Global Kokum Butter Market Size, Share, And Enhanced Productivity By Product Type (Unrefined Kokum Butter, Refined Kokum Butter), By Nature (Organic, Conventional), By Extraction Method (Solvent Extraction, Mechanical Extraction), By Application (Cosmetics and Personal Care, Food Processing, Confectionery, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170650

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

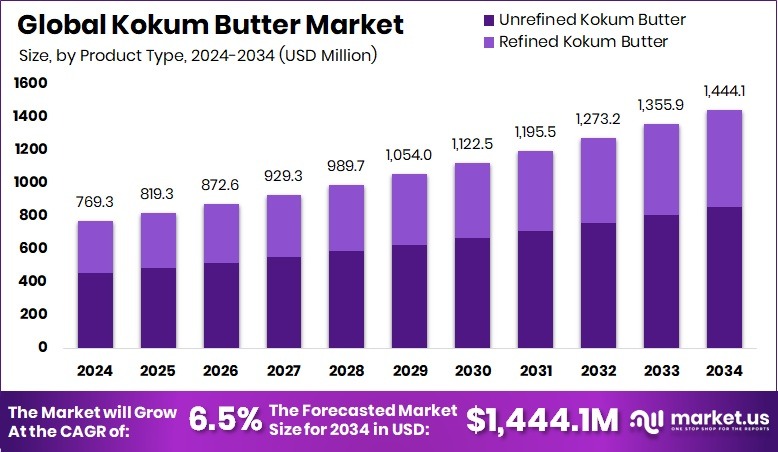

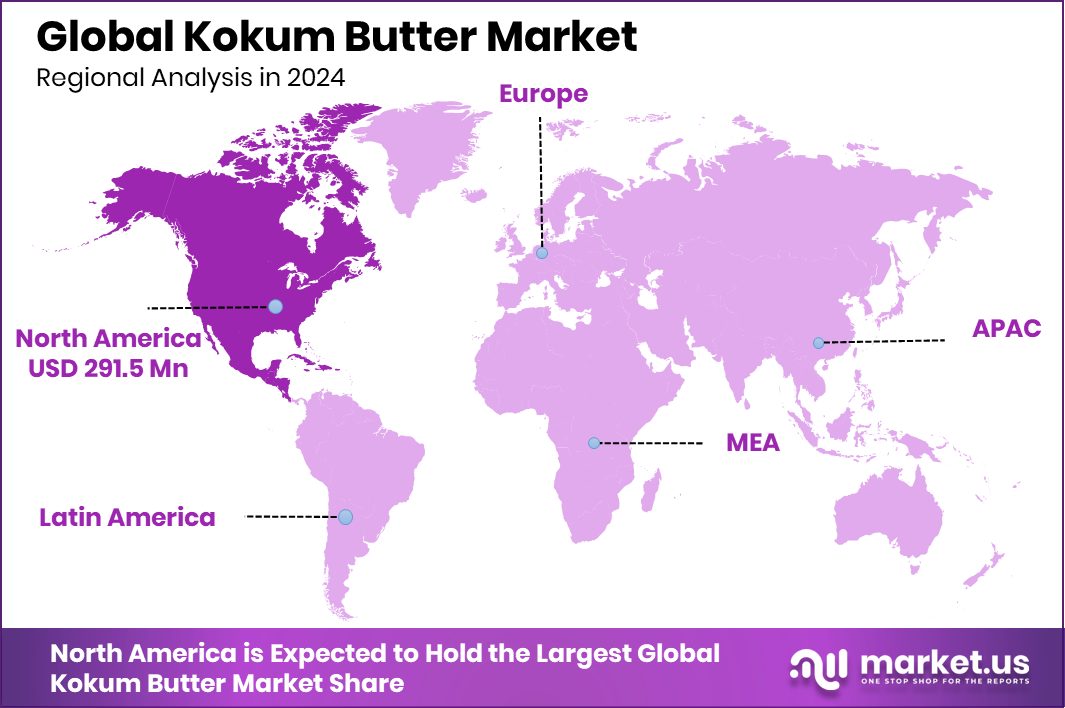

The Global Kokum Butter Market is expected to be worth around USD 1,444.1 million by 2034, up from USD 769.3 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. In North America, the Kokum Butter Market accounted for a 37.9% share of USD 291.5 Mn.

Kokum butter is a natural plant fat extracted from the seeds of the kokum fruit, mainly valued for its firm texture, long shelf life, and non-greasy feel. It is widely used where stable consistency and natural origin matter. Kokum butter stands out for being solid at room temperature, easy to blend, and suitable for formulations that require structure without heavy processing.

The kokum butter market refers to the commercial ecosystem covering sourcing, processing, distribution, and application of this butter across industries. Market growth is supported by increasing preference for naturally derived fats and ingredients that offer functional performance without synthetic additives. Its versatility and consistency make it suitable for both small-scale and structured manufacturing uses.

One major growth factor is rising interest in organic and plant-based production systems. This is supported by funding flows such as €1.1m awarded for promoting organic production, encouraging cleaner sourcing practices. However, global funding dynamics remain uneven, as nearly USD 1 billion in funding dried up for entrepreneurs across six African countries, impacting raw material ecosystems.

Demand is also shaped by broader investment momentum in natural food and ingredient spaces. Examples include All Things Butter securing £2.2m investment and Sid’s Farm raising USD 10 million in Series A funding to expand operations, reflecting wider interest in natural fat and dairy-adjacent products.

Key opportunity signals include:

- California startup receiving USD 10 million funding for an organic fertilizer plant, strengthening upstream organic supply chains

- Nithin Kamath-backed startup selling premium ghee at Rs 2,495 per 500 ml, showing consumer willingness to pay for natural, story-driven products

Key Takeaways

- The Global Kokum Butter Market is expected to be worth around USD 1,444.1 million by 2034, up from USD 769.3 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- Unrefined kokum butter led the Kokum Butter Market with 59.4% share, driven by skincare demand.

- Conventional products dominated the Kokum Butter Market at 69.3%, supported by established supply chains globally.

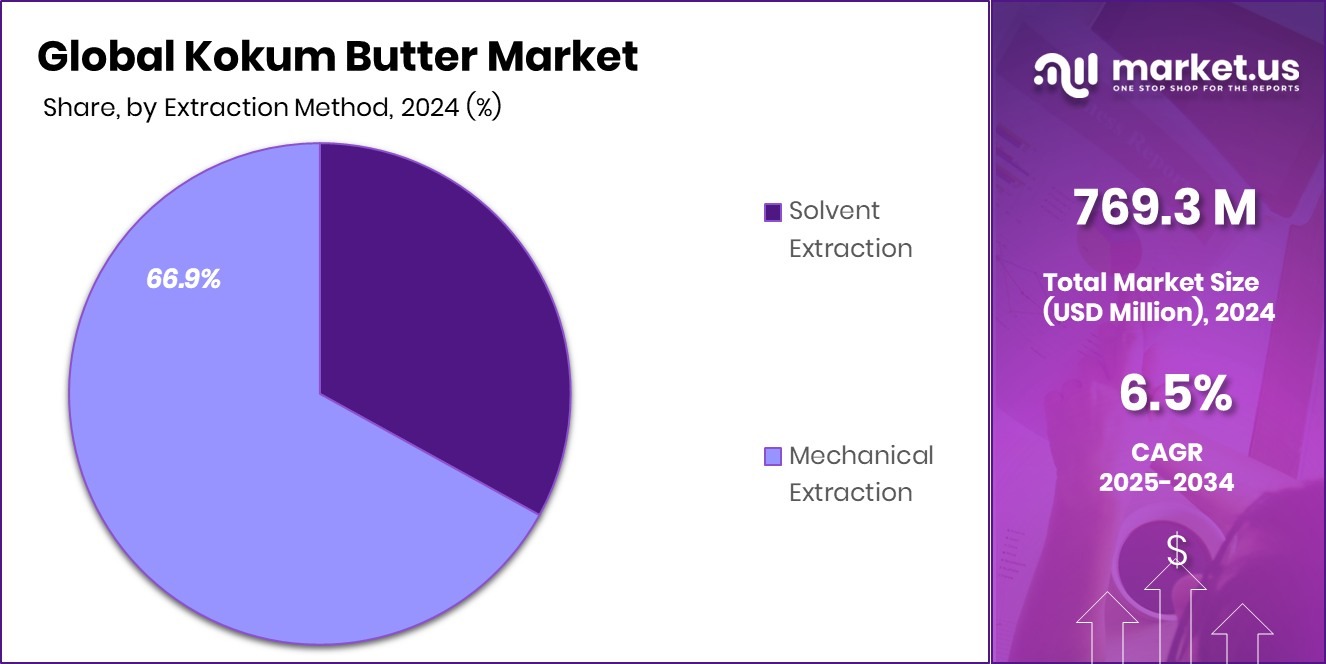

- Mechanical extraction held 66.9% in the Kokum Butter Market due to cost efficiency and scalability.

- Cosmetics and personal care applications captured 47.4% of the Kokum Butter Market consumption worldwide growth.

- The North America Kokum Butter Market reached USD 291.5 Mn, holding 37.9% of the regional share.

By Product Type Analysis

In Kokum Butter Market, the unrefined product type leads with a 59.4% share.

In 2024, Unrefined Kokum Butter held a dominant market position in By Product Type segment of Kokum Butter Market, with a 59.4% share. This dominance reflects a strong preference for minimally processed butter that retains its natural fatty acid profile, aroma, and texture. Unrefined kokum butter is widely valued for its purity and traditional appeal, making it suitable for applications where natural composition and functional performance are critical. Buyers continue to associate unrefined variants with higher authenticity and better performance characteristics.

The segment’s leadership is further supported by steady demand from manufacturers seeking consistent quality and natural sourcing. Its solid texture, stable shelf life, and compatibility with formulation processes reinforce its strong position. As a result, unrefined kokum butter remains a core product choice within the overall market structure.

By Nature Analysis

Within the Kokum Butter Market, conventional nature dominates demand, accounting for 69.3%.

In 2024, Conventional held a dominant market position in By Nature segment of the Kokum Butter Market, with a 69.3% share. This strong share highlights continued reliance on conventional production systems that ensure stable supply volumes and predictable quality. Conventional kokum butter remains widely accepted across commercial channels due to its cost efficiency and established sourcing networks.

Market participants favor conventional nature products for their scalability and consistent availability, which supports large-scale manufacturing needs. The segment’s dominance reflects well-established trade practices and steady demand patterns. As procurement decisions prioritize reliability and uniform quality, conventional kokum butter continues to anchor the market’s supply framework.

By Extraction Method Analysis

Mechanical extraction leads Kokum Butter Market production methods with a 66.9%.

In 2024, Mechanical Extraction held a dominant market position in By Extraction Method segment of Kokum Butter Market, with a 66.9% share. This dominance is driven by the method’s ability to preserve the butter’s natural structure while ensuring efficient yield. Mechanical extraction is widely adopted due to its straightforward process and minimal chemical intervention.

The method supports consistent texture and quality, which are essential for downstream processing and formulation stability. Its operational efficiency and repeatable outcomes strengthen its position across supply chains. As a result, mechanical extraction remains the preferred approach, reinforcing its leading role in the market.

By Application Analysis

Cosmetics and personal care drive Kokum Butter Market applications, holding 47.4%.

In 2024, Cosmetics and Personal Care held a dominant market position in By Application segment of the Kokum Butter Market, with a 47.4% share. This leadership reflects strong usage of kokum butter in formulations requiring stable emollient properties and smooth application performance. Its non-greasy texture and firm consistency make it well-suited for personal care products.

The segment’s dominance is supported by steady incorporation into routine product lines where functional reliability matters. Manufacturers value its compatibility with diverse formulations, sustaining consistent demand. As a result, cosmetics and personal care continue to represent the primary application focus within the kokum butter market.

Key Market Segments

By Product Type

- Unrefined Kokum Butter

- Refined Kokum Butter

By Nature

- Organic

- Conventional

By Extraction Method

- Solvent Extraction

- Mechanical Extraction

By Application

- Cosmetics and Personal Care

- Food Processing

- Confectionery

- Pharmaceuticals

- Others

Driving Factors

Rising Natural Fat Demand Strengthens Kokum Butter Adoption

One major driving factor for the Kokum Butter Market is the growing shift toward natural, minimally processed fats across food and ingredient value chains. Manufacturers increasingly look for stable plant-based fats that offer structure, shelf stability, and clean-label appeal. This demand aligns with broader investments in food innovation and processing efficiency.

For example, Tender Food evolving into Lasso after a USD 6.5M raise highlights efforts to improve food quality by reducing ultra-processed ingredients, indirectly supporting demand for natural fat alternatives.

Similarly, FloVision Solutions raising USD 8.7M Series A shows how technology is improving food production facilities, enabling better handling of specialty ingredients like kokum butter. In emerging markets, Wonderland Foods raising Rs 140 crore reflects rising capital interest in food processing expansion. Public-sector backing further reinforces this driver, as AFIR granting €259.3 million for 102 processing investment projects strengthens processing infrastructure that benefits natural ingredient adoption.

Restraining Factors

Limited Processing Scale Slows Kokum Butter Market Growth

One key restraining factor for the Kokum Butter Market is the limited scale and uneven modernization of food and ingredient processing systems. While interest in natural fats is rising, many processors still lack advanced infrastructure to handle specialty butters efficiently. Recent funding highlights this gap.

BRAINR raised USD 13 million in seed funding to digitize food manufacturing, showing that many facilities still rely on outdated systems. Similarly, the launch of Lasso with USD 6.5 million in funding and FloVision Solutions securing USD 8.7 million in Series A funding underline the need for better yield control and quality analytics in food production.

Even with Wonderland Foods securing ₹140 crore in its first institutional funding round, expansion efforts take time to translate into widespread processing readiness. Until such upgrades become more common, handling and scaling niche ingredients like kokum butter remains challenging.

Growth Opportunity

Agricultural Funding Programs Open New Kokum Supply Opportunities

A major growth opportunity for the Kokum Butter Market lies in rising agricultural and food-system funding that can strengthen raw material sourcing and processing capacity. In India, the AgriSURE Fund offers agri-startups funding of up to Rs 25 crore, encouraging innovation in farming, post-harvest handling, and value-added crop utilization. This can support better kokum cultivation and localized processing models.

At the same time, Untamed raised USD 12.8 million in funding, reflecting increasing investor confidence in ingredient-focused food businesses. Government-led support also matters, as the Fortified Rice Scheme extension to 2028 with ₹17,082 crore funding strengthens food infrastructure and distribution systems that indirectly benefit specialty ingredients.

However, contrasting trends such as the USDA and DOGE cutting about USD 1 billion in school nutrition funding programs highlight regional funding gaps, making emerging-market support even more critical.

Latest Trends

Premium Natural Ingredients Gain Traction In Confectionery

One of the latest trends shaping the Kokum Butter Market is its growing alignment with premium and indulgent food categories, especially confectionery and snack products. Brands are increasingly focused on texture, mouthfeel, and clean ingredient appeal, creating space for stable natural fats like kokum butter. This trend is reflected in recent funding activity across the confectionery space. Fireside Ventures’ leading INR 20 crore funding in Oroos Confectionery highlights rising interest in premium sweets.

Similarly, Doughlicious securing USD 5 million in funding shows demand for enhanced product ranges with better ingredient quality. Canada’s Awake Chocolate reaching USD 8 million funding points to strong momentum in functional and premium chocolates. In addition, Candytoy Corporate raising Rs 110 crore to expand manufacturing facilities signals capacity growth for ingredient-rich confectionery production.

Regional Analysis

North America leads the Kokum Butter Market with a 37.9% share valued at USD 291.5 Mn.

North America dominates the Kokum Butter Market, accounting for a 37.9% share valued at USD 291.5 Mn, reflecting strong commercial adoption and well-established demand channels across the region. The market benefits from consistent usage of kokum butter in structured manufacturing environments, where quality consistency and supply reliability are prioritized. Europe represents a mature regional market, supported by the steady incorporation of kokum butter into established product formulations, driven by long-standing industry practices and stable consumption patterns.

Asia Pacific shows a growing regional presence, supported by its proximity to raw material origins and traditional familiarity with kokum-based products, which sustains internal demand and regional trade activity.

The Middle East & Africa region maintains a developing market position, where gradual awareness and selective application usage contribute to moderate demand levels without rapid expansion. Latin America reflects an emerging regional landscape, characterized by niche adoption and gradual integration of kokum butter into localized applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AAK continues to play a strategically important role in the global Kokum Butter Market through its strong focus on specialty vegetable fats and functional lipid solutions. The company’s expertise in handling plant-based fats positions it well to meet industry expectations around consistency, texture performance, and formulation reliability. AAK’s integrated sourcing and processing capabilities support a steady supply, making it a preferred partner for manufacturers requiring dependable butter quality for downstream applications.

Wilmar International maintains a notable presence in the kokum butter value chain due to its broad agribusiness footprint and operational scale. The company’s strength lies in efficient raw material handling and large-scale processing, which enables cost control and stable output. Wilmar’s experience across edible and specialty fats allows it to align kokum butter offerings with evolving industrial requirements, supporting long-term participation in this niche yet growing segment.

Fuji Oil brings strong formulation knowledge and processing precision to the Kokum Butter Market. Its emphasis on functional ingredients and tailored fat solutions enhances the usability of kokum butter in complex product formulations. Fuji Oil’s technical approach and product consistency help strengthen its position among customers seeking performance-driven plant-based butter ingredients, reinforcing its relevance in the global market landscape.

Top Key Players in the Market

- AAK

- Wilmar International

- Fuji Oil

- Cargill

- Mewah Group

- Manorama Group

- Felda Iffco

Recent Developments

- In October 2025, AAK entered a strategic joint venture with Kuala Lumpur Kepong Berhad (KLK) to establish the Nura Specialty Oils and Fats production plant in Pasir Gudang, Malaysia. This initiative aims to secure upstream access to high-purity feedstock for specialty fat products, particularly for cocoa butter alternatives and related plant-based fats. This strengthens AAK’s supply chain resilience and broadens its raw material base for specialty oils and fats products.

- In December 2024, Wilmar International’s subsidiary Lence Pte. Ltd. agreed to purchase up to 31.06% equity shares in Adani Wilmar Ltd, strengthening its ownership in this major food and edible oil business in India. This move helps Wilmar expand its footprint in one of Asia’s biggest edible oils markets and aligns with its core edible oils and fats operations.

Report Scope

Report Features Description Market Value (2024) USD 769.3 Million Forecast Revenue (2034) USD 1,444.1 Million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Unrefined Kokum Butter, Refined Kokum Butter), By Nature (Organic, Conventional), By Extraction Method (Solvent Extraction, Mechanical Extraction), By Application (Cosmetics and Personal Care, Food Processing, Confectionery, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AAK, Wilmar International, Fuji Oil, Cargill, Mewah Group, Manorama Group, Felda Iffco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AAK

- Wilmar International

- Fuji Oil

- Cargill

- Mewah Group

- Manorama Group

- Felda Iffco