Global Lycopene Market Size, Share, And Business Benefits By Form (Beadlets, Oil Suspension, Powder, Emulsion), By Nature (Synthetic, Natural), By Application (Dietary Supplements, Food and Beverages, Personal Care, Pharmaceuticals, Others), By Property (Health Ingredient, Coloring Agent), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152337

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

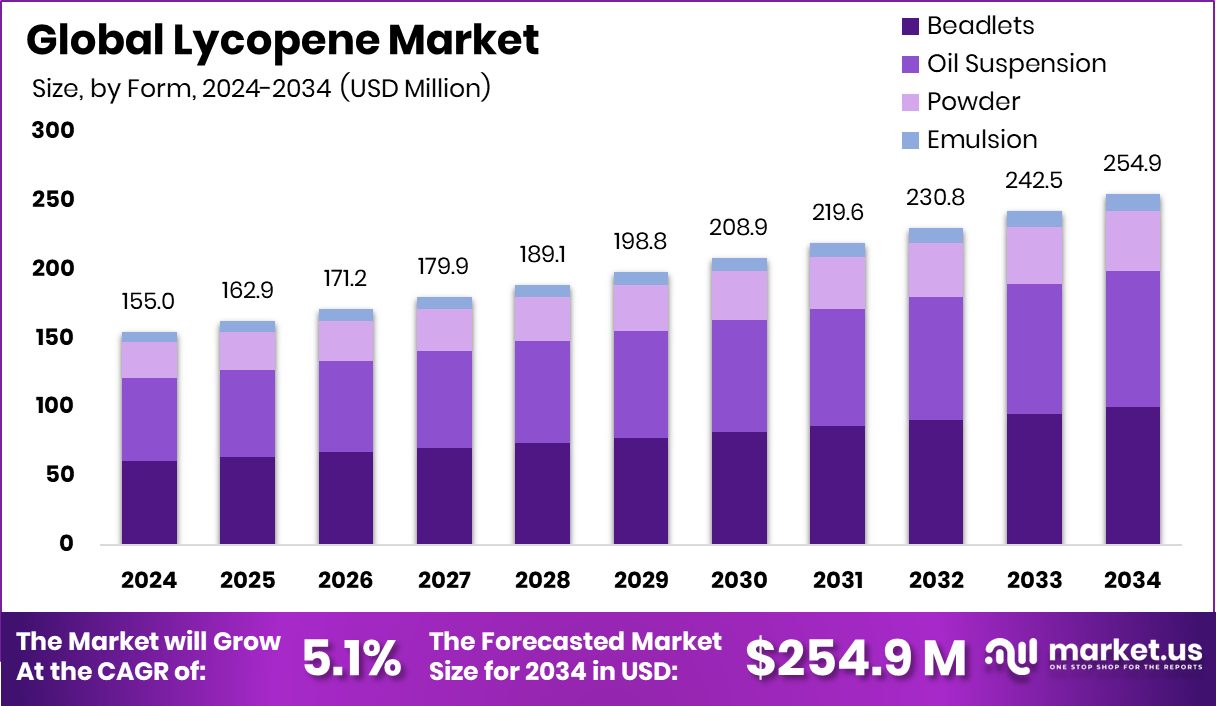

Global Lycopene Market is expected to be worth around USD 254.9 million by 2034, up from USD 155.0 million in 2024, and grow at a CAGR of 5.1% from 2025 to 2034. High health awareness in North America, 42.8% drives demand for antioxidant-rich lycopene products.

Lycopene is a naturally occurring red pigment found in various fruits and vegetables, with tomatoes being the most prominent source. It is a powerful antioxidant that belongs to the carotenoid family, known for neutralizing free radicals in the body. Unlike some other nutrients, lycopene is not converted into vitamin A but still offers numerous health benefits, including improved heart health, protection against certain types of cancers, and support for skin and eye health.

The lycopene market involves the extraction, formulation, and sale of lycopene for use in supplements, food and beverages, cosmetics, and pharmaceuticals. Its growing popularity as a natural antioxidant and health-promoting compound has driven demand across multiple industries. The market caters to consumers looking for clean-label and plant-based ingredients, especially in dietary supplements and functional foods. It also finds use in anti-aging skincare formulations and fortified health drinks.

The growth of the lycopene market is largely driven by rising consumer awareness around lifestyle-related diseases and the increasing adoption of antioxidant-rich supplements. The growing burden of cardiovascular diseases and cancers has led consumers to explore natural preventive solutions, where lycopene’s scientifically backed benefits are gaining attention. According to an industry report, ARTAH Nutrition secures £2.85 million in funding to expand its dietary supplement operations.

Key Takeaways

- Global Lycopene Market is expected to be worth around USD 254.9 million by 2034, up from USD 155.0 million in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- In the Lycopene market, beadlets form accounts for 39.2% due to better stability and absorption.

- Synthetic lycopene dominates the market with a 57.9% share, driven by consistent quality and lower production costs.

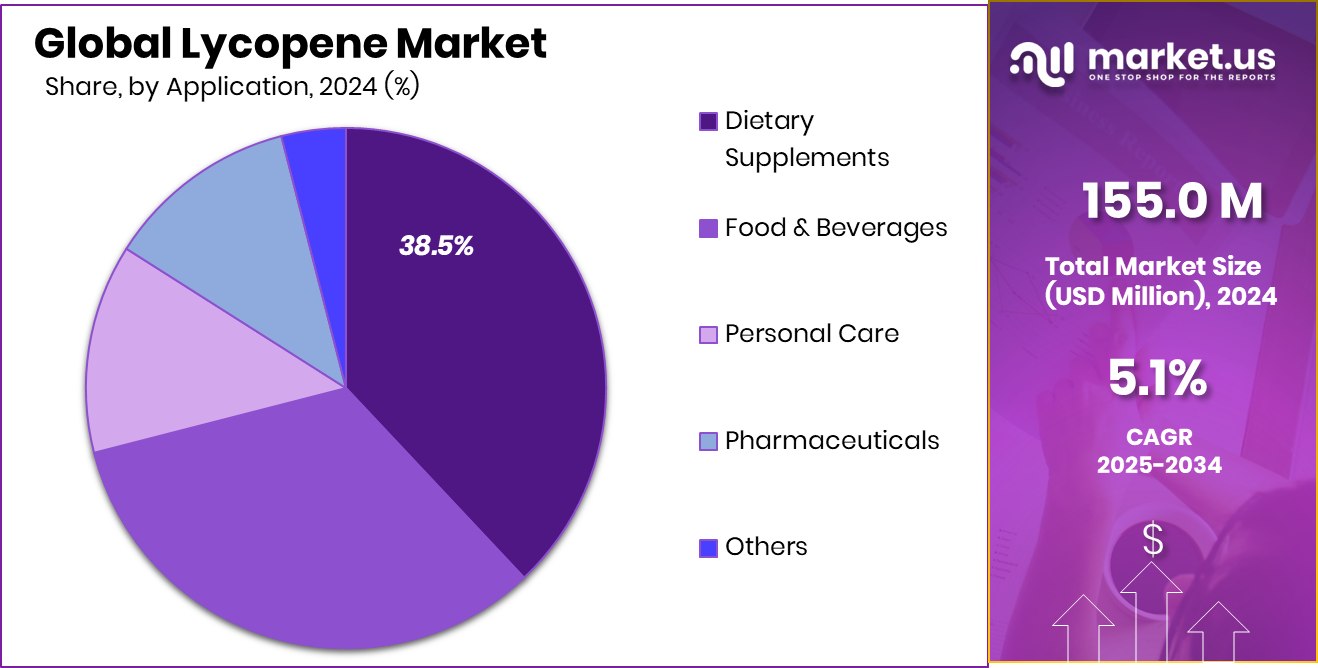

- Dietary supplements lead the application segment with a 38.5% share, as consumers seek antioxidant-rich health solutions.

- Lycopene as a health ingredient holds a 69.4% share, reflecting its wide use in wellness-focused formulations.

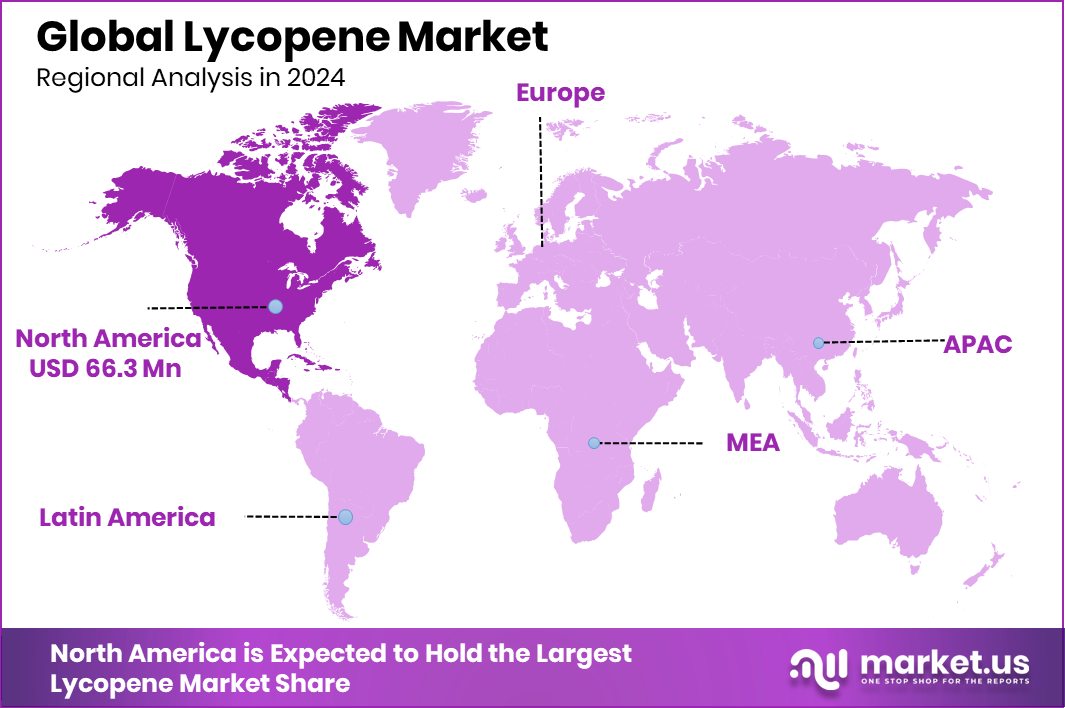

- The North American market was valued at USD 66.3 million during the same year.

By Form Analysis

Lycopene market sees a 39.2% share in bead form.

In 2024, Beadlets held a dominant market position in the By Form segment of the Lycopene Market, with a 39.2% share. This significant market share can be attributed to Bendlets enhanced stability, extended shelf life, and superior protection of the active lycopene compound during processing and storage.

Beadlets are widely favored for their ease of formulation in dietary supplements and functional food applications, allowing for controlled release and better bioavailability. Their dry, free-flowing nature makes them suitable for both solid dosage forms such as tablets and capsules, as well as for inclusion in fortified food products.

The beadlet form also enables consistent dosing and efficient incorporation into multi-nutrient blends, which has strengthened its presence across nutraceutical and pharmaceutical sectors. The increasing consumer preference for natural health products with predictable efficacy has further supported the use of beadle technology in lycopene delivery.

Moreover, manufacturers have leaned toward this form due to its compatibility with modern encapsulation and granulation processes, which enhances production efficiency. The 39.2% market share held by beadlets in 2024 highlights the continued reliance on this form to meet evolving industry and consumer demands, particularly where product stability and ingredient integrity are crucial.

By Nature Analysis

Synthetic lycopene dominates the market, accounting for 57.9% of the overall share.

In 2024, Synthetic held a dominant market position in the By Nature segment of the Lycopene Market, with a 57.9% share. This high share reflects the widespread adoption of synthetic lycopene due to its cost-effectiveness, consistent quality, and scalable production.

Synthetic lycopene is produced through controlled chemical synthesis, ensuring a stable supply chain that is less dependent on agricultural variables such as weather or crop yield. These attributes have made it a preferred option for manufacturers across various industries, particularly in pharmaceuticals, food coloring, and dietary supplements.

The ability to produce synthetic lycopene in large volumes with high purity levels has enabled manufacturers to meet growing market demands without compromising on quality standards. Additionally, synthetic lycopene offers a longer shelf life and improved stability under high-temperature processing, which is essential for its use in processed foods and heat-sensitive applications.

Regulatory approvals for synthetic forms in several global markets have also supported its commercial adoption. The 57.9% share in 2024 confirms the market’s reliance on synthetic lycopene as a practical and efficient alternative, catering to the needs of industries that prioritize consistency, affordability, and large-scale availability.

By Application Analysis

Dietary supplements lead usage, holding 38.5% of the application share.

In 2024, Dietary Supplements held a dominant market position in the By Application segment of the Lycopene Market, with a 38.5% share. This leadership position is driven by growing consumer awareness regarding the health benefits of antioxidants and the increasing use of lycopene in preventive healthcare.

As a potent antioxidant, lycopene is widely recognized for supporting cardiovascular health, reducing oxidative stress, and potentially lowering the risk of certain chronic conditions. These attributes have made it a preferred ingredient in dietary supplements aimed at improving general wellness and age-related health issues.

The rising trend of self-care and daily supplementation, particularly among aging populations and health-conscious individuals, has further supported the strong demand for lycopene-based supplements. The convenience of capsule and tablet formulations, combined with their targeted health benefits, has ensured sustained consumer interest. Additionally, dietary supplements offer a concentrated and easily measurable dosage, enhancing consumer confidence in their effectiveness.

With increasing preference for natural and functional ingredients in the nutraceutical sector, lycopene has become a staple inclusion in antioxidant and heart-health product lines. The 38.5% market share held by dietary supplements in 2024 highlights their central role in driving the growth and utilization of lycopene in everyday health management routines.

By Property Analysis

As a health ingredient, lycopene covers 69.4% market share.

In 2024, Health Ingredient held a dominant market position in the By Property segment of the Lycopene Market, with a 69.4% share. This substantial share reflects the strong positioning of lycopene as a functional ingredient primarily recognized for its health-enhancing properties.

Known for its antioxidant activity and potential to support cardiovascular, skin, and prostate health, lycopene has become widely integrated into health-focused product formulations. Its use as a health ingredient aligns with the growing consumer demand for natural compounds that contribute to disease prevention and overall well-being.

Manufacturers are increasingly leveraging lycopene’s health benefits to formulate products that support daily wellness, particularly in supplements, fortified foods, and functional beverages. The association of lycopene with immune support and anti-inflammatory effects has further strengthened its application as a health ingredient. Its acceptance across regulatory bodies and inclusion in scientifically backed formulations have helped gain consumer trust and widespread adoption.

The 69.4% share in 2024 underscores lycopene’s prominence in health-oriented markets, where functionality, preventive care, and nutritional value drive product innovation and purchasing decisions. This dominance reflects how lycopene’s positioning as a health ingredient has become central to its market success across various consumer wellness applications.

Key Market Segments

By Form

- Beadlets

- Oil Suspension

- Powder

- Emulsion

By Nature

- Synthetic

- Natural

By Application

- Dietary Supplements

- Food and Beverages

- Personal Care

- Pharmaceuticals

- Others

By Property

- Health Ingredient

- Coloring Agent

Driving Factors

Rising Demand for Natural Antioxidants in Nutrition

One of the top driving factors for the lycopene market is the growing demand for natural antioxidants in everyday nutrition. Consumers are increasingly choosing natural ingredients over synthetic ones to support long-term health and prevent lifestyle-related diseases. Lycopene, found mainly in tomatoes and red fruits, is valued for its strong antioxidant properties, which help protect cells from damage and reduce inflammation.

As people become more health-conscious and look for clean-label, plant-based options, the use of lycopene in supplements, functional foods, and beverages is rising steadily. The growing focus on preventive healthcare, along with rising awareness about natural bioactive compounds, is expected to drive consistent demand for lycopene as a trusted and effective health-supporting ingredient.

Restraining Factors

High Production Costs Limit Widespread Lycopene Adoption

One of the key restraining factors in the lycopene market is the high cost of production. Extracting lycopene, especially from natural sources like tomatoes, involves complex and expensive processing methods that require advanced technology and strict quality control. These costs increase the final price of lycopene-based products, making them less accessible to cost-sensitive consumers and smaller manufacturers.

In price-driven markets, this can reduce demand and limit the market’s expansion. Moreover, maintaining product stability and purity during processing and storage adds further to manufacturing expenses. As a result, despite its proven health benefits, the growth of the lycopene market faces challenges due to cost-related barriers, particularly in emerging economies where affordability is a major concern.

Growth Opportunity

Expanding Use in Skincare and Cosmetic Products

A major growth opportunity for the lycopene market lies in its expanding use in skincare and cosmetic products. Known for its strong antioxidant and anti-aging properties, lycopene helps protect the skin from damage caused by UV rays and environmental pollution. As consumers increasingly seek natural and plant-based ingredients in personal care products, lycopene is gaining attention for its ability to improve skin texture, reduce wrinkles, and support overall skin health.

Cosmetic brands are exploring their use in creams, serums, and lotions, tapping into the clean beauty trend. With rising awareness of skincare and the shift toward chemical-free formulations, the demand for lycopene in the beauty industry is expected to grow significantly in the coming years.

Latest Trends

Lycopene Fortified Foods Gaining Strong Consumer Interest

A key trend shaping the lycopene market is the growing popularity of lycopene-fortified foods. Consumers are actively looking for everyday food items that offer added health benefits, especially those that support heart health, skin protection, and immune function. Manufacturers are responding by adding lycopene to common products like juices, dairy, snacks, and sauces. This approach allows people to get health benefits naturally through their regular diet without needing separate supplements.

As awareness about antioxidants and preventive nutrition continues to rise, lycopene-enriched foods are gaining more shelf space in supermarkets. This trend reflects a shift in consumer preference toward convenient, functional foods that deliver both nutrition and taste, helping to expand lycopene’s presence in daily consumption habits.

Regional Analysis

In North America, the lycopene market captured a 42.8% share in 2024.

In 2024, North America emerged as the dominating region in the global lycopene market, accounting for a significant 42.8% market share and reaching a valuation of USD 66.3 million. This leadership position can be attributed to the region’s heightened consumer awareness regarding antioxidant-rich health products and the widespread adoption of functional foods and dietary supplements. The robust presence of nutraceutical manufacturers and a health-conscious population further reinforces the strong demand for lycopene in North America.

In Europe, the market continues to grow steadily, supported by a mature food and pharmaceutical industry that is increasingly incorporating natural ingredients into product formulations. The Asia Pacific region is witnessing rising interest in lycopene due to increasing health awareness, urbanization, and a growing middle-class population seeking preventive health solutions.

Meanwhile, the Middle East & Africa and Latin America markets are at a developing stage, with gradual uptake of health and wellness trends that are expected to stimulate future demand for lycopene-enriched products. However, despite these regional advancements, North America remains the most prominent player in the global lycopene landscape, driven by established distribution networks, evolving dietary patterns, and a strong emphasis on natural health products across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, several key companies contributed significantly to the global lycopene market through a combination of strategic investments, product development, and supply chain integration. These include Divi’s Laboratories, DSM, Farbest Brands, and Lycored.

Divi’s Laboratories demonstrated strong performance by leveraging its robust pharmaceutical-grade manufacturing capabilities. Known for its biotechnological expertise, the company optimized production processes to maintain consistent quality and high purity standards in lycopene derivatives. By integrating upstream fermentation and extraction operations, Divi’s enhanced cost control ensures reliable delivery schedules to health ingredient customers.

DSM continued to reinforce its position through deep engagement in the health and nutrition sector. The company’s focus on clinical evidence and application-specific formulations elevated its lycopene offerings within functional foods and nutritional supplements. DSM’s global distribution network and established partnerships with food and beverage brands helped drive wider adoption of lycopene-fortified products.

Farbest Brands further enriched the market through its specialization in natural lycopene, extracted from tomato processing streams. By positioning its products as clean-label and non-GM, Farbest tapped into consumer demand for plant-based antioxidants. The company’s scalable tomato-extraction infrastructure enabled cost-effective production, presenting an appealing option for formulators seeking both natural origins and economic feasibility.

Lycored remained a prominent producer with a strong emphasis on innovation and clinical validation. Building on its proprietary extraction technologies, Lycored provided standardized lycopene extracts tailored for lifestyle health applications, such as skincare and sports nutrition. Its investment in textile research and transparent supply chain practices reinforced market confidence in product traceability and consistency.

Top Key Players in the Market

- Allied Biotech Corporation

- Archer-Daniels-Midland Company

- BASF SE

- Divi’s Laboratories

- DSM

- Farbest Brands

- Lycored

- LyondellBasell Industries

- Plamed Green Science Group

- San-Ei Gen F.F.I., Inc

- Shaanxi Kingsci Biotechnology Co. Ltd

- Vidya Herbs

- Wellgreen Technology Co Ltd

- Xi’an Natural Field Bio-Technology Co.,Ltd

- Zhejiang NHU CO. Ltd

Recent Developments

- In February 2025, DSM–after merging with Firmenich–completed a series of portfolio adjustments, including divesting non-core units to prioritize Health, Nutrition & Care, which encompasses carotenoids like lycopene.

- In December 2024, BASF will continue to offer LycoVit® 10 CWD/S, a synthetic, cold-water dispersible lycopene formulation designed for beverage and food applications. It is formulated to be stable under light and heat, and suitable for vegetarian and allergen-free products.

Report Scope

Report Features Description Market Value (2024) USD 155.0 Million Forecast Revenue (2034) USD 254.9 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Beadlets, Oil Suspension, Powder, Emulsion), By Nature (Synthetic, Natural), By Application (Dietary Supplements, Food and Beverages, Personal Care, Pharmaceuticals, Others), By Property (Health Ingredient, Coloring Agent) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Allied Biotech Corporation, Archer-Daniels-Midland Company, BASF SE, Divi’s Laboratories, DSM, Farbest Brands, Lycored, LyondellBasell Industries, Plamed Green Science Group, San-Ei Gen F.F.I., Inc, Shaanxi Kingsci Biotechnology Co. Ltd, Vidya Herbs, Wellgreen Technology Co Ltd, Xi’an Natural Field Bio-Technology Co.,Ltd, Zhejiang NHU CO. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allied Biotech Corporation

- Archer-Daniels-Midland Company

- BASF SE

- Divi’s Laboratories

- DSM

- Farbest Brands

- Lycored

- LyondellBasell Industries

- Plamed Green Science Group

- San-Ei Gen F.F.I., Inc

- Shaanxi Kingsci Biotechnology Co. Ltd

- Vidya Herbs

- Wellgreen Technology Co Ltd

- Xi'an Natural Field Bio-Technology Co.,Ltd

- Zhejiang NHU CO. Ltd