Global Metallurgical Coal Market Size, Share, And Business Benefits By Type (Hard Coking Coal (HCC), Semi-soft Coking Coal (SSCC), Pulverized Coal Injection), By Ash Content (Low-Sulphur Coal, Medium-Sulphur Coal, High-Sulphur Coal), By Application (Underground Mining, Surface Mining), By End-User (Iron and Steel, Chemical and Pharmaceutical, Paper and Pulp, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160597

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

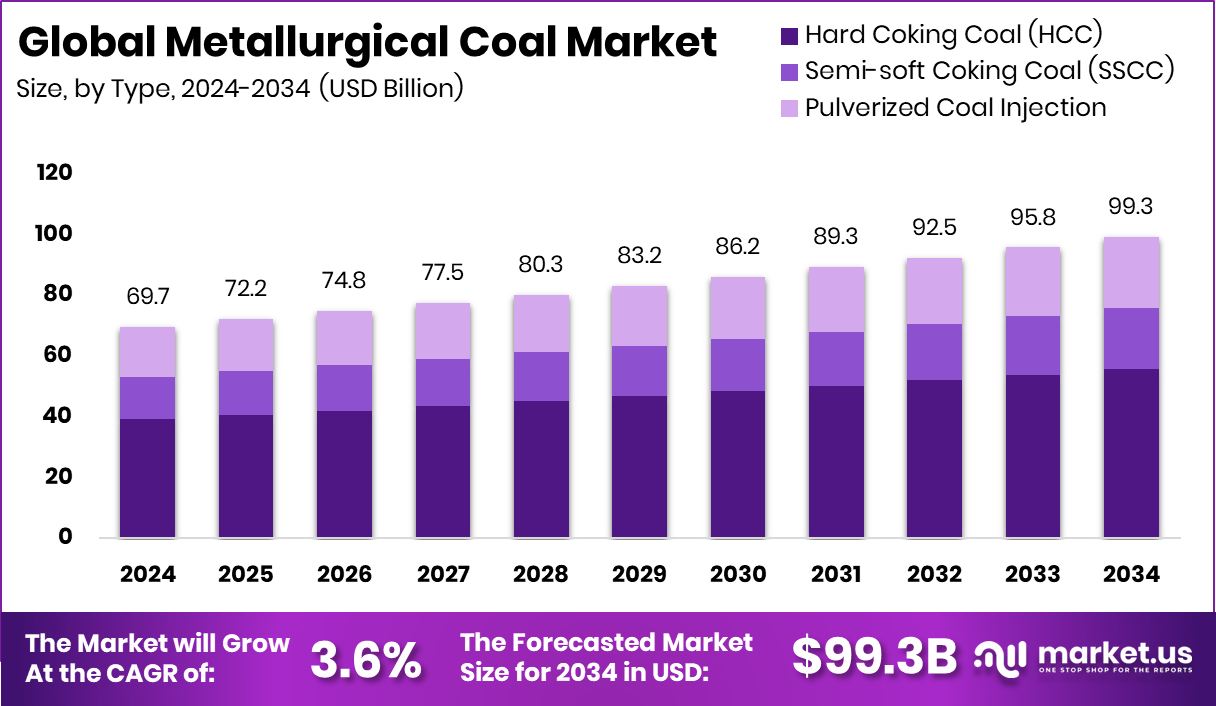

The Global Metallurgical Coal Market is expected to be worth around USD 99.3 billion by 2034, up from USD 69.7 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

Metallurgical coal (also called “coking coal”) is a type of coal with chemical properties that allow it to be transformed into coke, which is a key input in traditional steelmaking. In blast furnaces, coke acts as both a reducing agent (removing oxygen from iron ore) and a high-temperature fuel, and it provides a rigid porous structure so gases can pass through. Without metallurgical coal, classic steel production via the blast furnace – basic oxygen furnace route – would be very difficult.

The metallurgical coal market encompasses the full supply chain of mining, processing, trading, and pricing of coking coal used for steel production. It is shaped by global steel output, import/export balances, logistic constraints, environmental regulation, and the pace of transition toward low-emission steel technologies. Because steel demand is regionally uneven and coal supply is geographically constrained, price volatility and supply risk are intrinsic to this market.

Urbanization, infrastructure expansion, and industrialization in developing economies continue to fuel steel demand, which in turn supports metallurgical coal growth. Regions that are expanding heavy industries or investing in bridges, railways, and buildings will need more steel, thus more coking coal input. Also, constrained new supply (limited new mines coming onstream) tends to tighten the balance, reinforcing price signals that favor investment in existing deposits.

Many steelmakers still rely on the blast furnace route and have long capital cycles, so metallurgical coal demand is somewhat sticky even as green steel technologies emerge. In markets where domestic sources of high-grade coking coal are limited, imports remain essential. The delayed or slower adoption of hydrogen-based or electric arc furnace steelmaking prolongs the relevance of metallurgical coal.

There is an opportunity in investing in cleaner coal mining, carbon capture in coke plants, and hybrid approaches that blend traditional steelmaking with lower emissions. Meanwhile, large funding moves are altering the energy and steel landscape: Electra raised $186 million in a Temasek-led round to advance green steel production; the Australian government has announced a A$1 billion fund to support low-emission iron and steel; a USD 500 million grant has been pledged to expand green iron production capacity; and Australia has launched a USD 636 million green iron fund, offering a lifeline to traditional steel works.

These funding flows signal strong policy support for decarbonization, posing both a challenge (downward pressure on coal demand over time) and a pathway for integration of cleaner technologies in the coal-steel ecosystem.

Key Takeaways

- The Global Metallurgical Coal Market is expected to be worth around USD 99.3 billion by 2034, up from USD 69.7 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In 2024, Hard Coking Coal (HCC) dominated the Metallurgical Coal Market with a 56.3% share.

- Low-Sulphur Coal held a 59.2% share, enhancing efficiency and reducing steel production emissions.

- Underground Mining captured 67.4% of the Metallurgical Coal Market due to its high resource concentration.

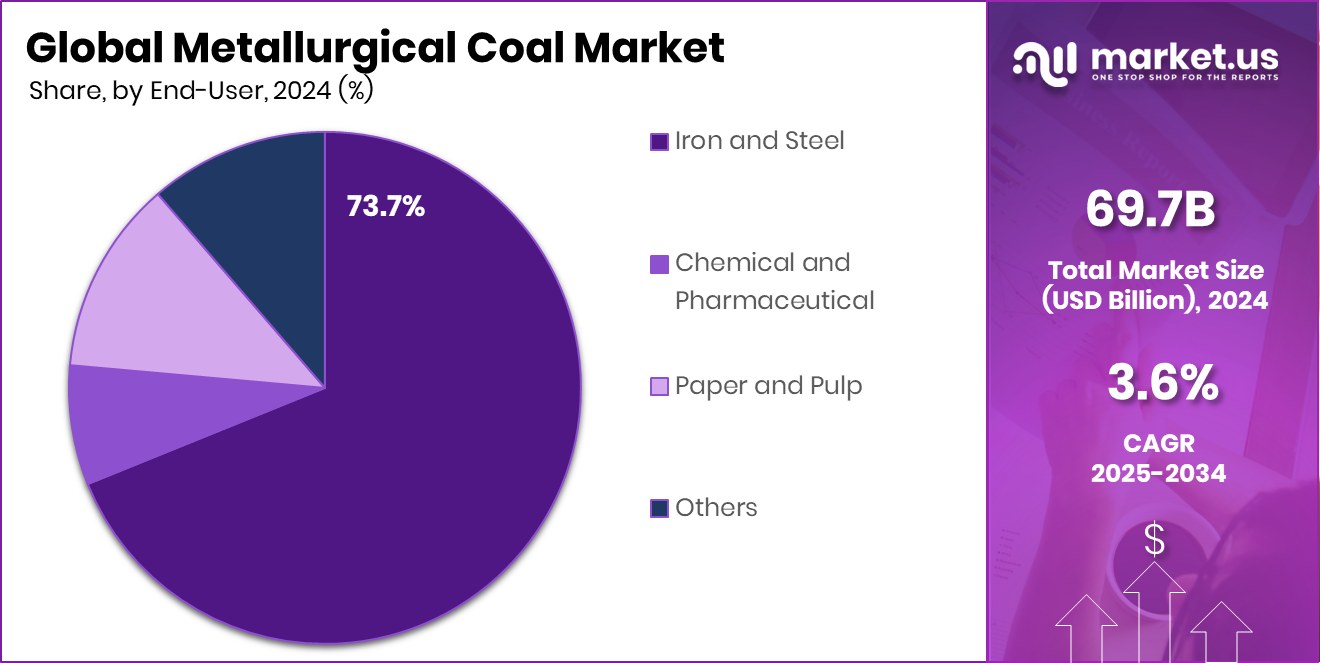

- The Iron and Steel segment dominated the Metallurgical Coal Market, accounting for a 73.7% share in 2024.

By Type Analysis

In 2024, Hard Coking Coal (HCC) dominated the Metallurgical Coal Market with a 56.3% share.

In 2024, Hard Coking Coal (HCC) held a dominant market position in the By Type segment of the Metallurgical Coal Market, with a 56.3% share. Its superior coking properties, including high carbon content and strong coke strength after reaction, make it the preferred choice for blast furnace steelmaking. HCC’s consistent performance in maintaining furnace efficiency and reducing impurities supports its leading market status. The growing demand for premium-grade coal from major steel-producing nations further reinforced its dominance.

Moreover, infrastructure development and industrial growth across emerging economies continued to drive the consumption of HCC, as industries prioritize quality and efficiency in steel production processes, ensuring its steady market leadership in 2024.

By Ash Content Analysis

Low-sulfur coal held a dominant 59.2% share in the metallurgical coal market in 2024.

In 2024, Low-Sulphur Coal held a dominant market position in the By Ash Content segment of the Metallurgical Coal Market, with a 59.2% share. Its low impurity levels and cleaner combustion profile make it ideal for high-grade steel production, reducing environmental emissions and improving furnace efficiency. Steel manufacturers increasingly prefer low-sulphur coal to meet tightening global emission norms and enhance product quality.

The use of this coal type helps minimize slag formation and lowers desulphurization costs in blast furnaces. Additionally, regulatory pressure and rising adoption of eco-friendly practices in major steel-producing regions supported its wider acceptance. These advantages collectively strengthened Low-Sulphur Coal’s leading position in the market during 2024.

By Application Analysis

Underground mining led the metallurgical coal market with a 67.4% share in 2024.

In 2024, Underground Mining held a dominant market position in the By Application segment of the Metallurgical Coal Market, with a 67.4% share. This mining method is preferred for accessing deep coal seams that offer high-quality metallurgical coal suitable for steelmaking. It ensures better control over extraction, reduces surface disruption, and supports sustainable mining operations. The dominance of underground mining is driven by increasing demand for premium-grade hard coking coal, often located in deeper reserves.Moreover, advancements in mining technology, including automation and enhanced safety systems, have improved productivity and efficiency in underground operations. These factors collectively reinforced the segment’s strong position in the global metallurgical coal industry during 2024.

By End-User Analysis

The iron and steel sector dominated the metallurgical coal market with a 73.7% share in 2024.

In 2024, Iron and Steel held a dominant market position in the By End-User segment of the Metallurgical Coal Market, with a 73.7% share. The segment’s leadership is driven by the essential role of metallurgical coal in producing coke, a critical input for blast furnace steelmaking. Continuous demand for construction materials, automotive components, and industrial machinery sustained steel production levels globally.

The iron and steel sector’s reliance on high-grade coking coal for achieving superior metal quality and energy efficiency further reinforced its dominance. Additionally, ongoing infrastructure expansion and industrialization across developing economies contributed to the growing consumption of metallurgical coal, ensuring the segment’s strong market presence in 2024.

Key Market Segments

By Type

- Hard Coking Coal (HCC)

- Semi-soft Coking Coal (SSCC)

- Pulverized Coal Injection

By Ash Content

- Low-Sulphur Coal

- Medium-Sulphur Coal

- High-Sulphur Coal

By Application

- Underground Mining

- Surface Mining

By End-User

- Iron and Steel

- Chemical and Pharmaceutical

- Paper and Pulp

- Others

Driving Factors

Rising Demand for Green Steel Production Worldwide

One of the key driving factors for the Metallurgical Coal Market is the growing shift toward cleaner and more efficient steelmaking methods. While metallurgical coal remains vital for producing high-strength steel, industries are now focusing on reducing emissions during iron and steel production. The need for low-carbon technologies and sustainable steel processes has encouraged major investments in green steel innovations.

A notable example is Electra, which raised $186 million to reinvent ironmaking and clean up iron production using renewable energy-based processes. Such initiatives are reshaping the global steel landscape by combining traditional metallurgical coal usage with eco-friendly solutions, ensuring a balanced transition toward sustainable industrial growth and environmental responsibility.

Restraining Factors

Growing Shift Toward Low-Emission Steel Alternatives

A major restraining factor for the Metallurgical Coal Market is the global movement toward low-emission and carbon-free steel production. Governments and industries are investing heavily in green technologies that reduce reliance on traditional coking coal. The introduction of hydrogen-based and electric-arc furnace methods is gaining momentum as countries aim to meet net-zero targets.

Recently, guidelines were released for $500 million in grants through the Green Iron Investment Fund, supporting the development of cleaner iron and steelmaking technologies. These initiatives encourage steel producers to adopt eco-friendly processes, gradually reducing the demand for metallurgical coal. As environmental policies tighten and sustainable solutions expand, the market faces long-term challenges in maintaining traditional coal-based production levels.

Growth Opportunity

Advancement in Clean Ironmaking Technologies Worldwide

A key growth opportunity for the Metallurgical Coal Market lies in the advancement of clean and energy-efficient ironmaking technologies. As industries look for sustainable production methods, metallurgical coal can play a transitional role by supporting hybrid steelmaking systems that blend traditional and low-carbon techniques. Emerging technologies focused on reducing emissions while maintaining steel quality create new possibilities for market stability.

A notable development is Electra, which found a cheap, clean way to purify iron and is raising $257 million to make it happen. Such innovations open doors for partnerships between coal producers and green steel developers, promoting responsible resource use and encouraging investments that balance environmental goals with industrial progress.

Latest Trends

Rising Investments in Green Iron and Hydrogen Projects

One of the latest trends in the Metallurgical Coal Market is the increasing investment in green iron and hydrogen-based steel initiatives. Governments and industries are actively funding projects that aim to reduce carbon emissions in steelmaking while maintaining production efficiency.

A significant example is Australia’s announcement of a new A$1 billion Green Iron Fund, introduced after a 250 MW green hydrogen project for steelworks was shelved. This fund is designed to boost low-emission steel production and support industries transitioning to cleaner technologies. Such developments indicate a growing trend toward integrating renewable energy and advanced processing methods, reshaping the metallurgical coal market’s future by promoting sustainability alongside industrial growth.

Regional Analysis

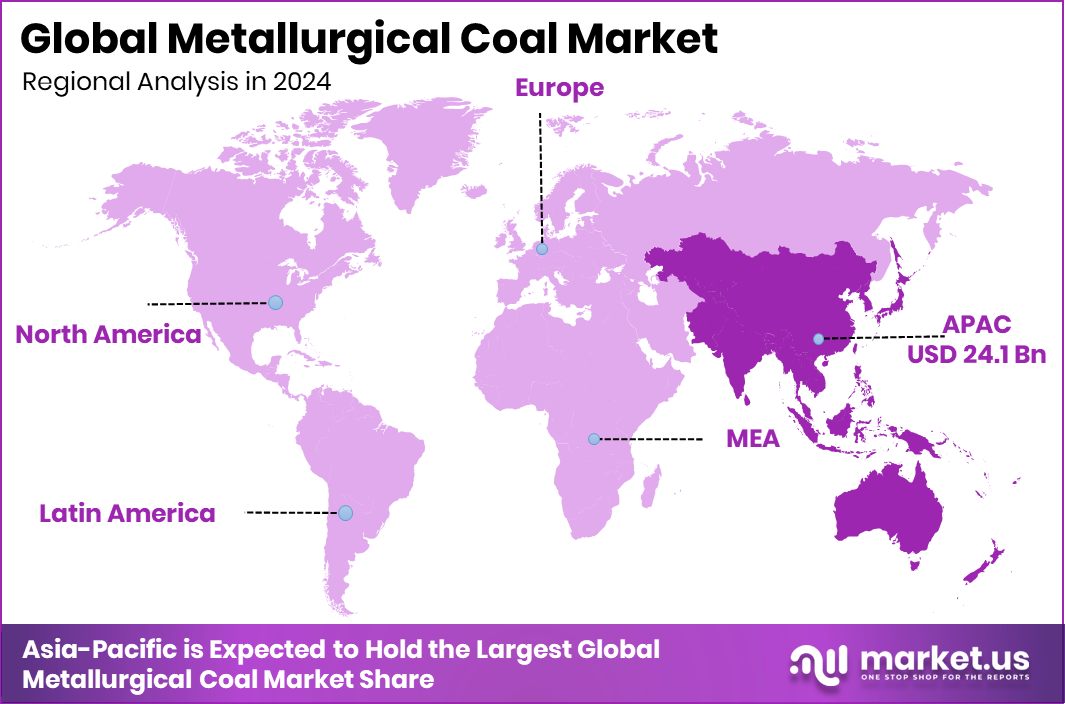

In 2024, the Asia-Pacific dominated the Metallurgical Coal Market with a 34.60% share.

In 2024, Asia-Pacific held a dominant position in the Metallurgical Coal Market, accounting for 34.60% of the global share, valued at USD 24.1 billion. The region’s leadership is driven by its robust steel production base, particularly in countries like China, India, Japan, and South Korea, which collectively account for the majority of global steel output. Rapid urbanization, industrial expansion, and ongoing infrastructure projects continue to fuel demand for metallurgical coal across the Asia-Pacific.

In North America and Europe, the market is supported by steady industrial activity and efforts to balance traditional coal use with emerging green steel technologies.

Meanwhile, Latin America and the Middle East & Africa show gradual growth, supported by increasing investments in mining and metal industries. However, Asia-Pacific remains the key driver due to its large-scale consumption of hard coking coal and continued infrastructure investments. The region’s evolving energy and industrial policies, combined with government-backed initiatives to improve mining efficiency and sustainability, further strengthen its market position.

This dominance underscores Asia-Pacific’s vital role in shaping the global metallurgical coal supply chain, reflecting its strategic importance in meeting the world’s growing demand for high-quality steel and related products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Coal India Limited, the world’s largest coal producer, maintained its strong position by focusing on expanding underground mining capacity and improving efficiency through mechanization and digital monitoring. The company’s commitment to balancing production with environmental sustainability aligns with India’s growing industrial and infrastructure requirements.

China Shenhua Energy Company, a key Chinese state-owned enterprise, emphasized technological modernization in mining operations, improving safety standards, and optimizing resource recovery. Its vertically integrated structure—from coal extraction to power generation—offers resilience against market fluctuations and secures supply for China’s massive steel sector.

Peabody Energy, a major U.S.-based producer, leveraged its diversified coal portfolio to meet domestic and international metallurgical coal demand. The company’s operational focus remained on enhancing mine productivity and adopting cleaner extraction practices to comply with tightening environmental norms.

Top Key Players in the Market

- Coal India Limited

- China Shenhua Energy Company

- Peabody Energy

- Anglo American

- RWE AG

- BHP Billiton

- Alpha Natural Resources

- Adaro Energy

Recent Developments

- In August 2025, China Shenhua completed the acquisition of 100% equity of Hangjin Energy, a move intended to consolidate coal, power, and coal-chemical assets under its listed unit, reducing internal transactions and aiming to strengthen core resource holdings.

- In November 2024, Peabody agreed to acquire Anglo American’s Australian steelmaking coal assets for USD 3.78 billion, intending to strengthen its metallurgical coal portfolio.

Report Scope

Report Features Description Market Value (2024) USD 69.7 Billion Forecast Revenue (2034) USD 99.3 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hard Coking Coal (HCC), Semi-soft Coking Coal (SSCC), Pulverized Coal Injection), By Ash Content (Low-Sulphur Coal, Medium-Sulphur Coal, High-Sulphur Coal), By Application (Underground Mining, Surface Mining), By End-User (Iron and Steel, Chemical and Pharmaceutical, Paper and Pulp, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Coal India Limited, China Shenhua Energy Company, Peabody Energy, Anglo American, RWE AG, BHP Billiton, Alpha Natural Resources, Adaro Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metallurgical Coal MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Metallurgical Coal MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Coal India Limited

- China Shenhua Energy Company

- Peabody Energy

- Anglo American

- RWE AG

- BHP Billiton

- Alpha Natural Resources

- Adaro Energy