Global Marine Oligosaccharides Market Size, Share, And Business Benefit By Source (Seaweed, Shellfish, Fish), By Product Type (Fucooligosaccharides, Chitooligosaccharides, Mannooligosaccharides, Galactooligosaccharides), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165620

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

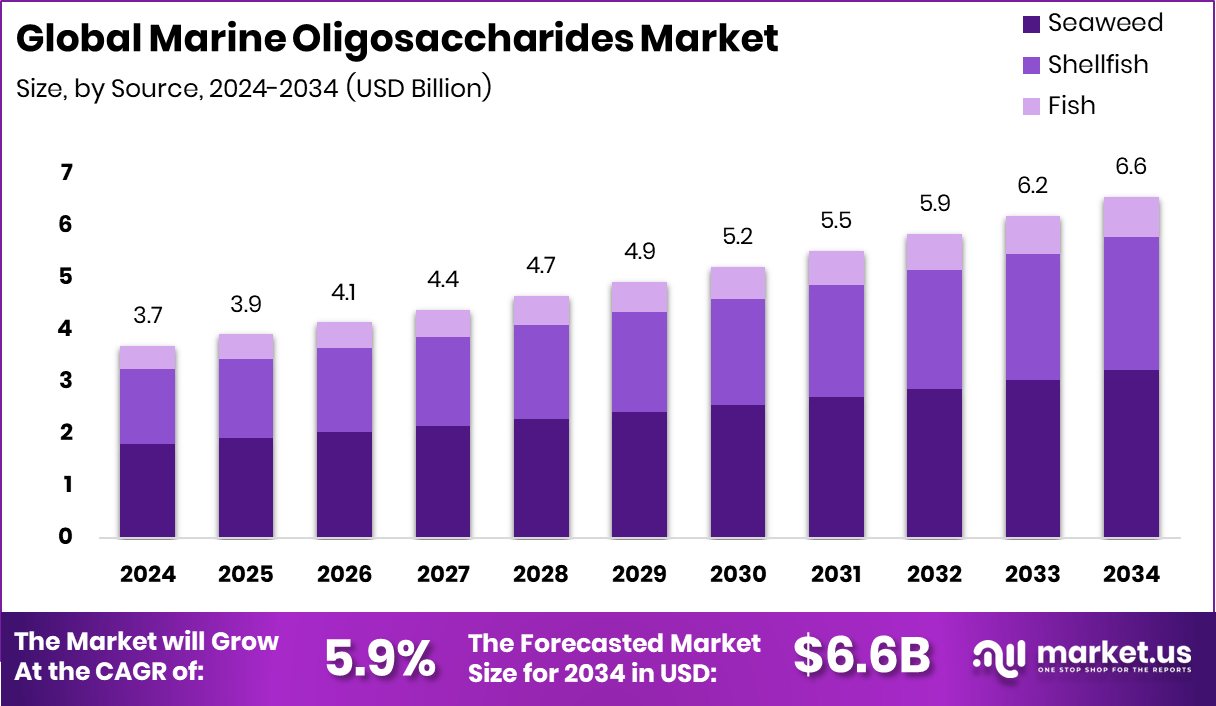

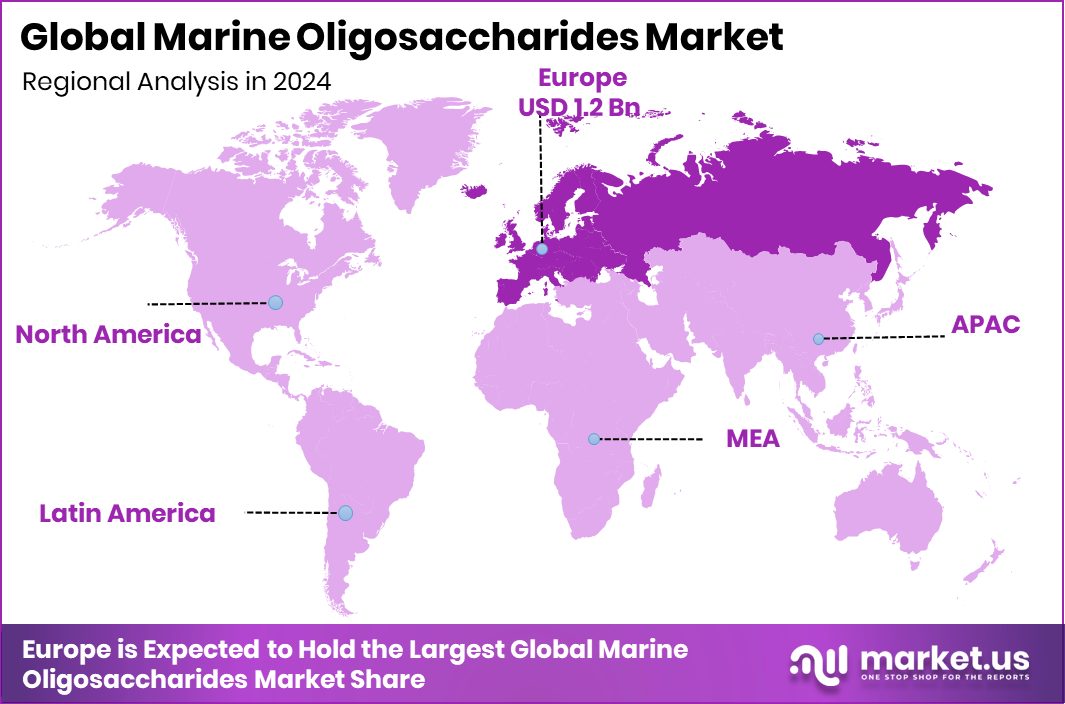

The Global Marine Oligosaccharides Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Europe maintained a solid 34.90% position, reaching USD 1.2 Bn valuation.

Marine oligosaccharides are small, bioactive carbohydrate molecules derived from seaweed, marine algae, and certain ocean-based microorganisms. They are valued for their natural functional properties, including antioxidant activity, immune support, gut-health benefits, and biodegradable behavior. Their clean-label nature and versatility have pushed them into nutrition, skincare, pharmaceuticals, and eco-friendly material applications.

The market for marine oligosaccharides is expanding as industries shift toward natural, ocean-sourced ingredients with better sustainability credentials. Companies are exploring seaweed-based inputs for food, cosmetics, biodegradable materials, and novel health-focused formulations. This growing interest aligns with the broader move toward circular and low-impact resources that reduce reliance on synthetic additives.

Growth is supported by rising consumer preference for natural bioactives and the global movement toward marine-derived ingredients. New funding initiatives are boosting innovation, such as Europe’s €1.8M call for seaweed startups, Amazon’s $100M Climate Fund, and the EU’s €5.7M allocation for new aquaculture projects, giving producers more room to scale technologies and optimize extraction methods.

Demand is driven by nutrition, wellness, and sustainable material segments seeking biodegradable, functional, and traceable ingredients. Supportive investments—such as Canada’s $1.1M commitment to the blue economy and SeaStock’s $740,000 FaBa funding—encourage higher production volumes, more refined processing, and greater confidence among end-use sectors.

Opportunities are widening as seaweed innovation accelerates. Fresh capital is shaping new product pathways, including Uluu’s $16M round, Banyu’s US$1.25M seed funding, and Zerocircle’s INR 20 crore and ₹20 crore raises to expand seaweed-based materials. These efforts help unlock advanced marine oligosaccharide applications in health, packaging, and sustainable consumer products.

Key Takeaways

- The Global Marine Oligosaccharides Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- The Marine Oligosaccharides Market sees seaweed holding 49.2% share, driven by rising sustainable ingredient adoption

- The Marine Oligosaccharides Market records chitooligosaccharides at a 39.7% share, supported by strong biomedical applications.

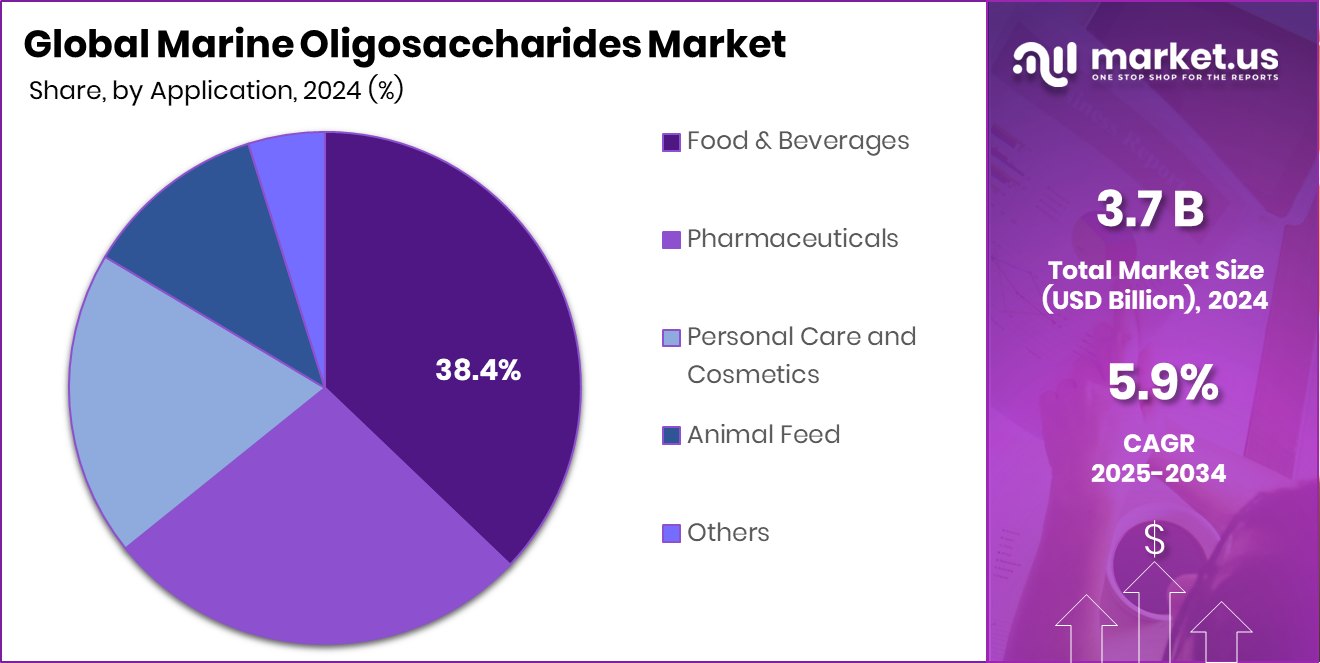

- The marine oligosaccharides market shows food and beverages holding a 38.4% share, led by natural ingredient trends.

- Europe’s 34.90% dominance supported Marine Oligosaccharides’ growth to USD 1.2 Bn.

By Source Analysis

Marine Oligosaccharides Market grows as seaweed supplies 49.2% sustainable inputs.

In 2024, Seaweed held a dominant market position in the By Source segment of the Marine Oligosaccharides Market, with a 49.2% share, reflecting its strong availability, established cultivation systems, and consistent quality output across coastal regions. Its biochemical richness and stable extraction efficiency supported wider adoption for food, nutraceutical, cosmetic, and biodegradable material applications.

Seaweed-derived oligosaccharides benefited from predictable harvest cycles and scalable processing methods, giving them an advantage over other marine sources. Industries favored seaweed because of its cleaner composition, easier refinement, and compatibility with multiple formulation needs.

As demand for natural marine ingredients continued to grow, seaweed maintained its leadership due to reliability, adaptability, and strong alignment with emerging product development trends.

By Product Type Analysis

Marine Oligosaccharides Market benefits because chitooligosaccharides hold a 39.7% share.

In 2024, Chitooligosaccharides held a dominant market position in the By Product Type segment of the Marine Oligosaccharides Market, with a 39.7% share, driven by their strong functional profile and broad suitability across wellness, food formulation, and skincare applications. Their natural bioactivity, including supportive roles in immunity and gut health, made them a preferred choice for product developers seeking clean, marine-sourced ingredients.

Chitooligosaccharides also benefited from steady raw material availability and well-established processing techniques, which helped maintain consistent quality. Their versatility in liquid, powder, and encapsulated formats strengthened their relevance in both consumer-facing and industrial formulations. With these advantages, they maintained clear leadership within the product type landscape.

By Application Analysis

Marine Oligosaccharides Market advances as food and beverages capture a 38.4% share.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Marine Oligosaccharides Market, with a 38.4% share, supported by rising interest in natural functional ingredients that enhance nutrition, texture, and digestive wellness.

Marine oligosaccharides found strong acceptance in fortified foods, health drinks, and clean-label product lines, driven by their mild taste profile and compatibility with diverse formulations. Manufacturers favored them for their ability to support gut health and offer antioxidant benefits without relying on synthetic additives.

This segment’s growth was further reinforced by ongoing product innovation in functional beverages and everyday nutrition categories, helping Food and Beverages remain the leading application area within the market.

Key Market Segments

By Source

- Seaweed

- Shellfish

- Fish

By Product Type

- Fucooligosaccharides

- Chitooligosaccharides

- Mannooligosaccharides

- Galactooligosaccharides

By Application

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Animal Feed

- Others

Driving Factors

Rising Demand for Sustainable Marine Ingredients

A key driving factor for the Marine Oligosaccharides Market is the growing shift toward sustainable, ocean-based ingredients that support cleaner production and natural functionality. Companies and researchers are exploring marine sources more seriously as global consumers move away from synthetic additives. Fresh funding activity is also strengthening this momentum.

Berlin-based BLUU Seafood secured €16 million in Series A funding, showing expanding confidence in marine-derived solutions. At the same time, the state-supported $300K emergency grants for Washington shellfish growers highlight how governments are backing marine farming systems that indirectly support raw material availability for marine-based ingredients.

Together, these efforts help improve supply stability, increase research capacity, and accelerate commercial adoption of marine oligosaccharides across nutrition, wellness, and sustainable product segments.

Restraining Factors

Limited Processing Capacity Slows Market Growth

A major restraining factor for the Marine Oligosaccharides Market is the limited processing infrastructure available for large-scale extraction and refinement of marine ingredients. Many producers rely on small or fragmented facilities, which slows output and raises production costs. Although new funding supports broader marine development, the core challenge of scaling extraction technology still persists.

Initiatives such as the GBP 100 million UK Seafood Fund extended through 2025 and the $1.1M pledged by federal authorities for two seaweed and shellfish projects on Vancouver Island help strengthen the wider marine ecosystem, but they do not fully resolve the bottlenecks in specialized oligosaccharide processing. As a result, manufacturers continue to face technical constraints that limit rapid market expansion.

Growth Opportunity

Expanding Marine Innovation Unlocks New Uses

A major growth opportunity for the Marine Oligosaccharides Market lies in the rapid expansion of marine-based innovation, which is creating new ways to use sea-derived ingredients in food, wellness, and sustainable products. As more companies explore ocean resources, demand for refined marine oligosaccharides increases. Recent funding activity is adding strong momentum to this shift.

Bluu Seafood secured $17.5 million to advance cultivated fish products, signaling broader interest in marine biotechnology and improved utilization of ocean materials. At the same time, oyster and mussel farmers receiving government funding of up to £150,000 strengthens the aquaculture ecosystem, improving raw material availability. These developments open the door for new product formulations, higher production capacity, and wider commercial adoption of marine oligosaccharides.

Latest Trends

Growing Shift Toward Advanced Marine Bioprocessing

One of the latest trends in the Marine Oligosaccharides Market is the growing move toward advanced bioprocessing methods that make marine ingredients cleaner, more efficient, and easier to use across food, wellness, and sustainable material applications. Companies are focusing on improving extraction purity, enhancing stability, and creating specialized formats that fit modern product needs. This trend is reinforced by strong financial support entering the broader marine sector.

The Fisheries and Seafood Scheme reopening with around £6 million of investment, the £14 million Marine Fund Scotland, and Bluefront closing its second seafood investment fund with $100 million raised, all strengthen marine supply chains. These developments help accelerate technology upgrades, research expansion, and future-ready processing capabilities for marine oligosaccharides.

Regional Analysis

Europe held a 34.90% share, reflecting USD 1.2 Bn market strength.

Europe remained the dominant region, holding a 34.90% share valued at USD 1.2 Bn, driven by its strong focus on marine biotechnology, established aquaculture practices, and increasing demand for natural functional ingredients.

North America continued to show steady interest, supported by its growing preference for clean-label formulations and expanding applications of marine-derived bioactives in nutrition and wellness.

Asia Pacific maintained a rapidly developing ecosystem, shaped by widespread seaweed cultivation and rising investments in marine processing technologies, though no specific values are provided.

The Middle East & Africa region reflected early-stage adoption, with gradual movement toward marine-based solutions in specialty food and personal-care segments. Latin America also showed emerging potential, mainly influenced by its coastal resources and rising exploration of marine-sourced ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill continues to benefit from its global presence in ingredients and bioprocessing, giving it the infrastructure and technical capability to explore marine-derived carbohydrates as part of its broader portfolio of functional, naturally sourced ingredients. Its experience in sustainable raw-material handling positions it well to support marine-based innovations.

FMC Corporation, with its long history in marine-origin ingredients and specialty solutions, maintains a strategic advantage through its background in refining bio-based materials. Its operational familiarity with marine-sourced inputs supports ongoing development of oligosaccharide formulations aligned with health, nutrition, and agricultural uses.

Alfa Chemistry, known for providing research-grade chemicals and specialized compounds, plays a different but important role by enabling laboratory-scale development and customized marine oligosaccharide molecules for R&D, pilot trials, and niche applications. Together, these companies contribute across scale, specialization, and application breadth—supporting product innovation, broadening technical understanding, and strengthening the supply base for marine oligosaccharides as demand for natural, ocean-derived functional materials continues to rise.

Top Key Players in the Market

- Cargill

- FMC Corporation

- Alfa Chemistry

- Gobalsir Inc

- DSM

- Others

Recent Developments

- In November 2025, Cargill announced the creation of its Micronutrition & Health Solutions business (launched in 2024), combining several acquired units into a unified science-based portfolio for animal and human health.

- In July 2024, FMC announced the signing of a definitive agreement with Envu to sell its Global Specialty Solutions (GSS) business. The sale was completed in November 2024, and the GSS business covered non-crop markets (such as turf, golf courses, and pest control), which FMC is exiting to focus on its core crop protection business.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Seaweed, Shellfish, Fish), By Product Type (Fucooligosaccharides, Chitooligosaccharides, Mannooligosaccharides, Galactooligosaccharides), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, FMC Corporation, Alfa Chemistry, Gobalsir Inc, DSM, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marine Oligosaccharides MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Marine Oligosaccharides MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill

- FMC Corporation

- Alfa Chemistry

- Gobalsir Inc

- DSM

- Others