Global L-Citrulline Market Size, Share, And Business Benefits By Form (Capsules, Tablets, Powders, Others), By End-Use (Sports Nutrition and Bodybuilding, Pharmaceuticals and Healthcare, Food and Beverage, Others), By Distribution Channel (Supermarket and Hypermarkets, Pharmacy and Drug Stores, Health Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155973

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

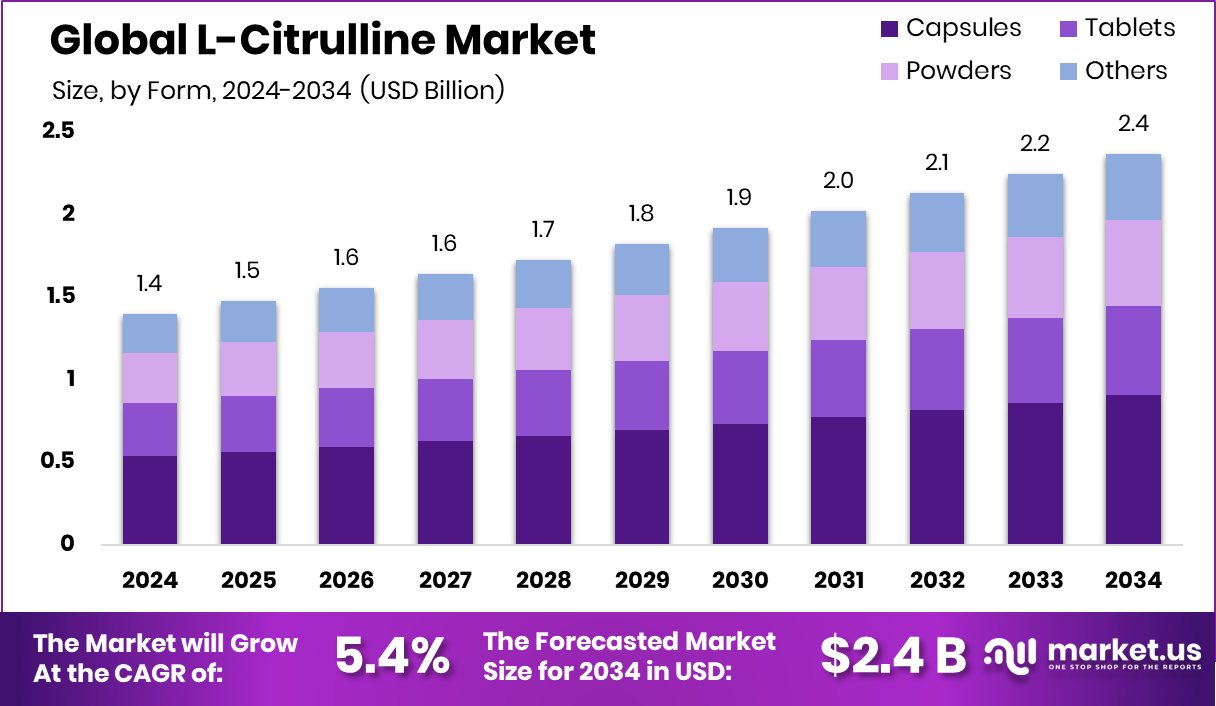

The Global L-Citrulline Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. Strong fitness culture and health awareness fueled North America’s 43.70%, USD 0.6 Bn market.

L-Citrulline is a naturally occurring amino acid that plays a key role in the body’s nitric oxide cycle. It is not directly used to build proteins but is important for widening blood vessels, improving circulation, and supporting muscle recovery. Found in foods like watermelon and also produced in the body, L-Citrulline is often taken as a supplement to boost energy, improve exercise performance, and support heart health.

The L-Citrulline market refers to the global trade, production, and consumption of this amino acid in the form of dietary supplements, functional foods, sports nutrition products, and pharmaceuticals. With increasing focus on fitness, cardiovascular well-being, and preventive healthcare, the demand for L-Citrulline is growing across multiple industries. Recent moves such as D2C sports nutrition brand Nutrabay securing $5 million funding from RPSG Capital Ventures and India’s HealthKart reaching a $500M valuation through fresh investment underline the sector’s momentum.

One major growth factor driving the market is the rising trend of sports and fitness activities. Athletes and fitness enthusiasts are increasingly turning to L-Citrulline for its role in reducing fatigue, improving endurance, and aiding faster recovery. This health-conscious lifestyle shift is creating consistent demand. UConn Husky Nutrition & Sport obtaining $4.9 million in federal funding further highlights the growing institutional support for sports nutrition.

The demand for L-Citrulline is also supported by its applications beyond fitness, particularly in heart health and blood pressure management. With lifestyle-related health concerns becoming more common, consumers are looking for safe and effective natural supplements, fueling wider adoption.

Key Takeaways

- The Global L-Citrulline Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Capsules dominated the L-Citrulline market with 38.2%, driven by convenience and consumer preference.

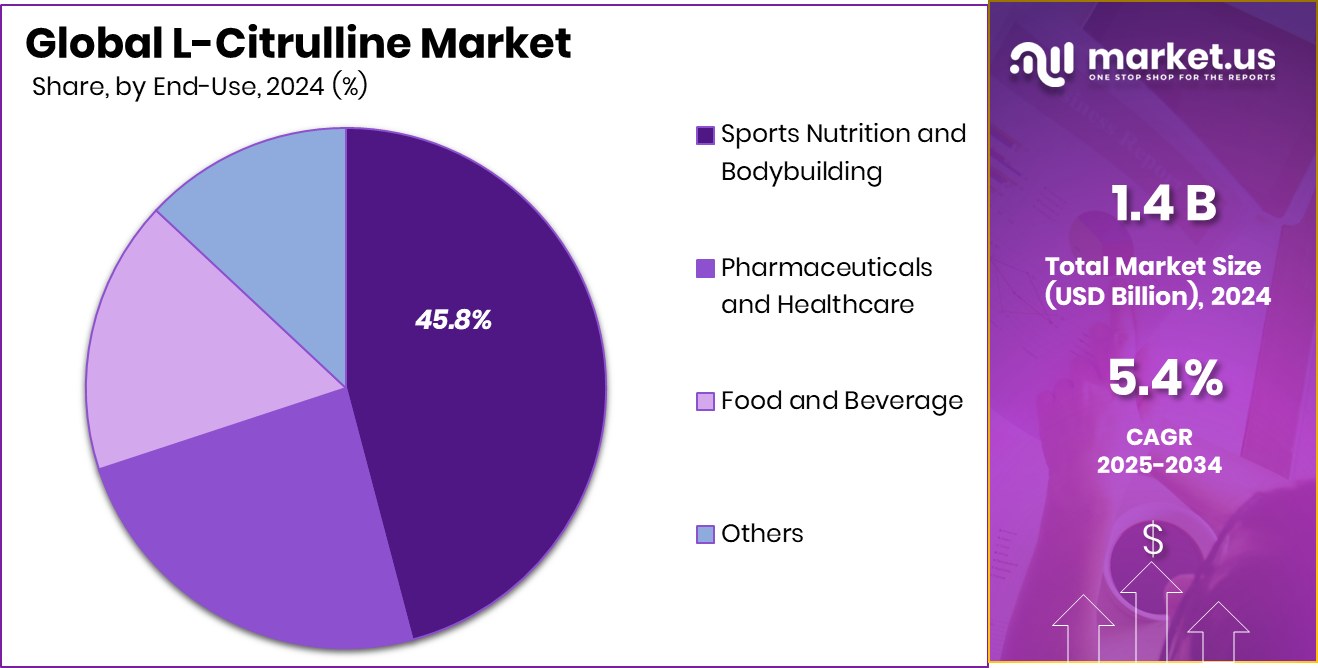

- Sports nutrition and bodybuilding led the L-Citrulline market, capturing 45.8% in 2024.

- Supermarkets and hypermarkets accounted for a 31.4% share, making L-Citrulline widely accessible globally.

- The North America L-Citrulline Market reached a value of nearly USD 0.6 Bn.

By Form Analysis

L-Citrulline the market in capsule form, accounts for 38.2 percent share.

In 2024, Capsules held a dominant market position in the By Form segment of the L-Citrulline Market, with a 38.2% share. Capsules have emerged as the most preferred form among consumers because they offer convenience, accurate dosage, and ease of daily use. Unlike powders or liquids, capsules are simple to carry, require no preparation, and ensure consistent intake, which strongly appeals to both fitness enthusiasts and individuals using L-Citrulline for general wellness.

The popularity of capsules is also linked to the rising adoption of dietary supplements in structured wellness routines. Consumers increasingly look for solutions that integrate smoothly into their lifestyle, and capsules meet this demand by providing a ready-to-use format with longer shelf stability. This advantage has strengthened their acceptance in both developed and emerging health markets.

Another factor behind capsule dominance is consumer trust in standardized formulations. Capsules often provide better labeling transparency and dosage control, which is important for users seeking performance enhancement, muscle recovery, or cardiovascular support. With growing health awareness, more people are choosing capsules as a reliable option.

By End-Use Analysis

Sports nutrition and bodybuilding drive 45.8 percent of the L-Citrulline market.

In 2024, sports nutrition and bodybuilding held a dominant market position in the by-end-use segment of the L-citrulline market, with a 45.8% share. This dominance reflects the strong connection between L-Citrulline and performance enhancement, as the ingredient is widely used to improve blood flow, reduce fatigue, and increase endurance during intense workouts. Athletes and fitness enthusiasts rely on it as part of their supplementation routine to achieve better exercise outcomes and faster recovery, making it a core product in the sports nutrition category.

The preference for L-Citrulline in this segment is also supported by the rising global fitness culture, where individuals are focusing on strength training, bodybuilding, and high-intensity workouts. The ability of L-Citrulline to delay muscle soreness and support nitric oxide production has positioned it as a valued supplement for achieving peak physical performance. With gyms, fitness clubs, and personalized training programs becoming mainstream, demand for specialized sports supplements continues to grow.

Moreover, the segment benefits from increasing awareness of natural performance enhancers over synthetic alternatives. Consumers see L-Citrulline as a safe and effective option for long-term use in sports nutrition, which further strengthens its share. This consistent demand ensures Sports Nutrition and bodybuilding remain the largest end-use category for L-citrulline in 2024.

By Distribution Channel Analysis

Supermarkets and hypermarkets represent 31.4 percent of the L-Citrulline

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the L-Citrulline Market, with a 31.4% share. This leadership is driven by the convenience and accessibility these retail formats provide, as they serve as one-stop destinations where consumers can easily find a wide range of dietary supplements, including L-Citrulline. The ability to physically compare products, check labeling, and choose from multiple brands has encouraged buyers to rely on these outlets for their supplement needs.

The dominance of supermarkets and hypermarkets also reflects changing consumer shopping behavior, where health and wellness products are increasingly integrated into everyday purchasing patterns. Shoppers prefer picking up L-Citrulline supplements alongside groceries and personal care products, reinforcing the convenience factor. Additionally, the presence of promotional offers, discounts, and loyalty programs in these large retail stores helps make L-Citrulline more attractive and affordable for regular buyers.

Another important factor is the trust consumers associate with established retail chains. The assurance of product authenticity, proper storage conditions, and regulatory compliance builds consumer confidence in purchasing supplements through these outlets. With health-conscious lifestyles becoming more mainstream, the steady footfall and visibility in supermarkets and hypermarkets have secured their position as the leading distribution channel for L-Citrulline in 2024.

Key Market Segments

By Form

- Capsules

- Tablets

- Powders

- Others

By End-Use

- Sports Nutrition and Bodybuilding

- Pharmaceuticals and Healthcare

- Food and Beverage

- Others

By Distribution Channel

- Supermarket and Hypermarkets

- Pharmacy and Drug Stores

- Health Stores

- Online

- Others

Driving Factors

Growing Fitness Culture Driving L-Citrulline Supplement Demand

One of the strongest driving factors for the L-Citrulline market in 2024 is the rapid growth of global fitness culture. More people are joining gyms, fitness clubs, and engaging in activities like weight training, cycling, and endurance sports. L-Citrulline is valued in this space because it helps improve blood circulation, reduces fatigue, and supports muscle recovery, making it an attractive choice for athletes and fitness enthusiasts.

The trend is not limited to professional athletes but also includes regular individuals focused on healthier lifestyles and improved physical performance. As health awareness rises, demand for natural and effective supplements like L-Citrulline continues to grow, positioning fitness culture as the key driver behind market expansion.

Restraining Factors

Limited Consumer Awareness Restrains L-Citrulline Market Growth

A key restraining factor for the L-Citrulline market in 2024 is the limited awareness among general consumers about its benefits. While fitness enthusiasts and athletes are familiar with its role in boosting endurance, reducing fatigue, and improving circulation, the broader population often lacks knowledge of its health advantages. Many people still associate supplements only with basic vitamins and minerals, which slows the adoption of specialized amino acids like L-Citrulline.

This gap in awareness prevents the market from reaching its full potential, especially in emerging regions where health education is limited. Unless more efforts are made in spreading knowledge through healthcare professionals, nutritionists, and retail promotions, the growth of L-Citrulline supplements will face constraints.

Growth Opportunity

Rising Use in Functional Foods Creates Market Opportunity

A major growth opportunity for the L-Citrulline market lies in its integration into functional foods and beverages. While capsules and powders dominate today, the future points toward everyday consumables like energy drinks, protein bars, and fortified snacks that include L-Citrulline as a key ingredient. This shift can help the supplement reach a wider consumer base, especially those who prefer nutrition through food rather than pills.

With growing interest in natural energy boosters and recovery solutions, food companies have a chance to innovate with new product lines. As consumers increasingly look for convenience and health benefits together, adding L-Citrulline to functional foods could significantly expand its market presence and create long-term growth momentum.

Latest Trends

Clean Label Supplements Emerging as Strong Market Trend

One of the latest trends shaping the L-Citrulline market in 2024 is the growing demand for clean-label supplements. Consumers are increasingly focused on transparency, preferring products that are free from artificial additives, synthetic fillers, and unnecessary chemicals. L-Citrulline, being naturally sourced and linked to health benefits like improved circulation and muscle recovery, fits well into this movement.

Brands are highlighting purity, natural origin, and clear labeling to attract health-conscious buyers. This trend is especially strong among younger consumers who carefully check ingredient lists before purchase. As awareness about wellness grows, clean label positioning not only boosts trust but also strengthens L-Citrulline’s image as a safe, effective, and natural option in the supplement market.

Regional Analysis

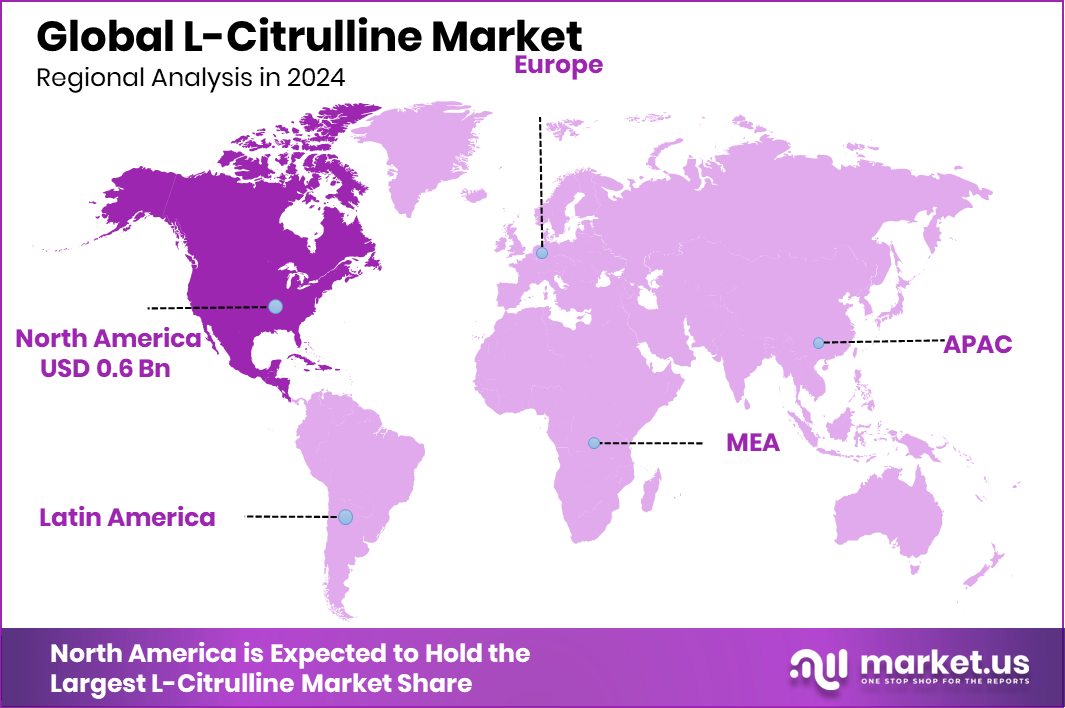

In 2024, North America dominated the L-Citrulline Market with a 43.70% share.

The L-Citrulline market shows strong regional diversity, with North America leading the global landscape. In 2024, North America accounted for 43.70% of the market, valued at around USD 0.6 billion, making it the most dominant region. This leadership is fueled by the region’s highly developed fitness culture, widespread adoption of dietary supplements, and strong consumer focus on cardiovascular and sports nutrition products.

The U.S. in particular has seen rapid growth in gym memberships and sports participation, creating consistent demand for performance-enhancing supplements such as L-Citrulline. Europe follows with steady expansion supported by rising interest in preventive healthcare and functional nutrition, while the Asia Pacific is emerging as a fast-growing market driven by increasing health awareness and a rising middle-class population adopting wellness products.

The Middle East & Africa and Latin America contribute smaller shares but are showing gradual uptake as awareness about natural amino acid supplements grows. North America’s clear dominance, however, highlights its position as the primary hub for supplement consumption and innovation in this category.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, NOW Foods has continued to strengthen its position in the global L-Citrulline market by focusing on high-quality dietary supplements that appeal to health-conscious consumers. Known for its broad portfolio of natural products, the company has leveraged its reputation for transparency and purity to attract both fitness enthusiasts and general wellness users. Its emphasis on sustainable sourcing and clean formulations has aligned well with the rising demand for safe and trustworthy amino acid supplements, keeping it a strong player in the space.

BulkSupplements has maintained its market relevance through its unique model of offering pure, bulk-form amino acids to a wide range of customers. By catering to both individual consumers and smaller supplement brands, the company has created a versatile position in the L-Citrulline market. Its focus on affordability, larger pack sizes, and direct-to-consumer distribution has helped it serve cost-conscious buyers, while also meeting the needs of athletes and gym-goers who prefer flexible dosages.

Primaforce has carved out its niche by targeting performance-driven consumers in the sports nutrition category. With products emphasizing muscle recovery, endurance, and strength-building, the company has gained attention among bodybuilders and athletes. Its positioning around scientifically backed formulations and clear labeling supports trust and product loyalty. In 2024, Primaforce continues to build credibility among fitness professionals, ensuring it remains competitive in the fast-growing amino acid supplement segment where L-Citrulline demand is rising steadily.

Top Key Players in the Market

- NOW Foods

- BulkSupplements

- Primaforce

- Pure Encapsulations

- Jarrow Formulas

- Glanbia plc

- Nutricost

- Doctor’s Best

- Life Extension

Recent Developments

- In April 2024, Glanbia agreed to acquire U.S.-based Flavor Producers for an initial $300 million, with up to $55 million deferred based on performance. The company will integrate Flavor Producers—specializing in organic, natural flavors and extracts—into its Nutritional segment.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Capsules, Tablets, Powders, Others), By End-Use (Sports Nutrition and Bodybuilding, Pharmaceuticals and Healthcare, Food and Beverage, Others), By Distribution Channel (Supermarket and Hypermarkets, Pharmacy and Drug Stores, Health Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NOW Foods, BulkSupplements, Primaforce, Pure Encapsulations, Jarrow Formulas, Glanbia plc, Nutricost, Doctor’s Best, Life Extension Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NOW Foods

- BulkSupplements

- Primaforce

- Pure Encapsulations

- Jarrow Formulas

- Glanbia plc

- Nutricost

- Doctor’s Best

- Life Extension