Global Liquid Silicone Rubber Market By Type (Industrial Grade LSR, Medical Grade LSR, Food-Contact Grade LSR), By Processing Method (Liquid Injection Molding, Transfer and Compression Molding), By Application (Seals, Gaskets and O Rings, Catheters and Medical Tubing, Electrical Connectors and Housings, Teats, Soothers and Infant Feeding, Wearable and Implantable Drug Delivery Systems), By End-use (Healthcare and Medical Devices, Automotive, Electrical and Electronics, Consumer Goods, Beauty and Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154102

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

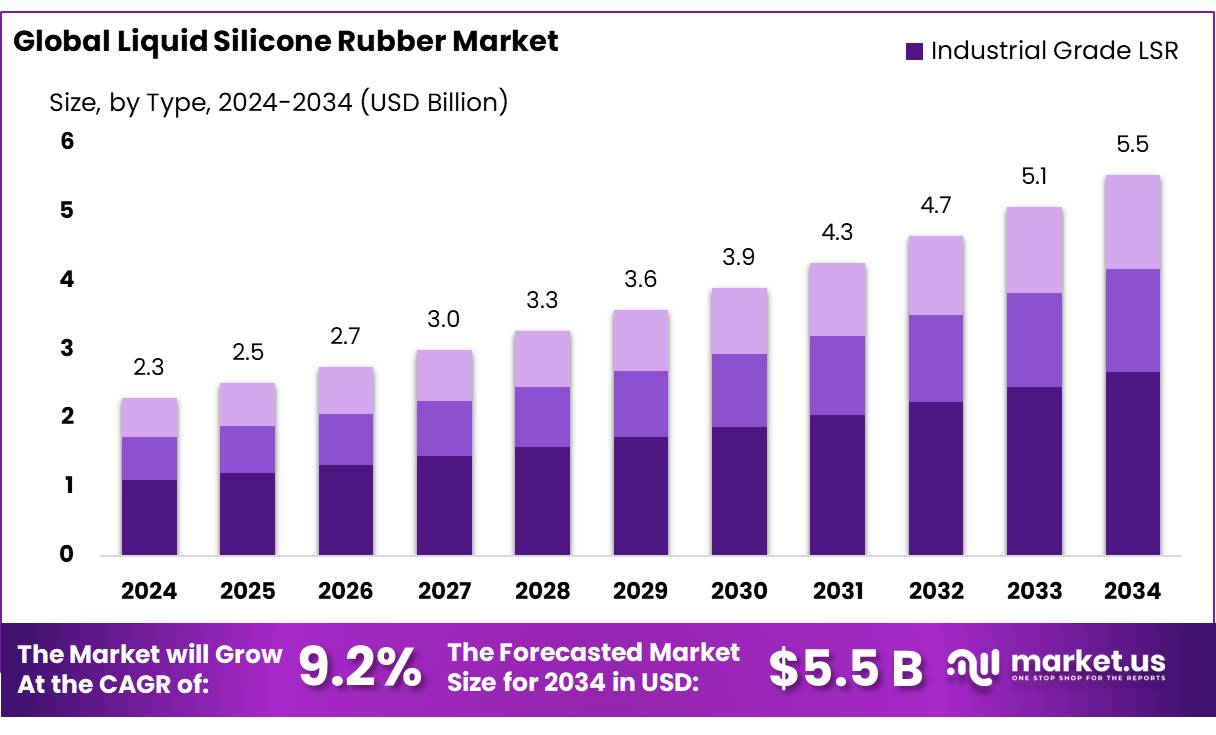

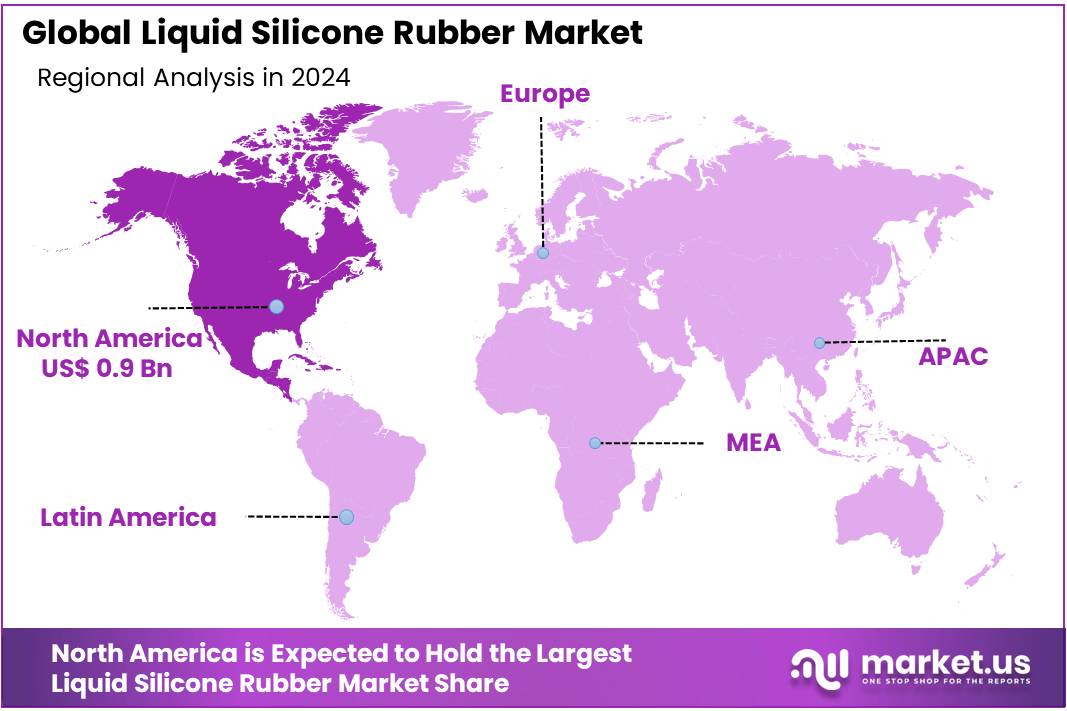

The Global Liquid Silicone Rubber Market size is expected to be worth around USD 5.5 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.8% share, holding USD 0.9 billion in revenue.

The Liquid Silicone Rubber (LSR) concentrates market has witnessed significant growth in recent years, primarily driven by the increasing demand for versatile materials across various industries, particularly in food-grade applications, healthcare, automotive, and electronics. Liquid Silicone Rubber, known for its flexibility, temperature resistance, and biocompatibility, is an advanced polymer that has found extensive use in molding applications due to its high performance in demanding environments. The increasing use of LSR concentrates in food-grade products, such as kitchenware, baby products, and medical devices, has been a key factor driving its growth.

The uptake of LSR concentrates is being driven by increasing demand for safe, hygienic, and durable food contact materials. In the United States, the FDA enforces regulation under 21 CFR 177.2600, ensuring that silicone rubber components intended for repeated use in food processing meet rigorous safety standards for migration and toxicity. This framework encourages manufacturers to favor FDA‑approved silicone in food machinery gaskets, tubing and contact seals.

The food industry’s growing preference for silicone-based materials, owing to their non-reactive and high heat-resistance properties, has provided significant growth opportunities for LSR concentrates. The material is increasingly used in manufacturing products like baby bottle nipples, bakeware, and cookware, which are in high demand globally.

Moreover, LSR is compliant with regulatory frameworks such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), making it a preferred material in the food industry. According to a report by the U.S. Food and Drug Administration, the global demand for food-safe materials is projected to rise by 4.5% annually, with a considerable portion of this growth attributed to the adoption of silicone-based products.

Key Takeaways

- Liquid Silicone Rubber Market size is expected to be worth around USD 5.5 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 9.2%.

- Industrial Grade LSR held a dominant market position, capturing more than a 48.2% share of the global liquid silicone rubber market.

- Liquid Injection Molding held a dominant market position, capturing more than a 72.1% share of the global liquid silicone rubber market.

- Seals, Gaskets and O Rings held a dominant market position, capturing more than a 35.8% share of the global liquid silicone rubber market.

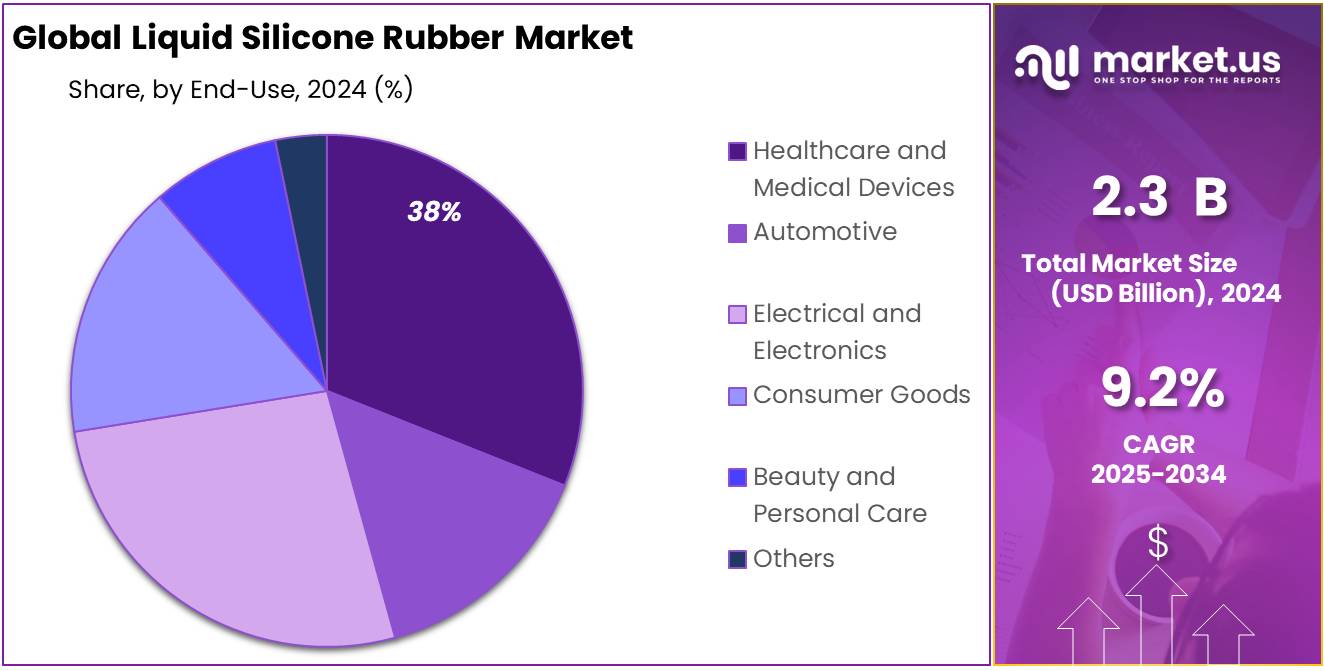

- Healthcare and Medical Devices held a dominant market position, capturing more than a 38.3% share of the global liquid silicone rubber market.

- North America held a dominant position in the liquid silicone rubber (LSR) market, commanding a 41.8% share and contributing approximately USD 0.9 billion.

By Type Analysis

Industrial Grade LSR leads with 48.2% due to its wide use in manufacturing applications.

In 2024, Industrial Grade LSR held a dominant market position, capturing more than a 48.2% share of the global liquid silicone rubber market. This segment remains the most widely used type due to its versatility in demanding industrial applications such as electrical insulation, automotive gaskets, and tooling components.

The material’s high resistance to heat, pressure, and harsh environments makes it ideal for consistent performance in mechanical and electronic systems. Industries continue to favor industrial-grade LSR for its moldability and durability, especially in mass production settings where precision and material stability are critical. By 2025, this segment is expected to maintain its lead as industrial automation and high-performance components drive further demand for robust elastomeric materials.

By Processing Method Analysis

Liquid Injection Molding dominates with 72.1% due to its speed, precision, and low waste output.

In 2024, Liquid Injection Molding held a dominant market position, capturing more than a 72.1% share of the global liquid silicone rubber market. This processing method is widely adopted because it allows for high-speed, automated production with excellent consistency and minimal material waste. It is especially valued in the automotive, electronics, and healthcare industries where precision, cleanliness, and volume efficiency are essential.

Liquid Injection Molding also supports the production of complex, intricate parts with tight tolerances, making it ideal for high-performance components. By 2025, the segment is expected to maintain its strong lead as demand continues for faster production cycles, scalable solutions, and energy-efficient processes across diverse industrial applications.

By Application Analysis

Seals, Gaskets, and O-Rings dominate with 35.8% due to high demand in machinery and fluid control.

In 2024, Seals, Gaskets and O Rings held a dominant market position, capturing more than a 35.8% share of the global liquid silicone rubber market. These components are widely used across industries like automotive, aerospace, electronics, and industrial machinery, where precision sealing is essential for safety, performance, and durability. Liquid silicone rubber is preferred for its excellent flexibility, temperature resistance, and chemical stability, making it ideal for producing reliable sealing components under extreme conditions.

The rise in manufacturing activities and growing emphasis on leak prevention and system efficiency have further boosted the use of LSR in this segment. By 2025, the demand for seals and gaskets is expected to grow steadily as industries continue to prioritize performance, lifecycle cost savings, and compliance with strict safety and material standards.

By End-use Analysis

Healthcare and Medical Devices dominate with 38.3% due to their strict safety and material purity requirements.

In 2024, Healthcare and Medical Devices held a dominant market position, capturing more than a 38.3% share of the global liquid silicone rubber market. This segment leads mainly because medical and healthcare applications demand materials that are biocompatible, sterile and capable of withstanding repeated sterilization cycles. Liquid silicone rubber meets these needs with its chemical inertness, high temperature resistance, and low toxicity—making it ideal for surgical instruments, tubing, catheters and implantable parts.

Hospitals and medical device manufacturers continue to specify LSR for products where patient safety and regulatory compliance are paramount. In 2025, demand in this segment is expected to maintain strong momentum as innovation in medical procedures and wearable devices further drives adoption of high-performance elastomeric materials in healthcare settings.

Key Market Segments

By Type

- Industrial Grade LSR

- Medical Grade LSR

- Food-Contact Grade LSR

By Processing Method

- Liquid Injection Molding

- Transfer and Compression Molding

By Application

- Seals, Gaskets and O Rings

- Catheters and Medical Tubing

- Electrical Connectors and Housings

- Teats, Soothers and Infant Feeding

- Wearable and Implantable Drug Delivery Systems

By End-use

- Healthcare and Medical Devices

- Automotive

- Electrical and Electronics

- Consumer Goods

- Beauty and Personal Care

- Others

Emerging Trends

Adoption of Sustainable Manufacturing Practices in Food-Grade Liquid Silicone Rubber

The food-grade liquid silicone rubber (LSR) industry is witnessing a significant shift towards sustainable manufacturing practices. This trend is driven by increasing consumer demand for eco-friendly products and stringent environmental regulations. Manufacturers are adopting greener production methods to reduce environmental impact and meet regulatory standards.

- In the United States, the Food and Drug Administration (FDA) has established regulations under 21 CFR 177.2600, which govern the use of rubber articles intended for repeated use in contact with food. These regulations ensure that materials do not transfer harmful substances to food, promoting the use of safe and sustainable materials. Manufacturers are aligning their production processes with these regulations to ensure compliance and consumer safety.

Similarly, in Europe, the European Union has set forth regulations such as EC 1935/2004 and EU 10/2011, which apply to materials and articles intended to come into contact with food. These regulations require that such materials do not release substances into food that could endanger human health or bring about an unacceptable change in the composition of the food. Food-grade LSR complies with these regulations, further bolstering its adoption in the food industry.

Drivers

Stringent Food Safety Regulations and Consumer Demand for Safe Materials

One of the primary drivers propelling the growth of the food-grade liquid silicone rubber (LSR) market is the increasing emphasis on food safety regulations and the rising consumer demand for safe, non-toxic materials in food-related products. Food-grade LSR is recognized for its compliance with stringent safety standards, making it a preferred choice for manufacturers in the food industry.

In the United States, the Food and Drug Administration (FDA) has established regulations under 21 CFR 177.2600, which govern the use of rubber articles intended for repeated use in contact with food. Materials that meet these regulations are deemed safe for food contact, ensuring that they do not impart harmful substances to food products. This regulatory framework has been instrumental in assuring both manufacturers and consumers of the safety of food-grade LSR products.

Similarly, in Europe, the European Union has set forth regulations such as EC 1935/2004 and EU 10/2011, which apply to materials and articles intended to come into contact with food. These regulations require that such materials do not release substances into food that could endanger human health or bring about an unacceptable change in the composition of the food. Food-grade LSR complies with these regulations, further bolstering its adoption in the food industry.

The adherence to these regulations not only ensures the safety of food-grade LSR products but also aligns with the growing consumer preference for materials that are free from harmful chemicals. Consumers are increasingly aware of the materials used in food-related products and are seeking options that offer both safety and sustainability. This shift in consumer behavior is prompting manufacturers to prioritize the use of materials like food-grade LSR that meet high safety standards.

Restraints

Regulatory Gaps and Migration Concerns in Food-Grade Liquid Silicone Rubber

In the United States, the Food and Drug Administration (FDA) regulates rubber articles intended for repeated food contact under 21 CFR 177.2600. This regulation ensures that materials do not transfer harmful substances to food. However, the FDA’s guidelines primarily focus on specific migration limits for certain substances and may not comprehensively address all potential chemical interactions between LSR and various food types. This limitation can lead to uncertainties regarding the safety of LSR products in diverse food applications.

Similarly, in Europe, Regulation (EC) No 1935/2004 sets general safety requirements for food contact materials, including silicones. However, as of the latest assessments, there is a lack of specific measures for silicones under this regulation. This absence of harmonized standards across EU member states can result in inconsistent safety assessments and enforcement practices, potentially compromising consumer health protection.

Furthermore, studies have highlighted concerns about the migration of substances from LSR into food. Research conducted by the U.S. Department of Agriculture found that certain silicone products could release substances into foods like carbonated water, orange juice, white wine, and olive oil under specific conditions. These findings underscore the importance of rigorous migration testing to ensure the safety of LSR products in actual food contact scenarios.

Opportunity

Expansion of Food-Grade Liquid Silicone Rubber Applications

The food-grade liquid silicone rubber (LSR) market is poised for significant growth, driven by its unique properties and increasing demand across various food industry applications. LSR’s non-toxic, heat-resistant, and flexible nature makes it an ideal material for food contact items such as baking molds, seals, gaskets, and kitchen utensils.

In the United States, the Food and Drug Administration (FDA) has established regulations under 21 CFR 177.2600, which govern the use of rubber articles intended for repeated use in contact with food. Materials that meet these regulations are deemed safe for food contact, ensuring that they do not impart harmful substances to food products. This regulatory framework has been instrumental in assuring both manufacturers and consumers of the safety of food-grade LSR products.

Similarly, in Europe, the European Union has set forth regulations such as EC 1935/2004 and EU 10/2011, which apply to materials and articles intended to come into contact with food. These regulations require that such materials do not release substances into food that could endanger human health or bring about an unacceptable change in the composition of the food. Food-grade LSR complies with these regulations, further bolstering its adoption in the food industry.

The demand for food-grade LSR is further fueled by its applications in various sectors. In the automotive industry, LSR is used for lightweight components, contributing to energy efficiency and reduced emissions. In packaging, it offers a sustainable alternative to conventional plastics, aligning with consumer preferences for eco-friendly products. The textile industry also benefits from LSR’s biodegradability and reduced environmental impact during production.

Regional Insights

North America leads with a 41.8% share, generating USD 0.9 billion in 2024.

In 2024, North America held a dominant position in the liquid silicone rubber (LSR) market, commanding a 41.8% share and contributing approximately USD 0.9 billion in regional revenue. This leadership is underpinned by well-established industrial infrastructure and strong demand across key sectors such as automotive, medical devices, and electronics. The United States forms the core of this regional strength, with its advanced manufacturing base and high adoption rates of LSR solutions in high-performance applications such as engine seals and medical tubing

Automotive OEMs in the U.S. have been integrating LSR into components like gaskets, seals, and electronic insulation, leveraging its excellent heat resistance, elasticity, and durability. Similarly, North America’s healthcare industry heavily relies on medical-grade LSR for applications including catheter components, surgical tools, and implantable seals, due to its biocompatibility and ease of sterilization

Moreover, regulatory frameworks in the region support high standards for materials in contact with sensitive systems, benefiting the growth of LSR in food-safe, medical, and hygiene products. The North American market also sees increasing focus on sustainability, with manufacturers preferring recyclable or long-lasting elastomers to reduce environmental impact.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Avantor, Inc. plays a notable role in the liquid silicone rubber market by supplying high-purity materials and solutions essential for advanced manufacturing. In 2024, the company strengthened its global footprint by focusing on specialty chemicals and life sciences applications. Its silicone materials are widely used in medical and pharmaceutical sectors, driven by demand for biocompatibility and flexibility. Avantor’s focus on innovation and expansion into healthcare polymers positions it as a reliable supplier in the evolving LSR market.

Dow is one of the foremost players in the global liquid silicone rubber market, offering a comprehensive range of LSR materials under its DOWSIL™ brand. In 2024, Dow invested in sustainable and high-performance LSR technologies for automotive, consumer, and industrial sectors. The company leverages its large-scale production and R&D capabilities to deliver reliable solutions with enhanced thermal stability and design flexibility, solidifying its leadership in silicone-based material innovation.

Elkem ASA is a key manufacturer of silicone-based materials, including high-quality liquid silicone rubber, under its brand Silbione™. In 2024, Elkem focused on expanding its capacity in Asia and Europe to meet growing demand in medical, automotive, and electronics sectors. The company emphasizes sustainability, offering LSR products with reduced environmental impact. Its vertically integrated production model and consistent investment in R&D have enabled Elkem to maintain a resilient position in the LSR market.

Top Key Players Outlook

- Avantor, Inc.

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- Jiangsu Tianchen New Material Co. Ltd

- KCC SILICONE CORPORATION

- Momentive Performance Materials

- RICO GROUP GmbH

- Shin-etsu Chemical Co. Ltd

- SIMTEC Silicone Parts, LLC

- Stockwell Elastomerics Inc.

- Trelleborg Group

- Wacker Chemie AG

- Wynca Tinyo Silicone Co., Ltd.

Recent Industry Developments

In 2024, Elkem reported a revenue of NOK 17.81 billion, a decrease of 15.73% compared to the previous year. However, the company achieved a significant turnaround in profitability, with earnings of NOK 488 million, marking a substantial increase of 577.78%.

In 2024, Avantor reported net sales of $6.78 billion, with a net income of $711.5 million and an adjusted EBITDA of $1,198.8 million, reflecting the company’s strong financial performance.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 5.5 Bn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade LSR, Medical Grade LSR, Food-Contact Grade LSR), By Processing Method (Liquid Injection Molding, Transfer and Compression Molding), By Application (Seals, Gaskets and O Rings, Catheters and Medical Tubing, Electrical Connectors and Housings, Teats, Soothers and Infant Feeding, Wearable and Implantable Drug Delivery Systems), By End-use (Healthcare and Medical Devices, Automotive, Electrical and Electronics, Consumer Goods, Beauty and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Avantor, Inc, CHT Germany GmbH, Dow, DuPont, Elkem ASA, Jiangsu Tianchen New Material Co. Ltd, KCC SILICONE CORPORATION, Momentive Performance Materials, RICO GROUP GmbH, Shin-etsu Chemical Co. Ltd, SIMTEC Silicone Parts, LLC, Stockwell Elastomerics Inc, Trelleborg Group, Wacker Chemie AG, Wynca Tinyo Silicone Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquid Silicone Rubber MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Liquid Silicone Rubber MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Avantor, Inc.

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- Jiangsu Tianchen New Material Co. Ltd

- KCC SILICONE CORPORATION

- Momentive Performance Materials

- RICO GROUP GmbH

- Shin-etsu Chemical Co. Ltd

- SIMTEC Silicone Parts, LLC

- Stockwell Elastomerics Inc.

- Trelleborg Group

- Wacker Chemie AG

- Wynca Tinyo Silicone Co., Ltd.