Global Location of Things Market Size, Share and Analysis Report By Application (Mapping and Navigation, Asset Management, Location Intelligence, Media and Marketing Engagement, Others), By Vertical (Government, Defence and Public Utilities, Transportation and Logistics, Retail and Consumer Goods, Manufacturing and Industrial, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173066

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- By Application

- By Vertical

- By Region

- Emerging Trends

- Use Case Adoption by Industry Vertical

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

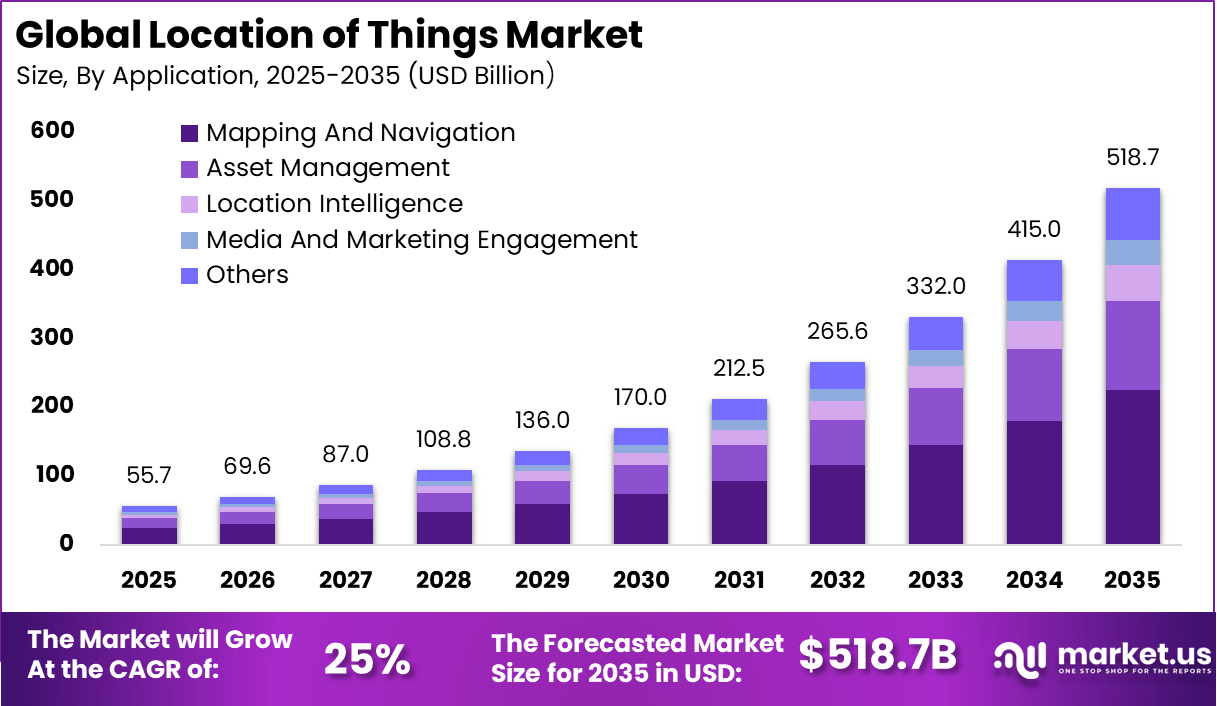

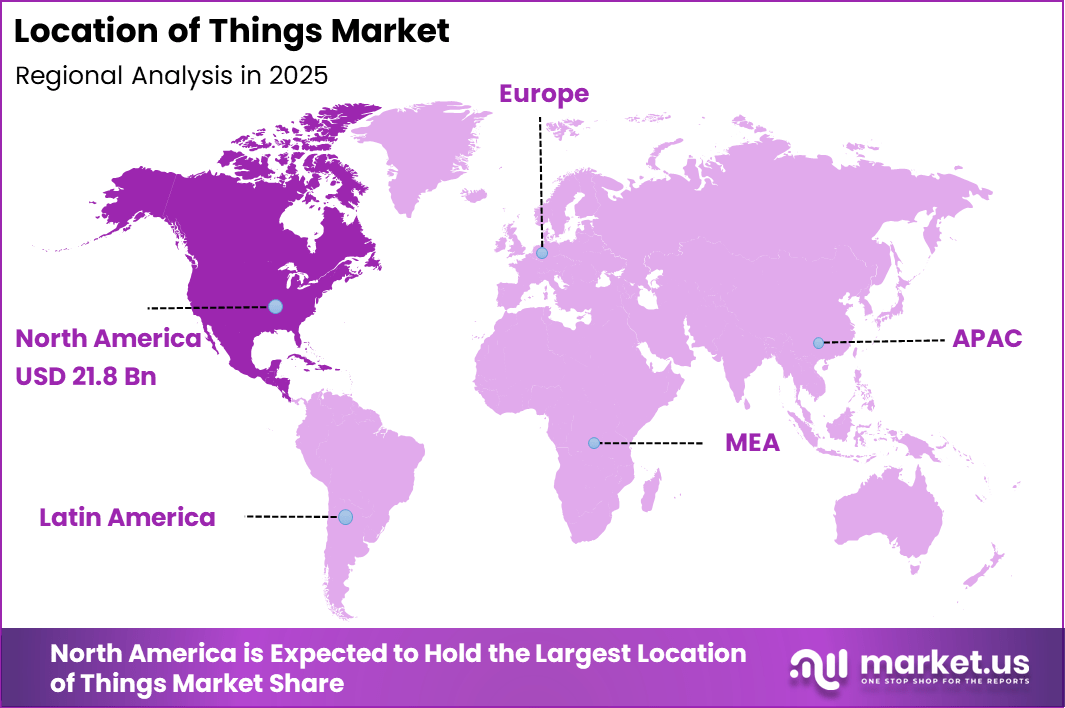

The Global Location of Things Market size is expected to be worth around USD 518.7 Billion By 2035, from USD 55.7 billion in 2025, growing at a CAGR of 25% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 39.3% share, holding USD 21.8 Billion revenue.

The Location of Things market refers to solutions that integrate spatial data with connected devices to determine and leverage physical location information. These solutions enable businesses to track, monitor, and analyze the position of assets, vehicles, people, and infrastructure within defined environments. The technology ecosystem includes sensors, wireless connectivity, geospatial analytics, and location processing software.

Adoption is observed across industries that require real time visibility and spatial insights for operational efficiency. Growth of the market has been supported by the rise of Internet of Things implementations and increasing demand for actionable location intelligence. Devices equipped with location sensing are generating unprecedented volumes of spatial data that can be analyzed for business value.

Demand for Location of Things solutions is influenced by the growth of smart infrastructure initiatives in urban and industrial settings. Smart cities deploy connected sensors and location based analytics to manage traffic flows, public safety, and utilities. These use cases require robust spatial platforms that can process large scale location data. Demand from public sector and infrastructure projects has contributed to market expansion.

Enterprise demand has also been shaped by mobility and remote workforce trends. Companies with distributed operations require tools to monitor and coordinate field teams and mobile assets. Location intelligence supports productivity measurement and service level improvements. As mobile computing becomes ubiquitous, demand for location aware applications continues to rise.

Top Market Takeaways

- Mapping and Navigation leads applications with a 43.5% share, driven by rising use of real-time location data in mobility, logistics, and urban planning.

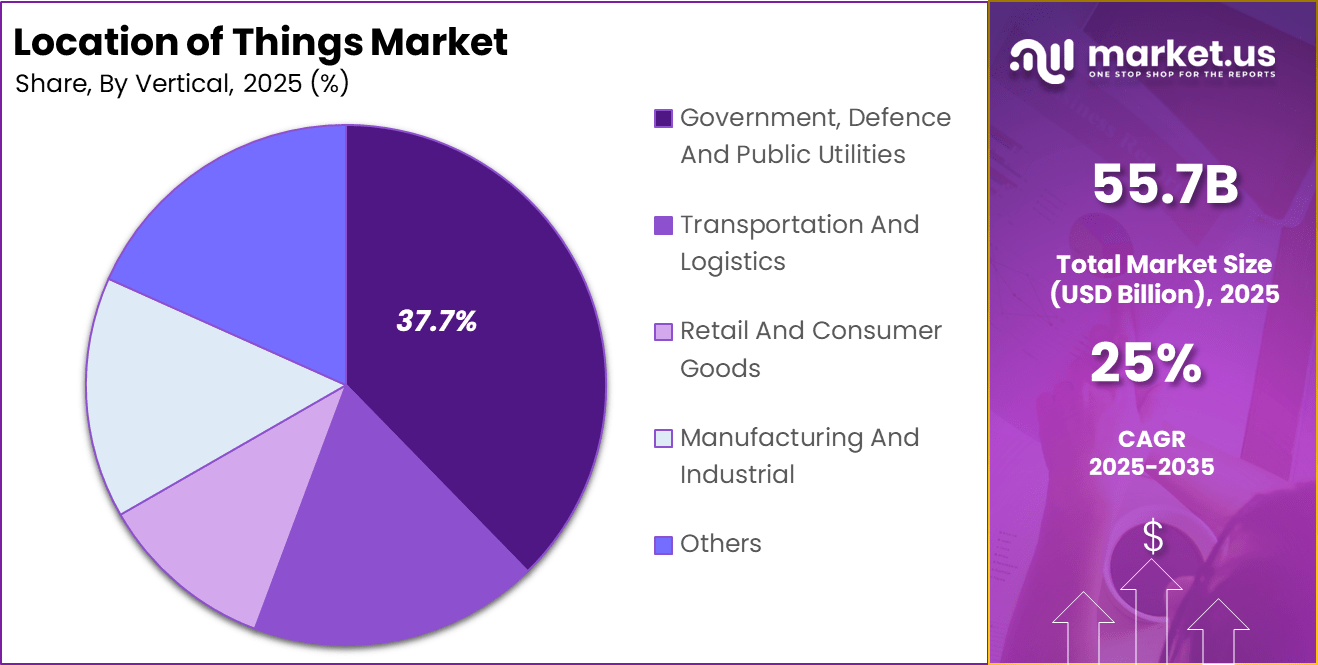

- Government, Defence, and Public Utilities dominate vertical adoption at 37.7%, reflecting strong demand for location intelligence in surveillance, asset tracking, and public infrastructure management.

- North America holds a 39.3% market share, supported by advanced IoT infrastructure, strong GPS adoption, and high investment in smart city initiatives.

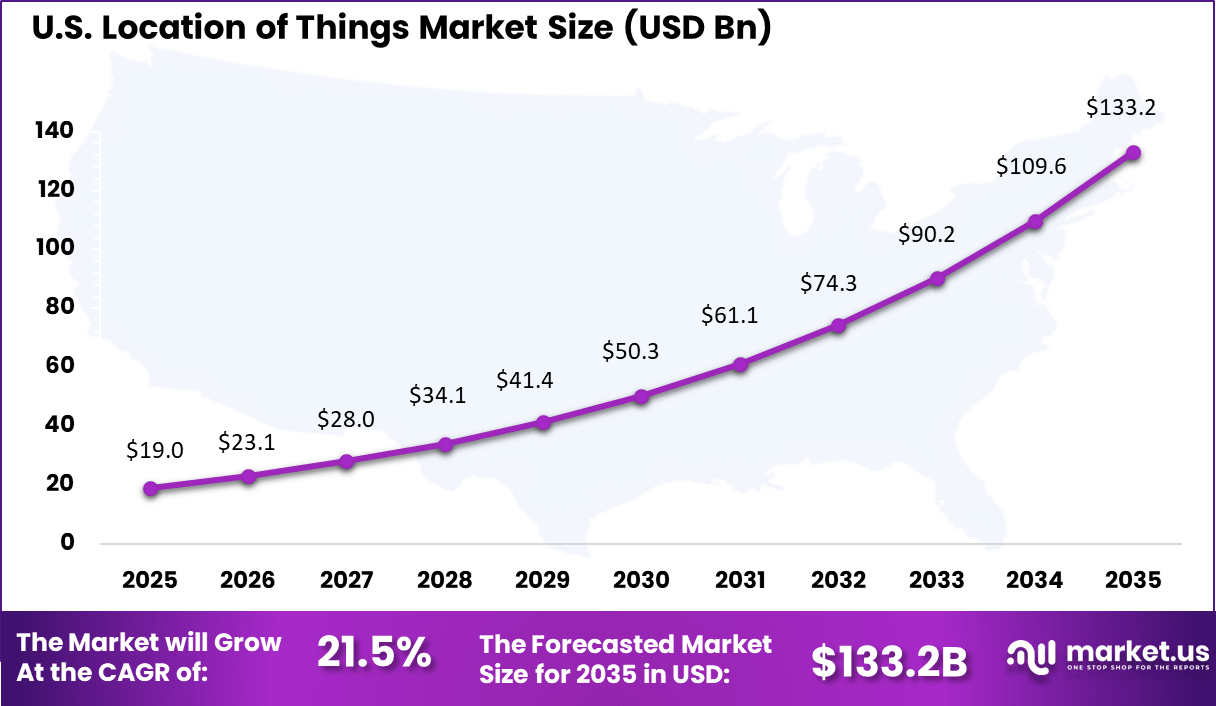

- The U.S. market reached USD 19.07 billion, expanding at a robust 21.5% CAGR, driven by large-scale deployment of geospatial analytics, connected devices, and location-based services across public and commercial sectors.

Key Statistics

Adoption Rates and Market Growth

- Global interconnected IoT devices are projected to exceed 40.6 billion by 2034, nearly doubling the estimated installed base in 2025, indicating strong long-term adoption momentum.

- Around 60-70% of large manufacturing, transportation, and energy enterprises have already implemented IoT solutions, with location-based use cases among the most widely deployed.

- Adoption is reinforced by outcomes, as 92% of enterprises report achieving a positive ROI from IoT and location intelligence implementations.

Key Usage Statistics by Industry and Application

- Location-based fleet management and supply chain tracking show an adoption rate of 54%, supporting route optimization, asset visibility, and delivery efficiency.

- About 46% of manufacturers use Industrial IoT in production environments, while 42% deploy real-time location systems, contributing to an average 7% improvement in labor efficiency and 52% gains in productivity.

- Retailers increasingly apply geolocation data to inventory tracking, store analytics, and personalized promotions, making location intelligence a core operational tool.

- Medical facilities are expected to deploy around 7.4 million IoT devices by 2026, with nearly 47% dedicated to location-based services such as patient flow management and equipment tracking.

- Early adoption continues through applications in disaster response, public safety, and connected transportation, supported by sustained public-sector investment.

- About 81% of stakeholders view IoT and location intelligence as critical enablers for smart city initiatives, particularly in traffic management and waste optimization.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Smart Infrastructure Expansion Adoption of connected transport systems, utilities, and smart city infrastructure is increasing demand for precise location technologies. ~6.8% North America, Europe Short to Mid Term Real-Time Navigation Demand Growing need for accurate indoor and outdoor positioning to support navigation, asset tracking, and mobility services. ~5.9% Global Short Term Defense and Public Safety Use High reliance on location intelligence for military operations, surveillance, and emergency preparedness activities. ~5.2% North America, Asia Pacific Long Term IoT Device Penetration Rapid growth of connected sensors, wearables, and tracking tags increases the need for scalable location services. ~4.4% Global Mid Term Emergency Response Optimization Accurate location data enables faster response times for disaster management and critical public services. ~2.7% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High Deployment Cost High upfront investment required for installing sensors, anchors, and supporting infrastructure. ~4.2% Emerging Markets Mid Term Regulatory Approval Delays Government clearance and compliance requirements slow large scale deployments. ~3.1% Europe, Asia Pacific Short to Mid Term Skilled Workforce Shortage Limited availability of professionals with expertise in location analytics and system integration. ~2.6% Global Mid Term Interoperability Gaps Lack of standardization across platforms creates integration and scalability challenges. ~2.0% Global Long Term Power Consumption Concerns Battery dependency of tracking devices limits long term use and increases maintenance needs. ~1.4% Global Short Term Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Government Agencies Very High ~34% Security and infrastructure efficiency Long term contracts Defense Organizations High ~22% Tactical and operational accuracy High value procurement Enterprises and Utilities Moderate to High ~21% Asset tracking and optimization Phased investments Logistics Operators Moderate ~15% Route efficiency and visibility ROI driven adoption Startups and Innovators Moderate ~8% New applications and services Agile deployment By Application

Mapping and navigation account for 43.5%, showing their central role in the Location of Things market. These applications use real-time location data to guide movement and asset positioning. Accurate mapping improves route planning and operational efficiency. Navigation systems support public services, logistics, and transportation activities. Reliable location data remains essential for these functions.

Growth in mapping and navigation is driven by increasing demand for real-time tracking. Organizations rely on precise location insights to reduce delays and errors. Integration with digital maps improves situational awareness. These applications support decision-making in dynamic environments. This sustains strong adoption.

By Vertical

Government, defence, and public utilities represent 37.7%, making them the leading vertical. These sectors rely on location data for infrastructure management and public safety. Location-based systems support monitoring of assets and personnel. Real-time visibility improves response coordination. Security and reliability are key priorities.

Adoption in this vertical is driven by the need for efficient public service delivery. Governments invest in systems that enhance operational oversight. Defence applications require accurate positioning for strategic planning. Public utilities use location data to manage networks. This supports continued demand.

By Region

North America accounts for 39.3%, supported by advanced digital infrastructure and technology adoption. The region actively deploys location-based systems across industries. High investment in smart infrastructure supports market growth. Data-driven decision-making is widely practiced. The region remains a major contributor.

The United States reached USD 19.07 Billion with a CAGR of 21.5%, reflecting rapid expansion. Growth is driven by adoption in public services and navigation systems. Organizations prioritize real-time location intelligence. Technology integration continues to increase. Market momentum remains strong.

Emerging Trends

The Location of Things market is evolving with the rising use of ultra-wideband and Bluetooth based positioning systems that provide more precise location tracking for objects and assets. These systems support fine-grained tracking with accuracy that was not possible with traditional GPS alone.

As a result, businesses can monitor tools, inventory, and vehicles with precise spatial context inside facilities as well as outdoors. This trend reflects a shift toward more intelligent asset visibility that improves decision making and operational control. Another trend gaining traction is the integration of location data into enterprise platforms such as supply chain systems, workforce management tools, and facility dashboards.

Real time location feeds are being combined with analytics to produce actionable insights such as route optimization, idle time alerts, and proximity-based alerts. This integration supports coordinated workflows and enhances responsiveness to changing conditions. As connectivity improves, location-enabled services are becoming core components of broader digital operations.

Use Case Adoption by Industry Vertical

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Government, Defence and Public Utilities Security, surveillance, and asset control 37.7% Advanced Transportation and Logistics Fleet and route management 24.6% Developing Smart Cities Traffic and crowd monitoring 18.9% Developing Industrial and Manufacturing Equipment and worker tracking 11.4% Developing Healthcare Patient and asset tracking 7.4% Early to Developing Opportunity Analysis

There is significant opportunity in expanding location-based services for safety and compliance monitoring. For example, tracking personnel in hazardous environments can trigger alerts when workers enter restricted zones or exceed safe exposure times. These safety use cases add value beyond asset tracking and support regulatory compliance requirements. Growing emphasis on workplace safety creates demand for such applications.

Another opportunity lies in combining location of things data with artificial intelligence to support predictive maintenance and operational forecasting. AI models can identify patterns related to asset movement, utilization rates, or dwell times that indicate potential failures or inefficiencies. Predictive insights enable proactive interventions that reduce downtime and lower operational costs. This combination of spatial intelligence and analytics enhances decision support for operations teams.

Challenge Analysis

A key challenge for the market is ensuring consistent location accuracy across varied environments such as indoors, urban canyons, and remote outdoor areas. Different physical settings can interfere with signals and reduce precision, requiring hybrid systems that switch between technologies. Maintaining reliable tracking across all contexts demands careful system design and sensor placement. Meeting performance expectations in complex environments remains difficult.

Another challenge is achieving standardization of protocols and data formats across diverse tracking technologies. The market includes many hardware vendors and network providers that use proprietary formats, which can hinder interoperability. Without standardized frameworks, enterprises may struggle to integrate disparate systems and scale solutions across multiple sites. Progress toward unified standards is needed to reduce integration friction.

Key Market Segments

By Application

- Mapping And Navigation

- Asset Management

- Location Intelligence

- Media And Marketing Engagement

- Others

By Vertical

- Government, Defence And Public Utilities

- Transportation And Logistics

- Retail And Consumer Goods

- Manufacturing And Industrial

- Healthcare

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Bosch, VIRDI, and Anviz lead the Location of Things market by integrating biometric identification with location aware security and access control systems. Their solutions are used across smart buildings, enterprise facilities, and public infrastructure. These companies focus on accuracy, reliability, and secure identity location mapping. Rising demand for real time tracking and access intelligence continues to reinforce their leadership.

Goodix, FocalTech, ievo Ltd, and Precise Biometric strengthen the market with fingerprint sensors, biometric algorithms, and embedded authentication technologies. Their offerings support location linked identity verification in IoT devices and edge systems. These providers emphasize low power consumption, fast response, and hardware software integration. Growing adoption of smart devices supports wider deployment.

LockSmithLedger, SPEX Forensics, and other players expand the landscape with forensic analysis, blockchain based access records, and niche location intelligence solutions. Their platforms address compliance, investigation, and secure audit trails. These companies focus on specialized use cases and data integrity. Increasing convergence of biometrics, IoT, and location data continues to drive steady growth in the Location of Things market.

Top Key Players in the Market

- VIRDI

- GitHub

- Bosch

- LockSmithLedger

- FocalTech

- Anviz

- SPEX Forensics

- ievo Ltd

- Goodix

- Precise Biometric

- Others

Recent Developments

- Bosch teamed up with Idemia in February 2025 to integrate contactless scanners like MorphoWave into its Building Integration System, targeting high-stakes sites like airports. This fits LoT trends where biometrics link to IoT for real-time location tracking and access.

Report Scope

Report Features Description Market Value (2025) USD 55.7 Bn Forecast Revenue (2035) USD 518.7 Bn CAGR(2026-2035) 25% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Mapping and Navigation, Asset Management, Location Intelligence, Media and Marketing Engagement, Others), By Vertical (Government, Defence and Public Utilities, Transportation and Logistics, Retail and Consumer Goods, Manufacturing and Industrial, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape VIRDI, GitHub, Bosch, LockSmithLedger, FocalTech, Anviz, SPEX Forensics, ievo Ltd, Goodix, Precise Biometrics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- VIRDI

- GitHub

- Bosch

- LockSmithLedger

- FocalTech

- Anviz

- SPEX Forensics

- ievo Ltd

- Goodix

- Precise Biometric

- Others