, these regions reflect a balanced global landscape where North America leads with innovation and adoption, while the Asia Pacific continues to emerge as a strong growth contributor in the years ahead.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Dow stands out in the methacrylic acid space with its strong North American base. Its manufacturing site at Deer Park, Texas, supports a wide array of specialty monomers, including glacial methacrylic acid, underscoring Dow’s role not only in commodity volumes but also in high-value derivative feedstocks. Through this asset and its integrated monomer and resin portfolio, Dow can leverage scale and downstream value-streaming, positioning itself to capture demand from coatings, adhesives, and performance plastics.

BASF maintains its significance through its broad portfolio of methacrylic-acid esters and feedstocks serving the polymer, coating, and construction markets. With its global footprint and established resin and acrylate business lines, BASF is well-placed to respond to regional demand fluctuations and application diversification. Its ability to offer a wide range of methacrylic derivatives gives it flexibility and resilience in a market that increasingly seeks value-added solutions rather than pure commodity supply.

Evonik differentiates by focusing on specialty monomers and functional methacrylates. Its VISIOMER® line of specialty methacrylates reflects a shift toward higher-margin applications and sustainable chemistry. By catering to niche end-uses with value-added features (such as enhanced adhesion, durability, or eco-performance), Evonik is aligning with market trends that favour innovation and sustainability rather than purely volume-based competition.

Top Key Players in the Market

- Dow

- BASF SE

- Evonik Industries

- Formosa Korea

- KURARAY CO., LTD

- LG Chem

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- DHALOP CHEMICALS

- AECOCHEM

- Central Drug House

Recent Developments

- In December 2024, Dow completed the sale of its flexible-packaging laminating adhesives business for $150 million. This divestiture included five manufacturing sites across the U.S., Italy, and Mexico, and enables the company to focus more on its core downstream, high-value materials.

- In August 2024, BASF announced that starting in Q4 2024, it will switch its entire production of ethyl acrylate (EA) to a bio-based version. The new EA will contain a certified 14C-traceable bio-content of 40% and deliver approximately a 30% lower product carbon footprint compared to fossil-based EA. This signals BASF’s pivot toward sustainable (meth)acrylate chemistry, which overlaps with methacrylic-acid derivatives and application markets.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid, Glacial), By Application (Paint, Adhesive, Fibre Processing Agent, Rubber Modifier, Leather Treatment, Paper Processing Agent, Lubricant Additive, Cement Mixing Agent, Others), By End Use (Construction, Automobiles, Electronics, Textile, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow, BASF SE, Evonik Industries, Formosa Korea, KURARAY CO., LTD, LG Chem, MITSUBISHI GAS CHEMICAL COMPANY, INC, DHALOP CHEMICALS, AECOCHEM, Central Drug House Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Methacrylic Acid MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Methacrylic Acid MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow

- BASF SE

- Evonik Industries

- Formosa Korea

- KURARAY CO., LTD

- LG Chem

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- DHALOP CHEMICALS

- AECOCHEM

- Central Drug House