Global Lipase Market By Microbial (Animal, and Plant), By Formulation (Powder, and Liquid), By Application (Food and Beverages, Biodiesel, Detergents and Cleaning Products, Pharmaceutical, Animal Feed, Cosmetics and Personal Care, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 145545

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

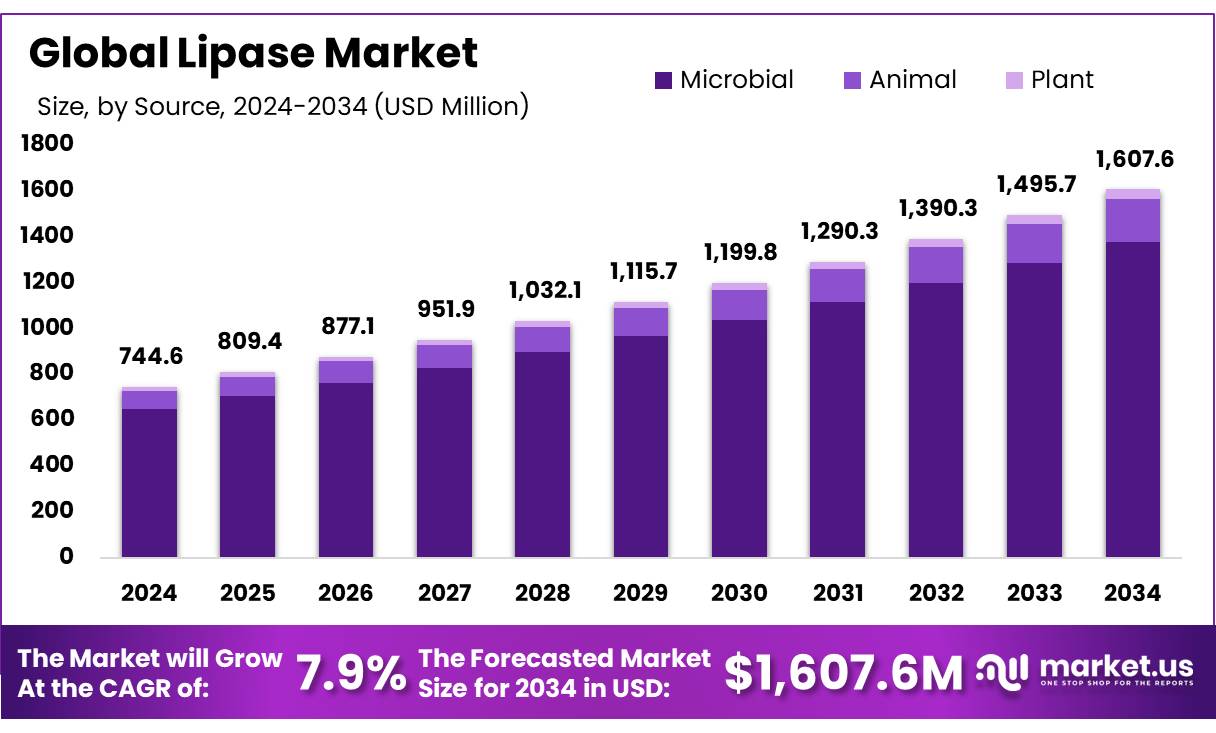

The Global Lipase Market size is expected to be worth around USD 1,607.6 million by 2034, from USD 744.6 million in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Lipase is an enzyme that catalyzes the breakdown of triglycerides into glycerol and free fatty acids by hydrolyzing the ester bonds within the triglyceride structure. Naturally occurring in various living organisms, including plants, animals, and microorganisms, lipases play a critical role in lipid metabolism by breaking down triglycerides into free fatty acids and glycerol. This enzymatic action is essential for the digestion and absorption of dietary lipids in the body.

Beyond their physiological function, lipases have gained significant industrial relevance due to their diverse catalytic capabilities, including hydrolysis, esterification, alcoholysis, and transesterification. These catalytic functions make lipases highly valuable for numerous applications, ranging from food processing and pharmaceuticals to biodiesel production and wastewater treatment.

The global lipase market is witnessing substantial growth driven by its expanding applications in food processing, pharmaceuticals, biodiesel production, and cleaning products. The enzyme’s versatility, specificity, and environmental benefits make it an attractive alternative to conventional chemical catalysts, particularly in industries seeking sustainable and eco-friendly processing solutions. As technological advancements continue to improve enzyme stability and production efficiency, the demand for lipase enzymes is expected to rise across diverse sectors, positioning it as a critical component in the transition towards greener industrial processes.

Key Takeaways

- The global lipase market was valued at USD 744.6 million in 2024.

- The global lipase market is projected to grow at a CAGR of 7.9% and is estimated to reach USD 1,607.6 million by 2034.

- Among sources, microbial accounted for the largest market share of 87.1%.

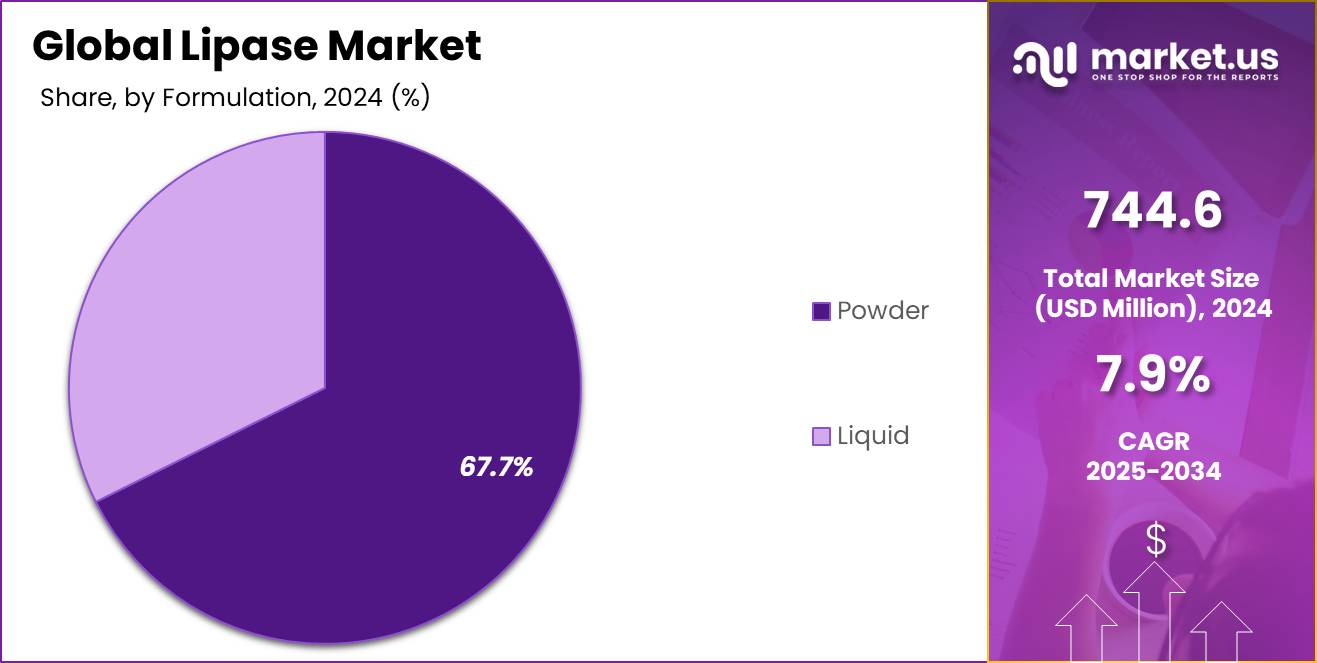

- Among formulations, powder lipase led the market with a largest share of 67.7%.

- Based on application, food & beverages accounted for the majority of the market share 40.8%.

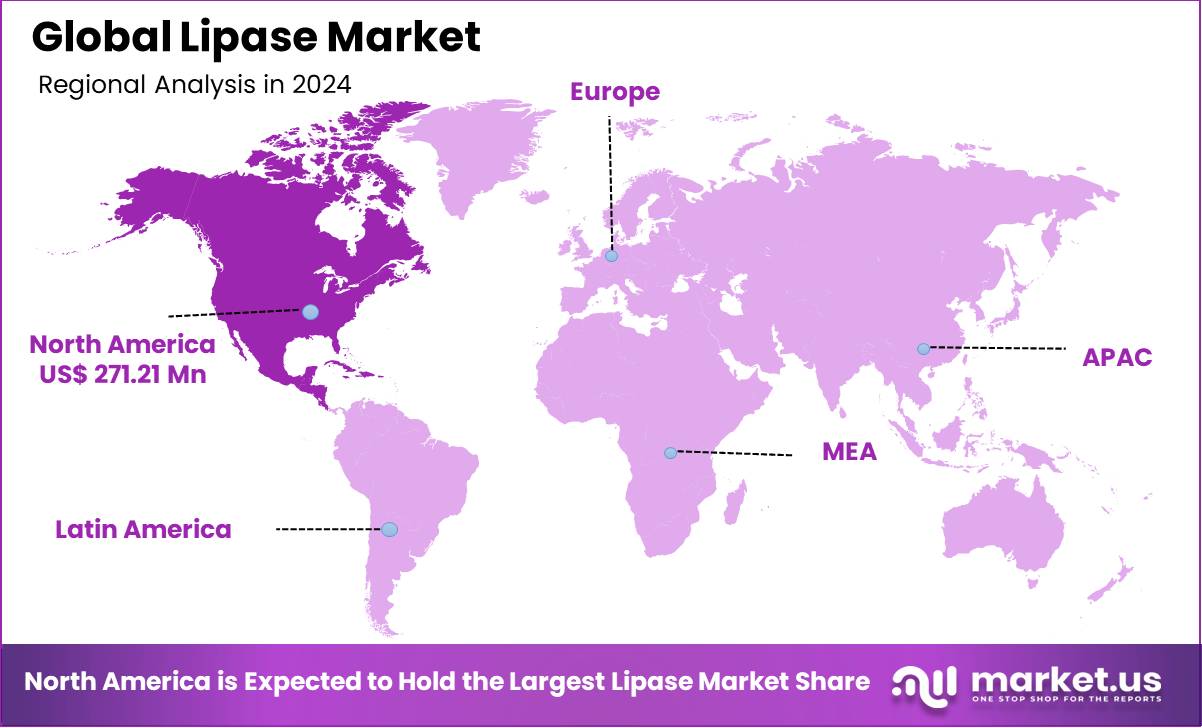

- North America is estimated as the largest market for lipase with a share of 36.4% of the market share.

Source Analysis

Microbial Lipases Dominated the Market, Owing to Its Superior Efficiency

The lipase market is segmented based on source as microbial, animal, and plant. In 2024, the microbial segment held a significant revenue share of 87.1% in the global lipase market due to its superior efficiency, scalability, and cost-effectiveness in industrial applications. Microbial lipases—produced mainly from bacteria and fungi offer advantages such as high enzyme yield, faster growth cycles, and the ability to be cultivated under controlled fermentation conditions. These enzymes are highly stable across a broad range of pH and temperature levels, making them ideal for use in pharmaceuticals, food processing, animal feed, and biofuels.

Additionally, microbial sources can be genetically engineered to enhance enzyme activity, specificity, and resistance to harsh processing environments, providing customized solutions for different industries. In comparison, plant and animal-derived lipases are limited by raw material availability, extraction complexities, and variability in enzyme composition. The growing demand for sustainable and non-animal-derived enzymes, especially in vegetarian and vegan product formulations, has further increased reliance on microbial lipases. Moreover, regulatory bodies are more inclined to approve microbial enzymes due to their consistent quality and safety profile.

Global Lipase Market, By Source, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Microbial 466.71 508.82 549.34 596.61 648.28 Animal 58.87 63.25 67.60 72.88 79.00 Plant 13.02 13.95 14.87 15.99 17.30 Formulation Analysis

Owing to Ease of Storage Powder Lipase Dominates Global Market.

Based on formulation, the market is further divided into powder and liquid. In 2024, the powder accounted for the largest share of the global lipase market, commanding a significant 67.7%. This dominance is primarily due to the superior stability, ease of storage, and extended shelf life that powdered lipase offers compared to its liquid counterpart. Powdered lipase is less sensitive to temperature and moisture changes, making it ideal for transportation and long-term storage—particularly important for industries operating in varied climatic conditions.

It is widely used across food processing, animal feed, and pharmaceutical sectors due to its ease of handling and accurate dosing in industrial applications. In food and bakery industries, powdered lipases blend seamlessly into dry mixes, allowing for consistent performance in dough conditioning and flavor development.

Moreover, its compact nature reduces packaging and shipping costs, offering economic advantages. Powder formulations also allow for better enzyme activity control and can be easily incorporated into premixes and feed additives without compromising product integrity. As a result, manufacturers and end-users alike favor powdered lipase for its functional flexibility, cost-effectiveness, and performance reliability, which together contributed to its leading market share.

Global Lipase Market, By Formulation, 2020-2024 (USD Mn)

Formulation 2020 2021 2022 2023 2024 Powder 357.08 391.55 424.60 462.68 503.73 Liquid 181.52 194.46 207.21 222.80 240.85 Application Analysis

The Lipase Market Was Dominated By The Food & Beverages Sector

Based on applications, the market is further divided into food & beverages, biodiesel, detergents & cleaning products, pharmaceutical, animal feed, cosmetics & personal care, others. In 2024, the food & beverages sector held the largest share of the global lipase market, accounting for 40.9% of the total market, due to the enzyme’s versatile role in enhancing food quality, flavor, and processing efficiency. Lipases are widely used in dairy products like cheese and yogurt to accelerate ripening, improve texture, and develop distinctive flavors. They also play a crucial role in bakery applications by improving dough stability, crumb structure, and shelf life.

In the edible oils segment, lipases help modify fats and oils through enzymatic interesterification, creating healthier fat profiles without trans fats—catering to growing health-conscious consumers. The increasing demand for clean-label, enzyme-based processing solutions further supports lipase usage as a natural alternative to chemical additives.

Additionally, lipase’s ability to break down fats makes it valuable in flavor enhancement and lipid modification in sauces, meat products, and snacks. The global rise in consumption of processed and convenience foods, especially in urban markets, has driven industrial demand for enzymes that ensure consistency and quality. Combined with strict food safety regulations and the push for sustainable food processing, the food & beverages sector continues to be the leading application segment, leveraging lipases for both functional and economic benefits across a wide range of products.

Global Lipase Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Food & Beverages 206.14 230.47 252.96 278.10 304.37 Biodiesel 49.90 53.87 57.93 62.86 68.63 Detergents & Cleaning Products 137.74 145.89 154.23 164.65 176.40 Pharmaceutical 31.00 33.35 35.73 38.64 42.04 Animal Feed 69.32 74.89 80.50 87.29 95.15 Cosmetics & Personal Care 20.16 21.73 23.28 25.19 27.42 Others 24.35 25.82 27.16 28.76 30.57 Key Market Segments

By Source

- Microbial

- Animal

- Plant

By Formulation

- Powder

- Liquid

By Application

- Food & Beverages

- Bakery

- Dairy

- Confectionery

- Beverages

- Others

- Biodiesel

- Detergents & Cleaning Products

- Pharmaceutical

- Digestive Enzymes Supplements

- Pharmaceutical Synthesis

- Animal Feed

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

- Cosmetics & Personal Care

- Skin Care

- Hair Care

- Others

- Others

Drivers

Rising Demand From Processed and Convenience Foods Expected to Boost The Lipase Market.

The rising demand for processed and convenience foods is significantly influencing market dynamics, driven by evolving consumer lifestyles, urbanization, and economic factors. In the United States, data from the USDA’s Economic Research Service indicates that between 1999 and 2010, the average share of household food budgets allocated to fast-food meals increased from 24% to 27%, while expenditures on sit-down restaurant meals decreased from 25% to 23%. Additionally, ready-to-eat (RTE) and ready-to-cook (RTC) meals and snacks accounted for 26% of the average household food budget during this period, highlighting a shift towards more convenient food options.

Time constraints, particularly among working adults, have been identified as a significant factor influencing this trend. Households where all adults are employed tend to purchase 12% less ready-to-eat food from grocery stores and 72% more food from full-service restaurants compared to households where not all adults are employed. This shift underscores the impact of employment patterns on food purchasing behaviors.

The increasing demand for processed and convenience foods presents both opportunities and challenges for the food industry. On the other hand, it raises concerns about nutritional quality and public health, as convenience foods are often associated with higher levels of sodium, sugars, and fats. Addressing these issues necessitates strategic investments in cost-effective technologies, process optimization, and supportive regulatory frameworks to enhance efficiency and competitiveness across industries.

Restraints

High Production and Purification Costs May Hamper The Growth Of the Market

High production and purification costs significantly impede market growth across various industries, particularly in sectors requiring stringent quality and purity standards. In the manufacturing sector, unit labor costs have risen notably. According to the U.S. Bureau of Labor Statistics, unit labor costs in the nonfarm business sector increased by 5.7% in the first quarter of 2025, reflecting a 4.8% increase in hourly compensation and a 0.8% decrease in productivity.

These escalating labor costs contribute to higher overall production expenses, affecting the competitiveness and profitability of manufacturing enterprises. In the food and beverage industry, processing and marketing costs constitute a significant portion of the total value added. Data from the U.S. Department of Agriculture’s Economic Research Service indicates that meat processing accounts for 22.2% and other food processing for 15.4% of the food sector’s total value added.

These substantial percentages underscore the financial burden of processing activities, which include purification processes essential for ensuring food safety and quality. Environmental compliance further exacerbates production costs.

Opportunity

Biotechnology-Driven Production Is Anticipated To Create More Opportunities For Emerging Players

Biotechnology-driven production is revolutionizing the global lipase market by enabling more efficient, sustainable, and versatile enzyme production processes. Microbial engineering, a key biotechnological approach, involves the use of genetically modified microorganisms such as bacteria, fungi, and yeasts to produce lipases with enhanced stability, specificity, and catalytic efficiency. For instance, researchers have developed recombinant strains of Aspergillus niger and Candida rugosa that can produce lipases with higher yields and greater stability under varying temperature and pH conditions.

This advancement not only reduces production costs but also expands the range of applications for lipases in industries such as food processing, pharmaceuticals, and biofuels. In the food sector, lipases are increasingly used for fat modification in dairy products, enhancing flavor profiles and improving fat digestion in low-fat products. The pharmaceutical industry leverages lipases for the synthesis of enantiomerically pure compounds, crucial for drug formulations.

In the biofuel sector, enzymatic transesterification using lipases offers a greener alternative to conventional chemical catalysts, producing biodiesel with fewer byproducts and lower energy consumption. Furthermore, biotechnology-driven lipase production aligns with global sustainability initiatives by utilizing renewable feedstocks and generating minimal waste. Government-funded research programs and grants are accelerating innovation in enzyme biotechnology.

For instance, the European Union’s Horizon Europe program allocates substantial funding for biotechnological research, fostering advancements in enzyme engineering for industrial applications. Similarly, the U.S. Department of Energy supports initiatives focused on bio-based enzyme production for renewable energy and bioprocessing.

Trends

Enzyme Engineering Innovation

Enzyme engineering is emerging as a transformative trend in the global lipase market, driven by advancements in biotechnology and the increasing demand for more efficient and sustainable biocatalysts. Through techniques such as directed evolution and protein engineering, researchers are developing lipases with enhanced thermal stability, substrate specificity, and catalytic activity. These engineered enzymes are tailored to perform optimally under industrial conditions, enabling more robust and cost-effective processes in sectors such as pharmaceuticals, food processing, and biofuels.

For instance, recombinant lipases derived from genetically modified microorganisms like Escherichia coli and Aspergillus niger exhibit improved activity at extreme temperatures and pH levels, making them ideal for large-scale industrial applications. This trend is further supported by government-funded research initiatives aimed at reducing the environmental footprint of chemical manufacturing through enzyme-based processes.

The U.S. Department of Energy, for instance, has allocated grants for projects focused on developing advanced biocatalysts for biofuel production, emphasizing the role of lipases in converting low-cost feedstocks into biodiesel. Similarly, the European Union’s Horizon Europe program is funding enzyme engineering projects to produce high-performance biocatalysts for sustainable industrial processes. Moreover, immobilization techniques are being employed to extend enzyme lifespans and enable enzyme reuse, significantly lowering production costs and reducing waste. In the food industry, engineered lipases are being utilized to enhance fat modification processes, producing healthier trans-fat-free food products.

Geopolitical Impact Analysis

Trade Tariff Policies Have Impacted Import/Export and Disrupted The Global Supply Chain Activities.

The implementation of a comprehensive tariff policy by the United States in May 2025 has significantly altered the trade landscape for food and dairy products, impacting importers, exporters, and domestic consumers alike. Under the new policy framework, a universal baseline tariff of 10% has been levied on all imported goods, including food and dairy products. This strategic shift marks a substantial change from previous trade agreements, where numerous food and dairy items benefited from reduced or zero tariffs, promoting free trade and cost-effective imports.

However, the current tariff structure aims to protect domestic industries by imposing uniform duties across various product categories. The Harmonized Tariff Schedule of the United States provides detailed guidelines regarding specific tariff rates for various food and dairy products. Certain dairy products such as butter and cheese are now subject to tariff-rate quotas (TRQs), which allow a designated quantity of imports at a reduced tariff rate, beyond which higher rates are applied. This measure seeks to strike a balance between supporting local dairy producers and maintaining adequate supply levels to meet consumer demand. Nevertheless, these TRQs have increased costs for importers and, subsequently, for consumers.

- The overall price level in the U.S. has increased by 2.3% in the short run due to all 2025 tariffs, resulting in an average annual loss of $3,800 per household. For lower-income households, the annual loss is estimated at $1,700.

Regional Analysis

North America Held the Largest Share of the Global Lipase Market

In 2024, North America dominated the global lipase market with a 36.4% share, primarily driven by the region’s advanced pharmaceutical and food processing industries, high awareness of enzyme-based health solutions, and robust R&D infrastructure. The United States, in particular, has witnessed increased adoption of lipase enzymes in dietary supplements, clinical nutrition, and digestive aids due to a rising focus on gut health, obesity management, and enzyme deficiency treatments. Additionally, the food and beverage sector—especially in dairy, bakery, and processed food applications—has incorporated lipases for flavor enhancement, shelf-life extension, and fat breakdown. Regulatory approvals by bodies like the FDA and the presence of major biotechnology companies further support commercial enzyme production and application innovation.

Moreover, North America’s well-developed industrial enzyme market and growing demand for sustainable, bio-based processing technologies have increased the use of lipases in biodiesel production and waste management. The region also benefits from a mature supply chain, advanced manufacturing capabilities, and consistent product innovation tailored to diverse end-use industries. Together, these factors have firmly established North America as the leading region in the global lipase market in 2024.

Global Lipase Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 196.90 213.65 231.46 250.40 271.21 Europe 180.25 196.15 208.28 226.02 245.56 Asia Pacific 106.98 117.35 128.55 140.61 153.99 Middle East & Africa 25.05 27.09 29.26 31.55 34.06 Latin America 29.42 31.78 34.26 36.89 39.77 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In The Lipase Market, Companies Sustain Their Competitive Edge Through A Combination Of Product Innovation, Strategic Partnerships, Regulatory Compliance, And Expansion Into High-Growth Sectors.

R&D investment plays a central role, enabling firms to develop advanced lipase formulations with improved temperature and pH stability, higher catalytic efficiency, and application-specific functionality particularly for use in food processing, pharmaceuticals, and biofuels. Several leading players are focused on enzyme engineering and fermentation optimization to reduce production costs and increase enzyme yields.

Companies maintain competitiveness by forming partnerships with food manufacturers, pharmaceutical firms, and biofuel producers, allowing them to tailor lipase solutions for specific industrial needs and ensure long-term supply agreements. Additionally, compliance with global food safety and pharma-grade regulations (such as GRAS status in the U.S. or EFSA approval in the EU) strengthens brand reliability and enables product access to regulated markets.

The following are some of the major players in the industry

- Novonesis Group

- DSM-Firmenich AG

- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- Kerry Group

- Antozyme Biotech Pvt Ltd

- RENCO

- Sacco System

- Creative Enzymes

- AB Enzymes

- International Flavors & Fragrances Inc.

- BRAIN Biotech Group

- Aumgene Biosciences

- Meito Sangyo Co., Ltd

- Other Key Players

Key Development

- In September 2024, Biocatalysts Ltd, announced the launch of Lipomod™ 70MDP, a unique lipase formulated specifically to optimize the hydrolysis of plant-based oils. This newest addition to Biocatalysts Ltd.’s specialty enzyme portfolio is set to offer enhanced efficiency and versatility across various industries, including food processing and industrial manufacturing.

- In April 2023, Firmenich International SA announced the successful completion of its merger with DSM, forming DSM-Firmenich AG — the leading innovation partner in the fields of nutrition, health, and beauty. This milestone was achieved following the fulfillment of all customary conditions, completion of the share exchange offer, and the contribution of Firmenich shares into DSM-Firmenich AG.

Report Scope

Report Features Description Market Value (2024) US$ 744.6 Mn Forecast Revenue (2034) US$ 1,607.6 Mn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Microbial (Animal, and Plant), By Formulation (Powder, and Liquid), By Application (Food & Beverages, Biodiesel, Detergents & Cleaning Products, Pharmaceutical , Animal Feed, Cosmetics & Personal Care, and Others Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Novonesis Group, DSM-Firmenich AG, Advanced Enzyme Technologies Amano Enzyme Inc., Kerry Group, Antozyme Biotech Pvt Ltd., RENCO, Sacco System, Creative Enzymes, AB Enzymes, International Flavors & Fragrances Inc., BRAIN Biotech Group, Aumgene Biosciences, Meito Sangyo Co., Ltd., Other Key Players

Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novozymes

- Novonesis

- Amano Enzyme Inc.

- Creative Enzymes

- AB Enzymes

- Enzyme Development Corporation

- Biocatalysts

- Aumgene Biosciences

- Chr. Hansen Holdings A/S

- Advanced Enzyme Tech

- Clerici-Sacco Group

- Renco Newzealand