Global Lab Automation Market By Type of Automation (Modular Automation, Total Laboratory Automation and Robotic Process Automation), By Product (Systems & Workstations, Software & Informatics), By Workflow Stage (Pre-Analytical Automation, Analytical Automation and Post-Analytical Automation), By Application (Clinical Diagnostics, Drug Discovery, Genomics & Proteomics, Microbiology and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Clinical Diagnostic Laboratories, Industrial & Environmental Testing Labs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172538

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type of Automation Analysis

- Product Analysis

- Workflow Stage Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

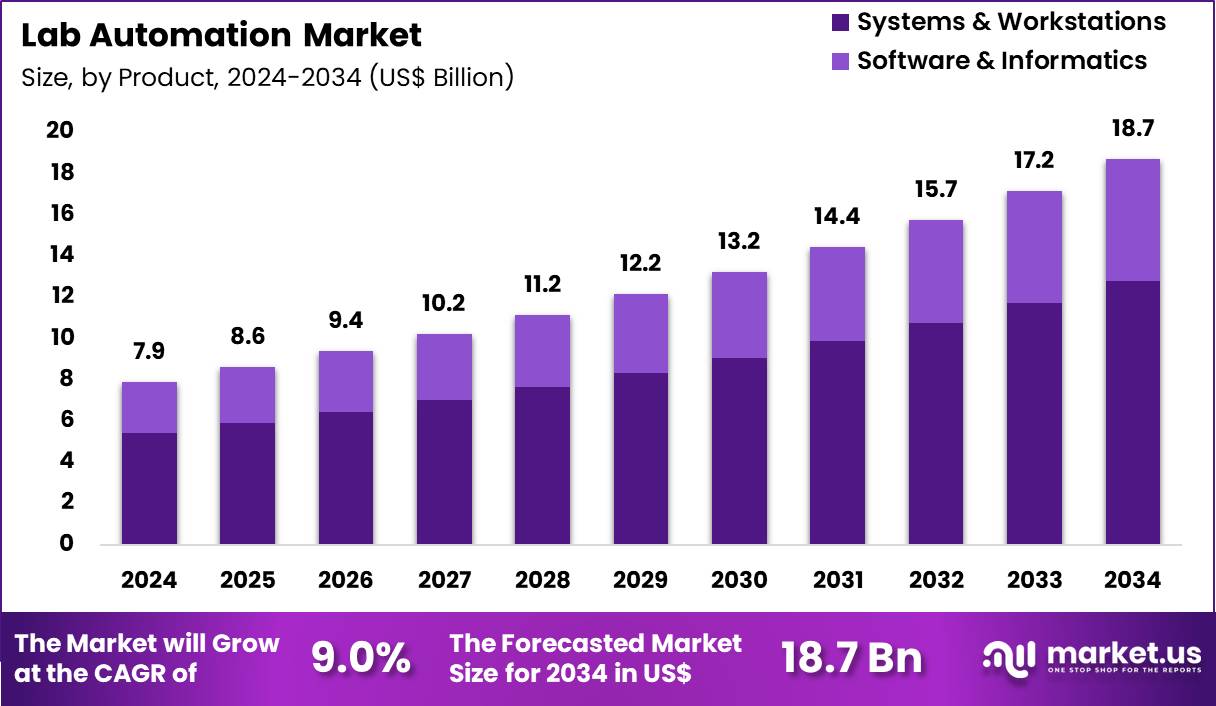

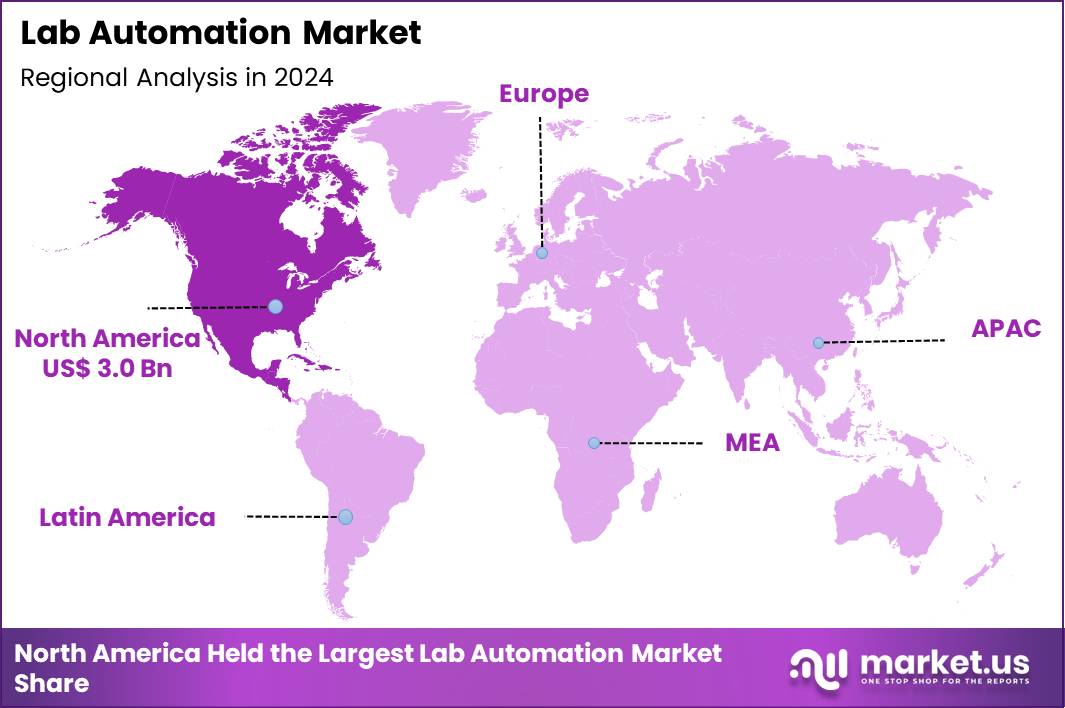

The Global Lab Automation Market size is expected to be worth around US$ 18.7 Billion by 2034 from US$ 7.9 Billion in 2024, growing at a CAGR of 9.0% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 3.0 Billion.

Growing demand for high-throughput processing in life sciences research propels laboratories to adopt automation systems that streamline repetitive tasks and enhance experimental reproducibility. Researchers increasingly deploy robotic liquid handlers for precise pipetting in drug discovery assays, ensuring uniform compound distribution across microplates. These technologies support genomic sequencing workflows by automating DNA extraction and library preparation, accelerating variant analysis in precision medicine initiatives.

Laboratories utilize automated incubators and plate readers for cell-based screening, maintaining controlled environments for prolonged cytotoxicity studies. Clinicians integrate automation in diagnostic testing to handle ELISA protocols efficiently, detecting biomarkers for infectious diseases and autoimmune conditions. In April 2025, QIAGEN announced plans to introduce three new sample preparation instruments, QIAmini, QIAsprint Connect, and QIAsymphony Connect, targeting low to high throughput laboratory workflows between 2025 and 2026.

This announcement drives the lab automation market by addressing scalability and flexibility requirements across oncology, genomics, and clinical research applications. Automated sample preparation reduces hands on time, minimizes variability, and supports consistent data quality across throughput levels. The expansion of modular, connected instruments enables laboratories to progressively automate workflows, reinforcing sustained investment in lab automation technologies.

Pharmaceutical developers capitalize on opportunities to implement fully integrated workstations that combine sample preparation with downstream analysis, optimizing workflows in proteomics research. Manufacturers design modular robotic arms adaptable to varying assay formats, expanding utility in synthetic biology for gene assembly and cloning. These systems facilitate high-content imaging automation, enabling real-time monitoring of organoid cultures in regenerative medicine studies.

Opportunities emerge in automating chromatography purification steps, enhancing throughput for recombinant protein production in biomanufacturing. Companies advance barcode tracking integrations to ensure sample traceability throughout complex virology testing pipelines. Firms pursue scalable automation solutions for next-generation sequencing quality control, supporting error-free data generation in hereditary disease diagnostics.

Industry pioneers embed machine learning algorithms into automation software, predicting optimal parameters for assay optimization in metabolomics profiling. Developers introduce collaborative robots that safely interact with human operators, broadening applications in hybrid manual-automated pathology slide preparation. Market leaders refine vision-guided systems for accurate colony picking in microbiology, streamlining antibiotic susceptibility testing.

Innovators incorporate cloud-based control platforms to enable remote monitoring of automated qPCR setups in vaccine development. Companies prioritize energy-efficient designs that sustain long-term operations in continuous flow chemistry for small molecule synthesis. Ongoing innovations emphasize interoperability standards, allowing seamless integration of diverse instruments in multi-omics research environments.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.9 Billion, with a CAGR of 9.0%, and is expected to reach US$ 18.7 Billion by the year 2034.

- The type of automation segment is divided into modular automation, total laboratory automation and robotic process automation, with total laboratory automation taking the lead in 2024 with a market share of 56.1%.

- Considering product, the market is divided into systems & workstations and software & informatics. Among these, systems & workstations held a significant share of 68.4%.

- Furthermore, concerning the workflow stage segment, the market is segregated into pre-analytical automation, analytical automation and post-analytical automation. The analytical automation sector stands out as the dominant player, holding the largest revenue share of 45.3% in the market.

- The application segment is segregated into clinical diagnostics, drug discovery, genomics & proteomics, microbiology and others, with the drug discovery segment leading the market, holding a revenue share of 39.0%.

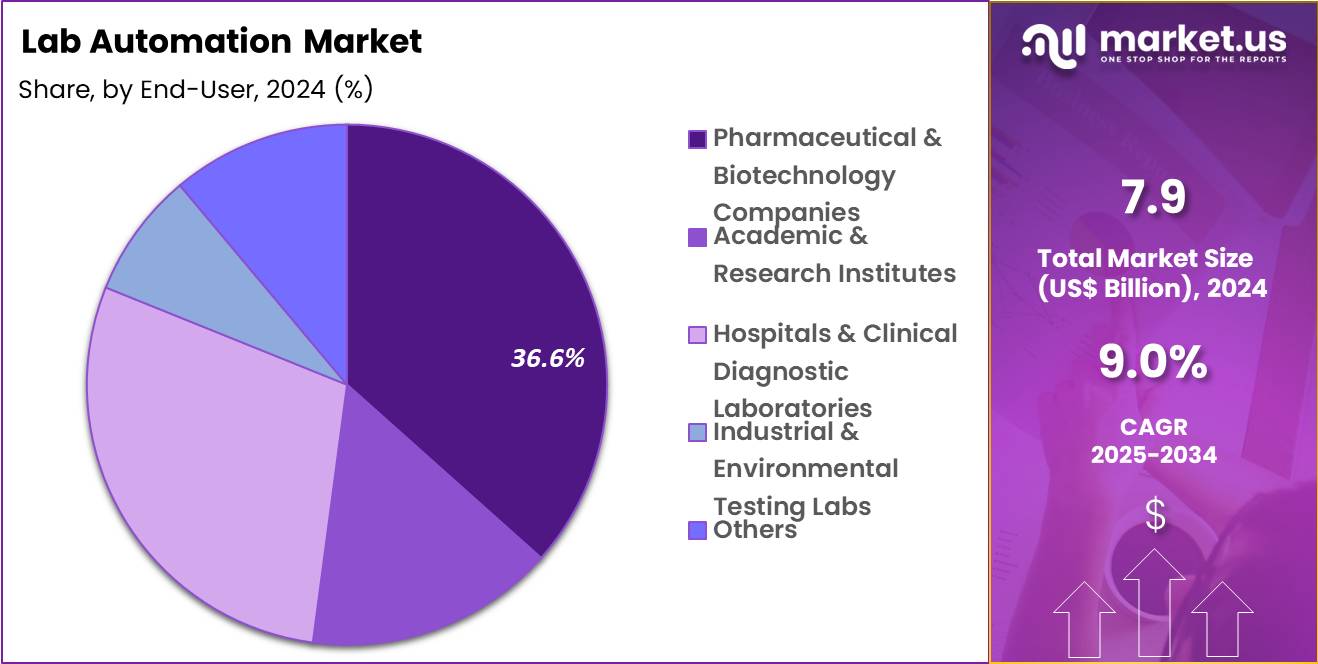

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, academic & research institutes, hospitals & clinical diagnostic laboratories, industrial & environmental testing labs and others. Among these, pharmaceutical & biotechnology companies held a significant share of 36.6%.

- North America led the market by securing a market share of 38.2% in 2024.

Type of Automation Analysis

Total laboratory automation, accounting for 56.1%, is expected to dominate as laboratories seek end to end workflow integration to handle rising test volumes and complexity. Large clinical and research laboratories increasingly invest in fully automated tracks to reduce manual intervention and turnaround time. Growing pressure to improve accuracy and standardization strengthens adoption.

Automation helps laboratories address workforce shortages and skill gaps. Regulatory emphasis on quality control supports integrated systems. High throughput requirements in centralized labs further accelerate demand. Continuous operation capabilities improve productivity. These factors keep total laboratory automation anticipated to remain the leading automation type.

Product Analysis

Systems and workstations, holding 68.4%, are projected to lead the product segment due to their central role in executing automated laboratory processes. Physical automation platforms enable sample handling, analysis, and data capture at scale. Laboratories prioritize capital investment in hardware to achieve measurable efficiency gains.

Integration with existing instruments increases operational value. Demand rises as labs modernize legacy infrastructure. Vendors focus on modular and scalable systems to support future expansion. Reliability and throughput advantages drive purchasing decisions. These drivers keep systems and workstations likely to sustain dominance.

Workflow Stage Analysis

Analytical automation, representing 45.3%, is anticipated to grow strongly as laboratories focus on improving precision and reproducibility during testing. Analytical stages directly influence result accuracy, making automation critical for quality outcomes. High volume testing environments benefit from consistent processing and reduced error rates.

Advanced analyzers support complex assays across diagnostics and research. Automation shortens processing time and improves throughput. Integration with data systems enhances result traceability. Rising demand for standardized testing reinforces adoption. These factors keep analytical automation expected to remain the dominant workflow stage.

Application Analysis

Drug discovery, accounting for 39.0%, is projected to dominate application demand as pharmaceutical research increasingly relies on high throughput and data intensive experimentation. Automation supports rapid screening, assay development, and compound optimization. Growing investment in novel therapeutics expands laboratory workloads.

Automated platforms enable reproducible experiments and faster decision making. Integration with informatics tools strengthens data analysis. Pressure to reduce development timelines accelerates adoption. Advanced biologics and precision medicine research further increase automation needs. These dynamics keep drug discovery anticipated to lead application growth.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 36.6%, are expected to remain the largest end user due to sustained investment in research, development, and manufacturing quality. These organizations operate complex laboratories requiring scalable and compliant automation solutions. Competitive pressure to improve productivity drives continuous modernization.

Automation supports regulatory compliance and documentation requirements. Expanding pipelines increase sample volumes and assay diversity. In house automation improves control over critical processes. Strategic focus on innovation strengthens long term adoption. These factors keep pharmaceutical and biotechnology companies likely to dominate end user demand.

Key Market Segments

By Type of Automation

- Modular Automation

- Total Laboratory Automation

- Robotic Process Automation

By Product

- Systems & Workstations

- Automated Liquid Handling Systems

- Laboratory Robotics

- Automated Sample Storage & Retrieval Systems

- Analyzers & Detection Systems

- Microplate Readers

- Others

- Software & Informatics

By Workflow Stage

- Pre-Analytical Automation

- Analytical Automation

- Post-Analytical Automation

By Application

- Clinical Diagnostics

- Drug Discovery

- Genomics & Proteomics

- Microbiology

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Clinical Diagnostic Laboratories

- Industrial & Environmental Testing Labs

- Others

Drivers

Increasing number of novel drug approvals is driving the market

The lab automation market is considerably driven by the increasing number of novel drug approvals, which relies on automated systems for efficient screening, assay development, and quality control in pharmaceutical research. Automated platforms enable high-throughput processing of compounds, accelerating the identification of viable candidates in early discovery phases. Laboratories utilize robotics and integrated software to handle complex workflows, ensuring consistency in data generation for regulatory submissions.

The surge in approvals reflects heightened R&D activity, where automation minimizes human error and optimizes resource allocation. Biopharmaceutical firms adopt these technologies to meet demanding timelines for innovative therapies targeting oncology and infectious diseases. Enhanced reproducibility from automated protocols supports robust preclinical validation, critical for advancing to clinical trials.

Collaborative ecosystems between academia and industry leverage automation for translational research. Global regulatory frameworks encourage efficient development processes, further integrating automated tools. In 2022, the U.S. Food and Drug Administration approved 37 novel drugs. This was followed by 55 approvals in 2023 and 50 in 2024, indicating sustained pipeline momentum that bolsters demand for lab automation solutions.

Restraints

High implementation costs and integration complexities are restraining the market

The lab automation market is notably restrained by high implementation costs and integration complexities, which pose barriers to adoption in resource-limited settings. Initial investments encompass sophisticated hardware, software customization, and facility modifications to accommodate automated systems. Integration with existing laboratory information management systems often requires specialized expertise, leading to prolonged setup periods.

Smaller institutions face challenges in justifying expenditures without immediate returns on investment. Compatibility issues between legacy equipment and new robotic platforms exacerbate technical hurdles. Ongoing maintenance and calibration demands contribute to elevated operational expenses. Cybersecurity vulnerabilities in connected automated networks necessitate additional protective measures.

Workforce upskilling for system operation adds to financial and temporal burdens. Regulatory compliance for validated workflows in GMP environments further complicates deployment. These factors collectively limit scalability and hinder widespread penetration across diverse laboratory types.

Opportunities

Integration of AI in lab workflows is creating growth opportunities

The lab automation market offers substantial growth opportunities through the integration of artificial intelligence in lab workflows, enabling predictive analytics and optimized process control. AI algorithms facilitate real-time data interpretation, enhancing decision-making in assay optimization and compound selection. Laboratories can leverage machine learning to reduce variability and improve throughput in high-content screening. This integration supports scalable solutions for precision medicine, where automated systems handle vast datasets efficiently.

Collaborative development between technology providers and research entities accelerates AI-enabled innovations. Regulatory bodies recognize the potential for AI in improving reproducibility and efficiency. Investments in cloud-based platforms expand accessibility for remote monitoring and collaboration. Emerging applications in biomedicine and drug development further diversify opportunities. These advancements position AI as a pivotal element for future-proofing lab automation infrastructures. Continued progress in computational capabilities ensures alignment with evolving research demands.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the lab automation market as robust biopharmaceutical investments and escalating demand for efficient diagnostics propel laboratories worldwide to integrate robotic systems and AI-driven workflows for accelerated research outputs. Executives at leading firms strategically expand portfolios with modular automation platforms, capitalizing on global healthcare expansions to serve high-volume testing needs in emerging economies.

Persistent inflation and economic slowdowns, however, inflate costs for hardware components and software integrations, compelling smaller labs to defer upgrades and constrain operational scales amid tighter budgets. Geopolitical frictions, notably U.S.-China trade disputes and regional instabilities, routinely sever supply chains for critical sensors and controllers, generating production delays and sourcing uncertainties for manufacturers with heavy overseas dependencies.

Current U.S. tariffs impose elevated duties on imported robotics and industrial machinery, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic channels. These tariffs also incite reciprocal barriers from trading partners that curtail U.S. exports of advanced automation technologies and impede multinational R&D alliances. Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Integration of AI and robotics in total laboratory automation is a recent trend

In 2024 and 2025, the lab automation market has highlighted a prominent trend toward the integration of artificial intelligence and robotics in total laboratory automation to streamline end-to-end processes. These technologies enable predictive maintenance and automated error correction across pre-analytical to post-analytical phases. Robotic arms combined with AI facilitate precise sample handling and adaptive workflow adjustments based on real-time feedback.

Machine learning models analyze patterns to enhance quality control and reduce turnaround times. Internet-of-things connectivity supports seamless data flow between devices, fostering interconnected lab ecosystems. Leading providers have introduced solutions incorporating these features for clinical diagnostics and research applications. This trend addresses labor shortages by minimizing manual interventions while maintaining high accuracy.

Sustainability considerations influence designs to optimize resource usage through intelligent automation. Professional literature emphasizes the role of these integrations in advancing precision diagnostics. Overall, this evolution promotes resilient and efficient laboratory operations aligned with modern healthcare demands.

Regional Analysis

North America is leading the Lab Automation Market

In 2024, North America held a 38.2% share of the global lab automation market, energized by substantial federal commitments to research infrastructure and the widespread incorporation of artificial intelligence in life sciences workflows. Biomedical facilities increasingly implement robotic systems for high-precision liquid handling and sample tracking, mitigating human error in large-scale genomic and proteomic analyses. Regulatory agencies expedite clearances for integrated software platforms that synchronize data across multi-instrument setups, supporting compliance in clinical trial environments.

Pharmaceutical enterprises deploy automated high-content screening tools to hasten compound library evaluations, responding to urgent needs for novel antivirals and oncology agents. Academic consortia utilize modular workstations for cell-based assays, enabling collaborative projects on regenerative medicine amid talent constraints. Venture initiatives back sensor-enhanced grippers for delicate bioprocessing, optimizing throughput in resource-intensive R&D.

Public health directives promote automation in diagnostic labs, facilitating swift outbreak responses through scalable PCR setups. These drivers encapsulate a focused pursuit of efficiency and innovation in scientific endeavors. The National Science Foundation reported that federally owned and operated facilities performed $49.1 billion of research and experimental development in FY 2024, underscoring the extensive reliance on automated technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts envision substantial proliferation of laboratory automation solutions in Asia Pacific throughout the forecast period, as nations channel resources into technological upgrades to confront health and industrial imperatives. Biotechnology centers in South Korea and Indonesia install automated sequencers, streamlining genetic research for crop resilience against climate variabilities.

Manufacturers develop budget-friendly centrifuge robots, empowering small enterprises in the Philippines to scale fermentation processes for nutraceuticals. Cooperative frameworks exchange protocols for AI-optimized incubators, enhancing yield predictions in Thailand’s aquaculture labs. Policymakers enforce standards for barcode-integrated freezers, safeguarding specimen integrity in Vietnam’s expanding biorepositories.

Investment hubs incentivize assembly of vision systems for quality control, fortifying Malaysia’s semiconductor-adjacent bioelectronics sector. Vocational programs equip personnel with programming skills for workflow orchestration, bridging skill gaps in rural Indian facilities. These actions exploit economic vibrancy and collaborative networks, advancing precision-driven scientific progress. The World Bank reported that industrial robot adoption in Viet Nam from 2018 to 2022 created approximately 2 million jobs for skilled formal workers, demonstrating automation’s transformative impact on regional capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the lab automation market drive growth by deploying end-to-end robotic workflows that increase throughput, reduce manual errors, and address chronic staffing shortages across clinical and research laboratories. Companies scale adoption by integrating instruments, software, and data connectivity into unified platforms that streamline sample handling, analysis, and reporting.

Commercial strategies focus on long-term enterprise agreements with hospital networks, diagnostics chains, and biopharma clients that seek standardized, scalable laboratory operations. Innovation priorities include AI-enabled scheduling, modular automation cells, and flexible layouts that adapt to changing test volumes and assay menus.

Geographic expansion targets emerging healthcare systems investing in modern laboratory infrastructure and regulatory-compliant diagnostics capacity. Beckman Coulter Life Sciences exemplifies leadership through its comprehensive automation portfolio, deep expertise in clinical and research workflows, global service organization, and strong customer relationships that position the company as a strategic partner for modern high-performance laboratories.

Top Key Players

- Thermo Fisher Scientific

- Hamilton Company

- Agilent Technologies

- Eppendorf AG

- Tecan Group Ltd.

- Hudson Robotics

- HighRes Biosolutions

- SPT Labtech

- INTEGRA Biosciences

- QIAGEN

- PerkinElmer Inc.

- Siemens Healthineers

- Danaher

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- F. Hoffmann-La Roche Ltd

Recent Developments

- In September 2025, Eppendorf introduced the VisioNize box 2, a next generation digital connectivity hub that allows laboratories to remotely monitor, control, and integrate multiple instruments through a single platform. This launch drives the lab automation market by advancing digital laboratory infrastructure and enabling connected, data driven operations. Remote device management improves workflow efficiency, reduces manual intervention, and enhances safety compliance, encouraging laboratories to adopt integrated automation ecosystems. The growing emphasis on smart labs and centralized instrument oversight accelerates demand for connectivity solutions as a core component of lab automation strategies.

- In July 2025, Merck launched the AAW Automated Assay Workstation in Darmstadt, Germany, in collaboration with Opentrons, delivering a plug and play automation platform tailored for academic, biotech, and pharmaceutical laboratories. This development supports lab automation market growth by lowering technical and financial barriers to automation adoption. Simplified setup and standardized workflows enable faster assay execution and reproducibility, particularly for laboratories transitioning from manual to automated processes. By making automation more accessible across research environments, such platforms expand the addressable market and increase penetration of automated systems in early stage and applied research.

Report Scope

Report Features Description Market Value (2024) US$ 7.9 Billion Forecast Revenue (2034) US$ 18.7 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Automation (Modular Automation, Total Laboratory Automation and Robotic Process Automation), By Product (Systems & Workstations (Automated Liquid Handling Systems, Laboratory Robotics, Automated Sample Storage & Retrieval Systems, Analyzers & Detection Systems, Microplate Readers and Others) and Software & Informatics), By Workflow Stage (Pre-Analytical Automation, Analytical Automation and Post-Analytical Automation), By Application (Clinical Diagnostics, Drug Discovery, Genomics & Proteomics, Microbiology and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Clinical Diagnostic Laboratories, Industrial & Environmental Testing Labs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Hamilton Company, Agilent Technologies, Eppendorf AG, Tecan Group Ltd., Hudson Robotics, HighRes Biosolutions, SPT Labtech, INTEGRA Biosciences, QIAGEN, PerkinElmer Inc., Siemens Healthineers, Danaher, Aurora Biomed Inc., BMG LABTECH GmbH, F. Hoffmann-La Roche Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific

- Hamilton Company

- Agilent Technologies

- Eppendorf AG

- Tecan Group Ltd.

- Hudson Robotics

- HighRes Biosolutions

- SPT Labtech

- INTEGRA Biosciences

- QIAGEN

- PerkinElmer Inc.

- Siemens Healthineers

- Danaher

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- F. Hoffmann-La Roche Ltd